Similar presentations:

Restructuring of the enterprise (topic 6)

1.

Topic 6: "Restructuring of the enterprise"1. The essence and forms of enterprise restructuring

2. Forms and general preconditions of reorganization

3. Reorganization of enterprises aimed at consolidation (mergers, acquisitions,

acquisitions)

4. Division of enterprises

2.

1. The essence and forms of enterprise restructuringIn world practice, one of the most common ways of financial recovery of enterprises is

restructuring. This term is used quite often in Ukraine, but is interpreted ambiguously.

Restructuring is sometimes understood as the simple division of a large-scale

enterprise into components, ie the fragmentation of its structure and the creation of

several autonomous structural units, or its transformation into another entity. In a

broader sense, restructuring - is a set of reorganization measures aimed at creating

the preconditions for the company out of crisis and ensuring its further development.

In the Law of Ukraine "On restoring the solvency of the debtor or declaring him bankrupt"

№ 2343-12 restructuring means "implementation of organizational, economic, financial,

economic, legal, technical measures aimed at reorganizing the enterprise, in particular by

dividing it with the transfer of debt to a legal entity that is not subject to reorganization, if

provided by the reorganization plan, to change the form of ownership, management,

organizational and legal form, which will contribute to the financial recovery of the

enterprise, increase the volume of competitive products, increase production efficiency and

meet the requirements of creditors. As can be seen in this definition, restructuring involves

the use of financial measures, which was not the case in the previous definition.

3.

Foreign experience shows that in order to increase theirprofitability in the future, companies often carry out

"precautionary" restructuring in order to strengthen their

financial position in the future. Therefore, it is advisable

to consider restructuring in a broader sense, as a process

of preparation and implementation of programs of

comprehensive change in the enterprise, in order to

increase its market value. The need for constant

restructuring of the enterprise is caused by the instability

of the market environment, competition between

manufacturers, suppliers, and firms that produce

substitute products, etc. Depending on the depth of the

crisis at the enterprise, the specifics of the industry and

the general economic environment, restructuring may

cover either all areas of the enterprise, or some of them

separately.

4.

• The restructuring process can be seen as a wayto remove the contradiction between market

requirements and outdated logic of the

enterprise.

• Restructuring of the enterprise is interpreted as

the implementation of organizational and

economic, legal, technical measures aimed at

changing the structure of the enterprise, its

management, forms of ownership, organizational

and legal forms, as the ability to lead the

company to financial recovery, increase

competitive output, increase efficiency.

5.

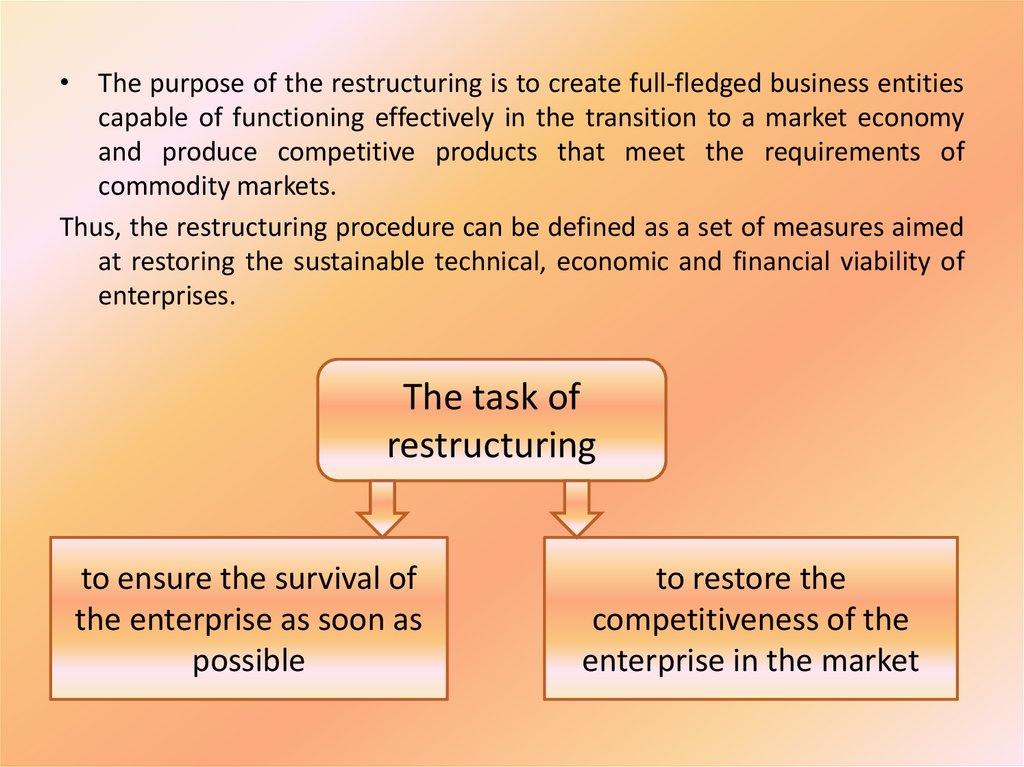

• The purpose of the restructuring is to create full-fledged business entitiescapable of functioning effectively in the transition to a market economy

and produce competitive products that meet the requirements of

commodity markets.

Thus, the restructuring procedure can be defined as a set of measures aimed

at restoring the sustainable technical, economic and financial viability of

enterprises.

The task of

restructuring

to ensure the survival of

the enterprise as soon as

possible

to restore the

competitiveness of the

enterprise in the market

6.

The main areas of restructuring are:• improving the structure and management

functions,

• overcoming the backlog in technical and

technological aspects of activity,

• improving marketing and financial and economic

policy and achieving on this basis the growth of

production efficiency, reduction of production

costs,

• improving the financial and economic

performance,

• meeting the needs of consumers.

7.

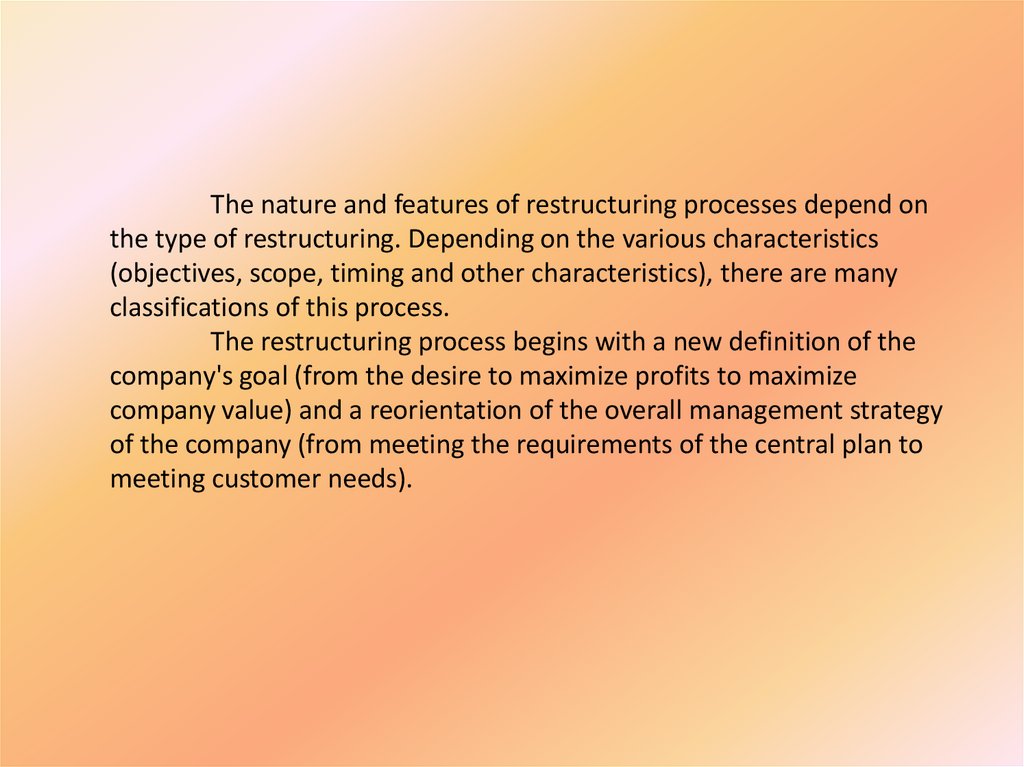

The nature and features of restructuring processes depend onthe type of restructuring. Depending on the various characteristics

(objectives, scope, timing and other characteristics), there are many

classifications of this process.

The restructuring process begins with a new definition of the

company's goal (from the desire to maximize profits to maximize

company value) and a reorientation of the overall management strategy

of the company (from meeting the requirements of the central plan to

meeting customer needs).

8.

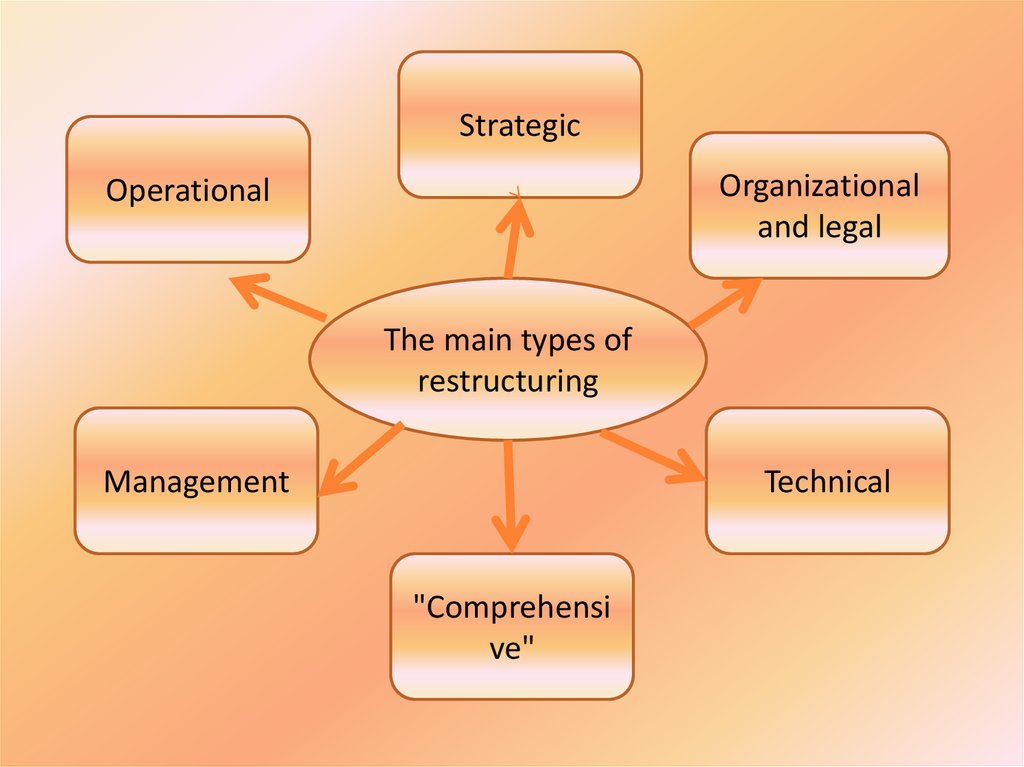

StrategicOrganizational

and legal

Operational

The main types of

restructuring

Management

Technical

"Comprehensi

ve"

9.

Operational restructuring• The operational restructuring of the enterprise

(organization) solves two main problems: ensuring

liquidity and significantly improving the results of its

(her) activities. The period of operational restructuring

lasts about 3-4 months.

Strategic restructuring

• Strategic restructuring of the enterprise (organization)

ensures its long-term competitiveness. To achieve such

competitiveness it is necessary to determine the

strategic goal of the enterprise, develop a strategic

concept of development, as well as areas and tools for

achieving this goal.

10.

Organizational and legal restructuringOrganizational and legal type of restructuring is

characterized by the processes of commercialization,

corporatization, change of organizational structure

and the owner of state enterprises.

Management restructuring

Management restructuring is associated with the

training and retraining of personnel with a focus on the

competitive operation of the enterprise, changing its

organizational structure, management, technology,

innovation and marketing policy.

11.

Technical restructuringTechnical restructuring is associated with ensuring the

state of the enterprise, at which it reaches the

appropriate level of production capacity, technology,

know-how, management skills, staff qualifications,

efficient supply systems and logistics, ie all that allows

the company to reach market with efficient and

competitive products.

"Comprehensive" restructuring

"Comprehensive" restructuring includes the development of

a new organizational structure, appropriate product, labor,

technical and technological policies, changes in

management, organization and more. Restructuring of the

enterprise in this way lasts mostly up to three years.

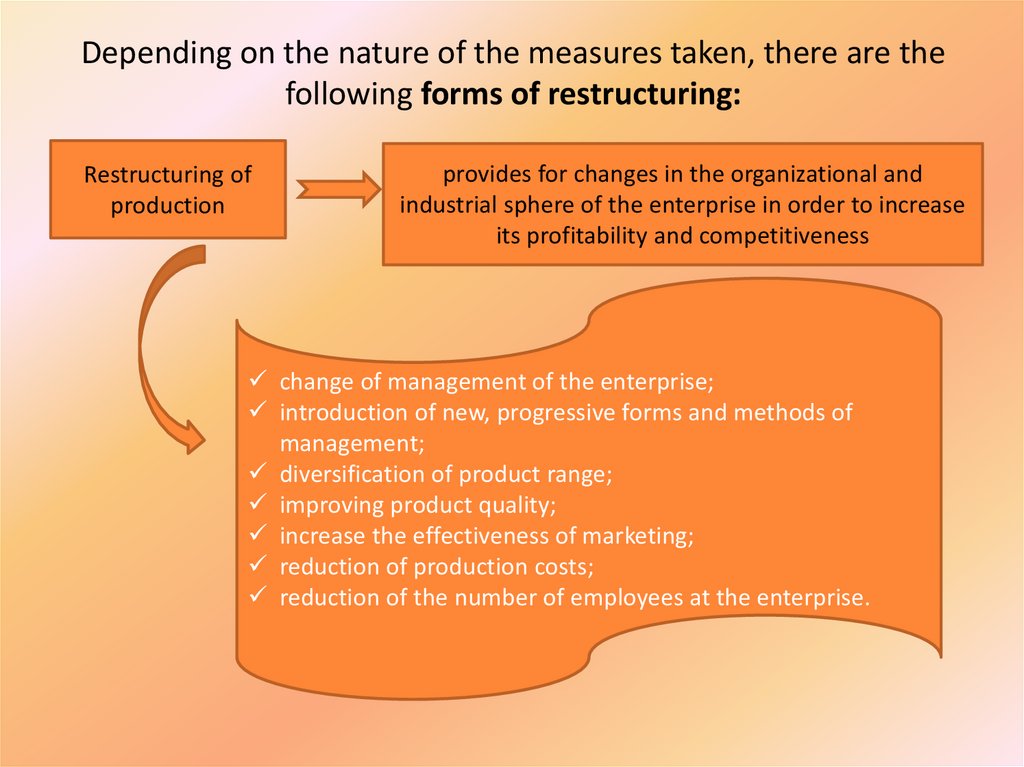

12. Depending on the nature of the measures taken, there are the following forms of restructuring:

Restructuring ofproduction

provides for changes in the organizational and

industrial sphere of the enterprise in order to increase

its profitability and competitiveness

change of management of the enterprise;

introduction of new, progressive forms and methods of

management;

diversification of product range;

improving product quality;

increase the effectiveness of marketing;

reduction of production costs;

reduction of the number of employees at the enterprise.

13.

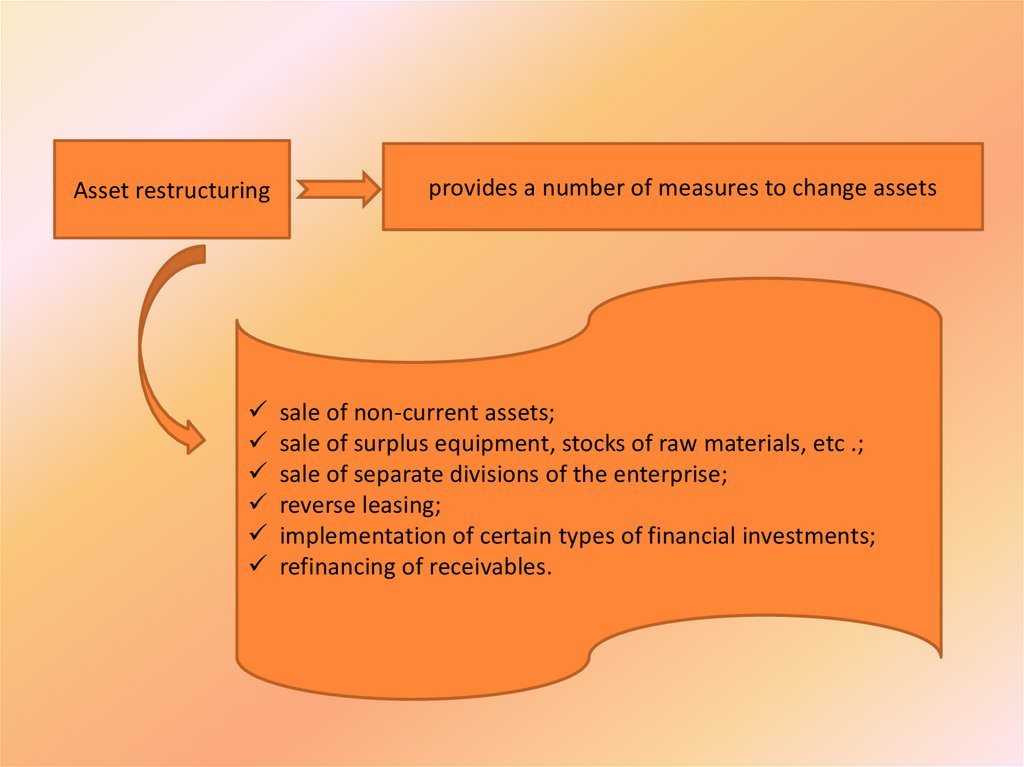

Asset restructuringprovides a number of measures to change assets

sale of non-current assets;

sale of surplus equipment, stocks of raw materials, etc .;

sale of separate divisions of the enterprise;

reverse leasing;

implementation of certain types of financial investments;

refinancing of receivables.

14.

associated with changes in the structure and size ofequity and debt capital, as well as changes in

investment activities of the enterprise

Financial

restructuring

debt restructuring to creditors;

obtaining additional loans;

increase of the authorized capital;

freezing of investments.

15.

Corporate restructuringprovides for the reorganization of the enterprise,

which aims to change the owner of the statutory fund,

the creation of new legal entities and (or) a new

organizational and legal form of activity

partial or full privatization;

division of large enterprises into parts;

separation from large enterprises of certain subdivisions, in

particular objects of social and cultural life and other non-core

subdivisions;

joining others or merging with others, more powerful under the

enterprise.

16.

17. 2. Forms and general preconditions of reorganization

On formal grounds, three types ofreorganization are considered:

aimed at the consolidation of the enterprise

(mergers, acquisitions, acquisitions);

aimed at crushing the enterprise (division,

separation);

without changes in the size of the enterprise

(transformation).

18. Reorganization of enterprises that have accounts payable is carried out in compliance with the requirements for debt transfer:

• the transfer (transfer) of the debtor's debt to anotherperson is allowed only with the consent of the creditor;

• the new debtor has the right to raise against the

creditor's claim all objections based on the relationship

between the creditor and the original debtor;

• the guarantee and pledge by a third party shall be

terminated with the transfer (transfer) of the debt, if

the guarantor or the mortgagor has not agreed to be

responsible for the new debtor;

• receivables and debt transfers based on a written

agreement must also be made in writing.

19.

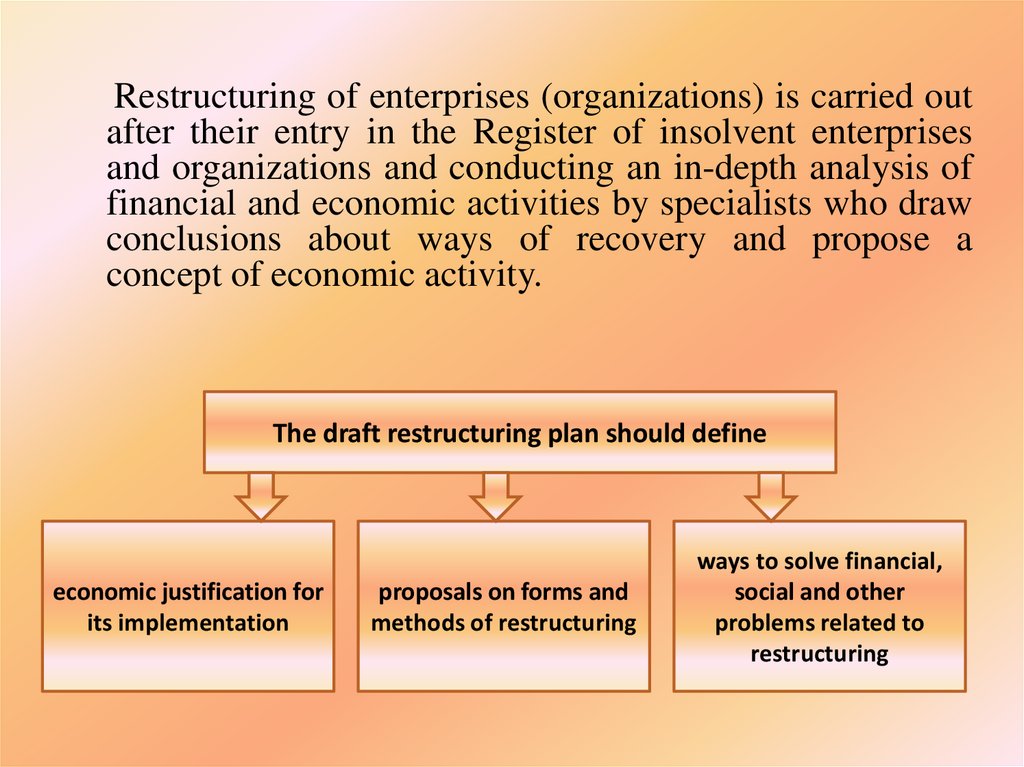

Restructuring of enterprises (organizations) is carried outafter their entry in the Register of insolvent enterprises

and organizations and conducting an in-depth analysis of

financial and economic activities by specialists who draw

conclusions about ways of recovery and propose a

concept of economic activity.

The draft restructuring plan should define

economic justification for

its implementation

proposals on forms and

methods of restructuring

ways to solve financial,

social and other

problems related to

restructuring

20.

The procedure for restructuring the enterprise(organization)

The concept of enterprise development is developed depending on

the conditions of its economic activity on the following issues:

organizational, production, investment, economic, foreign

economic activity, personnel management, social and

environmental.

The development of the concept should be based on a clearly

defined and articulated goal of enterprise restructuring and

include the following issues:

- analysis of external and internal factors influencing the economic activity of the

enterprise;

- choice of option (type) of enterprise restructuring;

- justification of strategic development of the enterprise;

- assessment of the possibility of overcoming difficulties during the restructuring

period;

- development of a business plan for a restructured enterprise.

21.

Due to the different financial and economicsituation, specifics of activities, strategic goals and

objectives of enterprises, all restructuring projects

are unique and designed to be implemented only in

a particular entity, but we can identify the main

objectives in the restructuring of the enterprise:

1. Modernization, replacement or reduction of the production

and economic base of the existing enterprise.

2. Significant change in the management system and use of

human resources of the enterprise.

3. Qualitative change of relations with consumers and / or

creation of a new target group of clients.

22.

The restructuring program is designed to

synthesize the results of analytical work and on their

basis to clearly define the objectives, ways, means,

conditions for achieving the goals, future activities,

resources and their sources.

A comprehensive restructuring program is useful

not only for companies on the brink of financial and

economic crisis, but also quite successful. It helps to

understand the need for important management

decisions, to outline strategic directions for production

development. Implementation of restructuring will help

to improve economic and financial and economic

activities, increase the efficiency of the enterprise

23.

The development of the restructuring program involves the following actions:• 1. Carrying out of the complex financial and economic analysis of a

condition of the enterprise, including with detailing on separate

structural divisions.

• 2. Implementation of comprehensive business diagnostics of the

enterprise (analysis of development strategy, marketing and sales policy,

accounting policy, production, investment policy, organizational and

managerial structure, etc.).

• 3. Development of the forecast financial and economic model of

enterprise development for 3-5 years without restructuring.

• 4. Identification of the main advantages and problems of the enterprise,

development of proposals for optimizing the state of the enterprise

(financial recovery, reengineering, modernization and possible sources

of its financing, etc.).

• 5. Development of several alternative forecast financial and economic

models of enterprise development, taking into account the main

possible measures and risks, determining the basic option.

Development of a final document for the practical implementation of the

project.

24.

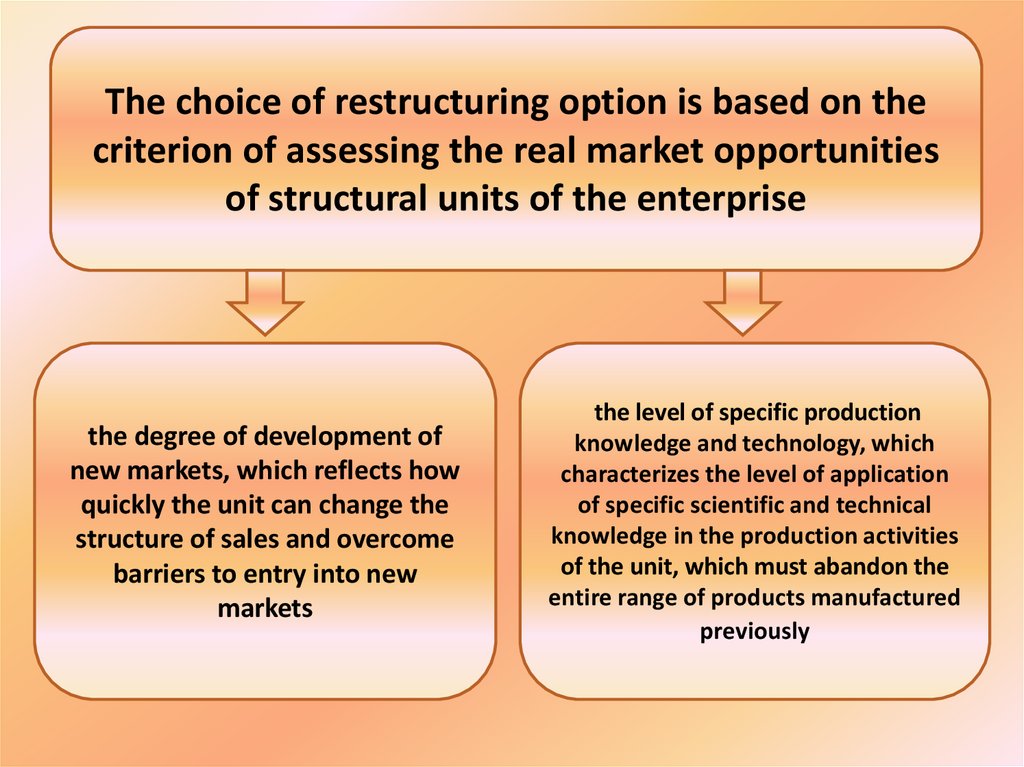

The choice of restructuring option is based on thecriterion of assessing the real market opportunities

of structural units of the enterprise

the degree of development of

new markets, which reflects how

quickly the unit can change the

structure of sales and overcome

barriers to entry into new

markets

the level of specific production

knowledge and technology, which

characterizes the level of application

of specific scientific and technical

knowledge in the production activities

of the unit, which must abandon the

entire range of products manufactured

previously

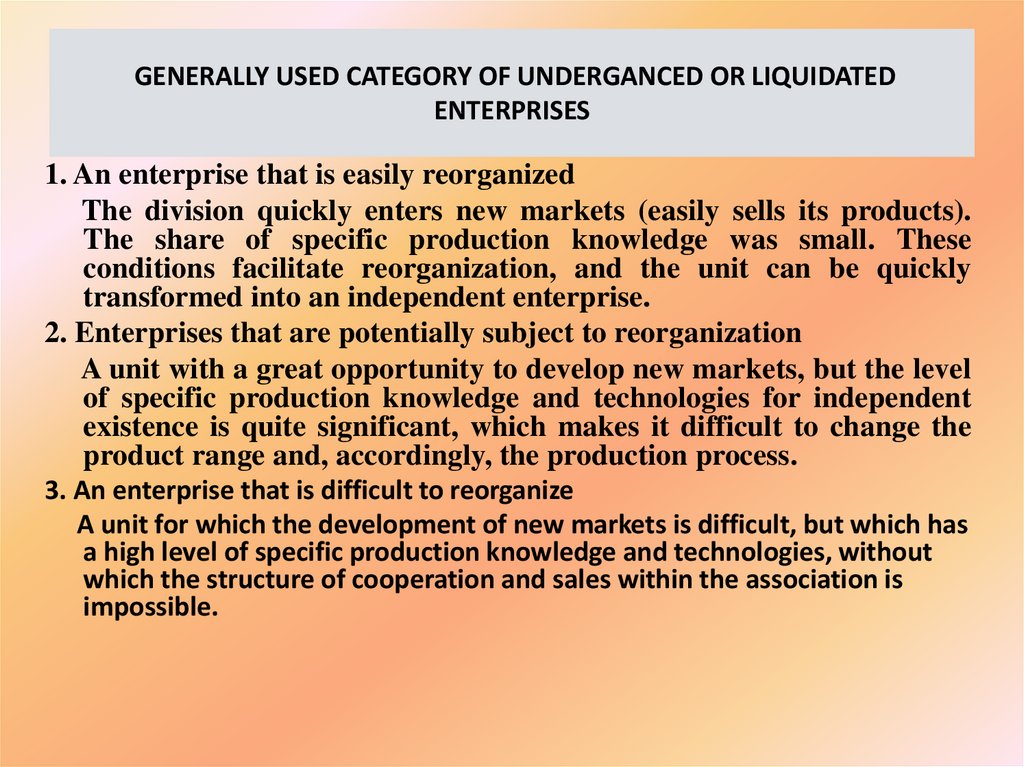

25. GENERALLY USED CATEGORY OF UNDERGANCED OR LIQUIDATED ENTERPRISES

1. An enterprise that is easily reorganizedThe division quickly enters new markets (easily sells its products).

The share of specific production knowledge was small. These

conditions facilitate reorganization, and the unit can be quickly

transformed into an independent enterprise.

2. Enterprises that are potentially subject to reorganization

A unit with a great opportunity to develop new markets, but the level

of specific production knowledge and technologies for independent

existence is quite significant, which makes it difficult to change the

product range and, accordingly, the production process.

3. An enterprise that is difficult to reorganize

A unit for which the development of new markets is difficult, but which has

a high level of specific production knowledge and technologies, without

which the structure of cooperation and sales within the association is

impossible.

26.

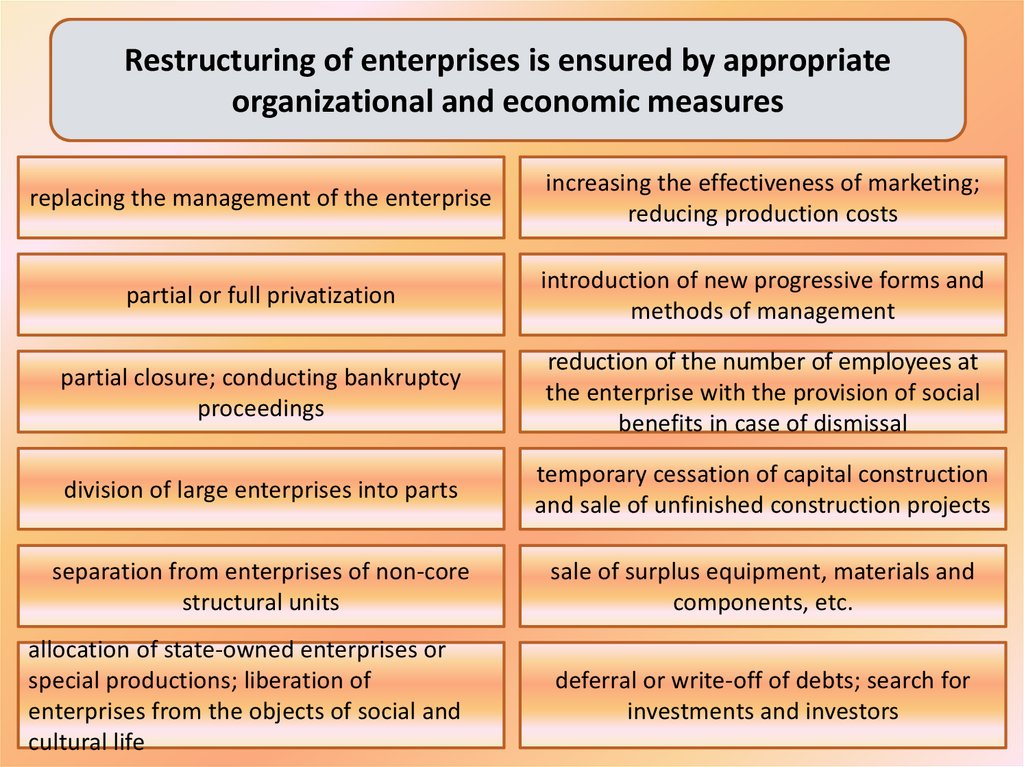

Restructuring of enterprises is ensured by appropriateorganizational and economic measures

replacing the management of the enterprise

increasing the effectiveness of marketing;

reducing production costs

partial or full privatization

introduction of new progressive forms and

methods of management

partial closure; conducting bankruptcy

proceedings

reduction of the number of employees at

the enterprise with the provision of social

benefits in case of dismissal

division of large enterprises into parts

temporary cessation of capital construction

and sale of unfinished construction projects

separation from enterprises of non-core

structural units

sale of surplus equipment, materials and

components, etc.

allocation of state-owned enterprises or

special productions; liberation of

enterprises from the objects of social and

cultural life

deferral or write-off of debts; search for

investments and investors

27.

• As a result of restructuring measures there arepositive changes in the organization of the

enterprise, the development of methods of

managing it in the areas of sales, pricing,

financial, investment, personnel policy.

• Restructuring of the enterprise is a long

process carried out with the help of specialists

of various profiles and aimed at improving the

efficiency of the internal potential of the

enterprise and adaptation to new market

conditions.

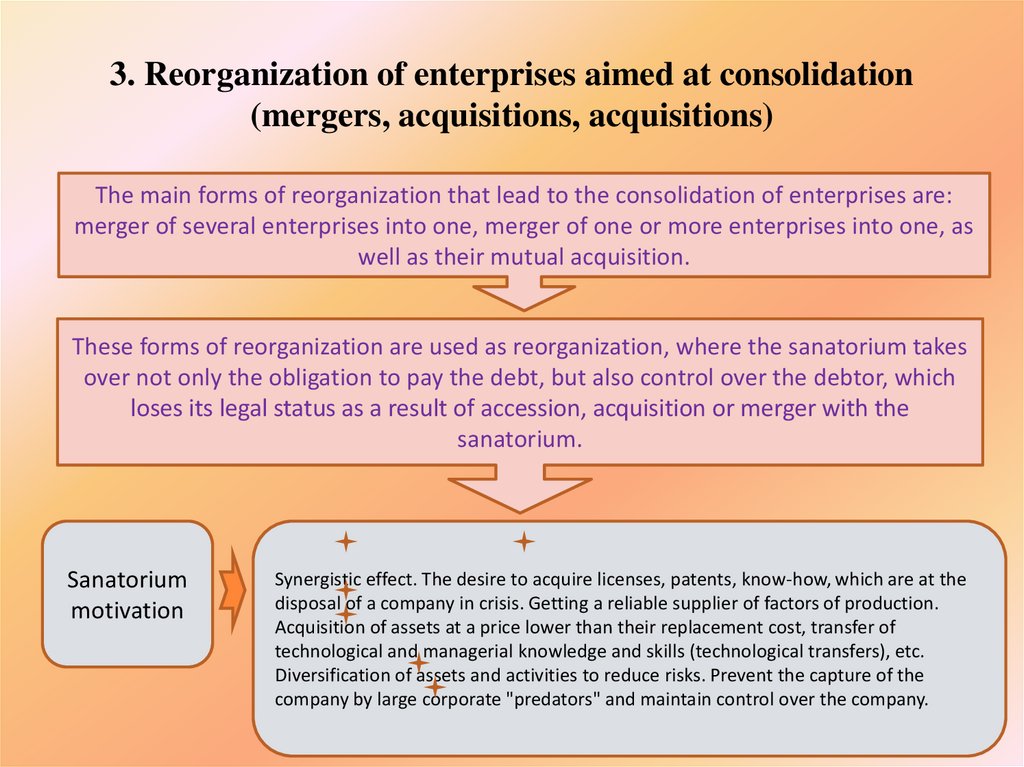

28. 3. Reorganization of enterprises aimed at consolidation (mergers, acquisitions, acquisitions)

The main forms of reorganization that lead to the consolidation of enterprises are:merger of several enterprises into one, merger of one or more enterprises into one, as

well as their mutual acquisition.

These forms of reorganization are used as reorganization, where the sanatorium takes

over not only the obligation to pay the debt, but also control over the debtor, which

loses its legal status as a result of accession, acquisition or merger with the

sanatorium.

Sanatorium

motivation

Synergistic effect. The desire to acquire licenses, patents, know-how, which are at the

disposal of a company in crisis. Getting a reliable supplier of factors of production.

Acquisition of assets at a price lower than their replacement cost, transfer of

technological and managerial knowledge and skills (technological transfers), etc.

Diversification of assets and activities to reduce risks. Prevent the capture of the

company by large corporate "predators" and maintain control over the company.

29.

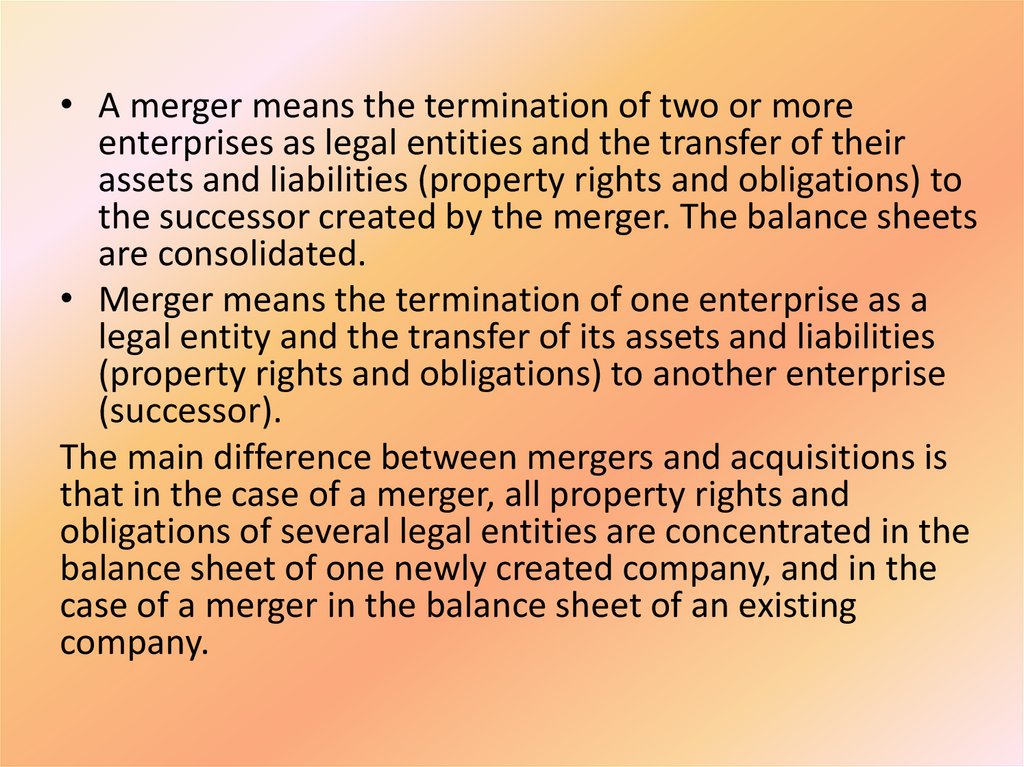

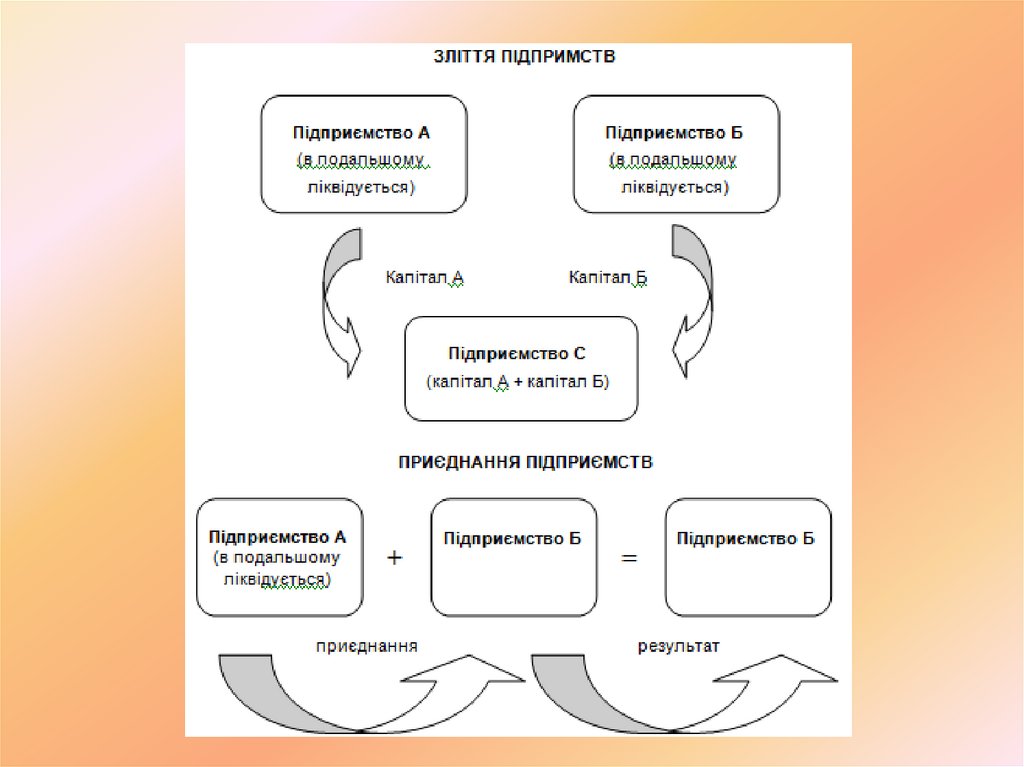

• A merger means the termination of two or moreenterprises as legal entities and the transfer of their

assets and liabilities (property rights and obligations) to

the successor created by the merger. The balance sheets

are consolidated.

• Merger means the termination of one enterprise as a

legal entity and the transfer of its assets and liabilities

(property rights and obligations) to another enterprise

(successor).

The main difference between mergers and acquisitions is

that in the case of a merger, all property rights and

obligations of several legal entities are concentrated in the

balance sheet of one newly created company, and in the

case of a merger in the balance sheet of an existing

company.

30.

31.

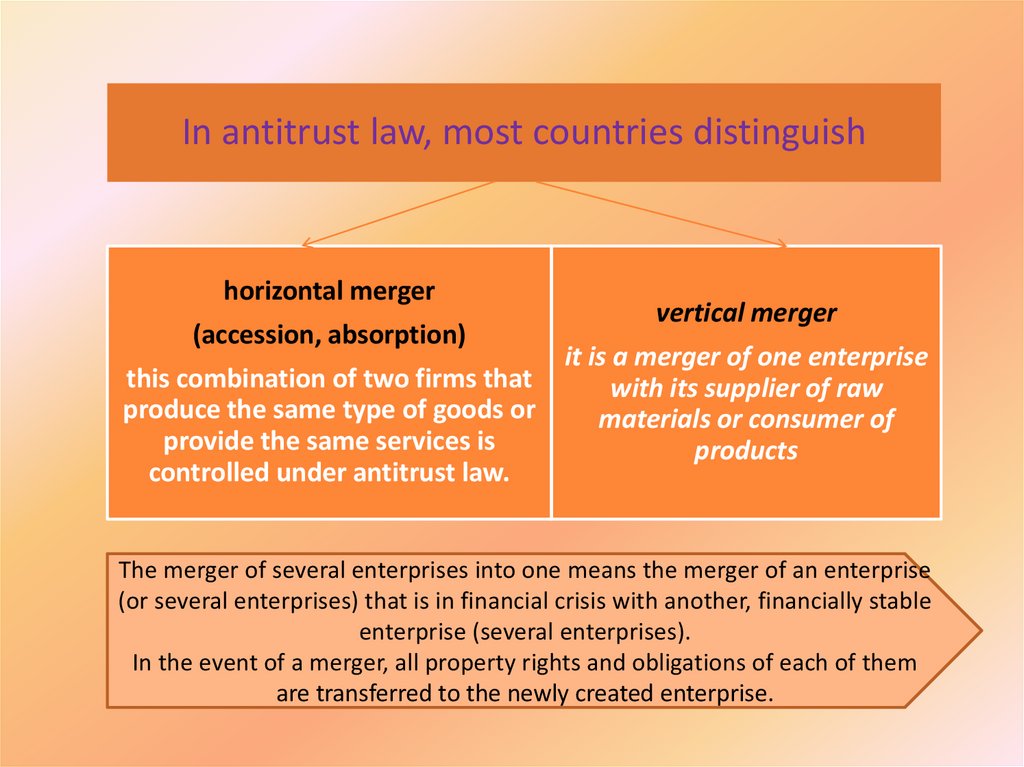

In antitrust law, most countries distinguishhorizontal merger

(accession, absorption)

this combination of two firms that

produce the same type of goods or

provide the same services is

controlled under antitrust law.

vertical merger

it is a merger of one enterprise

with its supplier of raw

materials or consumer of

products

The merger of several enterprises into one means the merger of an enterprise

(or several enterprises) that is in financial crisis with another, financially stable

enterprise (several enterprises).

In the event of a merger, all property rights and obligations of each of them

are transferred to the newly created enterprise.

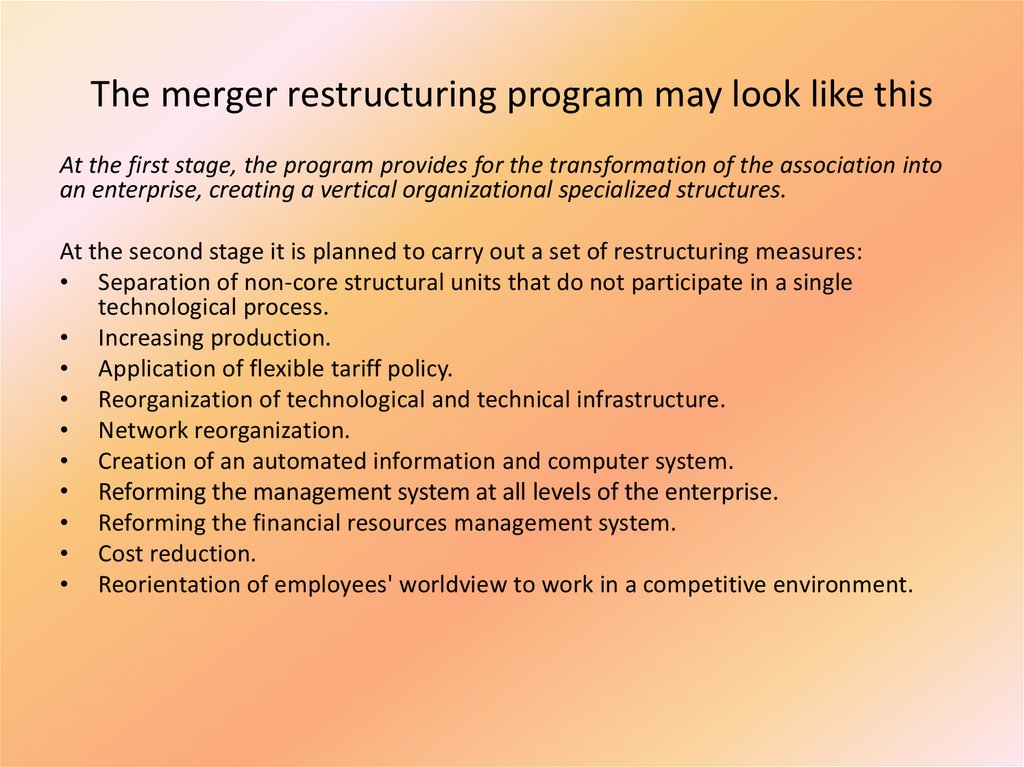

32. The merger restructuring program may look like this

At the first stage, the program provides for the transformation of the association intoan enterprise, creating a vertical organizational specialized structures.

At the second stage it is planned to carry out a set of restructuring measures:

• Separation of non-core structural units that do not participate in a single

technological process.

• Increasing production.

• Application of flexible tariff policy.

• Reorganization of technological and technical infrastructure.

• Network reorganization.

• Creation of an automated information and computer system.

• Reforming the management system at all levels of the enterprise.

• Reforming the financial resources management system.

• Cost reduction.

• Reorientation of employees' worldview to work in a competitive environment.

33.

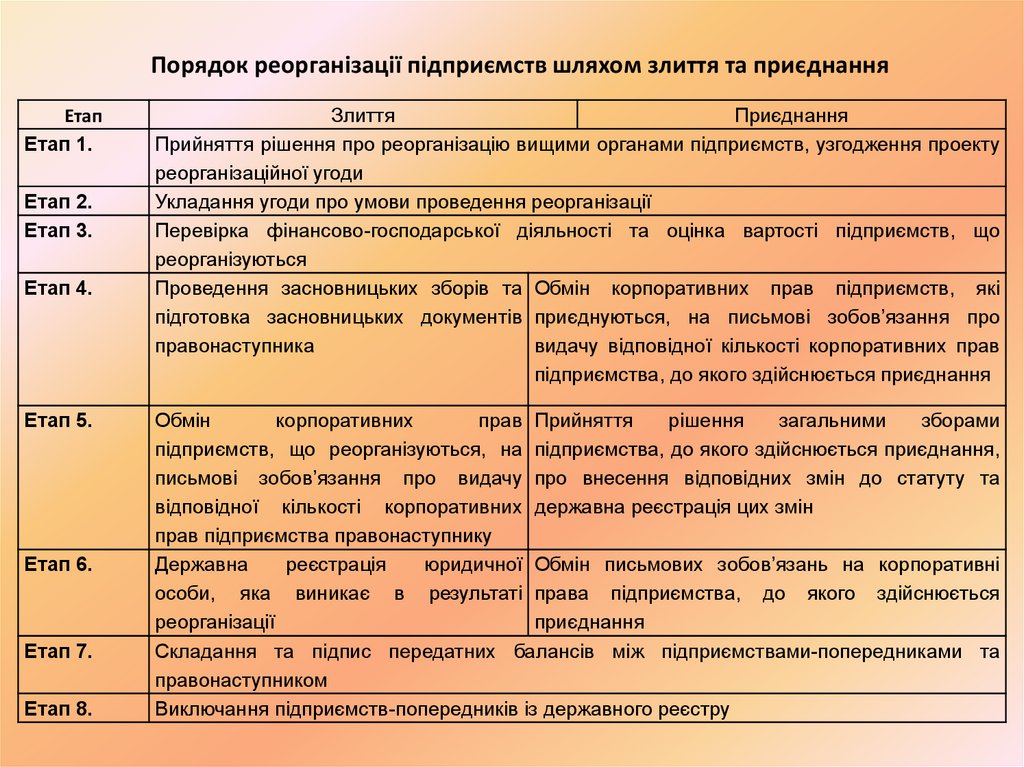

Порядок реорганізації підприємств шляхом злиття та приєднанняЕтап

Етап 1.

Етап 2.

Етап 3.

Етап 4.

Етап 5.

Етап 6.

Етап 7.

Етап 8.

Злиття

Приєднання

Прийняття рішення про реорганізацію вищими органами підприємств, узгодження проекту

реорганізаційної угоди

Укладання угоди про умови проведення реорганізації

Перевірка фінансово-господарської діяльності та оцінка вартості підприємств, що

реорганізуються

Проведення засновницьких зборів та Обмін корпоративних прав підприємств, які

підготовка засновницьких документів приєднуються, на письмові зобов’язання про

правонаступника

видачу відповідної кількості корпоративних прав

підприємства, до якого здійснюється приєднання

Обмін

корпоративних

прав Прийняття

рішення

загальними

зборами

підприємств, що реорганізуються, на підприємства, до якого здійснюється приєднання,

письмові зобов’язання про видачу про внесення відповідних змін до статуту та

відповідної кількості корпоративних державна реєстрація цих змін

прав підприємства правонаступнику

Державна

реєстрація

юридичної Обмін письмових зобов’язань на корпоративні

особи, яка виникає в результаті права підприємства, до якого здійснюється

реорганізації

приєднання

Складання та підпис передатних балансів між підприємствами-попередниками та

правонаступником

Виключання підприємств-попередників із державного реєстру

34.

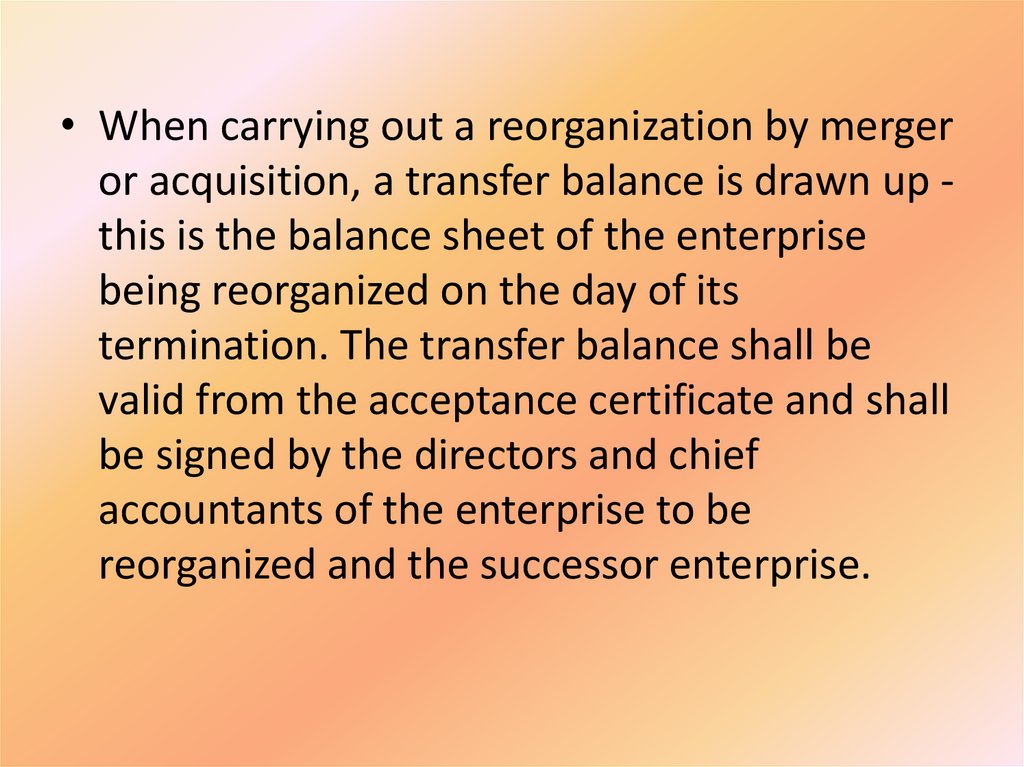

• When carrying out a reorganization by mergeror acquisition, a transfer balance is drawn up this is the balance sheet of the enterprise

being reorganized on the day of its

termination. The transfer balance shall be

valid from the acceptance certificate and shall

be signed by the directors and chief

accountants of the enterprise to be

reorganized and the successor enterprise.

35. 4. Division of enterprises

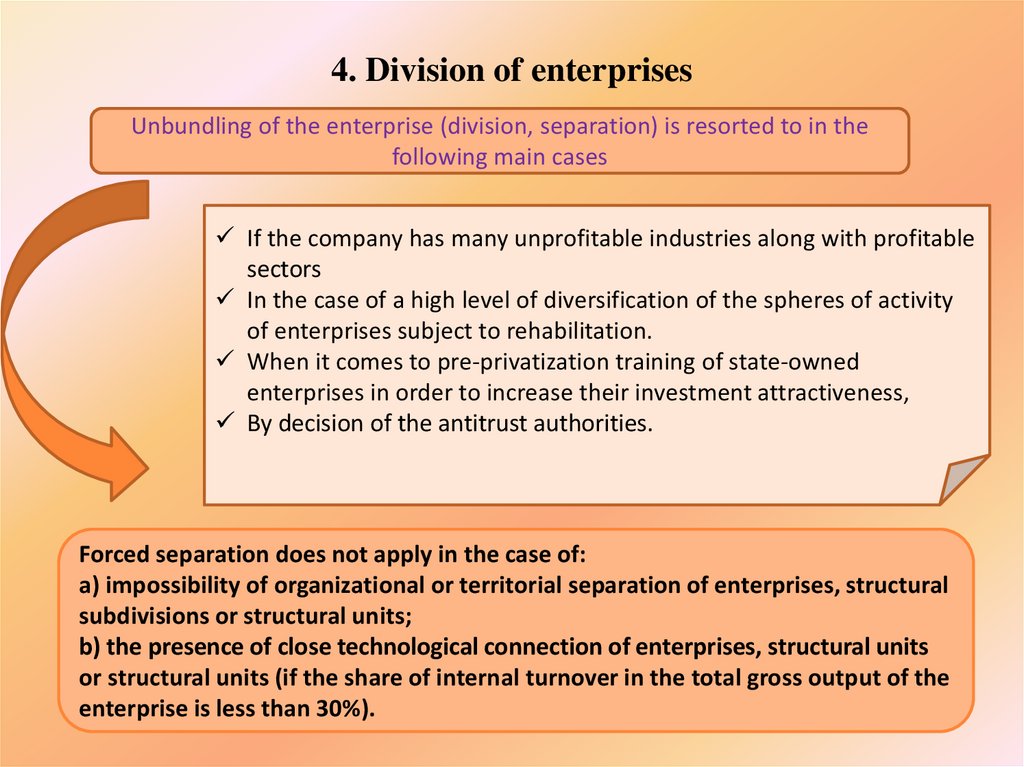

Unbundling of the enterprise (division, separation) is resorted to in thefollowing main cases

If the company has many unprofitable industries along with profitable

sectors

In the case of a high level of diversification of the spheres of activity

of enterprises subject to rehabilitation.

When it comes to pre-privatization training of state-owned

enterprises in order to increase their investment attractiveness,

By decision of the antitrust authorities.

Forced separation does not apply in the case of:

a) impossibility of organizational or territorial separation of enterprises, structural

subdivisions or structural units;

b) the presence of close technological connection of enterprises, structural units

or structural units (if the share of internal turnover in the total gross output of the

enterprise is less than 30%).

36.

the main purpose of theexpansion of the enterprise

there is a separation of

rehabilitatively capable production

units (productions) for their

financial recovery and registration

as independent legal entities.

This direction of reorganization allows us to focus on certain

strategic areas of the enterprise, guided by the principle: it is

economically more expedient to "keep on the surface a viable

part of the debtor than to drown the whole enterprise."

37.

Reorganization by division is that the legal entity ceases its activities, and on its basisseveral new enterprises are created, registered in the form of independent legal

entities.

As a result of the division of the enterprise, the property rights and obligations (assets

and liabilities) of the reorganized enterprise are transferred to the newly created

enterprises according to the distribution act (balance sheet) in the relevant parts.

Reorganization by separation is the separation from the existing enterprise of one or

more structural units, as well as on the basis of the structural unit of existing

associations in accordance with the decision of their labor and with the consent of the

owners or their authorized body.

During the separation of one or more new enterprises from the enterprise, the

property rights and obligations of the reorganized enterprise are transferred to each of

them according to the distribution act (balance sheet) in the relevant parts.

Transformation is a method of reorganization that involves changing the

form of ownership or organizational and legal form of a legal entity

without terminating the economic activity of the enterprise. When one

enterprise is transformed into another, all the property rights and

obligations of the former enterprise are transferred to the newly

established enterprise.

38.

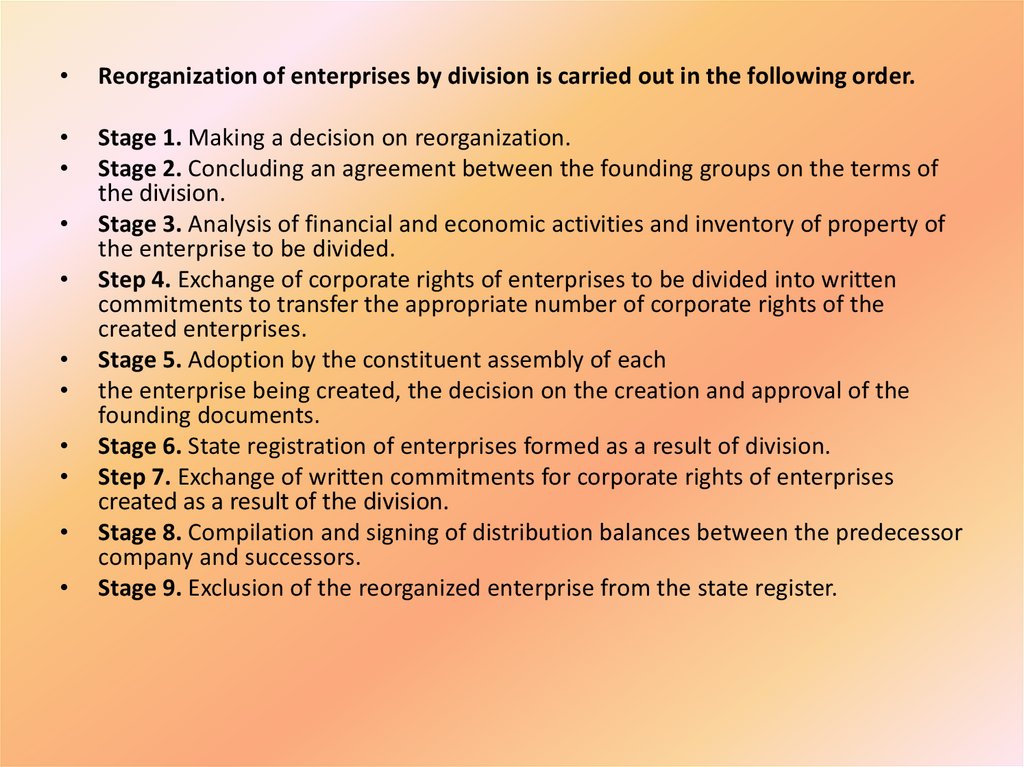

Reorganization of enterprises by division is carried out in the following order.

Stage 1. Making a decision on reorganization.

Stage 2. Concluding an agreement between the founding groups on the terms of

the division.

Stage 3. Analysis of financial and economic activities and inventory of property of

the enterprise to be divided.

Step 4. Exchange of corporate rights of enterprises to be divided into written

commitments to transfer the appropriate number of corporate rights of the

created enterprises.

Stage 5. Adoption by the constituent assembly of each

the enterprise being created, the decision on the creation and approval of the

founding documents.

Stage 6. State registration of enterprises formed as a result of division.

Step 7. Exchange of written commitments for corporate rights of enterprises

created as a result of the division.

Stage 8. Compilation and signing of distribution balances between the predecessor

company and successors.

Stage 9. Exclusion of the reorganized enterprise from the state register.

39.

• Upon separation from the existing enterprise, one or morestructural subdivisions are separated, which are registered

as new enterprises. The property rights and obligations of

the reorganized enterprise are transferred to each of the

successor enterprises according to the distribution balance

in the relevant parts.

• Upon separation, the reorganized enterprise continues its

financial and economic activities and is not excluded from

the state register, but only changes are made to the

constituent documents in accordance with applicable law.

• During the division and separation, part of the property

rights and obligations may be transferred not to new

enterprises, but to already operating entities.

40.

• When enterprises are unbundled, a distributionbalance sheet is drawn up - this is the balance sheet

of an enterprise that is reorganized by division or

allocation on the day of its termination. It reflects the

separate items of assets and liabilities distributed

between it and the successor companies.

• The distribution balance is drawn up by the

commission on termination of the legal entity (in case

of division) or by the commission on separation (in

case of separation of the enterprise).

• The distribution balance is approved by the

participants of the legal entity or the higher body that

made the decision to terminate (allocate) it.

41.

• Transformation is a method of reorganization, which involveschanging the form of ownership or organizational and legal form

without terminating the economic activity of the enterprise.

• The transformation is carried out in order to bring the legal form of

organization of economic activity in line with the internal and

external conditions of doing business. The reasons for the

reorganization of the enterprise through transformation may be:

• change of tax legislation;

• the need to expand funding for growing economic activity of the

enterprise;

• obtaining opportunities to attract additional capital from the

financial market;

• minimization of the risk of establishing control over the company by

an external investor or one of the shareholders;

• achieving greater openness of the company to attract investors or,

conversely, reduce the level of publicity of the enterprise.

42.

The most common examples of enterprisetransformation are:

the limited liability company is reorganized into a joint

stock company;

the private enterprise is reorganized into a limited liability

company;

a closed joint stock company is transformed into an open

one.

For example, in the transformation of a closed joint stock

company into an open one, the owners are interested

in greater publicity of the enterprise in order to ensure

the attraction of external investment resources to

finance the expansion of production.

43.

Transformation of business entities may be carried out voluntarily, ieby decision of the owners, or necessarily in accordance with the

provisions of the Civil Code of Ukraine, in the following cases:

• 1) a general partnership is liquidated if there is one participant left

in its owners. He has the right within 6 months from the moment

when he became the sole participant, to transform such a company

into another company in the manner prescribed by the Civil Code of

Ukraine;

• 2) a limited partnership (trust) is liquidated when all depositors

withdraw from its members.

• 3) a limited liability company and a joint stock company must

comply with the requirements for the size of their net assets. If they

are insufficient to prevent compulsory liquidation in accordance

with the law, the company may be transformed into another

organizational and legal form, in which there are no mandatory

requirements for the amount of net assets.

44.

The transformation of the enterprise is carried out in the followingstages:

• Stage 1. Adoption by the general meeting participants

(shareholders) of the decision to terminate the company by

transformation.

• Stage 2. Notification of the state registrar on the termination of the

company and the appointment of a commission to carry out its

transformation.

• Submission of documents to the state registrar for registration of

termination of a legal entity shall be carried out not later than the

next day from the moment of making the relevant decision by the

general meeting of owners.

• The Commission on Termination of the Company shall publish in

the official printed publications a notice on the termination of the

legal entity, on the procedure and terms of the application by

creditors of claims against it. This period shall not be less than two

months from the date of publication of the notice of termination of

the legal entity.

45.

• Stage 3. Submission to the tax authority of a package of documents forderegistration of the taxpayer.

• Stage 4. Notification of social insurance funds on the decision to transform

the enterprise.

• Stage 5. Carrying out work with creditors of the transforming enterprise:

notification of creditors about carrying out reorganization of the company

in the form of transformation; receiving creditors' claims for repayment

(including early) of accounts payable.

• Creditors may submit their claims to the company for a period of not less

than 2 months.

• Stage 6. The beginning of the procedure of conversion of the rights of

participants (shareholders) to share (shares) in the authorized capital of

the transformed company.

• The first part of the conversion procedure involves the formation of debts

to participants (shareholders) to receive shares (stakes) in the authorized

capital of the successor. The corporate rights of the enterprise being

reorganized are exchanged for written commitments to issue the

appropriate number of corporate rights to the enterprise being created.

46.

• Stage 7. Compilation of the register of creditors' claims, repaymentor rejection of claims, preparation of the transfer deed containing |

information on the succession of all obligations of the company to

all its creditors and debtors.

• Failure to submit a properly drafted transfer deed to the state

registration body is grounds for refusing to make an entry in the

unified state register on termination of the legal entity and state

registration of the created legal entity - successor (Part 4 of Article

107 of the Civil Code of Ukraine).

• Stage 8. Convening a constituent assembly and deciding on the

establishment of the enterprise and approval of changes to the

founding documents.

• Stage 9. State registration of enterprise transformation, renewal of

licenses.

• Stage 10. Completion of the procedure of conversion of the rights

of participants (shareholders) in the authorized capital.

47.

• The second part of the conversion procedure is related tothe repayment by the successor of the debt to the

shareholders (participants) on receipt in the authorized

capital. Written commitments are exchanged for the

corporate rights of the company created as a result of the

transformation.

• When one enterprise is transformed into another, all

property rights and obligations of the former enterprise are

transferred to the newly established enterprise.

• The size of the share (in percent) of each founder

(participant, shareholder) in the authorized capital of the

reorganized enterprise must be equal to the size of his

share in the authorized capital of the company created as a

result of transformation.

48.

When transforming a closed joint-stockcompany into an open one, the nominal value

and number of shares of the joint-stock

company created as a result of the

transformation must be equal to the nominal

value and number of shares of the joint-stock

company at the time of the reorganization

decision.

49.

50.

Test questions

1. What is the reorganization of enterprises?

2. What are the reasons for the reorganization of enterprises?

3. What forms of reorganization of enterprises are distinguished in the economic literature?

4. Which document defines the conditions for reorganization of enterprises?

5. In which cases is the reorganization of enterprises aimed at their consolidation?

6. What types of reorganization of the enterprise aimed at their consolidation, do you know?

7. What is the difference between horizontal and vertical consolidation of enterprises?

8. In what order is the merger and acquisition of enterprises?

9. What is the transfer balance of the enterprise?

10. Name the reasons for the unbundling of enterprises.

11. In what order is the division of enterprises?

12. How is the division of the enterprise different from the separation of the enterprise?

13. What is the essence of the transformation of the enterprise?

14. In which cases is the transformation of the enterprise regulated by law?

15. How to transform the company?

law

law