Similar presentations:

Making banking accessible for Pakistan

1.

Making banking accessible for Pakistan2.

MARKET OPPORTUNITYLarge addressable market size

250m

population

5th most populous country in

the world

80%

of the population is unbanked

78%

Mobile internet connected

(173m connections)

9.4m

Mobile phone banking users

$50bn+

in remittences from abroad

192%

YoY growth in mobile

transaction volume

309.5m

number of financial

transactions (mobile, internet

and e-commerce) in Q1 2021

3.

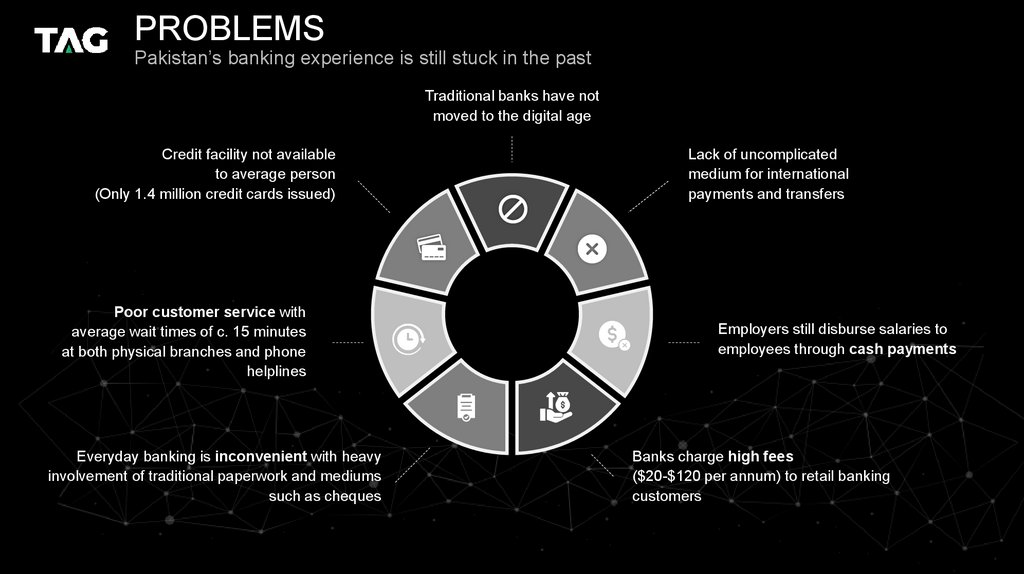

PROBLEMSPakistan’s banking experience is still stuck in the past

Traditional banks have not

moved to the digital age

Credit facility not available

to average person

(Only 1.4 million credit cards issued)

Poor customer service with

average wait times of c. 15 minutes

at both physical branches and phone

helplines

Everyday banking is inconvenient with heavy

involvement of traditional paperwork and mediums

such as cheques

Lack of uncomplicated

medium for international

payments and transfers

Employers still disburse salaries to

employees through cash payments

Banks charge high fees

($20-$120 per annum) to retail banking

customers

4.

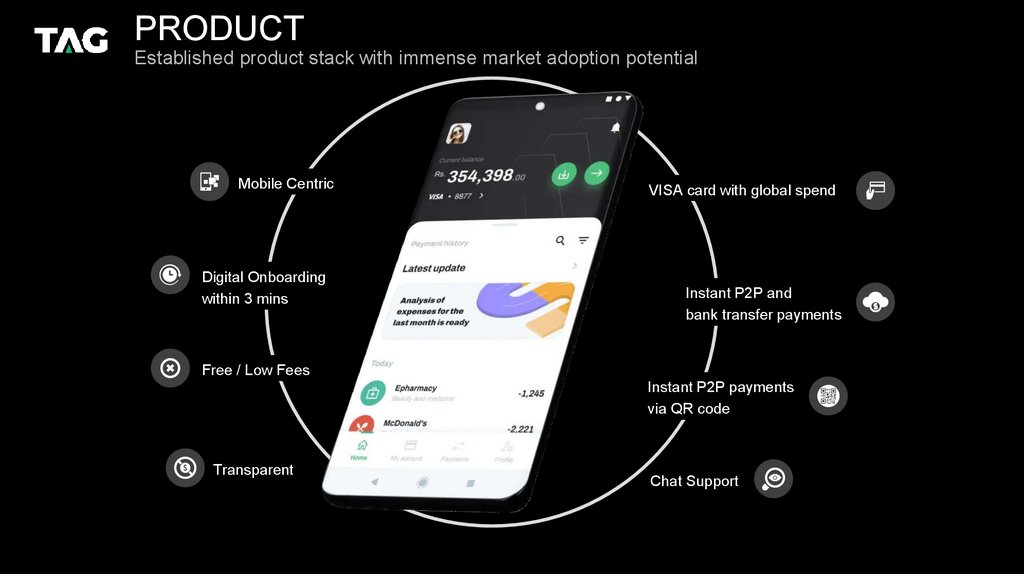

PRODUCTEstablished product stack with immense market adoption potential

Mobile Centric

Digital Onboarding

within 3 mins

VISA card with global spend

Instant P2P and

bank transfer payments

Free / Low Fees

Instant P2P payments

via QR code

Transparent

Chat Support

5.

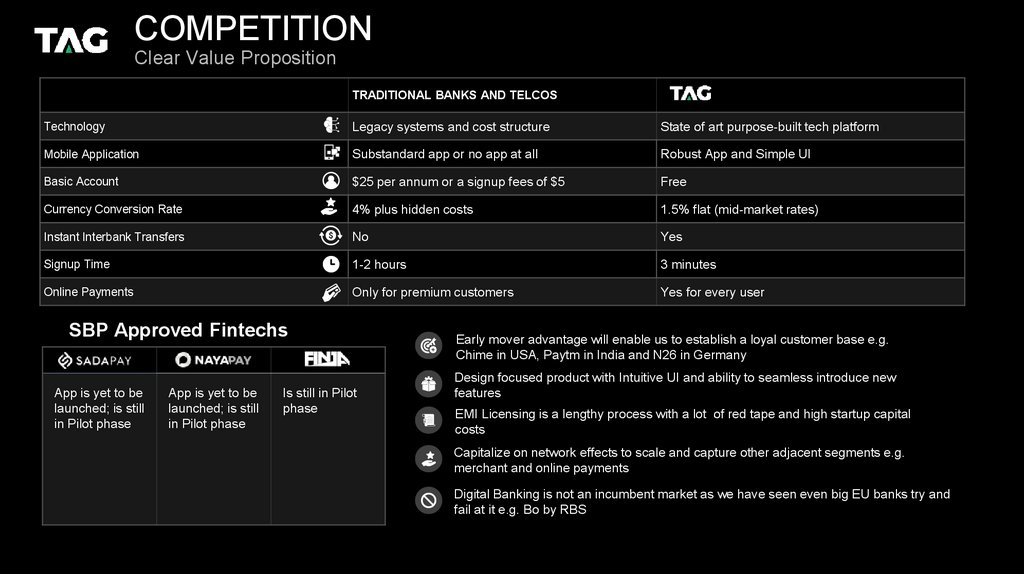

COMPETITIONClear Value Proposition

TRADITIONAL BANKS AND TELCOS

Technology

Legacy systems and cost structure

State of art purpose-built tech platform

Mobile Application

Substandard app or no app at all

Robust App and Simple UI

Basic Account

$25 per annum or a signup fees of $5

Free

Currency Conversion Rate

4% plus hidden costs

1.5% flat (mid-market rates)

Instant Interbank Transfers

No

Yes

Signup Time

1-2 hours

3 minutes

Online Payments

Only for premium customers

Yes for every user

SBP Approved Fintechs

App is yet to be

launched; is still

in Pilot phase

App is yet to be

launched; is still

in Pilot phase

Is still in Pilot

phase

Early mover advantage will enable us to establish a loyal customer base e.g.

Chime in USA, Paytm in India and N26 in Germany

Design focused product with Intuitive UI and ability to seamless introduce new

features

EMI Licensing is a lengthy process with a lot of red tape and high startup capital

costs

Capitalize on network effects to scale and capture other adjacent segments e.g.

merchant and online payments

Digital Banking is not an incumbent market as we have seen even big EU banks try and

fail at it e.g. Bo by RBS

6.

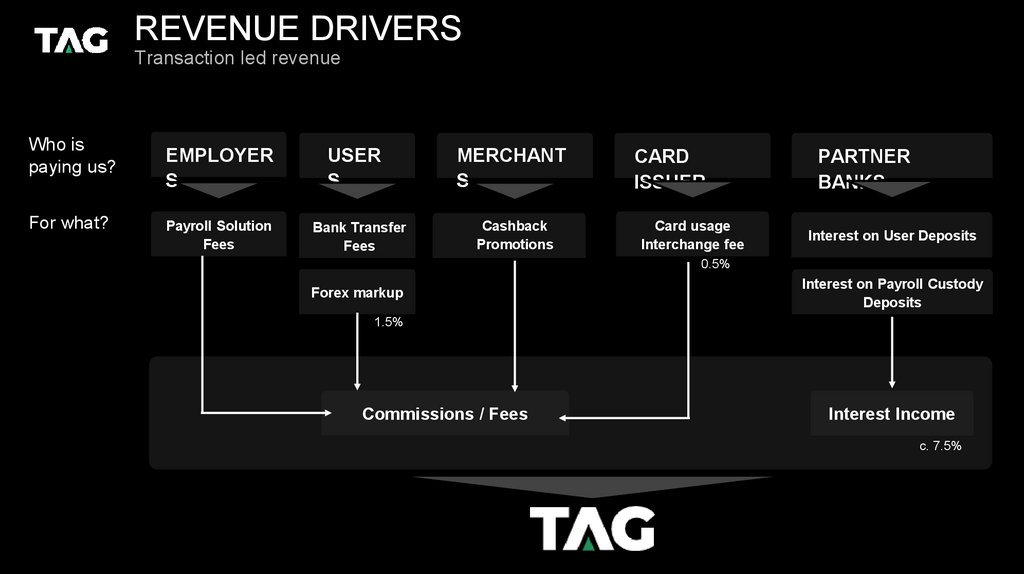

REVENUE DRIVERSTransaction led revenue

Who is

paying us?

For what?

EMPLOYER

S

Payroll Solution

Fees

USER

S

Bank Transfer

Fees

MERCHANT

S

Cashback

Promotions

CARD

ISSUER

Card usage

Interchange fee

PARTNER

BANKS

Interest on User Deposits

0.5%

Forex markup

Interest on Payroll Custody

Deposits

1.5%

Commissions / Fees

Interest Income

c. 7.5%

7.

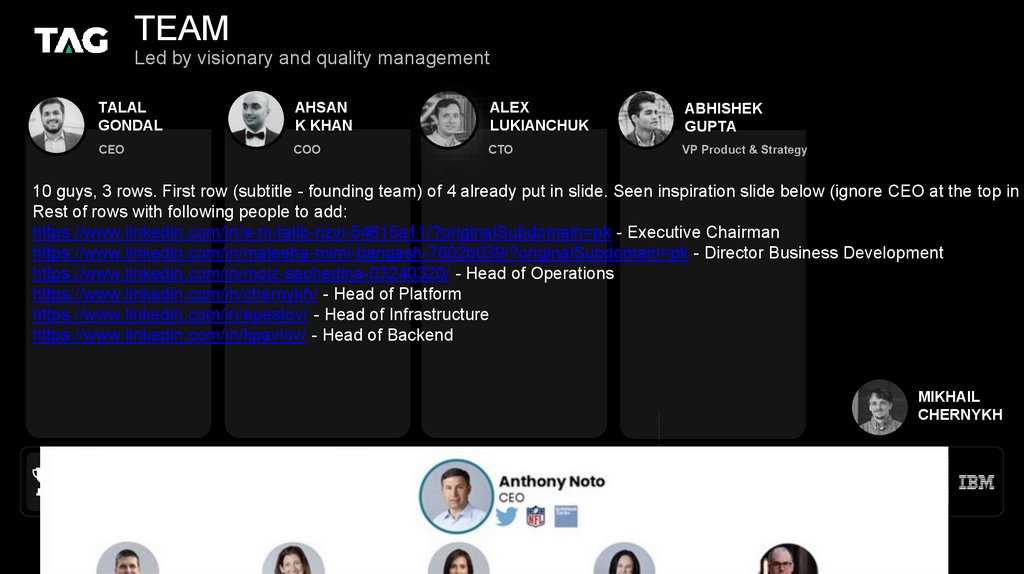

TEAMLed by visionary and quality management

TALAL

GONDAL

AHSAN

K KHAN

ALEX

LUKIANCHUK

ABHISHEK

GUPTA

CEO

COO

CTO

VP Product & Strategy

10 guys, 3 rows. First row (subtitle - founding team) of 4 already put in slide. Seen inspiration slide below (ignore CEO at the top in s

Rest of rows with following people to add:

https://www.linkedin.com/in/s-m-talib-rizvi-54615a11/?originalSubdomain=pk - Executive Chairman

https://www.linkedin.com/in/maleeha-mimi-bangash-7602b039/?originalSubdomain=pk - Director Business Development

https://www.linkedin.com/in/moiz-sachedina-03240320/ - Head of Operations

https://www.linkedin.com/in/chernykh/ - Head of Platform

https://www.linkedin.com/in/epestov/ - Head of Infrastructure

https://www.linkedin.com/in/kpavlov/ - Head of Backend

MIKHAIL

CHERNYKH

Successfully

managed

8.

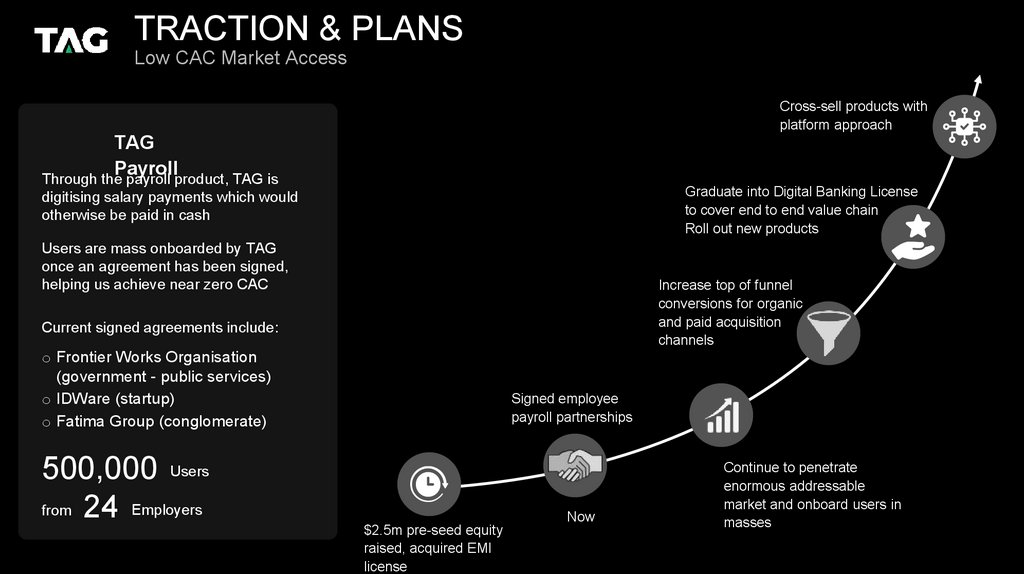

TRACTION & PLANSLow CAC Market Access

Cross-sell products with

platform approach

TAG

Payroll

Through the payroll product, TAG is

Graduate into Digital Banking License

to cover end to end value chain

Roll out new products

digitising salary payments which would

otherwise be paid in cash

Users are mass onboarded by TAG

once an agreement has been signed,

helping us achieve near zero CAC

Increase top of funnel

conversions for organic

and paid acquisition

channels

Current signed agreements include:

o Frontier Works Organisation

(government - public services)

o IDWare (startup)

o Fatima Group (conglomerate)

Signed employee

payroll partnerships

500,000 Users

from 24 Employers

Now

$2.5m pre-seed equity

raised, acquired EMI

license

Continue to penetrate

enormous addressable

market and onboard users in

masses

9.

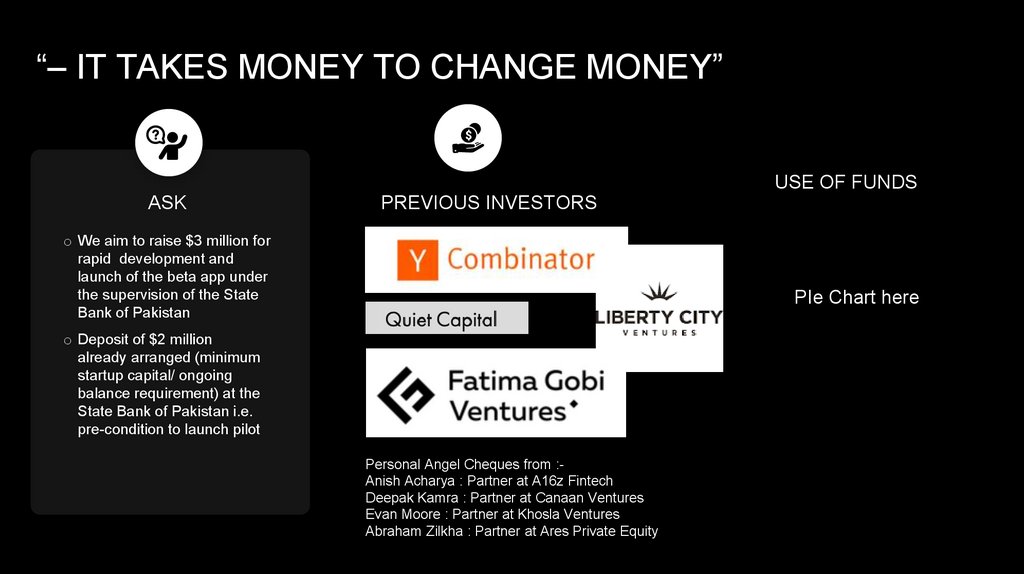

“– IT TAKES MONEY TO CHANGE MONEY”USE OF FUNDS

ASK

PREVIOUS INVESTORS

o We aim to raise $3 million for

rapid development and

launch of the beta app under

the supervision of the State

Bank of Pakistan

PIe Chart here

o Deposit of $2 million

already arranged (minimum

startup capital/ ongoing

balance requirement) at the

State Bank of Pakistan i.e.

pre-condition to launch pilot

Personal Angel Cheques from :Anish Acharya : Partner at A16z Fintech

Deepak Kamra : Partner at Canaan Ventures

Evan Moore : Partner at Khosla Ventures

Abraham Zilkha : Partner at Ares Private Equity

finance

finance