Similar presentations:

Marketing & communication ema region

1. Marketing & communication ema region

Varvara astakhovaMarketing &

communication

ema region

2. Introduction

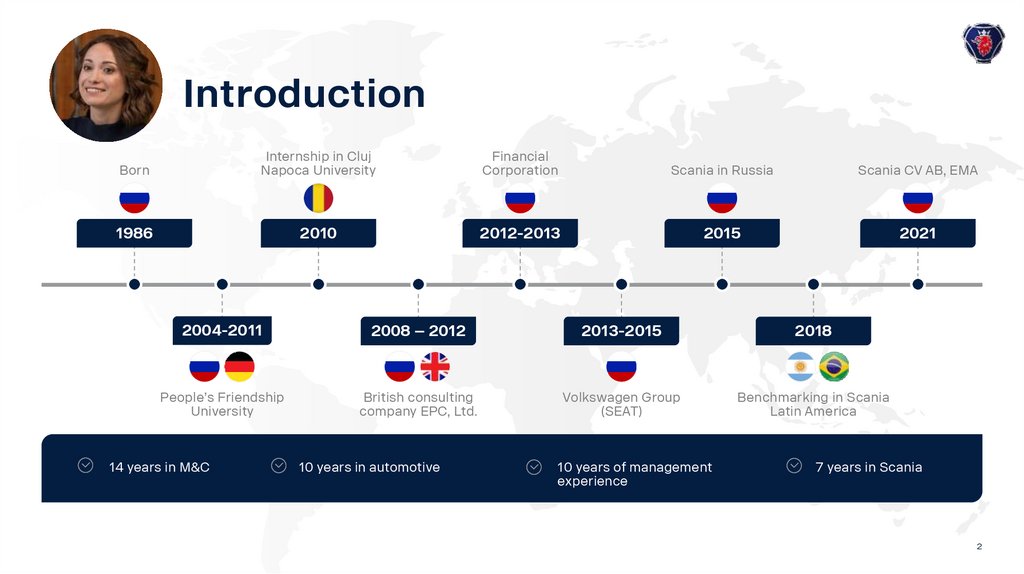

BornInternship in Cluj

Napoca University

Financial

Corporation

Scania in Russia

Scania CV AB, EMA

1986

2010

2012-2013

2015

2021

2004-2011

2008 – 2012

2013-2015

2018

People’s Friendship

University

British consulting

company EPC, Ltd.

Volkswagen Group

(SEAT)

Benchmarking in Scania

Latin America

14 years in M&C

10 years in automotive

10 years of management

experience

7 years in Scania

2

3. Structure

MarketsRegional Marketing Heads

EU (3)

EMA

AOR

LA

Regional Management

Teams

Communication

Department

3

4. Purpose of regional M&C function

Purpose of regional M&C function• Analyze and systemize information from markets

• Act as first point of contact for markets, guide and ensure prompt answer

• Create wider and deeper understanding of local challenges

• Transmit insights from the markets to central level

• Create transparency and opportunities between markets

• Identify markets’ demands as priority and coordinate regional and central recourses to

find needed support in CV AB

• Host regular working meetings to collect & priorities support as well as give updates

about ongoing activities

24 November 2016

4

5. Current split 30/70%. Scope of work

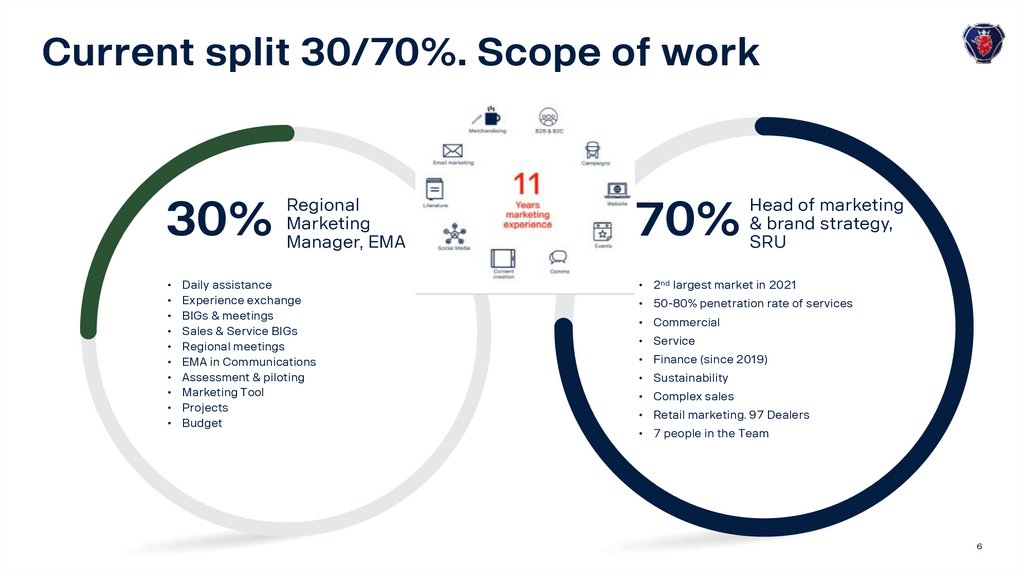

30%Regional

Marketing

Manager, EMA

Daily assistance

Experience exchange

BIGs & meetings

Sales & Service BIGs

Regional meetings

EMA in Communications

Assessment & piloting

Marketing Tool

Projects

Budget

70%

Head of marketing

& brand strategy,

SRU

• 2nd largest market in 2021

• 50-80% penetration rate of services

• Commercial

• Service

• Finance (since 2019)

• Sustainability

• Complex sales

• Retail marketing. 97 Dealers

• 7 people in the Team

6

6. Current split 30/70%. Scope of work

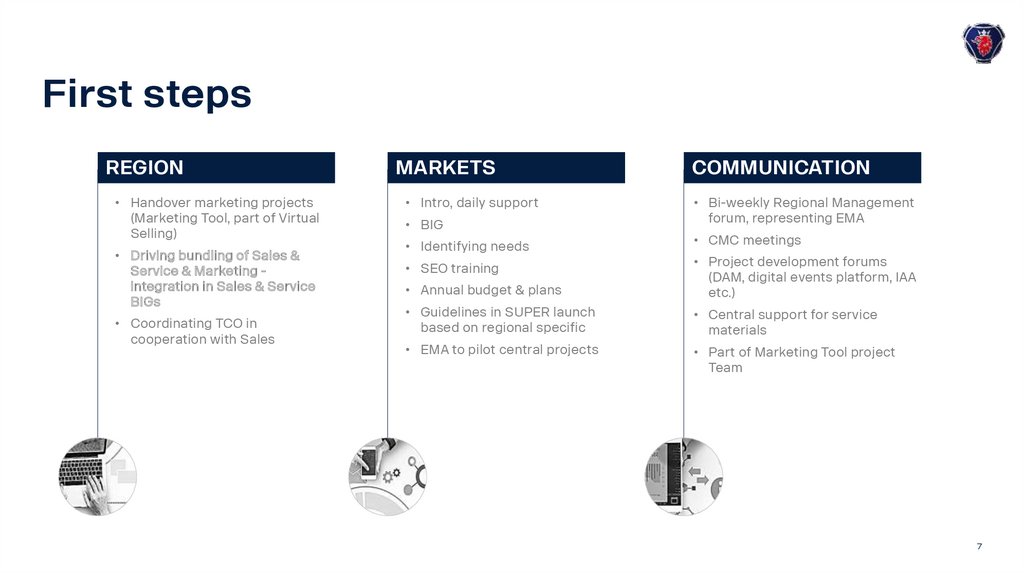

First stepsREGION

• Handover marketing projects

(Marketing Tool, part of Virtual

Selling)

• Driving bundling of Sales &

Service & Marketing integration in Sales & Service

BIGs

• Coordinating TCO in

cooperation with Sales

MARKETS

• Intro, daily support

• BIG

COMMUNICATION

• Bi-weekly Regional Management

forum, representing EMA

• Identifying needs

• CMC meetings

• SEO training

• Annual budget & plans

• Project development forums

(DAM, digital events platform, IAA

etc.)

• Guidelines in SUPER launch

based on regional specific

• Central support for service

materials

• EMA to pilot central projects

• Part of Marketing Tool project

Team

7

7. First steps

First results8. First results

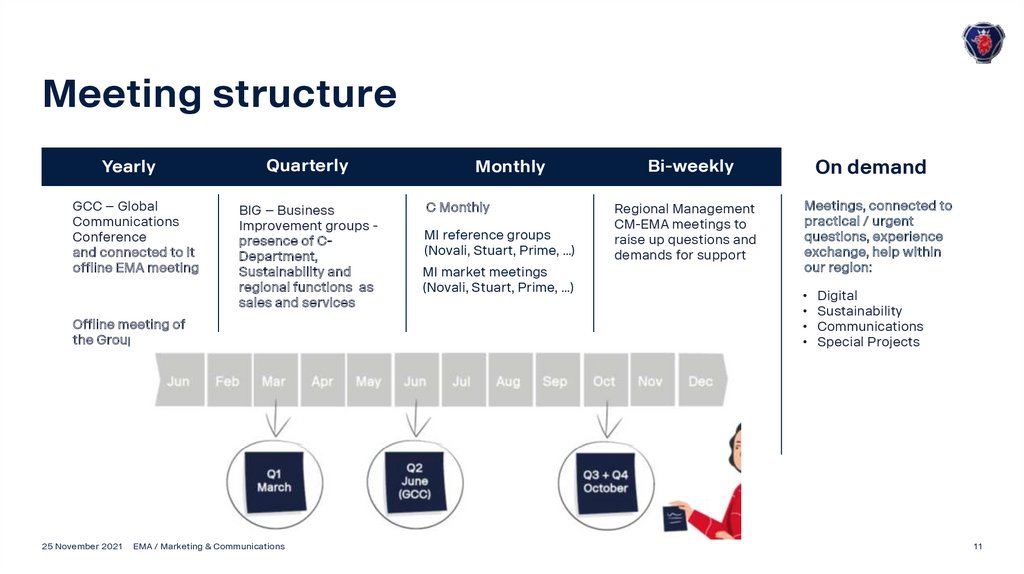

Meeting structureYearly

Markets

offline BIG

GCC

Region

C-D

Quarterly

Monthly

Bi-Weekly

On demand

each BU

BIG

CMM

CMC

CM-EMA

practical matters, experience

exchange, help

10

9. Meeting structure

YearlyGCC – Global

Communications

Conference

and connected to it

offline EMA meeting

Offline meeting of

the Group

25 November 2021

Quarterly

BIG – Business

Improvement groups presence of CDepartment,

Sustainability and

regional functions as

sales and services

Meetings between

Region and each

Business Unit

EMA / Marketing & Communications

Monthly

C Monthly

MI reference groups

(Novali, Stuart, Prime, …)

MI market meetings

(Novali, Stuart, Prime, …)

Bi-weekly

Regional Management

CM-EMA meetings to

raise up questions and

demands for support

On demand

Meetings, connected to

practical / urgent

questions, experience

exchange, help within

our region:

Digital

Sustainability

Communications

Special Projects

11

10. Meeting structure

Some achievements• Lead capture: WEB upgrade, forms integration

• Trust Content diversity: tour

• Brand premium image: SUPER

24 November 2016

Info class internal Department / Name / Subject

12

11. Meeting structure

Ongoing activities• Marketing Tool: product offering,

competitor comparison, TCO

• Benchmarking sessions between

markets (Touring, Service)

• Piloting central projects

• Experience/ materials exchange

• Service Communications

• Virtual selling experience exchange

• Regional content tour

• Budget allocation of the markets

• EMA sustainability regional strategy

• Regular meetings per meeting structure

13

12. Some achievements

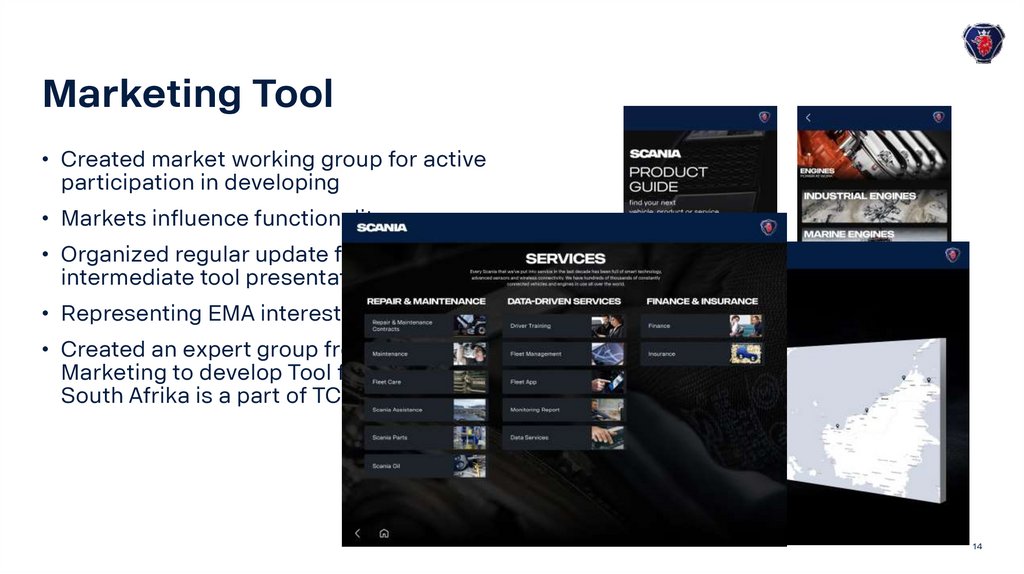

Marketing Tool• Created market working group for active

participation in developing

• Markets influence functionality

• Organized regular update for the Region with

intermediate tool presentation

• Representing EMA interest in expert PM group

• Created an expert group from Sales and

Marketing to develop Tool functionality, where

South Afrika is a part of TCO project Group

14

13. Ongoing activities

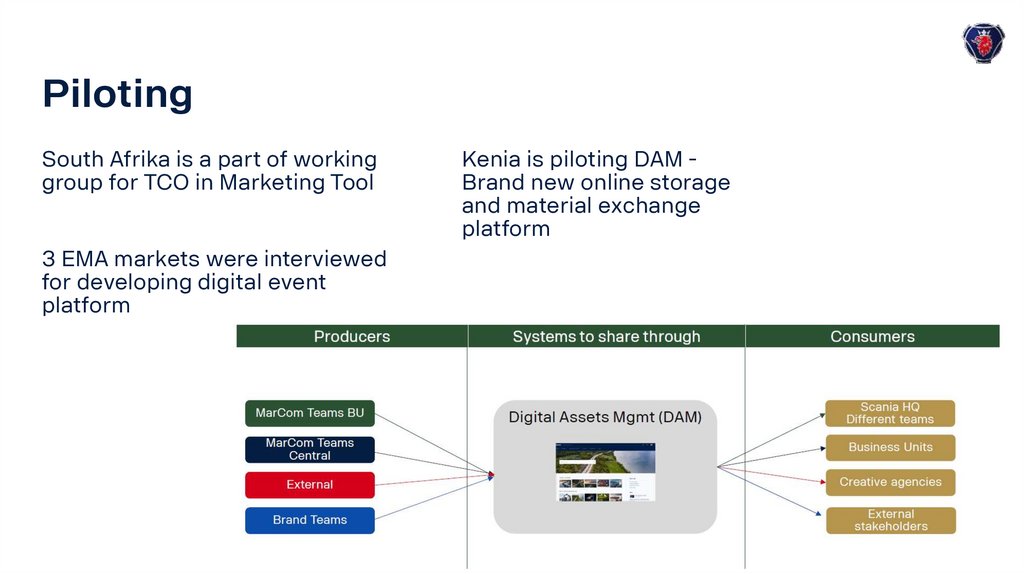

PilotingSouth Afrika is a part of working

group for TCO in Marketing Tool

Kenia is piloting DAM Brand new online storage

and material exchange

platform

3 EMA markets were interviewed

for developing digital event

platform

15

14. Marketing Tool

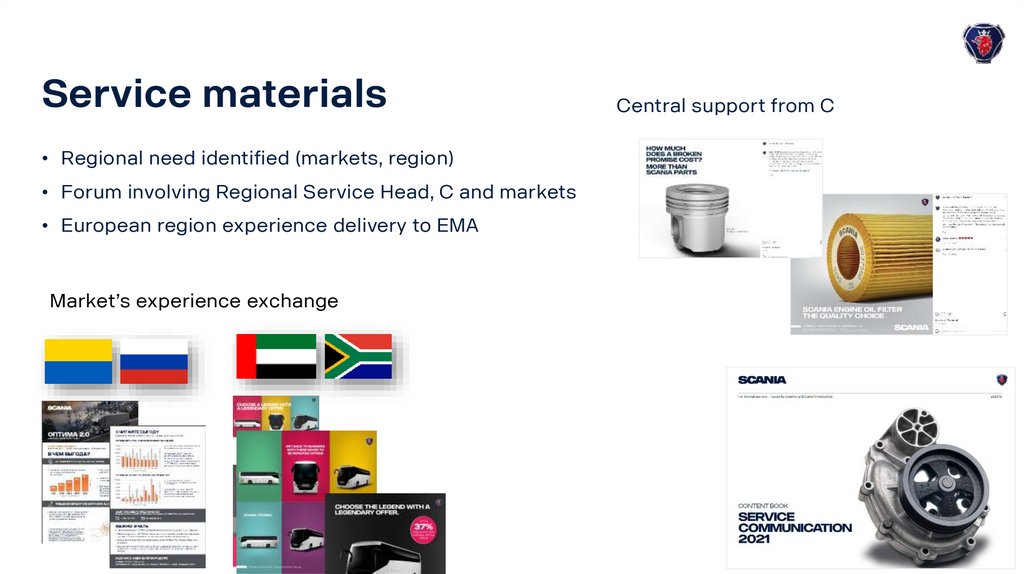

Service materialsCentral support from C

• Regional need identified (markets, region)

• Forum involving Regional Service Head, C and markets

• European region experience delivery to EMA

Market’s experience exchange

16

15. Piloting

Regional content tour• Lack of diverse content in central sources identified

• Markets are looking for local content to build trust

among target audience though visual communication

• Hight cost of local content production by each market +

strict technical requirements from C

• Experience from Latin Amerika as basis for negotiation

• Preliminary timing – autumn 2022

• Objects: People, workshop, vehicles in operations &

local conditions

• To be used: SoMe, POSM, WEB, exhibitions, brand

decoration etc.

17

16. Service materials

Sustainability regional strategy• Special approach to communicate sustainability

in developing economics is required

• Communications & Sustainability CV AB

engaged

• Image, Commercial and Government aspects

• Different sides of sustainability (human rights,

fuel efficiency, driver safety etc.) in brief

• Argumentation of emission level Euro+

18

17. Regional content tour

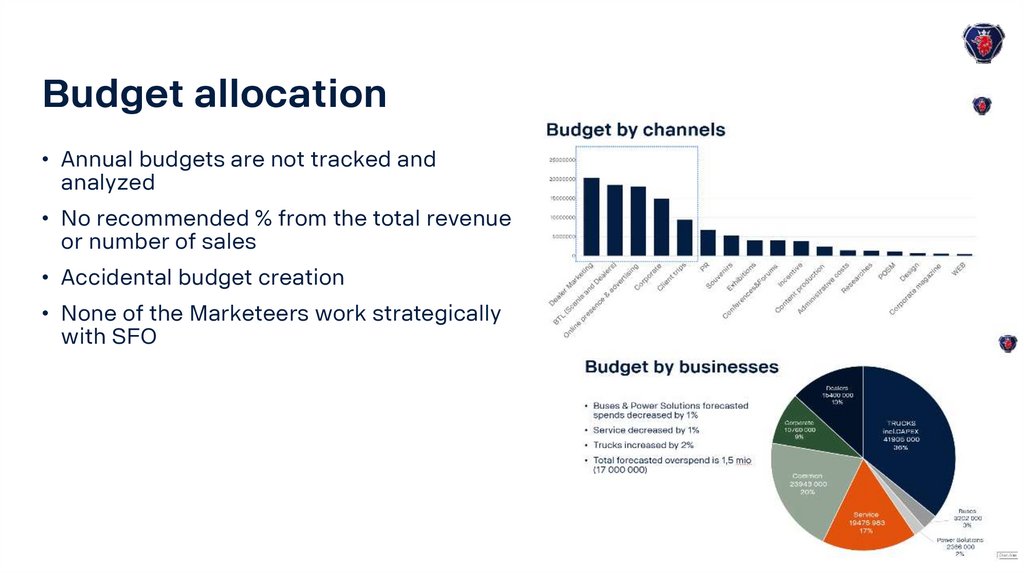

Budget allocation• Annual budgets are not tracked and

analyzed

Outcome of analyze

• No recommended % from the total revenue

or number of sales

• Accidental budget creation

• None of the Marketeers work strategically

with SFO

19

18. Sustainability regional strategy

MI Stuart, non E-6 marketsCoordination launch in EMA

Innovative image of Scania at non-E6 markets

Future Customer target audience

Global news spread fast, it’s important to inform our local Customers about what’s happening in

Scania globally

SUA

SMA

SME

SEA

20

19. Budget allocation

AEM global update• Switched to a new version of the platform within global project

• Integration of leadgeneration forms

• Showroom / configurator implementation

• Accidental budget creation

• None of the Marketeers work strategically with SFO

21

20. MI Stuart, non E-6 markets

Potential21. AEM global update

Potential• Increasing traffic generation to WEB , configurator in full power to achieve better

leadgeneration

• Promo and integration of financial services

• Internal communication: Scania World & Employer branding (content generation, team

gathering, spirit, internal business-oriented competition etc)

• CRM Marketing Module implementation, experience exchange best practice of usage,

implementation, integration with sales and marketing module

• Integration of marketing in retail projects

• Regional demo fleet to support local events

• SoMe strategy to increase ER

Look after non-captives: Turkey, Algeria, Egypt, Sudan, Israel

23

marketing

marketing