Similar presentations:

Topic 1. Introduction

1.

TOPIC 1INTRODUCTION

Click to add text TO FINANCE

Elena Rogova, Professor, erogova@hse.ru

10.01.2022

TOPIC 1 – KEY CONCEPTS OF FINANCE

1

2.

1-1KEY CONCEPTS OF FINANCE

Elena Rogova, Professor, erogova@hse.ru

10.01.2022

KEY CONCEPTS OF FINANCE

2

3.

WHAT IS FINANCE?• Finance is the study of how and under what

terms savings (money) are allocated between

lenders and borrowers.

– Finance is distinct from economics in that it

addresses not only how resources are allocated

but also under what terms and through what

channels

• Financial contracts or securities occur whenever

funds are transferred from issuer to buyer.

10.01.2022

KEY CONCEPTS OF FINANCE

3

4.

REAL VERSUS FINANCIAL ASSETS• Real assets are tangible things owned by

persons and businesses

–

–

–

–

Residential structures and property

Major appliances and automobiles

Office towers, factories, mines

Machinery and equipment

• Financial assets are what one individual has lent to

another

– Consumer credit

loans

– Mortgages

10.01.2022

KEY CONCEPTS OF FINANCE

4

5.

FINANCE EXAMPLES• Investing personal money in stocks, bonds, or guaranteed

investment certificates (GICs)

• Borrowing money from institutional investors by issuing bonds

on behalf of a public company

• Lending money to people by providing them a mortgage to

buy a house with

• Using Excel spreadsheets to build a budget and financial

model for a corporation

• Saving personal money in a high-interest savings account

• Developing a forecast for government spending and revenue

collection

10.01.2022

KEY CONCEPTS OF FINANCE

5

6.

FINANCE: EXAMPLES (1)• If you receive $1 million today, then what decision would you

make regarding consumption and investment? Suppose you

spend (consume)

$100,000 now. This leaves you with $900,000. You can

postpone consumption to future time periods by investing

the $900,000 today.

• On the other hand, what if you have $20,000 but need to

consume $30,000. You can borrow the

$10,000 and pay it back in a future period along with the

interest.

10.01.2022

KEY CONCEPTS OF FINANCE

6

7.

FINANCE: EXAMPLES (1)• If you receive $1 million today, then what decision would you

make regarding consumption and investment?

• Suppose you spend (consume) $100,000 now. This leaves you

with $900,000. You can postpone consumption to future time

periods by investing the $900,000 today.

• On the other hand, what if you have $20,000 but need to

consume $30,000. You can borrow the $10,000 and pay it

back in a future period along with the interest.

10.01.2022

KEY CONCEPTS OF FINANCE

7

8.

FINANCE: EXAMPLES (2)• A firm must spend $100 million for the required assets if a proposed

project is approved. Important issues are:

• Should the project be accepted or rejected?

• What do investors demand as a (minimum acceptable) project rate of

return?

• What are the project’s forecasted future cash flows?

• How risky are these forecasted cash flows?

• Where will the $100 million come from, i.e., what mix of equity and debt

financing should be used?

• If a firm has $200 million of cash flow, but needs reinvest $100 million, what

should be done with the remaining $100 million of cash?

10.01.2022

Pay it out as a dividend or repurchase some stock?

KEY CONCEPTS OF FINANCE

8

9.

FINANCE: EXAMPLES (3)• A mutual fund manager that manages a fund with

$10 billion portfolio receives an additional $100

million in cash from new investors.

• Which stocks or bonds to purchase?

• How will any proposed new investments affect the

expected return and risk of the overall portfolio?

10.01.2022

KEY CONCEPTS OF FINANCE

9

10.

GENERAL AREAS OF FINANCE• Financial Markets and Institutions: banks,

insurance companies, savings and loans, and

credits unions

• Investments: determining the values, risks, and returns

of financial assets (stocks, bonds) and the optimal mix

of securities to be held in a portfolio of investments

• Financial Services: how to invest money (home

purchase, financial stability, budgeting)

• Managerial (Business) Finance: firms’ decisions

about their cash flows (plant expansion, credit terms,

• inventory, cash on hand, earnings, dividends,…)

10.01.2022

KEY CONCEPTS OF FINANCE

10

11.

FINANCE DISCIPLINES• Public finance is about the taxing and spending

activities of the government. Focus is on microeconomic

functions of government – policies that affect overall

unemployment or price levels are left for

macroeconomics. Scope of public finance is unclear –

government has role in many activities, but focus will be

on taxes and spending.

• Corporate finance is every decision that a business

makes has financial implications, and any decision which

affects the finances of a business.

• Personal Finance is managing your personal budget,

money and investment.

10.01.2022

KEY CONCEPTS OF FINANCE

11

12.

FINANCE THEORY• Finance Theory is the study of the behavior of

individuals in the inter-temporal allocation (over time)

of their resources in an uncertain environment, and the

study of the function of economic institutions and

markets in making these allocations possible.

• Financial theory consists of:

the set of concepts that help to organize one’s thinking

about how to allocate resources over time;

the set of quantitative models used to help evaluate

alternatives, make decisions, and implement them. These

concepts and models apply at all levels and scales of

decision making.

10.01.2022

KEY CONCEPTS OF FINANCE

12

13.

BASIC TENET OF FINANCE• The existence of economic organizations (e.g. firms

and governments) facilitates the satisfaction of

people’s consumption preferences.

• Two features: The costs and benefits of financial

decisions are

1) Spread out over time

2) Usually not known with certainty in advance by

either the decision makers or anybody else.

10.01.2022

KEY CONCEPTS OF FINANCE

13

14.

THE VALUE CREATION FUNCTION OF FINANCE• The practice of finance exists for the creation of value

• Financial contracting brings about the substitution of

real wealth (i.e. real business assets) for financial

wealth (i.e. securities)

• Investing in financial securities has better attributes

than in real assets.

• Value is created in the real assets held by businesses,

and then transmitted into the value of financial

wealth issued by businesses and held by investors.

10.01.2022

KEY CONCEPTS OF FINANCE

14

15.

BASIC CONCEPTS OF FINANCE10.01.2022

Risk and Return

Time value of Money

Cash is King

Financial Markets Efficiency

KEY CONCEPTS OF FINANCE

15

16.

BASIC CONCEPTS OF FINANCE: RISK AND RETURN• The higher is the risk of investments, the higher is the

return that investors require

Practical implications

Financial assets valuation,

Capital

investments projects

Companies valuation,

Credit ratings assignment etc.

10.01.2022

decision-making,

KEY CONCEPTS OF FINANCE

16

17.

THREE TYPES OF RISK• Autonomous risk

related to a specific project

or business unit

• Corporate risk

related to a whole company

A

B

C

Y

X

N

• Market risk

Related to a market portfolio

of securities (stocks and bonds)

10.01.2022

KEY CONCEPTS OF FINANCE

17

18.

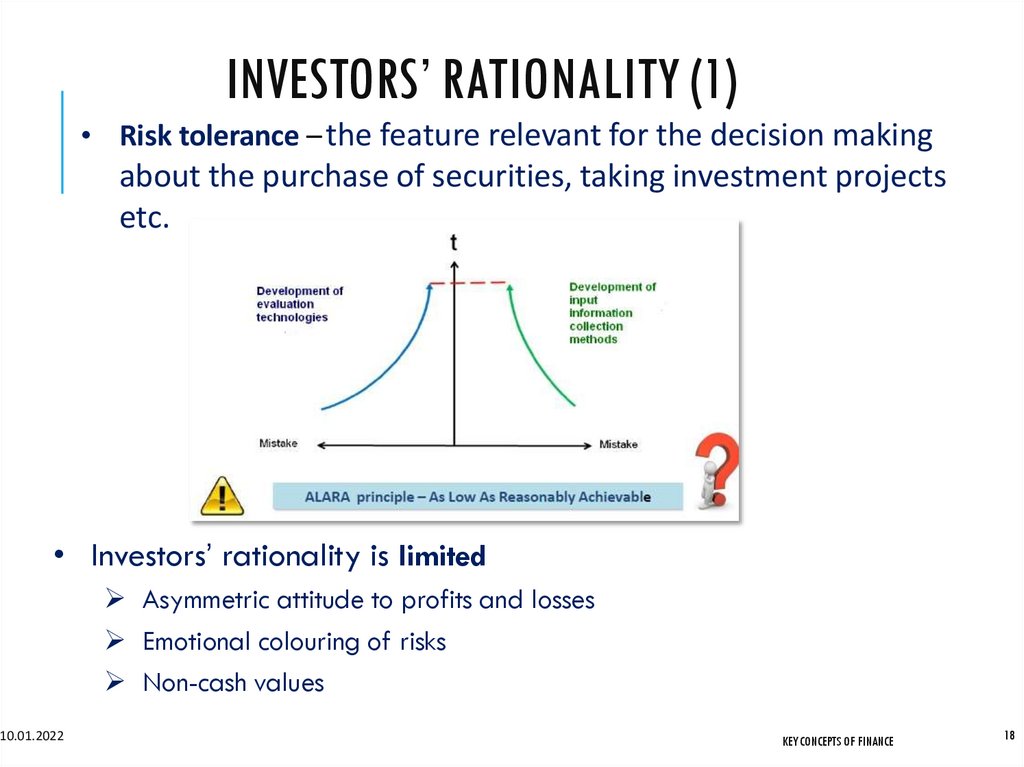

INVESTORS’ RATIONALITY (1)• Risk tolerance – the feature relevant for the decision making

about the purchase of securities, taking investment projects

etc.

• Investors’ rationality is limited

Asymmetric attitude to profits and losses

Emotional colouring of risks

Non-cash values

10.01.2022

KEY CONCEPTS OF FINANCE

18

19.

TEST 1• You can choose between two games

(1) You throw a dice and got $60 if 6 appears

OR

(2)You throw a dice and got $10 regardless which number

appears

(2)Which game would you choose?

10.01.2022

KEY CONCEPTS OF FINANCE

19

20.

TEST 1• You can choose between two games

(1) You throw a dice and got $60 if 6 appears

OR

(2) You throw a dice and got $10 regardless which number appears

• Which game would you choose?

Test 1 (modified)

(1) You throw a dice and got $60,000 if 6 appears

OR

(2)You throw a dice and got $10,000 regardless which number

appears

• Which game would you choose now?

10.01.2022

KEY CONCEPTS OF FINANCE

20

21.

RISK TOLERANCE• If you prefer the first game, you are a RISKTAKER

• It you choose the second one, you are a RISKAVERTER

– Risk aversion is a typical feature of rational investors

• If you are indifferent to your choice, you are

RISK-NEUTRAL

10.01.2022

KEY CONCEPTS OF FINANCE

21

22.

BASIC CONCEPTS OF FINANCE: TIMEVALUE OF MONEY

• One ruble in your pocket today has more value

than the right to get this one ruble in a couple of

days

Practical implications of the concept

• Interest rates term structure,

• Financial assets valuation,

• Business valuation etc.

10.01.2022

KEY CONCEPTS OF FINANCE

22

23.

10.01.202223

24.

10.01.2022KEY CONCEPTS OF FINANCE 24

25.

TEST 2• You have won in a competition and now can choose a

prize:

(1) 5,000 rubles now

OR

(2) 10,000 rubles in a year

• Which prize would you choose?

10.01.2022

KEY CONCEPTS OF FINANCE

25

26.

TEST 2• You have won in a competition and now can choose a prize:

(1) 5,000 rubles now

OR

(2) 10,000 rubles in a year

• Which prize would you choose?

Test 2 (modified)

• You have won in a competition and now can choose a prize:

(1) 5,000,000 rubles now

OR

(2) 10,000,000 rubles in a year

• Which prize would you choose now?

10.01.2022

KEY CONCEPTS OF FINANCE

26

27.

INVESTORS’ RATIONALITY (2)• Investors’ rationality can be limited by:

– Asymmetric attitude

to big and small amounts of money

– Asymmetric attitude

to close and far future

10.01.2022

KEY CONCEPTS OF FINANCE

27

28.

BASIC CONCEPTS OF FINANCE: PRIORITY TO CASHFLOWS (CASH IS KING)

• CASH can be immediately used for consumption or business

objectives

• Accountancy-based indicators do not fully reflect cash flows:

Accruals policy

Non-cash profits and losses

Practical implications of the concept

Financial reporting standards,

Performance indicators of companies and their divisions

Capital investments decision making and financial assets valuation

10.01.2022

KEY CONCEPTS OF FINANCE

28

29.

INVESTORS’ RATIONALITY (3)Investors’ rationality is limited by:

– The historical belief in “paper-fixed” financial results

got on the base of accountancy

10.01.2022

KEY CONCEPTS OF FINANCE

29

30.

BASIC CONCEPTS OF FINANCE:FINANCIAL MARKETS EFFICIENCY

Efficient markets hypothesis by E. Fama (EMH)

At the efficient capital market, all the information available is fully

reflected in stock prices

That’s why the new information immediately changes stock prices –market

signals should be considered by decision-takers

• Financial markets data provides the fair asset pricing

Practical implications of the concept

Investors relations

Mergers and

acquisitions Dividend

payments Personal

investments

10.01.2022

KEY CONCEPTS OF FINANCE

30

31.

INVESTORS’ RATIONALITY (4)• Investors’ rationality is limited by:

– Lack of information

asymmetric access to information for different

players

– Subjective attitude to market signals

emotional colouring

– Costly information processing and limited

ability to interpret the information

10.01.2022

KEY CONCEPTS OF FINANCE

31

finance

finance