Similar presentations:

Infosys – a unique business model

1. Infosys – A Unique Business Model

®Infosys – A Unique

Business Model

2. Safe Harbor

®Safe Harbor

Certain statements in this presentation concerning our future growth prospects are

forward looking statements which involve a number of risks and uncertainties that could

cause actual results to differ materially from those in such forward looking statements.

The risks and uncertainties relating to these statements include, but are not limited to,

risks and uncertainties regarding fluctuations in earnings, our ability to manage growth,

intense competition in IT services including those factors which may affect our cost

advantage, wage increases in India, our ability to attract and retain highly skilled

professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client

concentration, restrictions on immigration, our ability to manage our international

operations, reduced demand for technology in our key focus areas, disruptions in

telecommunication networks, our ability to successfully complete and integrate potential

acquisitions, liability for damages on our service contracts, the success of the

companies in which Infosys has made strategic investments, withdrawal of governmental

fiscal incentives, political instability, legal restrictions on raising capital or acquiring

companies outside India, and unauthorized use of our intellectual property and general

economic conditions affecting our industry. Additional risks that could affect our future

operating results are more fully described in our United States Securities and Exchange

Commission filings including our Annual Report on Form 20-F for the fiscal year ended

March 31, 2000, and our Quarterly Reports filed on Form 6-K for the quarters ended

June 30, 2000, September 30, 2000 and December 31, 2000. These filings are available

at www.sec.gov.

Infosys may, from time to time, make additional written and oral

forward looking statements, including statements contained in the company’s filings with

the Securities and Exchange Commission and our reports to shareholders. The

company does not undertake to update any forward looking statement that may be

made from time to time by or on behalf of the company.

3. Infosys - An Overview

®Infosys - An Overview

End-to-end IT solutions provider

One of the most profitable software

services providers in the world

Publicly traded in India since 1993

Fifth most valuable company in

India

Listed on NASDAQ since

March 1999

Present market cap at US$ 5.5

billion (as of May 11, 2001) [based

on BSE prices]

4. Continuous Growth Revenues and Operating Profit

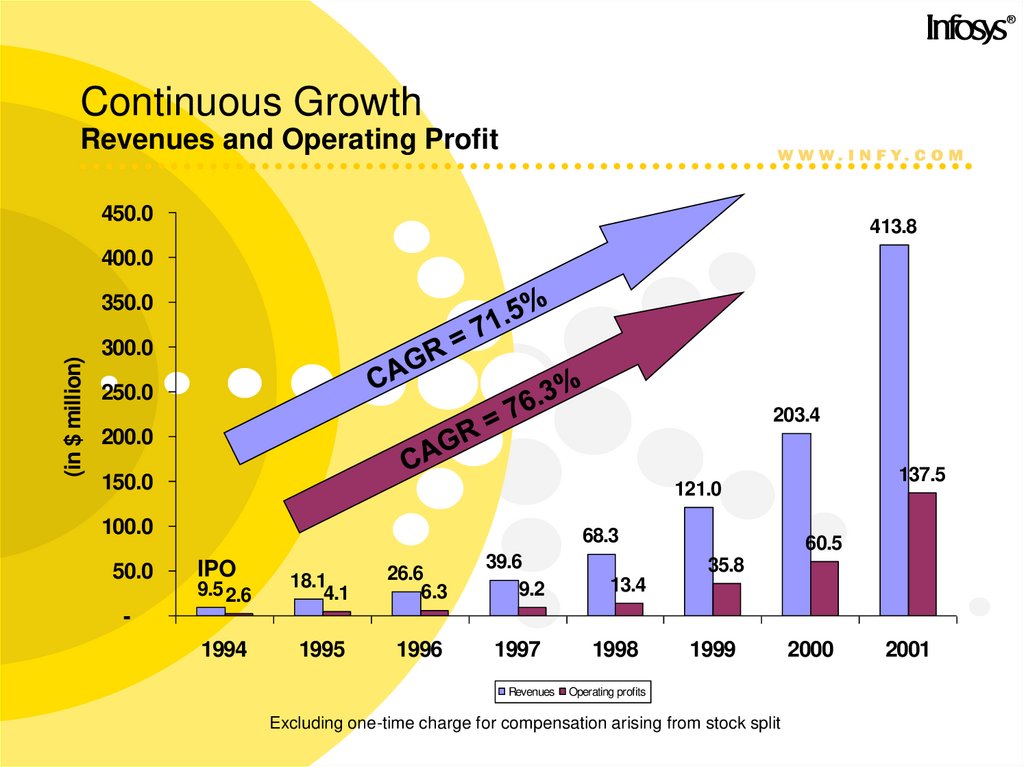

®Continuous Growth

Revenues and Operating Profit

450.0

413.8

400.0

(in $ million)

350.0

300.0

250.0

203.4

200.0

150.0

100.0

50.0

137.5

121.0

68.3

9.5 2.6

18.1

4.1

26.6

6.3

39.6

9.2

1994

1995

1996

1997

IPO

60.5

35.8

13.4

1998

-

Revenues

1999

Operating profits

Excluding one-time charge for compensation arising from stock split

2000

2001

5. Growing Earnings Per Share

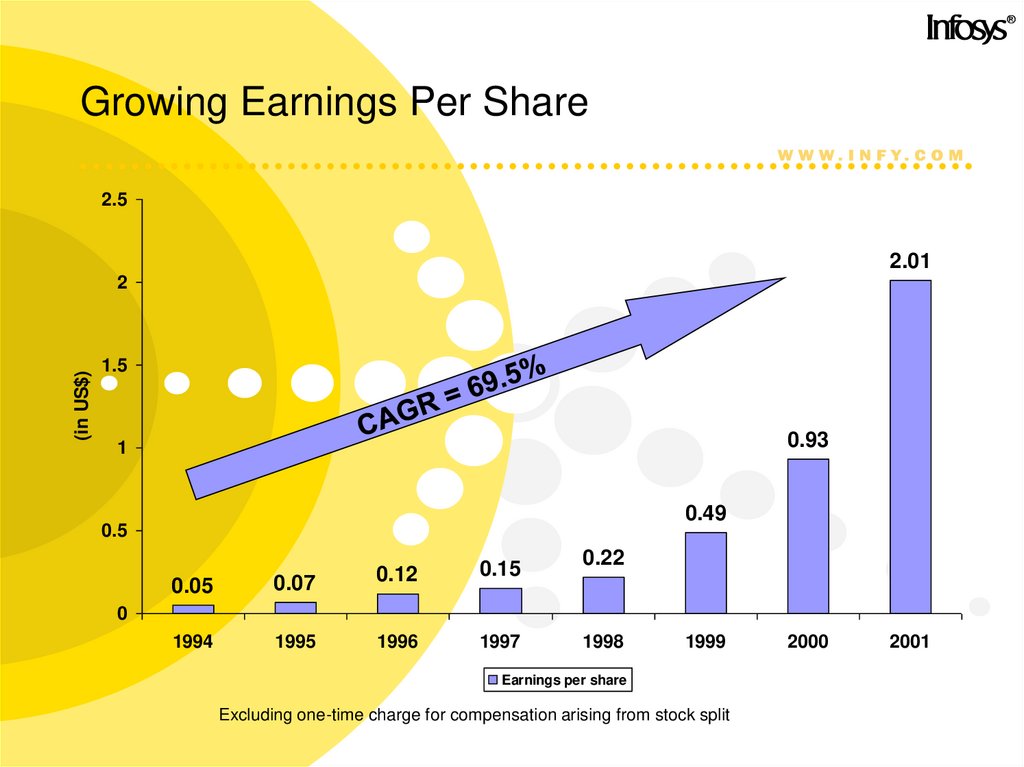

®Growing Earnings Per Share

2.5

2.01

(in US$)

2

1.5

0.93

1

0.49

0.5

0.05

0.07

0.12

1994

1995

1996

0.15

1997

0.22

0

1998

1999

Earnings per share

Excluding one-time charge for compensation arising from stock split

2000

2001

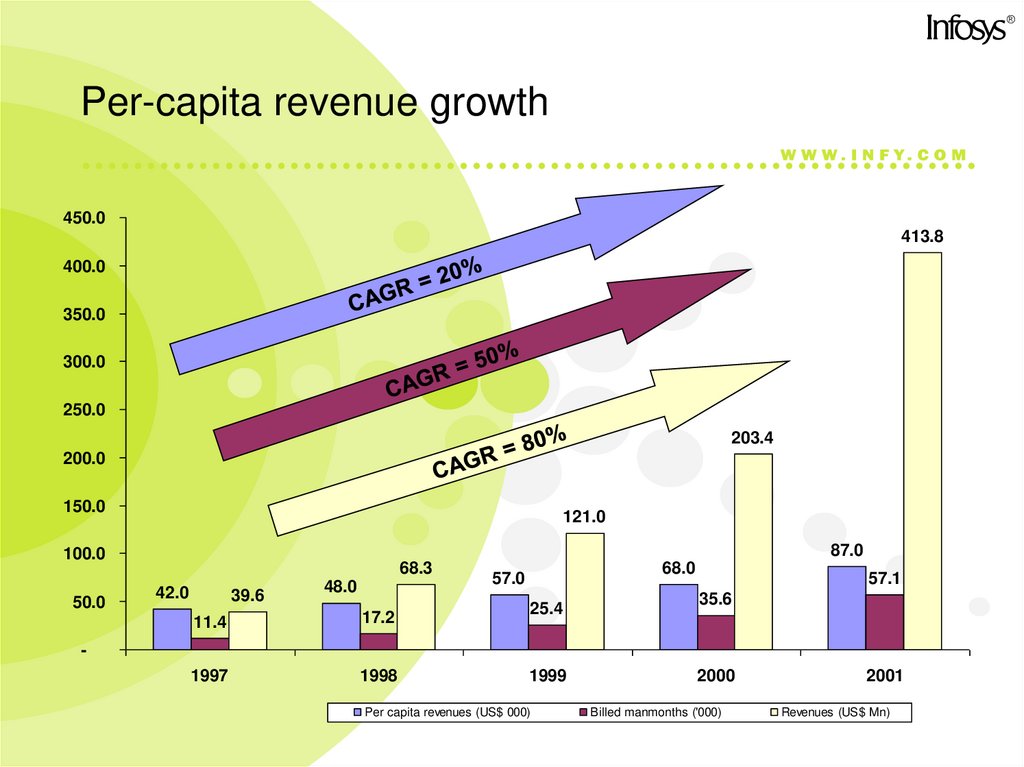

6. Per-capita revenue growth

®Per-capita revenue growth

450.0

413.8

400.0

350.0

300.0

250.0

203.4

200.0

150.0

121.0

87.0

100.0

50.0

68.3

42.0

39.6

48.0

11.4

17.2

1997

1998

68.0

57.0

25.4

57.1

35.6

1999

Per capita revenues (US$ 000)

2000

Billed manmonths ('000)

2001

Revenues (US$ Mn)

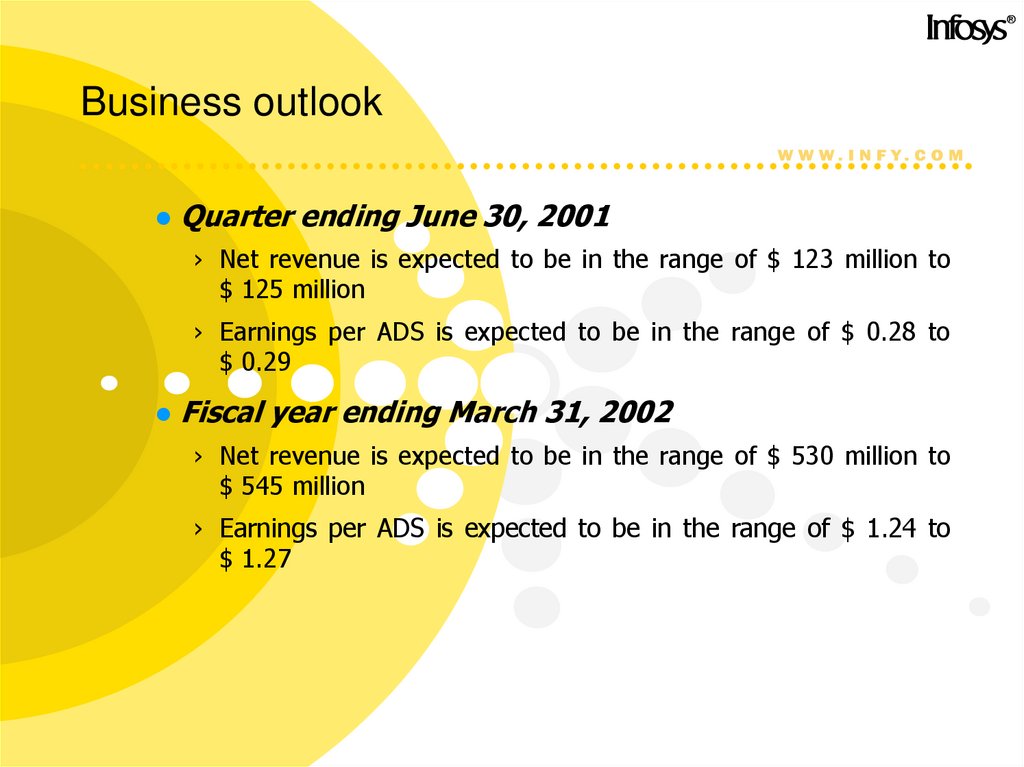

7. Business outlook

®Business outlook

Quarter ending June 30, 2001

› Net revenue is expected to be in the range of $ 123 million to

$ 125 million

› Earnings per ADS is expected to be in the range of $ 0.28 to

$ 0.29

Fiscal year ending March 31, 2002

› Net revenue is expected to be in the range of $ 530 million to

$ 545 million

› Earnings per ADS is expected to be in the range of $ 1.24 to

$ 1.27

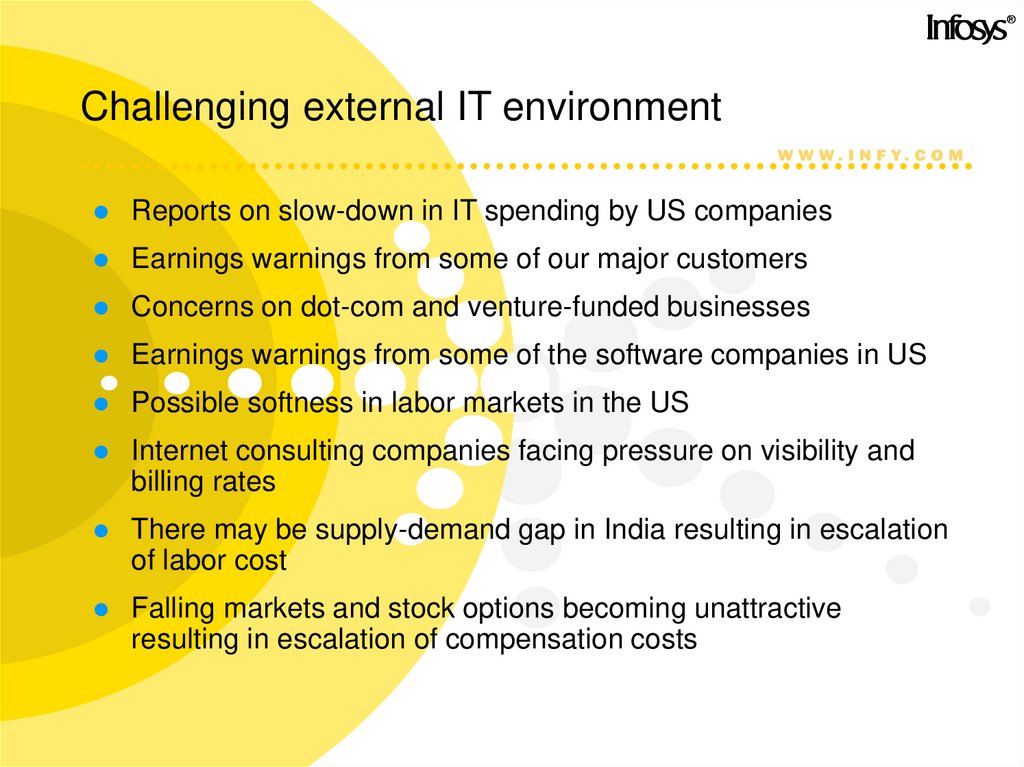

8. Challenging external IT environment

®Challenging external IT environment

Reports on slow-down in IT spending by US companies

Earnings warnings from some of our major customers

Concerns on dot-com and venture-funded businesses

Earnings warnings from some of the software companies in US

Possible softness in labor markets in the US

Internet consulting companies facing pressure on visibility and

billing rates

There may be supply-demand gap in India resulting in escalation

of labor cost

Falling markets and stock options becoming unattractive

resulting in escalation of compensation costs

9. Investors’ Concerns

®Investors’ Concerns

Business

Effect of slow-down in IT spending in US on Infosys

Visibility in business

Future revenue growth

Per capita revenues

Ability to increase the per-capita revenues on a go-forward basis

Impact on the per-capita revenue growth rate due to reduced dot-com / venture-funded

businesses

Hiring and Utilization

Ability to attract the best and the brightest

Lower utilization rates coupled with increased hiring

Labor cost escalation due to falling market price of the stock

Margins

Ability to maintain or grow the margins on a go-forward basis

Exposure to dot-com/venture funded companies

Strategic investments and accounts receivable

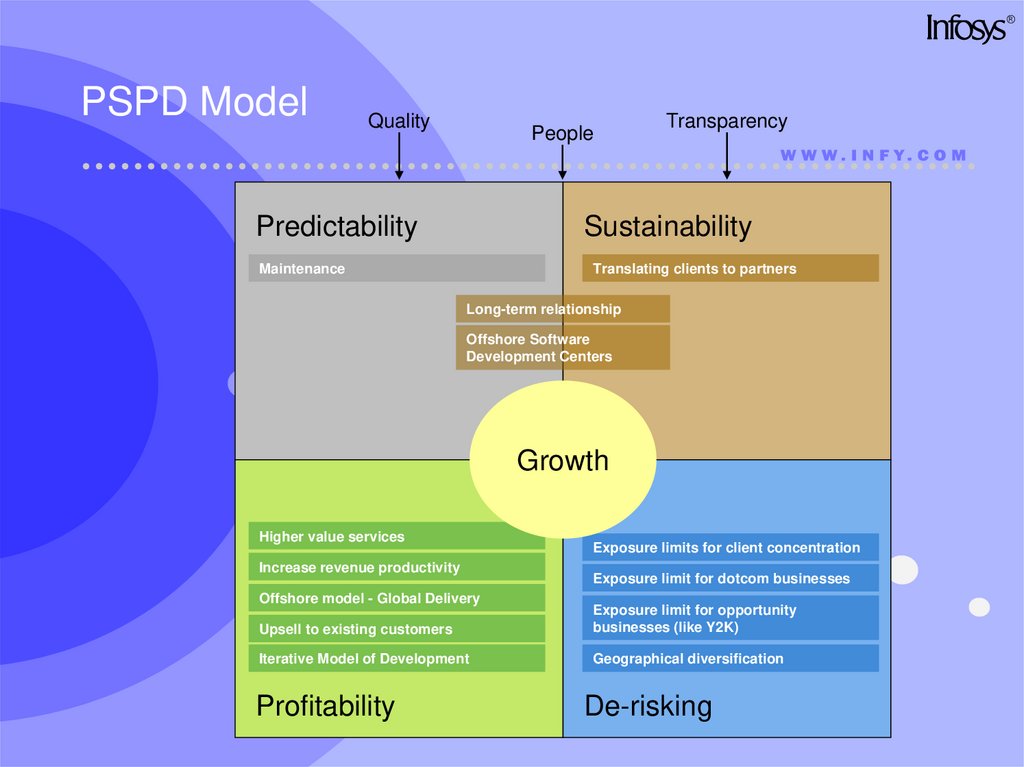

10. PSPD Model

®PSPD Model

Quality

People

Transparency

Predictability

Sustainability

Maintenance

Translating clients to partners

Long-term relationship

Offshore Software

Development Centers

Growth

Higher value services

Increase revenue productivity

Offshore model - Global Delivery

Exposure limits for client concentration

Exposure limit for dotcom businesses

Upsell to existing customers

Exposure limit for opportunity

businesses (like Y2K)

Iterative Model of Development

Geographical diversification

Profitability

De-risking

11.

®Repeat business through the years

94.0

92.0

90.0

(in %)

88.0

86.0

84.0

82.0

80.0

78.0

Repeat business (% to total revenues)

1996

1997

1998

1999

2000

2001

91.8

84.1

83.1

90.0

87.6

84.5

12.

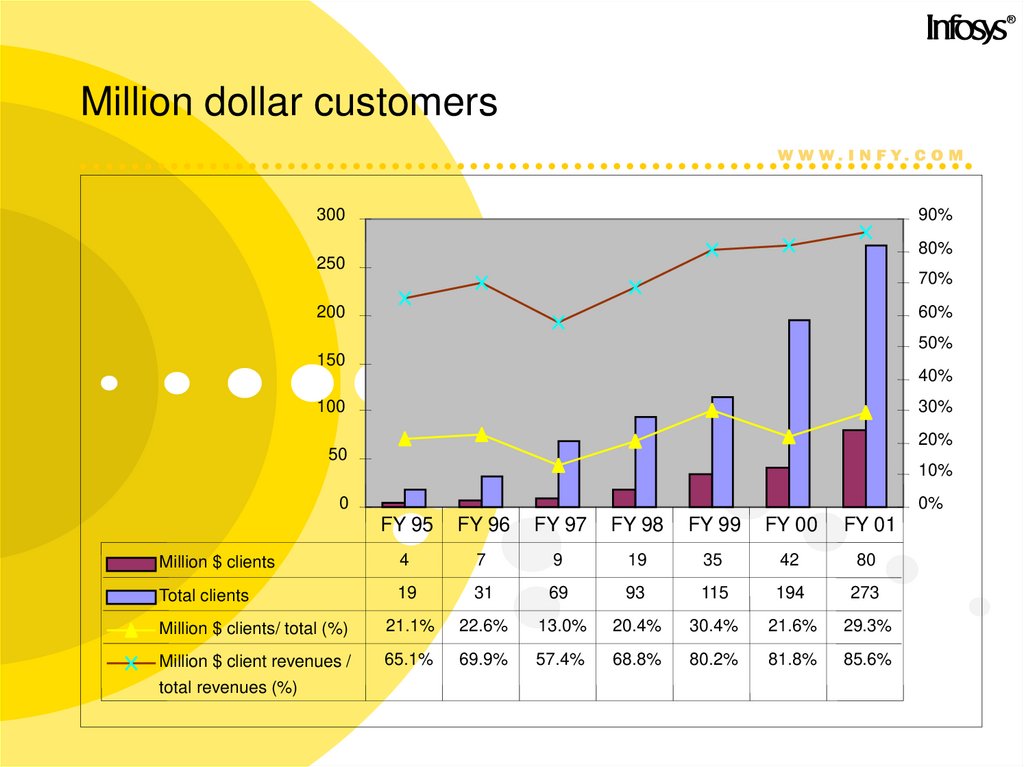

®Million dollar customers

300

90%

80%

250

70%

200

60%

50%

150

40%

100

30%

20%

50

10%

0

0%

FY 95

FY 96

FY 97

FY 98

FY 99

FY 00

FY 01

Million $ clients

4

7

9

19

35

42

80

Total clients

19

31

69

93

115

194

273

Million $ clients/ total (%)

21.1%

22.6%

13.0%

20.4%

30.4%

21.6%

29.3%

Million $ client revenues /

65.1%

69.9%

57.4%

68.8%

80.2%

81.8%

85.6%

total revenues (%)

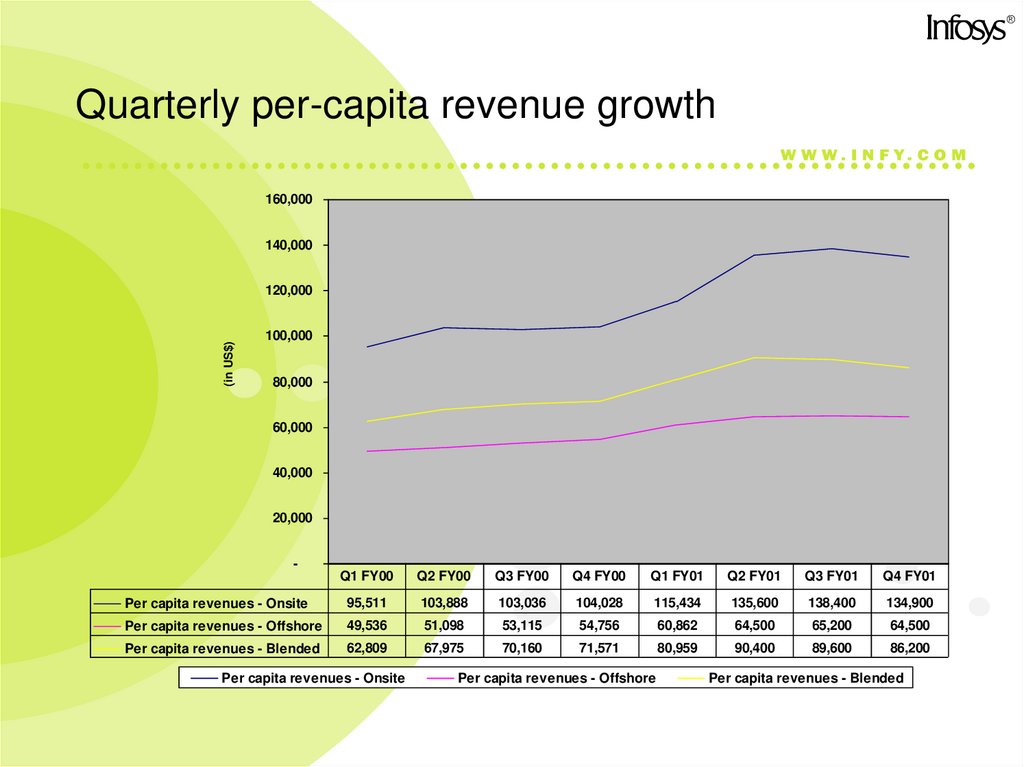

13. Quarterly per-capita revenue growth

®Quarterly per-capita revenue growth

160,000

140,000

(in US$)

120,000

100,000

80,000

60,000

40,000

20,000

Q1 FY00

Q2 FY00

Q3 FY00

Q4 FY00

Q1 FY01

Q2 FY01

Q3 FY01

Q4 FY01

Per capita revenues - Onsite

95,511

103,888

103,036

104,028

115,434

135,600

138,400

134,900

Per capita revenues - Offshore

49,536

51,098

53,115

54,756

60,862

64,500

65,200

64,500

Per capita revenues - Blended

62,809

67,975

70,160

71,571

80,959

90,400

89,600

86,200

Per capita revenues - Onsite

Per capita revenues - Offshore

Per capita revenues - Blended

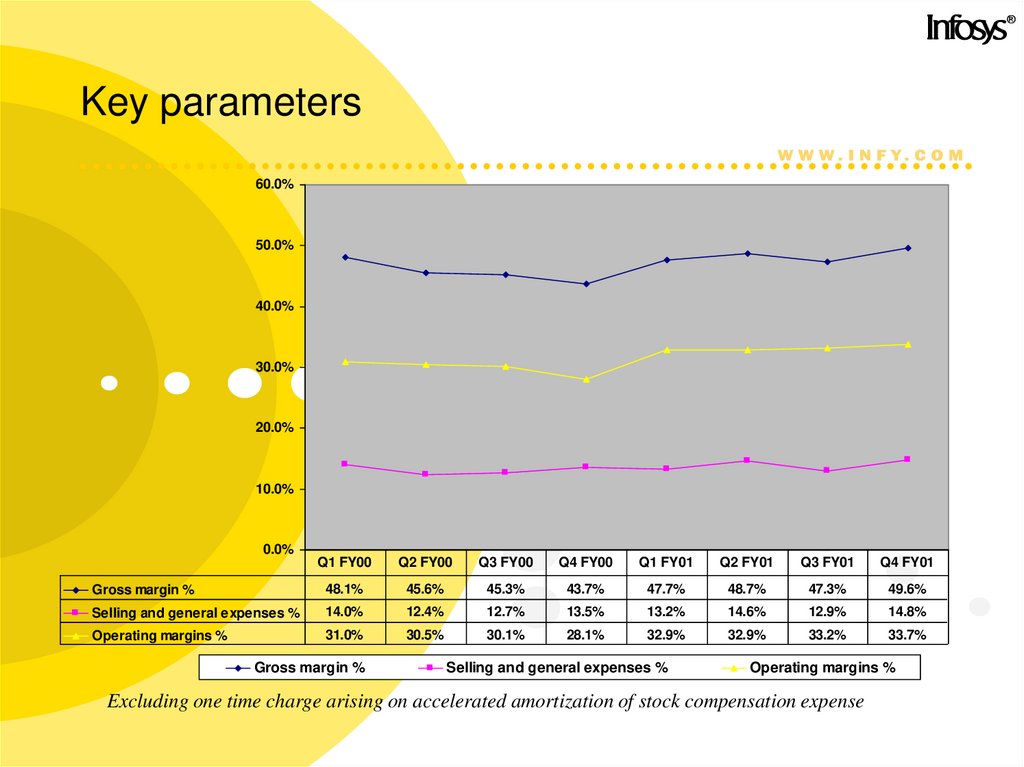

14. Key parameters

®Key parameters

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

Q1 FY00

Q2 FY00

Q3 FY00

Q4 FY00

Q1 FY01

Q2 FY01

Q3 FY01

Q4 FY01

Gross margin %

48.1%

45.6%

45.3%

43.7%

47.7%

48.7%

47.3%

49.6%

Selling and general expenses %

14.0%

12.4%

12.7%

13.5%

13.2%

14.6%

12.9%

14.8%

Operating margins %

31.0%

30.5%

30.1%

28.1%

32.9%

32.9%

33.2%

33.7%

Gross margin %

Selling and general expenses %

Operating margins %

Excluding one time charge arising on accelerated amortization of stock compensation expense

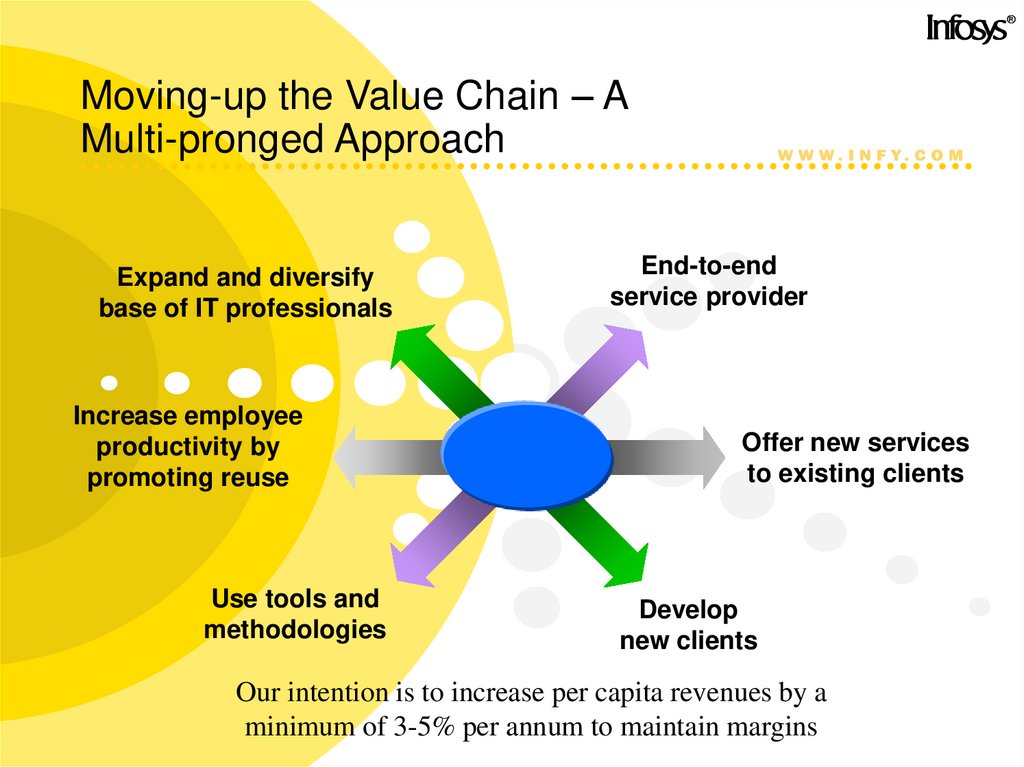

15. Moving-up the Value Chain – A Multi-pronged Approach

®Moving-up the Value Chain – A

Multi-pronged Approach

Expand and diversify

base of IT professionals

Increase employee

productivity by

promoting reuse

Use tools and

methodologies

End-to-end

service provider

Offer new services

to existing clients

Develop

new clients

Our intention is to increase per capita revenues by a

minimum of 3-5% per annum to maintain margins

16.

®Hiring and utilization

17. Infosys: the Employer-of-choice

®Infosys: the Employer-of-choice

Adjudged “India’s Best Employer” by the

first Business Today-Hewitt Survey

conducted in December 2000

› Ability to attract the best and the brightest

High investment in technology and training

› 14 weeks of intensive training for new hires

› 55 member faculty, including 8 Ph.Ds

All employees in Infosys are covered by the

stock option plan

Incubation mechanism for employees to

launch their own ventures. Piloted

OnMobile - a end to end wireless solutions

provider

Attrition rate of 11% for fiscal 2001 and 9%

for fiscal 2000

18. Our views on labor cost pressures

®Our views on labor cost pressures

Wage pressures for freshers may not arise because of

increased market penetration. This is due to:

› Softening of wages in the US markets due to lay-offs

› Slowdown in hiring by second / third tier companies in India

due to a decline in business opportunities

Wage pressures already exist in the market for project

managers since demand outweighs supply

› This situation may not change

We require a growth rate of ~3-5% in per capita revenues

to neutralize wage pressures

19. The impact of stock options

®The impact of stock options

Stock options are not a substitute for salaries.

Stock options are granted as additional incentive

Stock options are widely distributed amongst employees

Most of the senior employees of the company (around 1550) are covered

under the 1994 stock option plan that created substantial wealth in their

hands

62% of options outstanding under the 1994 plan

(covering 1,472

employees) will vest after 2 years

Part of the grants under the 1998 and 1999 option plan, have already

vested

Stock options have created 80 dollar millionaires and over 1,150 rupee

millionaires, at Infosys

The employee ownership in Infosys including the outstanding option

grants is 11.7%

20. We continue to focus on margins

®We continue to focus on margins

21. Utilization rates and margins (%)

®Utilization rates and margins (%)

90.0%

51.0%

50.0%

80.0%

49.0%

70.0%

48.0%

60.0%

47.0%

50.0%

46.0%

40.0%

45.0%

44.0%

30.0%

43.0%

20.0%

42.0%

10.0%

0.0%

41.0%

Q1 FY00

Q2 FY00

Q3 FY00

Q4 FY00

Q1 FY01

Q2 FY01

Q3 FY01

Q4 FY01

Utilization % -IT

75.8%

71.2%

68.1%

76.6%

74.9%

65.4%

66.7%

64.9%

Utilization % -ET

80.5%

81.1%

74.8%

81.5%

85.6%

80.5%

77.6%

73.0%

Gross margin %

48.1%

45.6%

45.3%

43.7%

47.7%

48.7%

47.3%

49.6%

Utilization % -IT

ET – excluding trainees

IT – including trainees

Utilization % -ET

40.0%

Gross margin %

Margins are the key. Bench is for strategic reasons. The cost of

bench is hardly $800 per month per person

22. Strategic investments

®Strategic investments

Investments are key to Infosys’ strategic objectives of gaining access to

niche technologies and markets

We leveraged the expertise derived from our relationships with our investee

companies to deliver value to large clients across the globe

We become the IT strategic partner for our investee companies

Benefits arise in the form of revenue and net income enhancements

Investments are also envisaged in technology specific venture capital funds

We have invested:

› $3 million in Cidra, a developer of photonic devices for high-precision wavelength

management and control for next-generation optical networks (FY01 revenues $1.7 million and cumulative revenues of $ 2.1 million)

› $ 0.4 million in M-Commerce Ventures Pte Ltd., Singapore, an early stage VC fund

› $ 1.5 million in Asia Net Media BVI Ltd. (FY01 revenues - $0.9 million and

cumulative revenues of $ 1.1 million)

› $ 0.5 million in PurpleYogi Inc

23. We have today the infrastructure, processes and people to manage future growth

®We have today the infrastructure, processes and

people to manage future growth

24. Creating physical infrastructure

®Creating physical infrastructure

140.0

120.0

(in $ Mn)

100.0

80.0

60.0

40.0

20.0

-

Q1 00

Q2 00

Q3 00

Q4 00

Q1 01

Q2 01

Q3 01

Q4 01

Capital expenditure

5.0

8.9

10.8

12.2

19.4

25.0

26.8

29.7

Capital commitments (end of quarter)

7.9

14.2

16.0

18.5

26.6

26.4

26.3

34.0

Operating cash flows earned in the next quarter

14.7

14.2

29.0

20.6

43.4

29.0

44.5

-

Cash balances (end of quarter)

102.6

104.1

106.8

116.6

105.8

116.5

110.9

124.1

Capital expenditure

Capital commitments (end of quarter)

Operating cash flows earned in the next quarter

Cash balances (end of quarter)

As of March 31, 2001, we had software development space of 1.66 million sq. ft. capable of accommodating 10,100

personnel and 1.91 million sq. ft. capable of accommodating 8,500 personnel under construction.

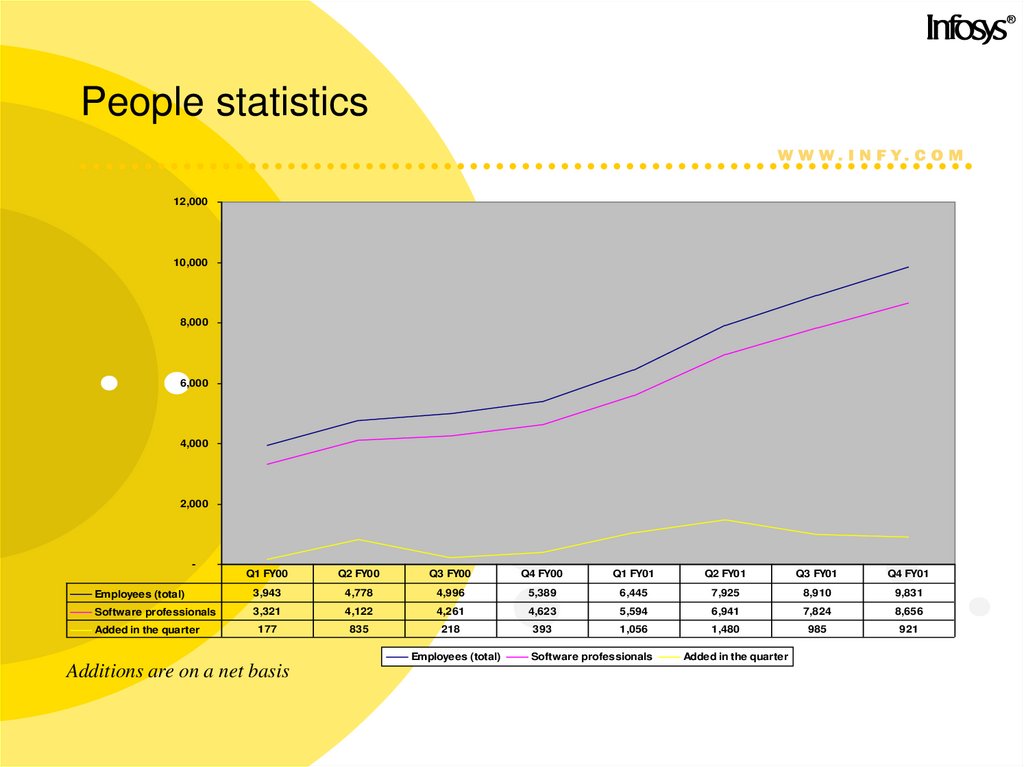

25. People statistics

®People statistics

12,000

10,000

8,000

6,000

4,000

2,000

-

Q1 FY00

Q2 FY00

Q3 FY00

Q4 FY00

Q1 FY01

Q2 FY01

Q3 FY01

Q4 FY01

Employees (total)

3,943

4,778

4,996

5,389

6,445

7,925

8,910

9,831

Software professionals

3,321

4,122

4,261

4,623

5,594

6,941

7,824

8,656

Added in the quarter

177

835

218

393

1,056

1,480

985

921

Employees (total)

Additions are on a net basis

Software professionals

Added in the quarter

26. World-class Quality Processes

®World-class Quality Processes

CMM Level 5

Six Sigma

Baldrige

Focus on defect prevention, technology insertion

and process changes to improve quality and productivity

Reduction in cycle time and defects for six cross

functional processes

Orders Through Remittance (OTR)

Visa processing

US Payroll

Cross functional teams to address improvement areas in

strategic management functions

Leadership Development, Customer Relationship

Management, Human Resource Management,

Information Systems and Process Management

We have strong internal quality processes to manage growth

27. We have built a strong brand

®We have built a strong brand

Prominently covered in Business

Week, New York Times and Wall

Street Journal

Most admired company in India -

poll by India’s largest business

daily, The Economic Times

Infosys figures in Forbes

“20 for 2000”

First recipient of the UTI award for

corporate governance - chosen

from over 7500 listed companies in

India

28. We have won several awards

®We have won several awards

The Far Eastern Economic Review rated Infosys as

the No. 1 company in India in the Review 2000, an

annual survey of Asia's leading companies

Infosys became the first IT company to win the IMC

Ramkrishna Bajaj National Quality Award in the

services category

We were judged by the Financial Technology Asia

Magazine as the Best Regional Software House

The BankAway product from Infosys won the CSIWipro award for the Best Packaged Application for

the year 2000

“Silver Shield” Award for the Best Presented

Accounts awarded by the ICAI for Non-financial

Private Sector Companies for six consecutive years

ended March 31, 1995 through 2000

29. In summary

®In summary

We have a unique business model which is fully

poised to exploit the growth opportunities in

the market and minimize risk

30. Thank You

®Thank You

Visit us at www.infy.com

business

business