Similar presentations:

Investments. Cash flow

1. INVESTMENTS

Ivan Kotliarovivan.kotliarov@mail.ru

2. CASH FLOW

• Net amount of cash being transferred inand out of a business during a given

period of time

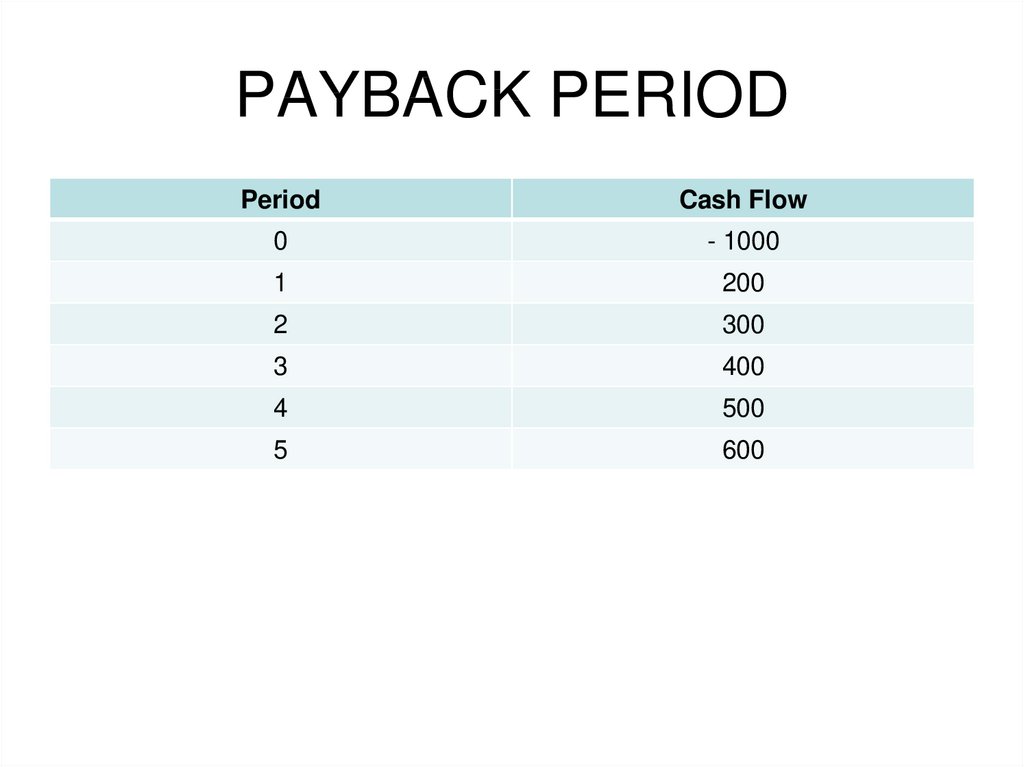

3. PAYBACK PERIOD

• Number of years necessary for thecomplete compensation of investments

4. PAYBACK PERIOD

PeriodCash Flow

0

- 1000

1

200

2

300

3

400

4

500

5

600

5. PAYBACK PERIOD

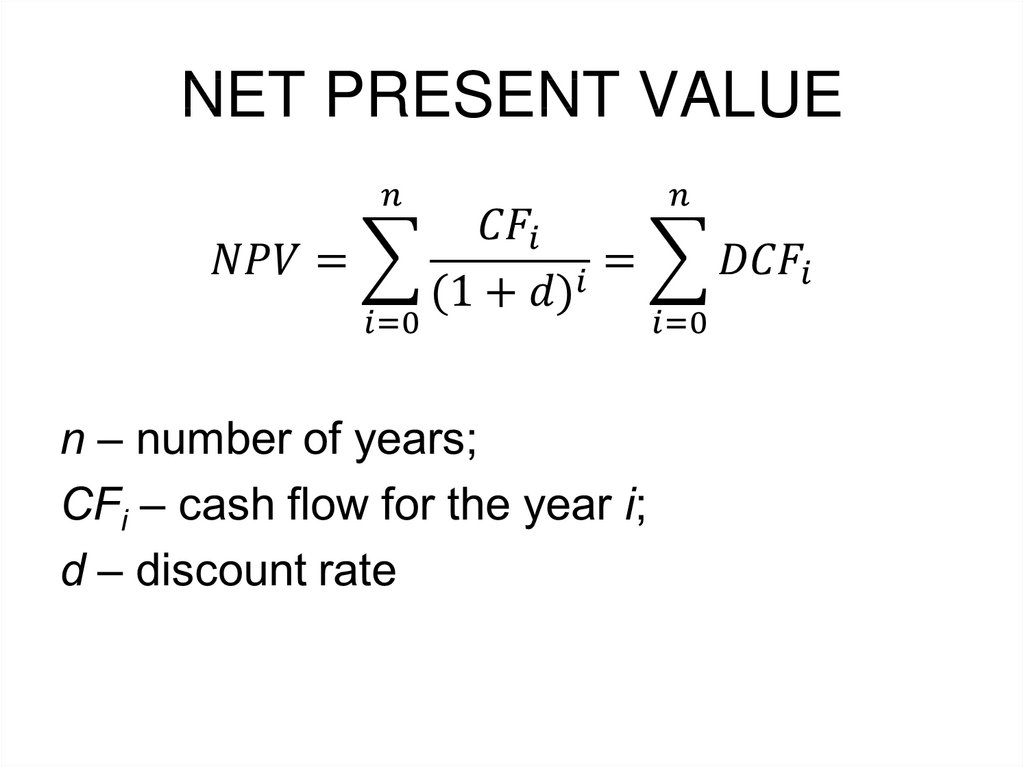

6. NET PRESENT VALUE

7. NET PRESENT VALUE

PeriodCash Flow

0

- 1000

1

200

2

300

3

400

4

500

5

600

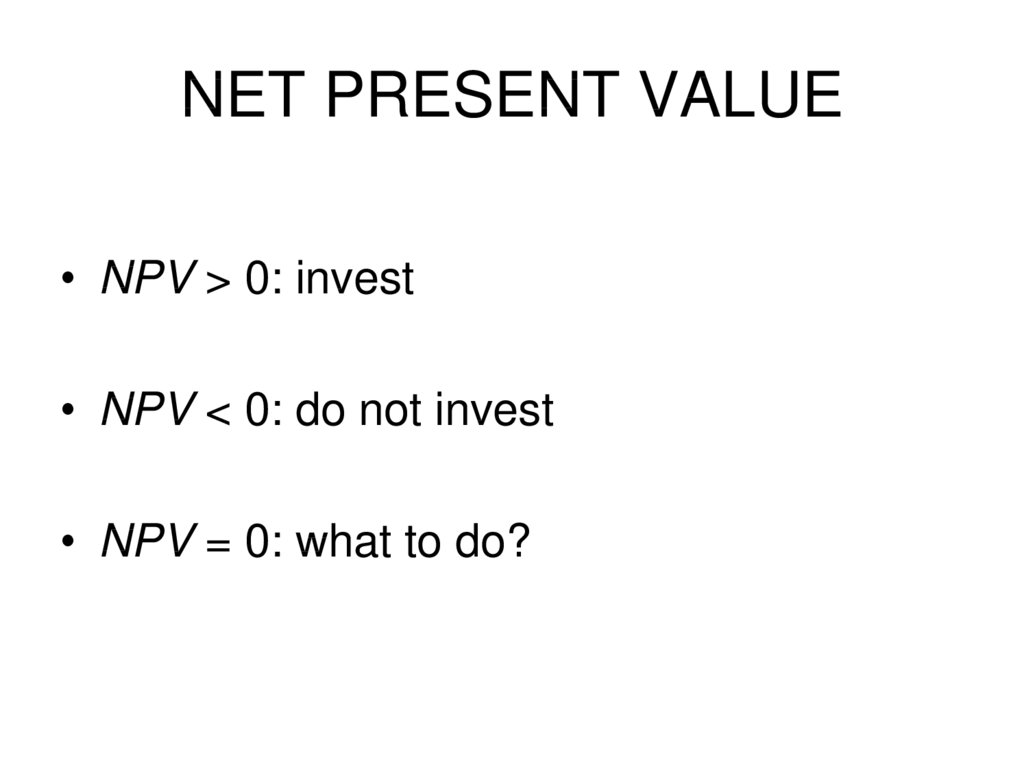

8. NET PRESENT VALUE

• NPV > 0: invest• NPV < 0: do not invest

• NPV = 0: what to do?

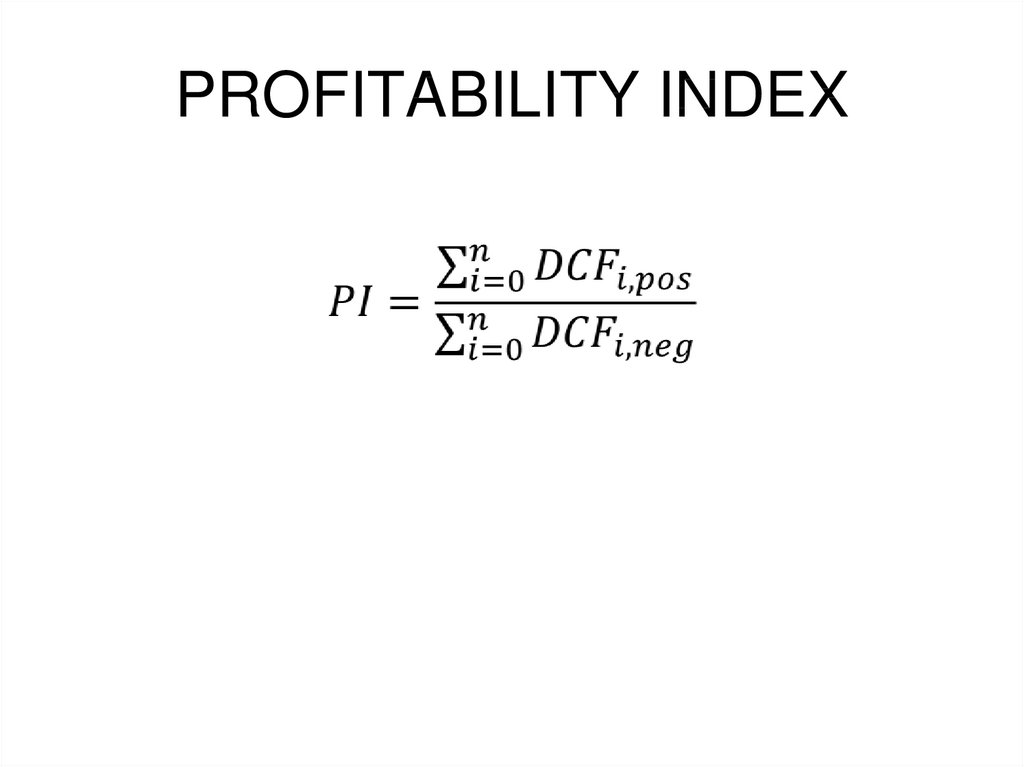

9. PROFITABILITY INDEX

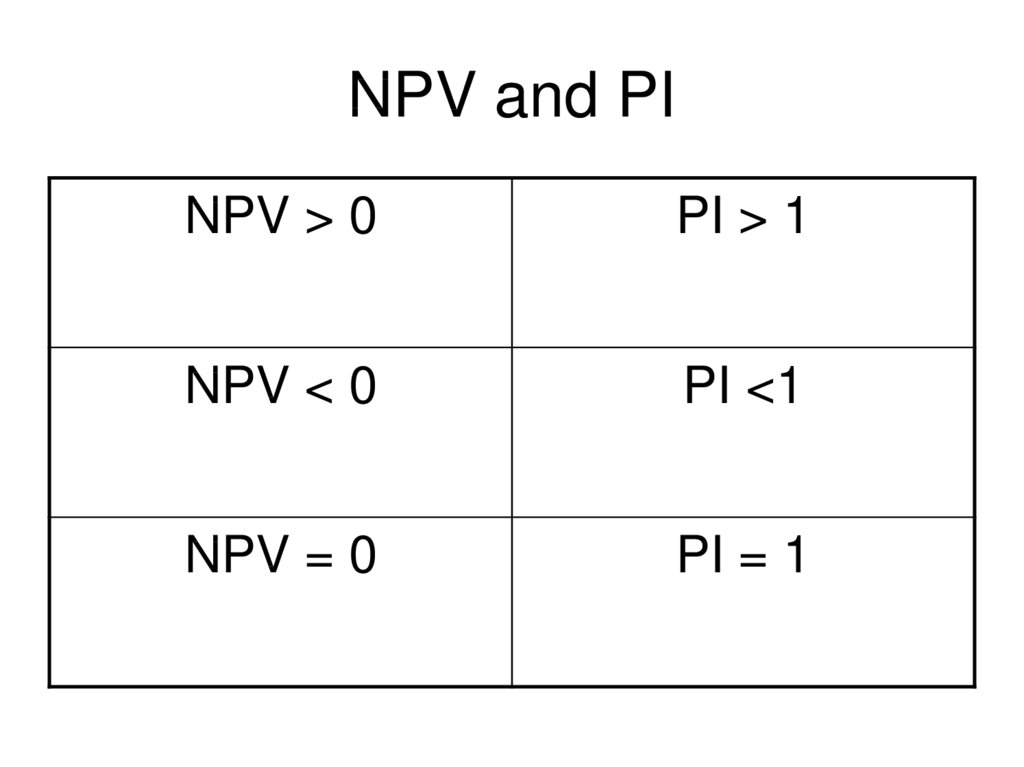

10. NPV and PI

NPV > 0PI > 1

NPV < 0

PI <1

NPV = 0

PI = 1

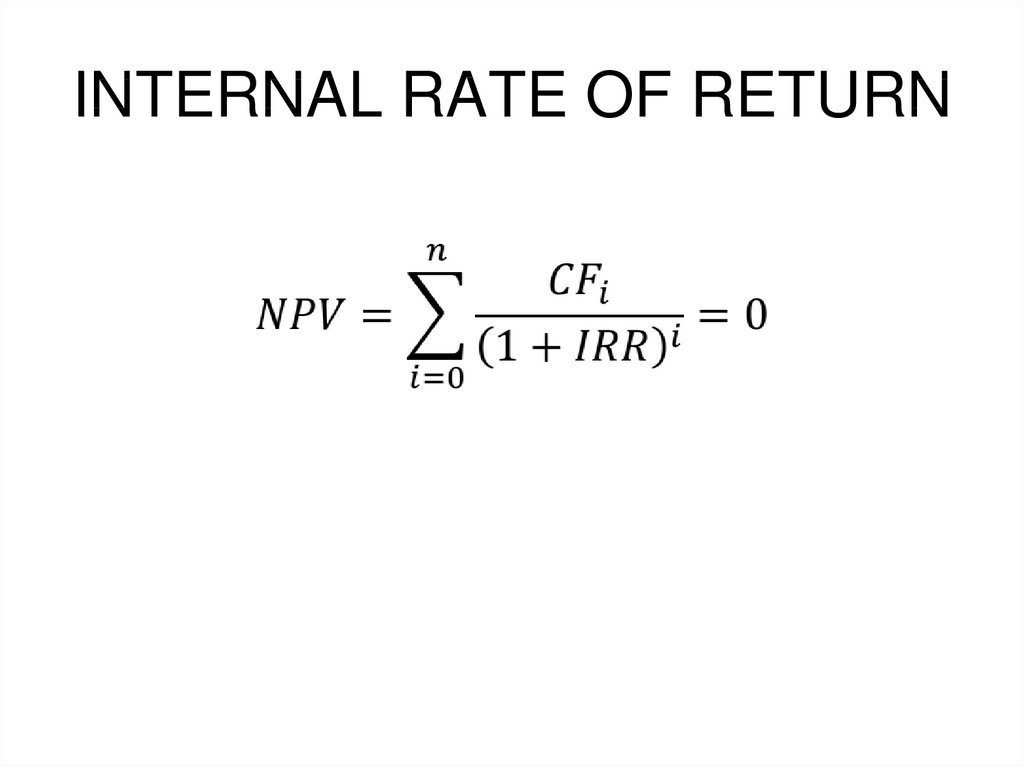

11. INTERNAL RATE OF RETURN

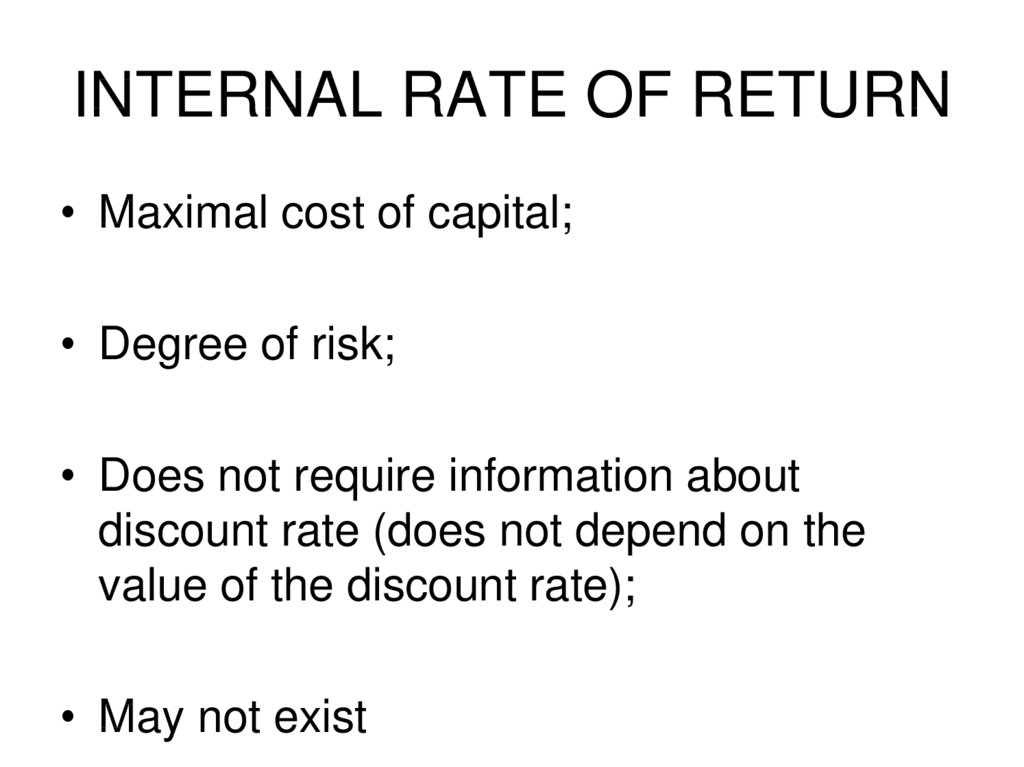

12. INTERNAL RATE OF RETURN

• Maximal cost of capital;• Degree of risk;

• Does not require information about

discount rate (does not depend on the

value of the discount rate);

• May not exist

13. INVESTMENT PROJECTS

Standard ProjectsNon-standard Projects

• Standard Cash Flows

(just one change of sign)

• Non-standard Cash

Flows (more than one

change of sign)

finance

finance