Similar presentations:

Purpose of the capital market (lecture 11)

1.

2.

Lecture 11. Capital MarketsMurodullo Bazarov

m.bazarov@wiut.uz

ATB205

office hours: Tues 11:00-13:00

3.

MEQ & RYL4.

Lecture Outline• Purpose of the Capital Market

• Capital Market Participants

• Capital Market Trading

• Types of Bonds

• Treasury Notes and Bonds

• Municipal Bonds

• Corporate Bonds

• Financial Guarantees for Bonds

5.

Purpose of the Capital Market• Original maturity is greater than one year, typically for long-term financing

or investments

• Best known capital market securities:

─Stocks and bonds

6.

Capital Market Participants• Primary issuers of securities:

─Federal and local governments: debt issuers

─Corporations: equity and debt issuers

• Largest purchasers of securities:

─You and me

─And other financial market players

7.

Capital Market Trading1. Primary market for initial sale (IPO)

2. Secondary market

─ Over-the-counter

─ Organized exchanges (i.e., NYSE)

8.

Types of Bonds• Bonds are securities that represent debt owed by the issuer to the

investor, and typically have specified payments on specific dates.

• Types of bonds we will examine include long-term government bonds

(T-bonds), municipal bonds, and corporate bonds.

9.

Treasury Notes and Bonds• The U.S. Treasury issues notes and bonds to finance its operations.

• The following table summarizes the maturity differences among the

various Treasury securities.

10.

Treasury Bond Interest Rates• No default risk since the Treasury can print money to payoff the debt

• Very low interest rates, often considered the risk-free rate (although inflation risk is

still present)

Interest Rate on Treasury Bonds and the Inflation Rate, 1973–2013

(January of each year)

11.

Money Market Instruments: Treasury Bills12.

Municipal Bonds• Issued by local, county, and state governments

• Used to finance public interest projects

• Tax-free municipal interest rate = taxable interest rate (1 marginal

tax rate)

Suppose the rate on a corporate bond is 9% and the rate on a municipal

bond is 6.75%. Which should you choose?

Answer: Find the marginal tax rate:

6.75% = 9% (1 – MTR), or MTR = 25%

If you are in a marginal tax rate above 25%, the municipal bond offers a

higher after-tax cash flow.

13.

Municipal BondsSuppose the rate on a corporate bond is 5% and the rate on a municipal

bond is 3.7%. Which should you choose? Your marginal tax rate is 28%.

Find the equivalent tax-free rate (ETFR):

ETFR = 5% (1 – MTR) = 5% (1 – 0.28)

The ETFR = 3.6%. If the actual muni-rate is above this (it is), choose the

municipal bond

14.

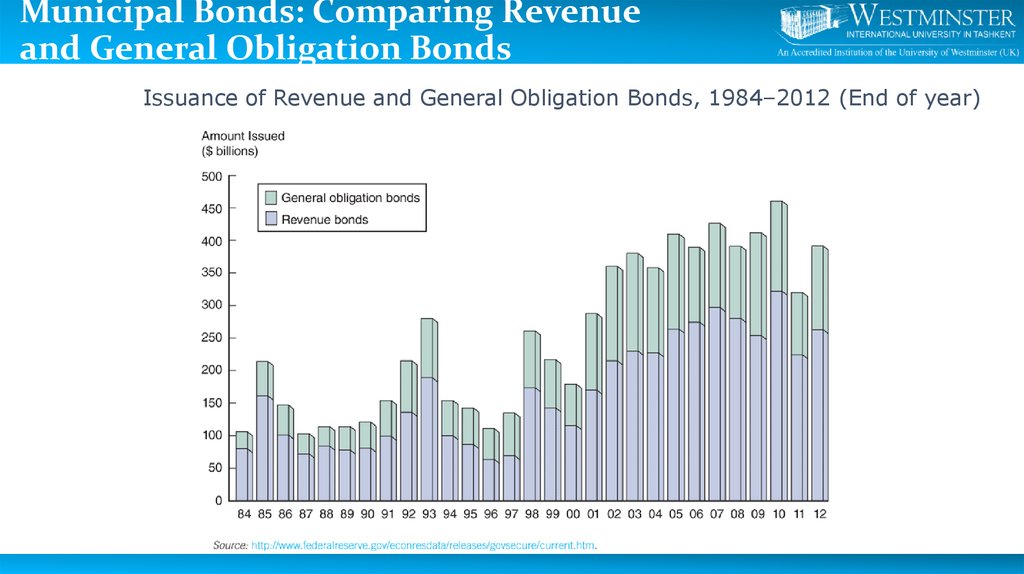

Municipal Bonds• Two types

─General obligation bonds

─Revenue bonds

• NOT default-free (e.g., Orange County California)

─Defaults in 1990 amounted to $1.4 billion in this market

• Read more examples:

http://www.municipalbonds.com/news/the-biggest-municipal-bonddisasters-of-all-time/

15.

Municipal Bonds: Comparing Revenueand General Obligation Bonds

Issuance of Revenue and General Obligation Bonds, 1984–2012 (End of year)

16.

Corporate Bonds• Typically have a face value of $1,000, although some have a face value of

$5,000 or $10,000

• Pay interest semi-annually

• Cannot be redeemed anytime the issuer wishes, unless a specific

clause states this (call option).

• Degree of risk varies with each bond, even from the same issuer.

Following suite, the required interest rate varies with level

of risk.

• The degree of risk ranges from low-risk (AAA) to higher risk (BBB).

Any bonds rated below BBB are considered sub-investment grade debt.

17.

Corporate Bonds: Interest RatesCorporate Bond Interest Rates, 1973–2012 (End of year)

18.

Characteristics of Corporate Bonds• Registered Bonds

─ Replaced “bearer” bonds

─ Internal revenue service (IRS) can track interest income this way

• Restrictive Covenants

─ Mitigates conflicts with shareholder interests

─ May limit dividends, new debt, ratios, etc.

─ Usually includes a cross-default clause

• Call Provisions

─ Higher required yield

─ Mechanism to adhere to a sinking fund provision

─ Interest of the stockholders

─ Alternative opportunities

• Conversion

─ Some debt may be converted to equity

─ Similar to a stock option, but usually more limited

19.

Characteristics of Corporate Bonds• Secured Bonds

─Mortgage bonds

─Equipment trust certificates

• Unsecured Bonds

─Debentures

─Subordinated debentures

─Variable-rate bonds

• Junk Bonds

─Debt that is rated below BBB

─Michael Milken developed this market in the mid-1980s, although he was

subsequently convicted of insider trading

(http://www.businessinsider.com/michael-milken-life-story-2017-5)

20.

Financial Guarantees for Bonds• Some debt issuers purchase financial guarantees to lower the risk of

their debt.

• The guarantee provides for timely payment of interest and principal,

and are usually backed by large insurance companies.

• https://www.investopedia.com/terms/c/creditdefaultswap.asp

• As it turns out, not all guarantees actually make sense!

─In 1995, JP Morgan created the credit default swap (CDS), a type of insurance

on bonds.

─In 2000, Congress removed CDSs from any oversight.

─By 2008, the CDS market was over $62 trillion!

─2008 losses on mortgages lead to huge payouts on this insurance

21.

Investing in Bonds• Bonds are the most popular alternative to stocks for long-term

investing.

• Even though the bonds of a corporation are less risky than its equity,

investors still have risk: price risk and interest rate risk,

22.

Investing in BondsBonds and Stocks Issued, 1983–2012

23.

Investing in Stocks1.

Represents ownership

in a firm

2. Earn a return in

two ways

─ Price of the stock rises

over time

─ Dividends are paid to the stockholder

3. Stockholders have claim on all assets

4. Right to vote for directors

and on certain issues

5. Two types

─

Common stock

• Right to vote

• Receive dividends

─

Preferred stock

• Receive a fixed dividend

• Do not usually vote

24.

Investing in Stocks: How Stocks are Sold• Organized exchanges

─NYSE is best known, with daily volume around 4 billion shares, with peaks at 7

billion.

─“Organized” used to imply a specific trading location. But computer systems (ECNs)

have replaced this idea.

─Others include the ASE (US), and Nikkei, LSE, DAX (international)

─Listing requirements exclude small firms

• Over-the-counter markets

─Best example is NASDAQ in history

─Dealers stand ready to make a market

─Today, about 3,000 different securities are listed on NASDAQ.

─Important market for thinly-traded securities—securities that don’t trade very often.

Without a dealer ready to make a market, the equity would be difficult to trade.

25.

Investing in Stocks: Organized vs. OTC• Organized exchanges (e.g., NYSE)

─Auction markets with floor specialists

─25% of trades are filled directly by specialist

─Remaining trades are filled through SuperDOT

• Over-the-counter markets

─Multiple market makers set bid and ask prices

─Multiple dealers for any given security

─Examples: The OTC Markets Group operates some of the most

well-known networks, such as the Best Market (OTCQX), the

Venture Market (OTCQB), and the Pink Open Market and

NASDAQ in history

26.

How the Market Sets Security Prices• Generally speaking, prices are set in competitive markets as the price

set by the buyer willing to pay the most for an item.

• The buyer willing to pay the most for an asset is usually the buyer who

can make the best use of the asset.

• Superior information can play an important role.

• Consider the following three valuations for a stock with certain

dividends but different perceived risk:

• But, who perceives the lowest risk, is willing to pay the most and will

determine the “market” price.

27.

Errors in ValuationAlthough the pricing models are useful, market participants frequently

encounter problems in using them. Any of these can have a significant

impact on price in the Gordon model.

finance

finance