Similar presentations:

Wheat & feed market in Saudi Arabia

1.

Grain Silos & Flour MillsOrganization (GSFMO)

Kingdom of Saudi Arabia

Wheat and Feed Market in Saudi Arabia

By H.E. Eng. Waleed El Khereiji

Director General of Grain Silos & Flour mills Organization

Saudi French Opportunities Forum (9-12th April 2015)

2. GSFMO Background & Overview KSA Wheat & Flour Market Overview GSFMO Privatization Program Next Steps & Implications

GSFMO Background & OverviewKSA Wheat & Flour Market Overview

GSFMO Privatization Program

Next Steps & Implications

2

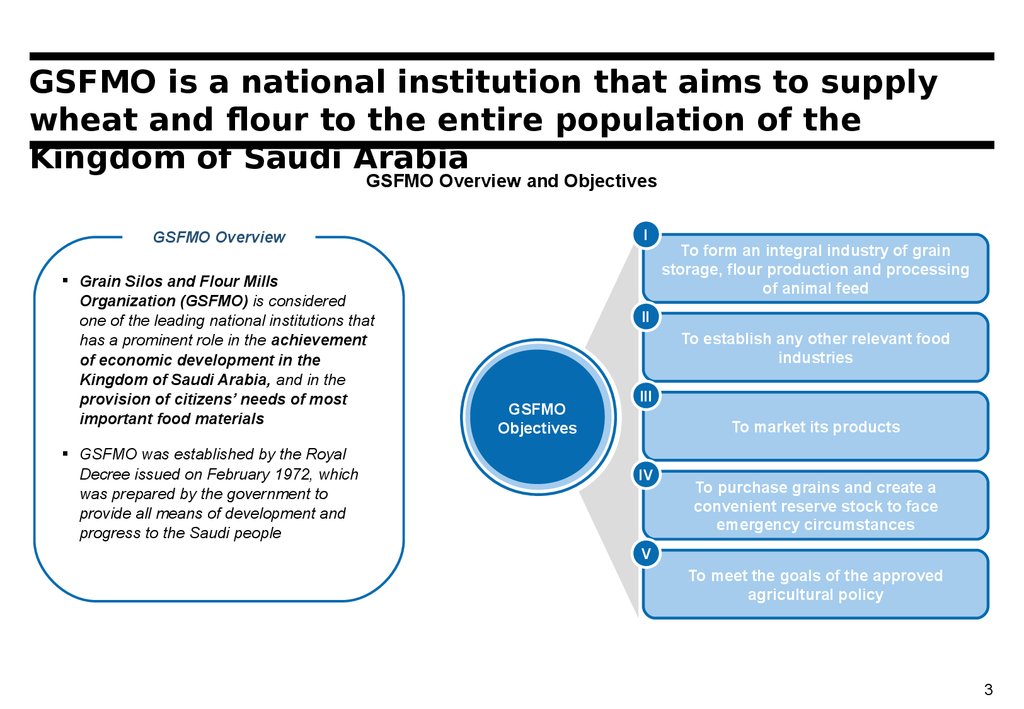

3. GSFMO is a national institution that aims to supply wheat and flour to the entire population of the Kingdom of Saudi Arabia

GSFMO Overview and ObjectivesI

GSFMO Overview

Grain Silos and Flour Mills

Organization (GSFMO) is considered

one of the leading national institutions that

has a prominent role in the achievement

of economic development in the

Kingdom of Saudi Arabia, and in the

provision of citizens’ needs of most

important food materials

GSFMO was established by the Royal

Decree issued on February 1972, which

was prepared by the government to

provide all means of development and

progress to the Saudi people

To form an integral industry of grain

storage, flour production and processing

of animal feed

II

To establish any other relevant food

industries

GSFMO

Objectives

III

To market its products

IV

To purchase grains and create a

convenient reserve stock to face

emergency circumstances

V

To meet the goals of the approved

agricultural policy

3

4.

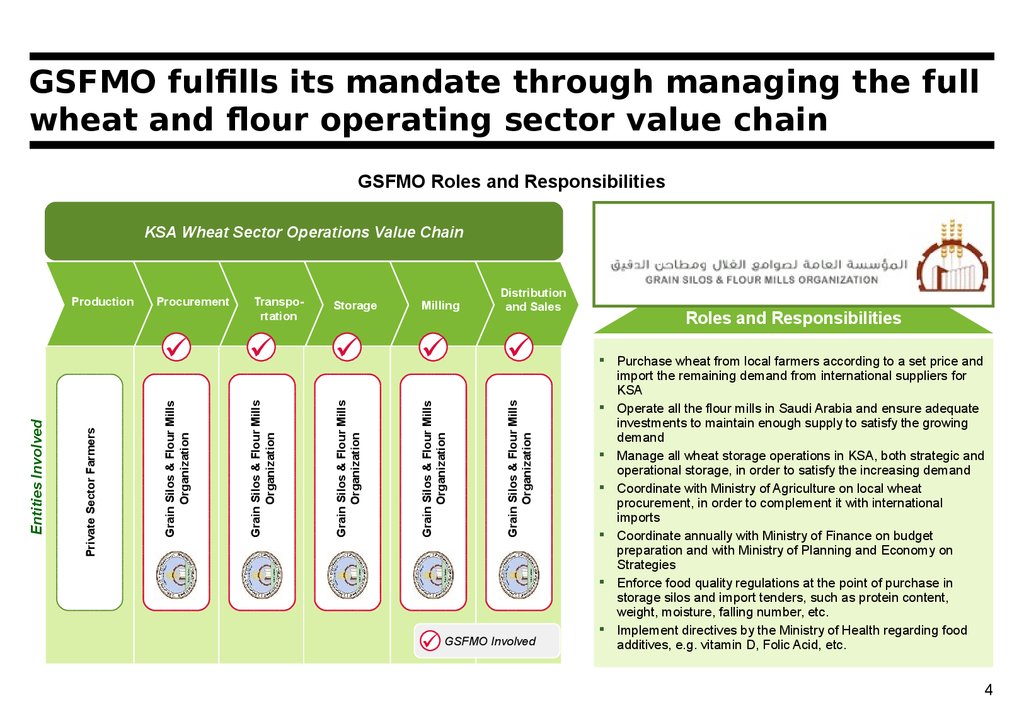

GSFMO fulfills its mandate through managing the fullwheat and flour operating sector value chain

GSFMO Roles and Responsibilities

KSA Wheat Sector Operations Value Chain

Distribution

and Sales

Grain Silos & Flour Mills

Organization

Milling

Grain Silos & Flour Mills

Organization

Storage

Grain Silos & Flour Mills

Organization

Transportation

Grain Silos & Flour Mills

Organization

Procurement

Grain Silos & Flour Mills

Organization

Private Sector Farmers

Entities Involved

Production

GSFMO Involved

Roles and Responsibilities

Purchase wheat from local farmers according to a set price and

import the remaining demand from international suppliers for

KSA

Operate all the flour mills in Saudi Arabia and ensure adequate

investments to maintain enough supply to satisfy the growing

demand

Manage all wheat storage operations in KSA, both strategic and

operational storage, in order to satisfy the increasing demand

Coordinate with Ministry of Agriculture on local wheat

procurement, in order to complement it with international

imports

Coordinate annually with Ministry of Finance on budget

preparation and with Ministry of Planning and Economy on

Strategies

Enforce food quality regulations at the point of purchase in

storage silos and import tenders, such as protein content,

weight, moisture, falling number, etc.

Implement directives by the Ministry of Health regarding food

additives, e.g. vitamin D, Folic Acid, etc.

4

5.

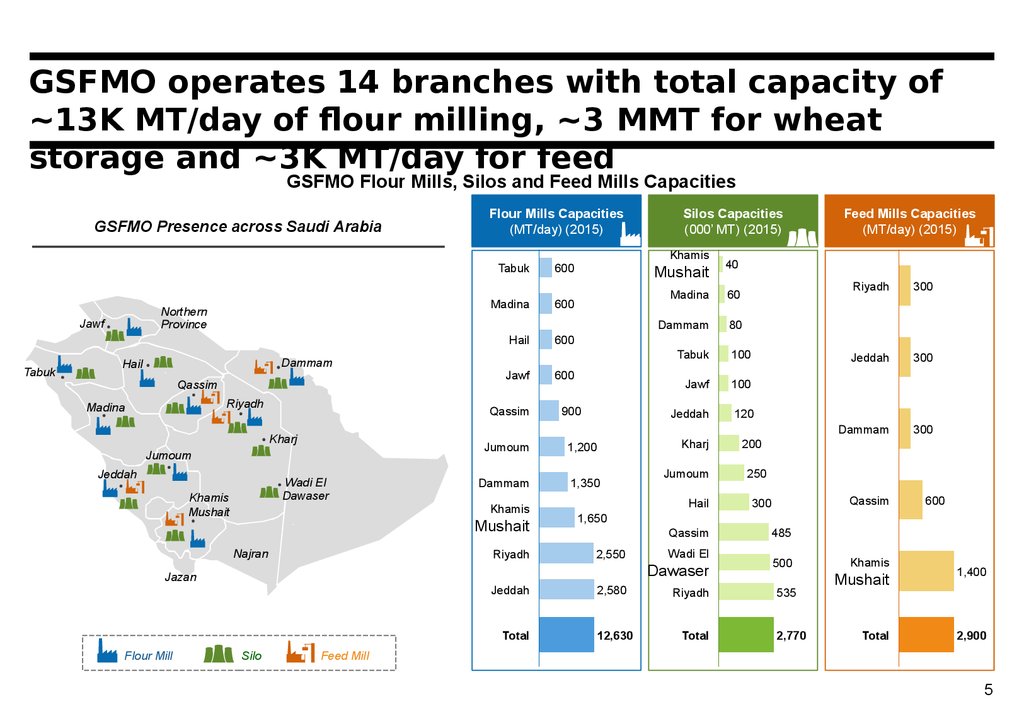

GSFMO operates 14 branches with total capacity of~13K MT/day of flour milling, ~3 MMT for wheat

storage and ~3K MT/day for feed

GSFMO Flour Mills, Silos and Feed Mills Capacities

GSFMO Presence across Saudi Arabia

Northern

Province

Jawf

Tabuk

Dammam

Hail

Qassim

Riyadh

Madina

Jumoum

Wadi El

Dawaser

Khamis

Mushait

Tabuk

600

Madina

600

Hail

600

Jawf

Qassim

Kharj

Jeddah

Flour Mills Capacities

(MT/day) (2015)

900

Dammam

1,350

Riyadh

Mushait

40

Madina

60

Dammam

80

Tabuk

100

Jawf

100

Jeddah

120

Kharj

Jumoum

Hail

Jeddah

Total

Silo

Feed Mills Capacities

(MT/day) (2015)

Riyadh

300

Jeddah

300

Dammam

300

200

250

Qassim

300

600

1,650

Qassim

2,550

Wadi El

Dawaser

Jazan

Flour Mill

600

1,200

Mushait

Najran

Khamis

Jumoum

Khamis

Silos Capacities

(000’ MT) (2015)

2,580

12,630

Riyadh

Total

485

500

535

2,770

Khamis

Mushait

1,400

Total

2,900

Feed Mill

5

6.

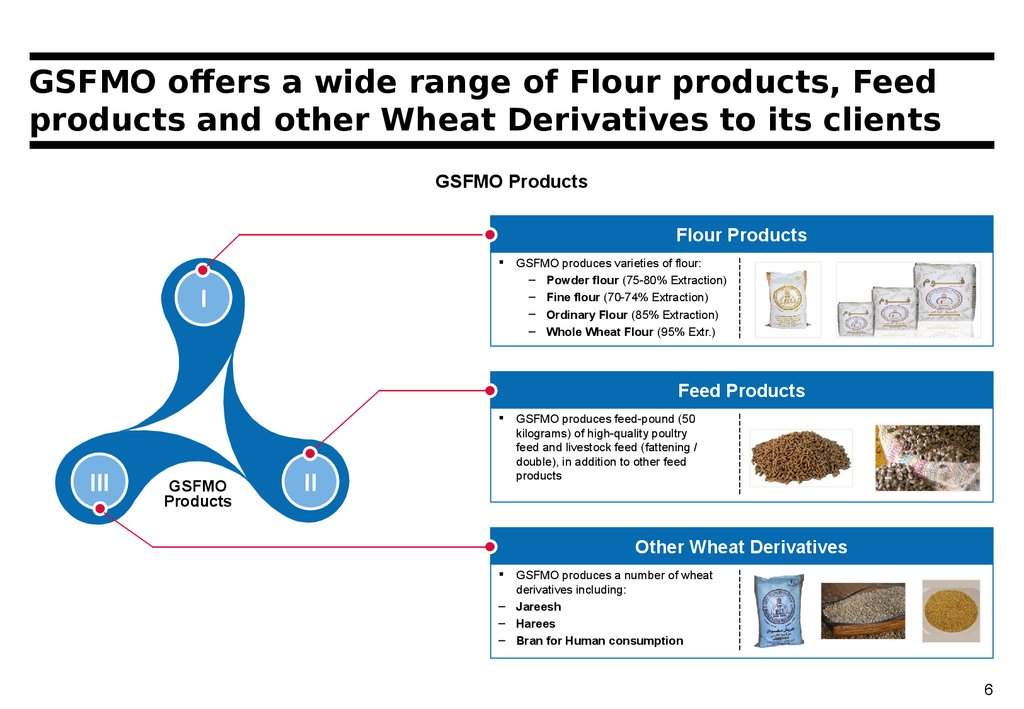

GSFMO offers a wide range of Flour products, Feedproducts and other Wheat Derivatives to its clients

GSFMO Products

Flour Products

I

GSFMO produces varieties of flour:

– Powder flour (75-80% Extraction)

– Fine flour (70-74% Extraction)

– Ordinary Flour (85% Extraction)

– Whole Wheat Flour (95% Extr.)

Feed Products

III

GSFMO

Products

II

GSFMO produces feed-pound (50

kilograms) of high-quality poultry

feed and livestock feed (fattening /

double), in addition to other feed

products

Other Wheat Derivatives

GSFMO produces a number of wheat

derivatives including:

– Jareesh

– Harees

– Bran for Human consumption

6

7.

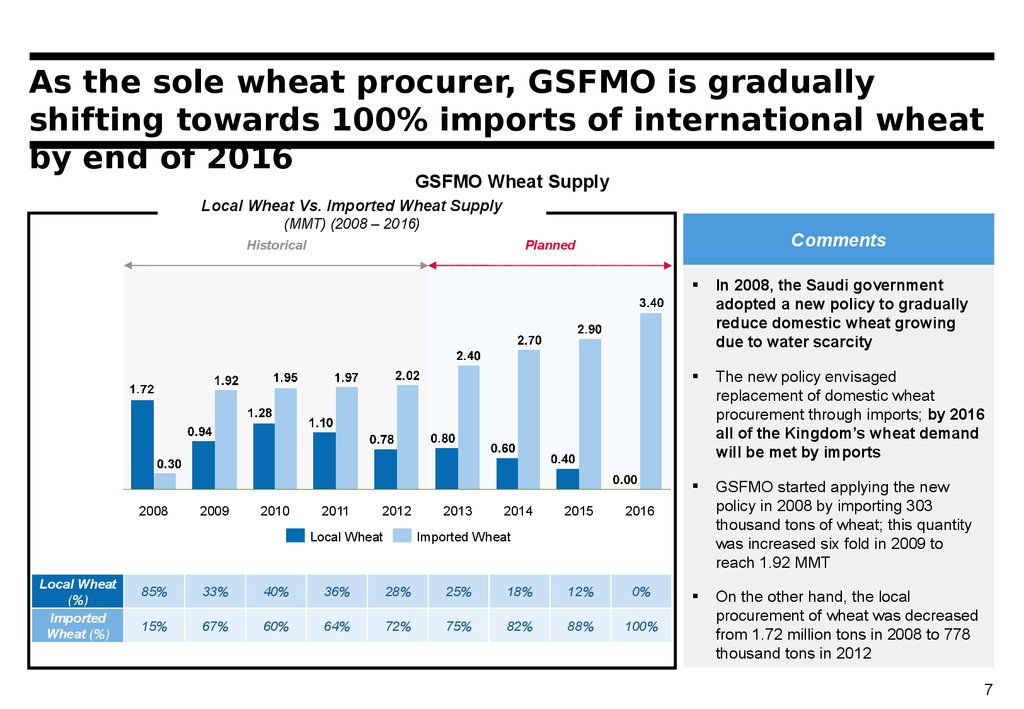

As the sole wheat procurer, GSFMO is graduallyshifting towards 100% imports of international wheat

by end of 2016

GSFMO Wheat Supply

Local Wheat Vs. Imported Wheat Supply

(MMT) (2008 – 2016)

Historical

2008

2009

2010

2011

2012

Local Wheat

Local Wheat

(%)

Imported

Wheat (%)

Comments

Planned

2013

2014

2015

2016

In 2008, the Saudi government

adopted a new policy to gradually

reduce domestic wheat growing

due to water scarcity

The new policy envisaged

replacement of domestic wheat

procurement through imports; by 2016

all of the Kingdom’s wheat demand

will be met by imports

GSFMO started applying the new

policy in 2008 by importing 303

thousand tons of wheat; this quantity

was increased six fold in 2009 to

reach 1.92 MMT

On the other hand, the local

procurement of wheat was decreased

from 1.72 million tons in 2008 to 778

thousand tons in 2012

Imported Wheat

85%

33%

40%

36%

28%

25%

18%

12%

0%

15%

67%

60%

64%

72%

75%

82%

88%

100%

7

8.

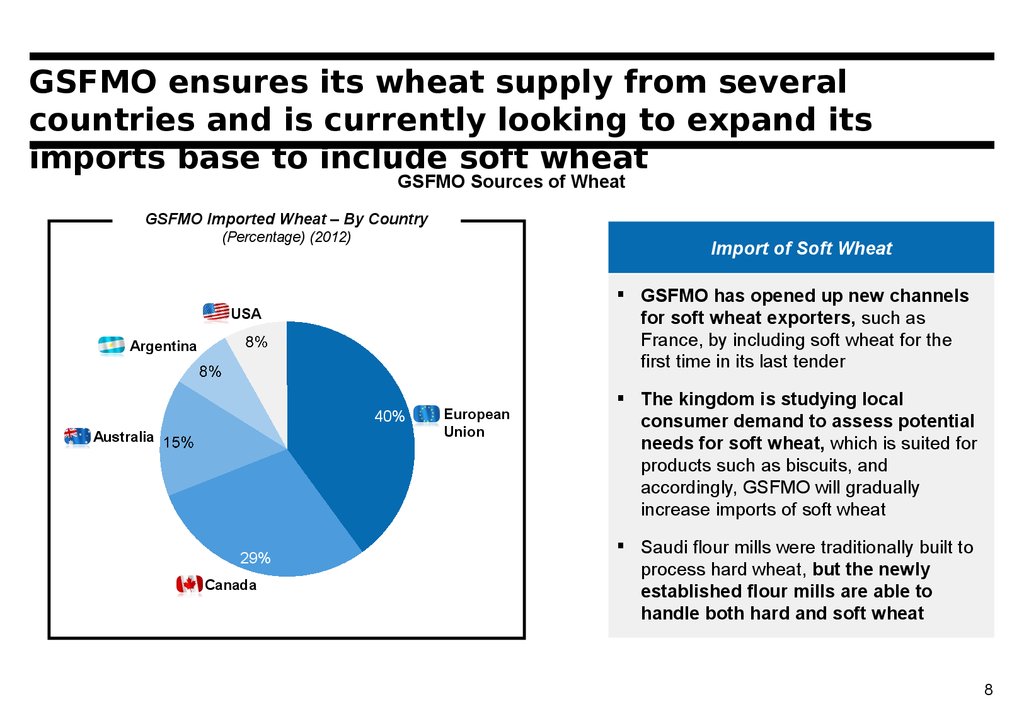

GSFMO ensures its wheat supply from severalcountries and is currently looking to expand its

imports base to include soft wheat

GSFMO Sources of Wheat

GSFMO Imported Wheat – By Country

(Percentage) (2012)

Import of Soft Wheat

GSFMO has opened up new channels

for soft wheat exporters, such as

France, by including soft wheat for the

first time in its last tender

USA

Argentina

40%

Australia

29%

Canada

European

Union

The kingdom is studying local

consumer demand to assess potential

needs for soft wheat, which is suited for

products such as biscuits, and

accordingly, GSFMO will gradually

increase imports of soft wheat

Saudi flour mills were traditionally built to

process hard wheat, but the newly

established flour mills are able to

handle both hard and soft wheat

8

9. GSFMO Background & Overview KSA Wheat & Flour Market Overview GSFMO Privatization Program Next Steps & Implications

GSFMO Background & OverviewKSA Wheat & Flour Market Overview

GSFMO Privatization Program

Next Steps & Implications

9

10.

KSA’s population is expected to grow at 2.4% perannum reaching a total of ~40 Million in 2025

Saudi Population Growth

(Million) (2004 – 2025)

Historical

Forecast

2.4%

28.4

29.0

29.7

30.4

2011

2012

2013

2014

31.2

31.9

32.7

33.5

2015

2016

2017

2018

34.3

35.1

35.9

36.8

2019

2020

2021

2022

37.7

38.6

2023

2024

39.6

24.2

2004

2025

10

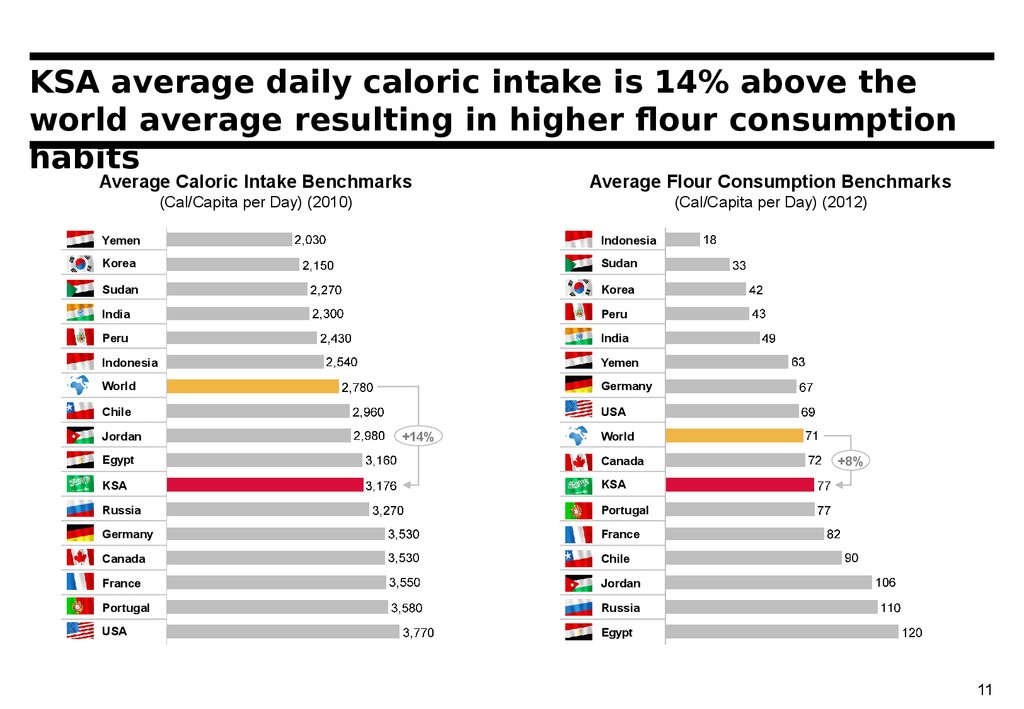

11.

KSA average daily caloric intake is 14% above theworld average resulting in higher flour consumption

habits

Average Caloric Intake Benchmarks

Average Flour Consumption Benchmarks

(Cal/Capita per Day) (2010)

(Cal/Capita per Day) (2012)

Yemen

Indonesia

Korea

Sudan

Sudan

Korea

India

Peru

Peru

India

Indonesia

Yemen

World

Germany

Chile

USA

Jordan

+14%

World

Egypt

Canada

KSA

KSA

Russia

Portugal

Germany

France

Canada

Chile

France

Jordan

Portugal

Russia

USA

Egypt

+8%

11

12.

In 2025, flour demand in Saudi Arabia is expected toreach 3.6 MMT which is equivalent to around 4.5 MMT

of wheat demand

Flour and Wheat Demand in KSA

Historical

3.2%

Yearly Flour Demand

Forecast

(MMT/Year)

(2012 - 2025)

Forecast

2.9%

3.4

3.5

3.6

2.5

2.6

2.7

2.8

3.0

2.5

2.9

2.4

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

4.0

4.1

4.2

4.3

4.5

2021

2022

2023

2024

2025

Historical

Forecast

3.2%

Yearly Wheat

Demand Forecast

(MMT/Year)

(2012 - 2025)

3.3

2.3

2.0

2005

3.2

3.1

2.9%

2.5

2005

3.3

3.5

2.9

3.2

3.7

3.1

3.6

3.0

3.4

3.8

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

12

13.

Accordingly, GSFMO has adopted milling capacityupgrades and expansion plans to continuously

address KSA’s wheat demand

GSFMO Capacity Upgrades and Expansion Plans

16,050

12,630

Current Capacity

3,420

Future Plans

Wheat (MT/Day)

Total Future

Capacity

+15%

+38%

4,300

2,770

Current Capacity

+28%

1,530

Future Plans

Total Future

Capacity

4,400

2,900

1,500

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Current Capacity

Future Plans

Total Future

Capacity

Wheat Supply

Wheat Demand

13

14. GSFMO Background & Overview KSA Wheat & Flour Market Overview GSFMO Privatization Program Next Steps & Implications

GSFMO Background & OverviewKSA Wheat & Flour Market Overview

GSFMO Privatization Program

Next Steps & Implications

14

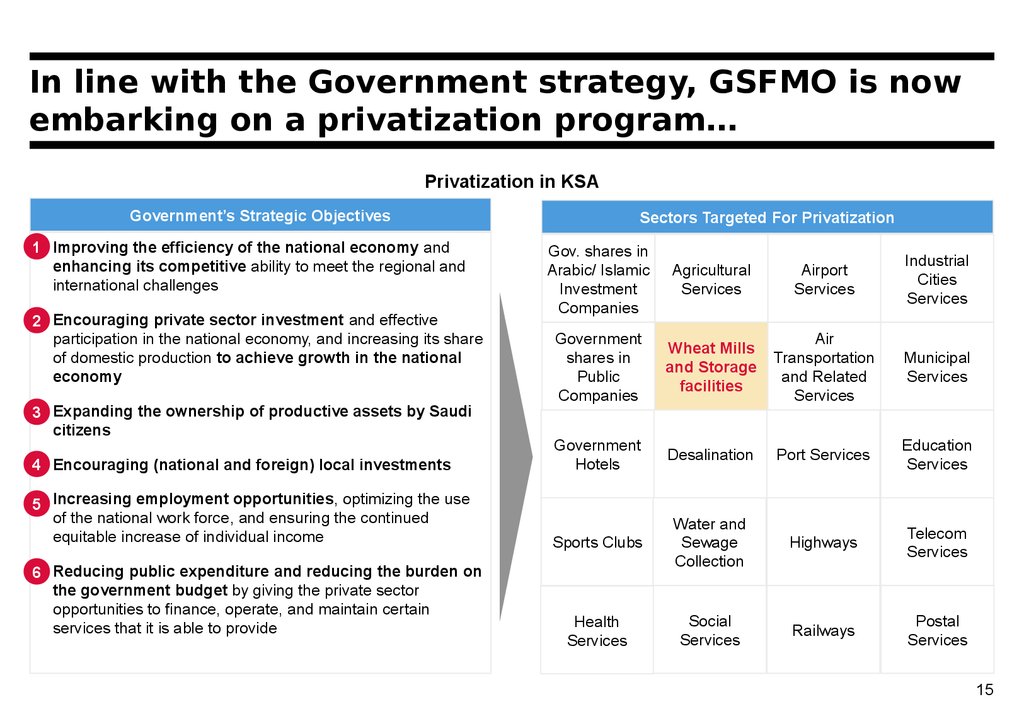

15. In line with the Government strategy, GSFMO is now embarking on a privatization program…

Privatization in KSAGovernment’s Strategic Objectives

1 Improving the efficiency of the national economy and

enhancing its competitive ability to meet the regional and

international challenges

2 Encouraging private sector investment and effective

participation in the national economy, and increasing its share

of domestic production to achieve growth in the national

economy

3 Expanding the ownership of productive assets by Saudi

citizens

4 Encouraging (national and foreign) local investments

5 Increasing employment opportunities, optimizing the use

of the national work force, and ensuring the continued

equitable increase of individual income

6 Reducing public expenditure and reducing the burden on

the government budget by giving the private sector

opportunities to finance, operate, and maintain certain

services that it is able to provide

Sectors Targeted For Privatization

Gov. shares in

Arabic/ Islamic

Investment

Companies

Agricultural

Services

Airport

Services

Industrial

Cities

Services

Government

shares in

Public

Companies

Wheat Mills

and Storage

facilities

Air

Transportation

and Related

Services

Municipal

Services

Government

Hotels

Desalination

Port Services

Education

Services

Sports Clubs

Water and

Sewage

Collection

Highways

Telecom

Services

Health

Services

Social

Services

Railways

Postal

Services

15

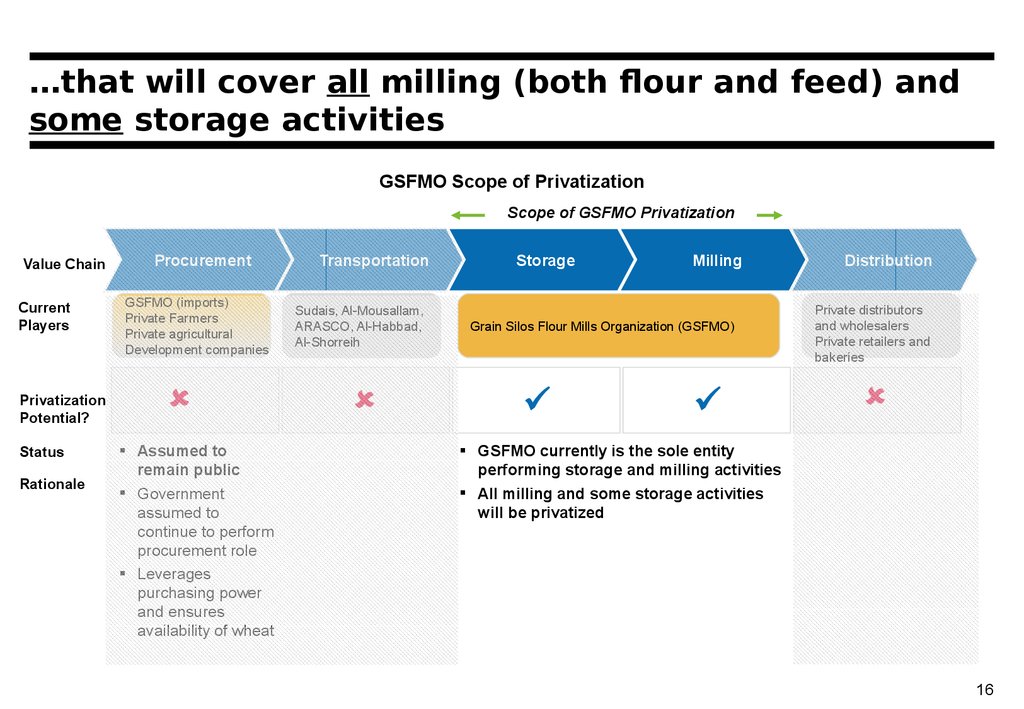

16.

…that will cover all milling (both flour and feed) andsome storage activities

GSFMO Scope of Privatization

Scope of GSFMO Privatization

Value Chain

Current

Players

Procurement

GSFMO (imports)

Private Farmers

Private agricultural

Development companies

Transportation

Sudais, Al-Mousallam,

ARASCO, Al-Habbad,

Al-Shorreih

Storage

Milling

Grain Silos Flour Mills Organization (GSFMO)

Distribution

Private distributors

and wholesalers

Private retailers and

bakeries

Privatization

Potential?

Status

Rationale

Assumed to

remain public

Government

assumed to

continue to perform

procurement role

Leverages

purchasing power

and ensures

availability of wheat

GSFMO currently is the sole entity

performing storage and milling activities

All milling and some storage activities

will be privatized

16

17.

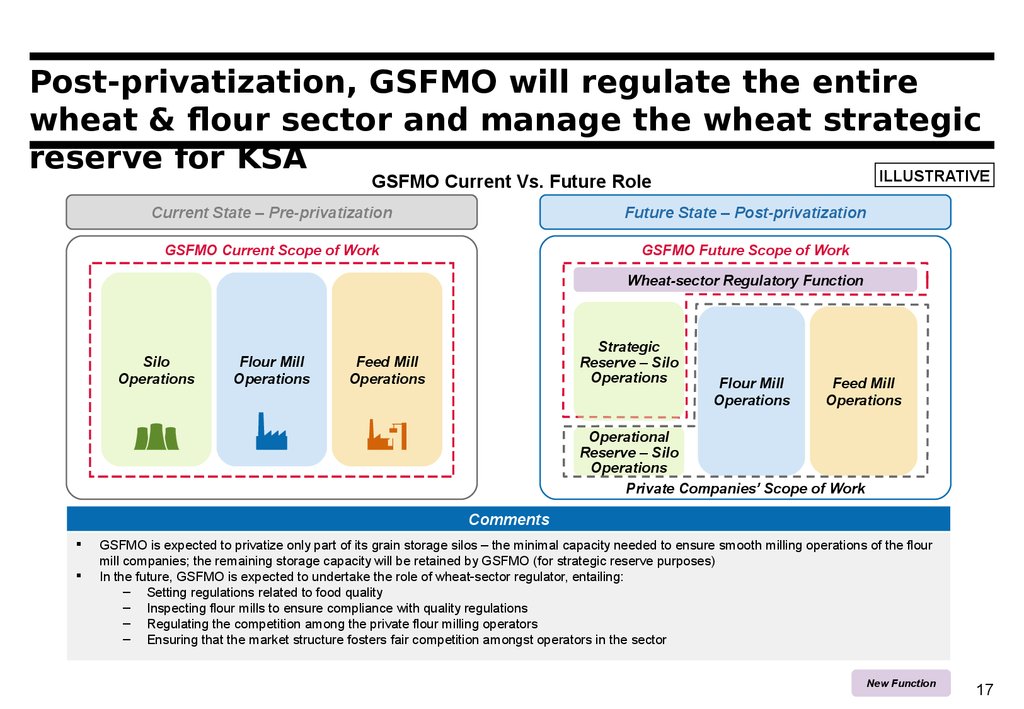

Post-privatization, GSFMO will regulate the entirewheat & flour sector and manage the wheat strategic

reserve for KSA

ILLUSTRATIVE

GSFMO Current Vs. Future Role

Current State – Pre-privatization

Future State – Post-privatization

GSFMO Current Scope of Work

GSFMO Future Scope of Work

Wheat-sector Regulatory Function

Silo

Operations

Flour Mill

Operations

Strategic

Reserve – Silo

Operations

Feed Mill

Operations

Flour Mill

Operations

Feed Mill

Operations

Operational

Reserve – Silo

Operations

Private Companies’ Scope of Work

Comments

GSFMO is expected to privatize only part of its grain storage silos – the minimal capacity needed to ensure smooth milling operations of the flour

mill companies; the remaining storage capacity will be retained by GSFMO (for strategic reserve purposes)

In the future, GSFMO is expected to undertake the role of wheat-sector regulator, entailing:

– Setting regulations related to food quality

– Inspecting flour mills to ensure compliance with quality regulations

– Regulating the competition among the private flour milling operators

– Ensuring that the market structure fosters fair competition amongst operators in the sector

New Function

17

18. GSFMO Background & Overview KSA Wheat & Flour Market Overview GSFMO Privatization Program Next Steps & Implications

GSFMO Background & OverviewKSA Wheat & Flour Market Overview

GSFMO Privatization Program

Next Steps & Implications

18

19.

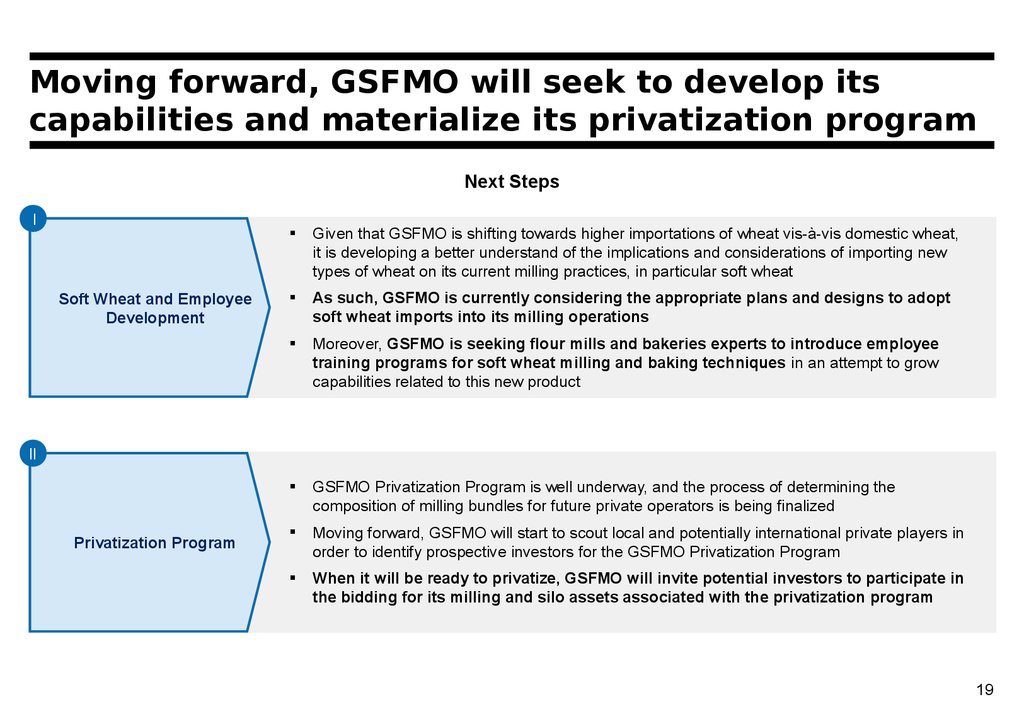

Moving forward, GSFMO will seek to develop itscapabilities and materialize its privatization program

Next Steps

I

Soft Wheat and Employee

Development

Given that GSFMO is shifting towards higher importations of wheat vis-à-vis domestic wheat,

it is developing a better understand of the implications and considerations of importing new

types of wheat on its current milling practices, in particular soft wheat

As such, GSFMO is currently considering the appropriate plans and designs to adopt

soft wheat imports into its milling operations

Moreover, GSFMO is seeking flour mills and bakeries experts to introduce employee

training programs for soft wheat milling and baking techniques in an attempt to grow

capabilities related to this new product

GSFMO Privatization Program is well underway, and the process of determining the

composition of milling bundles for future private operators is being finalized

Moving forward, GSFMO will start to scout local and potentially international private players in

order to identify prospective investors for the GSFMO Privatization Program

When it will be ready to privatize, GSFMO will invite potential investors to participate in

the bidding for its milling and silo assets associated with the privatization program

II

Privatization Program

19

economics

economics english

english