Similar presentations:

R-finance LLP microfinance organization

1.

R-FINANCE LLP MICROFINANCE ORGANIZATION(01.01.2024)

2.

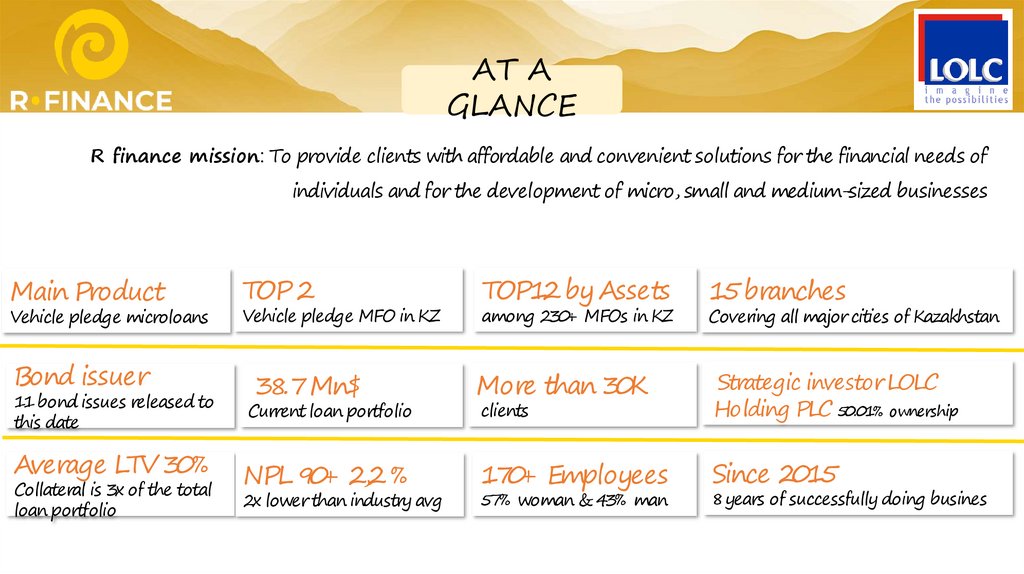

AT AGLANCE

R finance mission: To provide clients with affordable and convenient solutions for the financial needs of

individuals and for the development of micro, small and medium-sized businesses

Main Product

TOP 2

TOP12 by Assets

15 branches

Bond issuer

38.7Mn$

More than 30K

clients

Strategic investor LOLC

Holding PLC 50.01% ownership

NPL 90+ 2,2 %

170+ Employees

Since 2015

Vehicle pledge microloans

11 bond issues released to

this date

Average LTV 30%

Collateral is 3x of the total

loan portfolio

Vehicle pledge MFO in KZ

Current loan portfolio

2x lower than industry avg

among 230+ MFOs in KZ

57% woman & 43% man

Covering all major cities of Kazakhstan

8 years of successfully doing busines

3.

COVERAGE

Headquarters located in

Astana

Petropavlosvk

Kostanay

Pavlodar

Astana

Oral

Semey Oskemen

Karagandy

Atyrau

Kyzylorda

Aktau

Taraz

Shymkent

Almaty

The branch network encompasses 15

locations strategically positioned in key cities

across Kazakhstan, representing all major

urban centers in the region.

4.

MILESTONES

Establishment of

business

R- finance registered

with Agency for

Regulation and

Development of

financial Markets

Indefinite

Microfinance license

issued by a regulator

May 2020

February 2015

March 2021

Fortune holdings a

Singapore based

LOLC subsidiary

acquired 50.01%

stake of the company

January 2023

October 2017

December 2020

January 2022

R-finance pivots to

vehicle pledge loans

product line

First Bond issues are

listed on Kazakhstan

stock exchange and

AIX

Successful financial &

legal Due Diligence by

KPMG

5.

ABOUT LOLCGROUP

6.

R-FINANCEADVANTAGES

No Fees. R-finance does not charge

any fees for microloan application

or disbursement

Pledged vehicles are available for driving

Vehicle evaluation and microloan

disbursement under 1 hour 15

minutes

Maximum microloan size – 160k

$. Up to 5 years duration of the

loan.

Call center available 7 days a week

Differentiated, annuity and discrete

available monthly payment options

7.

LOAN APPLICATIONPROCESS

1

Step 1 – Online request

Leave a request at our website

and our call center manager

will call you in a few minutes

2

Step 2 – Meeting at the

office

Your vehicle will be evaluated

and our manager will help you

choose right loan condition and

fill out application all at same

place

3

Step 3 – loan distribution

Loan funds are available for

collection in cash form or as

card transfer in 1 hour!

8.

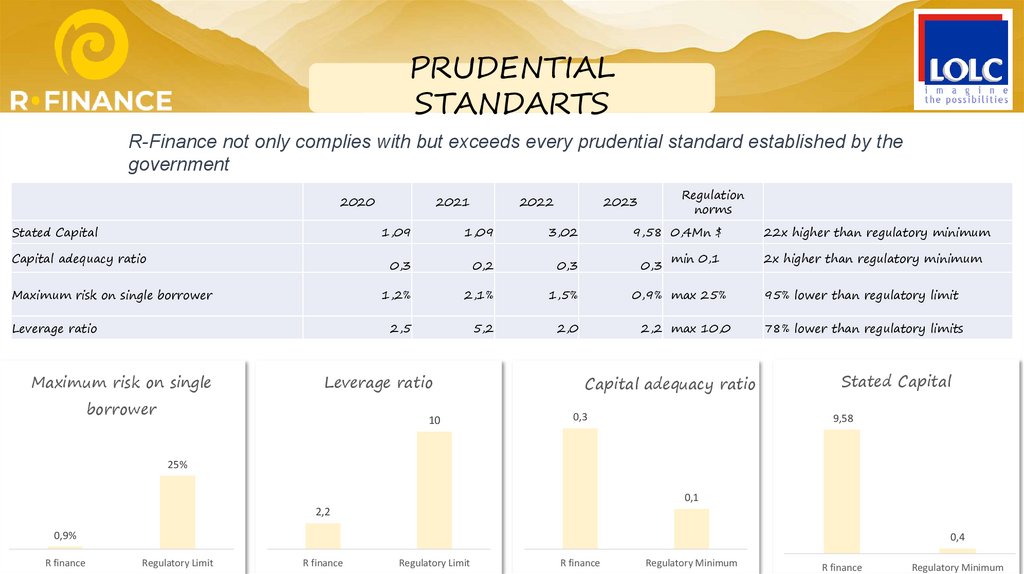

PRUDENTIALSTANDARTS

R-Finance not only complies with but exceeds every prudential standard established by the

government

2020

Stated Capital

Сapital adequacy ratio

Maximum risk on single borrower

Leverage ratio

Maximum risk on single

2021

Regulation

norms

2023

1,09

1,09

3,02

0,3

0,2

0,3

1,2%

2,1%

1,5%

0,9% max 25%

95% lower than regulatory limit

2,5

5,2

2,0

2,2 max 10,0

78% lower than regulatory limits

Leverage ratio

borrower

2022

10

9,58 0,4Mn $

0,3

min 0,1

Capital adequacy ratio

0,3

22х higher than regulatory minimum

2х higher than regulatory minimum

Stated Capital

9,58

25%

0,1

2,2

0,9%

R finance

0,4

Regulatory Limit

R finance

Regulatory Limit

R finance

Regulatory Minimum

R finance

Regulatory Minimum

9.

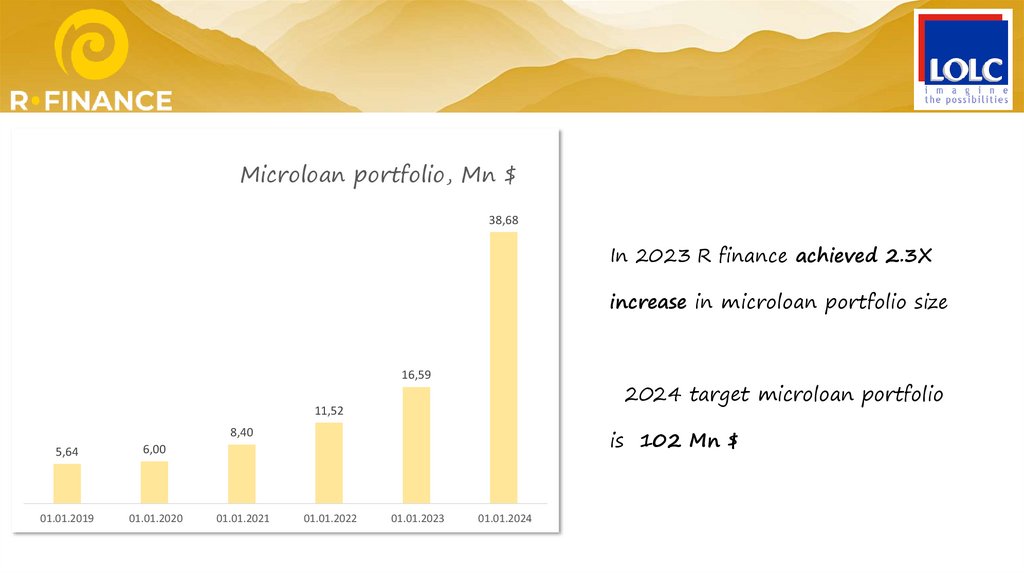

MICROL OAN PORTFOL IO10.

Microloan portfolio, Mn $38,68

In 2023 R finance achieved 2.3X

increase in microloan portfolio size

16,59

2024 target microloan portfolio

11,52

is 102 Mn $

8,40

5,64

6,00

01.01.2019

01.01.2020

01.01.2021

01.01.2022

01.01.2023

01.01.2024

11.

Portfolio quality19,6%

18,8%

18,5%

16,0%

14,3%

13,2%

11,7%

11,3%

11,4%

11,3%

10,9%

6,6%

4,7%

5,7%

5,5%

4,0%

3,6%

2,2%

2018

2019

2020

DPD 1+

2021

DPD 30+

NPL 90+

2022

2023

12.

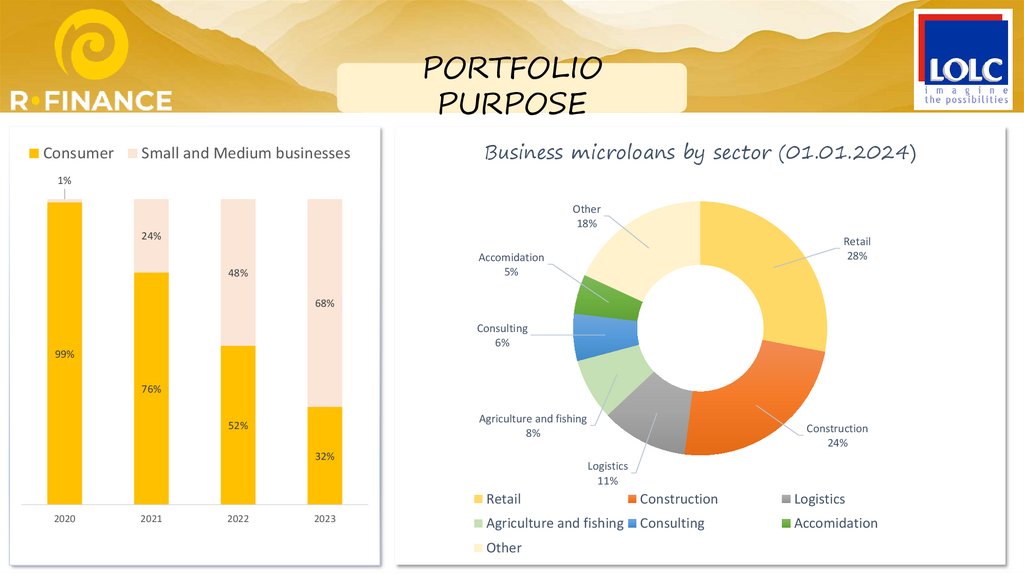

PORTFOLIOPURPOSE

Consumer

Small and Medium businesses

Business microloans by sector (01.01.2024)

1%

Other

18%

24%

Retail

28%

Accomidation

5%

48%

68%

Consulting

6%

99%

76%

Agriculture and fishing

8%

52%

32%

2020

2021

2022

2023

Construction

24%

Logistics

11%

Retail

Construction

Logistics

Agriculture and fishing

Consulting

Accomidation

Other

13.

FINANCIAL SOURCES14.

PROFITABILITY* The decline in return ratios (ROA & ROE) in 2023 is attributed to the simultaneous increase in assets and equity resulting from capitalization through LOIC. Although the

investments have expanded, the full returns have not materialized yet, primarily due to R Finance's cautious and low-risk approach to portfolio growth

33%

8%

27%

21%

Return on Equity

Return on Assets

Return on Sales

7%

24%

20%

17%

16%

5%

19%

4%

2020

2021

2022

2023

2020

2020

2021

2022

2021

2022

2023

2023

Revenue, Mn $

Net income Mn $

2,37

12,01

1,62

5,99

2,58

2020

3,62

2021

2022

2023

0,53

0,62

2020

2021

2022

2023

15.

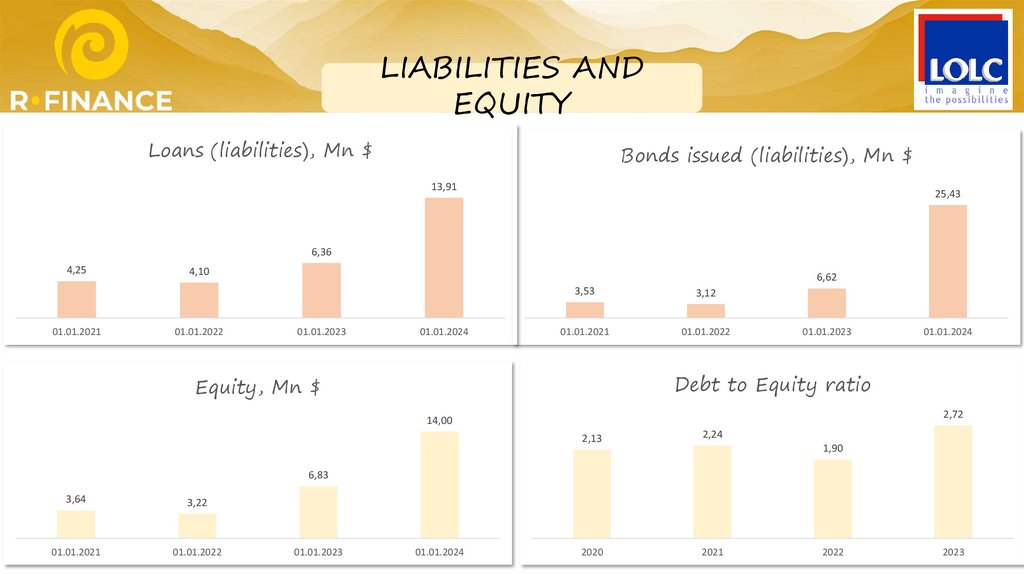

LIABILITIES ANDEQUITY

Loans (liabilities), Mn $

Bonds issued (liabilities), Mn $

13,91

25,43

6,36

4,25

01.01.2021

4,10

01.01.2022

6,62

01.01.2023

01.01.2024

3,53

3,12

01.01.2021

01.01.2022

01.01.2023

01.01.2024

Debt to Equity ratio

Equity, Mn $

2,72

14,00

2,13

2,24

2020

2021

1,90

6,83

3,64

3,22

01.01.2021

01.01.2022

01.01.2023

01.01.2024

2022

2023

16.

BOND LISTINGSMFRFb1

MFRFb3

MFRFb5

MFRFb7

MFRFb9

Volume: 4,2Mn $

Rate: 20%

Maturity:

Feb.2024

Tenure: 3 years

Currency: KZT

Stock Exchange:

KASE

Volume: 2,1Mn $

Rate: 25%

Maturity:

Jun.2025

Tenure: 3 years

Currency: KZT

Stock Exchange:

KASE

Volume: 2,1Mn $;

Rate: 20%;

Maturity: repaid

on Dec.2023

Tenure: 1 year

Currency: KZT

Stock Exchange:

KASE

Volume: 6,3Mn $

Rate: 25%

Maturity:

Jun.2025

Tenure: 2 years

Currency: KZT

Stock Exchange:

KASE

Volume: 6,3Mn $

Rate: 25%

Maturity:

Dec.2026

Tenure: 3 years

Currency: KZT

Stock Exchange:

KASE

RFIN.0825

Volume:10 Mn $

Rate: 7%

Maturity: repaid

on Sep.2023

Tenure: 5 years

Currency: USD

Stock Exchange:

AIX

MFRFb2

MFRFb4

MFRFb6

MFRFb8

MFRFb10

Volume: 2,1Mn $

Rate: 18%

Maturity: repaid

on

Dec.2023

Tenure: 3 years

Currency: KZT

Stock Exchange:

KASE

Volume: 4,2Mn $

Rate: 25%

Maturity:

Mar.2026

Tenure: 3 years

Currency: KZT

Stock Exchange:

KASE

Volume: 2,1Mn $

Rate: 20%

Maturity:

May.2024

Tenure: 1 year

Currency: KZT

Stock Exchange:

KASE

Volume: 2,1Mn $

Rate: 20%

Maturity:

Oct.2024

Tenure: 1 year

Currency: KZT

Stock Exchange:

KASE

Volume: 4,3Mn $

Rate: 20%

Maturity:

Dec.2024

Tenure: 1 year

Currency: KZT

Stock Exchange:

KASE

finance

finance