Similar presentations:

Russia softwood timber market developments

1.

RUSSIA SOFTWOOD TIMBERMARKET DEVELOPMENTS

Sviatoslav Bychkov, ILIM TIMBER

DANA 2021 NZ Forest - Wood Products Outlook Conference

Auckland March 16th 2021

2.

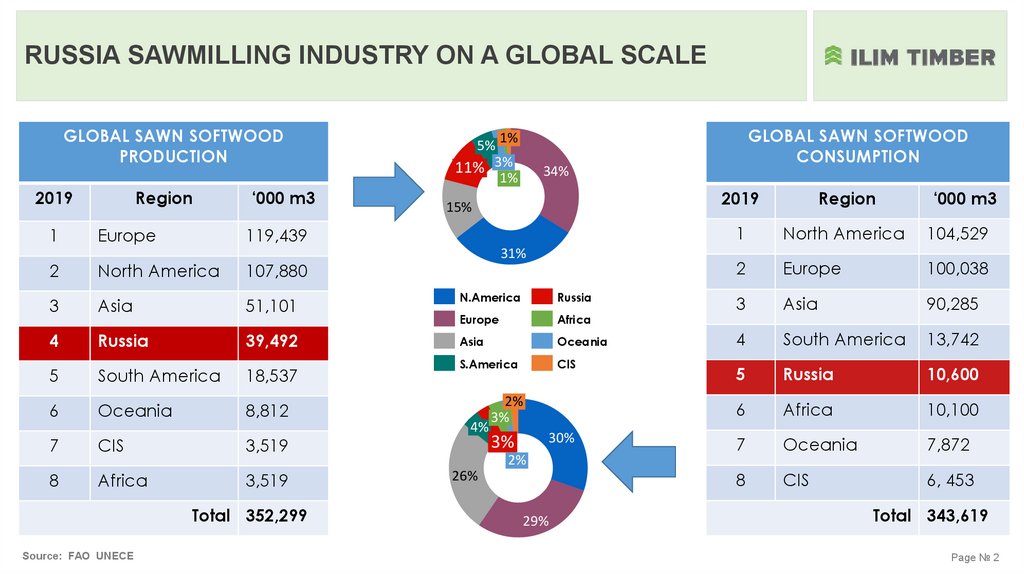

RUSSIA SAWMILLING INDUSTRY ON A GLOBAL SCALEGLOBAL SAWN SOFTWOOD

PRODUCTION

2019

1

Region

Europe

‘000 m3

1%

5%

11% 3%

1%

34%

15%

119,439

31%

2

North America

107,880

3

Asia

51,101

N.America

Russia

Europe

Africa

4

Russia

39,492

Asia

Oceania

5

South America

18,537

S.America

CIS

6

Oceania

8,812

7

8

CIS

Africa

3,519

3,519

Total 352,299

Source: FAO UNECE

4%

GLOBAL SAWN SOFTWOOD

CONSUMPTION

2%

3%

30%

3%

2%

26%

29%

2019

Region

‘000 m3

1

North America

104,529

2

Europe

100,038

3

Asia

90,285

4

South America

13,742

5

Russia

10,600

6

Africa

10,100

7

Oceania

7,872

8

CIS

6, 453

Total 343,619

Page № 2

3.

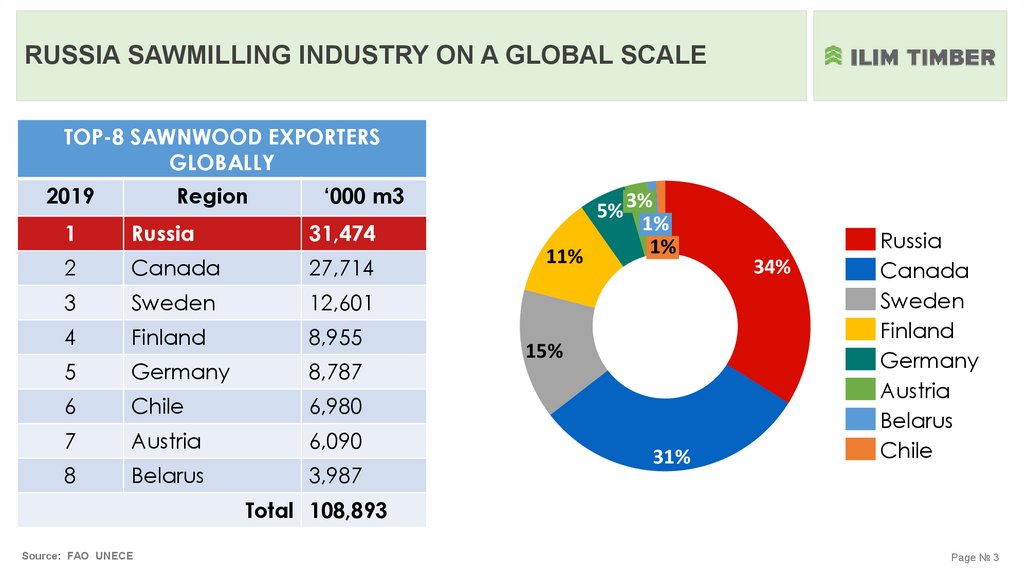

RUSSIA SAWMILLING INDUSTRY ON A GLOBAL SCALETOP-8 SAWNWOOD EXPORTERS

GLOBALLY

2019

Region

‘000 m3

1

Russia

31,474

2

Canada

27,714

3

Sweden

12,601

4

Finland

8,955

5

Germany

8,787

6

Chile

6,980

7

Austria

6,090

8

Belarus

3,987

5% 3%

1%

1%

11%

15%

31%

34%

Russia

Canada

Sweden

Finland

Germany

Austria

Belarus

Chile

Total 108,893

Source: FAO UNECE

Page № 3

4.

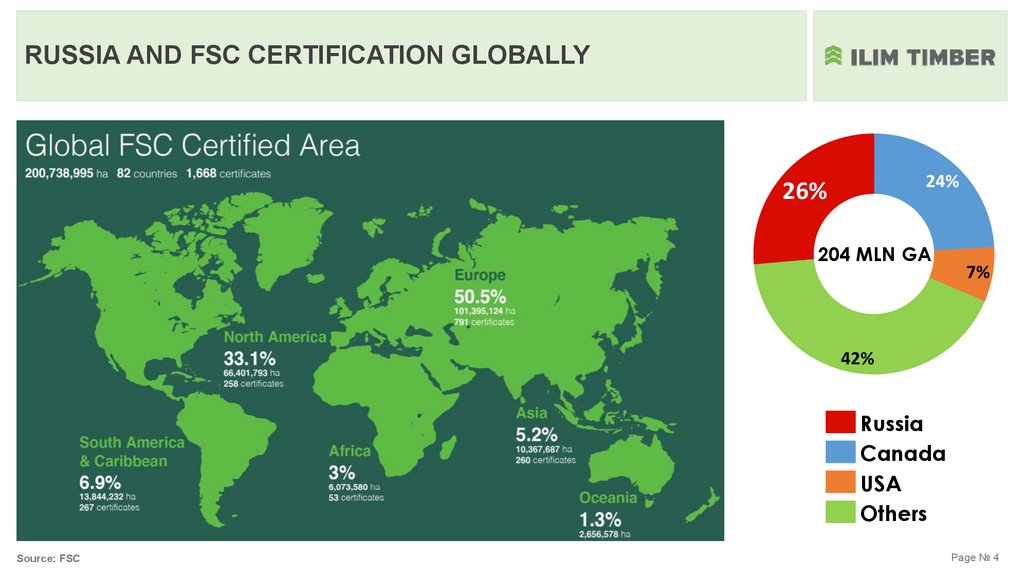

RUSSIA AND FSC CERTIFICATION GLOBALLY24%

26%

204 MLN GA

7%

42%

Russia

Canada

USA

Others

Source: FSC

Page № 4

5.

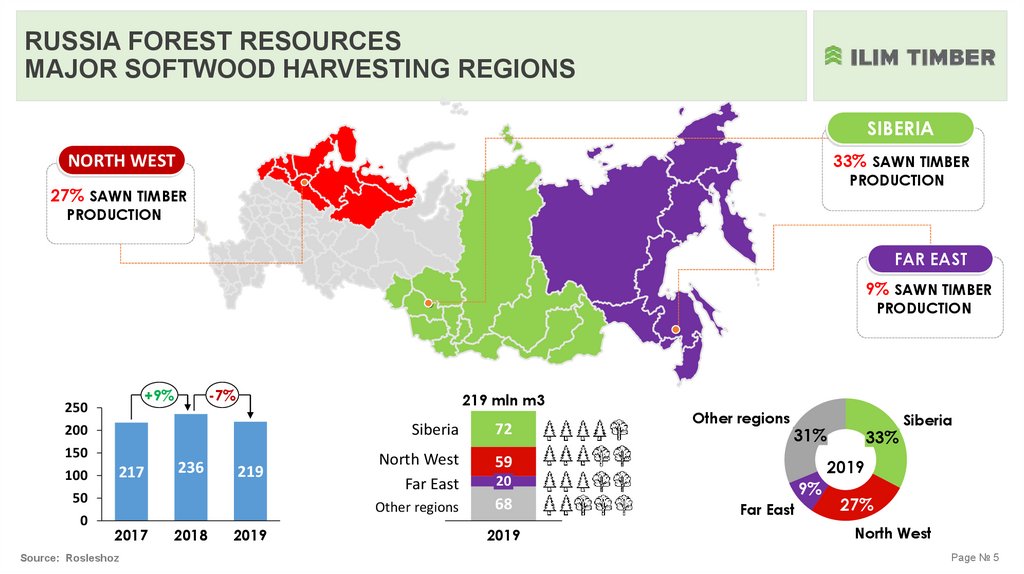

RUSSIA FOREST RESOURCESMAJOR SOFTWOOD HARVESTING REGIONS

SIBERIA

33% SAWN TIMBER

NORTH WEST

PRODUCTION

27% SAWN TIMBER

PRODUCTION

FAR EAST

9% SAWN TIMBER

PRODUCTION

+9%

250

-7%

219 mln m3

200

150

100

217

236

219

50

0

2017

Source: Rosleshoz

2018

2019

Siberia

72

North West

Far East

59

Other regions

68

Other regions

31%

2019

20

2019

33%

Siberia

9%

Far East

27%

North West

Page № 5

6.

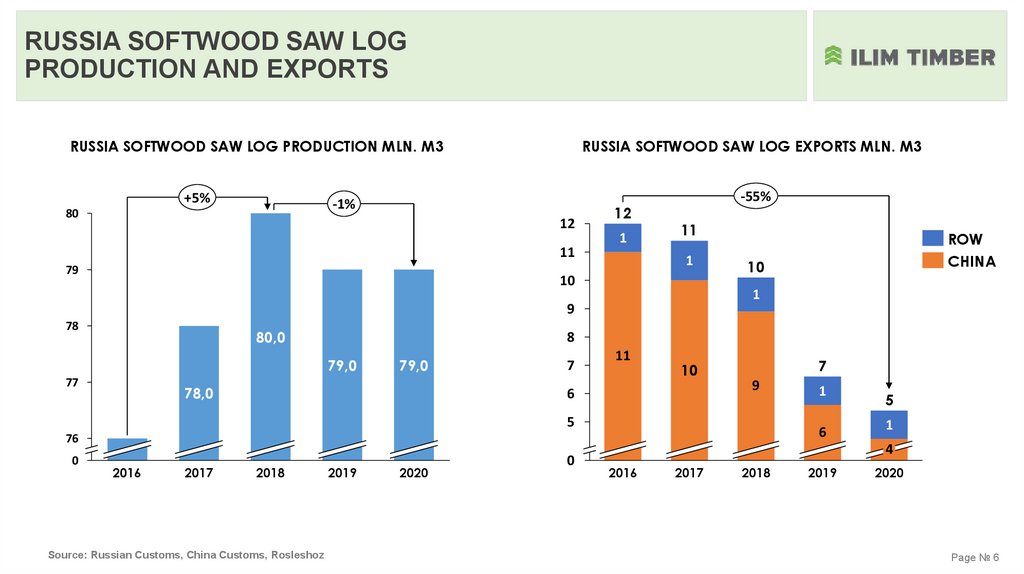

RUSSIA SOFTWOOD SAW LOGPRODUCTION AND EXPORTS

RUSSIA SOFTWOOD SAW LOG PRODUCTION MLN. M3

+5%

RUSSIA SOFTWOOD SAW LOG EXPORTS MLN. M3

-1%

80

12

11

79

12

1

-55%

11

1

10

80,0

8

79,0

77

10

1

9

78

79,0

78,0

7

11

7

10

9

6

5

76

0

2016

2017

2018

Source: Russian Customs, China Customs, Rosleshoz

ROW

CHINA

2019

2020

0

1

5

6

1

4

2016

2017

2018

2019

2020

Page № 6

7.

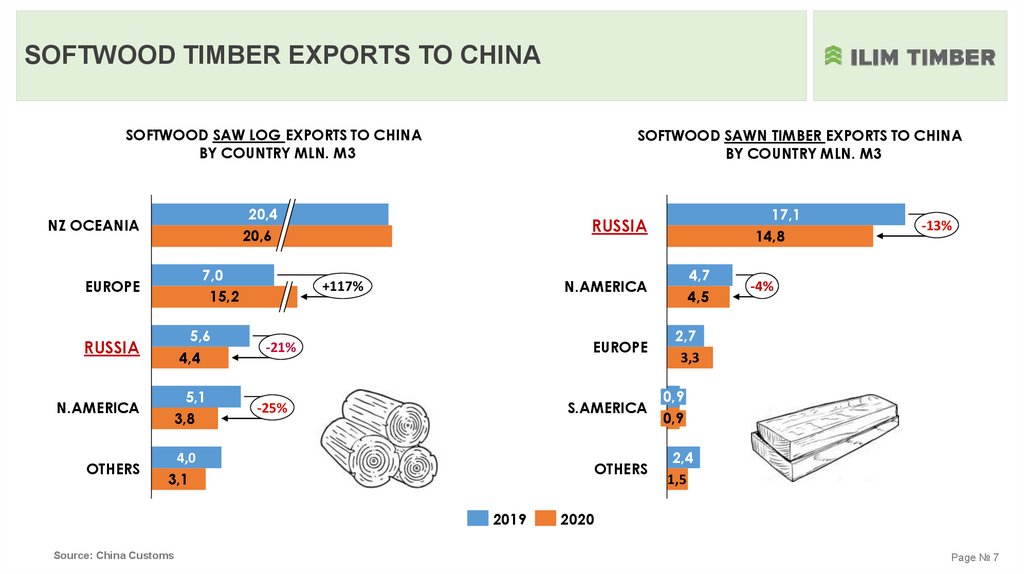

SOFTWOOD TIMBER EXPORTS TO CHINASOFTWOOD SAW LOG EXPORTS TO CHINA

BY COUNTRY MLN. M3

20,4

20,6

NZ OCEANIA

7,0

15,2

EUROPE

RUSSIA

5,6

4,4

N.AMERICA

5,1

3,8

OTHERS

SOFTWOOD SAWN TIMBER EXPORTS TO CHINA

BY COUNTRY MLN. M3

4,7

4,5

N.AMERICA

+117%

EUROPE

-21%

S.AMERICA

-25%

4,0

3,1

OTHERS

2019

Source: China Customs

17,1

14,8

RUSSIA

-13%

-4%

2,7

3,3

0,9

0,9

2,4

1,5

2020

Page № 7

8.

RUSSIA SOFTWOOD SAWN TIMBER EXPORTSVOLUME, SPECIES AND ORIGING MLN M3

+44%

31

Larch

-5%

30

29

3,3

11,4

Spruce

14,2

Pine

28

27

26

30,8

29,4

25

24

26,8

23

16%

27,6

FAR EAST 10%

2020

24,3

22

0

OTHERS

44% SIBERIA

22,4

21,4

2014

30%

2015

Source: Russian Customs

2016

2017

2018

2019

2020

NORTH WEST

Page № 8

9.

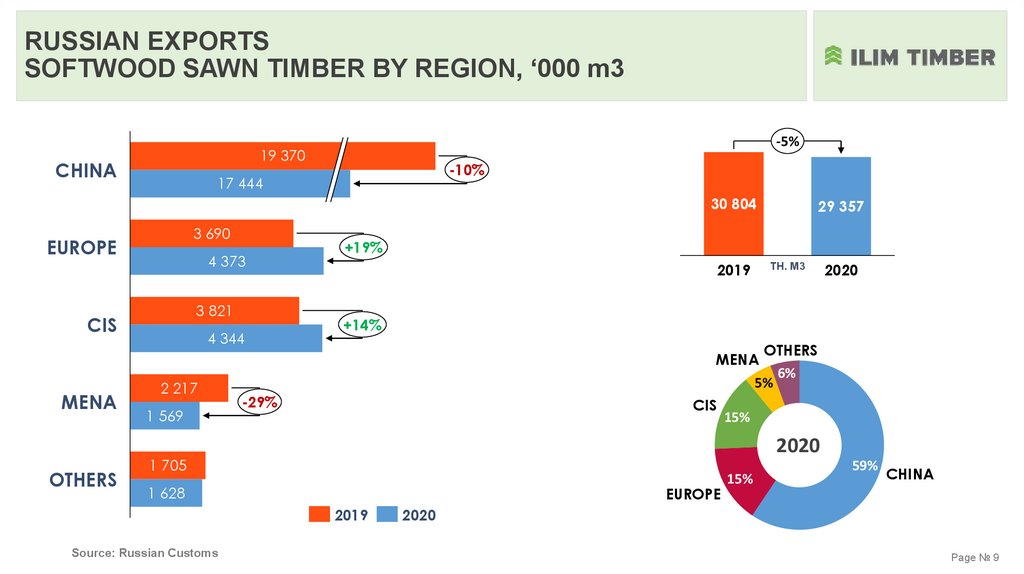

RUSSIAN EXPORTSSOFTWOOD SAWN TIMBER BY REGION, ‘000 m3

-5%

19 370

CHINA

-10%

17 444

30 804

3 690

EUROPE

4 373

3 821

CIS

MENA

OTHERS

4 344

2 217

1 569

+19%

2019

TH. M3

2020

+14%

OTHERS

MENA

6%

5%

-29%

CIS

15%

2020

1 705

1 628

EUROPE

2019

Source: Russian Customs

29 357

15%

59%

CHINA

2020

Page № 9

10.

SAWN TIMBER CONTAINER SHIPMENT TO CHINA.RAILWAY AND SEA TRANSPORT

EXPORT BY LAND

Russia—China 2019-2020 H1*

Zabaikalsk – 327 036 TEU

Naushki – 307 528 TEU

Dostyk – 73 556 TEU

Grodekovo – 50 792 TEU

St. Petersburg

Moscow

Nizhny Novgorod

Ekaterinburg

Novorossiysk

Zabaikalsk

Naushki

Dostyk

Manchukuo

Changchun

Shenyang

Zamyn-Uud

Beijin

g

Shílóng

Chendu

Wuhan

Chongqing

Border crossings/Ports

*Source: MCC of the Russian Railways

Dalian

Incheon

Quingdao

St. Petersburg – 240 268 TEU

Vladivostok – 233 480 TEU

Novorossiysk – 1 396 TEU

Representative office of

RZHD Logistika, OAO

Grodekovo

Vladivostok

Irkutsk

EXPORT BY SEA

Russia—China 2019-2020 H1*

Krasnoyarsk

Novosibirsk

Nanking

Suzhou

Shanghai

Yiwu

Changsha

Freight consolidation points

Page № 10

11.

ONE BELT, ONE ROADEXPORT BY LAND

Russia—China 2019-2020H1*

• Krasnoyarsk

(Bazaiha st./Krasnoyarsk st.)

2 968 TEU

• Irkutsk (Batareynaya st.)

2 156 TEU

• Novosibirsk

(Inya-Vostochnaya st. /Klechiha st.)

840 TEU

• Kirov (Luza st.)

176 TEU

THE GROWTH OF CARGO TURNOVER AT THE BORDER

CROSSING IN ZABAIKALSK WILL BE 71% BY 2025.

INVESTMENT IN MODERNIZATION OF THE RAILWAY HUB

AMOUNTS TO 21.9 BILLION RUBLES

Kirov

Krasnoyarsk

Zabaykalsk

Novosibirsk

Irkutsk

Manzhouli

16 days for

container train

Naushki

Zamyn-Uud

Beijing

Tianjin

Suzhou

Shanghai

Chendu

Chongqing

Shipping points

Delivery points

*Source: MCC of the Russian Railways

Border crossings

Page № 11

12.

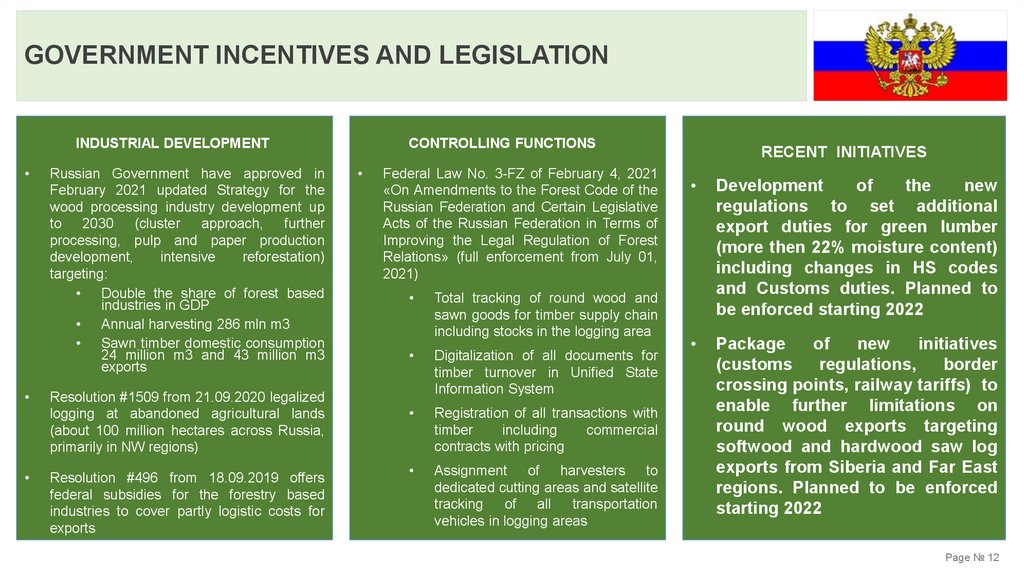

GOVERNMENT INCENTIVES AND LEGISLATIONINDUSTRIAL DEVELOPMENT

Russian Government have approved in

February 2021 updated Strategy for the

wood processing industry development up

to

2030

(cluster

approach,

further

processing, pulp and paper production

development,

intensive

reforestation)

targeting:

• Double the share of forest based

industries in GDP

Annual harvesting 286 mln m3

Sawn timber domestic consumption

24 million m3 and 43 million m3

exports

Resolution #1509 from 21.09.2020 legalized

logging at abandoned agricultural lands

(about 100 million hectares across Russia,

primarily in NW regions)

Resolution #496 from 18.09.2019 offers

federal subsidies for the forestry based

industries to cover partly logistic costs for

exports

CONTROLLING FUNCTIONS

Federal Law No. 3-FZ of February 4, 2021

«On Amendments to the Forest Code of the

Russian Federation and Certain Legislative

Acts of the Russian Federation in Terms of

Improving the Legal Regulation of Forest

Relations» (full enforcement from July 01,

2021)

Total tracking of round wood and

sawn goods for timber supply chain

including stocks in the logging area

Digitalization of all documents for

timber turnover in Unified State

Information System

Registration of all transactions with

timber

including

commercial

contracts with pricing

Assignment of

harvesters

to

dedicated cutting areas and satellite

tracking

of

all

transportation

vehicles in logging areas

RECENT INITIATIVES

Development

of

the

new

regulations to set additional

export duties for green lumber

(more then 22% moisture content)

including changes in HS codes

and Customs duties. Planned to

be enforced starting 2022

Package

of

new

initiatives

(customs

regulations,

border

crossing points, railway tariffs) to

enable further limitations on

round wood exports targeting

softwood and hardwood saw log

exports from Siberia and Far East

regions. Planned to be enforced

starting 2022

Page № 12

13.

CONCLUSIONS• China remains the key market for Russian sawmills in all major lumber

production regions. «One Belt One Road» strategic initiative will give more

opportunities for Russian exporters

• Russian saw milling industry achieved maximal historic export volumes in

2019. The availability of saw log became a major limiting factor for further

growth in production capacity utilization

• Russian State in past 10 years has successfully promoted investments in

saw milling and is taking next steps to stop saw log exports completely in

order to increase share of further processing

• Recent Government incentives will drive modernization projects at existing

sawmills. The share of kiln dried sawn goods in Russian exports will

increase as well as further processed timber in the domestic market

Page № 13

14.

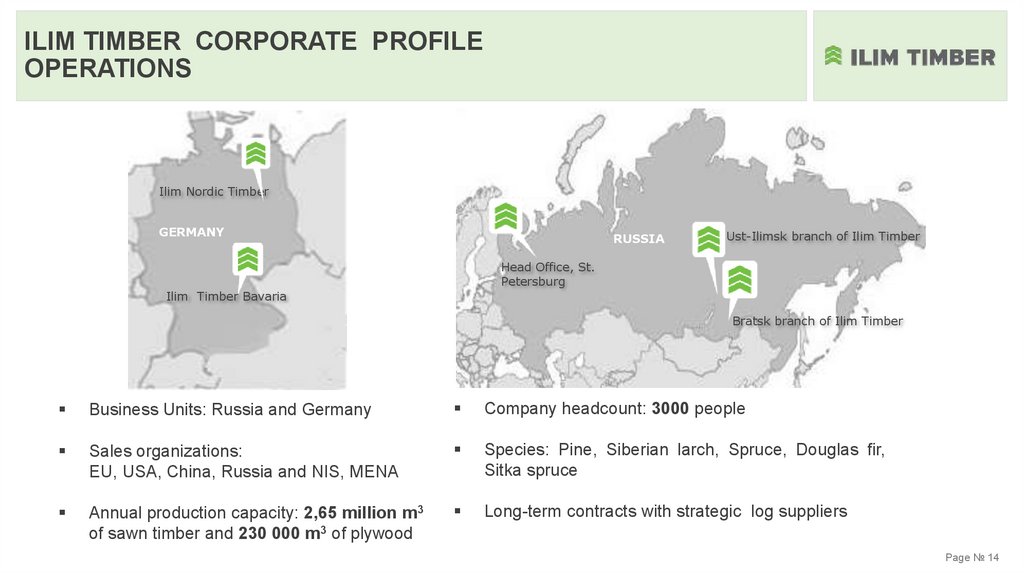

ILIM TIMBER CORPORATE PROFILEOPERATIONS

Ilim Nordic Timber

GERMANY

RUSSIA

Ust-Ilimsk branch of Ilim Timber

Head Office, St.

Petersburg

Ilim Timber Bavaria

Bratsk branch of Ilim Timber

Business Units: Russia and Germany

Company headcount: 3000 people

Sales organizations:

EU, USA, China, Russia and NIS, MENA

Species: Pine, Siberian larch, Spruce, Douglas fir,

Sitka spruce

Annual production capacity: 2,65 million m3

of sawn timber and 230 000 m3 of plywood

Long-term contracts with strategic log suppliers

Page № 14

15.

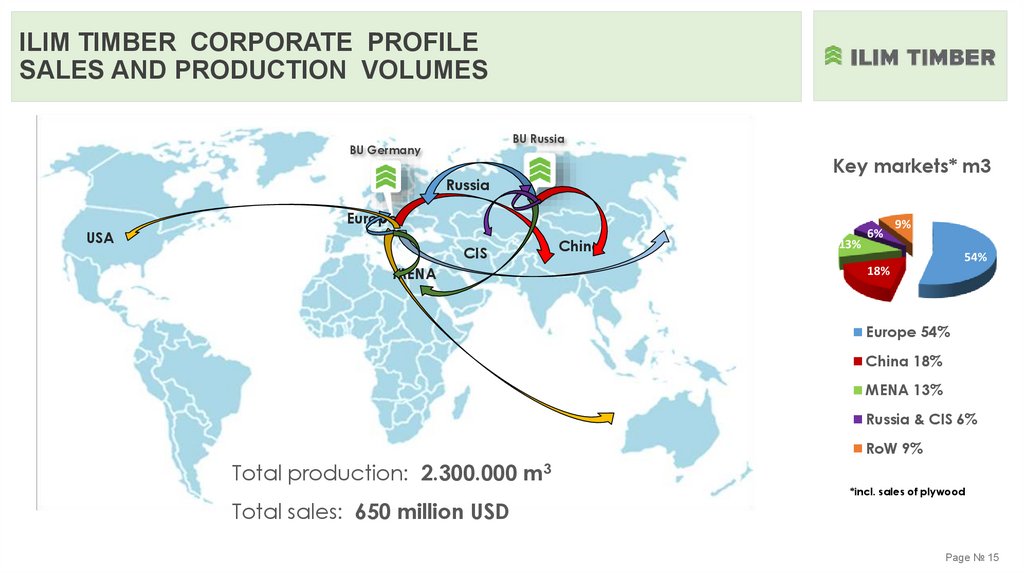

ILIM TIMBER CORPORATE PROFILESALES AND PRODUCTION VOLUMES

BU Russia

BU Germany

Key markets* m3

Russia

Europe

USA

CIS

MENA

China

13%

6%

9%

54%

18%

Europe 54%

China 18%

MENA 13%

Russia & CIS 6%

RoW 9%

Total production: 2.300.000 m3

Total sales: 650 million USD

*incl. sales of plywood

Page № 15

16.

THANK YOUFOR YOUR ATTENTION!

Page № 16

marketing

marketing