Similar presentations:

Classical Monetary Theories

1.

Classical Monetary Theories,The Neo-Classical Monetary

Thought: the historical

background and the analysis

of the theories .e historical

background and the analysis of

the theories."

2.

Classical monetary theoriesIt is argued that the amount of money in circulation

directly affects the price level. According to this theory,

if the amount of money in the economy increases, then

inflation occurs, and if it decreases, deflation.

3.

One of the main representatives ofclassical monetary theory was David

Ricardo, who argued that the money

supply should be fully provided with

gold or silver. Classical theories also

suggest that the economy can selfregulate through market mechanisms.

4.

The first stage of the policy of monetarism by Central Banks was theinclusion of monetary aggregates in their econometric models. Already in

1966, the US Federal Reserve began to study the dynamics of monetary

aggregates. After the United States, Germany, France, Italy, Spain and the

United Kingdom announced benchmarks for money supply growth. In

1979, European countries came to an agreement on the creation of the

European Monetary System, under which they pledged to keep the

exchange rates of their national currencies within certain limits.

5.

ResultsThey point out that the central bank should take an active

role in regulating the monetary system and controlling the

inflation rate. It also emphasizes the need for transparency

and reliability of monetary policy to ensure the stability of

the financial system and economic growth.

6.

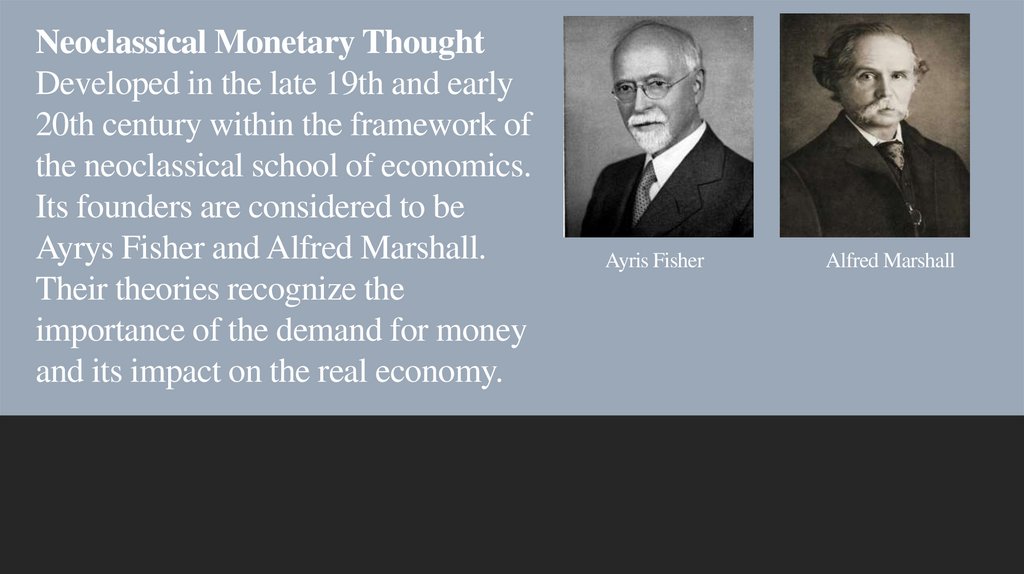

Neoclassical Monetary ThoughtDeveloped in the late 19th and early

20th century within the framework of

the neoclassical school of economics.

Its founders are considered to be

Ayrys Fisher and Alfred Marshall.

Their theories recognize the

importance of the demand for money

and its impact on the real economy.

Ayris Fisher

Alfred Marshall

7.

These theories suggest that the level of monetaryincome and prices depends on the general demand for

goods and services, and not only on the money supply.

They also emphasize that money is not always

effectively distributed in the economy and can cause

inefficiencies and imbalances.

8.

The new monetarism is based on several principles:• money plays a crucial role: to understand the monetary phenomenon and monetary policy, it

is necessary to use models in which money is introduced in an explicit and non-primitive

form to solve the problems of market imperfections;

• financial intermediaries also play an important role: although financial obligations of banks

and cash serve as a medium of circulation, both categories are not identical;

• when modeling imperfections of markets that are overcome through money and financial

intermediaries, it is necessary to use such abstraction and interpretation that do not interfere

with obtaining plausible answers to the questions posed, preference is given to simple

models;

• no model can be universal for solving every economic problem, it is necessary to have a

class of models using similar assumptions and tools to solve a variety of problems.

9.

Thank you foryour attention

biography

biography