Similar presentations:

Evaluating Strategic Options and Risk Assessment Business Planning

1. CH11. Evaluating Strategic Options and Risk Assessment

Business Planning2. Qualitative Evaluation of Strategic Choice

Consistency

Validity

Feasibility

Business Risk

Flexibility

3. Valuation Techniques Involving Comparable Business

Price/Earnings Ratio

EV/EBITDA Ratio

EV/Sales Ratio

EV/Customer Ratio

4. Discounted Cash Flow Analysis

• Principle 1. $1 today is worth morethan $1 tomorrow.

• Principle 2. A safe $1 is worth more

than a risky $1.

• Risk and Reward

• The Capital Asset Price Model

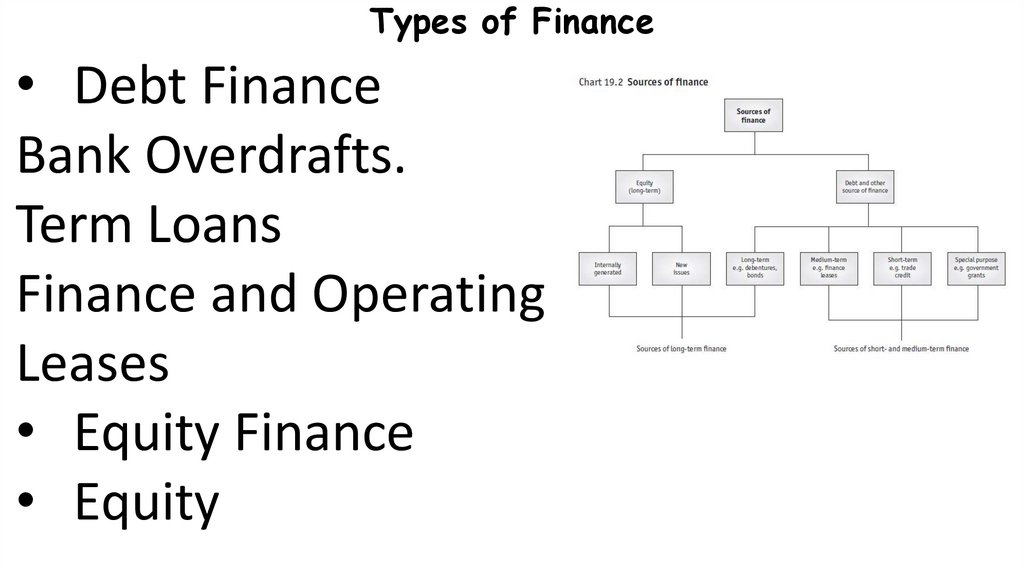

5. Types of Finance

• Debt FinanceBank Overdrafts.

Term Loans

Finance and Operating

Leases

• Equity Finance

• Equity

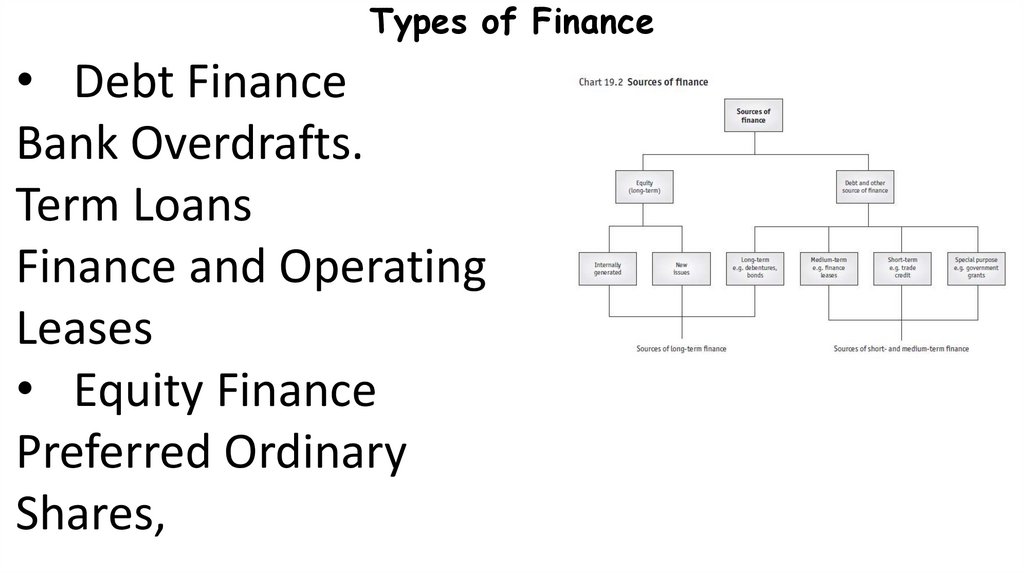

6. Types of Finance

• Debt FinanceBank Overdrafts.

Term Loans

Finance and Operating

Leases

• Equity Finance

Preferred Ordinary

Shares,

7. Risk Analysis

The dimensions of risk

The value of resources devoted to the project.

The proportion of total business resources represented by those resources.

The length of time for which the resources will be devoted to the project.

The inherent risk of the project.

The cost of exiting the project.

The recoverable costs were the project to fail

.

8. Risk Analysis

Types of Risk

Business risks can be categorized as:

1.Operational

2.Industry

3.Financial

4.Political

9. Operational Risks

Operational Risks

Key staff resign or are poached by a competitor.

Unforeseen problems occur in the production process.

Machinery breaks down or is incompatible with the raw materials.

Stocks become damaged.

Fire, theft and floods.

Information technology problems occur.

The product is so successful that the business cannot meet

demand.

The actions of a rogue employee result in large liabilities for the

business.

10. Industry Risks

Industry risks are caused by external developments in the industryand may develop as a result of actions by the business itself. They

include the following:

• A new firm enters the market.

• A key supplier closes and prevents the supply of crucial raw

materials.

• Demand for the product falls or fails to materialize.

• A competitor aggressively cuts prices.

• A new technology is developed making existing products

obsolete.

• Two competitors merge providing them with a major cost

advantage.

11. Financial Risks

Potential financial risks include the following:• A stockmarket collapse prevents a crucial fundraising equity issue

or a merger with a competitor.

• Interest rates increase dramatically, raising the cost of servicing

the business’s debts.

• There is a significant devaluation, which increases the costs of raw

materials purchased from abroad.

• High demand for the product leads to overtrading and a lack of

available working capital to fund the business’s activities.

12. Political Risks

Political risks include not only governmental risks but also thoseresulting from the actions of trade unions, lobbyists and activists.

They include the following:

• Sanctions imposed on a country prevent access to customers or

raw materials.

• Taxation rates are changed or taxation policy is altered.

• Grants, loans and subsidies are altered.

• Trade unions organise industrial action, preventing production

from continuing.

• Pressure from lobbyists requires a change in the business

practices of the business.

• The business suffers organised vandalism by radical protesters.

13. Risk Assessment

Quantifying the risksThe business planning model can be used to examine the financial

impact of risk. A useful technique is to run a sensitivity analysis

across the key inputs in the model that best relate to the identified

risks. Examples of typical inputs are as follows:

• The quantity demanded of the product.

• The selling price of the product.

• Distribution costs.

• Sales and marketing costs.

• The cost of raw materials.

• Interest rates.

• Taxation rates.

• Exchange rates.

14. Risk Assessment

Quantifying the risksThe business planning model can be used to examine the financial

impact of risk. A useful technique is to run a sensitivity analysis

across the key inputs in the model that best relate to the identified

risks. Examples of typical inputs are as follows:

• The quantity demanded of the product.

• The selling price of the product.

• Distribution costs.

• Sales and marketing costs.

• The cost of raw materials.

• Interest rates.

• Taxation rates.

• Exchange rates.

business

business