Similar presentations:

Inflation

1.

INFLATIONPrepared by Shlyakhtitskaya Anna

Second year student

Institute of Finance Economics and Management

Ek-b-18-6o group

2.

WHAT IS INFLATION?This is a general increase in prices in the country over a long period. When people talk

about inflation, they often mean the depreciation of money: for the same amount, after a

while you can buy less goods. With inflation, the cost of all goods does not necessarily

increase; some may even fall in price, but overall, the price level in the country is growing.

3.

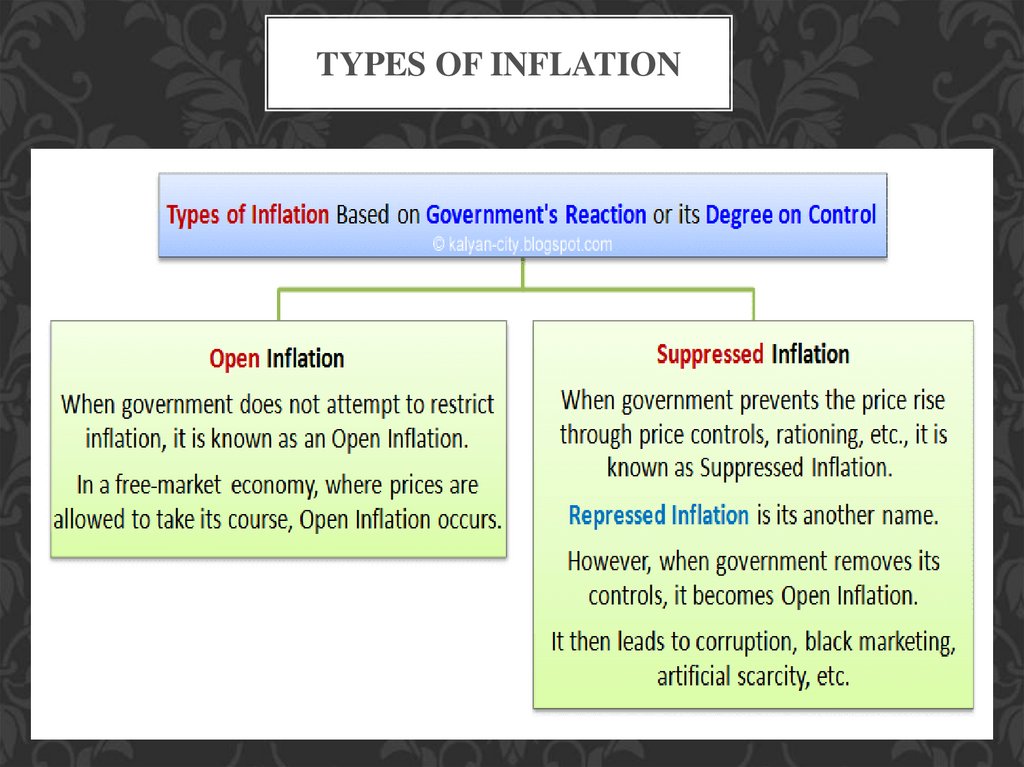

TYPES OF INFLATION4.

TYPES OF INFLATION5.

TYPES OF INFLATION6.

Most of the reasons are somehow related to the amount and availabilityof money for the economy. Such factors are called monetary. Inflation

accelerates when there is more free money in the economy.

CAUSES OF OCCURRENCE

interest on loans is reduced

taxes are reduced

production volumes are falling

budget spending is rising

salary is growing

7.

Prices even depend on how citizens themselves evaluate inflation.Economists use the term inflationary expectations - when buyers are

constantly waiting for price increases, are procured for the future

and create rush demand, which really increases the cost of goods.

Then manufacturers predict high inflation, start raising prices in

advance to offset future costs.

8.

In Russia, Rosstat considers inflation. To do this, every month,statistics look at how prices for goods and services that are included in

the consumer basket change. A consumer basket is a set of

approximately 700 goods and services, ranging from food to

smartphones and cars.

MEASUREMENT

Price changes are observed in all regions, and then they calculate the

average inflation rate for the country. A similar calculation technique is

used by statistics in other countries.

9.

COMPONENTSThe depreciation of money occurs for two reasons: due to inflation of

demand and costs.

Demand for inflation occurs when the

amount of money earned by the

population is higher than the value of

goods and services produced by all

these people. As a result, prices begin

to rise in order to balance supply and

demand.

Supply inflation begins when the cost of

goods and services increases - for

example, due to rising tariffs. To

maintain profitability, manufacturers are

raising prices.

10.

CONSEQUENCES OF INFLATIONModerate inflation is needed for the development of the economy: if

prices do not rise or even fall, it becomes unprofitable to produce new

goods. Economists call the annual increase in prices by 1-2%

acceptable. When this indicator exceeds 10% per year, and inflation

turns from moderate to galloping, it negatively affects the economy.

11.

The state is trying to regulate inflation. If you need to speed itup, state sign prints more money. At the same time, the

Central Bank lowers the key rate - the percentage at which

the state provides loans to commercial banks. They, in turn,

can lend to the population and entrepreneurs at a low rate.

WHO AND HOW HOLDS

BACK PRICES

If you need to slow inflation, the national sign prints less money, and the

Central Bank raises the key rate. Banks do not borrow from the state, but

attract citizens to open deposits. People stop spending and carry money

on deposits. Loan rates are rising. Money turnover decreases, prices and

demand for goods fall.

12.

INFLATION IN RUSSIA FOR 2020In March 2020, the inflation rate in Russia amounted to 0.55%, which is 0.22 more than

in February 2020 and 0.23 more than in March 2019. Along with this, inflation since

the beginning of 2020 amounted to 1.29%, and on an annualized basis - 2.55%. In

2020, Russia takes 1st place in terms of inflation in the world.

13.

THANK YOU FORATTENTION

finance

finance