Similar presentations:

Interest Rates

1.

BUS 362 Financial Institutions andMarkets

Week 3: Interest Rates

Assoc. Prof. Hülya Hazar

Faculty of Economics and Administrative Sciences, Department of

Business Administration

hulyahazar@aydin.edu.tr

1

2.

Financial Institutions and Markets1. Interest Rate

2. Present Value

3. Yield to Maturity

4. Types of Loans

5. Nominal vs Real Interest Rate

6. Fisher Effect

ue.aydin.edu.tr

2

3.

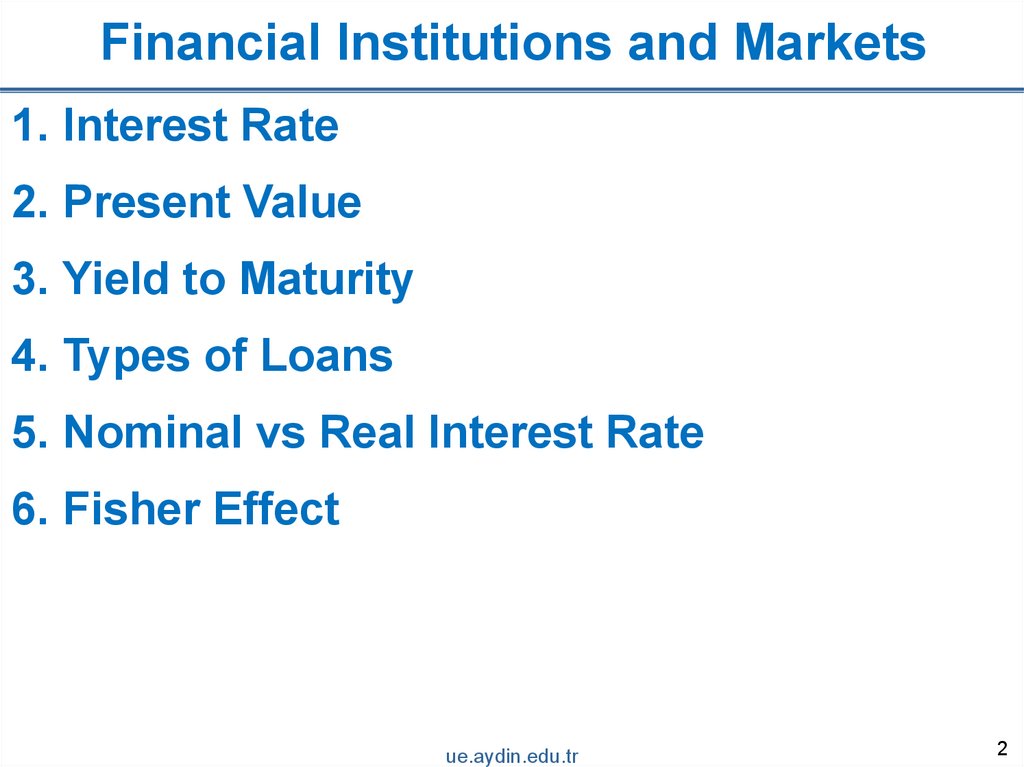

Financial Institutions and MarketsPresent Value

• The concept of present value (or present discounted value)

is based on the commonsense notion that a dollar of cash

flow paid to you one year from now is less valuable to you

than a dollar paid to you today.

ue.aydin.edu.tr

3

4.

Financial Institutions and MarketsPresent Value Applications:

• Simple Loan

Fixed Payment Loan

• Coupon Bond

• Discount Bond

ue.aydin.edu.tr

4

5.

Financial Institutions and MarketsYield to Maturity: Loans

• Yield to maturity = interest rate that equates today’s value

with present value of all future payments

• Examples:

1. Simple Loan Interest Rate (i = 10%)

$100 = $110 / (1 + i), or I = 10%

2. What is the present value of $250 to be paid in two

years if the interest rate is 15%?

$250 / (1 + 0.15)2 = $250 / 1.3225 = $189.04

ue.aydin.edu.tr

5

6.

Financial Institutions and MarketsSimple Loans require payment of one amount which equals

the loan principal plus the interest.

Fixed-Payment Loans are loans where the loan principal and

interest are repaid in several payments, often monthly, in equal

dollar amounts over the loan term.

Installment Loans, such as auto loans and home mortgages

are frequently of the fixed-payment type.

ue.aydin.edu.tr

6

7.

Financial Institutions and MarketsReal interest rate:

• Interest rate that is adjusted for expected changes in the

price level

ir = i − e

• Real interest rate more accurately reflects true cost of

borrowing

• When the real rate is low, there are greater incentives to

borrow and less to lend

ue.aydin.edu.tr

7

8.

Financial Institutions and MarketsExample:

ir = i - e

• If i = 5% and e = 0% then

5% − 0% = 5%

• If i = 10% and e = 20% then

10% − 20% = − 10%

ue.aydin.edu.tr

8

9.

Financial Institutions and MarketsDistinction Between Interest Rates and Returns:

Rate of Return: we can decompose returns into two pieces:

Return = C/Pt + (Pt+1 – Pt)/Pt

Return = Current Yield + Capital Gain Yield

ue.aydin.edu.tr

9

10.

Financial Institutions and MarketsAn asset is a piece of property that is a store of value. Facing

the question of whether to buy and hold an asset or whether to

buy one asset rather than another, an individual must consider

the following factors:

Wealth, the total resources owned by the individual,

including all assets

Expected return (the return expected over the next period)

on one asset relative to alternative assets

Risk (the degree of uncertainty associated with the return)

on one asset relative to alternative assets

Liquidity (the ease and speed with which an asset can be

turned into cash) relative to alternative assets

ue.aydin.edu.tr

10

11.

Financial Institutions and MarketsThe quantity demanded of an asset differs by factor.

Wealth: Holding everything else constant, an increase in

wealth raises the quantity demanded of an asset

Expected return: An increase in an asset’s expected return

relative to that of an alternative asset, holding everything

else unchanged, raises the quantity demanded of the asset

Risk: Holding everything else constant, if an asset’s risk

rises relative to that of alternative assets, its quantity

demanded will fall

Liquidity: The more liquid an asset is relative to alternative

assets, holding everything else unchanged, the more

desirable it is, and the greater will be the quantity

demanded

ue.aydin.edu.tr

11

12.

Financial Institutions and MarketsSupply and Demand for Bonds:

ue.aydin.edu.tr

12

13.

Financial Institutions and MarketsMarket Conditions:

• Market equilibrium occurs when the amount that people are

willing to buy (demand) equals the amount that people are

willing to sell (supply) at a given price

• Excess supply occurs when the amount that people are

willing to sell (supply) is greater than the amount people are

willing to buy (demand) at a given price

• Excess demand occurs when the amount that people are

willing to buy (demand) is greater than the amount that

people are willing to sell (supply) at a given price

ue.aydin.edu.tr

13

14.

Financial Institutions and MarketsChanges in e: The Fisher Effect:

If e

1. Relative Re , Bd shifts in to left

2. Bs , Bs shifts out to right

3. P , i

ue.aydin.edu.tr

14

15.

Financial Institutions and MarketsSummary of the Fisher Effect:

• If expected inflation rises from 5% to 10%, the expected

return on bonds relative to real assets falls and, as a result,

the demand for bonds falls.

• The rise in expected inflation also means that the real cost of

borrowing has declined, causing the quantity of bonds

supplied to increase.

• When the demand for bonds falls and the quantity of bonds

supplied increases, the equilibrium bond price falls.

• Since the bond price is negatively related to the interest rate,

this means that the interest rate will rise.

ue.aydin.edu.tr

15

16.

Subjects Covered1. Interest Rate

2. Present Value

3. Yield to Maturity

4. Types of Loans

5. Nominal vs Real Interest Rate

6. Fisher Effect

ue.aydin.edu.tr

16

17.

ReferencesReadings:

Chapter 3 and 4

Reference Book:

Mishkin, Frederic S. Financial Markets and Institutions. Eighth Edition.

UK: Pearson, 2016.

ue.aydin.edu.tr

17

18.

Financial Institutions and MarketsSee you next week…

ue.aydin.edu.tr

18

finance

finance