Similar presentations:

Absorption and Variable Costing

1.

Absorption and Variable CostingMcGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

2. Absorption Costing

A system of accounting for costs in which bothfixed and variable production costs are

considered product costs.

Fixed

Costs

Product

Variable

Costs

3. Variable Costing

A system of cost accounting that only assignsthe variable cost of production to products.

Fixed

Costs

Product

Variable

Costs

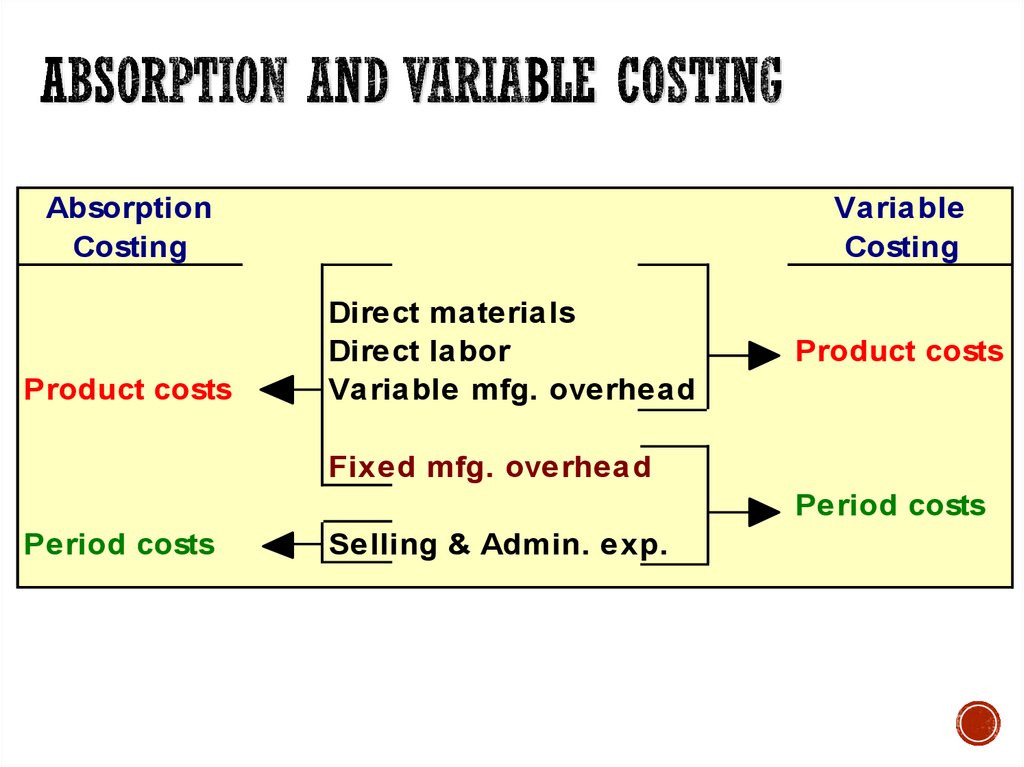

4. Absorption and Variable Costing

AbsorptionCosting

Product costs

Variable

Costing

Direct materials

Direct labor

Variable mfg. overhead

Product costs

Fixed mfg. overhead

Period costs

Period costs

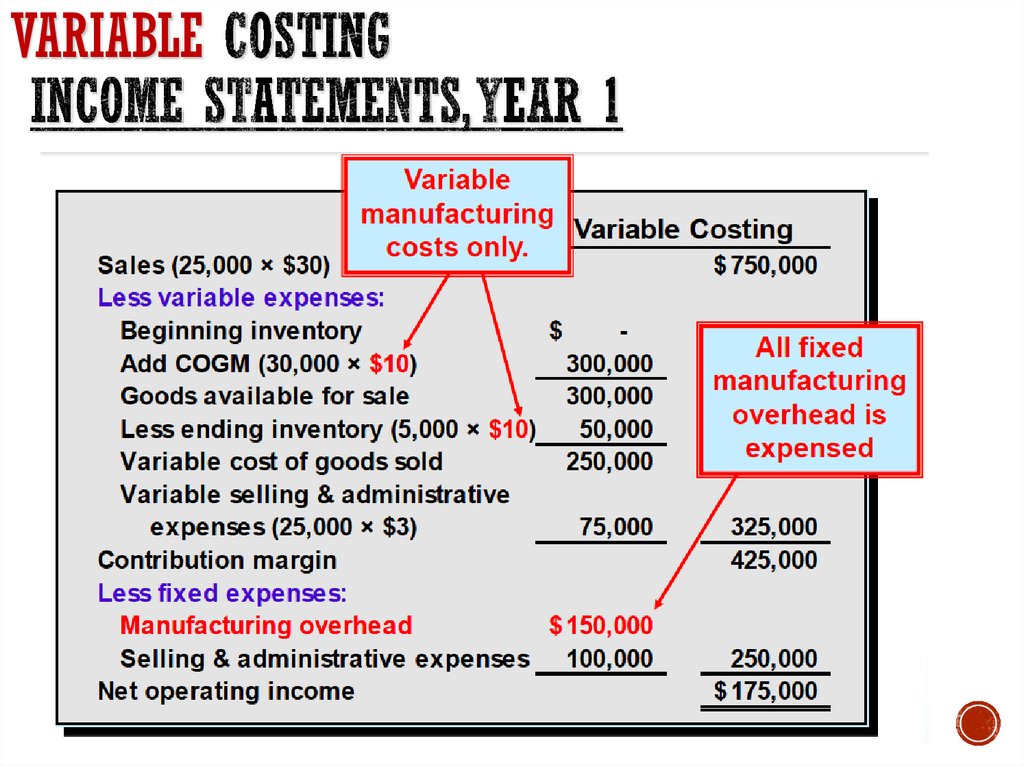

Selling & Admin. exp.

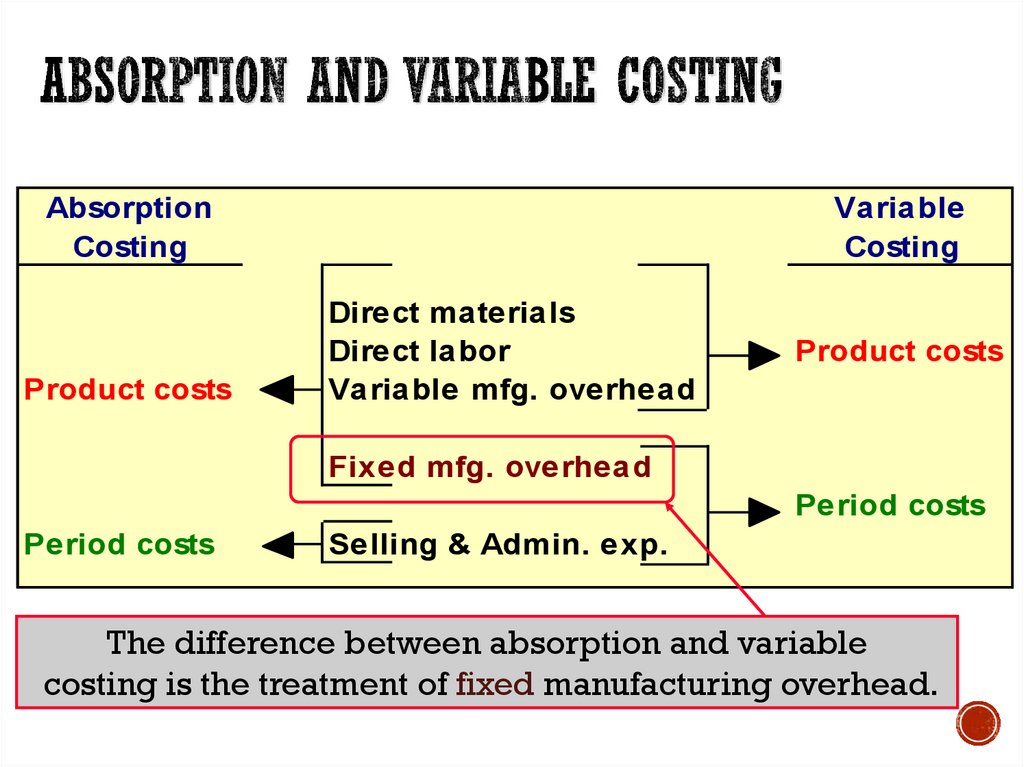

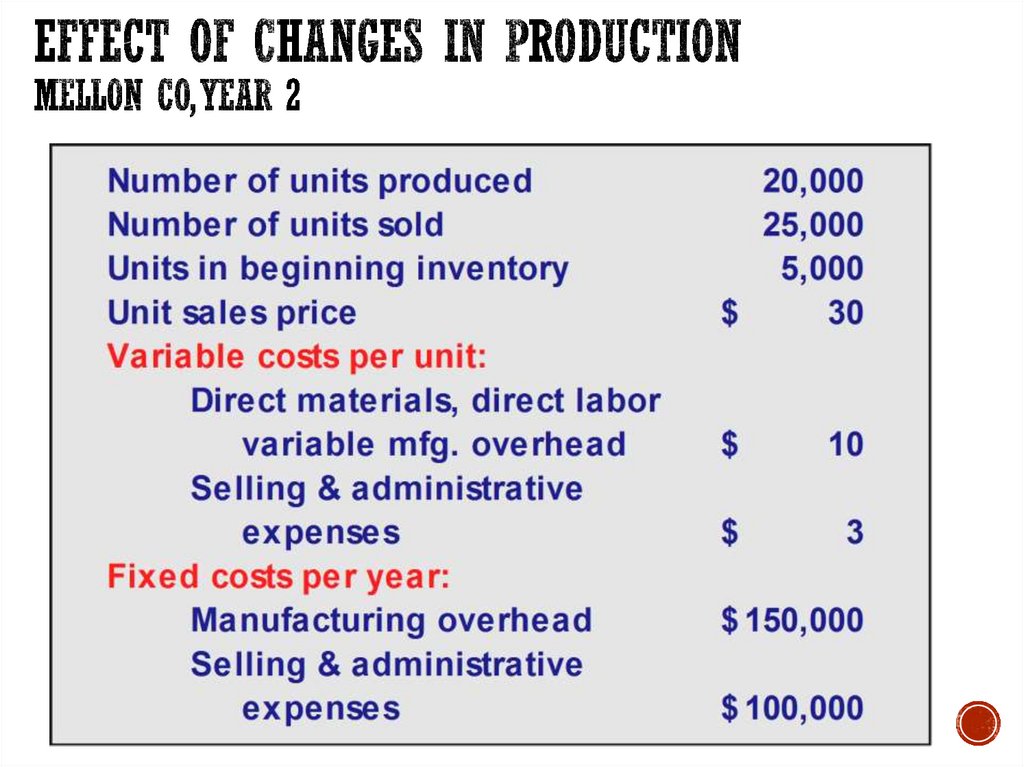

5. Absorption and Variable Costing

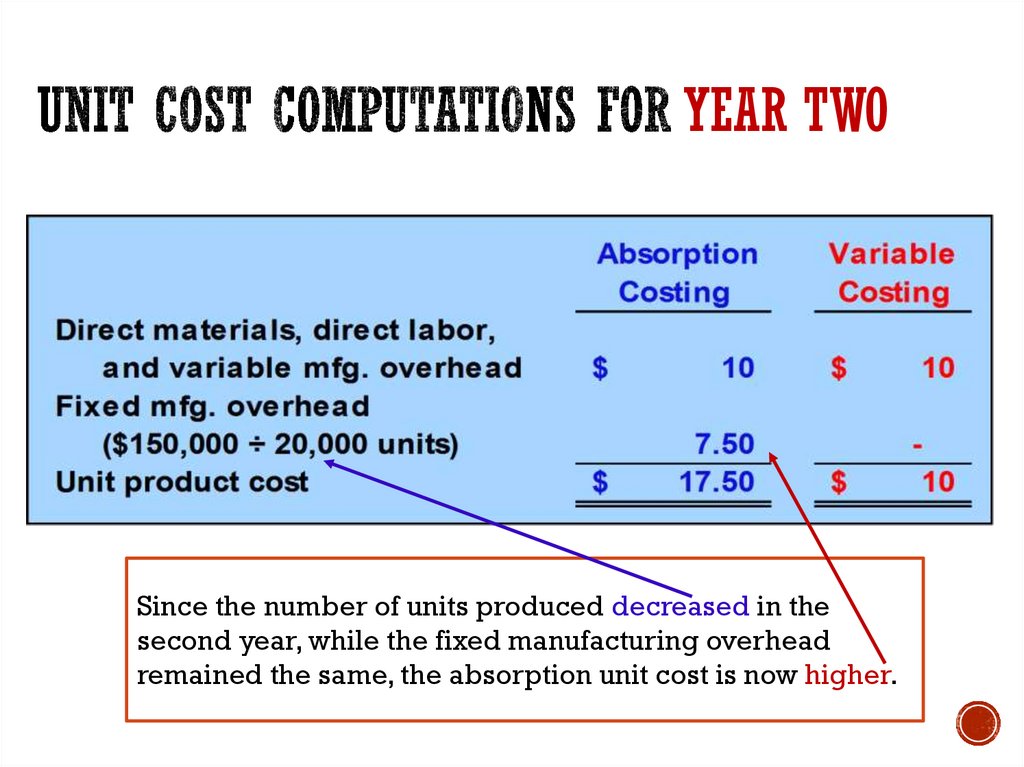

AbsorptionCosting

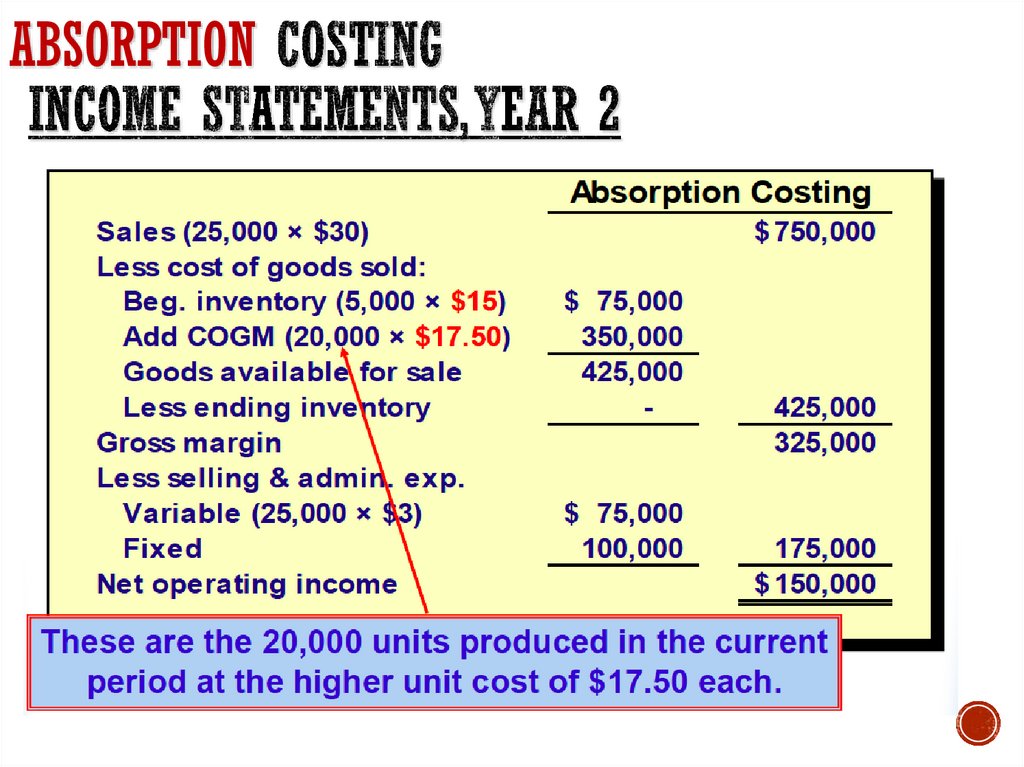

Product costs

Variable

Costing

Direct materials

Direct labor

Variable mfg. overhead

Product costs

Fixed mfg. overhead

Period costs

Period costs

Selling & Admin. exp.

The difference between absorption and variable

costing is the treatment of fixed manufacturing overhead.

6. Absorption and Variable Costing

Let’s put some numbers to an example andsee what we can learn about the difference

between absorption and variable costing.

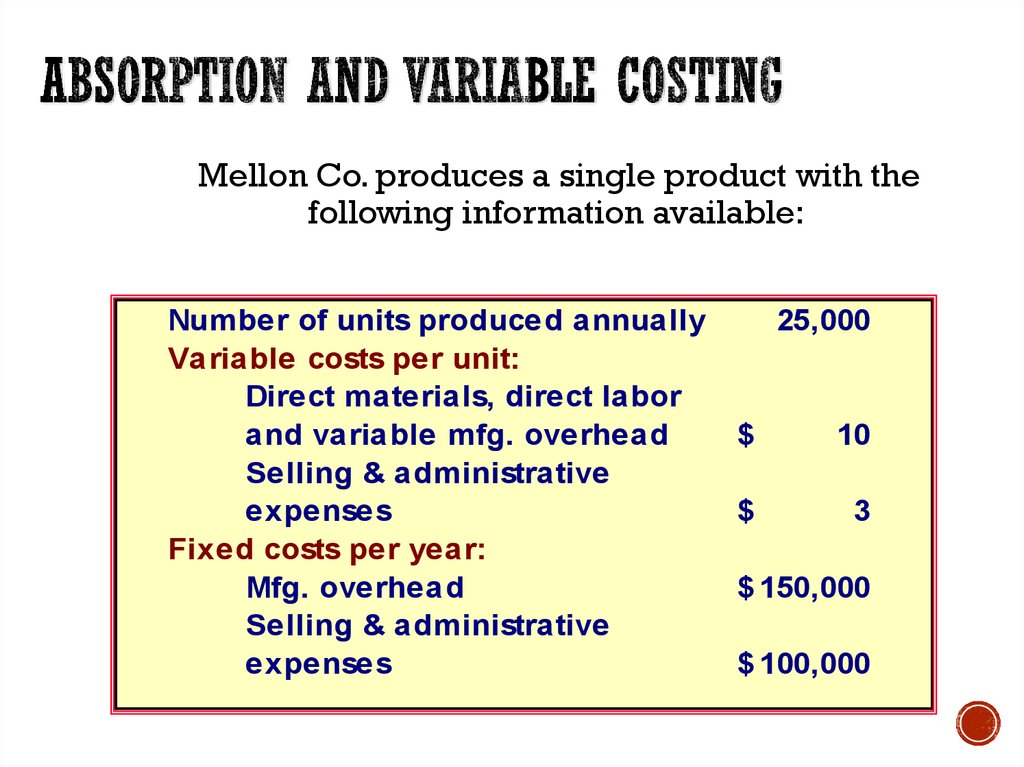

7. Absorption and Variable Costing

Mellon Co. produces a single product with thefollowing information available:

Number of units produced annually

Variable costs per unit:

Direct materials, direct labor

and variable mfg. overhead

Selling & administrative

expenses

Fixed costs per year:

Mfg. overhead

Selling & administrative

expenses

25,000

$

10

$

3

$ 150,000

$ 100,000

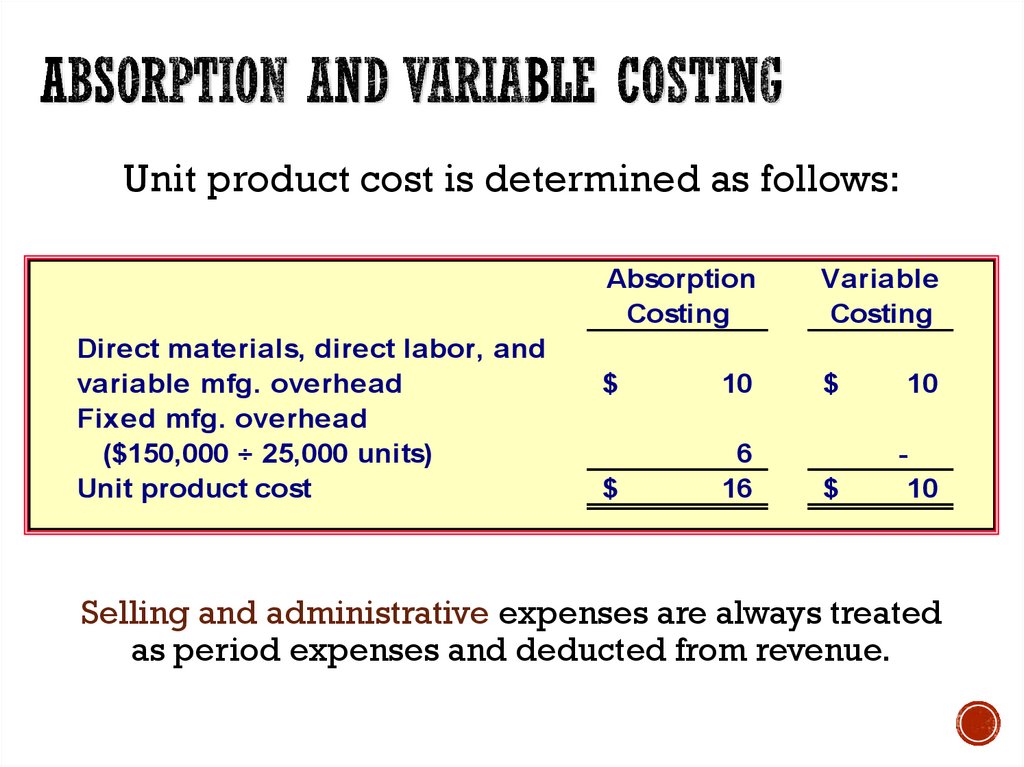

8. Absorption and Variable Costing

Unit product cost is determined as follows:Direct materials, direct labor, and

variable mfg. overhead

Fixed mfg. overhead

($150,000 ÷ 25,000 units)

Unit product cost

Absorption

Costing

Variable

Costing

$

10

$

10

$

6

16

$

10

Selling and administrative expenses are always treated

as period expenses and deducted from revenue.

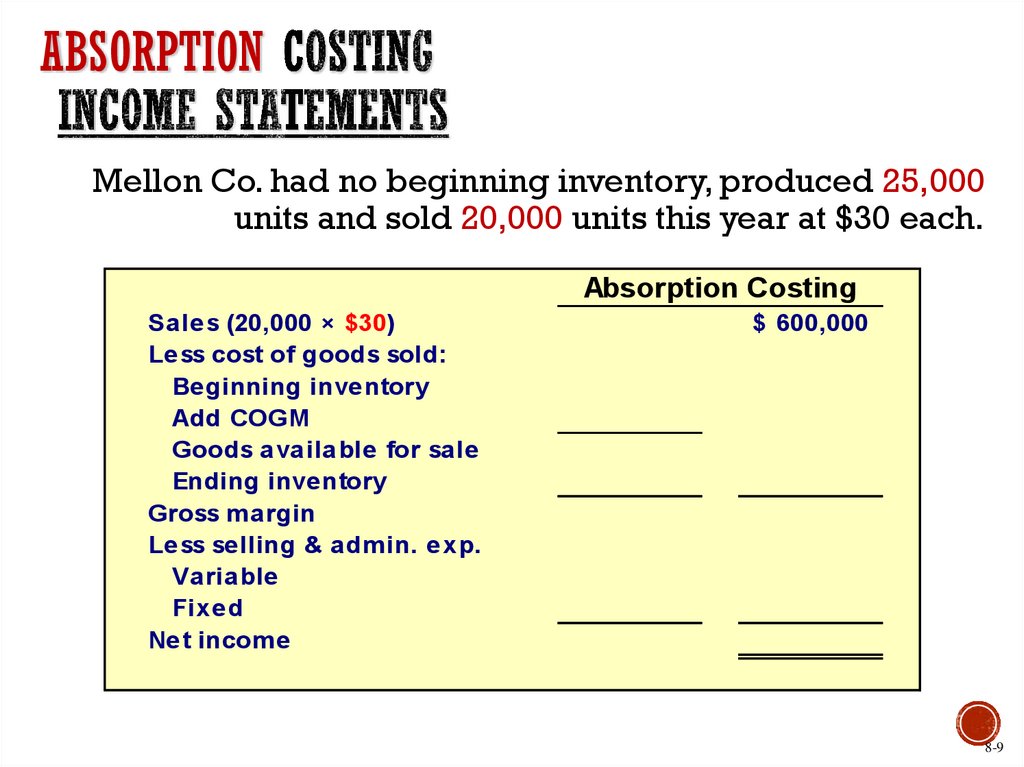

9. Absorption Costing Income Statements

ABSORPTIONMellon Co. had no beginning inventory, produced 25,000

units and sold 20,000 units this year at $30 each.

Absorption Costing

Sales (20,000 × $30)

Less cost of goods sold:

Beginning inventory

Add COGM

Goods available for sale

Ending inventory

Gross margin

Less selling & admin. exp.

Variable

Fixed

Net income

$ 600,000

8-9

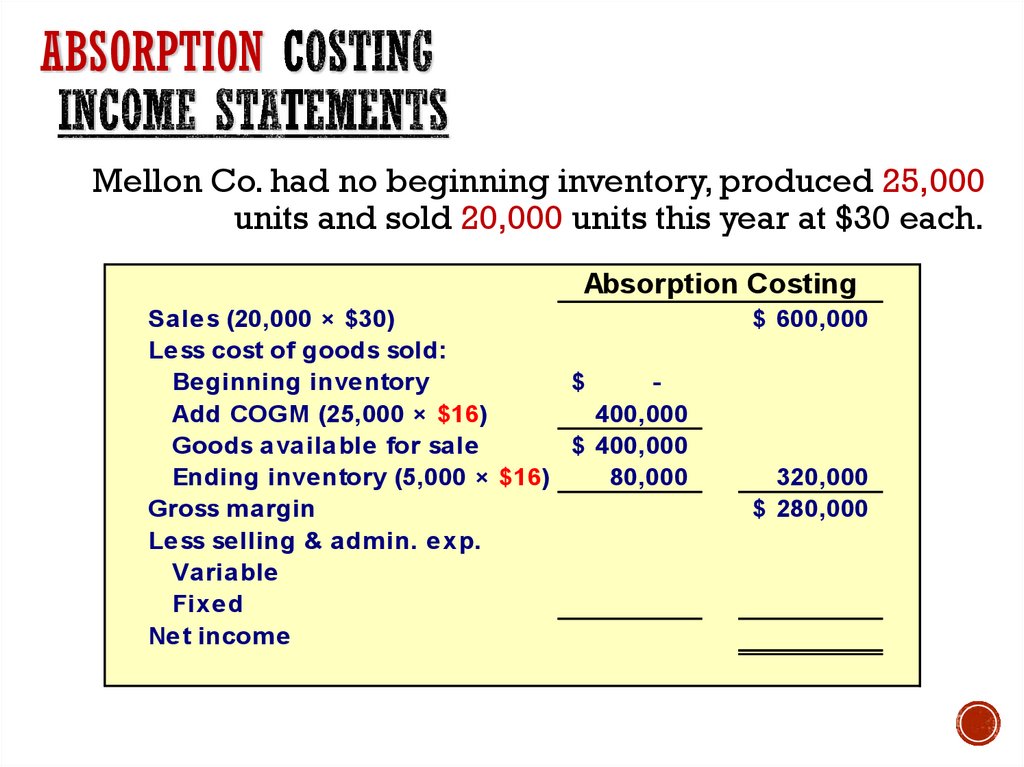

10. Absorption Costing Income Statements

ABSORPTIONMellon Co. had no beginning inventory, produced 25,000

units and sold 20,000 units this year at $30 each.

Absorption Costing

Sales (20,000 × $30)

Less cost of goods sold:

Beginning inventory

$

Add COGM (25,000 × $16)

400,000

Goods available for sale

$ 400,000

Ending inventory (5,000 × $16)

80,000

Gross margin

Less selling & admin. exp.

Variable

Fixed

Net income

$ 600,000

320,000

$ 280,000

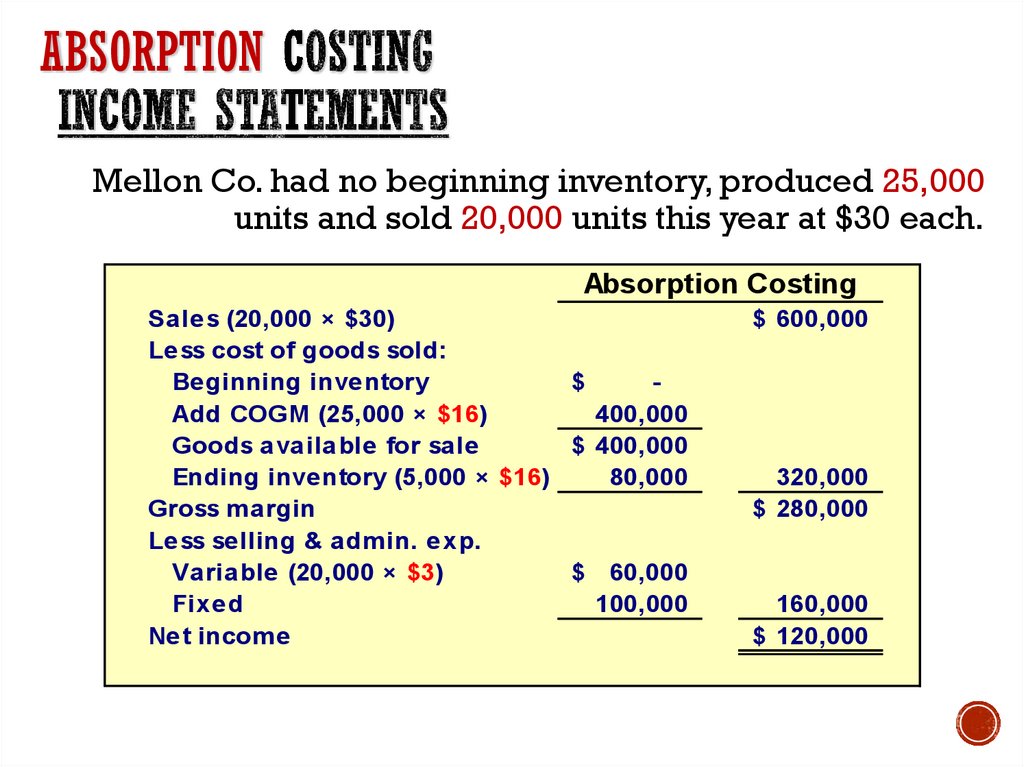

11. Absorption Costing Income Statements

ABSORPTIONMellon Co. had no beginning inventory, produced 25,000

units and sold 20,000 units this year at $30 each.

Absorption Costing

Sales (20,000 × $30)

Less cost of goods sold:

Beginning inventory

$

Add COGM (25,000 × $16)

400,000

Goods available for sale

$ 400,000

Ending inventory (5,000 × $16)

80,000

Gross margin

Less selling & admin. exp.

Variable (20,000 × $3)

$ 60,000

Fixed

100,000

Net income

$ 600,000

320,000

$ 280,000

160,000

$ 120,000

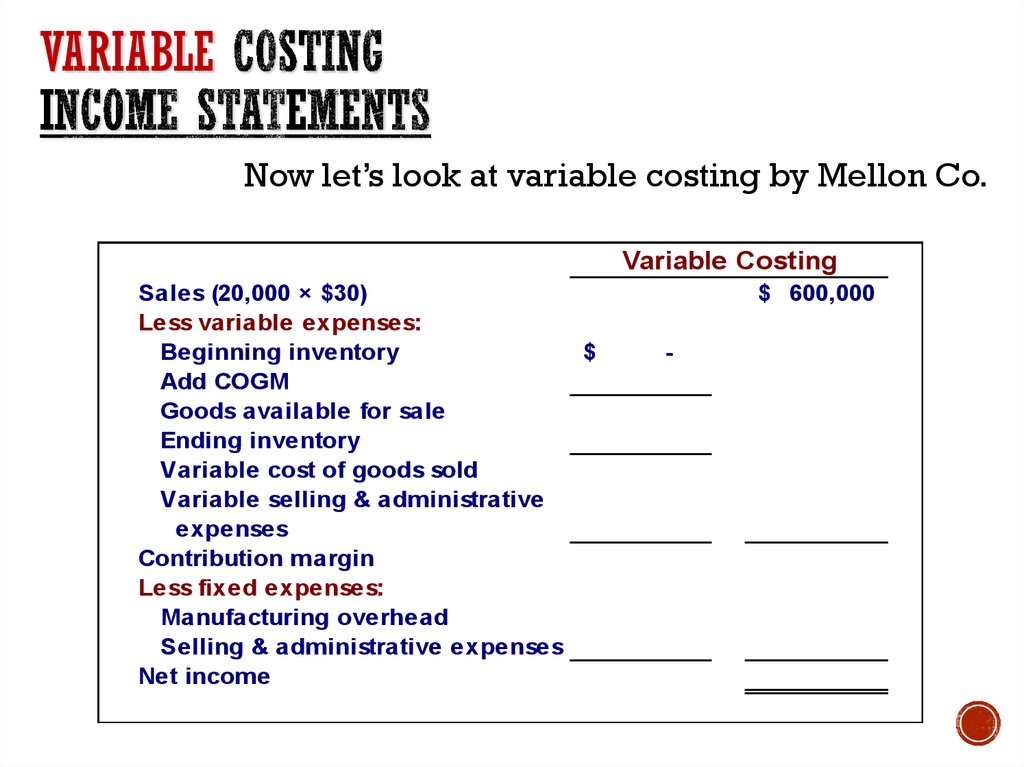

12. Variable Costing Income Statements

VARIABLENow let’s look at variable costing by Mellon Co.

Variable Costing

Sales (20,000 × $30)

Less variable expenses:

Beginning inventory

$

Add COGM

Goods available for sale

Ending inventory

Variable cost of goods sold

Variable selling & administrative

expenses

Contribution margin

Less fixed expenses:

Manufacturing overhead

Selling & administrative expenses

Net income

$ 600,000

-

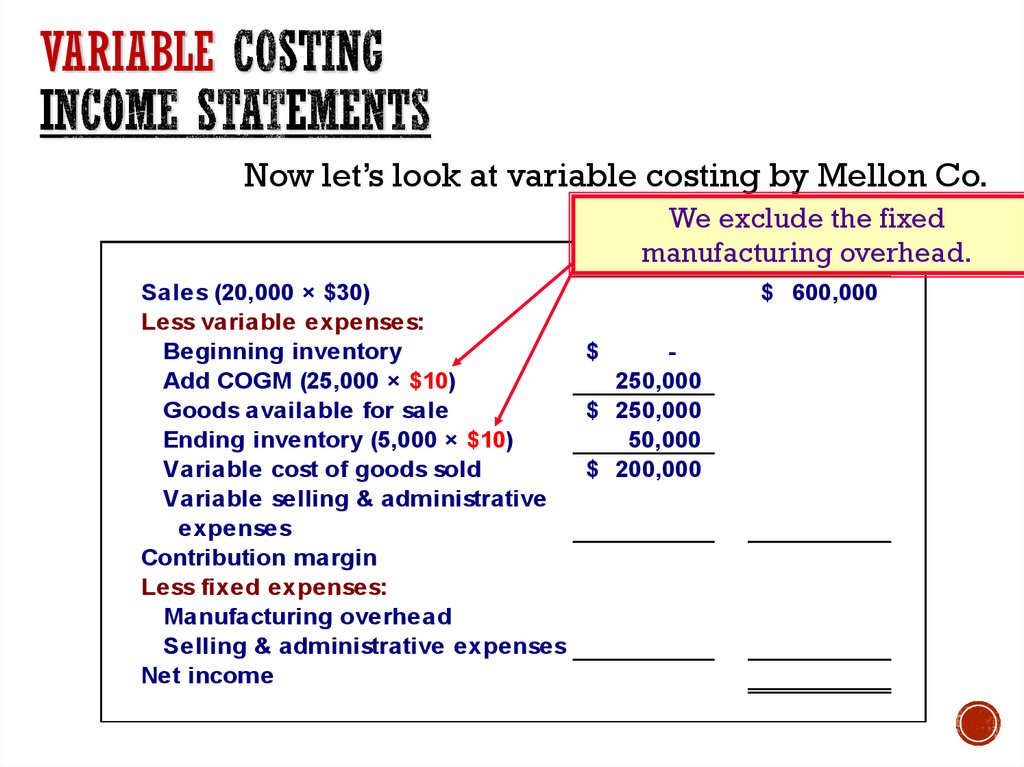

13. Variable Costing Income Statements

VARIABLENow let’s look at variable costing by Mellon Co.

We exclude the fixed

manufacturing

Variable

Costingoverhead.

Sales (20,000 × $30)

Less variable expenses:

Beginning inventory

$

Add COGM (25,000 × $10)

250,000

Goods available for sale

$ 250,000

Ending inventory (5,000 × $10)

50,000

Variable cost of goods sold

$ 200,000

Variable selling & administrative

expenses

Contribution margin

Less fixed expenses:

Manufacturing overhead

Selling & administrative expenses

Net income

$ 600,000

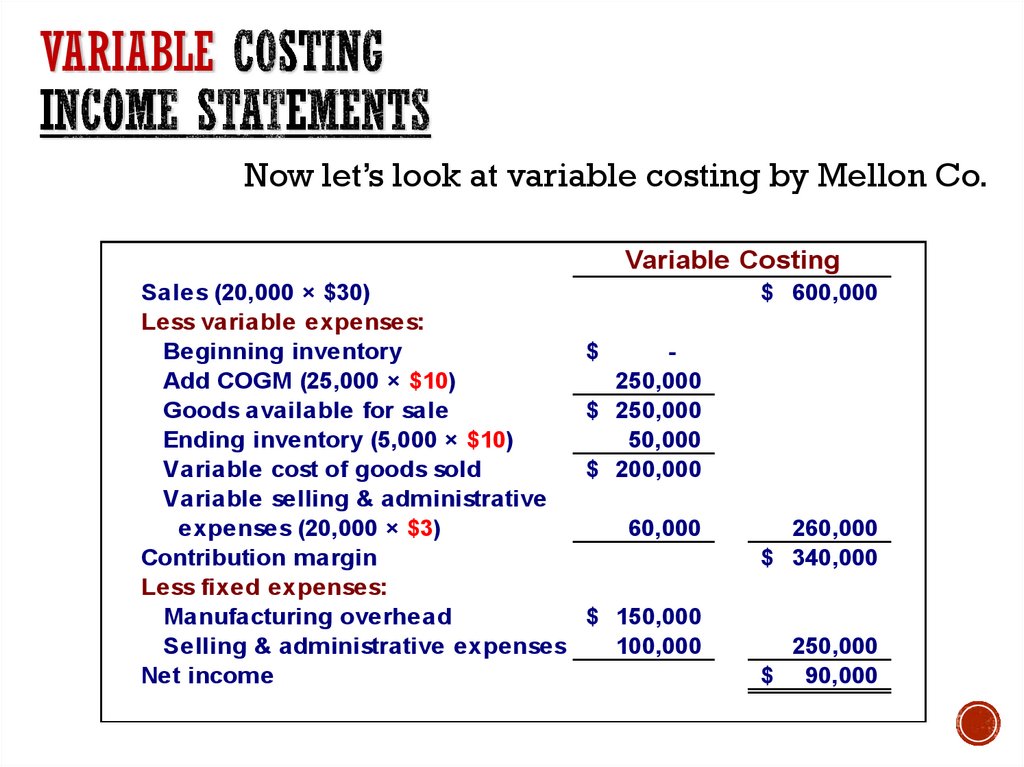

14. Variable Costing Income Statements

VARIABLENow let’s look at variable costing by Mellon Co.

Variable Costing

Sales (20,000 × $30)

Less variable expenses:

Beginning inventory

Add COGM (25,000 × $10)

Goods available for sale

Ending inventory (5,000 × $10)

Variable cost of goods sold

Variable selling & administrative

expenses (20,000 × $3)

Contribution margin

Less fixed expenses:

Manufacturing overhead

Selling & administrative expenses

Net income

$ 600,000

$

250,000

$ 250,000

50,000

$ 200,000

60,000

$ 150,000

100,000

260,000

$ 340,000

250,000

$ 90,000

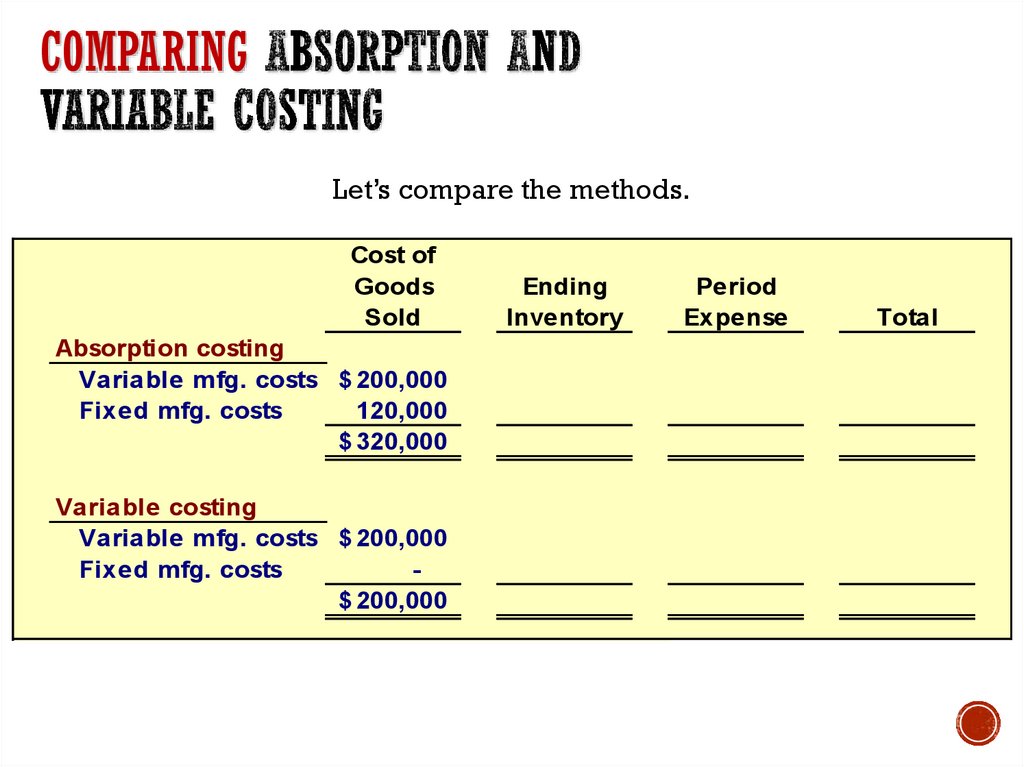

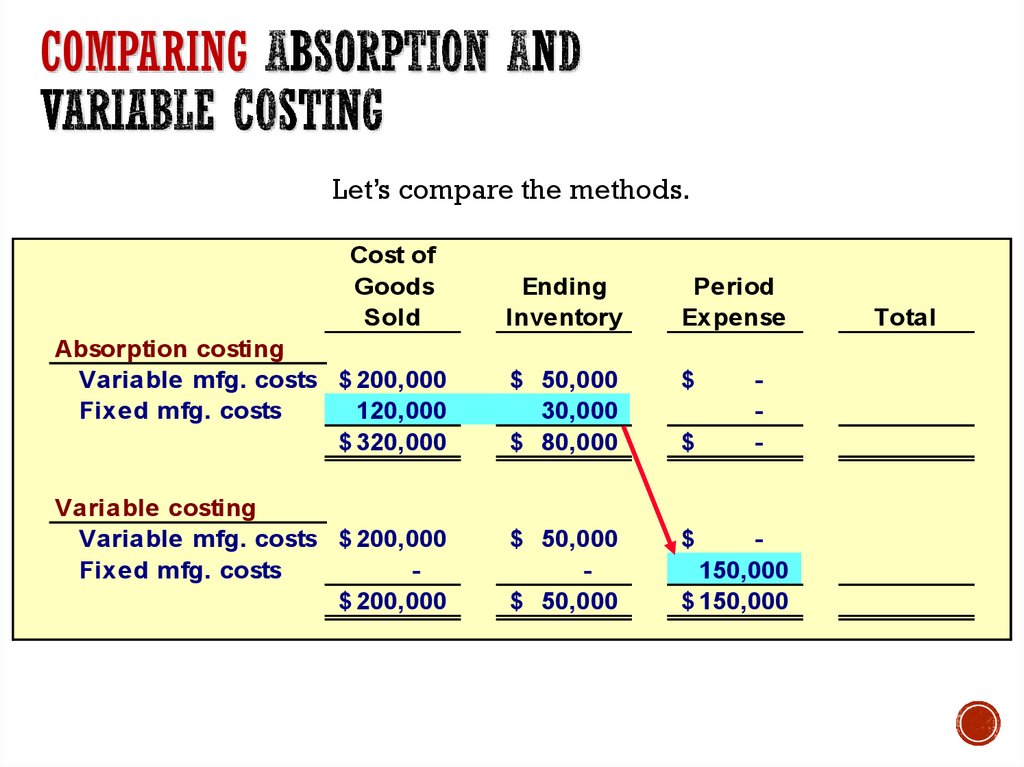

15. Comparing Absorption and Variable Costing

COMPARINGLet’s compare the methods.

Cost of

Goods

Sold

Absorption costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

120,000

$ 320,000

Variable costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

$ 200,000

Ending

Inventory

Period

Expense

Total

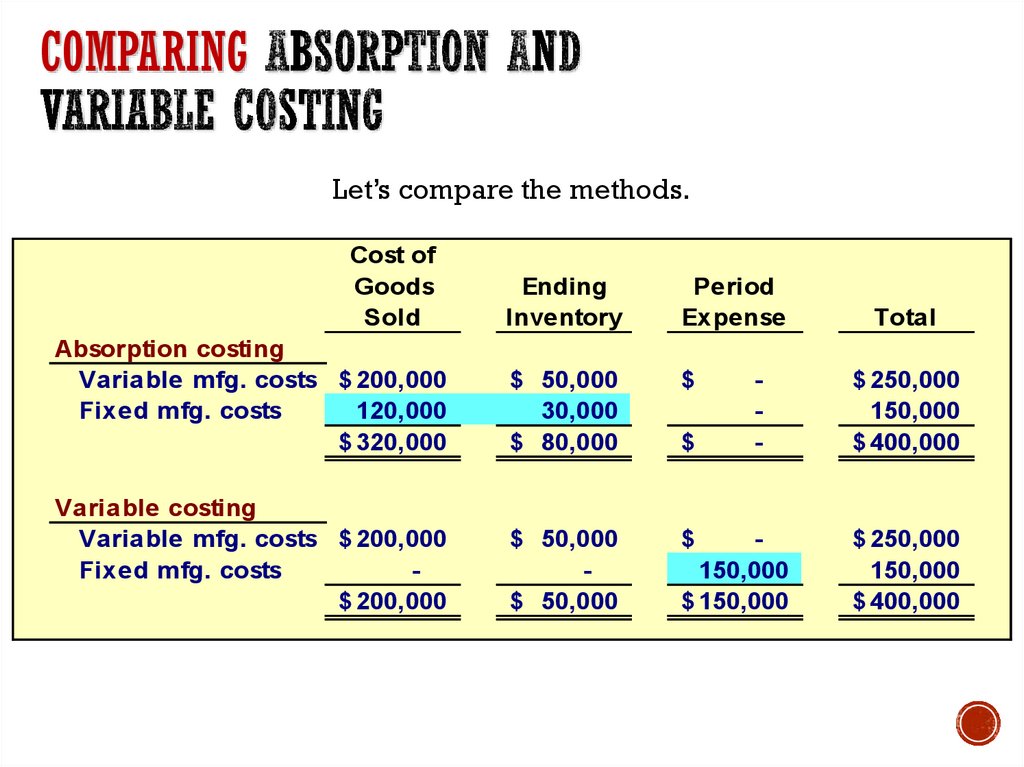

16. Comparing Absorption and Variable Costing

COMPARINGLet’s compare the methods.

Cost of

Goods

Sold

Ending

Inventory

Period

Expense

Absorption costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

120,000

$ 320,000

$ 50,000

30,000

$ 80,000

$

Variable costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

$ 200,000

$ 50,000

$ 50,000

$

$

-

150,000

$ 150,000

Total

17. Comparing Absorption and Variable Costing

COMPARINGLet’s compare the methods.

Cost of

Goods

Sold

Ending

Inventory

Period

Expense

Absorption costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

120,000

$ 320,000

$ 50,000

30,000

$ 80,000

$

Variable costing

Variable mfg. costs $ 200,000

Fixed mfg. costs

$ 200,000

$ 50,000

$ 50,000

$

$

-

150,000

$ 150,000

Total

$ 250,000

150,000

$ 400,000

$ 250,000

150,000

$ 400,000

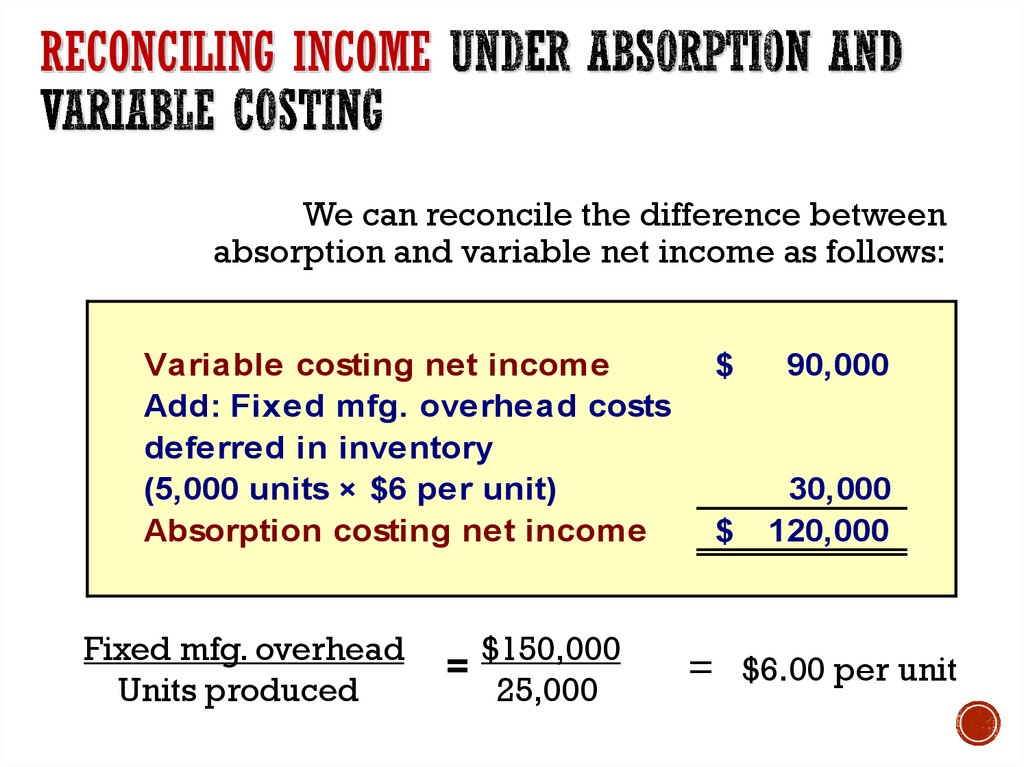

18. Reconciling Income Under Absorption and Variable Costing

RECONCILING INCOMEWe can reconcile the difference between

absorption and variable net income as follows:

Variable costing net income

Add: Fixed mfg. overhead costs

deferred in inventory

(5,000 units × $6 per unit)

Absorption costing net income

Fixed mfg. overhead

Units produced

$150,000

=

25,000

$

90,000

$

30,000

120,000

= $6.00 per unit

19. Extending the Example

Let’s look atthe second

year of

operations

for Mellon

Company.

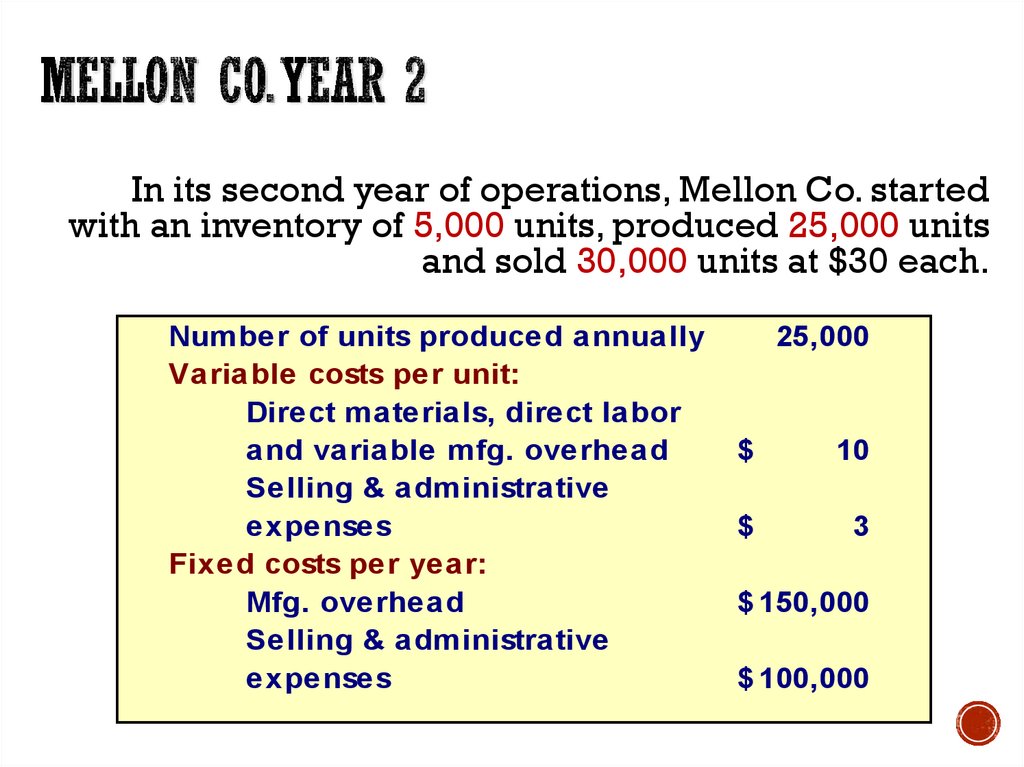

20. Mellon Co. Year 2

In its second year of operations, Mellon Co. startedwith an inventory of 5,000 units, produced 25,000 units

and sold 30,000 units at $30 each.

Number of units produced annually

Variable costs per unit:

Direct materials, direct labor

and variable mfg. overhead

Selling & administrative

expenses

Fixed costs per year:

Mfg. overhead

Selling & administrative

expenses

25,000

$

10

$

3

$ 150,000

$ 100,000

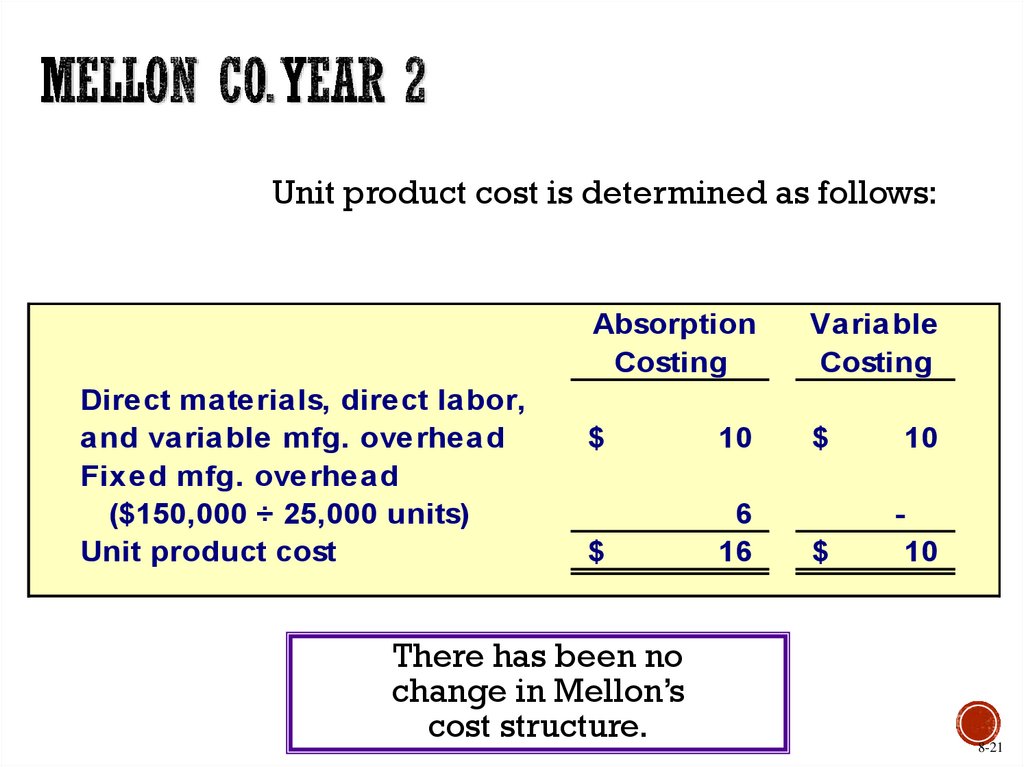

21. Mellon Co. Year 2

Unit product cost is determined as follows:Direct materials, direct labor,

and variable mfg. overhead

Fixed mfg. overhead

($150,000 ÷ 25,000 units)

Unit product cost

Absorption

Costing

Variable

Costing

$

10

$

10

$

6

16

$

10

There has been no

change in Mellon’s

cost structure.

8-21

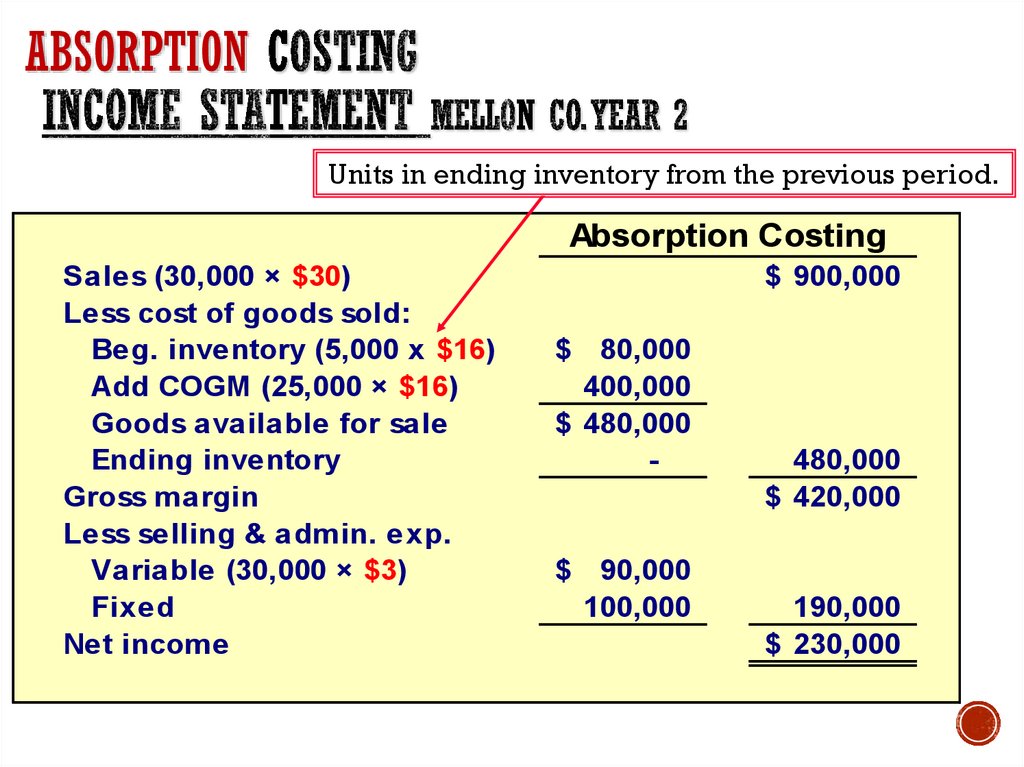

22. Absorption Costing Income Statement Mellon Co. Year 2

ABSORPTIONUnits in ending inventory from the previous period.

Absorption Costing

Sales (30,000 × $30)

Less cost of goods sold:

Beg. inventory (5,000 x $16)

Add COGM (25,000 × $16)

Goods available for sale

Ending inventory

Gross margin

Less selling & admin. exp.

Variable (30,000 × $3)

Fixed

Net income

$ 900,000

$ 80,000

400,000

$ 480,000

-

$ 90,000

100,000

480,000

$ 420,000

190,000

$ 230,000

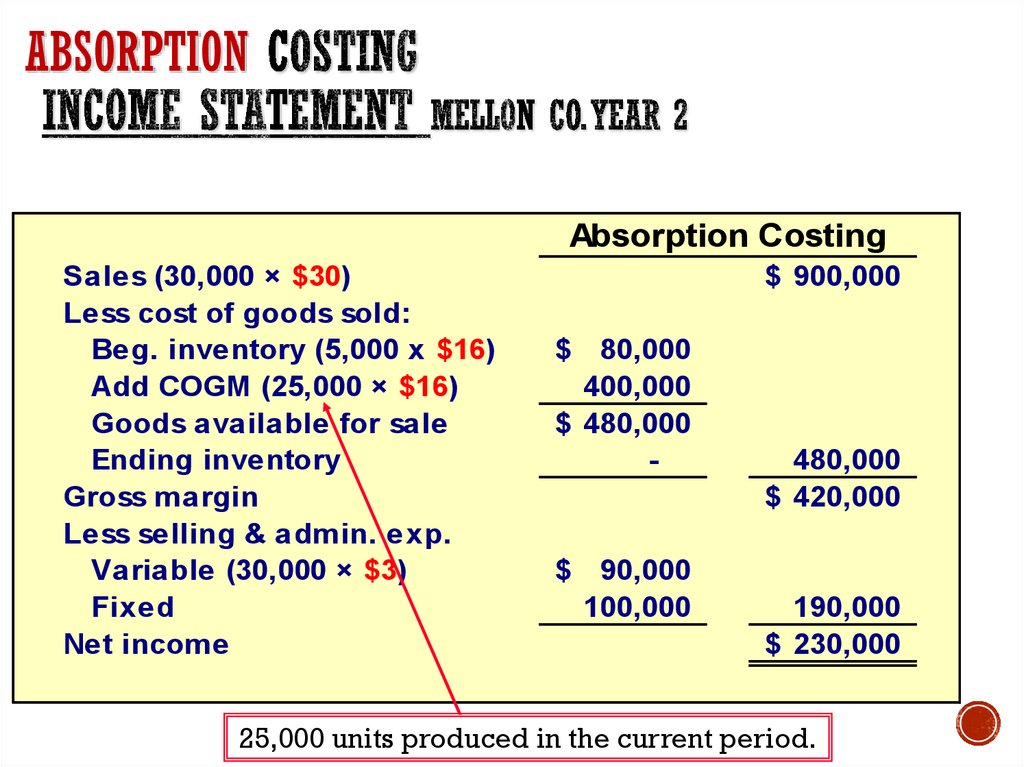

23. Absorption Costing Income Statement Mellon Co. Year 2

ABSORPTIONAbsorption Costing

Sales (30,000 × $30)

Less cost of goods sold:

Beg. inventory (5,000 x $16)

Add COGM (25,000 × $16)

Goods available for sale

Ending inventory

Gross margin

Less selling & admin. exp.

Variable (30,000 × $3)

Fixed

Net income

$ 900,000

$ 80,000

400,000

$ 480,000

-

$ 90,000

100,000

480,000

$ 420,000

190,000

$ 230,000

25,000 units produced in the current period.

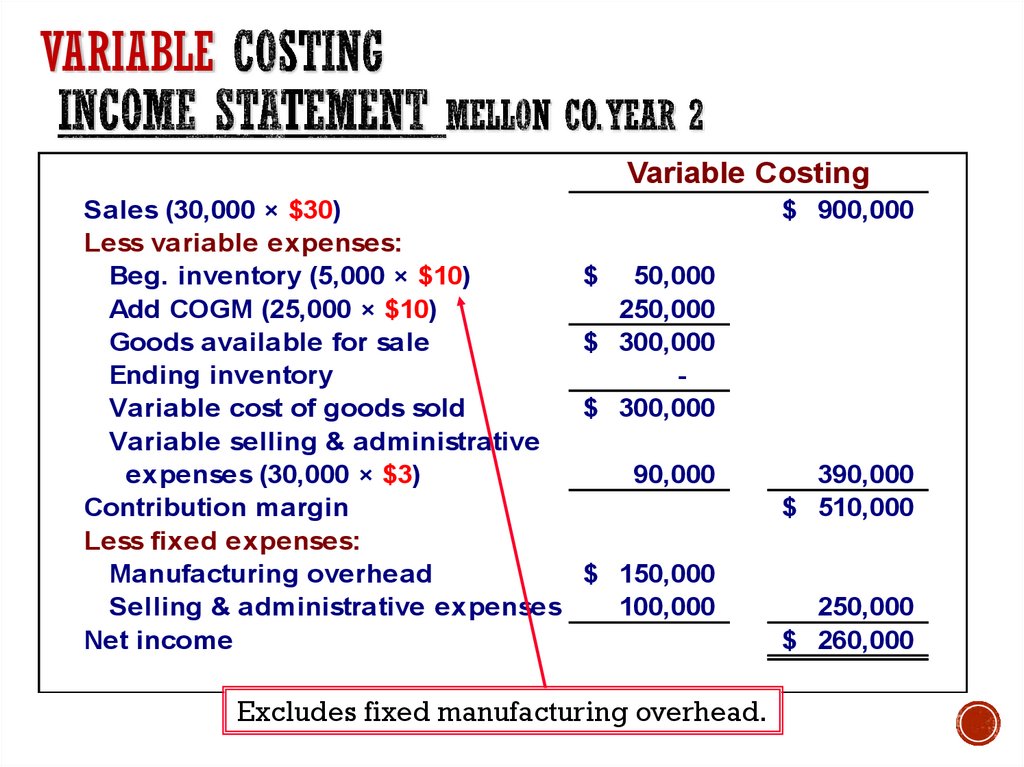

24. VARIABLE Costing Income Statement Mellon Co. Year 2

VARIABLEVariable Costing

Sales (30,000 × $30)

Less variable expenses:

Beg. inventory (5,000 × $10)

Add COGM (25,000 × $10)

Goods available for sale

Ending inventory

Variable cost of goods sold

Variable selling & administrative

expenses (30,000 × $3)

Contribution margin

Less fixed expenses:

Manufacturing overhead

Selling & administrative expenses

Net income

$ 900,000

$

50,000

250,000

$ 300,000

$ 300,000

90,000

$ 150,000

100,000

Excludes fixed manufacturing overhead.

390,000

$ 510,000

250,000

$ 260,000

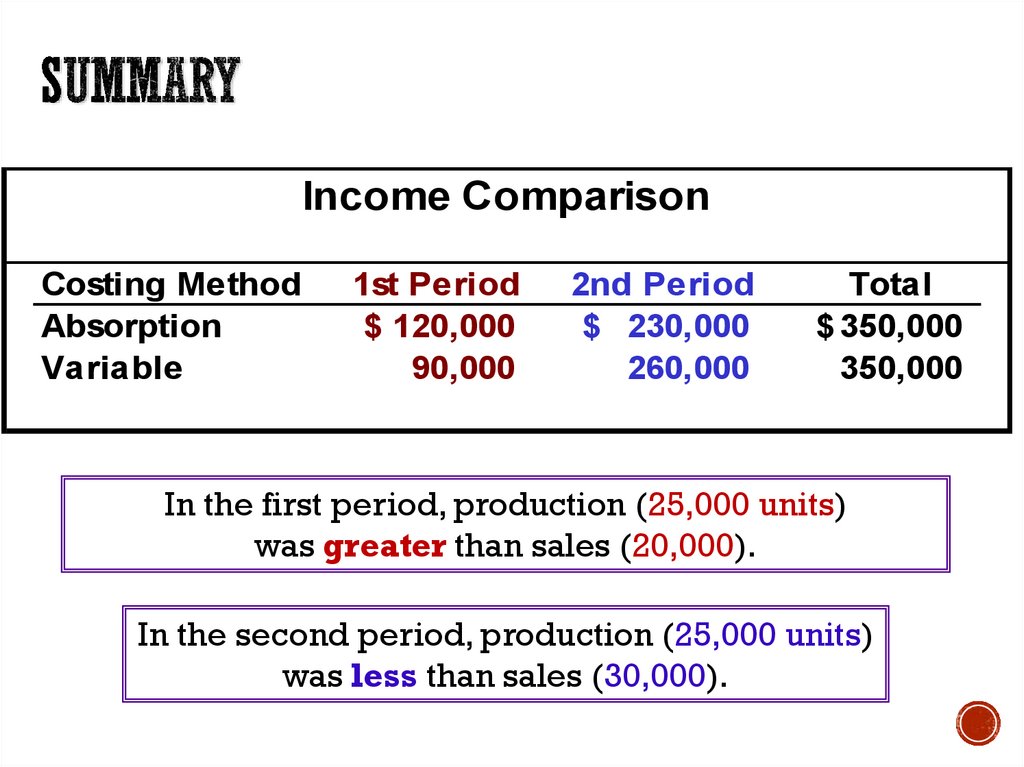

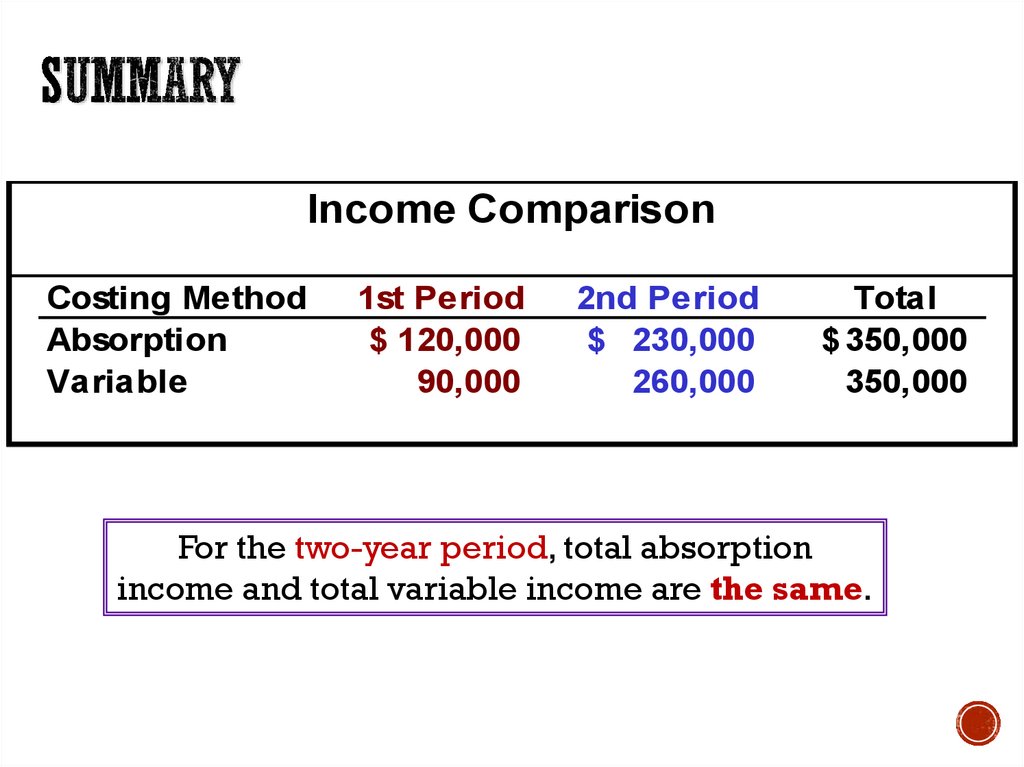

25. Summary

Income ComparisonCosting Method

Absorption

Variable

1st Period

$ 120,000

90,000

2nd Period

$ 230,000

260,000

Total

$ 350,000

350,000

In the first period, production (25,000 units)

was greater than sales (20,000).

In the second period, production (25,000 units)

was less than sales (30,000).

26. Summary

Income ComparisonCosting Method

Absorption

Variable

1st Period

$ 120,000

90,000

2nd Period

$ 230,000

260,000

Total

$ 350,000

350,000

For the two-year period, total absorption

income and total variable income are the same.

27. SUMMARY

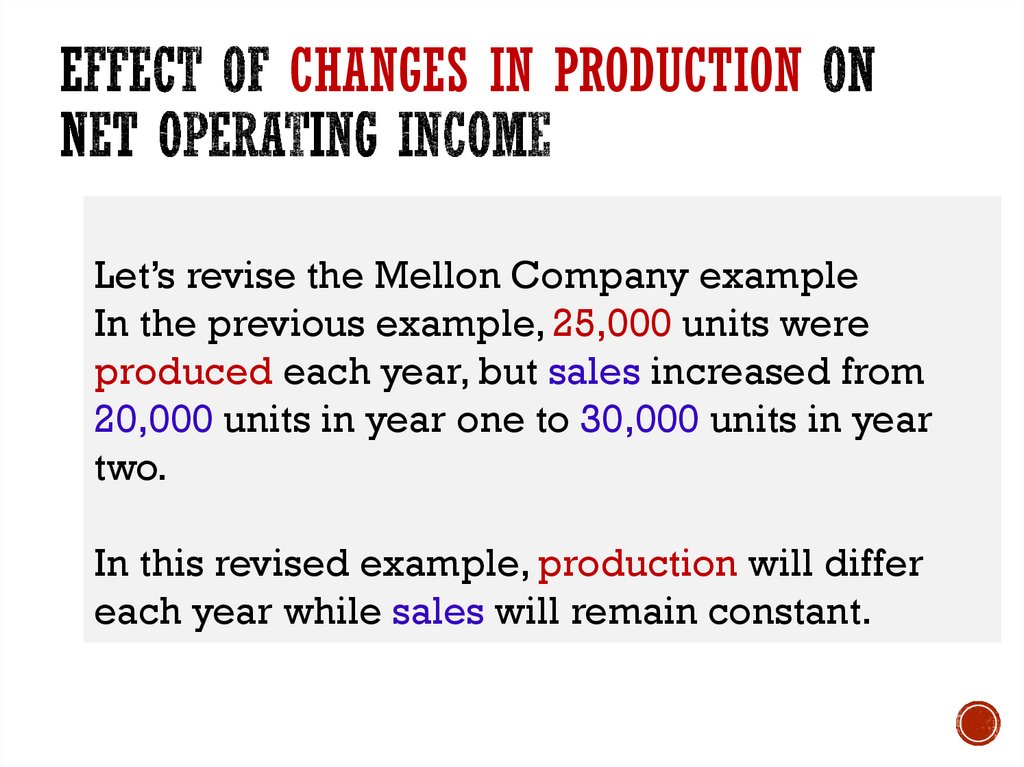

28. Effect of Changes in Production on Net Operating Income

CHANGES IN PRODUCTIONLet’s revise the Mellon Company example

In the previous example, 25,000 units were

produced each year, but sales increased from

20,000 units in year one to 30,000 units in year

two.

In this revised example, production will differ

each year while sales will remain constant.

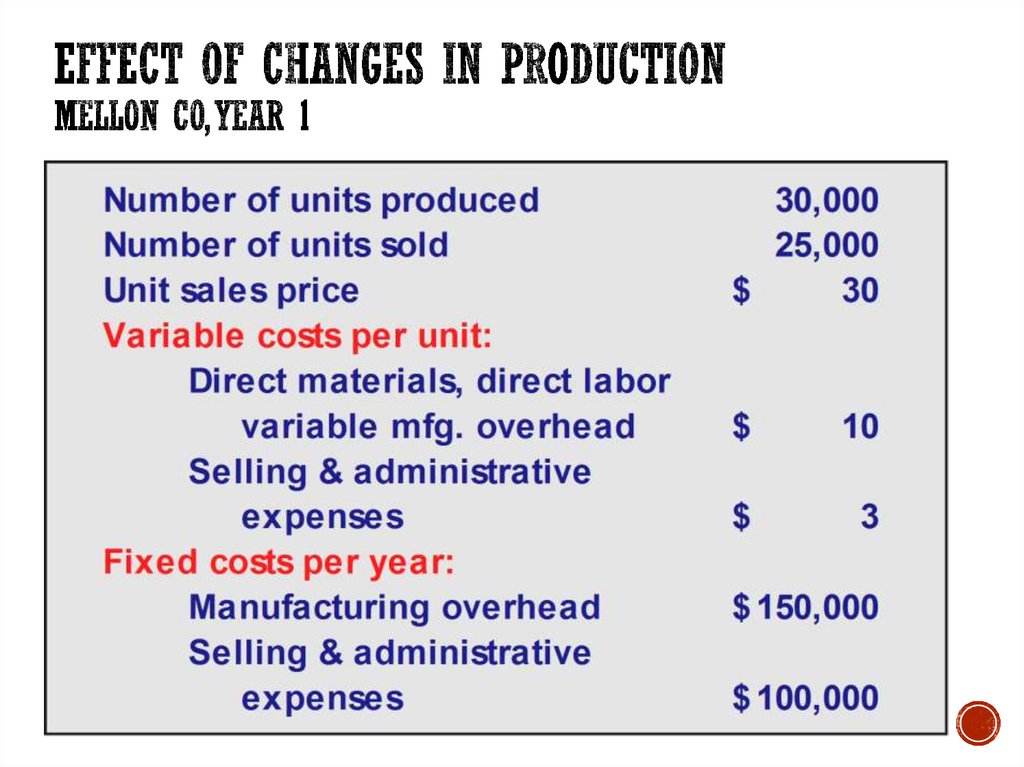

29. Effect of Changes in Production Mellon co, year 1

30. Unit Cost Computations for Year One

YEAR ONESince the number of units produced increased in this

example, while the fixed manufacturing overhead

remained the same, the absorption unit cost is less.

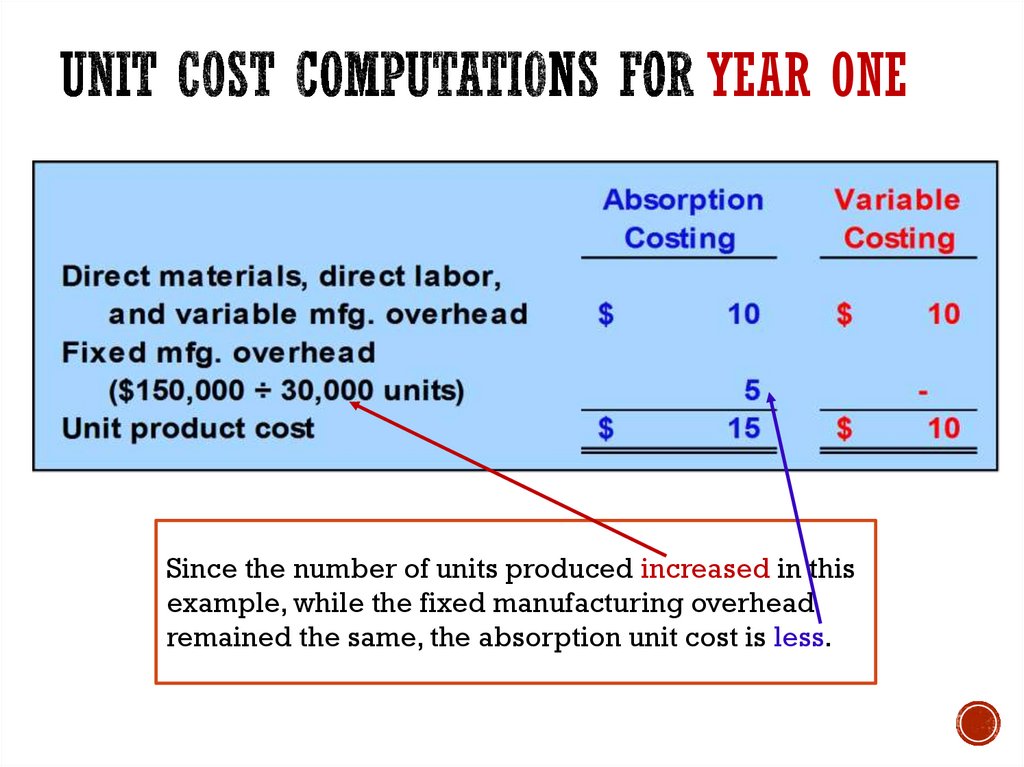

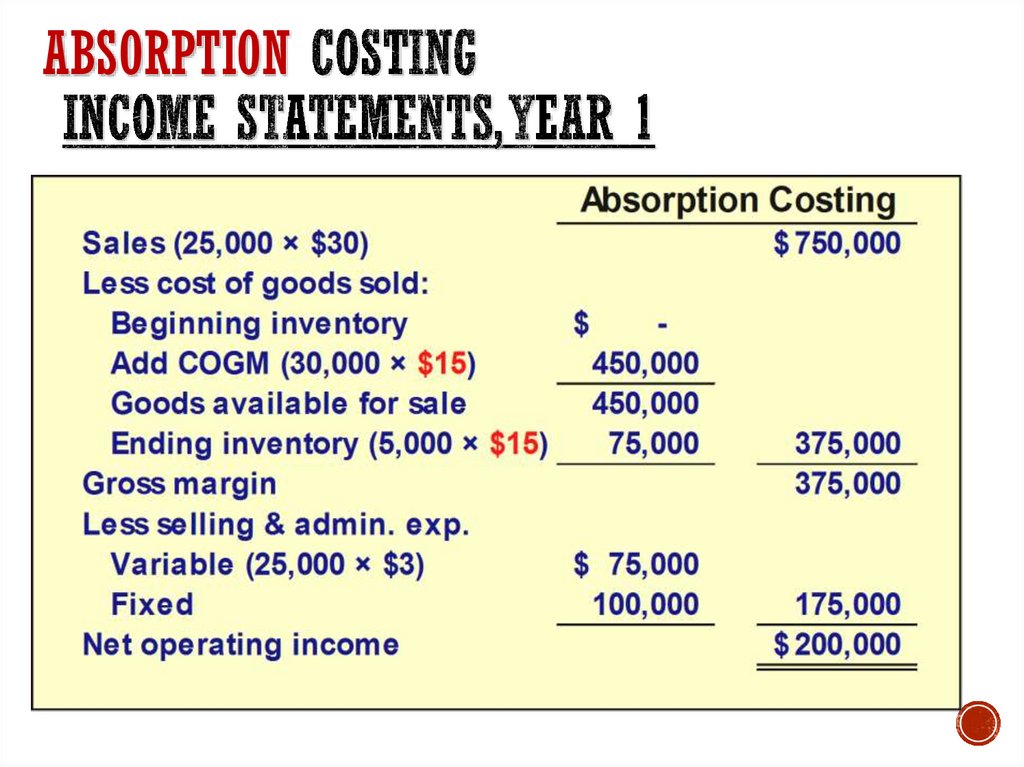

31. Absorption Costing Income Statements, year 1

ABSORPTION32. Variable Costing Income Statements, year 1

VARIABLE33. Effect of Changes in Production Mellon co, year 2

34. Unit Cost Computations for Year two

YEAR TWOSince the number of units produced decreased in the

second year, while the fixed manufacturing overhead

remained the same, the absorption unit cost is now higher.

35. Absorption Costing Income Statements, year 2

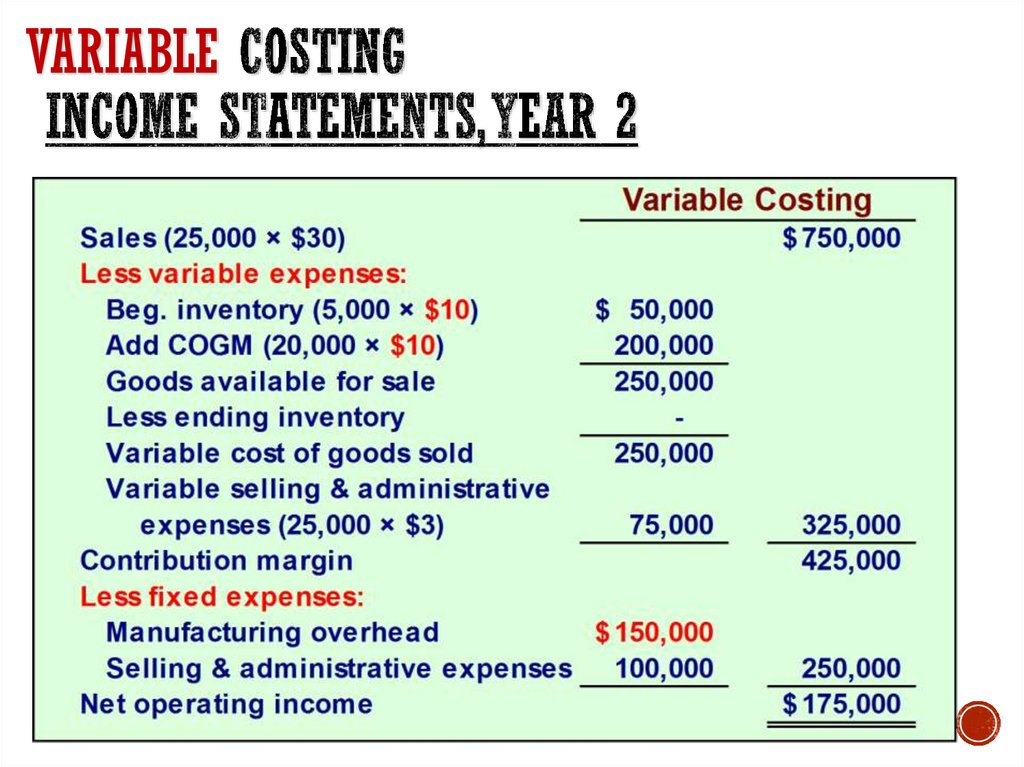

ABSORPTION36. Variable Costing Income Statements, year 2

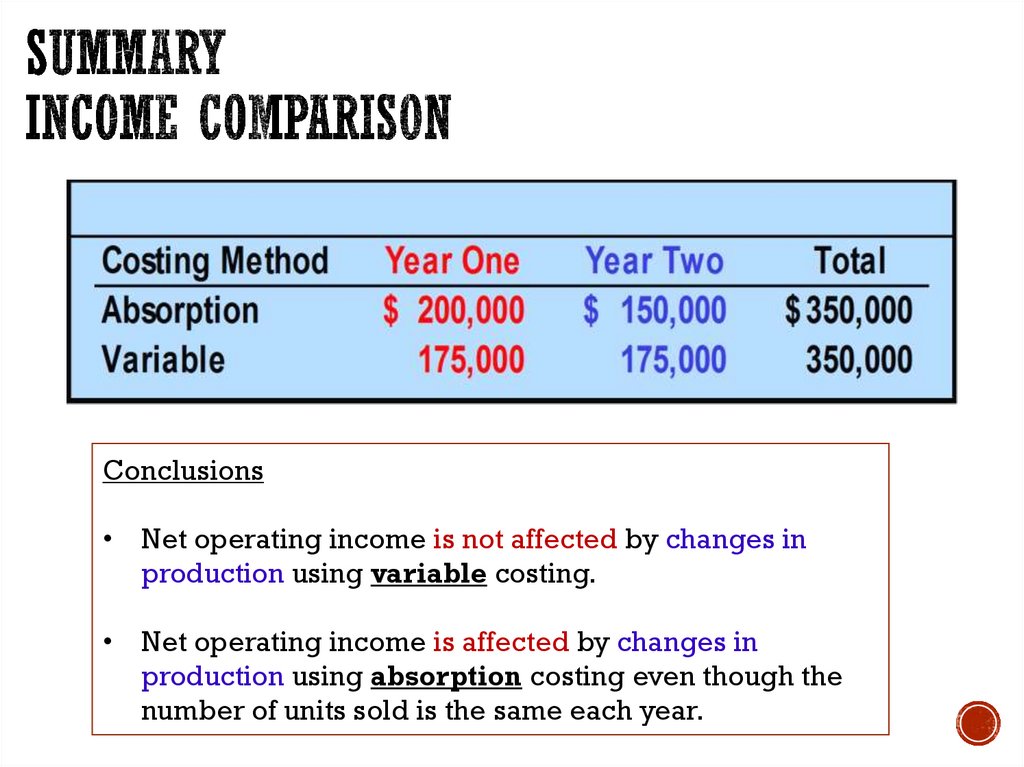

VARIABLE37. Summary Income Comparison

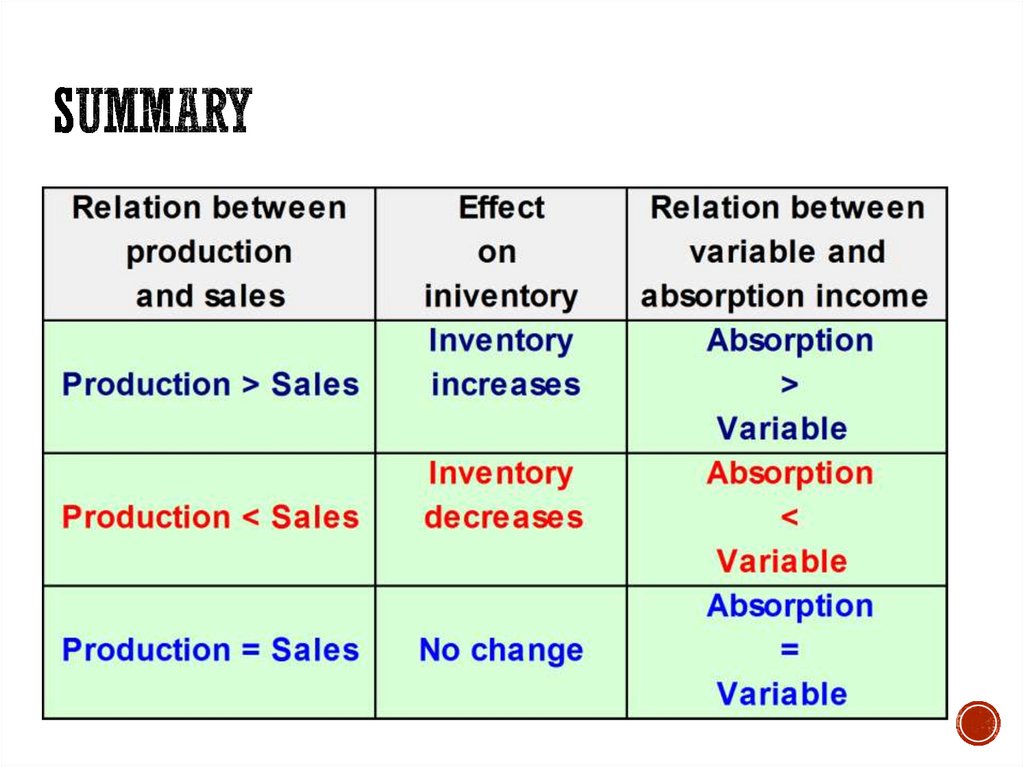

Conclusions• Net operating income is not affected by changes in

production using variable costing.

• Net operating income is affected by changes in

production using absorption costing even though the

number of units sold is the same each year.

38. Impact on the Manager

• Opponents of absorption costing argue thatshifting fixed manufacturing overhead costs

between periods can lead to misinterpretations

and faulty decisions

• Those who favor variable costing argue that the

income statements are easier to understand

because net operating income is only affected

by changes in unit sales. The resulting income

amounts are more consistent with managers’

expectations.

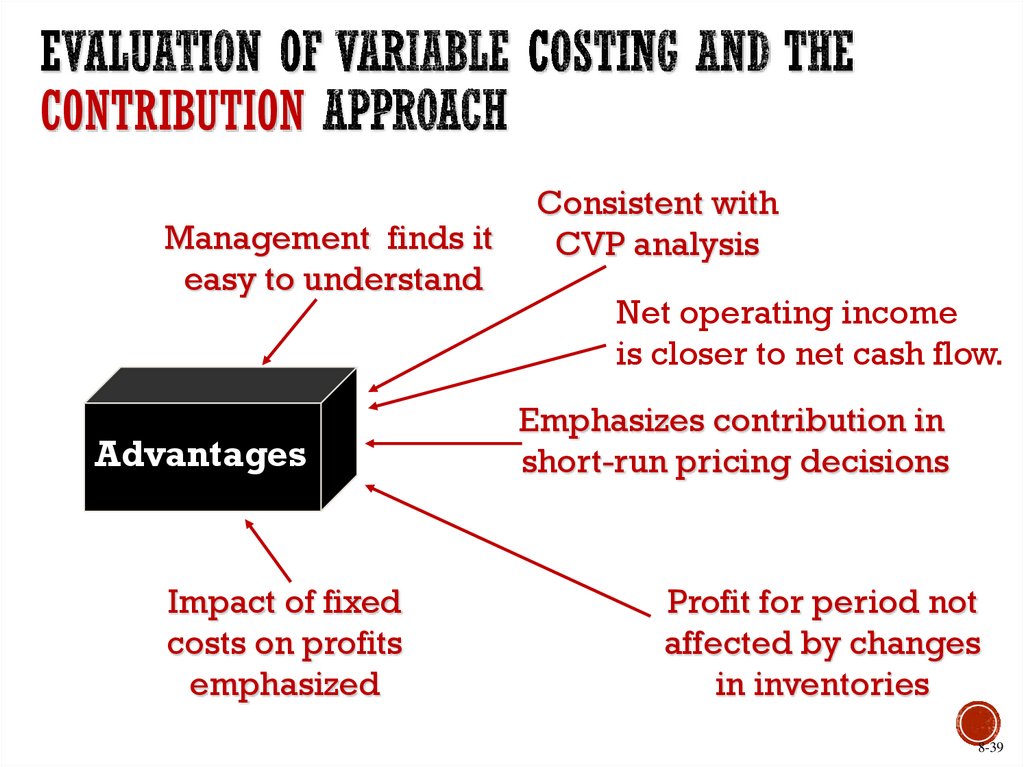

39. Evaluation of Variable Costing and the contribution approach

CONTRIBUTIONManagement finds it

easy to understand

Advantages

Impact of fixed

costs on profits

emphasized

Consistent with

CVP analysis

Net operating income

is closer to net cash flow.

Emphasizes contribution in

short-run pricing decisions

Profit for period not

affected by changes

in inventories

8-39

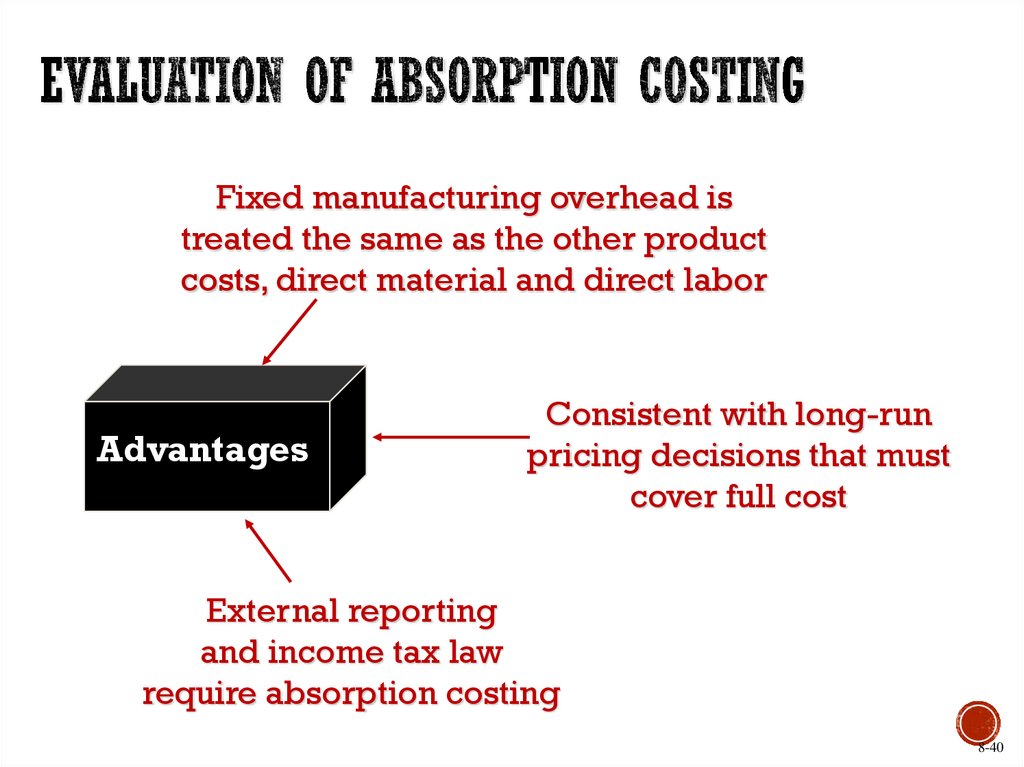

40. Evaluation of Absorption Costing

Fixed manufacturing overhead istreated the same as the other product

costs, direct material and direct labor

Advantages

Consistent with long-run

pricing decisions that must

cover full cost

External reporting

and income tax law

require absorption costing

8-40

english

english