Similar presentations:

Your money, your future activity

1. Your money, your future activity

Read the following statements from youngpeople talking about what they think about

money and the future, and compare their

thoughts with your own.

Check out what other people thought… our

survey said:

https://www.moneysense.ulsterbank.ie/schools/students/planning-your-future/lifechoices-and-savings/your-money-your-future/your-money-your-future-activity-%28textonly-version%29

2. Question 1 -Please tell us how much you agree with the statement : 'I think it's important to save money'

Strongly agree

Agree

Neither agree nor disagree

Disagree

Strongly disagree

Check out what surveys say

3. Question 1 -Please tell us how much you agree with the statement : 'I think it's important to save money'

Strongly agree (43%)

Agree (43%)

Neither agree nor disagree (9%)

Disagree (1%)

Strongly disagree (1%)

4. Question 2 - Do you agree or disagree with the statement 'I don't spend money on stuff if I think I might need the money for

something else'?• Agree

• Disagree

• Neither agree nor disagree

5. Question 2 - Do you agree or disagree with the statement 'I don't spend money on stuff if I think I might need the money for

something else'?• Agree ( 69%)

• Disagree (12%)

• Neither agree nor disagree( 19%)

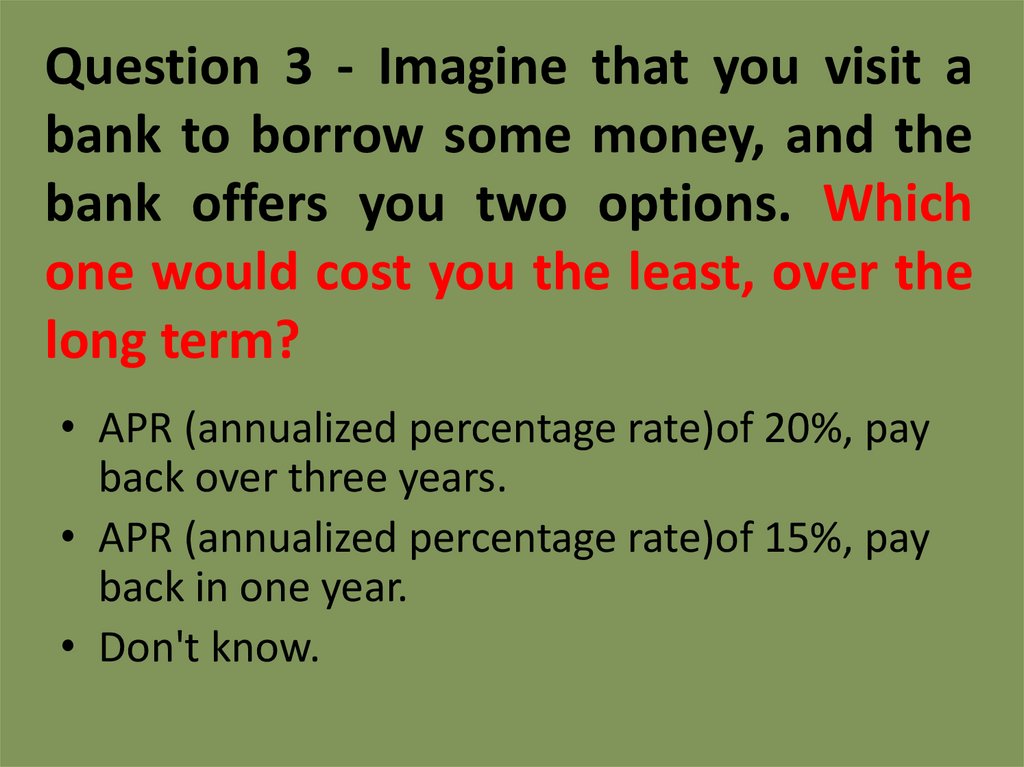

6. Question 3 - Imagine that you visit a bank to borrow some money, and the bank offers you two options. Which one would cost you

the least, over thelong term?

• APR (annualized percentage rate)of 20%, pay

back over three years.

• APR (annualized percentage rate)of 15%, pay

back in one year.

• Don't know.

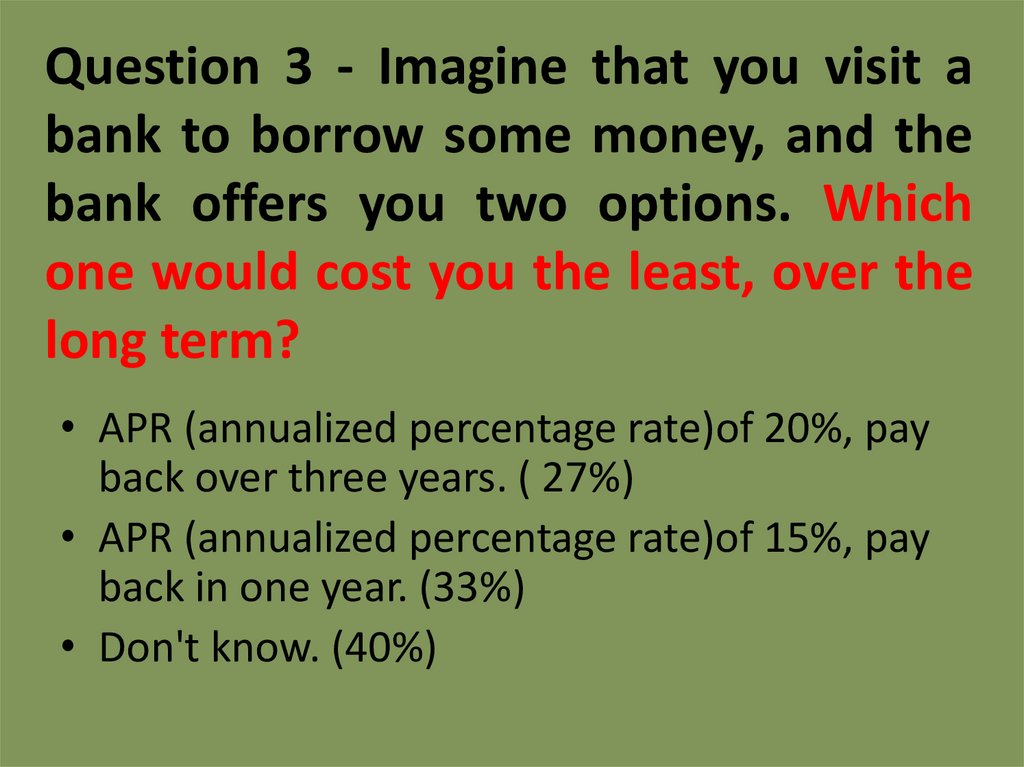

7. Question 3 - Imagine that you visit a bank to borrow some money, and the bank offers you two options. Which one would cost you

the least, over thelong term?

• APR (annualized percentage rate)of 20%, pay

back over three years. ( 27%)

• APR (annualized percentage rate)of 15%, pay

back in one year. (33%)

• Don't know. (40%)

8. Question 4 - Which of these do you think it's okay to borrow money from the bank for?

A house

A car

An MP3 player/iPod

A games console

A bike

A pair of trainers

A camera

9. Question 4 - Which of these do you think it's okay to borrow money from the bank for?

A house ( 85%)

A car ( 70%)

An MP3 player/iPod (6%)

A games console (7%)

A bike (7%)

A pair of trainers (4%)

A camera ( 5%)

10. Question 5 - Imagine you go to university: approximately how much money do you think you might owe, including fees, when you

finish?Over €50,000

Between €30,000 and €50,000

Between €15,000 and €30,000

Between €5,000 and €15,000

Between €0 and €5,000

Don't know

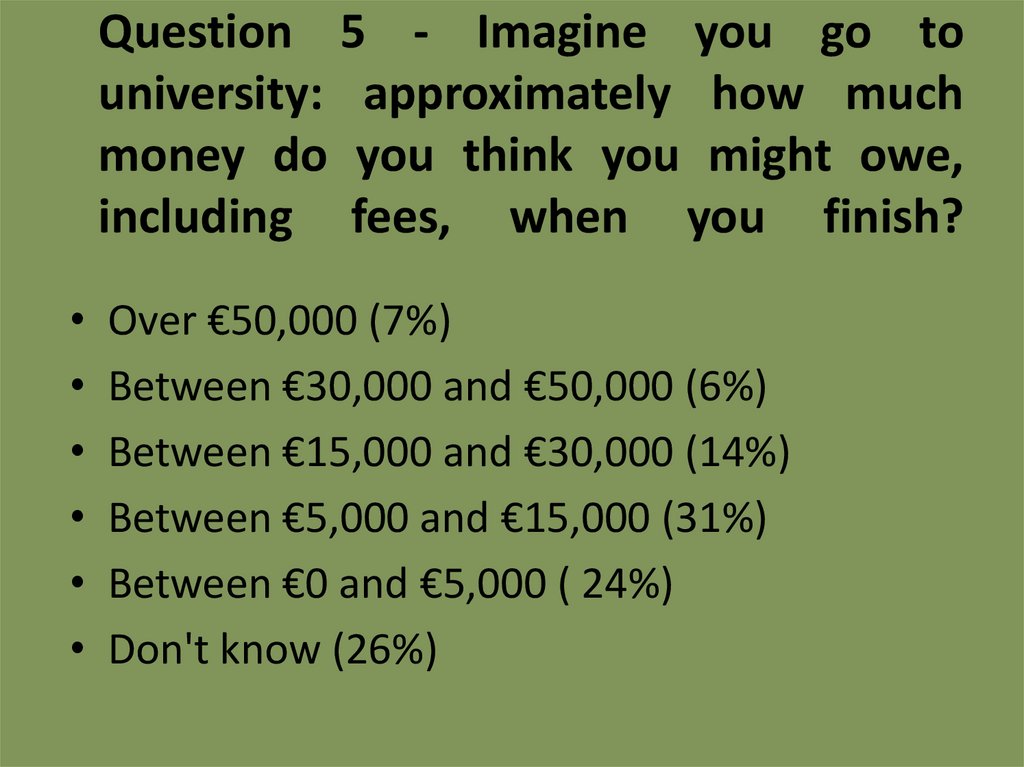

11. Question 5 - Imagine you go to university: approximately how much money do you think you might owe, including fees, when you

finish?Over €50,000 (7%)

Between €30,000 and €50,000 (6%)

Between €15,000 and €30,000 (14%)

Between €5,000 and €15,000 (31%)

Between €0 and €5,000 ( 24%)

Don't know (26%)

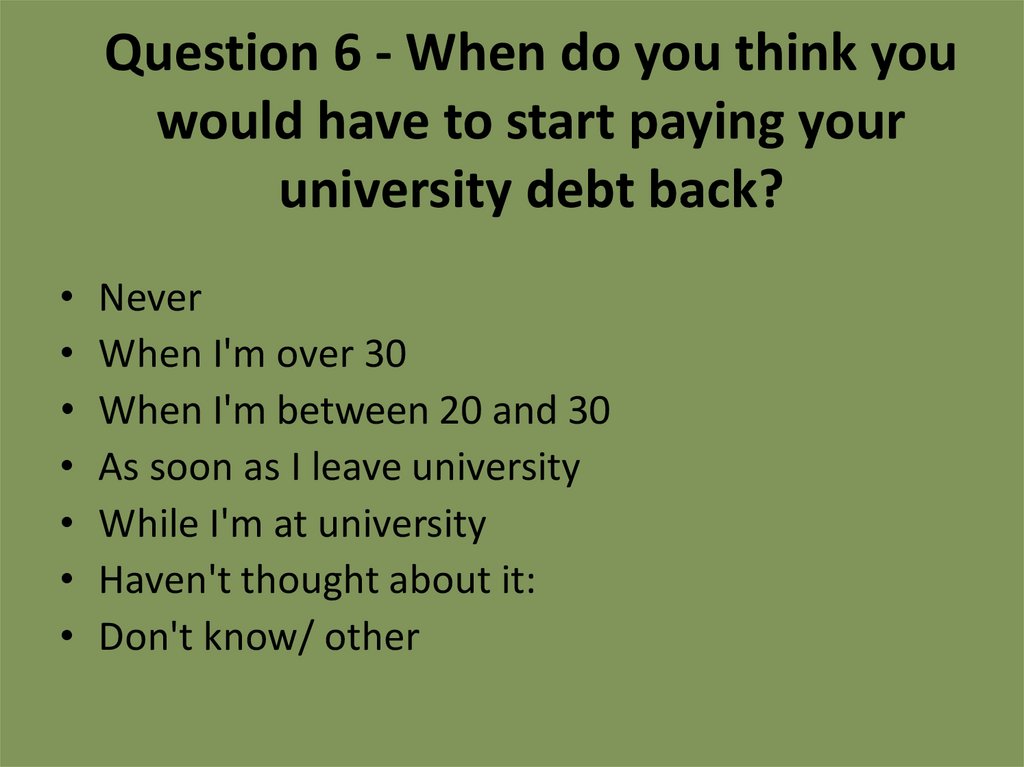

12. Question 6 - When do you think you would have to start paying your university debt back?

Never

When I'm over 30

When I'm between 20 and 30

As soon as I leave university

While I'm at university

Haven't thought about it:

Don't know/ other

13. Question 6 - When do you think you would have to start paying your university debt back?

Never (2%)

When I'm over 30 ( 1%)

When I'm between 20 and 30 (11%)

As soon as I leave university (20%)

While I'm at university (25%)

Haven't thought about it: (20%)

Don't know/ other (21%)

14. Question 7 - How much money, per year, do you expect to earn at the age of 25?

€0 - €10,000

€11,000 - €20,000

€21,000 - €30,000

€31,000 - €50,000

Over €50,000

15. Question 7 - How much money, per year, do you expect to earn at the age of 25?

€0 - €10,000 (44%)

€11,000 - €20,000 ( 11%)

€21,000 - €30,000 (22%)

€31,000 - €50,000 (15%)

Over €50,000 (8%)

16. Question 8 - Do you ever think that you might get into debt in the future?

Yes

No

Don't know

Don't know what debt is

17. Question 8 - Do you ever think that you might get into debt in the future?

Yes (27%)

No (35%)

Don't know (35%)

Don't know what debt is (3%)

18. Question 9 - What forms of debt would concern you the most?

Credit card debt

A loan from a bank

An overdraft

A loan from family/ friend

A student loan

None of these

19. Question 9 - What forms of debt would concern you the most?

Credit card debt (32%)

A loan from a bank (36%)

An overdraft (12%)

A loan from family/ friend (6%)

A student loan (11%)

None of these (3%)

20. 10. Which of these amounts do you think is a lot of debt to get into? Choose one option only

€50

€500

€5000

€20,000

€50,000

More than €50,000

21. 10. Which of these amounts do you think is a lot of debt to get into? Choose one option only

€50

€500

€5000

€20,000

€50,000

More than €50,000 (100%)

english

english