Similar presentations:

Financial information

1.

Foundation Year ProgramLecture 10: Financial information

Income statements

Balance Sheet

Analysis of accounts

Introduction to Business

2018-19

2. Learning outcomes

Foundation Year ProgramLEARNING OUTCOMES

Income statement

• Why businesses need to keep accounting

records such as income statements

• Why profits are always equal to cash

• Why profits are important

• The differences between gross, net and

retained profit

• What does the income statement contain

Introduction to Business

2018-19

3. Why to record

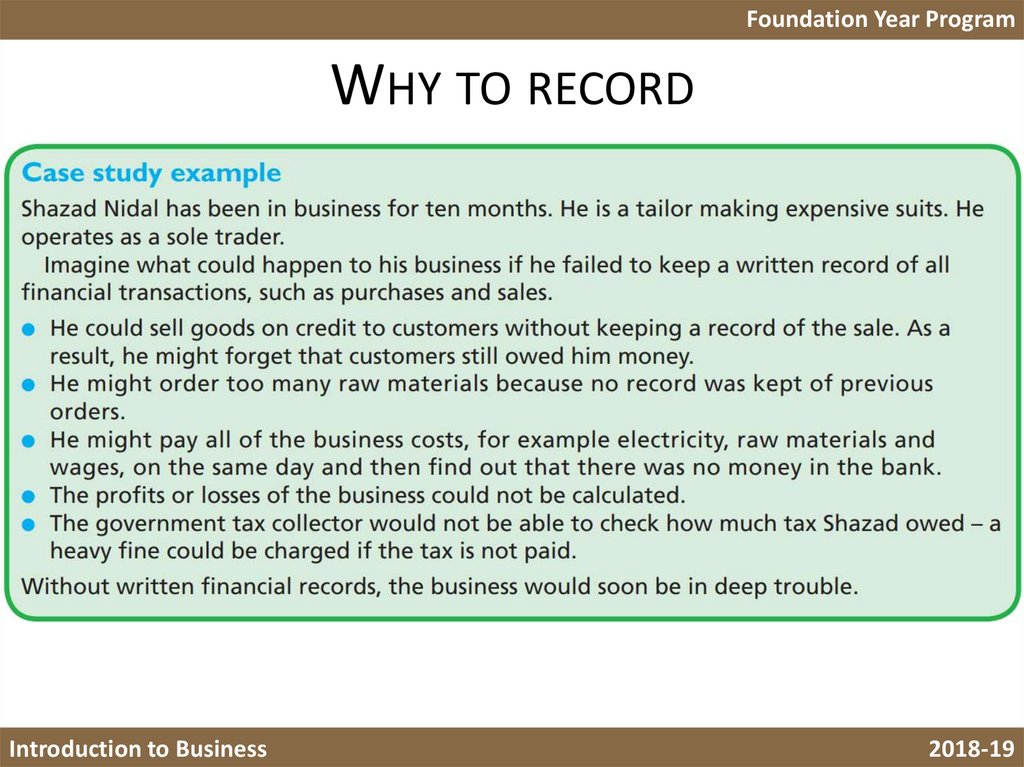

Foundation Year ProgramWHY TO RECORD

Introduction to Business

2018-19

4. Why profit is important?

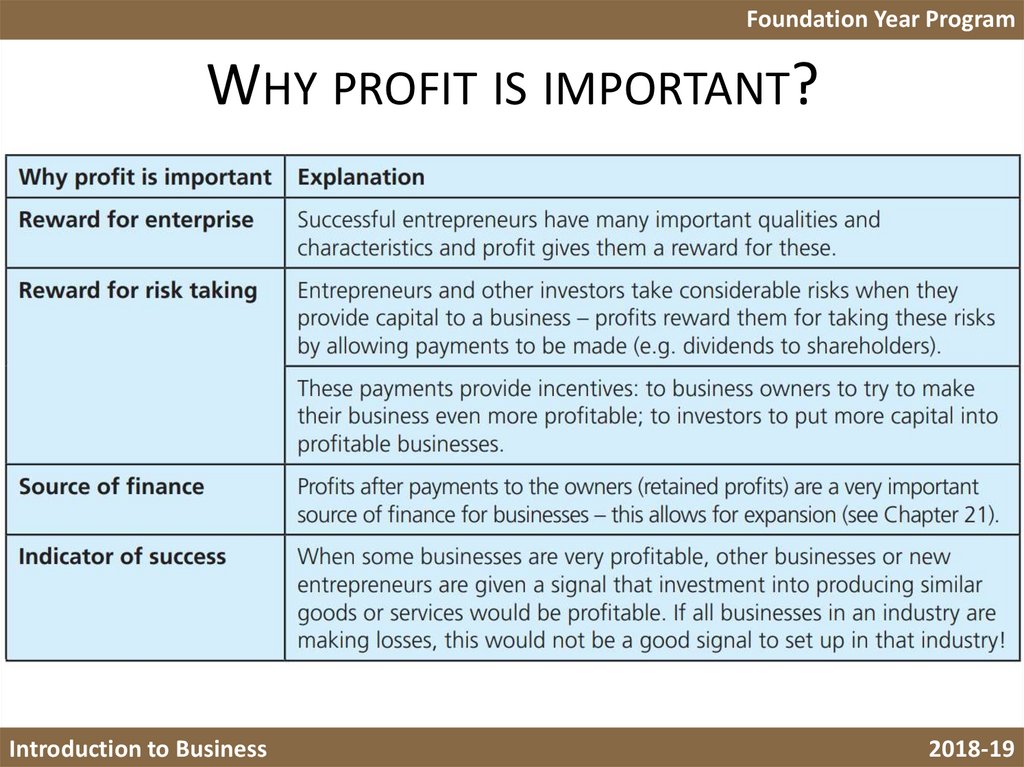

Foundation Year ProgramWHY PROFIT IS IMPORTANT?

Introduction to Business

2018-19

5. Income statement

Foundation Year ProgramINCOME STATEMENT

• Is it higher or lower than last year?

• If lower, why is profit falling?

• Is it higher or lower than other similar businesses?

Industrywide benchmark?

• If lower, what can we do to become as profitable as

others, achieving the benchmark?

If the business is making a loss, managers will want to

ask themselves:

• Is this short term- or long-term problem?

• Are other similar businesses also making losses?

• What decisions can we take to turn losses into profits?

Introduction to Business

2018-19

6. Income statement

Foundation Year ProgramINCOME STATEMENT

Gross profit: sale revenue – cost of the goods

• Gross profit does not make any allowance for

overhead (fixed) costs or expenses

• Costs of goods sold is not necessarily the same as the

total value of goods bought by the business

COGS: materials, manufacturing and direct labor

Introduction to Business

2018-19

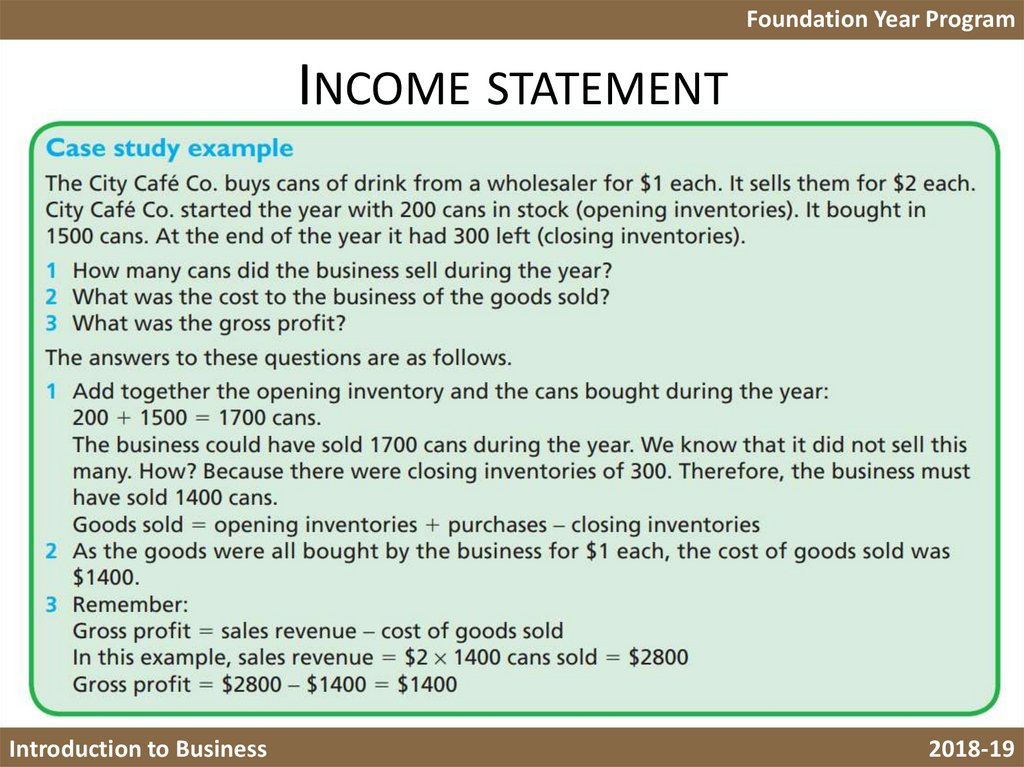

7. Income statement

Foundation Year ProgramINCOME STATEMENT

Introduction to Business

2018-19

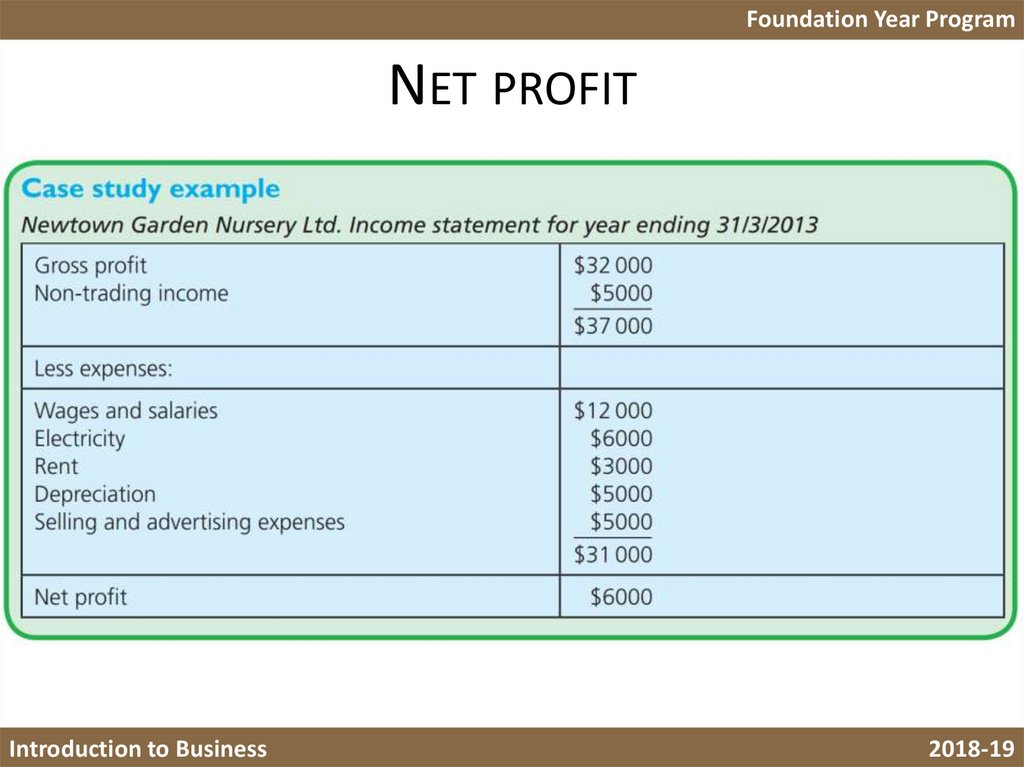

8. Net profit

Foundation Year ProgramNET PROFIT

Introduction to Business

2018-19

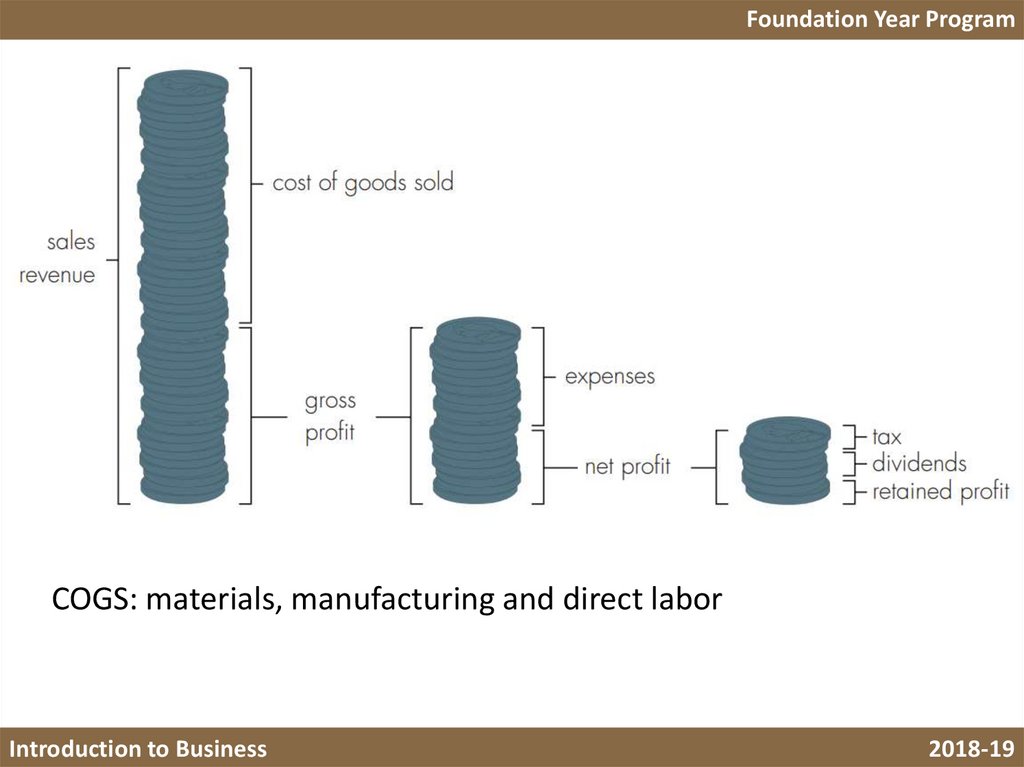

9.

Foundation Year ProgramCOGS: materials, manufacturing and direct labor

Introduction to Business

2018-19

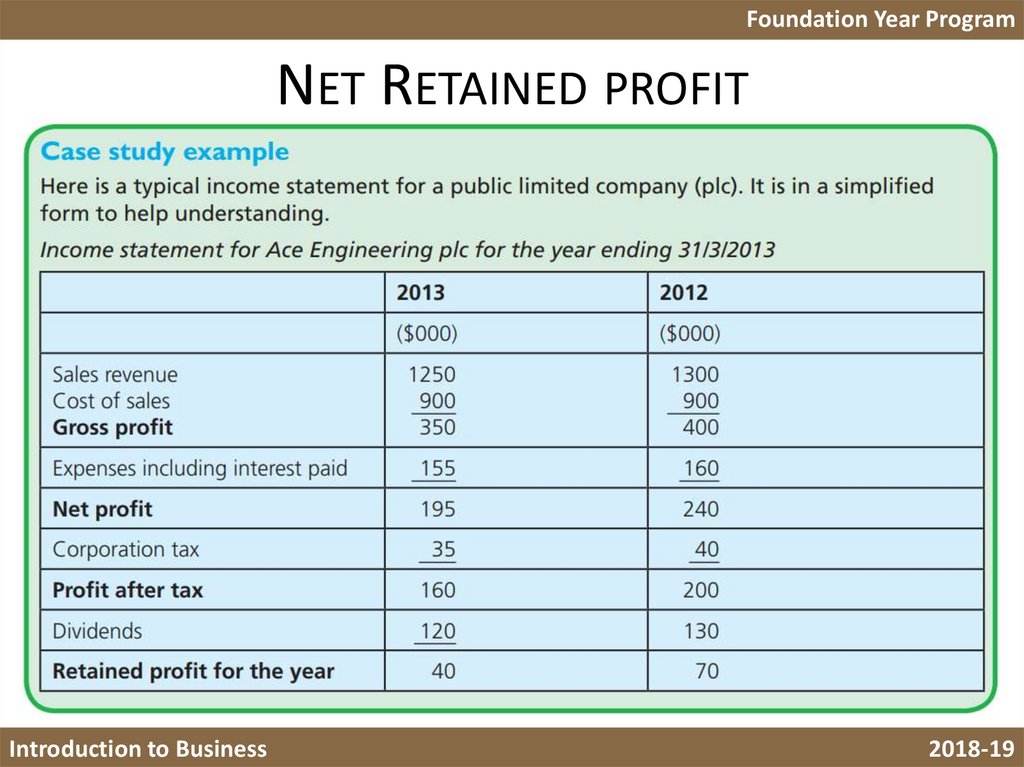

10. Net Retained profit

Foundation Year ProgramNET RETAINED PROFIT

Introduction to Business

2018-19

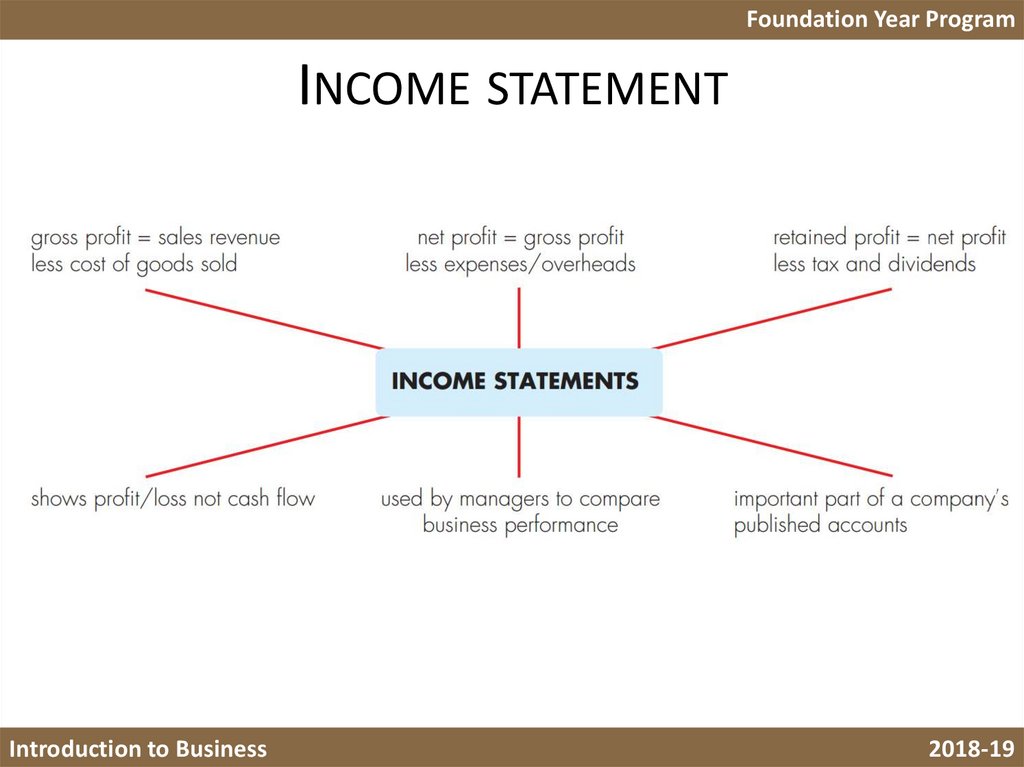

11. Income statement

Foundation Year ProgramINCOME STATEMENT

Introduction to Business

2018-19

12. Learning outcomes – Balance Sheet

Foundation Year ProgramLEARNING OUTCOMES – BALANCE SHEET

• The main elements of a balance sheet

• The main classification of assets and liabilities

• How to use examples to illustrate these

classification show to interpret simple balance

sheets and make inferences from them

Introduction to Business

2018-19

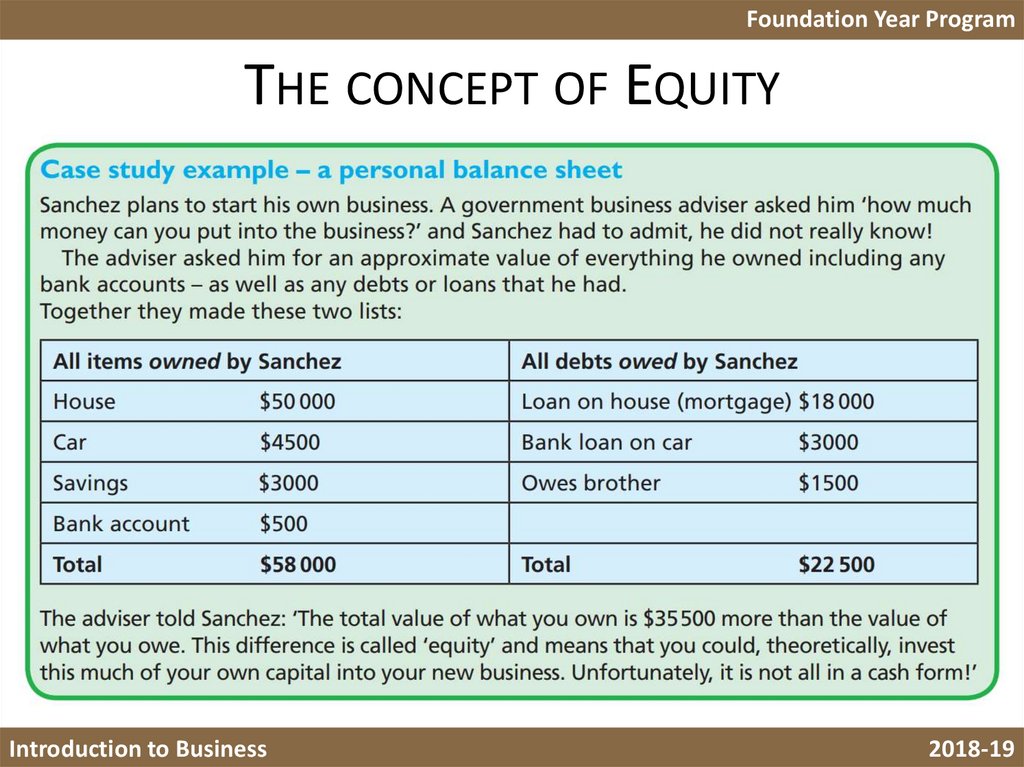

13. The concept of Equity

Foundation Year ProgramTHE CONCEPT OF EQUITY

Introduction to Business

2018-19

14. Balance sheet (BS)

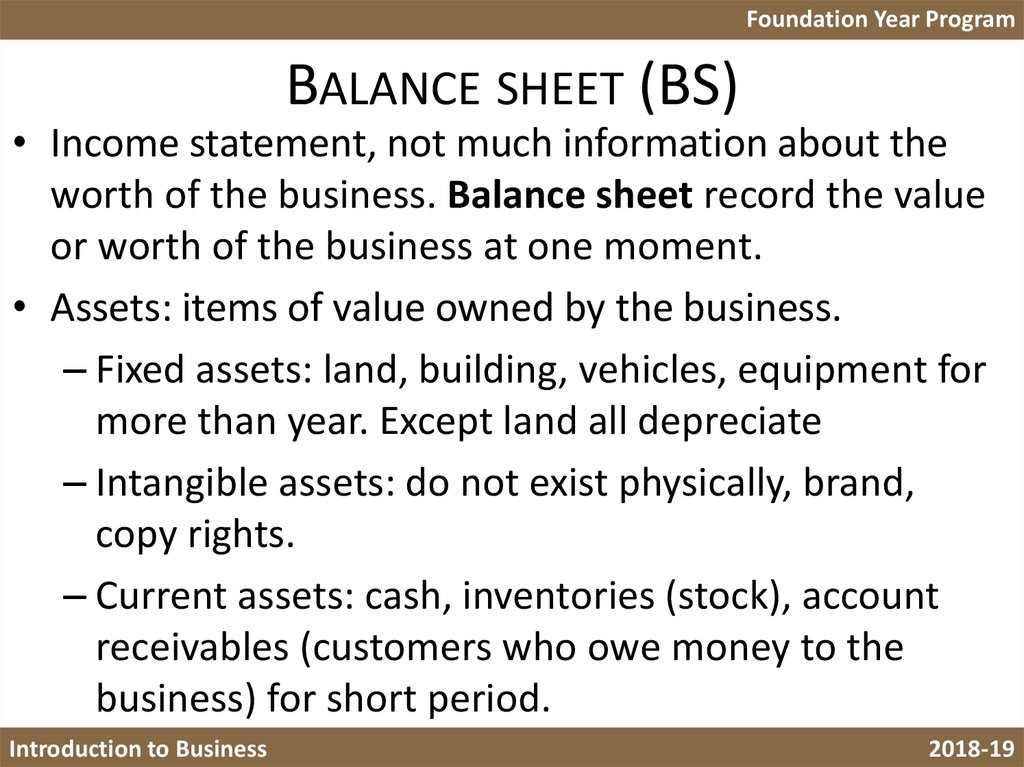

Foundation Year ProgramBALANCE SHEET (BS)

• Income statement, not much information about the

worth of the business. Balance sheet record the value

or worth of the business at one moment.

• Assets: items of value owned by the business.

– Fixed assets: land, building, vehicles, equipment for

more than year. Except land all depreciate

– Intangible assets: do not exist physically, brand,

copy rights.

– Current assets: cash, inventories (stock), account

receivables (customers who owe money to the

business) for short period.

Introduction to Business

2018-19

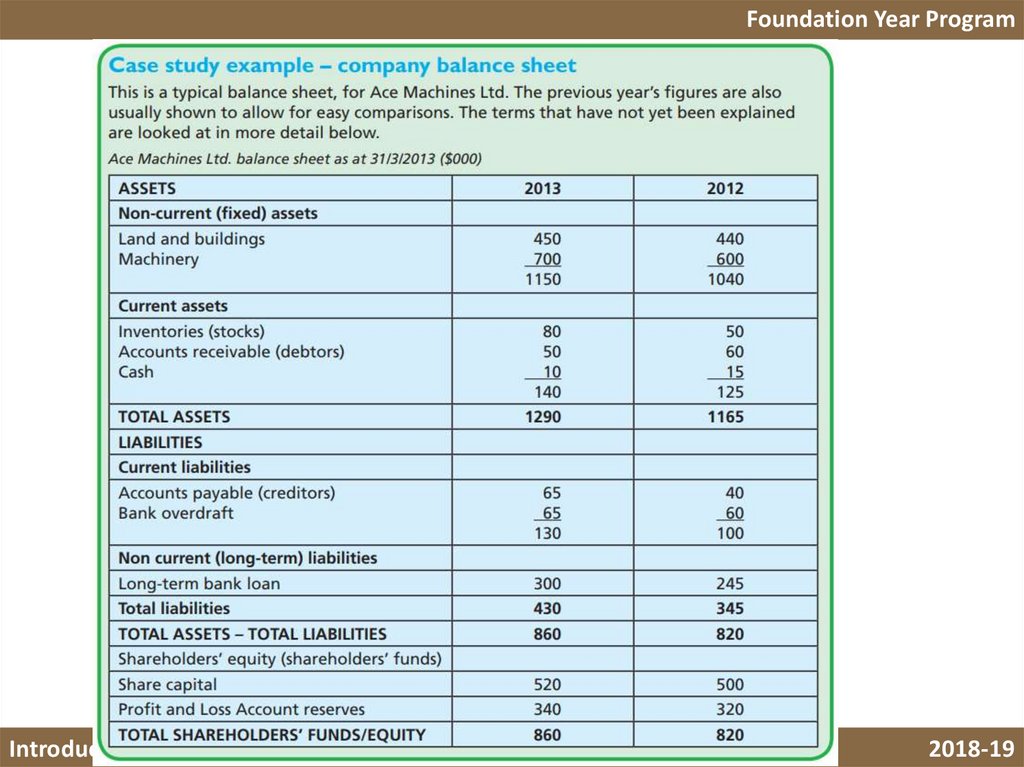

15. Balance sheet (BS)

Foundation Year ProgramBALANCE SHEET (BS)

• Liabilities: are the items owed by the business.

– Non-current liabilities- long term borrowing (do not

have to be paid within one year.

– Current liabilities-amount owed by the business to

be paid within one year (bank overdraft, supplier or

creditor)

english

english