Similar presentations:

Innovations and information and communication technologies in the state tax service

1.

INNOVATIONS AND INFORMATION ANDCOMMUNICATION TECHNOLOGIES IN THE STATE TAX

SERVICE

2.

1.Digitalization in

Tax

administration

3.

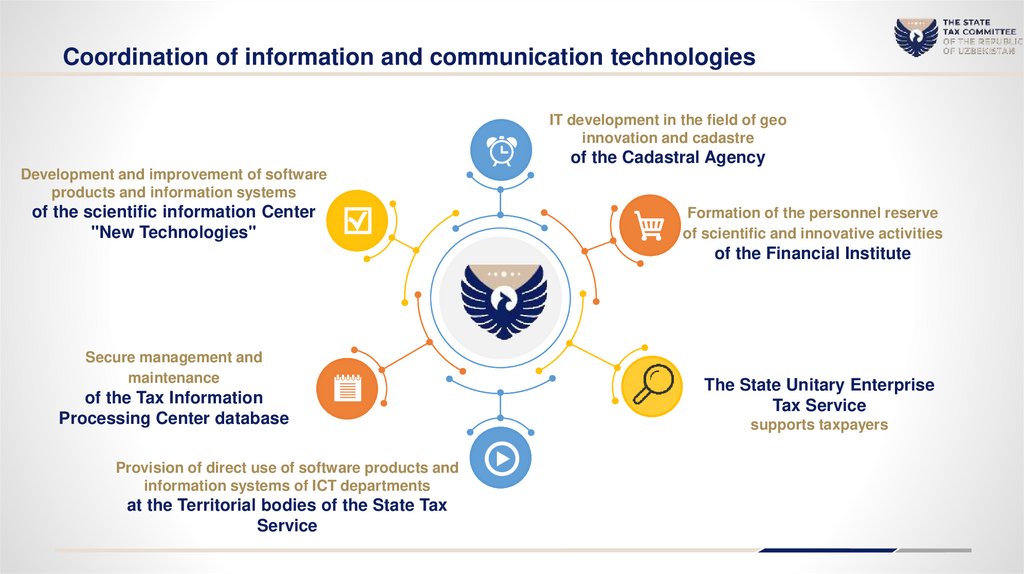

Coordination of information and communication technologiesIT development in the field of geo

innovation and cadastre

of the Cadastral Agency

Development and improvement of software

products and information systems

of the scientific information Center

"New Technologies"

Formation of the personnel reserve

of scientific and innovative activities

of the Financial Institute

Secure management and

maintenance

of the Tax Information

Processing Center database

Provision of direct use of software products and

information systems of ICT departments

at the Territorial bodies of the State Tax

Service

The State Unitary Enterprise

Tax Service

supports taxpayers

4.

Main tasks and directionsData Processing

Center

Information systems an

delectronic services

Information security

Communication networ

ks andmaintenance

5.

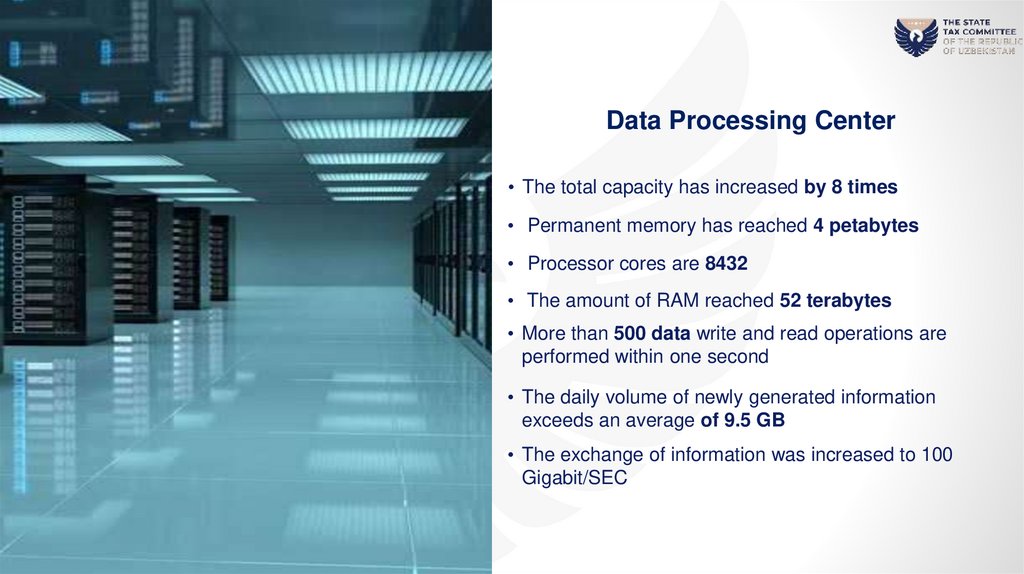

Data Processing Center• The total capacity has increased by 8 times

• Permanent memory has reached 4 petabytes

• Processor cores are 8432

• The amount of RAM reached 52 terabytes

• More than 500 data write and read operations are

performed within one second

• The daily volume of newly generated information

exceeds an average of 9.5 GB

• The exchange of information was increased to 100

Gigabit/SEC

6.

Studied foreign experienceRussia

Federation

Chinese

“Golden Tax III”

United Arab

Emirates

Korean

“Home Tax”

7.

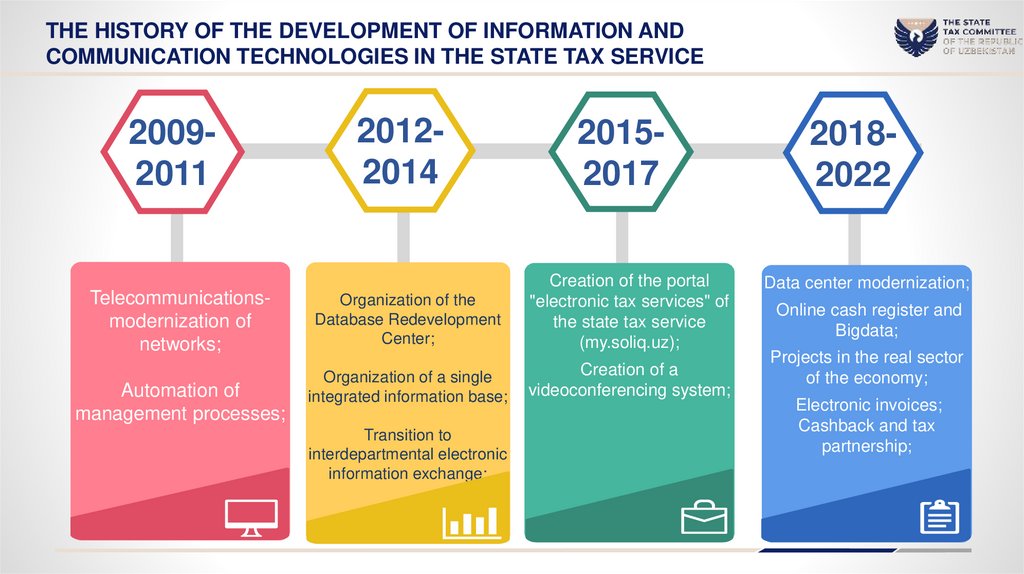

THE HISTORY OF THE DEVELOPMENT OF INFORMATION ANDCOMMUNICATION TECHNOLOGIES IN THE STATE TAX SERVICE

20092011

Telecommunicationsmodernization of

networks;

Text title is here

Replace your text here!

Replace your text

here!Replace your text here!

Replace your text here!

Automation of

management processes;

20122014

20152017

Organization of the

Database Redevelopment

Center;

Creation of the portal

"electronic tax services" of

the state tax service

(my.soliq.uz);

Organization of a single

integrated information base;

Creation of a

videoconferencing system;

Transition to

interdepartmental electronic

information exchange;

20182022

Data center modernization;

Online cash register and

Bigdata;

Projects in the real sector

of the economy;

Electronic invoices;

Cashback and tax

partnership;

8.

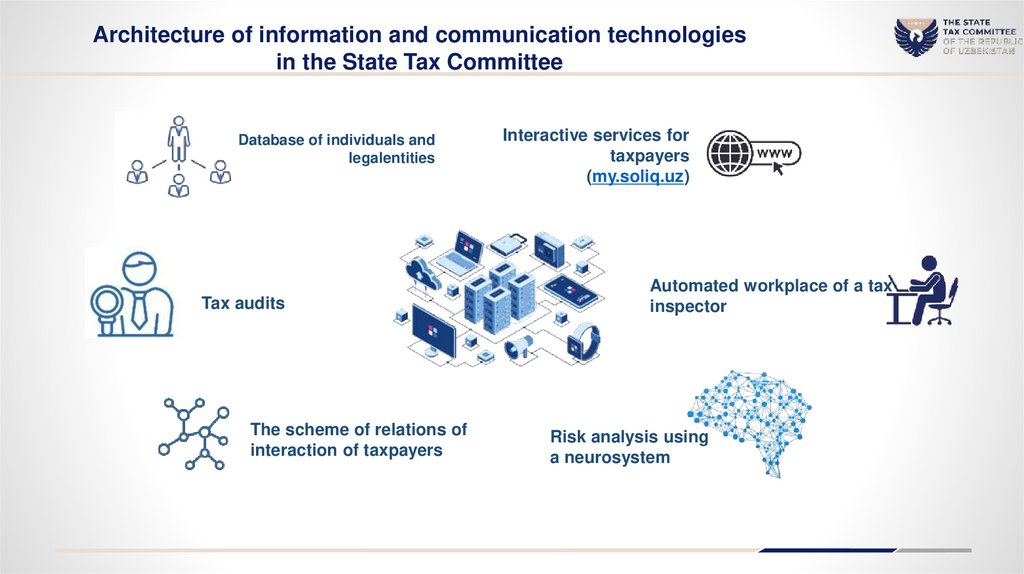

Architecture of information and communication technologiesin the State Tax Committee

Database of individuals and

legalentities

Tax audits

The scheme of relations of

interaction of taxpayers

Interactive services for

taxpayers

(my.soliq.uz)

Automated workplace of a tax

inspector

Risk analysis using

a neurosystem

9.

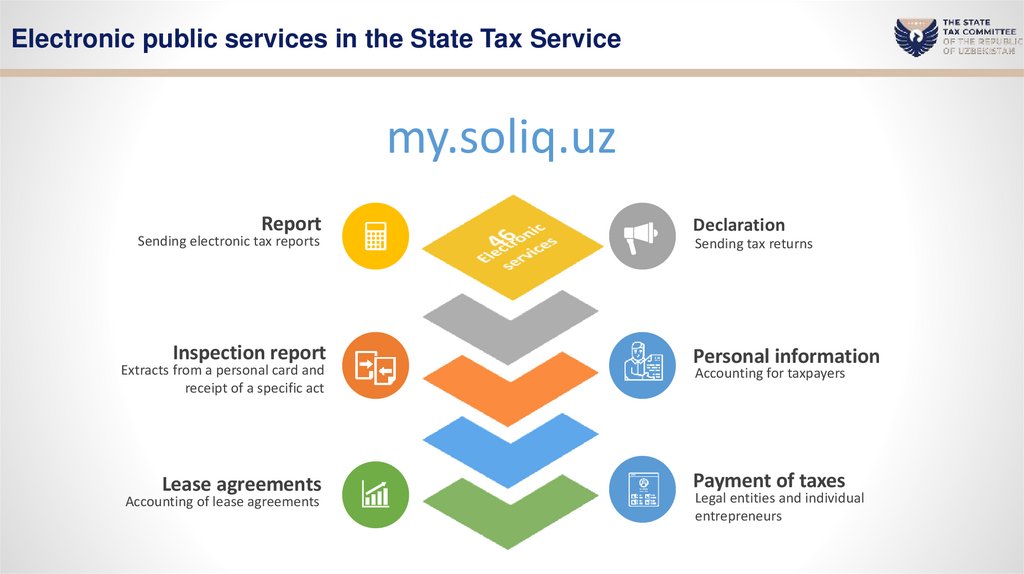

Electronic public services in the State Tax Servicemy.soliq.uz

Report

Sending electronic tax reports

Inspection report

Extracts from a personal card and

receipt of a specific act

Lease agreements

Accounting of lease agreements

Declaration

Sending tax returns

Personal information

Accounting for taxpayers

Payment of taxes

Legal entities and individual

entrepreneurs

10.

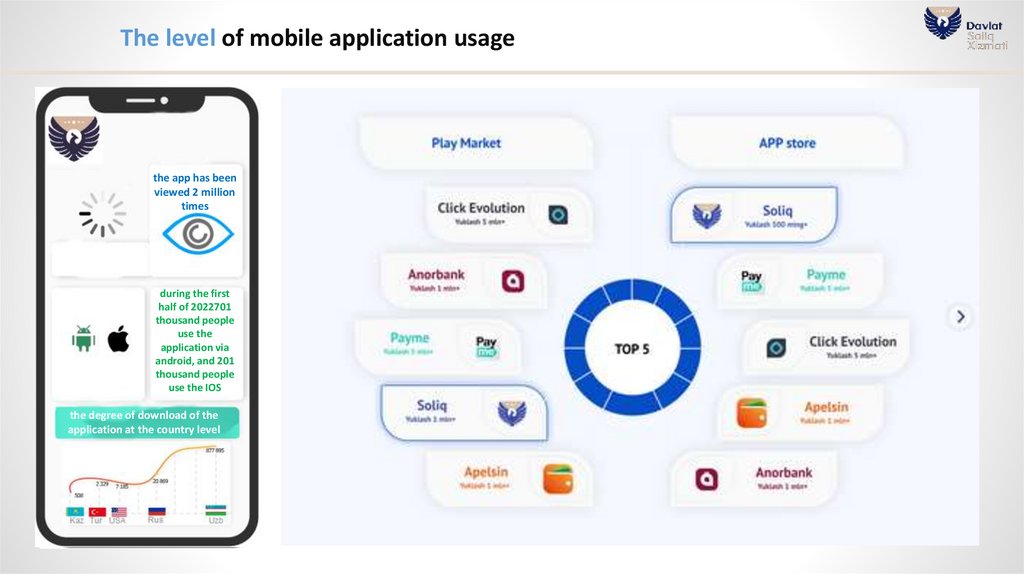

The level of mobile application usagethe app has been

viewed 2 million

times

during the first

half of 2022701

thousand people

use the

application via

android, and 201

thousand people

use the IOS

the degree of download of the

application at the country level

11.

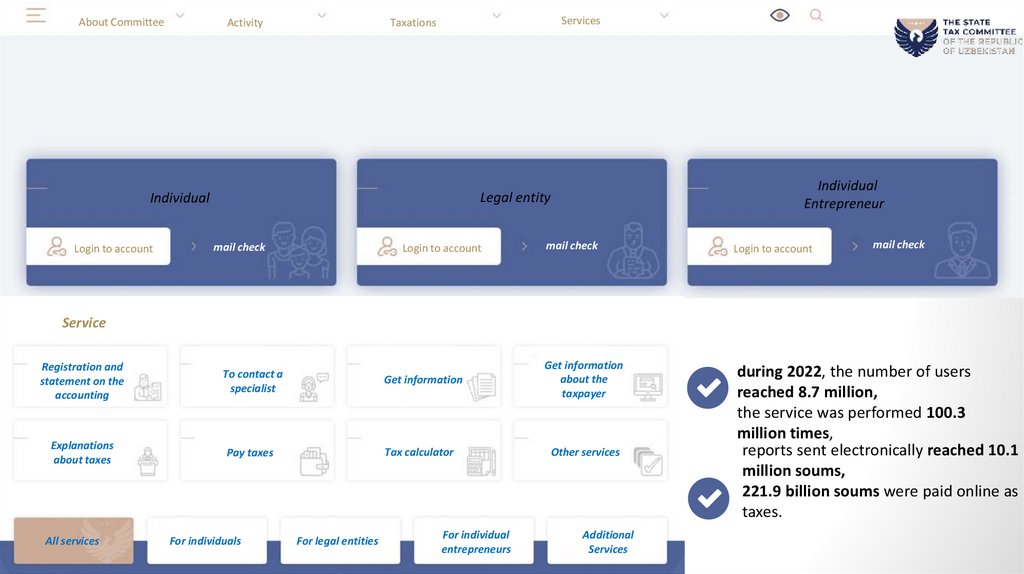

About CommitteeActivity

Services

Taxations

46

Login to account

Individual

Entrepreneur

Legal entity

Individual

mail check

Login to account

mail check

mail check

Login to account

during 2022, the number of users

reached 8.7 million,

the service was performed 100.3

million times,

reports sent electronically reached 10.1

million soums,

221.9 billion soums were paid online as

taxes.

Service

Registration and

statement on the

accounting

To contact a

specialist

Get information

Get information

about the

taxpayer

Explanations

about taxes

Pay taxes

Tax calculator

Other services

All services

For individuals

For legal entities

For individual

entrepreneurs

Additional

Services

12.

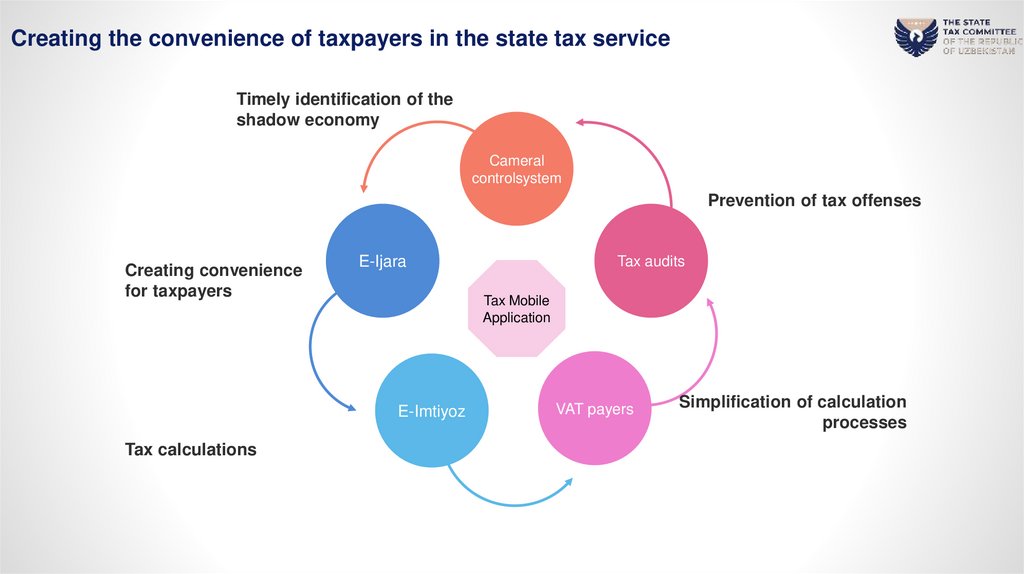

Creating the convenience of taxpayers in the state tax serviceTimely identification of the

shadow economy

Cameral

controlsystem

Prevention of tax offenses

Creating convenience

for taxpayers

E-Ijara

Tax Mobile

Application

E-Imtiyoz

Tax calculations

Tax audits

VAT payers

Simplification of calculation

processes

13.

2.Innovations

in the tax

system of

2022

14.

02Innovations in the tax system of 2022

03

01

In order to create greater convenience for business entities,

a portal was launched for voluntary electronic registration of

contracts (E-IJARA).

The focus is on accounting for credited and implemented

goods in an automatic mode based on the data of electronic

invoices and freight customs declarations.

E-IJARA

15.

02Innovations in the tax system

of 2022

02

03

02

The new E-Active information system (E-ombor) allows an

economic entity to keep records and track the receipt and

balance of products online. Also, the system has the ability

to create one or more warehouses for goods, move them

from one warehouse to another through the sections

“receipt of goods” and “disposal of goods”.

E-ACTIVE

16.

02Innovations in the tax system

of 2022

02

03

03

The unified interactive portal of public services has created

opportunities for online payment of state duties and fines

imposed by state authorities, other payments through the

relevant banking and other payment systems.

Portal of public services

17.

02Innovations in the tax system

of 2022

02

03

04

From January 1, 2022, the order of return (cashback) is

provided with 1% of the amount of purchase of physical

people when verify the checks by scanning a matrix bar

code in a mobile application from the budget.

CASHBACK

informatics

informatics law

law