Similar presentations:

The most effective lowering lipids in Russian Federation

1.

KRKA’s STATIN :THE MOST EFFECTIVE

LOWERING LIPIDS IN RUSSIAN

FEDERATION

Promotional proposals in RF

Marketing department in RF

January, 2004

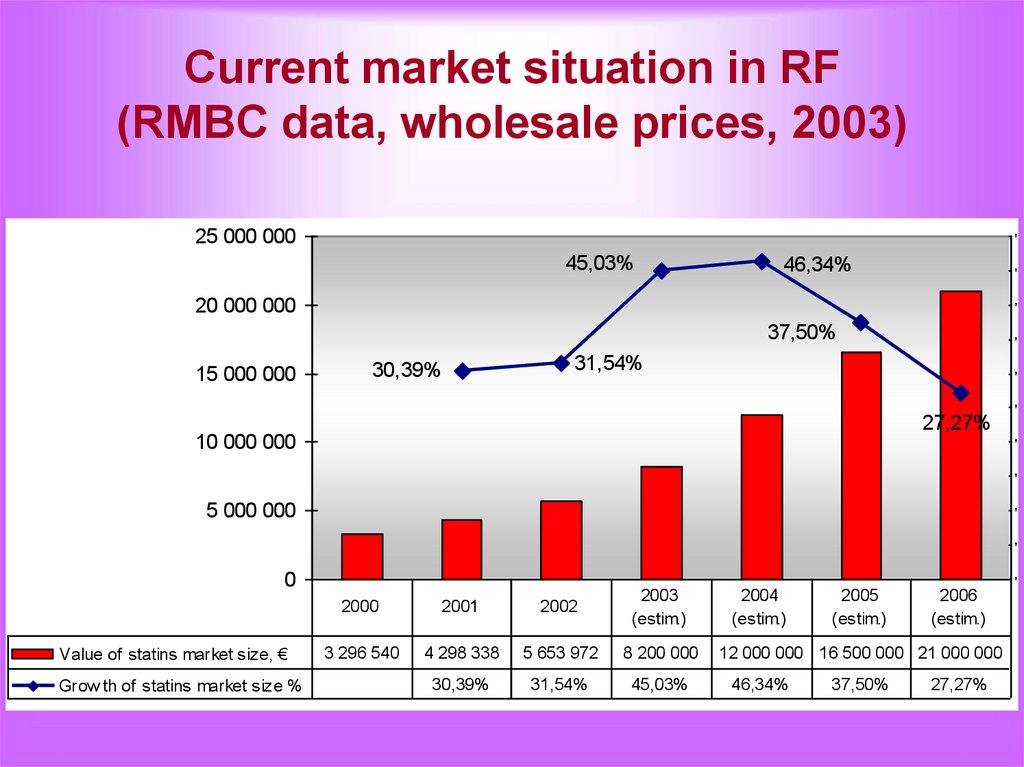

2. Current market situation in RF (RMBC data, wholesale prices, 2003)

25 000 0001

45,03%

46,34%

0

20 000 000

0

37,50%

15 000 000

0

31,54%

30,39%

0

0

27,27%

10 000 000

0

0

5 000 000

0

0

0

Value of statins market size, €

Grow th of statins market size %

0

2000

2001

2002

2003

(estim.)

3 296 540

4 298 338

5 653 972

8 200 000

30,39%

31,54%

45,03%

2004

(estim.)

2005

(estim.)

2006

(estim.)

12 000 000 16 500 000 21 000 000

46,34%

37,50%

27,27%

3. KRKA Statins in RF Market.

There will be three KRKA’s statinsin RF at the end of the year 2004:

• Vasilip is the leading statin.

• Atoris is the perspective statin.

• Holetar is the statin without active

promotion.

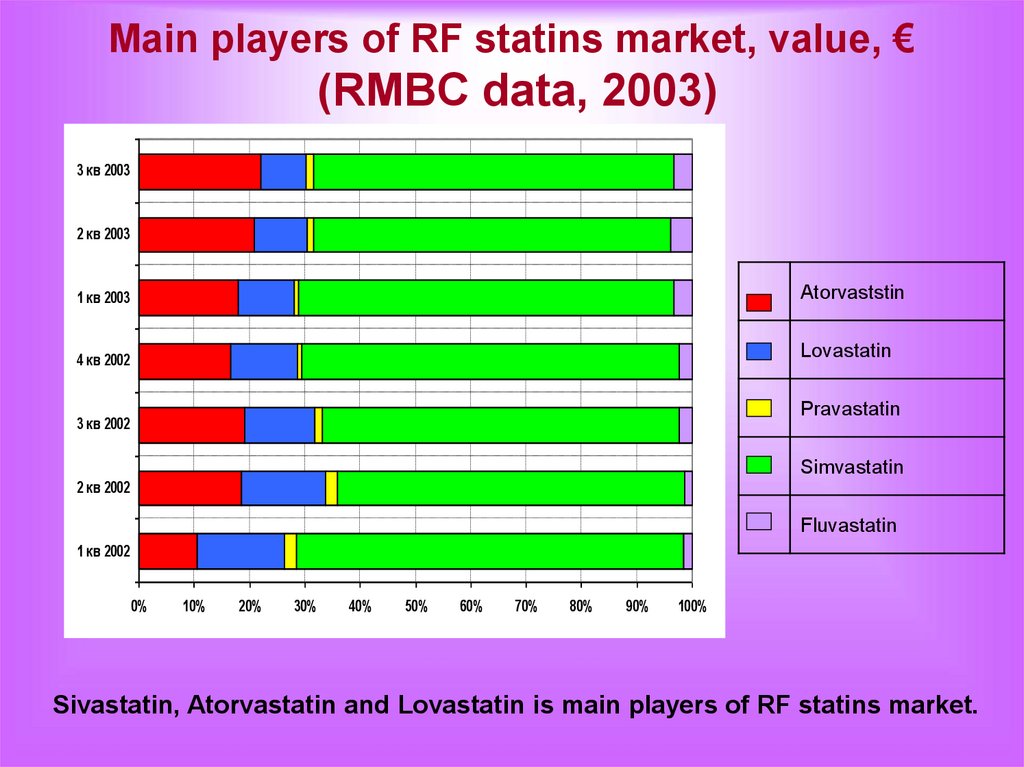

4. Main players of RF statins market, value, € (RMBC data, 2003)

3 кв 20032 кв 2003

1 кв 2003

Atorvaststin

4 кв 2002

Lovastatin

Pravastatin

3 кв 2002

Simvastatin

2 кв 2002

Fluvastatin

1 кв 2002

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Sivastatin, Atorvastatin and Lovastatin is main players of RF statins market.

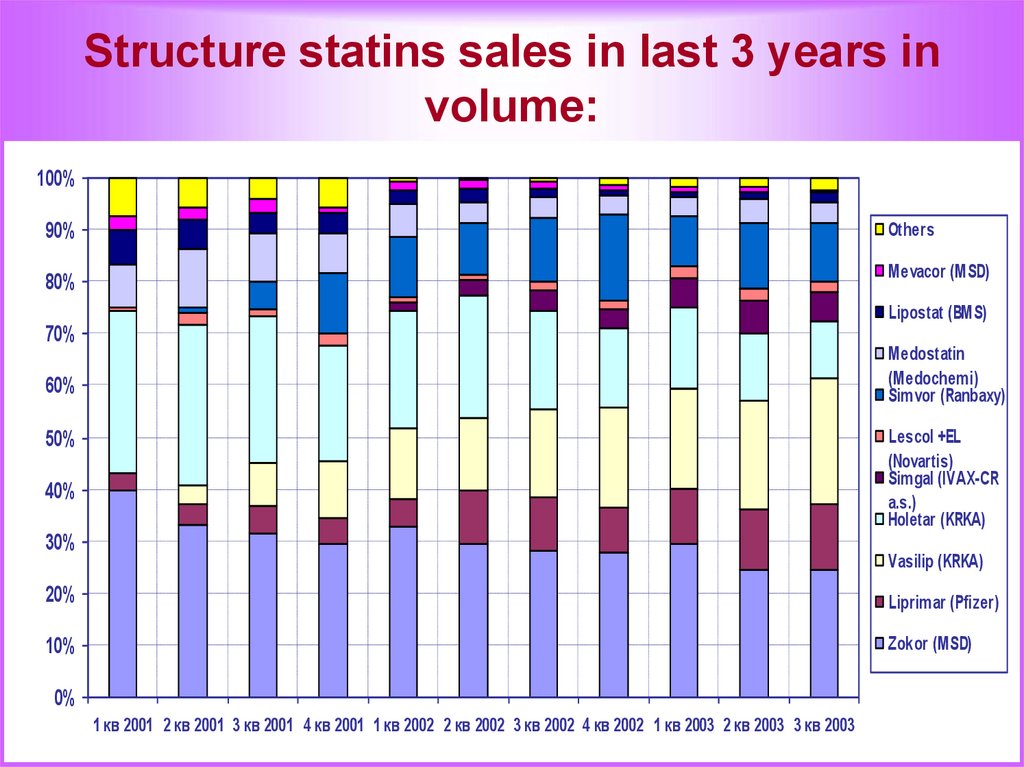

5. Structure statins sales in last 3 years in volume:

100%90%

Others

80%

Mevacor (MSD)

Lipostat (BMS)

70%

Medostatin

(Medochemi)

Simvor (Ranbaxy)

60%

Lescol +EL

(Novartis)

Simgal (IVAX-CR

a.s.)

Holetar (KRKA)

50%

40%

30%

Vasilip (KRKA)

20%

Liprimar (Pfizer)

10%

Zokor (MSD)

0%

1 кв 2001 2 кв 2001 3 кв 2001 4 кв 2001 1 кв 2002 2 кв 2002 3 кв 2002 4 кв 2002 1 кв 2003 2 кв 2003 3 кв 2003

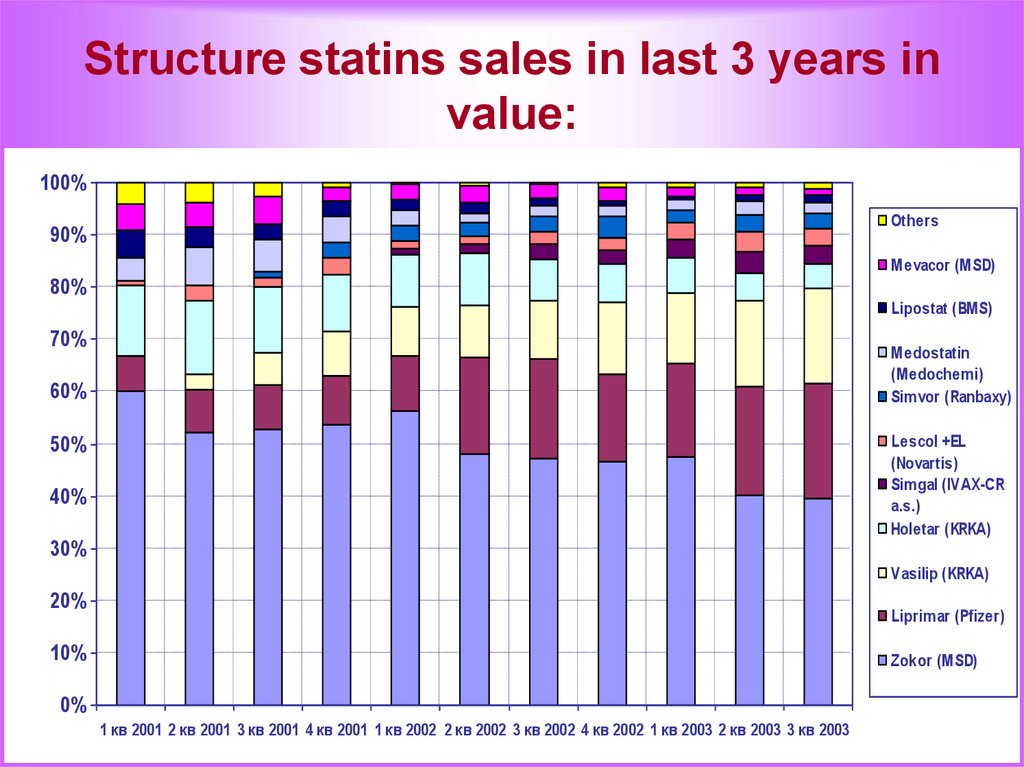

6. Structure statins sales in last 3 years in value:

100%Others

90%

Mevacor (MSD)

80%

Lipostat (BMS)

70%

Medostatin

(Medochemi)

Simvor (Ranbaxy)

60%

Lescol +EL

(Novartis)

Simgal (IVAX-CR

a.s.)

Holetar (KRKA)

50%

40%

30%

Vasilip (KRKA)

20%

Liprimar (Pfizer)

10%

Zokor (MSD)

0%

1 кв 2001 2 кв 2001 3 кв 2001 4 кв 2001 1 кв 2002 2 кв 2002 3 кв 2002 4 кв 2002 1 кв 2003 2 кв 2003 3 кв 2003

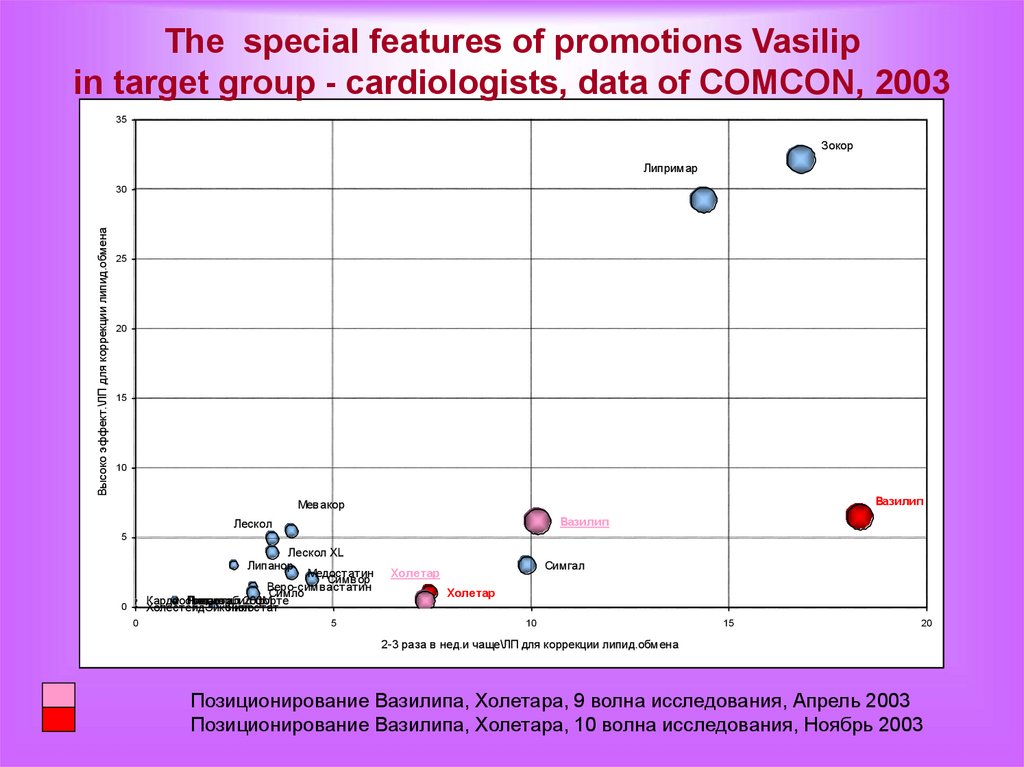

7. The special features of promotions Vasilip in target group - cardiologists, data of COMCON, 2003

35Зокор

Липримар

Высоко эффект.\ЛП для коррекции липид.обмена

30

25

20

15

10

Вазилип

Мев акор

Вазилип

Лескол

5

Лескол XL

Липанор

Медостатин

Симв ор

Веро-симв астатин

Симло

Кардиостатин

Липостабил

Ров

Липантил

акор 200М

форте

ХолестейдЭйконол

Липостат

0

0

5

Симгал

Холетар

Холетар

10

15

20

2-3 раза в нед.и чаще\ЛП для коррекции липид.обмена

Позиционирование Вазилипа, Холетара, 9 волна исследования, Апрель 2003

Позиционирование Вазилипа, Холетара, 10 волна исследования, Ноябрь 2003

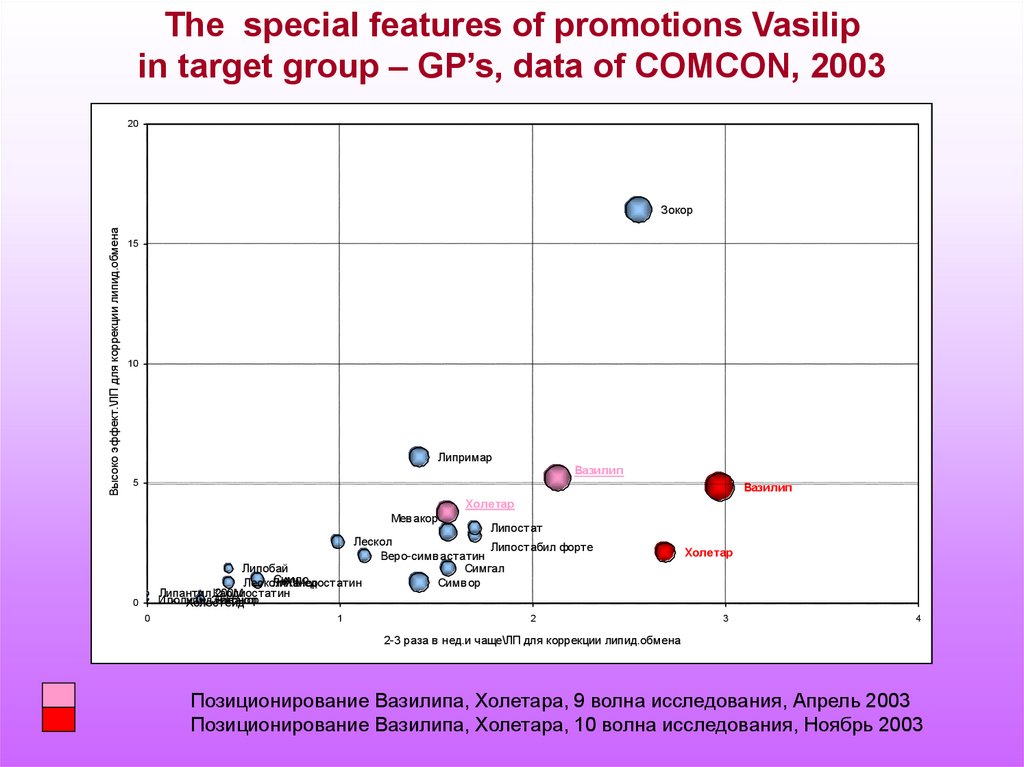

8.

The special features of promotions Vasilipin target group – GP’s, data of COMCON, 2003

20

Высоко эффект.\ЛП для коррекции липид.обмена

Зокор

15

10

Липримар

Вазилип

5

Вазилип

Холетар

Мев акор

Липостат

Лескол

Липостабил форте

Веро-симв астатин

Липобай

Симгал

Симло

Лескол

Липанор

XLМедостатин

Симв ор

Липантил Кардиостатин

200М

Иполипид

Эйконол

Ров акор

Холестейд

0

0

1

2

Холетар

3

4

2-3 раза в нед.и чаще\ЛП для коррекции липид.обмена

Позиционирование Вазилипа, Холетара, 9 волна исследования, Апрель 2003

Позиционирование Вазилипа, Холетара, 10 волна исследования, Ноябрь 2003

9. Vasilip plans and goals for year 2001 - 2006

20012002

2003

2004

(estim.)

2005

(estim.)

2006

(estim.)

Vasilip value,

wholesale

prices, €

196 278

638 617

1 424 660

4 500 000

5 000 000

6 600 000

Value of

statins market

size, €

4 298 338

5 653 971

8 200 000

12 000

000

16 500 000

21 000

000

Vasilip Market

share

4,5%

11,3%

17,4%

38%

30%

31%

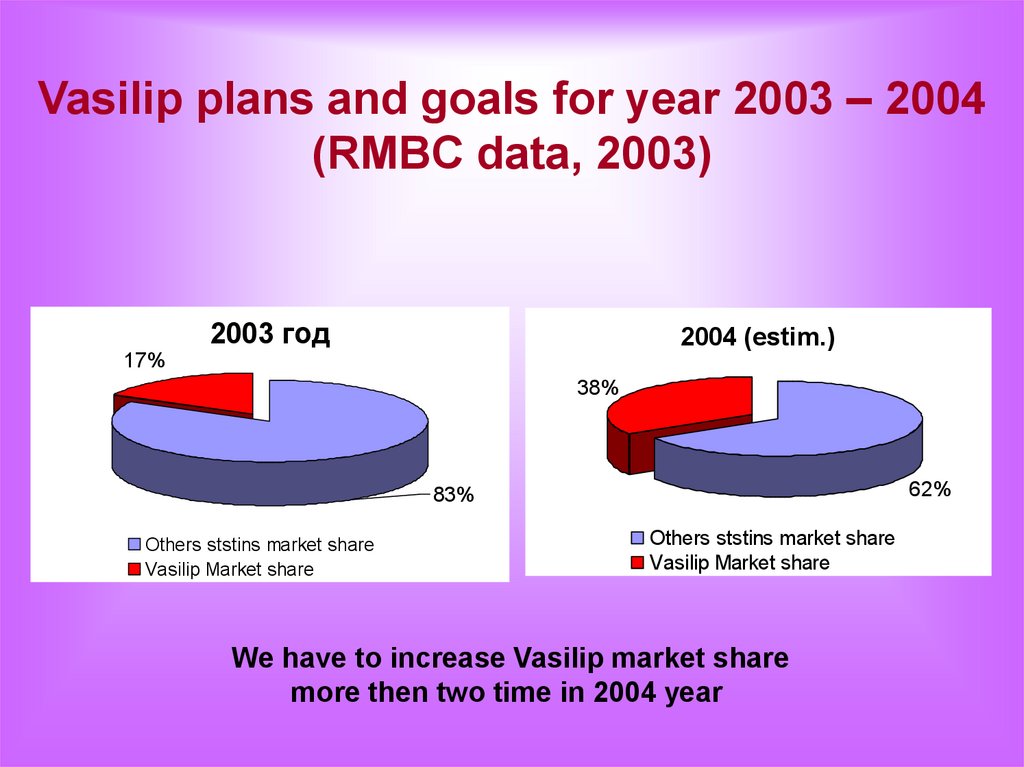

10. Vasilip plans and goals for year 2003 – 2004 (RMBC data, 2003)

17%2003 год

2004 (estim.)

38%

62%

83%

Others ststins market share

Vasilip Market share

Others ststins market share

Vasilip Market share

We have to increase Vasilip market share

more then two time in 2004 year

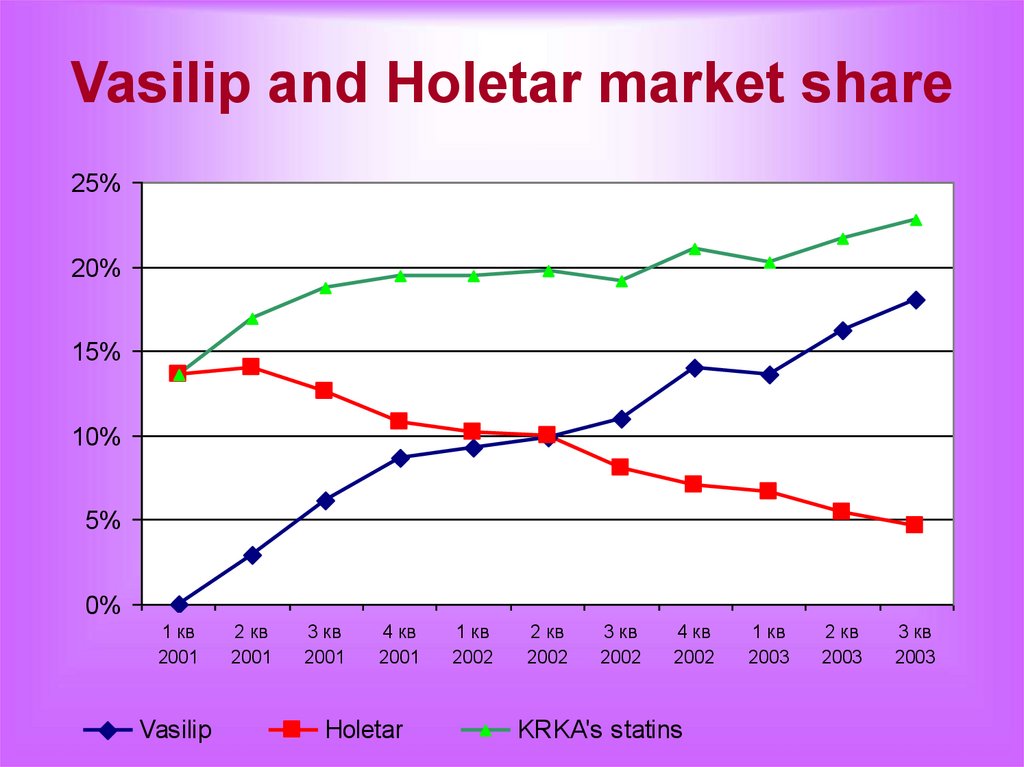

11. Vasilip and Holetar market share

25%20%

15%

10%

5%

0%

1 кв

2001

Vasilip

2 кв

2001

3 кв

2001

4 кв

2001

Holetar

1 кв

2002

2 кв

2002

3 кв

2002

4 кв

2002

KRKA's statins

1 кв

2003

2 кв

2003

3 кв

2003

12. Estimate Vasilip market share in 2004

• V18% + H5% = 23%• 23% + 23% / 100 x 10 = 25,3%

30% Market share – 3 600 000 €

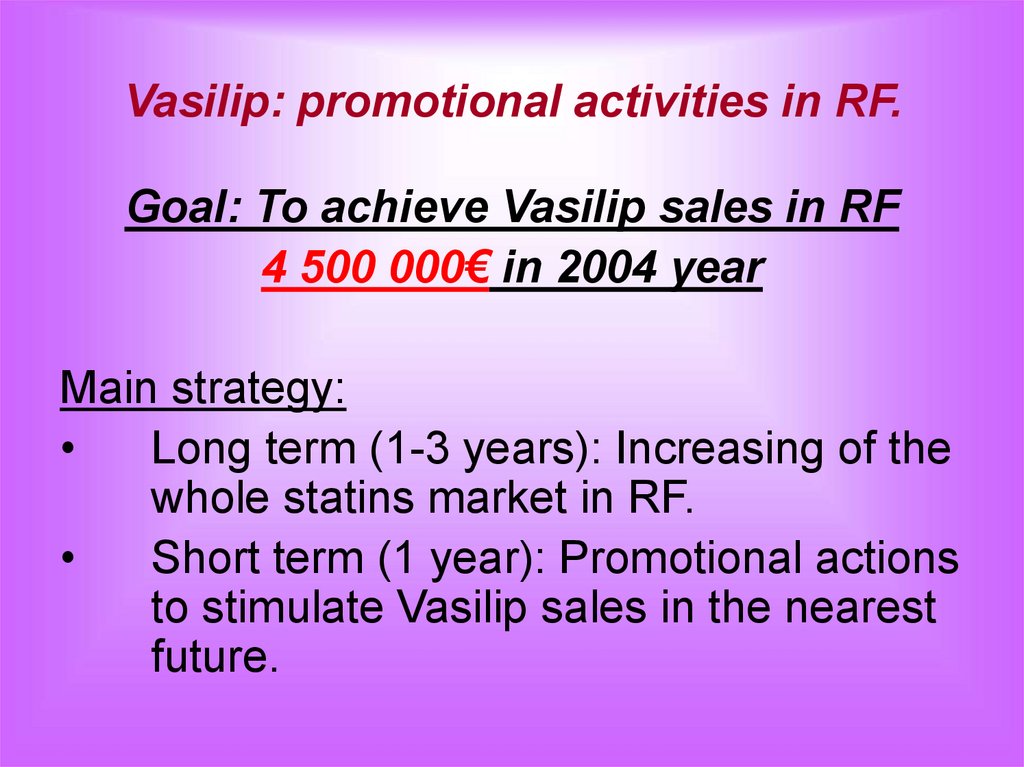

13. Vasilip: promotional activities in RF.

Goal: To achieve Vasilip sales in RF4 500 000€ in 2004 year

Main strategy:

Long term (1-3 years): Increasing of the

whole statins market in RF.

Short term (1 year): Promotional actions

to stimulate Vasilip sales in the nearest

future.

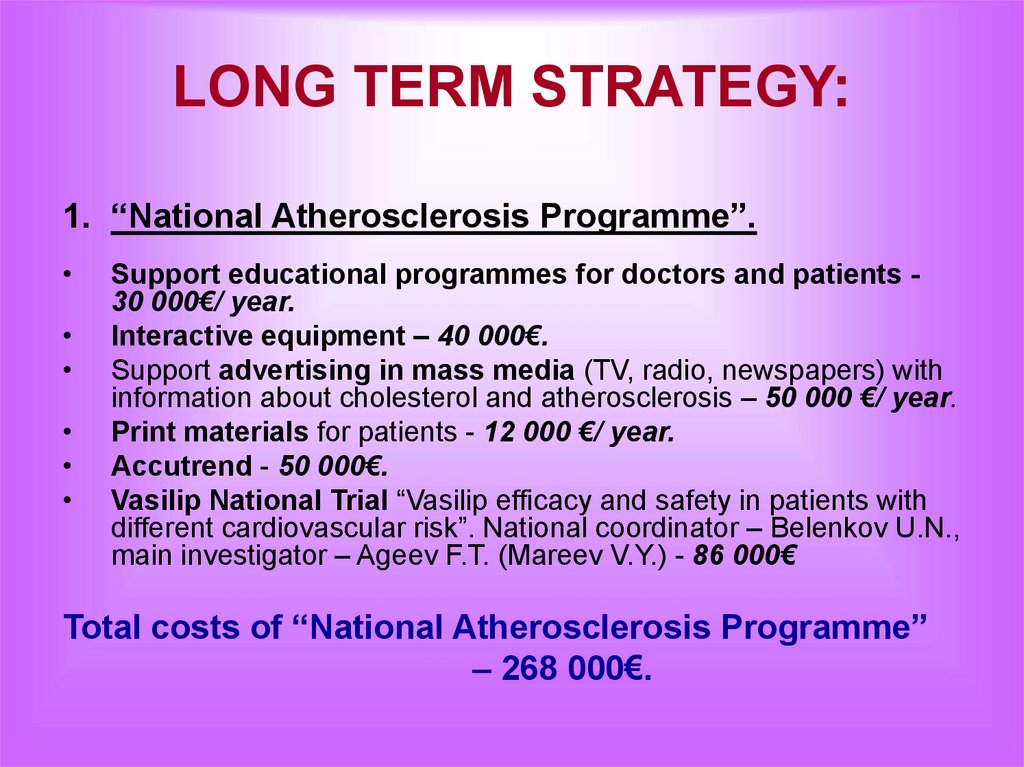

14. LONG TERM STRATEGY:

1. “National Atherosclerosis Programme”.Support educational programmes for doctors and patients 30 000€/ year.

Interactive equipment – 40 000€.

Support advertising in mass media (TV, radio, newspapers) with

information about cholesterol and atherosclerosis – 50 000 €/ year.

Print materials for patients - 12 000 €/ year.

Accutrend - 50 000€.

Vasilip National Trial “Vasilip efficacy and safety in patients with

different cardiovascular risk”. National coordinator – Belenkov U.N.,

main investigator – Ageev F.T. (Mareev V.Y.) - 86 000€

Total costs of “National Atherosclerosis Programme”

– 268 000€.

15. LONG TERM STRATEGY:

2. Including Vasilip in regionalreimbursement lists – 17 500€

3. Doctors competition: “The best scientific

work on Vasilip”

– 10 000 €/ year

4. Chemist's competition (only in regions)

– 22 000 €/ year

16. SHORT TERM STRATEGY: Promotional actions to stimulate Vasilip sales in the nearest future.

1. Postregistration studies• National scientific centre of Prophylactic

Medicine (Moskow). Study: “Vasilip

pleotropic effects in smokers

patients”. Total: 9 000€

• National scientific centre of Prophylactic

Medicine (Moskow). Study: “Effect of

Vasilip on postsprandial

hyperlipidemia”. Total: 9 000€

17. SHORT TERM STRATEGY: Promotional actions to stimulate Vasilip sales in the nearest future.

2. Seeding-trial:• The basic seeding-trial for cardiologists,

neurologist and GPs with high-middle potential.

Costs of this trial are planned in main budget.

• The additional seeding-trial for GPs with low

potential – 50 000€.

• The additional seeding-trial for cardiologists and

lipidologists with very high potential – 10 000€.

18. SHORT TERM STRATEGY: Promotional actions to stimulate Vasilip sales in the nearest future.

8. Competition for MRs of hospital line.– 1 000€.9. White Saturdays (ask Mr. Zorko, Poland case, from

Kranjska gora) –

€

10. Bus with laboratory. in Moscow –

11. Other costs - 3500€

€

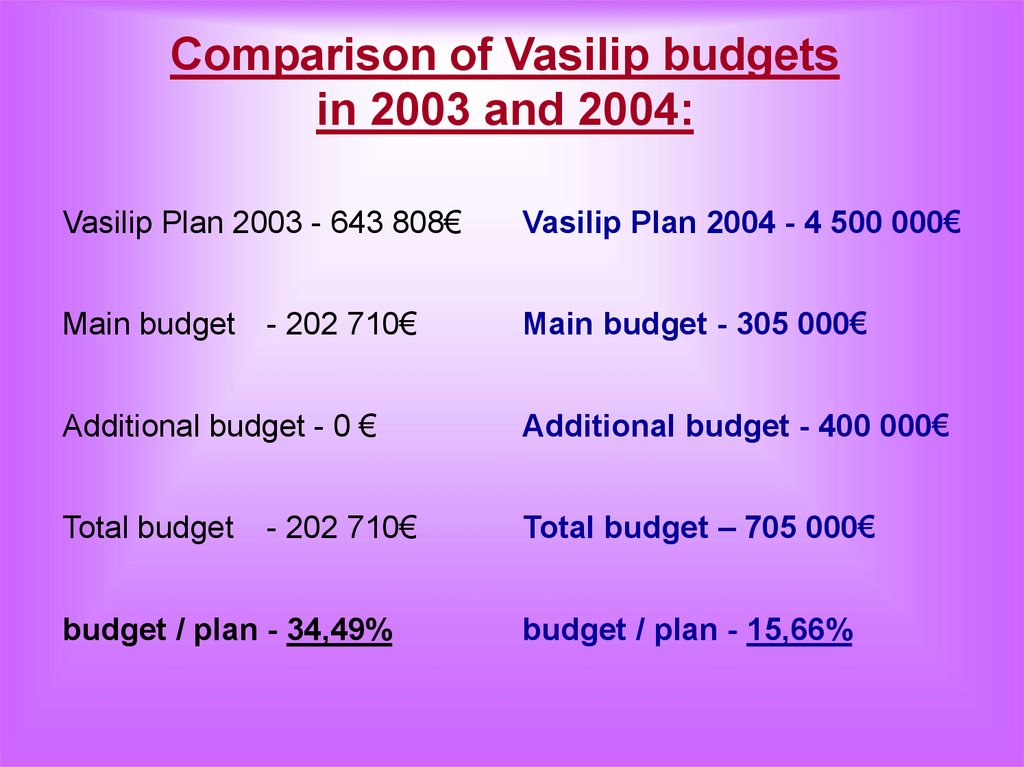

19. Comparison of Vasilip budgets in 2003 and 2004:

Vasilip Plan 2003 - 643 808€Main budget

- 202 710€

Additional budget - 0 €

Total budget

- 202 710€

budget / plan - 34,49%

Vasilip Plan 2004 - 4 500 000€

Main budget - 305 000€

Additional budget - 400 000€

Total budget – 705 000€

budget / plan - 15,66%

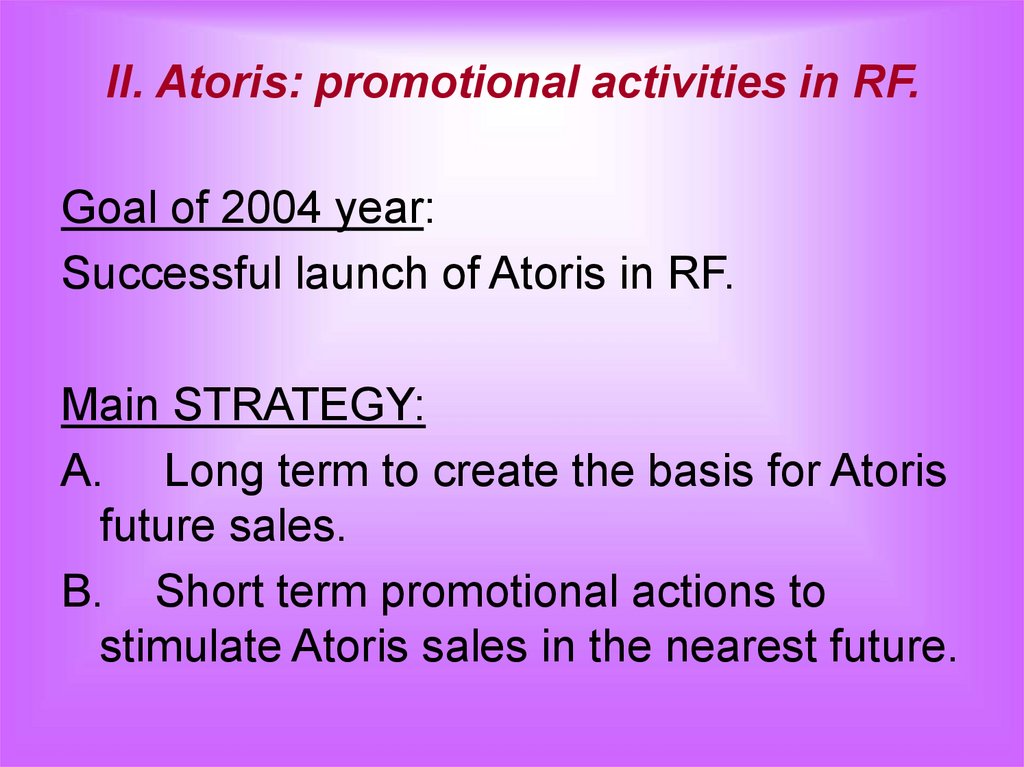

20. II. Atoris: promotional activities in RF.

Goal of 2004 year:Successful launch of Atoris in RF.

Main STRATEGY:

A. Long term to create the basis for Atoris

future sales.

B. Short term promotional actions to

stimulate Atoris sales in the nearest future.

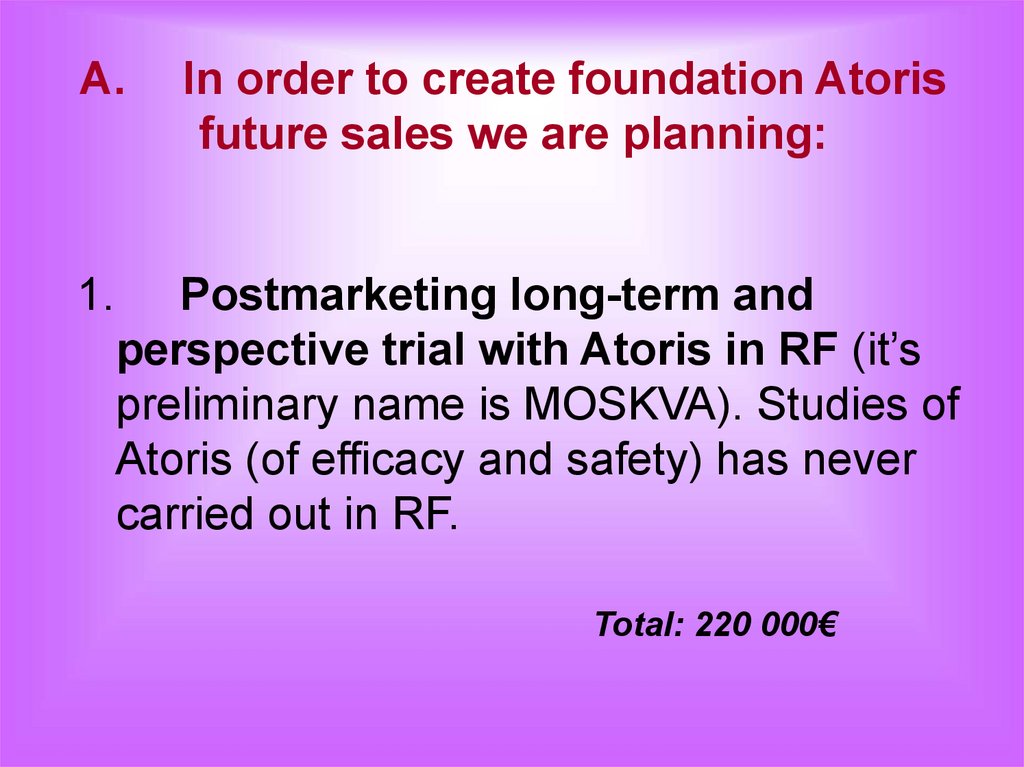

21. A. In order to create foundation Atoris future sales we are planning:

A.1.

In order to create foundation Atoris

future sales we are planning:

Postmarketing long-term and

perspective trial with Atoris in RF (it’s

preliminary name is MOSKVA). Studies of

Atoris (of efficacy and safety) has never

carried out in RF.

Total: 220 000€

22.

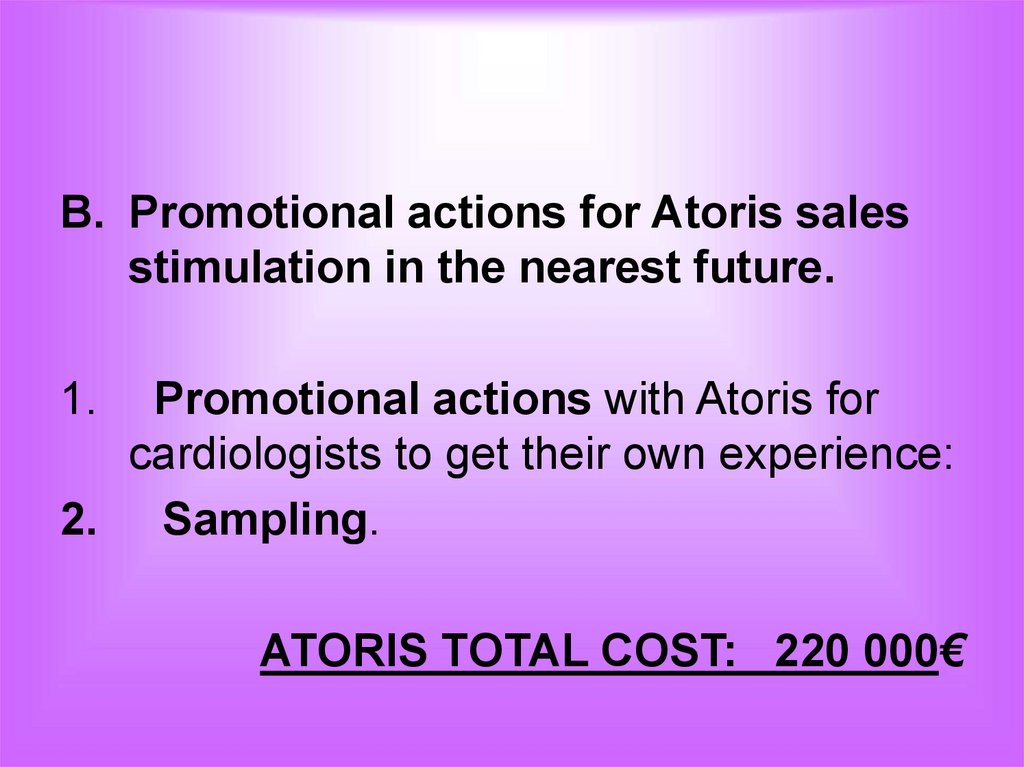

B. Promotional actions for Atoris salesstimulation in the nearest future.

1.

Promotional actions with Atoris for

cardiologists to get their own experience:

2. Sampling.

ATORIS TOTAL COST: 220 000€

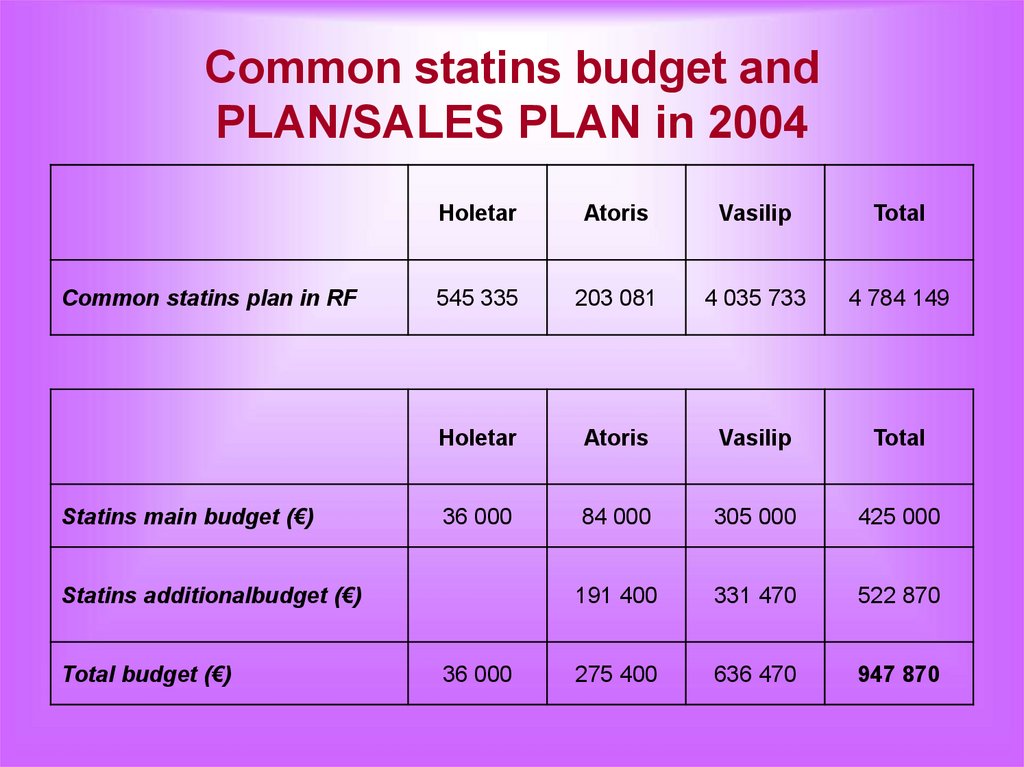

23. Common statins budget and PLAN/SALES PLAN in 2004

Common statins plan in RFStatins main budget (€)

Holetar

Atoris

Vasilip

Total

545 335

203 081

4 035 733

4 784 149

Holetar

Atoris

Vasilip

Total

36 000

84 000

305 000

425 000

191 400

331 470

522 870

275 400

636 470

947 870

Statins additionalbudget (€)

Total budget (€)

36 000

24. Statins plan, sales, budget for 2004, 2005 and index plan/sales for all years

Year2001

2002

2003

2004

Plan €

540 487

808 665

643 800

4 500 000

Sales €

353 494

519 730

1 940 945

?

Budget

122 263

189 248

202 710

636 470

plan/sales

1,53

1,55

0,33

?

% budget/plan

23%

23%

32%

14%

2005

5 000 000

economics

economics marketing

marketing