Similar presentations:

World Tourism Market. Status and prospects of product development in the world tourism market

1. World Tourism Market Winter semester 2017 TR – B5SE/01 3. 1. Status and prospects of product development in the world tourism

market.Addendum

Henryk F. Handszuh, M.Ec.Sc.

Former Director Market Department

World Tourism Organization (UNWTO)

Member, UNWTO Knowledge Nertwork

2. Status and prospects of product development in the world tourism market. Addendum

A variety of niche and not so niche tourism products on the global market• Adventure travel

• Black tourism

• Medical tourism

• Youth tourism

Human dimension of the world tourism market: international movements of

consumers

Passenger air transport

3. . Adventure travel

• All types of adventures can help people to cope with their fast-paced lives,as well as being ways to get out and explore nature, home or away.

• A rise in adventure travel today is attributed to the consumer shift away

from material possessions towards an interest in actual experiences.

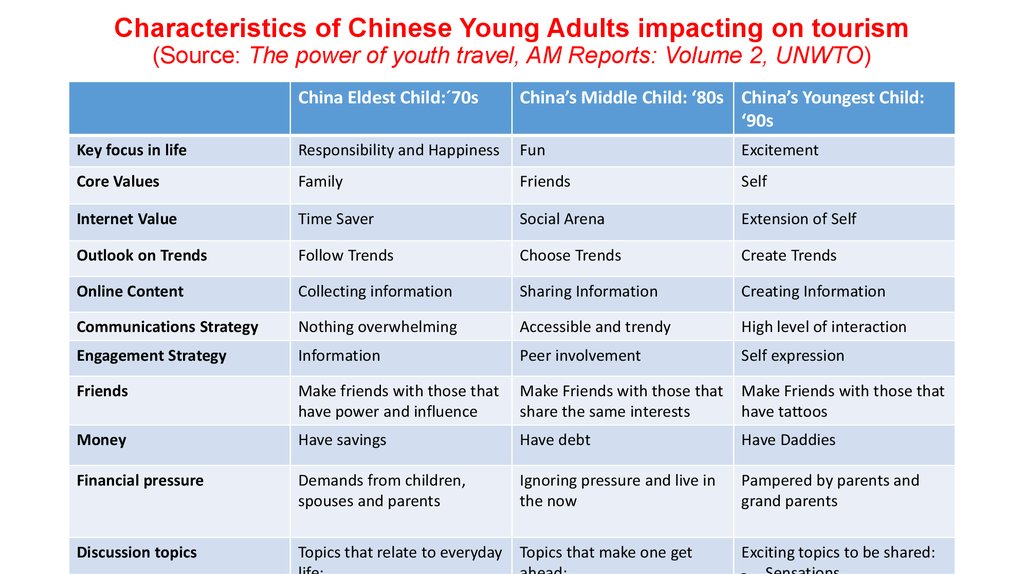

• The adventure travel of today mirrors the past experience of original

touring wilderness of the 19th century where “visitors from the areas of

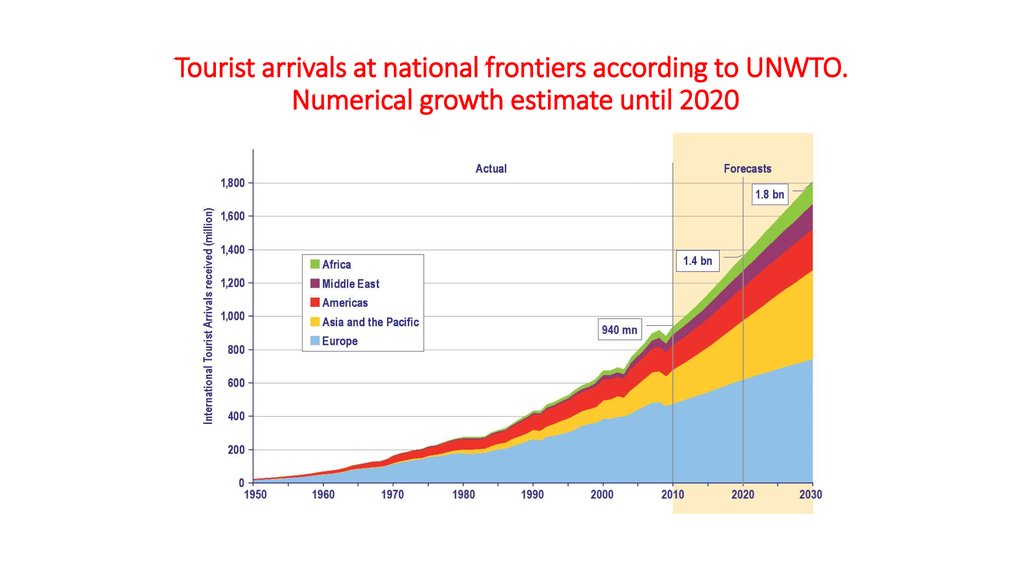

industrial civilization” (J. Urry) “opened their eyes and senses to the

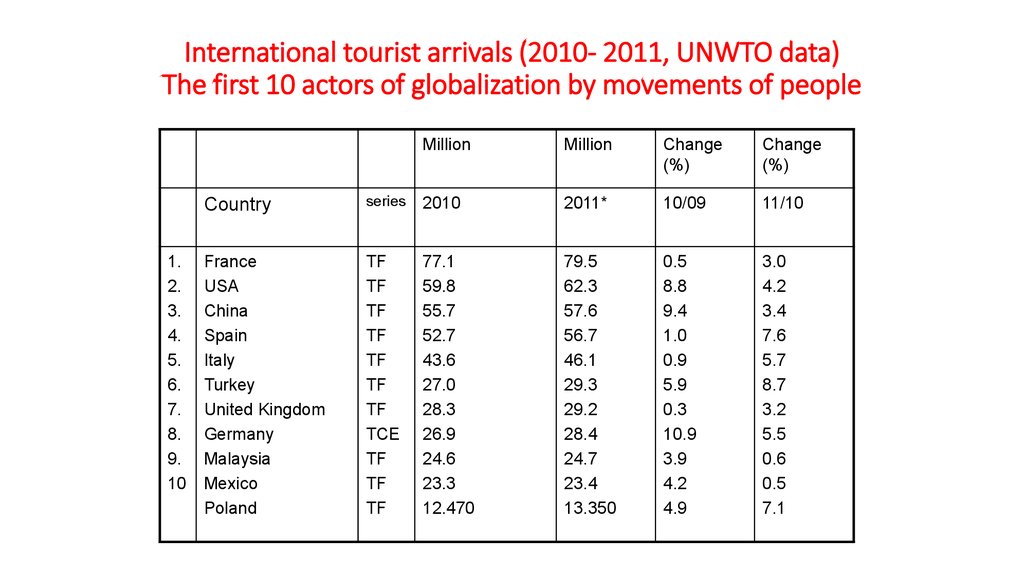

scenery, landscape, and fresh air, which so far had been hidden by

terrifying wilderness” (J. Kurowicki).

• Adventure travel has picked up again, in particular towards Africa, Asia and

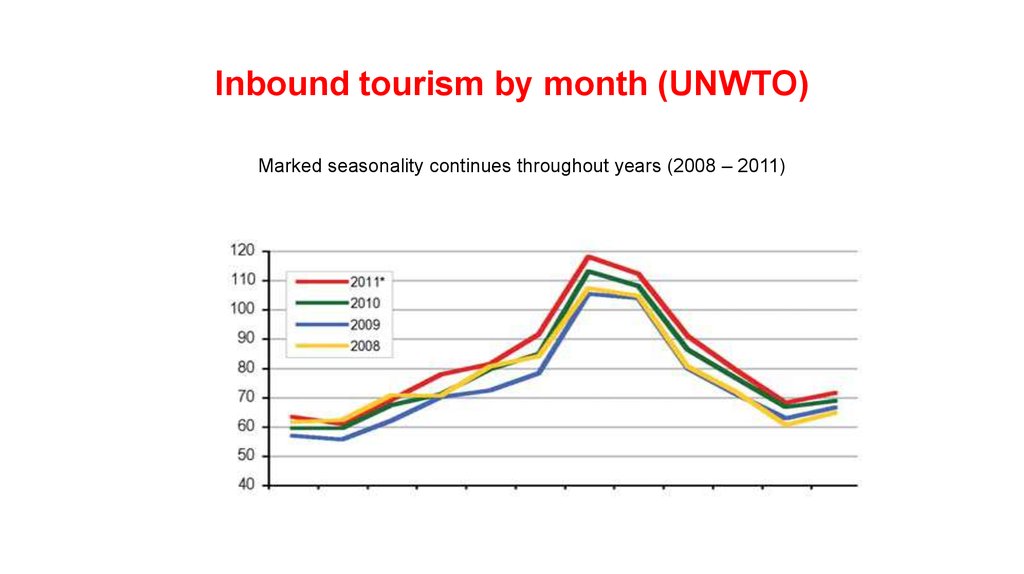

South America, as well as the Middle East – in the form of hiking.

4. Time factor in adventure tourism

• Adventure tourism requires sufficient time in order to practice it in the realsense.

• Time is becoming crucial in a world where everything moves fast, so a safari in

the middle of nowhere, or a walk in a national park with loved ones is the

ultimate form of wellness travel.

• Time spent with love ones, including oneself, is constantly ranked as most

important by respondents in surveys:

• Time with partner or spouse, with children, with parents, with friends,

with extended family or for myself.

5. . Microadventure travel boom in Europe

However, many busy Europeans do not have time for traditionaladventuring and so are opting instead for a microadventure, either

stand-alone or added to a holiday.

Sometimes known as soft adventure, these types of activities tend to

be low risk and are usually achievable with minimum previous

experience. They tie in with an increasing drive for healthier lifestyles.

• Microadventure travel is largely practiced by those who weekly

exercise (walk, hike) or participate in intensive physical activities (e.g.

practicing sports, fitness).

6. Adventure tourism ramifications

• Today´s adventure travel represents a dynamic resurgence of thephenomenon and lends itself to practicing renewed concepts of

nature admiration and contemplation under the new labels of

meditation, mindfulness, wellness or even practicing yoga in the

natural environment.

• Travellers’ concern with health and wellness while seeking unique and

authentic experiences is resulting in a demand for spiritual travel with

an adventure component.

7. Adventure tourism ramifications (2)

• Adventure travel shows strong linkages with cultural and ruraltourism, as well as ecotourism.

• Worldwide, the activity is successfully promoted by the Adventure

Travel Trade Association (ATTA) headquartered in Seattle, US. Year by

year, it gets more and more adherents. Its success is explained not

only by the fashion of adventure tourism, but also the ATTA ability to

communicate responsible adventure tourism standards (Adventure

Travel Guide Qualification and Performance Standard).

8. Adventure travel in Asia

• Adventure tourism continues to be practiced largely by Europeans and“Neo – Europeans”, but is now getting adherence in other world regions, in

particular in Asia.

• Due to the reborn interest in adventure tourism and its great potential

requiring travel trade governance, the Adventure Tour Operators

Association of India (ATOAI) has come into being.

• 2015 saw its big participation for the first time in an Adventure Tourism

Pavilion comprising operators specializing in adventure tourism during

Outbound Travel Mart (OTM) of TTF Travel & Tourism Fair held in Mumbai.

9. The new face of adventure tourism in Africa

• In Africa, this has been seen in a rise in the concept of “wellness in thewilderness”, where a traditional safari break is accompanied by meditation,

yoga and spa services.

• Typically, consumers of these types of breaks are relatively older and

wealthy holidaymakers, often female, who are looking for more than just a

typical African getaway.

• One aim for many clients is to gain life-enhancing skills through mindful

activities that can be applied to everyday life, offering a richer holiday

experience.

10. Adventure tourism offers to be found everywhere

• The vast majority of mindful safaris are in South Africa or Keya, butdestinations such as Botswana and Tanzania could offer differing

attractions such as animal migration.

• Other locations and activities that could match well with mindfulness

holidays include exploring flora and fauna in South America, or Canada’s

wild nature offering.

• While current consumers are mainly international leisure holidaymakers,

there is much scope to develop for “bleisure” tourists as well as diaspora

and regional visitors.

• Links with schools who are increasingly using mindfulness to assist students

with their busy lives could also prove a successful future direction for these

types of holidays.

11. Adventure tourism and sustainability

• The Global Wellness Summit found that in 2014, wellness travel (travelwith a purpose of improving health and wellbeing) was growing 74% more

than regular global travel.

• The mindfulness trend also combines well with travellers` increasing

interest in sustainable and reduced-footprint holidays, hence ecotourism.

• It helps accommodation providers offer to their guests a service which is

considered a luxury.

• The product of sustainable and safe adventure tourism is supported by a

great body of national and international standards (ISO).

12. Another face of wellbeing: medical tourism. Asia

• Disparity in healthcare costs between developed and emerging countries,coupled with advanced healthcare infrastructure in emerging economies is

helping to drive medical tourism in emerging countries.

• Asia continues to be the top medical destination in medical travel with

countries such as India, Malaysia, and Thailand already being wellestablished medical tourism destinations.

• Asian medical destinations continue to offer more and better medical

procedures and care than most other medical destinations. Several

hospitals in Asia have carved such outstanding reputation for themselves

that medical tourism has become a major money-spinner.

13. Another face of wellbeing: medical tourism Thailand followed by others.

• The Indian government has removed many visa restrictions andintroduced a visa-on-arrival scheme for medical tourists from selected

countries; this allows foreign nationals to stay in India for 30 days for

medical reasons and can even get a visa of up to 1 year depending

upon treatment requirements.

• Thailand accounts for maximum share of the Asia medical tourism

market, being followed by India and Singapore. South Korea stands at

the fourth spot in the year 2016 and is likely to almost double its

market share by the year 2022, while Malaysia is holding the last

spot.

14. Another face of wellbeing: medical tourism. Sri lanka

• Sri Lanka is amongst the emerging markets in South Asia to befavourably positioned to attract increasing international patients, with

countries such as India, Malaysia, and Thailand already being wellestablished medical tourism destinations.

• Medical tourism (not only ayerveda) is only at a nascent stage in Sri

Lanka; factors such as cost competitiveness, a booming private

healthcare industry, internationally trained workers, and so on should

help the development of Sri Lanka's medical tourism industry.

15. The dubious face of “fertility tourism”

• Fertility Tourism is a global tourism industry, bringing in over USD400million a year in India alone.

• For the right price, people can buy IVF treatments, donated eggs and

sperm along with surrogate mother. The clients are often white and rich.

The suppliers pressed into service are often neither.

• Based on the UN`s definition of human trafficking, fertility tourism often

results in human trafficking by recrcuiting people by coerción, twisting

power and vulnerability and given payments that result in physical

exploitation.

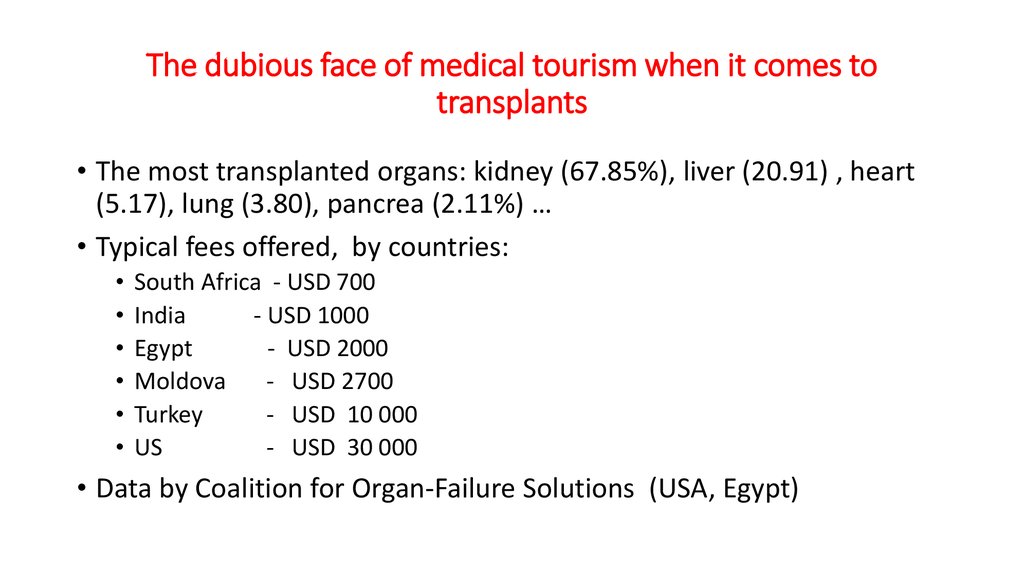

16. The dubious face of medical tourism when it comes to transplants

• The most transplanted organs: kidney (67.85%), liver (20.91) , heart(5.17), lung (3.80), pancrea (2.11%) …

• Typical fees offered, by countries:

South Africa - USD 700

India

- USD 1000

Egypt

- USD 2000

Moldova

- USD 2700

Turkey

- USD 10 000

US

- USD 30 000

• Data by Coalition for Organ-Failure Solutions (USA, Egypt)

17. The case of suicide tourists

• More than 600 people travelled to Switzerland for help taking their livesbetween 2008 and 2012, at one of four clinics which permit non-Swiss

nationals.

• Assisted dying clinics can operate legally in Switzerland, and have attracted

large number of people with terminal illnesses and debilitating medical

condition, with neurological conditions the most common reason for

seking euthanasia, followed by cancer and rheumatic diseases.

• The rise of suicide tourism has been a major factor in prompting debates

over the ethics of euthanasia.

18. Black tourism – visting atrocity and macabre sites

• As travellers embrace experiences, rather than just heading to thepool, visits to „dark tourism” sites have risen in tandem.

• The former Nazi extermination camp Auschwitz (UNESCO World

Heritage of 1978) heads the list.

• Torture museums have been commonplace for some time

• The Salem Bitch Museum (Massachusetts, US)

• New spectacular additions include Cambodia`s Killing Fields,

Chernobyl (CHERNOBYL.wel.come – enjoy Chernobyl, die later),

Fukushima Dai-ichi nuclear power plant.

• There is an Institute for Dark Tourism Research at the University of

Central Lancashire. Death sells.

19. Youth and trends in travel and tourism

• Human progress has always, through centuries, been possible justthanks to people`s travels.

• In tourism, youth is the principal agent of change and innovation

among other generational segments.

• Inasmuch as youth represents the future in general, it equally

represents the future of tourism.

• It is hence the principal trendsetter of tourism.

20. Characteristics of Chinese Young Adults impacting on tourism (Source: The power of youth travel, AM Reports: Volume 2, UNWTO)

China Eldest Child:´70sChina’s Middle Child: ‘80s China’s Youngest Child:

‘90s

Key focus in life

Responsibility and Happiness

Fun

Excitement

Core Values

Family

Friends

Self

Internet Value

Time Saver

Social Arena

Extension of Self

Outlook on Trends

Follow Trends

Choose Trends

Create Trends

Online Content

Collecting information

Sharing Information

Creating Information

Communications Strategy

Nothing overwhelming

Accessible and trendy

High level of interaction

Engagement Strategy

Information

Peer involvement

Self expression

Friends

Make friends with those that

have power and influence

Make Friends with those that

share the same interests

Make Friends with those that

have tattoos

Money

Have savings

Have debt

Have Daddies

Financial pressure

Demands from children,

spouses and parents

Ignoring pressure and live in

the now

Pampered by parents and

grand parents

Discussion topics

Topics that relate to everyday

Topics that make one get

Exciting topics to be shared:

21. World market dimension of international movements of people

• Unstopable and growing trend of international movements of people(movements of consumers).

• Principal protagonists and beneficiaries of international tourism.

• Regional diversification in distribution and trends.

• Some conclusions.

22. Tourist arrivals at national frontiers according to UNWTO. Numerical growth estimate until 2020

23. International tourist arrivals (2010- 2011, UNWTO data) The first 10 actors of globalization by movements of people

1.2.

3.

4.

5.

6.

7.

8.

9.

10

Million

Million

Change

(%)

Change

(%)

Country

series

2010

2011*

10/09

11/10

France

USA

China

Spain

Italy

Turkey

United Kingdom

Germany

Malaysia

Mexico

Poland

TF

TF

TF

TF

TF

TF

TF

TCE

TF

TF

TF

77.1

59.8

55.7

52.7

43.6

27.0

28.3

26.9

24.6

23.3

12.470

79.5

62.3

57.6

56.7

46.1

29.3

29.2

28.4

24.7

23.4

13.350

0.5

8.8

9.4

1.0

0.9

5.9

0.3

10.9

3.9

4.2

4.9

3.0

4.2

3.4

7.6

5.7

8.7

3.2

5.5

0.6

0.5

7.1

24. International tourist arrivals (2015-2016 UNWTO data) The first 10 actors of globalization by movements of people

1.2.

3.

4.

5.

6.

7.

8.

9.

10

Million

Million

Change

(%)

Change

(%)

Country

series

2015

2016*

15/14

11/10

France

USA

Spain

China

Italy

United Kingdom

Germany

Mexico

Thailand

Turkey

Poland

TF

TF

TF

TF

TF

TF

TCE

TF

TF

TF

TF

84.5

77.5

68.5

56.9

50.7

34.3

35.0

32.1

29.9

39.5

16.7

82.6

75.6

75.6

59.3

52.4

35.8

35.6

35.0

32.6

n.a.

17.4

0.9

3.3

5.5

2.3

4.4

5.6

6.0

9.4

20.6

0.8

-2.2

-2.4

10.3

4.2

3.2

4.0

1.7

8.9

8.9

n.a

25.

National destinations increasingly more diversifiedWorld's Top Tourism Destinations by International Tourist Arrivals

Rank

1

2

3

4

5

World

Share

1950

United States

Canada

Italy

France

Switzerland

6

7

8

9

10

Ireland

Aus tria

Spain

Germ any

United Kingdom

11

12

13

14

15

Norway

Argentina

Mexico

Netherlands

Denm ark

Others

Total

World

Share

1980

71%

France

United States

Spain

Italy

Aus tria

17%

Mexico

Canada

United Kingdom

Germ any

Belgium

World

Share

2005

40%

France

Spain

United States

China

Italy

33%

20%

United Kingdom

Mexico

Germ any

Turkey

Aus tria

14%

9%

Switzerland

Yugos lav SFR

Poland

10%

Form er Czechos lavakia

Greece

Rus s ian Federation

Canada

Malays ia

11%

Ukraine

Poland

3%

Others

Others

25 million

Source: World Tourism Organization (UNWTO) ©

30%

278 million

42%

80625million

26. Inbound tourism by month (UNWTO)

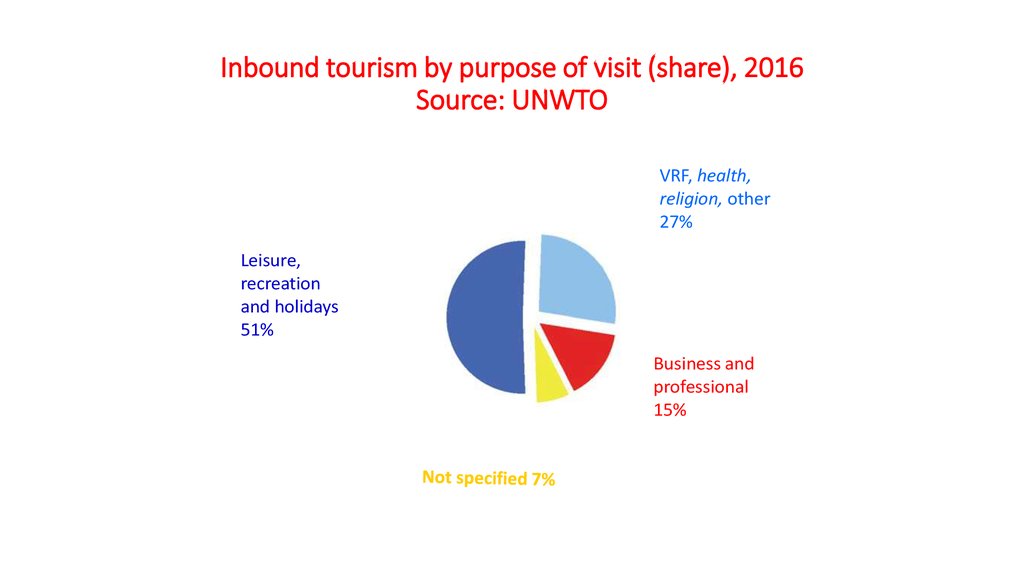

Marked seasonality continues throughout years (2008 – 2011)27. Inbound tourism by purpose of visit (share), 2016 Source: UNWTO

VRF, health,religion, other

27%

Leisure,

recreation

and holidays

51%

Business and

professional

15%

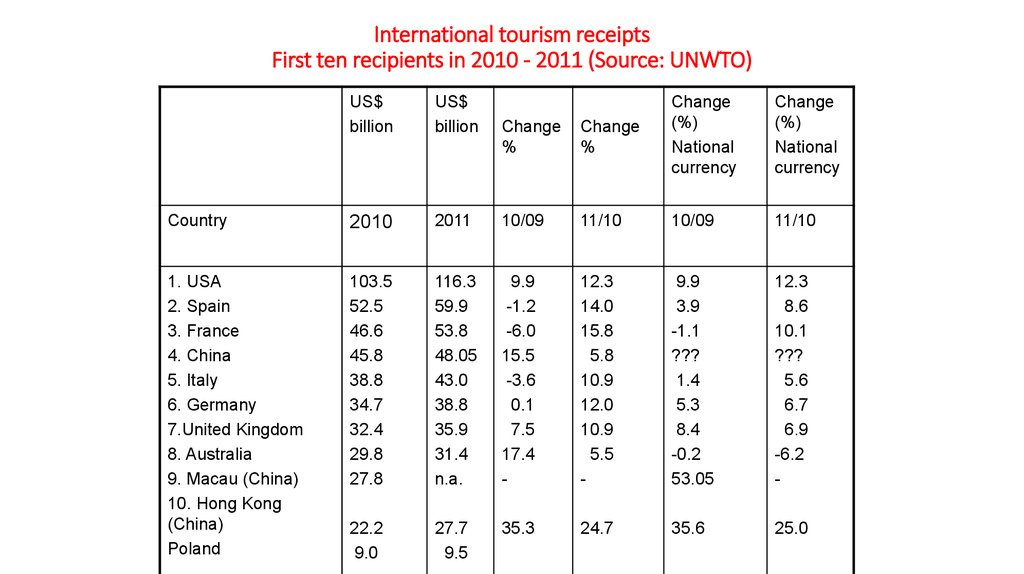

28. International tourism receipts First ten recipients in 2010 - 2011 (Source: UNWTO)

US$billion

US$

billion

Change

%

Change

%

Change

(%)

National

currency

Country

2010

1. USA

2. Spain

3. France

4. China

5. Italy

6. Germany

7.United Kingdom

8. Australia

9. Macau (China)

10. Hong Kong

(China)

Poland

Change

(%)

National

currency

2011

10/09

11/10

10/09

11/10

103.5

52.5

46.6

45.8

38.8

34.7

32.4

29.8

27.8

116.3

59.9

53.8

48.05

43.0

38.8

35.9

31.4

n.a.

9.9

-1.2

-6.0

15.5

-3.6

0.1

7.5

17.4

-

12.3

14.0

15.8

5.8

10.9

12.0

10.9

5.5

-

9.9

3.9

-1.1

???

1.4

5.3

8.4

-0.2

53.05

12.3

8.6

10.1

???

5.6

6.7

6.9

-6.2

-

22.2

9.0

27.7

9.5

35.3

24.7

35.6

25.0

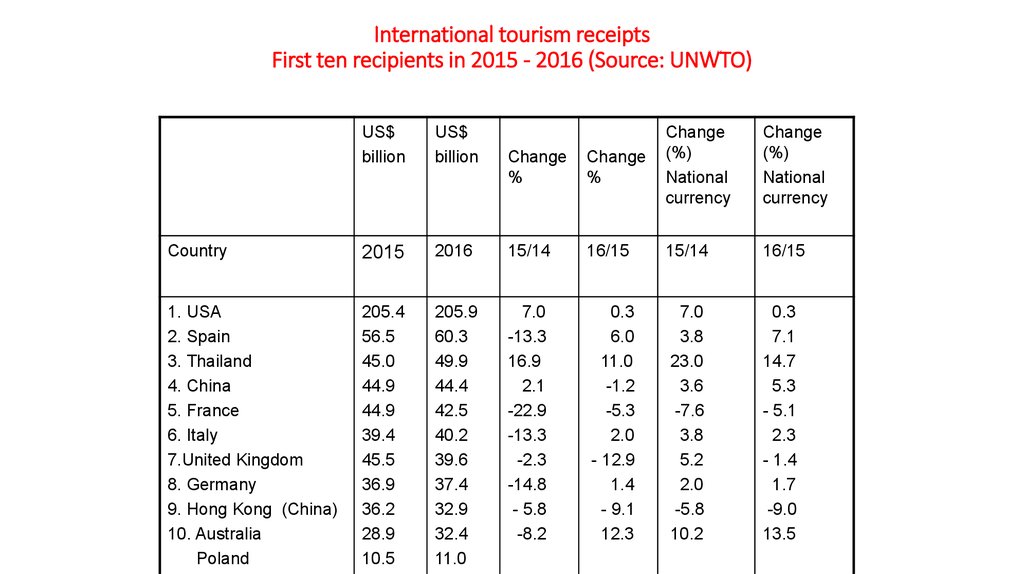

29. International tourism receipts First ten recipients in 2015 - 2016 (Source: UNWTO)

US$billion

US$

billion

Change

%

Change

%

Change

(%)

National

currency

Country

2015

1. USA

2. Spain

3. Thailand

4. China

5. France

6. Italy

7.United Kingdom

8. Germany

9. Hong Kong (China)

10. Australia

Poland

205.4

56.5

45.0

44.9

44.9

39.4

45.5

36.9

36.2

28.9

10.5

Change

(%)

National

currency

2016

15/14

16/15

15/14

16/15

205.9

60.3

49.9

44.4

42.5

40.2

39.6

37.4

32.9

32.4

11.0

7.0

-13.3

16.9

2.1

-22.9

-13.3

-2.3

-14.8

- 5.8

-8.2

0.3

6.0

11.0

-1.2

-5.3

2.0

- 12.9

1.4

- 9.1

12.3

7.0

3.8

23.0

3.6

-7.6

3.8

5.2

2.0

-5.8

10.2

0.3

7.1

14.7

5.3

- 5.1

2.3

- 1.4

1.7

-9.0

13.5

30.

Regional shares of international tourism in 2007Arrivals, receipts and market share (%)

International Tourist Arrivals (ITA)

908 million

International Tourism Receipts (ITR)

US$ 856 billion

Europe

ITA: 484 million (54%)

ITR: US$ 433 billion

(51%)

Middle East

ITA: 46 million

(5%)

Africa

ITR: US$ 34 bn

ITA: 44 million

(4%)(5%)

ITR: US$ 28 billion

(3%)

Asia and the Pacific

ITA: 184 million (20%)

ITR: US$ 189 billion

(22%)

UNWTO Market Department - Market Trends, Competitiveness and Trade in Tourism

30

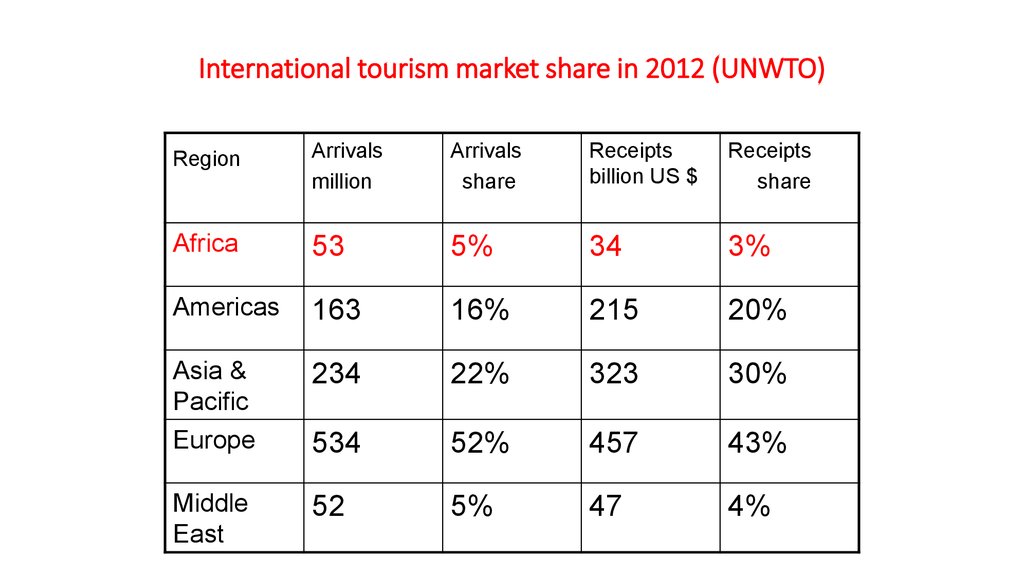

Services

31. International tourism market share in 2012 (UNWTO)

RegionArrivals

million

Arrivals

share

Receipts

billion US $

Receipts

share

Africa

53

5%

34

3%

Americas

163

16%

215

20%

Asia &

Pacific

Europe

234

22%

323

30%

534

52%

457

43%

Middle

East

52

5%

47

4%

32.

Regional shares of international tourism in 2016Arrivals, receipts and market share (%)

International Tourist Arrivals (ITA)

1.235 million

International Tourism Receipts (ITR)

US$ 1.220 billion

Europe

ITA: 615 million (50%)

ITR: US$ 447 billion

(37%)

Africa

ITA: 58 million

(5%)

ITR: US$ 35

billion (3%)

Middle East

ITA: 54million (4%)

ITR: US$ 34 bn

(5%)

Asia and the Pacific

ITA: 308 million (25%)

ITR: US$ 367 billion

(30%)

UNWTO Market Department - Market Trends, Competitiveness and Trade in Tourism

32

Services

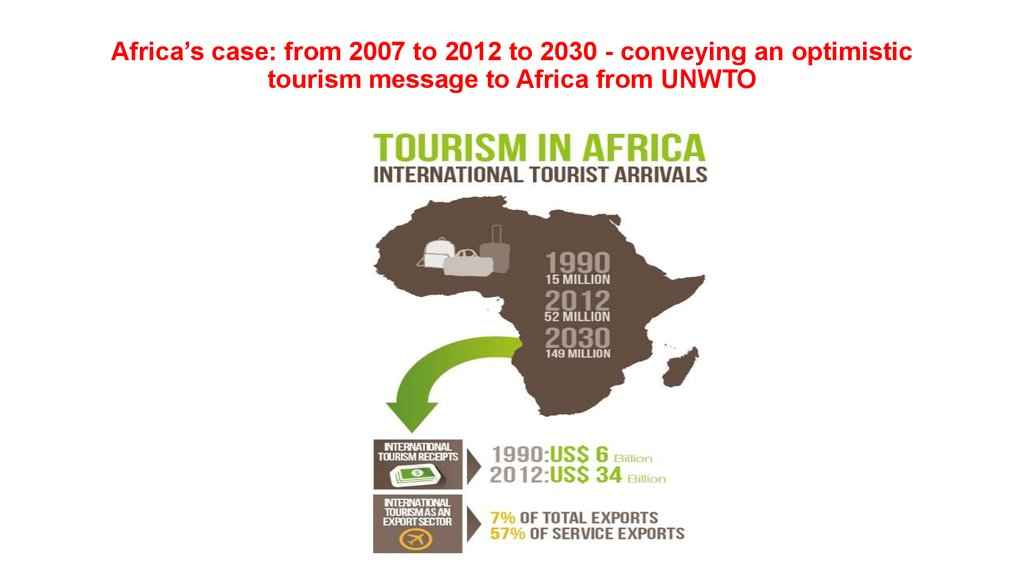

33. Africa’s case: from 2007 to 2012 to 2030 - conveying an optimistic tourism message to Africa from UNWTO

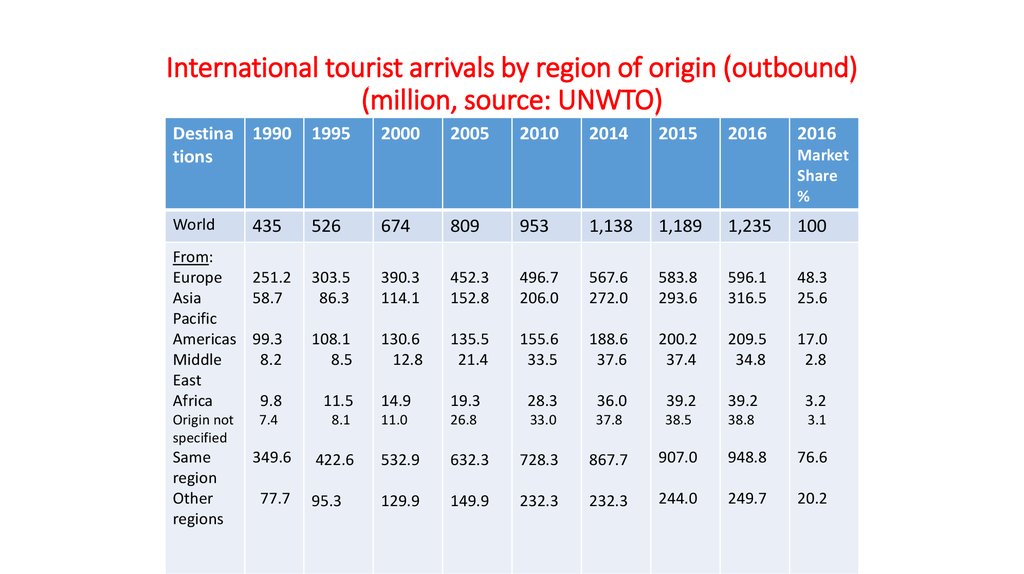

34. International tourist arrivals by region of origin (outbound) (million, source: UNWTO)

Destina 1990tions

1995

World

526

674

809

953

1,138

1,189

1,235

100

303.5

86.3

390.3

114.1

452.3

152.8

496.7

206.0

567.6

272.0

583.8

293.6

596.1

316.5

48.3

25.6

108.1

8.5

130.6

12.8

135.5

21.4

155.6

33.5

188.6

37.6

200.2

37.4

209.5

34.8

17.0

2.8

11.5

14.9

19.3

28.3

36.0

39.2

39.2

3.2

8.1

11.0

26.8

33.0

37.8

38.5

38.8

3.1

422.6

532.9

632.3

728.3

867.7

907.0

948.8

76.6

95.3

129.9

149.9

232.3

232.3

244.0

249.7

20.2

435

From:

Europe

251.2

Asia

58.7

Pacific

Americas 99.3

Middle

8.2

East

Africa

9.8

Origin not

specified

Same

region

Other

regions

7.4

349.6

77.7

2000

2005

2010

2014

2015

2016

2016

Market

Share

%

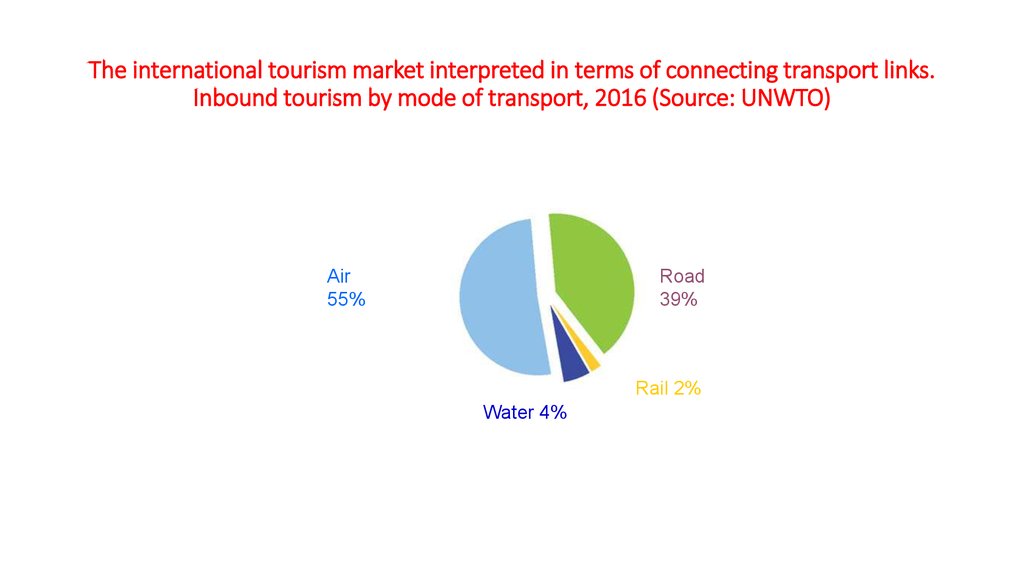

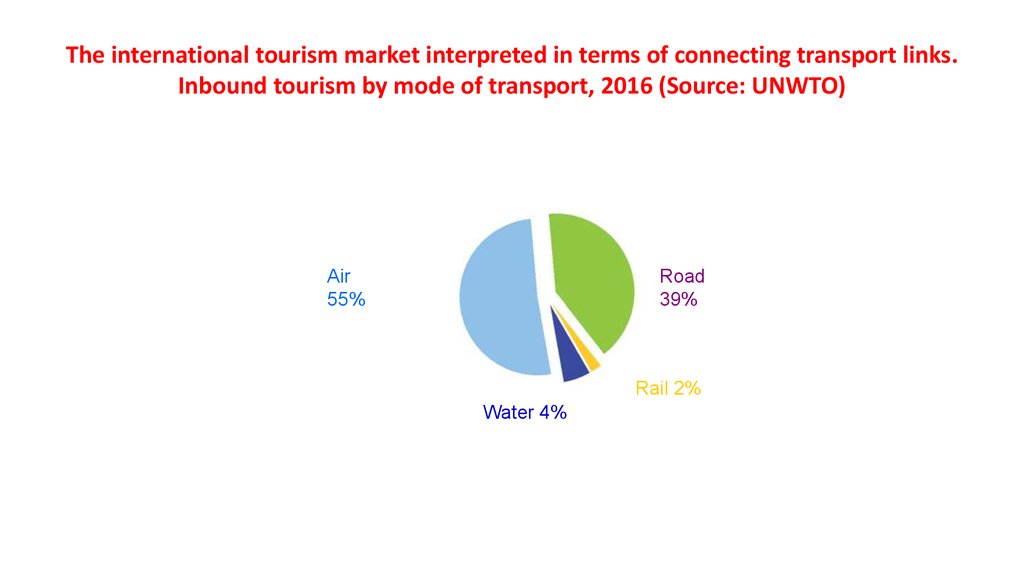

35. The international tourism market interpreted in terms of connecting transport links. Inbound tourism by mode of transport, 2016

(Source: UNWTO)Air

55%

Road

39%

Rail 2%

Water 4%

36. Some conclusions

• Developed economies, in particular EU countries and „Neo – Europe”(USA...) are the principal actors and beneficiaries (recipients) of

international movements of consumers, both inbound and outbound.

• Diversification of main tourism destinations, as well as travel generating

regions, with respect to ranking, is also taking place.

• Numerical growth of trips considered international picked up after 1990

due to the fragmentation of states (USSR, Yugoslavia, Czechoslovakia).

• The share of Europe and the Americas in international travel is being

reduced in favour of Asia (in particular due to China).

37. Some conclusions (2)

• The absolute volume of traffic, both inbound and outbound, is duenot only to the economic prowess, the purchasing power, disposable

income and attractiveness in the countries concerned, but also to the

volume of their population and territory.

• There is a majority and increasing share of international travellers

carried by air.

• Africa`s share in international tourism, in terms of arrivals (inbound),

departures (outbound) and receipts, remains low and stagnant.

38. Some conclusions (3)

• The economic, sociological and environmental value of internationaltourism statistics is relative and far from satisfactory for tourism policies at

world level.

• From the demand side, world or global tourism is a combination of both

international and domestic movements of people or consumers.

• Short-distance travel among European countries is reported as

international; long-distance travel between mainland US and its Pacific

states and islands is reported domestic; trips within China, but to its

territories (Macau, Hong Kong) is reported as international.

• Environmental impact of air, road and maritime transport carrying

passengers, hence tourists, does not respect administrative or political

borders, hence travel considered domestic should be included, as a

rule, in the count of world tourism.

39. Air Transport

• By Tourism Satellite Account (TSA) definition, passenger air transport is acharacteristic tourism activity. During recent years, it has become an even more

powerful agent of globalization by intensive linking and networking the material and

intangible supply of tourism with consumer demand on a global scale by means of:

• Increasing transport of passengers as consumers or tourists in the broad sense of

the term (including domestic flights and consumption abroad in both ways:

outbound and inbound),

as well as

• Increasing carriage of goods (cargo) and mail.

• Air transport is also globalizing or integrating within its own ranks

.

• The global market is both a platform of both fierce competition and

cooperation among world airlines.

40. Air transport (2)

• Air transport market globalization by means of, and within, air transportis taking place due to the processes of:

• Expansion of air carriers destinations

• Broadening the outreach of open skies

• Mergers of air carriers, to form transnational companies (eg. British

Airways and Iberia)

• Alliances of varying scope of integration and cooperation (such as

codesharing)

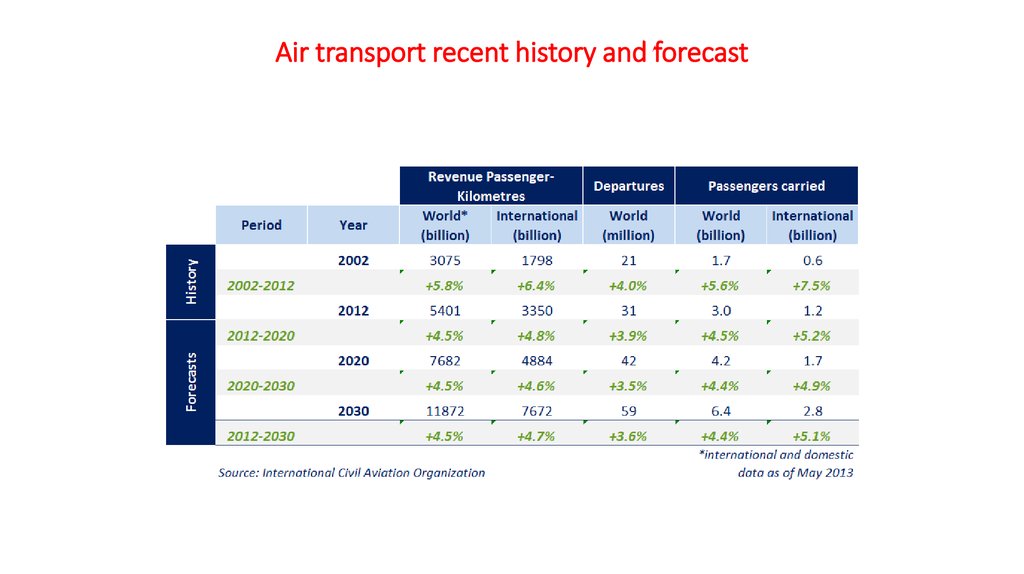

41. Air transport recent history and forecast

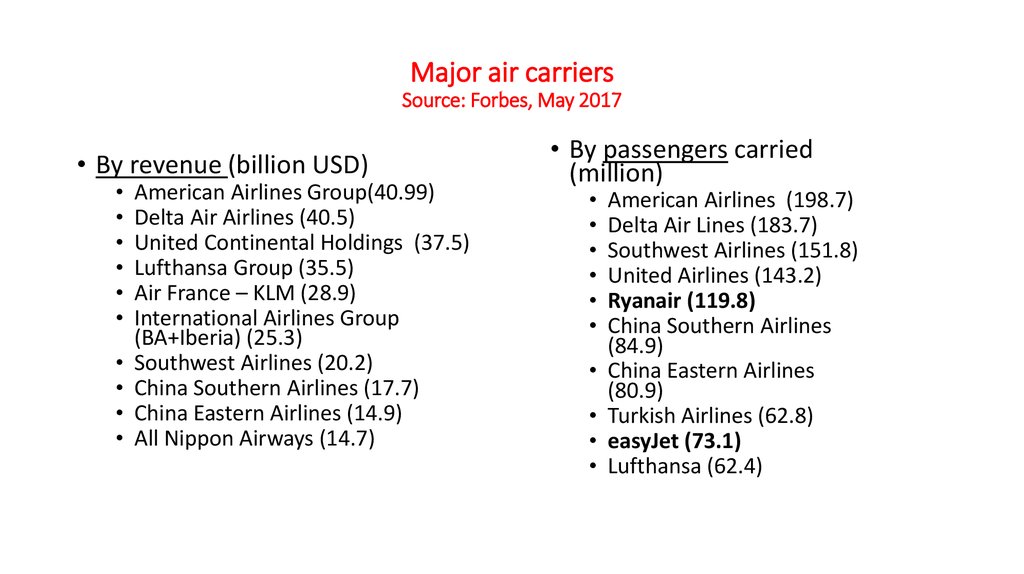

42. Major air carriers Source: Forbes, May 2017

• By revenue (billion USD)American Airlines Group(40.99)

Delta Air Airlines (40.5)

United Continental Holdings (37.5)

Lufthansa Group (35.5)

Air France – KLM (28.9)

International Airlines Group

(BA+Iberia) (25.3)

Southwest Airlines (20.2)

China Southern Airlines (17.7)

China Eastern Airlines (14.9)

All Nippon Airways (14.7)

• By passengers carried

(million)

American Airlines (198.7)

Delta Air Lines (183.7)

Southwest Airlines (151.8)

United Airlines (143.2)

Ryanair (119.8)

China Southern Airlines

(84.9)

China Eastern Airlines

(80.9)

Turkish Airlines (62.8)

easyJet (73.1)

Lufthansa (62.4)

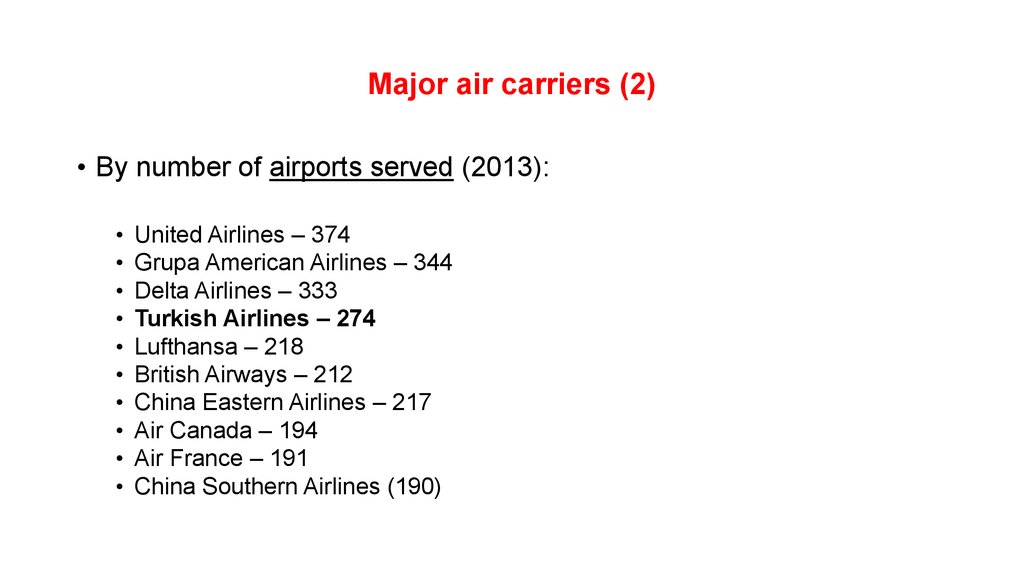

43. Major air carriers (2)

• By number of airports served (2013):United Airlines – 374

Grupa American Airlines – 344

Delta Airlines – 333

Turkish Airlines – 274

Lufthansa – 218

British Airways – 212

China Eastern Airlines – 217

Air Canada – 194

Air France – 191

China Southern Airlines (190)

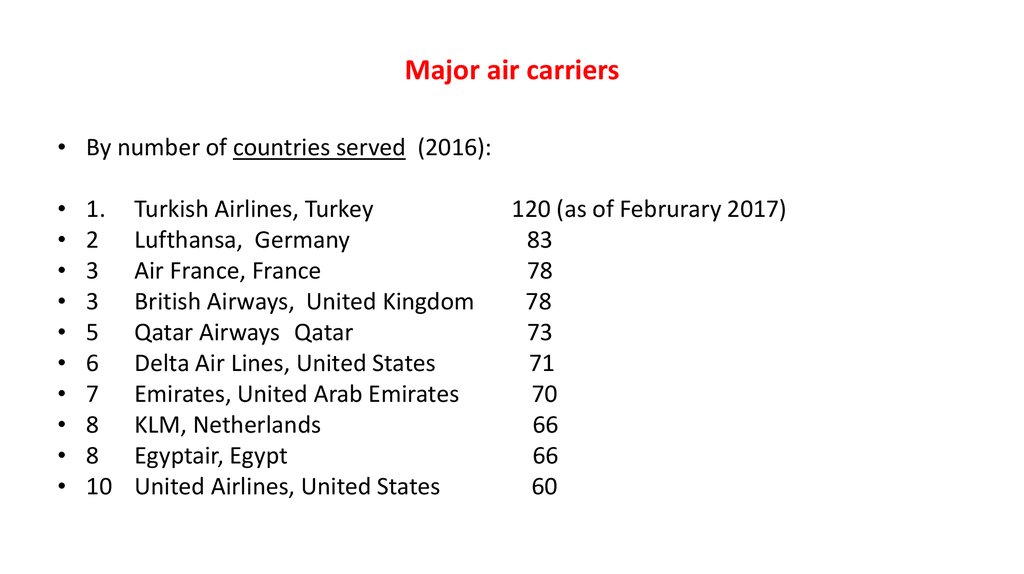

44. Major air carriers

• By number of countries served (2016):1.

2

3

3

5

6

7

8

8

10

Turkish Airlines, Turkey

Lufthansa, Germany

Air France, France

British Airways, United Kingdom

Qatar Airways Qatar

Delta Air Lines, United States

Emirates, United Arab Emirates

KLM, Netherlands

Egyptair, Egypt

United Airlines, United States

120 (as of Februrary 2017)

83

78

78

73

71

70

66

66

60

45. Air Transport (3)

• It was first deregulation, leading to liberalization of air transport, taking placein the US in 1978 (Airline Deregulation Act), which can conventionally be

considered as a beginning of the new wave of market globalization in this

area. From national and bilateral dimension (an agreement between US and

the Netherlands) it extended to the international (multilateral) arena.

• At the time, it was an international NGO, IATA (International Air Transport

Association) which played a role of commercial regulator settling accounts

(bank settlement plan) for air carriers belonging to the association. It was

therefore considered a sort of an air carriers` cartel. It did not deal, however,

with the issues of “freedoms of the air” conducive to globalization.

46. From the Chicago convention (Convention on International Civil Aviation) to the „open sky”

• The Chicago convention (1944) provides that “every State hascomplete and exclusive sovereignty over the airspace above its

territory”.

• Attached to the Chicago Convention is the International Air Services

Transport Agreement (IASTA) which provides for five freedoms in the

air also called traffic rights.

• Said freedoms are not tacitly available to the signatories of the Chicago

convention, but they need to be negotiated by means of bilateral air

agreements between governments of two countries on behalf of the air

carriers established in their territories.

• Traffic rights are not covered by the General Agreement on Trade in

Services (GATS) of 1995 of the World Trade Organization (WTO), even

though GATS deals with air transport services, but these are limited

only to the services suppied in airports and to aircraft.

47. From the Chicago convention (Convention on International Civil Aviation) to the „open sky”(2)

• The ability to make use of all the freedoms of the airwould amount to an entirely open sky, hence a global air

transport market.

• In practice every country engages on behalf of its

carriers in bilateral air transport agreements (also called

air service agreements, ASAs) agreements of varying

coverage.

• According to ICAO, in October 2012 there were as many

as 400 such agreements with 145 countries involved.

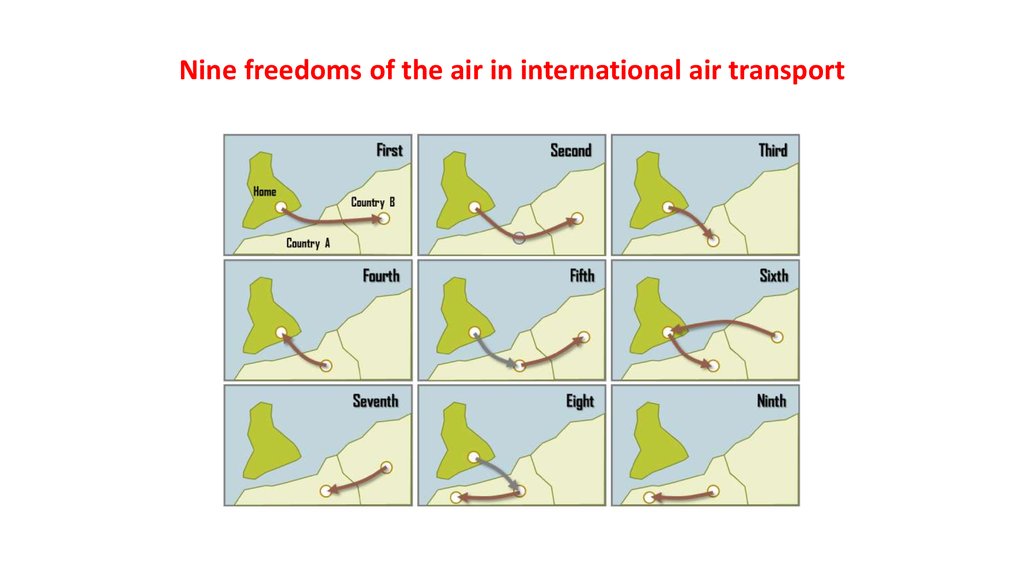

48. The first five Freedoms of the Air referred to in IASTA

First Freedom of the Air - the right or privilege, in respect of scheduled international air services, granted by

one State to another State or States to fly across its territory without landing

Second Freedom of the Air - the right or privilege, in respect of scheduled international air services, granted by

one State to another State or States to land in its territory for non-traffic purposes

Third Freedom of The Air - the right or privilege, in respect of scheduled international air services, granted by

one State to another State to put down, in the territory of the first State, traffic coming from the home State of

the carrier

Fourth Freedom of The Air - the right or privilege, in respect of scheduled international air services, granted by

one State to another State to take on, in the territory of the first State, traffic destined for the home State of the

carrier.

Fifth Freedom of The Air - the right or privilege, in respect of scheduled international air services, granted by

one State to another State to put down and to take on, in the territory of the first State, traffic coming from or

destined to a third State

49. Additional freedoms of the air identified in ASAs

Sixth Freedom of The Air - the right or privilege, in respect of scheduled international air services, of

transporting, via the home State of the carrier, traffic moving between two other States

Seventh Freedom of The Air - the right or privilege, in respect of scheduled international air services, granted

by one State to another State, of transporting traffic between the territory of the granting State and any third

State with no requirement to include on such operation any point in the territory of the recipient State, i.e. the

service need not connect to or be an extension of any service to/from the home State of the carrier.

Eighth Freedom of The Air - the right or privilege, in respect of scheduled international air services, of

transporting cabotage traffic between two points in the territory of the granting State on a service which

originates or terminates in the home country of the foreign carrier or (in connection with the Seventh Freedom

of the Air) outside the territory of the granting State (also known as a “consecutive cabotage”).

Ninth Freedom of The Air - the right or privilege of transporting cabotage traffic of the granting State on a

service performed entirely within the territory of the granting State (also known as a “stand alone "cabotage”).

50. Nine freedoms of the air in international air transport

51. From the Chicago convention (Convention on International Civil Aviation) to the „open sky”(3) Europe (EU)

• A rule-based “open sky”, or a common market of air transportservices, is enjoyed by the European Union in view of its single

European market.

• The rule of open skies is gradually introduced between the European

Union and other areas, including USA.

• The current arrengement in place is considered asymetric: it

concedes more rights to US carriers at the expense of the European

ones.

– Allowing Norwegian flights in USA was problematic.

52. Air transport liberalization in the European Union

• A rule-based “open sky”, or a common market of air transport services, isenjoyed by the European Union in view of its of the European single

market. It is technically based on three-four measures or packages and

supported by a regulation of 2008.

• The first measure, passed in 1987, addressed fares and limited each

government’s ability to regulate fares. It also allowed some airlines to

begin sharing capacity on routes.

• In 1990, the second round provided even more flexibility on fares

and capacity sharing and eliminated capacity controls on routes from

carriers’ home countries to other EU nations.

53. Air transport liberalization in the European Union (2)

• Finally, in 1993, the “third package” opened up the EU aviation market considerably. The thirdpackage allowed any EU -based airline to operate services anywhere within the EU, and in

1997 (fourth measure), this was extended to provide for cabotage, defined in this situation as

flights within another member state’s sovereign territory.

– The third package allowed airlines to fly anywhere they wanted in the EU (and later, via treaties, in Iceland,

Norway, and Switzerland) and to establish their own capacity and fares.

• The system is further supported by Regulation (EC) No 1008/2008 of the European Parliament and of

the Council of 24 September 2008 on common rules for the operation of air services in the

Community.

• The issue of air traffic control in European air space is on the agenda and competence of

EUROCONTROL.

54. Elements of Airline Alliances, based on the extent of integration and cooperation

Coordination of route networks and schedules;

Coordination of prices, inventory and yield management;

Revenue, cost and profit pooling and sharing;

Code sharing;

Joint marketing, advertising and distribution networks;

Joint procurement (purchase of fuel, catering, etc.)

55. Elements of Airline Alliances, based on the extent of integration and cooperation

• Reciprocal access to frequent flyer programs;• Sharing of airport facilities;

• Coordination of IT platforms (ticket reservation and distribution

systems, financial and accounting reporting, etc.);

• Coordination of cargo operations;

• Standardization of accounting, financial, product development and other

practices.

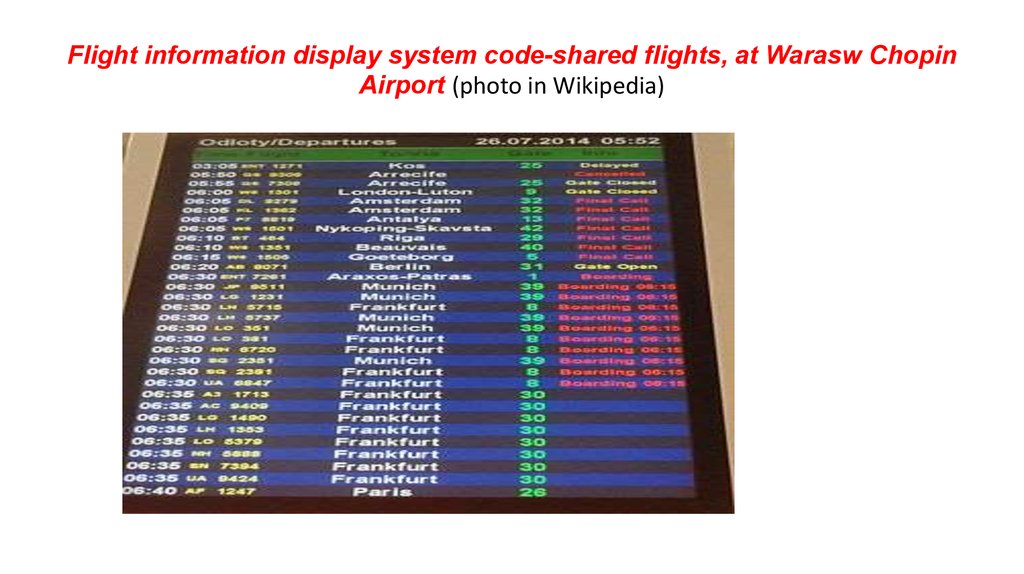

56. Flight information display system code-shared flights, at Warasw Chopin Airport (photo in Wikipedia)

57. The international tourism market interpreted in terms of connecting transport links. Inbound tourism by mode of transport, 2016

(Source: UNWTO)Air

55%

Road

39%

Rail 2%

Water 4%

58. The “ignored” part of the air transport market

• Aircraft industry• Airports

59. Some conclusions

• According to UNWTO, there is a majority and increasing share ofinternational travellers which are carried by air.

• ICAO data show both world (including domestic traffic) and

international travel by air, which better represent the wholeness

and complexity of the air travel market.

• ICAO figures on international traffic (number of passengers) exceed

and tend to double the UNWTO figures regarding international

tourist arrivals. This is partially explained by the fact that ICAO data

cover both outbound and inbound traffic (return trips).

60. Some conclusions (2)

• US-based airlines top the rankings, which is explained by the fact that they servein principle the enormous US domestic market.

• Year by year there are changes in the rankings putting up airlines originating in

China and welcoming successful newcomes, such as Turkish airlines.

• Low-cost airlines, in particular Ryanair, exert competitive, price-based pressure

on flagship airlines.

• Air transport appears as a powerful agent of globalization of the world tourism

market

61. World tourism market 3. Status and prospects of product development in the world tourism market. Addendum

End of chapter 3. Addendumhenryk.handszuh@gmail.com

economics

economics