Similar presentations:

Biotech business: funding opportunities

1.

BIOTECH BUSINESS:FUNDING

OPPORTUNITIES

2.

PRODUCT DEVELOPMENT CYCLE FOR A DRUG3.

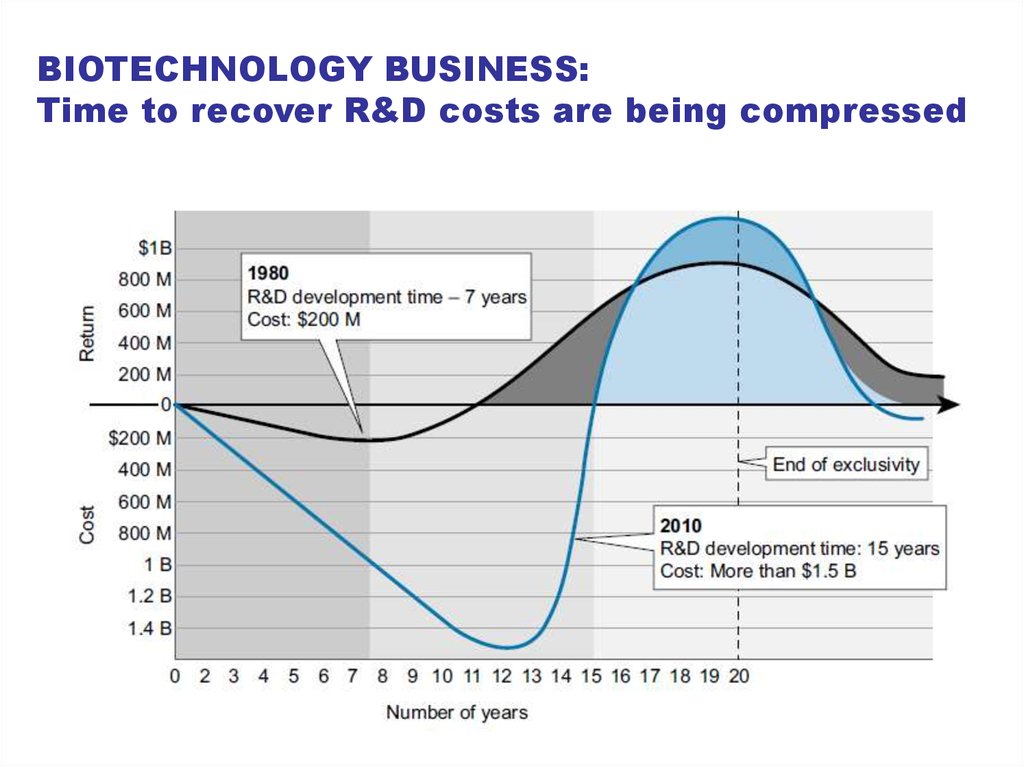

BIOTECHNOLOGY BUSINESS:Time to recover R&D costs are being compressed

4.

THE VALUE OF THE BIOTECH COMPANY’S ASSETvaries with market and geographic region

5.

THE SAN FRANCISCO BAY AREAa major biotechnology claster

6.

THE BOSTON/CAMBRIDGEa world-top biotechnology claster

7.

BioBAT AT BROOKLING ARMY TERMINALa biotechnology incubator

8.

SILICON VALLEY9.

MEDICON VALLEY10.

WHAT IS A BIOTECH CLUSTER?Abundance of high quality, adequately funded academic

research

Ready resource of seasoned and experienced biotechnology

entrepreneurs

Ready access to sources of at-risk, early and developmentstage capital willing to fund start-up concepts

Adequate supply of technically skilled workforce

experienced in the biotechnology industry

Availability of dedicated wet-laboratory and specialized

facilities at affordable rates

11.

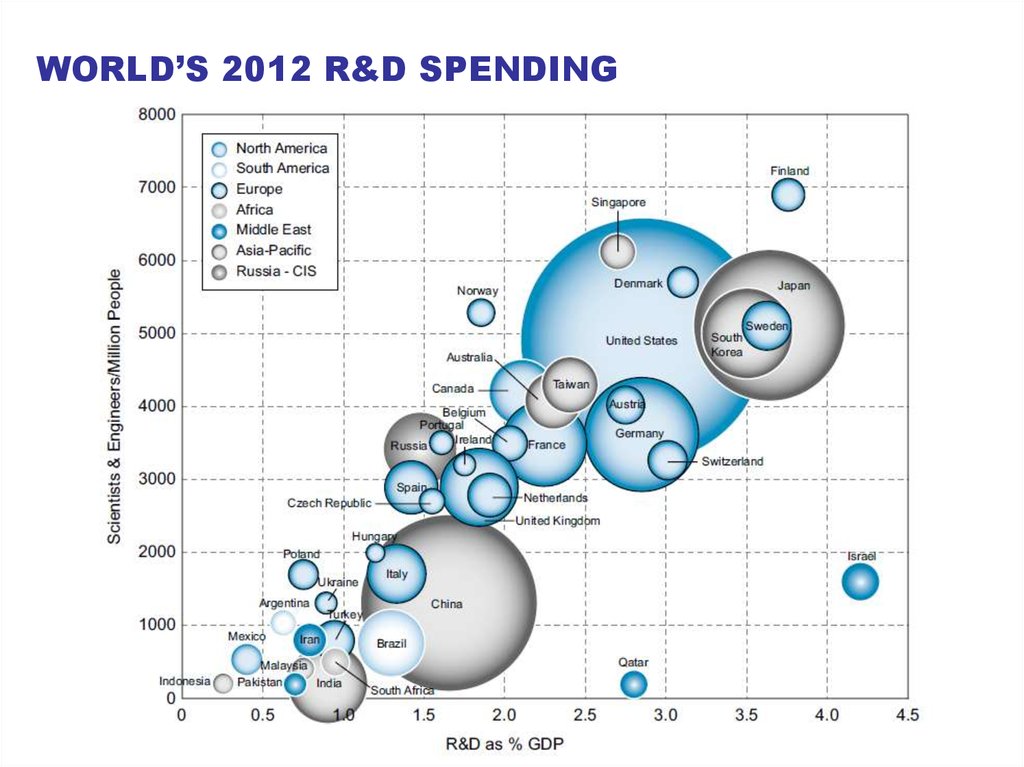

WORLD’S 2012 R&D SPENDING12.

CAPITAL RAISED IN 2012USA vs Europe

13.

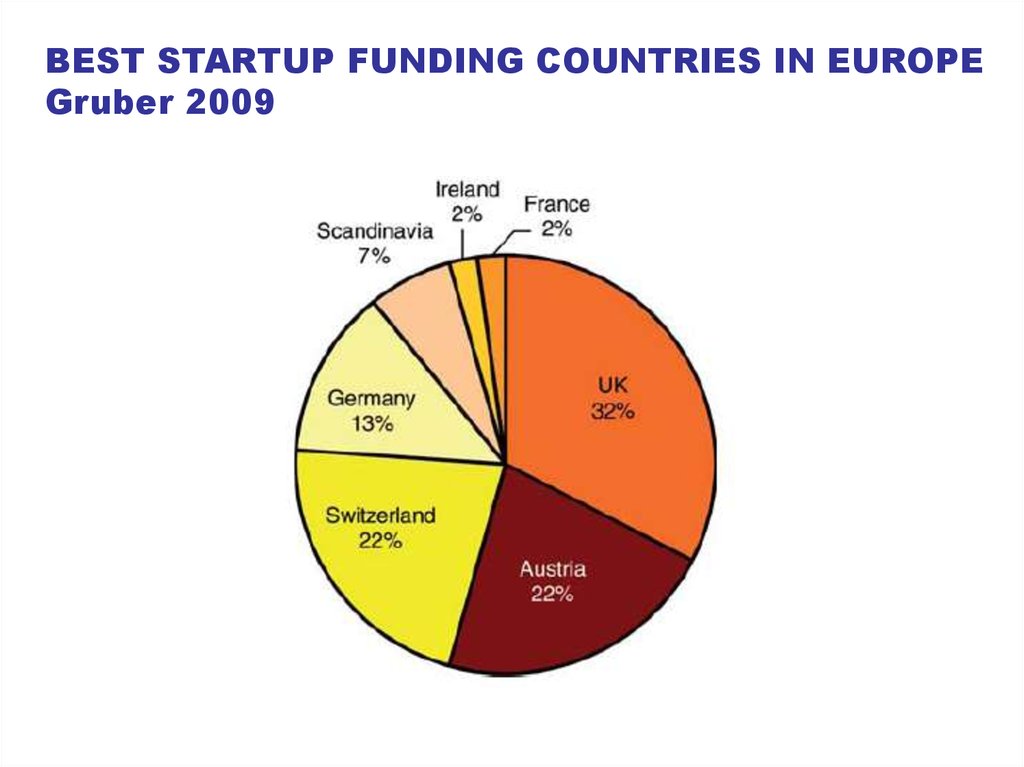

BEST STARTUP FUNDING COUNTRIES IN EUROPEGruber 2009

14.

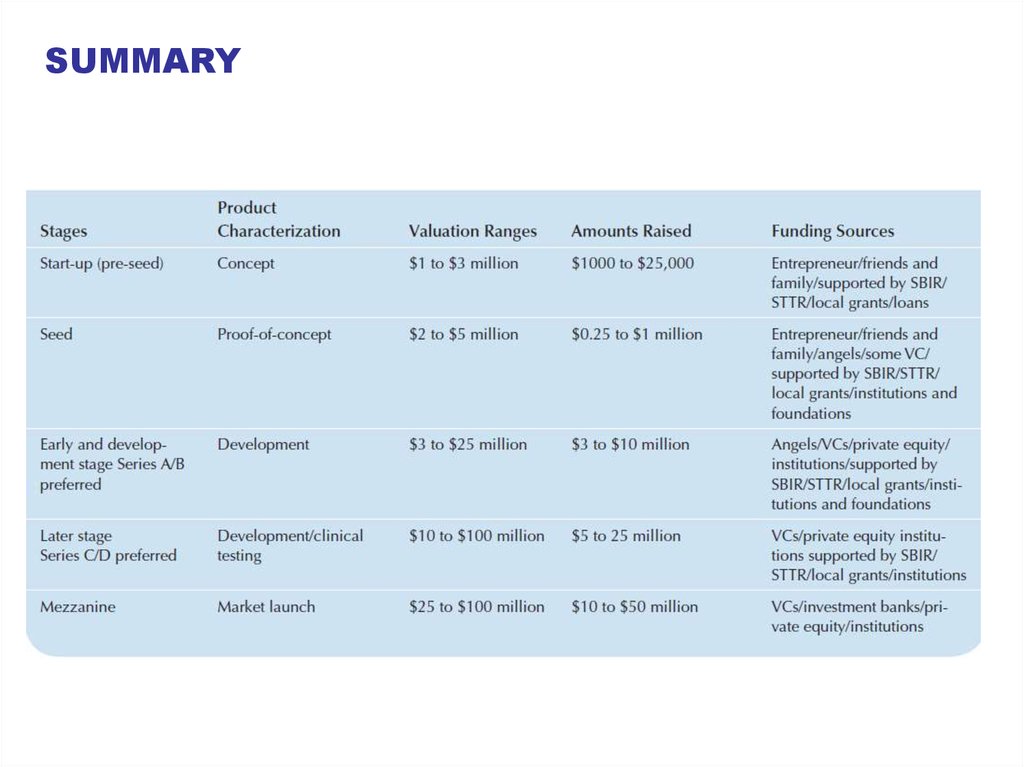

STARTUP FUNDING SOURCESPersonal capital

(Fools), Friends and Family (FFF)

Government grants and financing programs

Angel investors

Foundation with the focus in you sectors

Venture capital industry

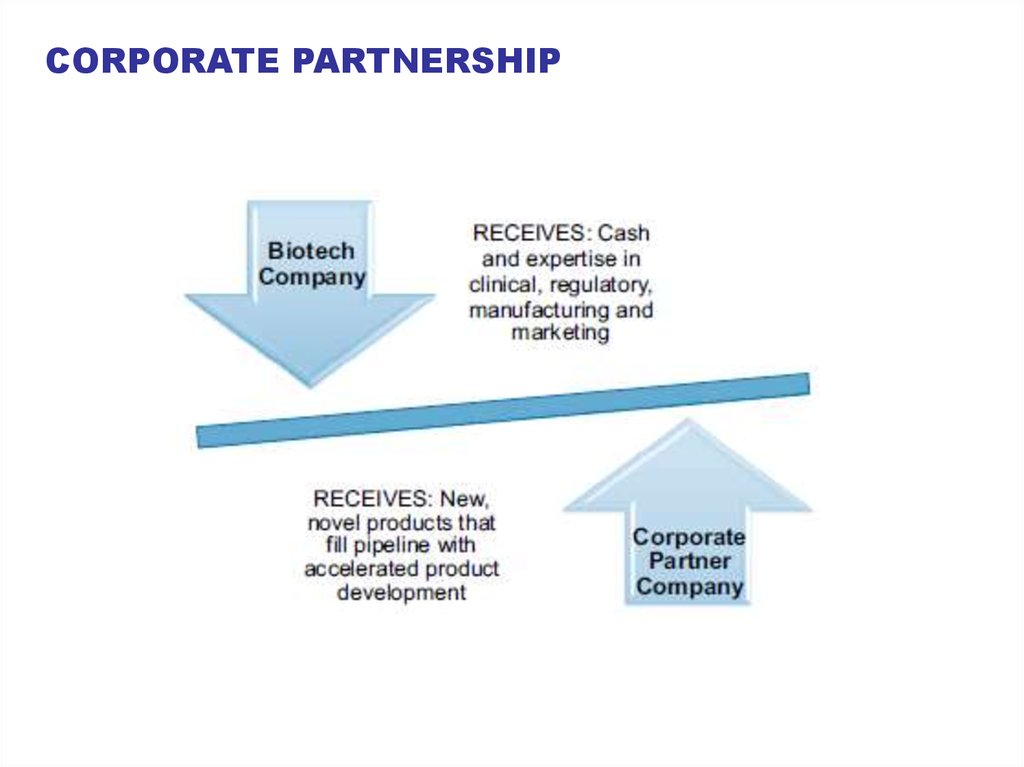

Institution corporate partnership

Institutional debt financing

15.

STARTUP FUNDING SOURCES16.

PERSONAL CAPITAL~5-20% of the company assets

relatively small, varies:

500 USD (Rob Swanson + Herb Boyer in Genentech)

tens of thousands USD

17.

FFFrelatively small, varies,

up to tens of thousands USD, sometimes up to hundreds of

thousands USD

18.

GOVERNMENT GRANTS AND FINANCINGPROGRAMS

relatively large (up to several millions USD), non-dilutive

hard to get

https://ec.europa.eu/research/participants/portal/desktop/en/opportunities/index.html

19.

GOVERNMENT GRANTS AND FINANCINGPROGRAMS

https://www.helmholtz.de/transfer/technologietransfer/transferinstrumente

/helmholtz_enterprise/

https://www.sbir.gov/

20.

ANGEL INVESTORSUSD 20-250 K, relatively easy to get

21.

VENTURE CAPITAL INVESMENTSLarge, highly professional management, high-diluting

business

business