Similar presentations:

Toward a Regional Action Agenda

1. Toward a Regional Action Agenda

Asia Pacific Climate Week2. Toward a Regional Action Agenda 1. Exploring new funding opportunities

Asia Pacific Climate Week3. Threat Assessment: Climate Change hits Asia Pacific countries hard

• Low income countries in Asia Pacificface climate change impacts

-

Floods

Droughts

Rising sea levels

Deforestation

Extreme temperatures

• Resources are scarce in these

countries

• Investment opportunities exist

• Public funds alone are not sufficient

• Global capital is abundant

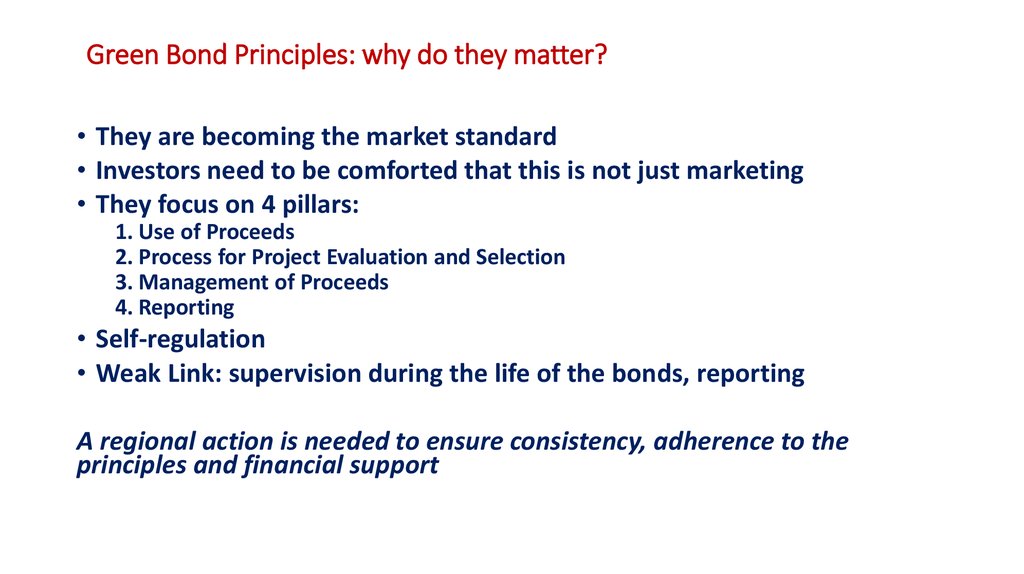

Need to urgently find solutions to bring

global capital to the investment

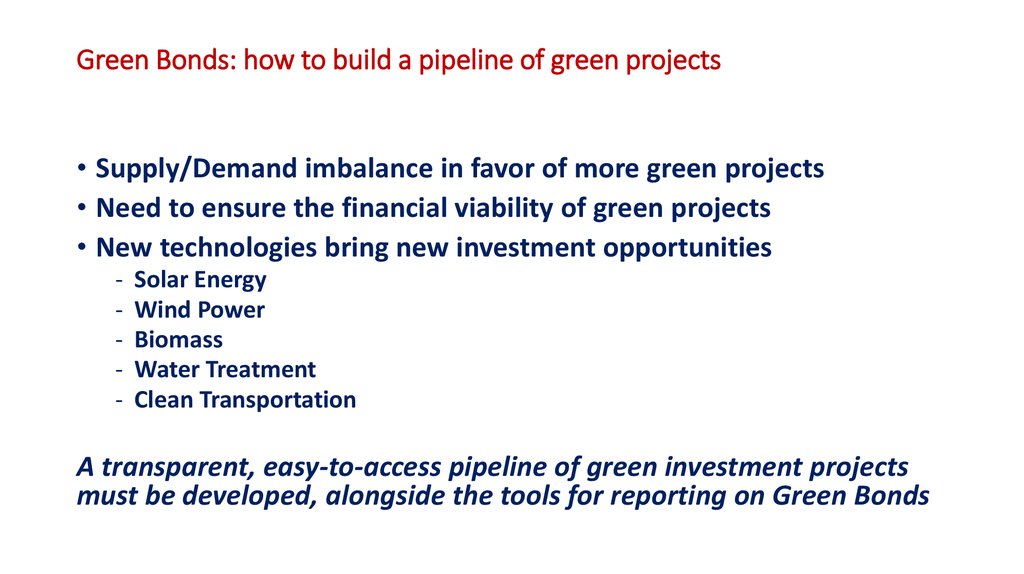

opportunities

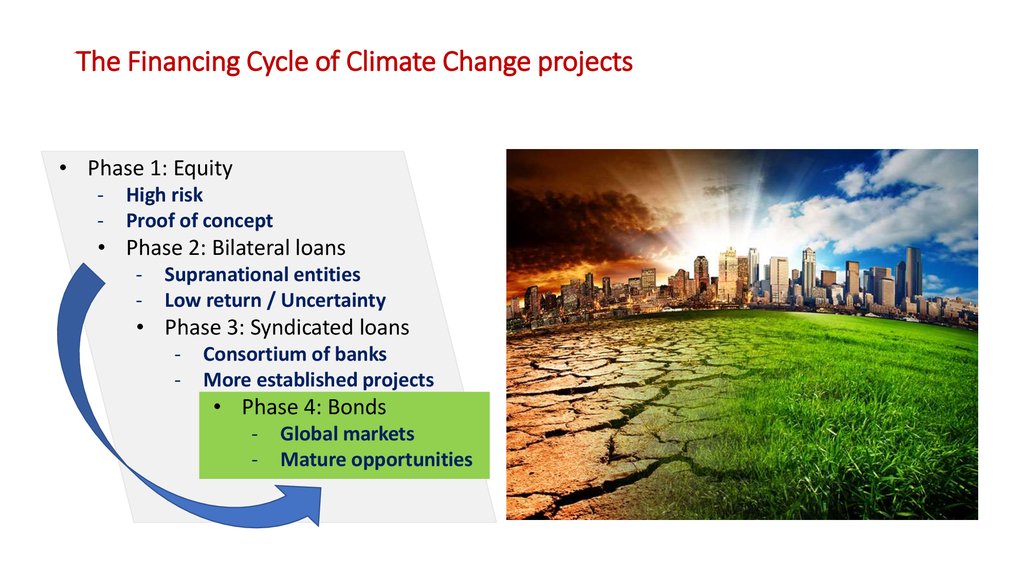

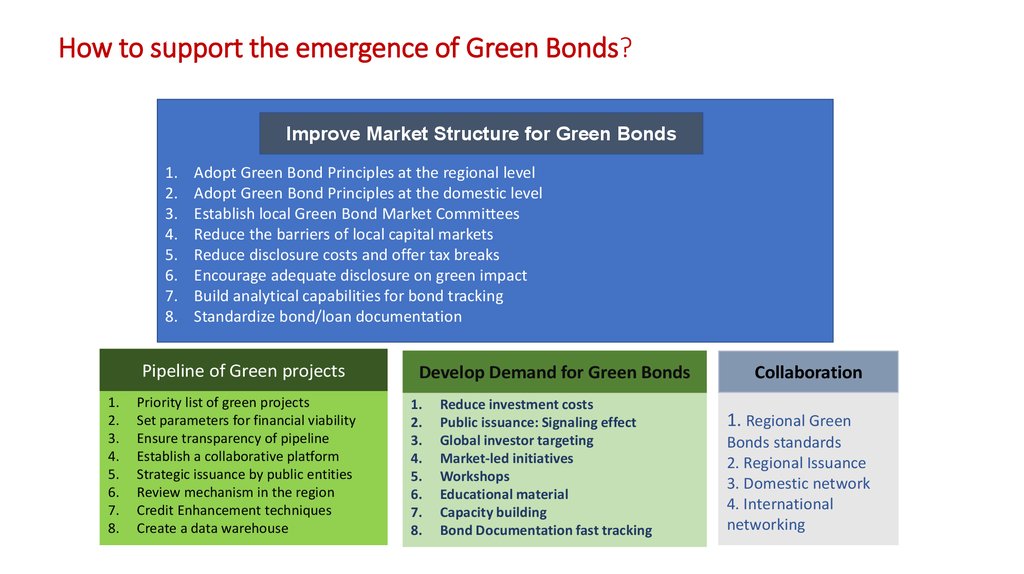

4. The Financing Cycle of Climate Change projects

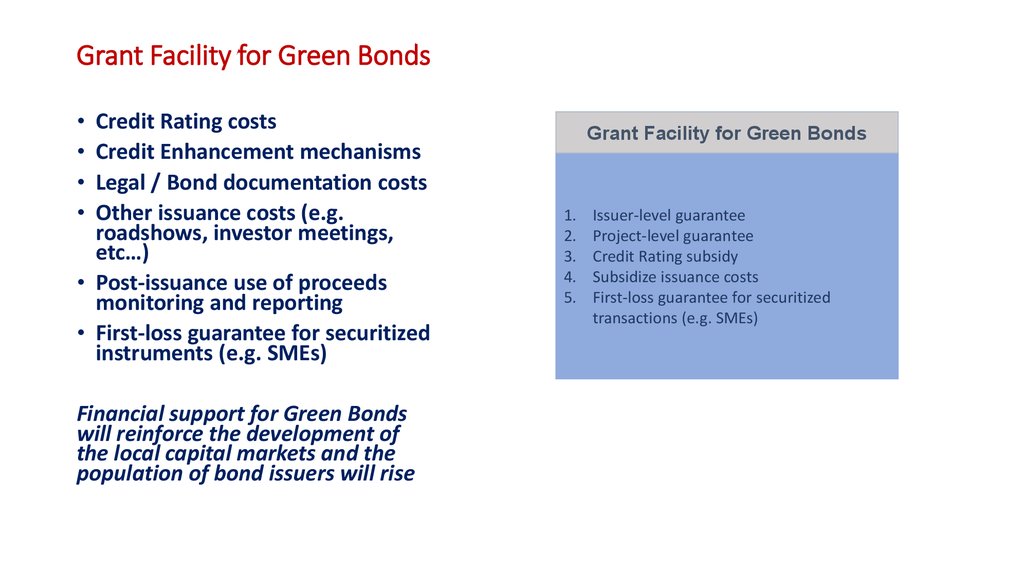

• Phase 1: Equity-

High risk

Proof of concept

• Phase 2: Bilateral loans

-

Supranational entities

Low return / Uncertainty

• Phase 3: Syndicated loans

-

Consortium of banks

More established projects

• Phase 4: Bonds

-

Global markets

Mature opportunities

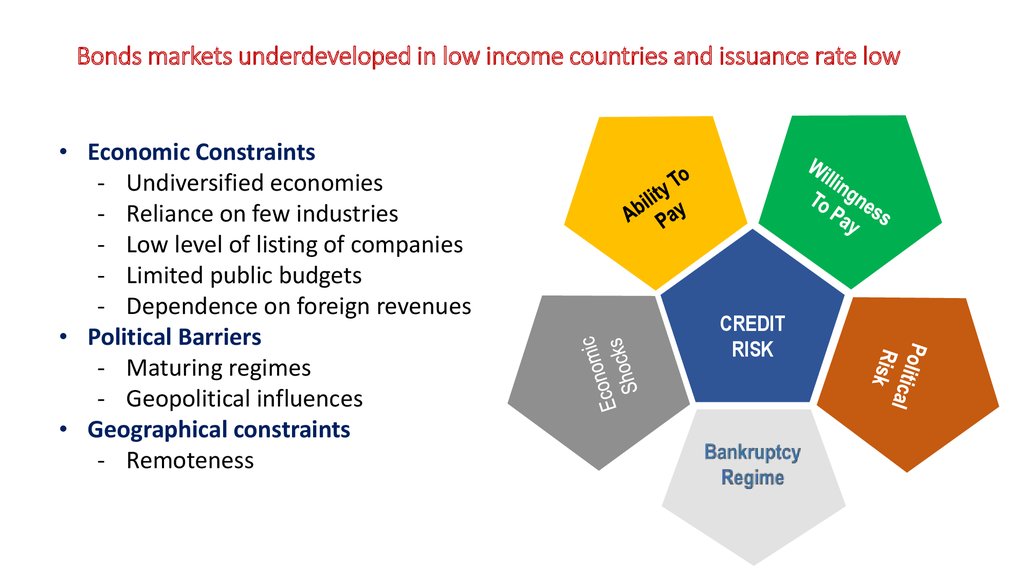

5. Bonds markets underdeveloped in low income countries and issuance rate low

• Economic Constraints- Undiversified economies

- Reliance on few industries

- Low level of listing of companies

- Limited public budgets

- Dependence on foreign revenues

• Political Barriers

- Maturing regimes

- Geopolitical influences

• Geographical constraints

- Remoteness

CREDIT

RISK

6. Starting Point: several countries are already “issuance”-ready

• Fiji (2017), Maldives(2017), Philippines, Sri

Lanka, Indonesia,

Pakistan,

Turkmenistan, Vietnam

Sovereign

Bond (8/25)

Credit Rating

(13/25)

No Bond

No Rating

(12/25)

• Bangladesh, Cambodia,

Fiji, Indonesia, Maldives,

Pakistan, Philippines,

PNG, Sri Lanka,

• Solomon Is., Tajikistan,

Uzbekistan, Vietnam

• Afghanistan, Bhutan,

Myanmar, Nepal, Palau,

Samoa, Timor-Leste,

Tonga, Turkmenistan,

Tuvalu, Vanuatu

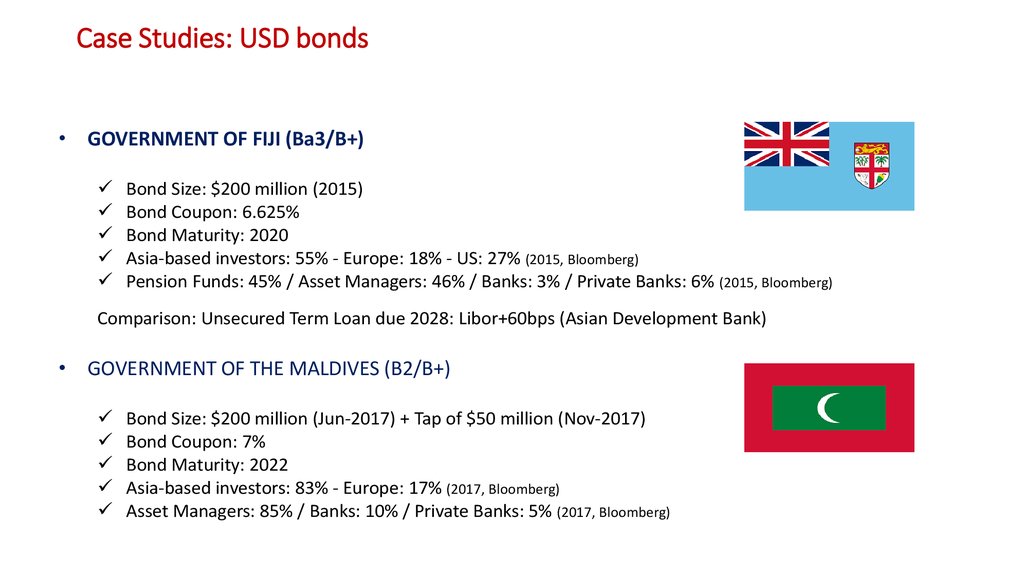

7. Case Studies: USD bonds

• GOVERNMENT OF FIJI (Ba3/B+)Bond Size: $200 million (2015)

Bond Coupon: 6.625%

Bond Maturity: 2020

Asia-based investors: 55% - Europe: 18% - US: 27% (2015, Bloomberg)

Pension Funds: 45% / Asset Managers: 46% / Banks: 3% / Private Banks: 6% (2015, Bloomberg)

Comparison: Unsecured Term Loan due 2028: Libor+60bps (Asian Development Bank)

• GOVERNMENT OF THE MALDIVES (B2/B+)

Bond Size: $200 million (Jun-2017) + Tap of $50 million (Nov-2017)

Bond Coupon: 7%

Bond Maturity: 2022

Asia-based investors: 83% - Europe: 17% (2017, Bloomberg)

Asset Managers: 85% / Banks: 10% / Private Banks: 5% (2017, Bloomberg)

8. Toward a Regional Action Agenda 2. Green Bonds

Asia Climate Week9. What is a “Green” Bond?

• Same as a standard Bond- Debt instrument

- Defined maturity from the start

- Foreign or Local currency

- Coupon

- Defined parameters (covenants)

• Difference

- Use of Proceeds must be “green”

- Additional reporting requirements

- Third-party certification

10. Why do they matter?

• Rising interest from investors:-

Fiduciary duties of managers

ESG mandates

Ethical investing

Private Investors

Sovereign Wealth Funds

High Net Worth Individuals

• Lack of diversification opportunities for

global fixed income investors

11. What do they finance?

GREEN BOND12. Are they cheaper/more expensive?

• No real evidence of a pricing difference- Over-subscription at issuance

- Pricing in line

- Buy and Hold investors

- New market segment

• Brown bonds will trade at a discount

over time, as seen as more “risky”

• Volumes expected to grow strongly in

the years to come

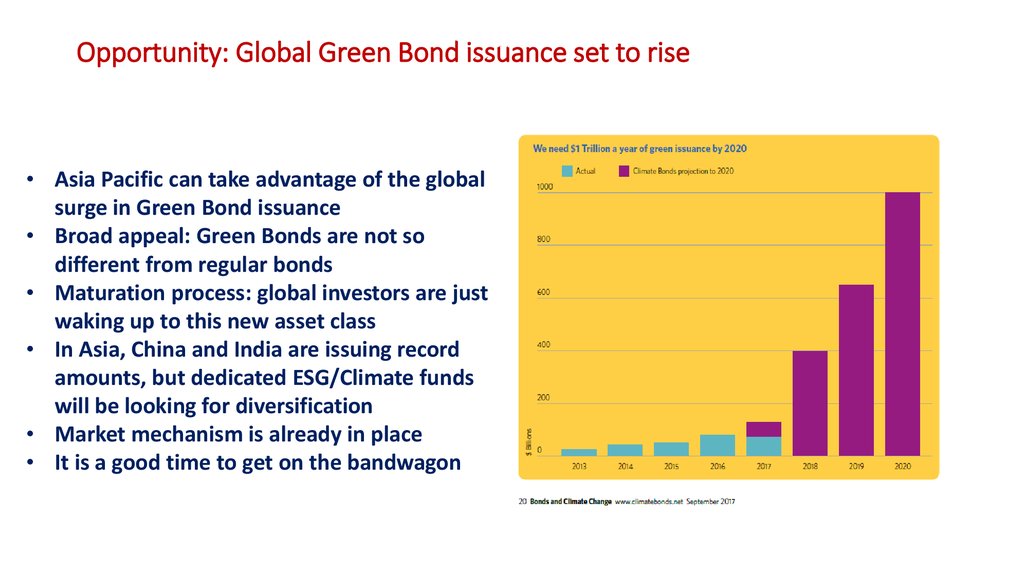

13. Opportunity: Global Green Bond issuance set to rise

• Asia Pacific can take advantage of the globalsurge in Green Bond issuance

• Broad appeal: Green Bonds are not so

different from regular bonds

• Maturation process: global investors are just

waking up to this new asset class

• In Asia, China and India are issuing record

amounts, but dedicated ESG/Climate funds

will be looking for diversification

• Market mechanism is already in place

• It is a good time to get on the bandwagon

14. Case Studies: Green bonds in Asia Pacific

• GOVERNMENT OF FIJIBond Size: FJD 100 million = USD 50 million (2017)

Bond Coupon: 4% (5 year) and 6.3% (13 year)

Bond Maturity: 2022 and 2030

Technical assistance from the World Bank and IFC

Third Party certification

• AP Renewables

Bond Size: PHP 10.7 billion = USD 225 million (2016)

Bond Coupon: 7% - Bond Maturity: 2026

Tiwi-MakBan geothermal project

75% guarantee from the Asian Development Bank

Private placement to BPI (sale to insurance companies)

Third Party certification

15. Toward a Regional Action Agenda 3. Road to Market

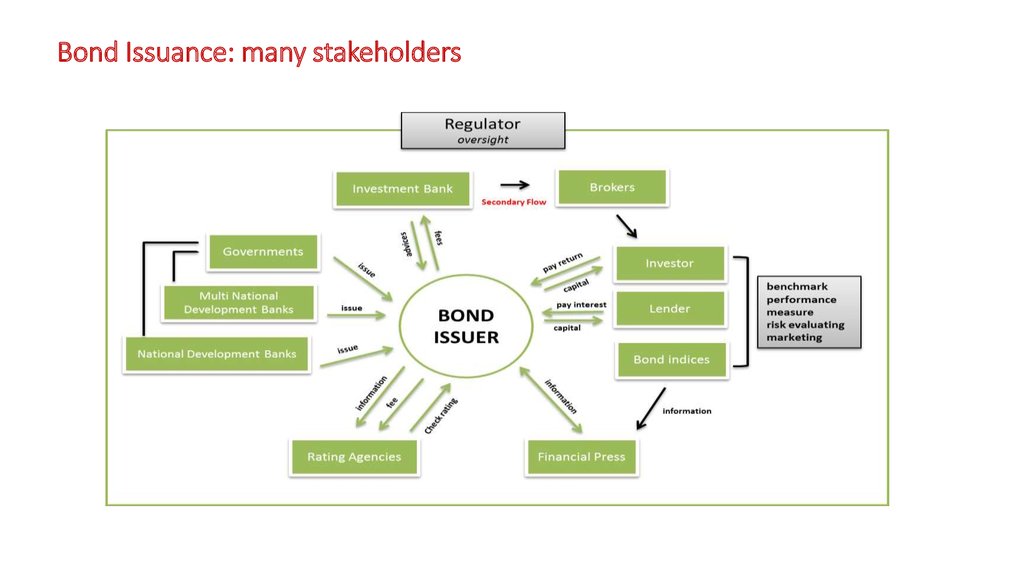

Asia Climate Week16. Bond Issuance: many stakeholders

17. Green Bond Principles: why do they matter?

• They are becoming the market standard• Investors need to be comforted that this is not just marketing

• They focus on 4 pillars:

1. Use of Proceeds

2. Process for Project Evaluation and Selection

3. Management of Proceeds

4. Reporting

• Self-regulation

• Weak Link: supervision during the life of the bonds, reporting

A regional action is needed to ensure consistency, adherence to the

principles and financial support

18. Green Bond Principles: Regional / Local

• Under-developed capital markets in target countries• Regional principles must be adhered to at the local level

• Suggestion: creation of Green Bond Committees at the local level

• Transfer of expertise, capacity building, project pipeline

Regional action is needed to ensure that the market knowledge is

properly transferred from the regional to the local level and the

requisite capacity is built through workshops, regional experts to

assist local teams, help from regional banks, technical experts, etc.

19. Green Bonds: how to build a pipeline of green projects

• Supply/Demand imbalance in favor of more green projects• Need to ensure the financial viability of green projects

• New technologies bring new investment opportunities

-

Solar Energy

Wind Power

Biomass

Water Treatment

Clean Transportation

A transparent, easy-to-access pipeline of green investment projects

must be developed, alongside the tools for reporting on Green Bonds

20. How to support the emergence of Green Bonds?

Improve Market Structure for Green Bonds1.

2.

3.

4.

5.

6.

7.

8.

Adopt Green Bond Principles at the regional level

Adopt Green Bond Principles at the domestic level

Establish local Green Bond Market Committees

Reduce the barriers of local capital markets

Reduce disclosure costs and offer tax breaks

Encourage adequate disclosure on green impact

Build analytical capabilities for bond tracking

Standardize bond/loan documentation

Pipeline of Green projects

1.

2.

3.

4.

5.

6.

7.

8.

Priority list of green projects

Set parameters for financial viability

Ensure transparency of pipeline

Establish a collaborative platform

Strategic issuance by public entities

Review mechanism in the region

Credit Enhancement techniques

Create a data warehouse

Develop Demand for Green Bonds

1.

2.

3.

4.

5.

6.

7.

8.

Reduce investment costs

Public issuance: Signaling effect

Global investor targeting

Market-led initiatives

Workshops

Educational material

Capacity building

Bond Documentation fast tracking

Collaboration

1. Regional Green

Bonds standards

2. Regional Issuance

3. Domestic network

4. International

networking

21. Grant Facility for Green Bonds

Credit Rating costs

Credit Enhancement mechanisms

Legal / Bond documentation costs

Other issuance costs (e.g.

roadshows, investor meetings,

etc…)

• Post-issuance use of proceeds

monitoring and reporting

• First-loss guarantee for securitized

instruments (e.g. SMEs)

Financial support for Green Bonds

will reinforce the development of

the local capital markets and the

population of bond issuers will rise

Grant Facility for Green Bonds

1.

2.

3.

4.

5.

Issuer-level guarantee

Project-level guarantee

Credit Rating subsidy

Subsidize issuance costs

First-loss guarantee for securitized

transactions (e.g. SMEs)

22. Concluding Remarks

• Opportunity to develop capital markets in Asia Pacific• Attract Private Capital for new investment opportunities

• Develop “green” investments in all countries

• Respond to market inefficiencies through a targeted programme

• Impact/Cost Ratio is highly favourable

• Build on the successes of the large countries

• Regional cooperation will bring benefits to all stakeholders

finance

finance