Similar presentations:

Tutorial 10. The Open Economy: the Mundell-Fleming Model

1.

Webster UniversityTutorial 10. The Open Economy:

the Mundell-Fleming Model

slide 1

2.

Question 1. Mundell-Fleming ModelExplain by making use of MF model briefly (2 or 3 sentences) why

a monetary contraction for a small open economy under fixed

exchange rates will have no effect on real income.

slide 2

3.

Question 1. Mundell-Fleming ModelAnswer:

A monetary contraction shifts the LM* curve to the left, putting

downward pressure on the exchange rate. However, the central

bank is committed to the original rate – people will then sell the

central bank foreign currency and buy domestic currency. This

will then INCREASE the money supply – in fact the money supply

returns to precisely what it was before, and thus output does not

get affected.

slide 3

4.

Question 2. Mundell-Fleming ModelIf a small open economy with a flexible exchange rate is

experiencing a recession, what will automatically happen over

time to its trade balance, foreign exchange rate, and national

output? Illustrate graphically.

slide 4

5.

Question 2. Mundell-Fleming ModelAnswer:

Say that Y(LR) is the long run

output for the economy, while Y1 is

where the economy is right now.

Then, what must happen is

PRICES WILL FALL – this of

course means that real money

balances rise, implying a rightward

shift in the LM* curve.

Note that this also implies a

decrease in the real exchange rate.

slide 5

6.

Question 3. Mundell-Fleming Model: FiscalPolicy under floating exchange rate regime

In the Mundell–Fleming model, what happens to the exchange

rate, aggregate income, and trade balance if an increase in taxes

occurs?

slide 6

7.

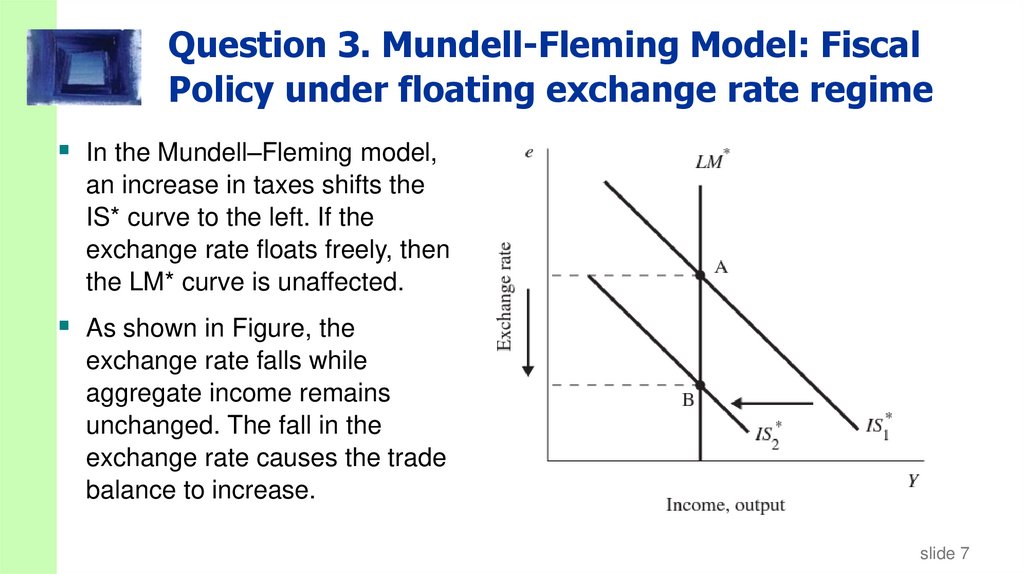

Question 3. Mundell-Fleming Model: FiscalPolicy under floating exchange rate regime

In the Mundell–Fleming model,

an increase in taxes shifts the

IS* curve to the left. If the

exchange rate floats freely, then

the LM* curve is unaffected.

As shown in Figure, the

exchange rate falls while

aggregate income remains

unchanged. The fall in the

exchange rate causes the trade

balance to increase.

slide 7

8.

Question 4. Mundell-Fleming Model: FiscalPolicy under fixed exchange rate regime

In the Mundell–Fleming model, what happens to the aggregate

income, and trade balance if an increase in taxes occurs?

slide 8

9.

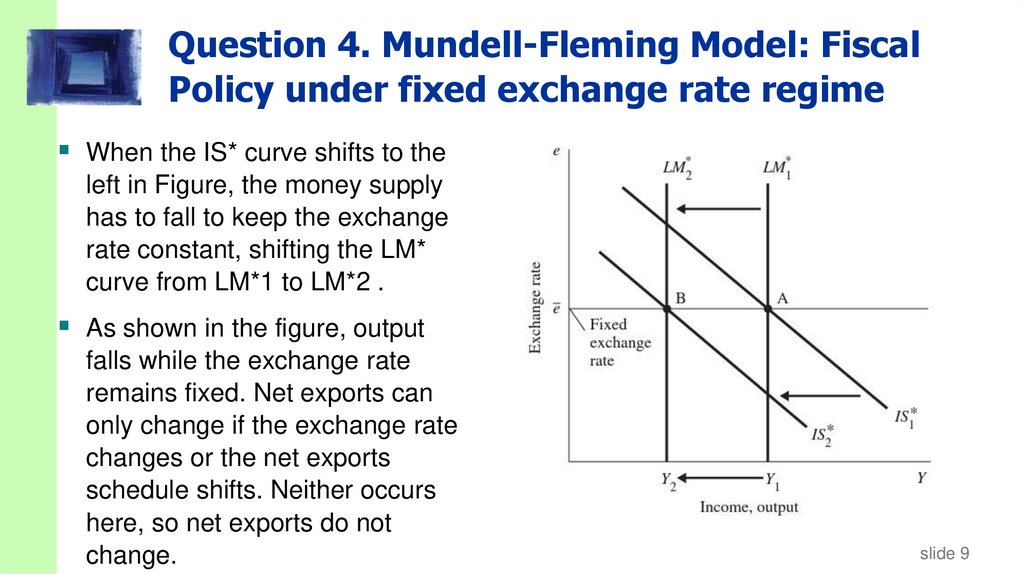

Question 4. Mundell-Fleming Model: FiscalPolicy under fixed exchange rate regime

When the IS* curve shifts to the

left in Figure, the money supply

has to fall to keep the exchange

rate constant, shifting the LM*

curve from LM*1 to LM*2 .

As shown in the figure, output

falls while the exchange rate

remains fixed. Net exports can

only change if the exchange rate

changes or the net exports

schedule shifts. Neither occurs

here, so net exports do not

change.

slide 9

10.

Question 5. Mundell-Fleming Model: FiscalPolicy effectiveness

From the answers to the questions 3 and 4, what we may

conclude about fiscal policy effectiveness: is it effective that under

fixed exchange rates or under floating exchange rates?

slide 10

11.

Question 5. Mundell-Fleming Model: FiscalPolicy effectiveness

From the answers to the questions 3 and 4, we conclude that in

an open economy, fiscal policy is effective at influencing output

under fixed exchange rates but ineffective under floating

exchange rates.

slide 11

12.

Question 6. Mundell-Fleming Model: MonetaryPolicy under floating exchange rate regime

In the Mundell–Fleming model, what happens to the exchange

rate, aggregate income, and trade balance if a reduction in the

money supply occurs?

slide 12

13.

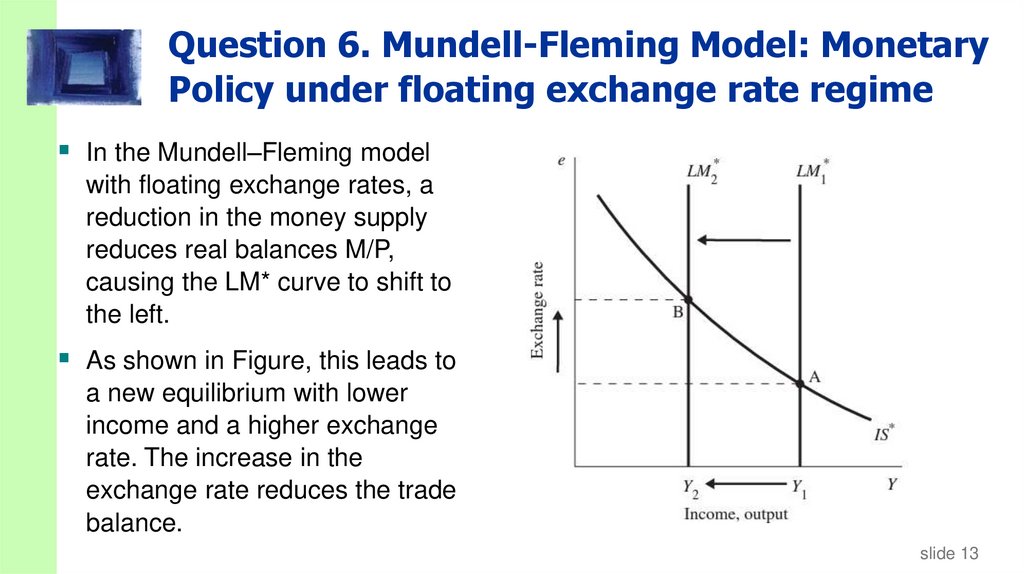

Question 6. Mundell-Fleming Model: MonetaryPolicy under floating exchange rate regime

In the Mundell–Fleming model

with floating exchange rates, a

reduction in the money supply

reduces real balances M/P,

causing the LM* curve to shift to

the left.

As shown in Figure, this leads to

a new equilibrium with lower

income and a higher exchange

rate. The increase in the

exchange rate reduces the trade

balance.

slide 13

14.

Question 7. Mundell-Fleming Model: MonetaryPolicy under fixed exchange rate regime

In the Mundell–Fleming model, what happens to the aggregate

income, and trade balance if a reduction in the money supply

occurs?

slide 14

15.

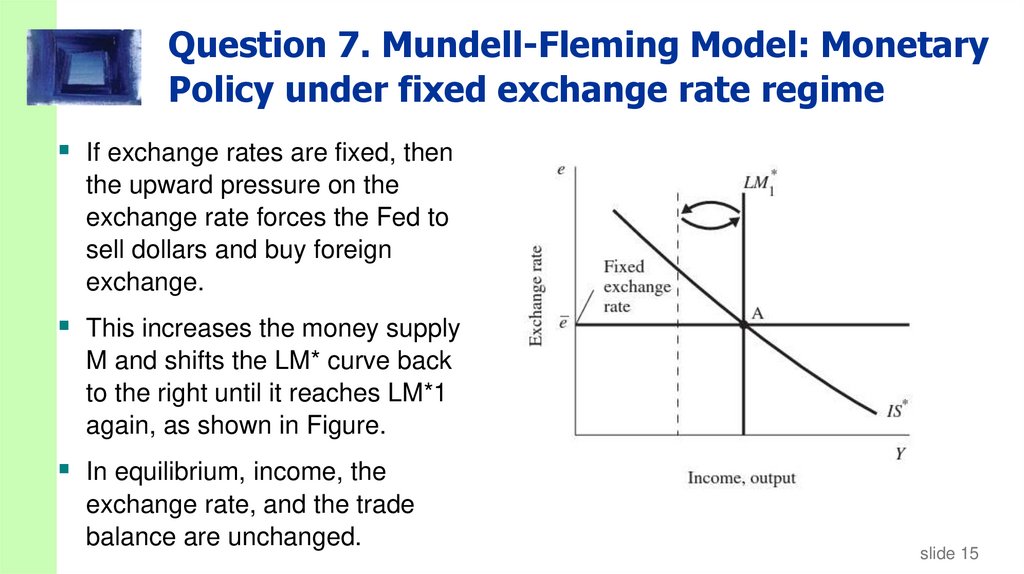

Question 7. Mundell-Fleming Model: MonetaryPolicy under fixed exchange rate regime

If exchange rates are fixed, then

the upward pressure on the

exchange rate forces the Fed to

sell dollars and buy foreign

exchange.

This increases the money supply

M and shifts the LM* curve back

to the right until it reaches LM*1

again, as shown in Figure.

In equilibrium, income, the

exchange rate, and the trade

balance are unchanged.

slide 15

16.

Question 8. Mundell-Fleming Model: MonetaryPolicy effectiveness

From the answers to the questions 3 and 4, what we may

conclude about monetary policy effectiveness: is it effective that

under fixed exchange rates or under floating exchange rates?

slide 16

17.

Question 8. Mundell-Fleming Model: MonetaryPolicy under floating exchange rate regime

From the answers to the questions 3 and 4, we conclude that in

an open economy, monetary policy is effective at influencing

output under floating exchange rates but impossible under fixed

exchange rates.

slide 17

18.

Question 9. Mundell-Fleming Model: TradePolicy under floating exchange rate regime

In the Mundell–Fleming model, what happens to the exchange

rate, aggregate income, and trade balance if a removing a quota

on imported cars occurs?

slide 18

19.

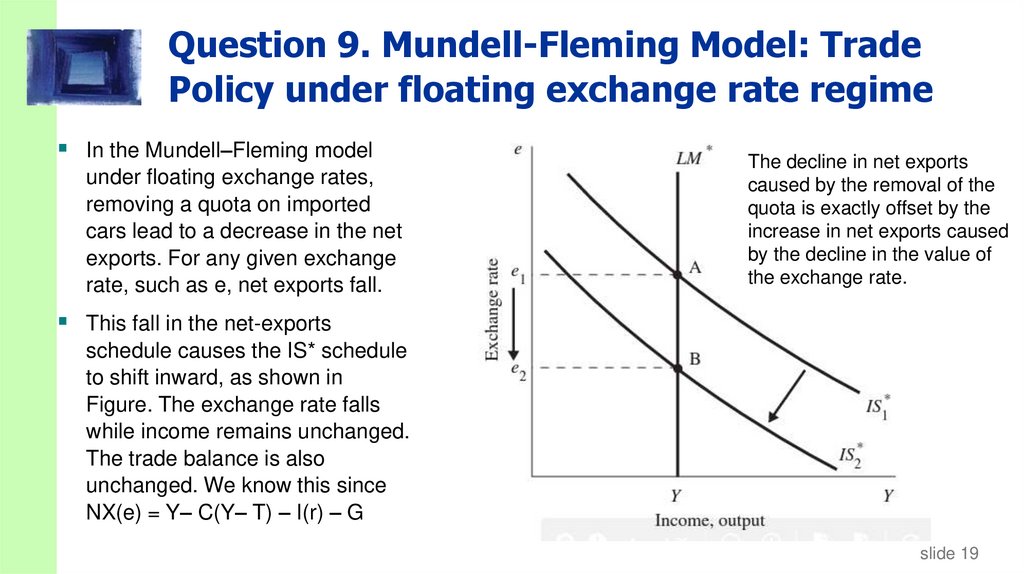

Question 9. Mundell-Fleming Model: TradePolicy under floating exchange rate regime

In the Mundell–Fleming model

under floating exchange rates,

removing a quota on imported

cars lead to a decrease in the net

exports. For any given exchange

rate, such as e, net exports fall.

The decline in net exports

caused by the removal of the

quota is exactly offset by the

increase in net exports caused

by the decline in the value of

the exchange rate.

This fall in the net-exports

schedule causes the IS* schedule

to shift inward, as shown in

Figure. The exchange rate falls

while income remains unchanged.

The trade balance is also

unchanged. We know this since

NX(e) = Y– C(Y– T) – I(r) – G

slide 19

20.

Question 10. Mundell-Fleming Model: TradePolicy under fixed exchange rate regime

In the Mundell–Fleming model, what happens to the exchange

rate, aggregate income, and trade balance if a removing a quota

on imported cars occurs?

slide 20

21.

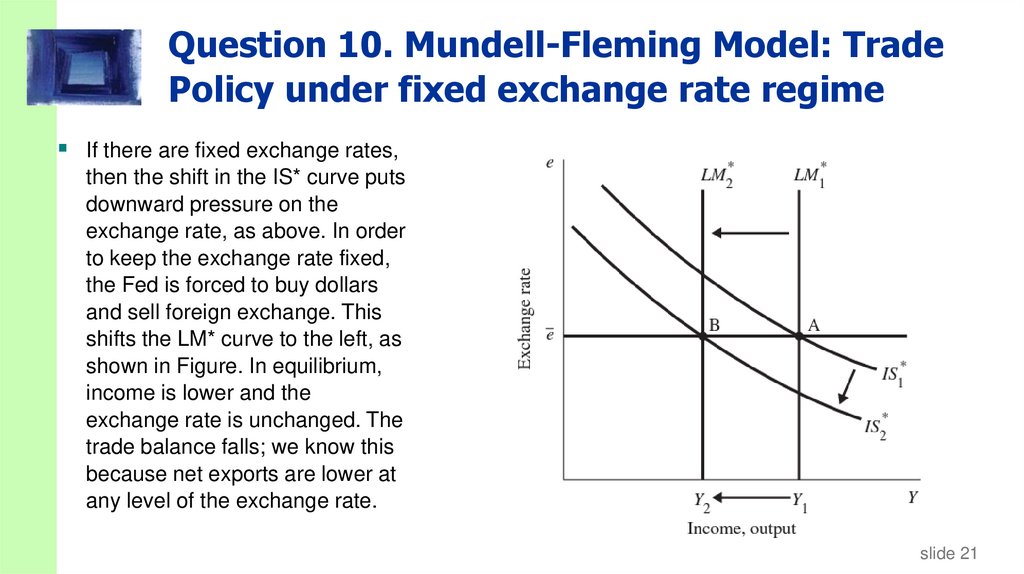

Question 10. Mundell-Fleming Model: TradePolicy under fixed exchange rate regime

If there are fixed exchange rates,

then the shift in the IS* curve puts

downward pressure on the

exchange rate, as above. In order

to keep the exchange rate fixed,

the Fed is forced to buy dollars

and sell foreign exchange. This

shifts the LM* curve to the left, as

shown in Figure. In equilibrium,

income is lower and the

exchange rate is unchanged. The

trade balance falls; we know this

because net exports are lower at

any level of the exchange rate.

slide 21

22.

Question 11. What does the impossibletrinity say?

slide 22

23.

Question 11. What does the impossibletrinity say?

The impossible trinity states that it is impossible for a nation to

have free capital flows, a fixed exchange rate, and independent

monetary policy. In other words, you can only have two of the

three. If you want free capital flows and an independent monetary

policy, then you cannot also peg the exchange rate. If you want a

fixed exchange rate and free capital flows, then you cannot have

independent monetary policy. If you want to have independent

monetary policy and a fixed exchange rate, then you need to

restrict capital flows.

slide 23

24.

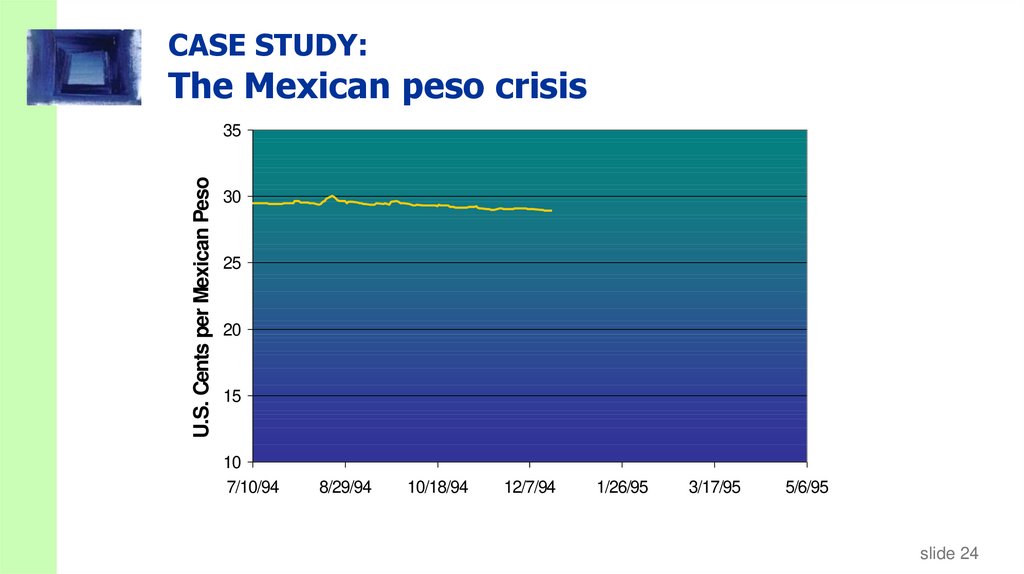

CASE STUDY:The Mexican peso crisis

U.S. Cents per Mexican Peso

35

30

25

20

15

10

7/10/94

8/29/94

10/18/94

12/7/94

1/26/95

3/17/95

5/6/95

slide 24

25.

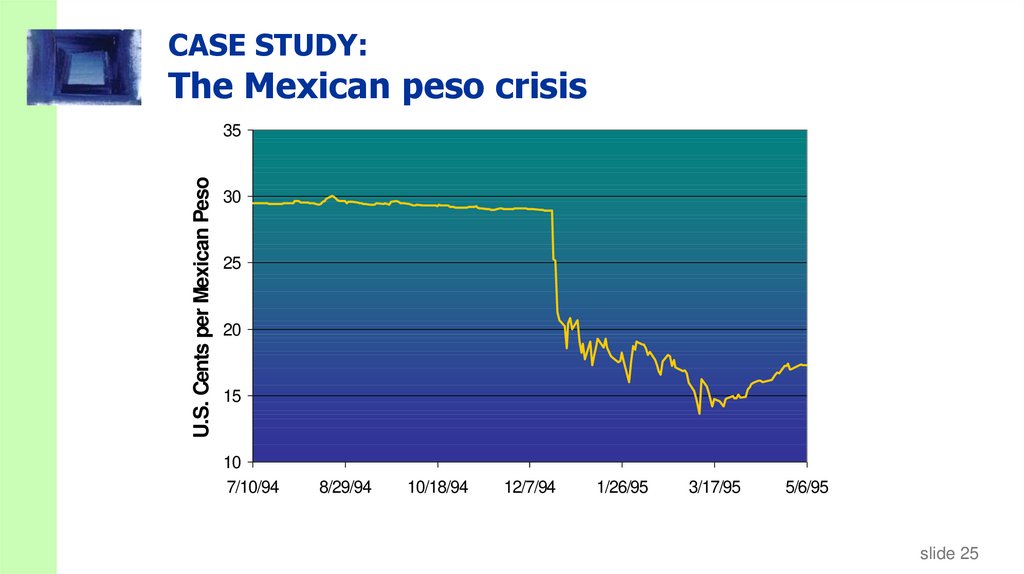

CASE STUDY:The Mexican peso crisis

U.S. Cents per Mexican Peso

35

30

25

20

15

10

7/10/94

8/29/94

10/18/94

12/7/94

1/26/95

3/17/95

5/6/95

slide 25

26.

The Peso crisis didn’t just hurt MexicoU.S. goods more expensive to Mexicans

U.S. firms lost revenue

Hundreds of bankruptcies along

U.S.-Mexican border

Mexican assets worth less in dollars

Reduced wealth of millions of U.S. citizens

slide 26

27.

Understanding the crisisIn the early 1990s, Mexico was an attractive place

for foreign investment.

During 1994, political developments caused an

increase in Mexico’s risk premium ( ):

peasant uprising in Chiapas

assassination of leading presidential candidate

Another factor:

The Federal Reserve raised U.S. interest rates

several times during 1994 to prevent U.S. inflation.

( r* > 0)

slide 27

28.

Understanding the crisisThese events put downward pressure on the peso.

Mexico’s central bank had repeatedly promised foreign investors that

it would not allow the peso’s value to fall,

so it bought pesos and sold dollars to

“prop up” the peso exchange rate.

Doing this requires that Mexico’s central bank have adequate

reserves of dollars.

Did it?

slide 28

29.

Dollar reserves of Mexico’s central bankDecember 1993 ……………… $28 billion

August 17, 1994 ……………… $17 billion

December 1, 1994 …………… $ 9 billion

December 15, 1994 ………… $ 7 billion

During 1994, Mexico’s central bank hid the

fact that its reserves were being depleted.

slide 29

30.

the disasterDec. 20: Mexico devalues the peso by 13%

(fixes e at 25 cents instead of 29 cents)

Investors are SHOCKED! – they had no idea

Mexico was running out of reserves.

, investors dump their Mexican assets and

pull their capital out of Mexico.

Dec. 22: central bank’s reserves nearly gone.

It abandons the fixed rate and lets e float.

In a week, e falls another 30%.

slide 30

31.

The rescue package1995: U.S. & IMF set up $50b line of credit to provide loan

guarantees to Mexico’s govt.

This helped restore confidence in Mexico, reduced the risk

premium.

After a hard recession in 1995, Mexico began a strong recovery

from the crisis.

slide 31

32.

CASE STUDY:The Southeast Asian crisis 1997-98

Problems in the banking system eroded

international confidence in SE Asian economies.

Risk premiums and interest rates rose.

Stock prices fell as foreign investors sold assets

and pulled their capital out.

Falling stock prices reduced the value of collateral

used for bank loans, increasing default rates,

which exacerbated the crisis.

Capital outflows depressed exchange rates.

slide 32

33.

Data on the SE Asian crisisexchange rate

stock market nominal GDP

% change from % change from

% change

7/97 to 1/98

7/97 to 1/98

1997-98

Indonesia

-59.4%

-32.6%

-16.2%

Japan

-12.0%

-18.2%

-4.3%

Malaysia

-36.4%

-43.8%

-6.8%

Singapore

-15.6%

-36.0%

-0.1%

S. Korea

-47.5%

-21.9%

-7.3%

Taiwan

-14.6%

-19.7%

n.a.

Thailand

-48.3%

-25.6%

-1.2%

U.S.

n.a.

2.7%

2.3%

slide 33

34.

CASE STUDY:The Chinese Currency Controversy

1995-2005: China fixed its exchange rate at 8.28

yuan per dollar, and restricted capital flows.

Many observers believed that the yuan was

significantly undervalued, as China was

accumulating large dollar reserves.

U.S. producers complained that China’s cheap

yuan gave Chinese producers an unfair advantage.

President Bush asked China to let its currency float;

Others in the U.S. wanted tariffs on Chinese goods.

slide 34

35.

CASE STUDY:The Chinese Currency Controversy

If China lets the yuan float, it may indeed

appreciate.

However, if China also allows greater capital

mobility, then Chinese citizens may start moving

their savings abroad.

Such capital outflows could cause the yuan to

depreciate rather than appreciate.

slide 35

economics

economics