Similar presentations:

Assets, Depreciation, Liabilities and Balance sheet

1.

Assets, Depreciation,Liabilities and

Balance sheet

1

2.

Balance SheetBalance Sheet is a report

on the financial condition

of the company at a

certain date. Date of the

report can be any, but

usually it's the end of the

month, quarter or fiscal

year.

2

3.

Сomposition of the balanceThe balance includes assets and

liabilities, the results of which are.

3

4.

Assets in the balance sheet arearranged in descending order of

degree of liquidity.

4

5.

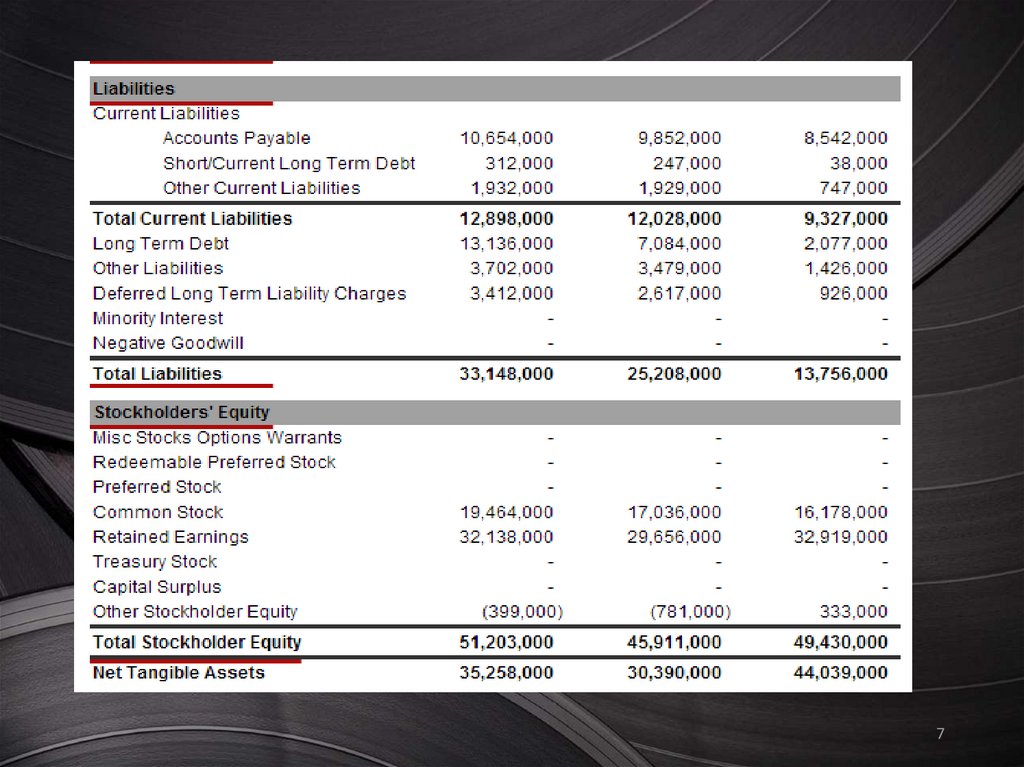

Liabilities that in international practice consists ofliabilities and Stockholders’ Equity, are displayed as

follows:

Liabilities are presented by descending of their

requirements (repayment);

Article equity are placed after the commitment.

5

6.

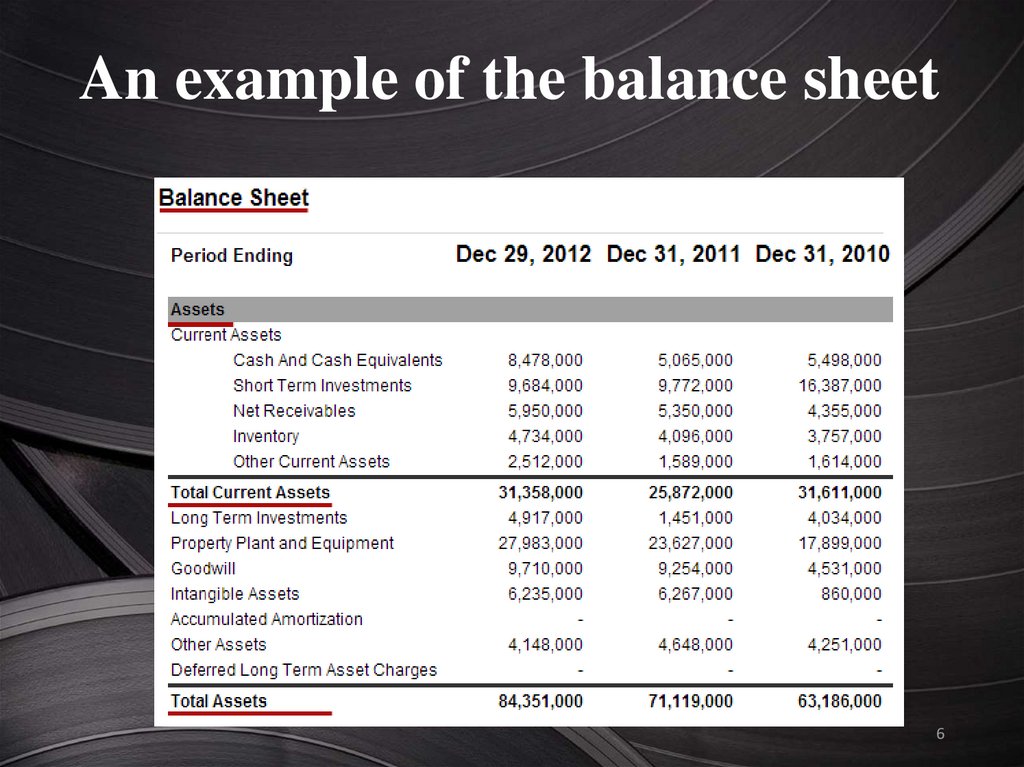

An example of the balance sheet6

7.

78.

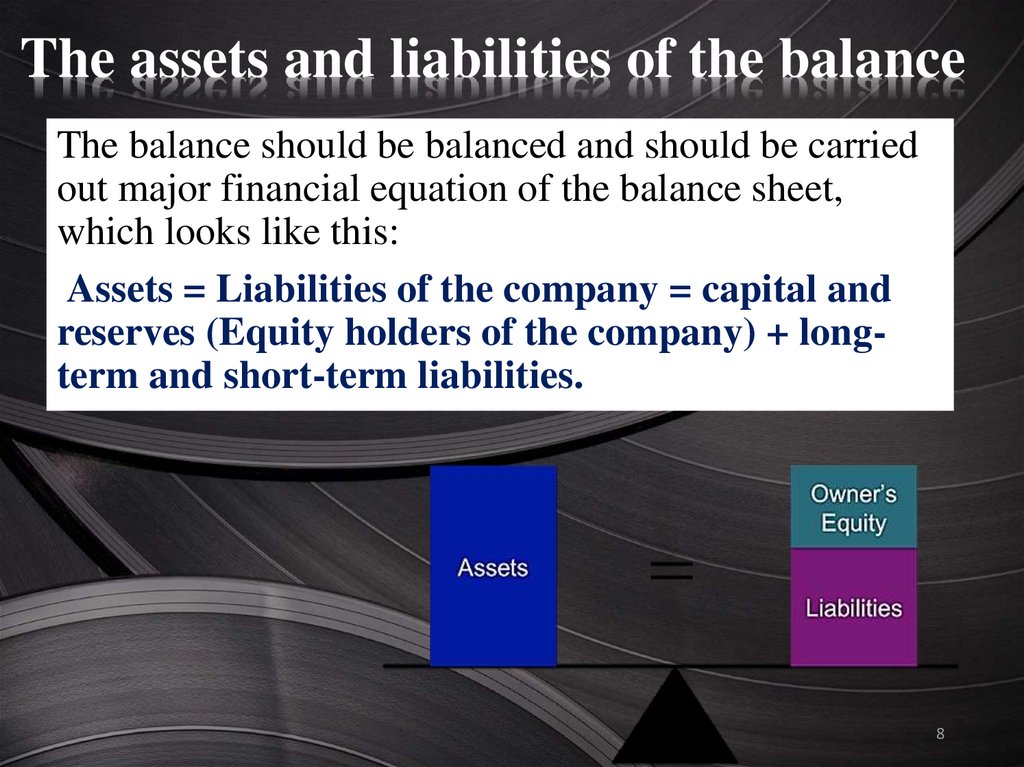

The assets and liabilities of the balanceThe balance should be balanced and should be carried

out major financial equation of the balance sheet,

which looks like this:

Assets = Liabilities of the company = capital and

reserves (Equity holders of the company) + longterm and short-term liabilities.

8

9.

Stockholders' EquityStockholders' Equity is the main source of

financing of the enterprise. . It represents the

aggregate amount of investments of shareholders

and net profit.

9

10.

The composition of the company'sown capital balance comprises:

Preferred

Stock

Common

Stock

Capital

Surplus

Retained

Earnings

Other

Stockholder

Equity

10

11.

Monetary and nonmonetary balance sheet itemsBalance Sheet Items are divided into:

Monetary

Nonmonetary

11

12.

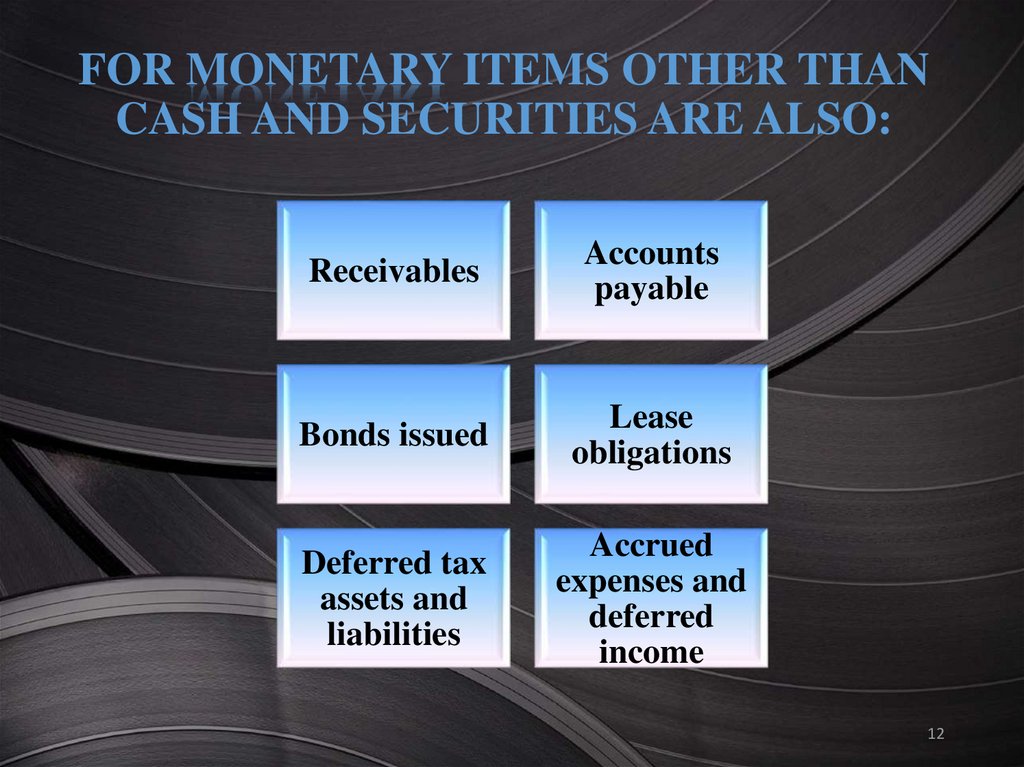

FOR MONETARY ITEMS OTHER THANCASH AND SECURITIES ARE ALSO:

Receivables

Accounts

payable

Bonds issued

Lease

obligations

Deferred tax

assets and

liabilities

Accrued

expenses and

deferred

income

12

13.

All the rest - it's nonmonetary items.That is, stocks of

goods and raw

materials are noncash items.

13

14.

The size of the monetary and nonmonetary items in the balance sheetrestated for the changes in the

exchange rate

14

english

english