Similar presentations:

Financial econometrics

1. Financial Econometrics

Dr. Kashif SaleemAssociate Professor (Finance)

University of Wollongong in Dubai

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

1

2. Univariate time series models

Univariate time series modelling–Moving average processes

–Autoregressive processes

–ARMA processes

–ARIMA process

–Exponential Smoothing

–Forecasting in Econometrics

–Vector Autoregressive Models

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

2

3. Moving Average Processes

Let ut (t=1,2,3,...) be a sequence of independently and identically

2

distributed (iid) random variables with E(ut)=0 and Var(ut)= , then

yt = + ut + 1ut-1 + 2ut-2 + ... + qut-q

is a qth order moving average model MA(q).

Its properties are

2

2

2

...

q

1

2

E(yt)= ; Var(yt) = 0 = (1+

) 2

Covariances

( s s 1 1 s 2 2 ... q q s ) 2

s

0 for s q

for

s 1,2,..., q

Quantitative Economic Analysis – 2016, Dr. Kashif Saleem (UOWD)

3

4. Autoregressive Processes

An autoregressive model of order p, an AR(p) can be expressed as

y t 1 y t 1 2 y t 2 ... p y t p u t

Or using the lag operator notation:

Lyt = yt-1

Liyt = yt-i

p

y t i y t i u t

i 1

p

or y Li y u

t

i

t

t

i 1

or

( L) y t u t

where

( L) 1 ( 1 L 2 L2 ... p Lp )

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

.

4

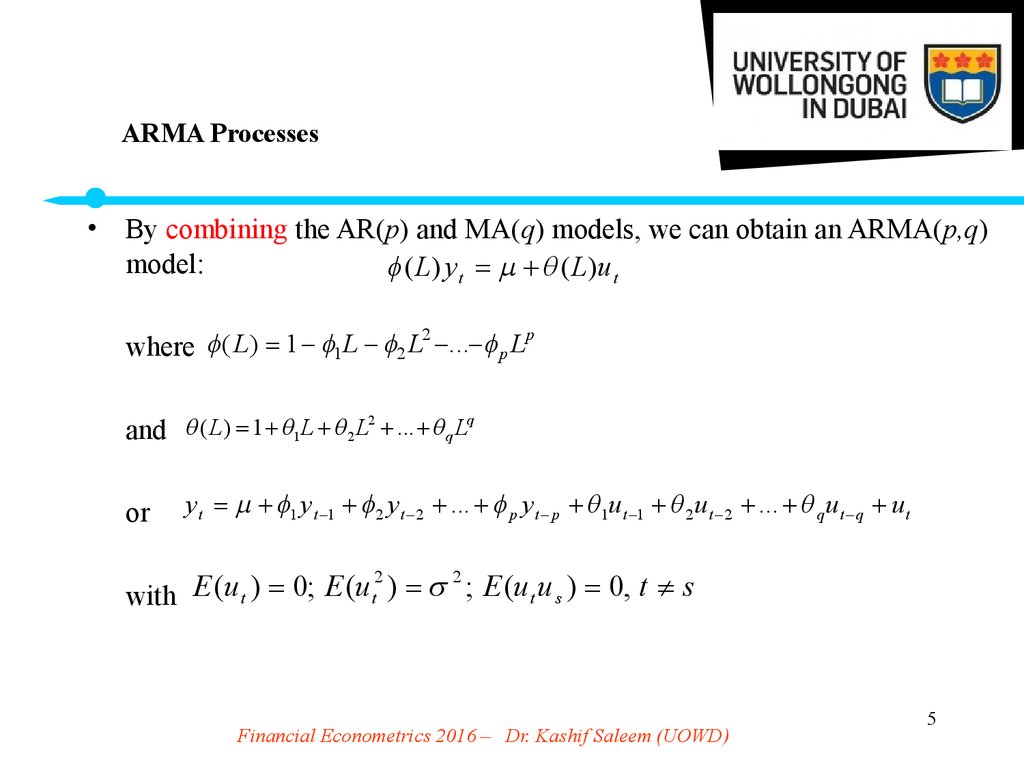

5. ARMA Processes

By combining the AR(p) and MA(q) models, we can obtain an ARMA(p,q)

model:

( L) y t ( L)u t

2

p

where ( L) 1 1 L 2 L ... p L

2

q

and ( L) 1 1L 2 L ... q L

or

y t 1 y t 1 2 y t 2 ... p y t p 1u t 1 2 u t 2 ... q u t q u t

2

2

E

(

u

)

0

;

E

(

u

)

; E (u t u s ) 0, t s

t

t

with

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

5

6. Summary of the Behaviour of the acf for AR and MA Processes

An autoregressive process has• a geometrically decaying acf

• number of non zero points of pacf = AR order

A moving average process has

• Number of non zero points of acf = MA order

• a geometrically decaying pacf

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

6

7. Some sample acf and pacf plots for standard processes

The acf and pacf are not produced analytically from the relevant formulae for a model of thattype, but rather are estimated using 100,000 simulated observations with disturbances drawn

from a normal distribution.

ACF and PACF for an MA(1) Model: yt = – 0.5ut-1 + ut

0.05

0

1

2

3

4

5

6

7

8

9

10

-0.05

acf and pacf

-0.1

-0.15

-0.2

-0.25

-0.3

acf

-0.35

pacf

-0.4

-0.45

Lag

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

7

8. ACF and PACF for an MA(2) Model: yt = 0.5ut-1 - 0.25ut-2 + ut

0.4acf

0.3

pacf

0.2

acf and pacf

0.1

0

1

2

3

4

5

6

7

8

9

10

-0.1

-0.2

-0.3

-0.4

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

8

9. ACF and PACF for a slowly decaying AR(1) Model: yt = 0.9yt-1 + ut

10.9

acf

pacf

0.8

0.7

acf and pacf

0.6

0.5

0.4

0.3

0.2

0.1

0

1

2

3

4

5

6

7

8

9

10

-0.1

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

9

10. ACF and PACF for a more rapidly decaying AR(1) Model: yt = 0.5yt-1 + ut

0.60.5

acf

pacf

acf and pacf

0.4

0.3

0.2

0.1

0

1

2

3

4

5

6

7

8

9

10

-0.1

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

10

11. ACF and PACF for a more rapidly decaying AR(1) Model with Negative Coefficient: yt = -0.5yt-1 + ut

0.30.2

0.1

0

acf and pacf

1

2

3

4

5

6

7

8

9

10

-0.1

-0.2

-0.3

-0.4

acf

pacf

-0.5

-0.6

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

11

12. ACF and PACF for a Non-stationary Model (i.e. a unit coefficient): yt = yt-1 + ut

10.9

acf

pacf

0.8

acf and pacf

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

1

2

3

4

5

6

7

8

9

10

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

12

13. ACF and PACF for an ARMA(1,1): yt = 0.5yt-1 + 0.5ut-1 + ut

0.80.6

acf

pacf

acf and pacf

0.4

0.2

0

1

2

3

4

5

6

7

8

9

10

-0.2

-0.4

Lags

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

13

14. Building ARMA Models - The Box Jenkins Approach

Box and Jenkins (1970) were the first to approach the task of estimating

an ARMA model in a systematic manner. There are 3 steps to their

approach:

1. Identification

2. Estimation

3. Model diagnostic checking

Step 1:

- Involves determining the order of the model.

- Use of graphical procedures

- A better procedure is now available

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

14

15. Building ARMA Models - The Box Jenkins Approach (cont’d)

Step 2:- Estimation of the parameters

- Can be done using least squares or maximum likelihood depending

on the model.

Step 3:

- Model checking

Box and Jenkins suggest 2 methods:

- deliberate overfitting –step 1 sugest lag2 – but we use lag 5

- residual diagnostics --- acf, pacf, LB test, etc.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

15

16. Some More Recent Developments in ARMA Modelling

Identification would typically not be done using acf’s.

using information criteria, which embody 2 factors

- a term which is a function of the RSS

- some penalty for adding extra parameters

The object is to choose the number of parameters which minimises the

information criterion.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

16

17. Information Criteria for Model Selection

The three most popular criteria are Akaike’s (1974) information criterion

(AIC), Schwarz’s (1978) Bayesian information criterion (SBIC), and the

Hannan-Quinn criterion (HQIC).

AIC ln( 2 ) 2 k / T

k

SBIC ln( ˆ 2 ) ln T

T

2

k

HQIC ln( ˆ 2 )

ln(ln(T ))

T

where k = p + q + 1, T = sample size. So we min. IC s.t.

p p, q q

SBIC embodies a stiffer penalty term than AIC.

• Which IC should be preferred if they suggest different model orders?

– SBIC is strongly consistent but (inefficient).

– AIC is not consistent, and will typically pick “bigger” models.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

17

18. ARIMA Models

As distinct from ARMA models. The I stands for integrated.

An integrated autoregressive process is one with a characteristic root

on the unit circle.

Typically researchers difference the variable as necessary and then

build an ARMA model on those differenced variables.

An ARMA(p,q) model in the variable differenced d times is

equivalent to an ARIMA(p,d,q) model on the original data.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

18

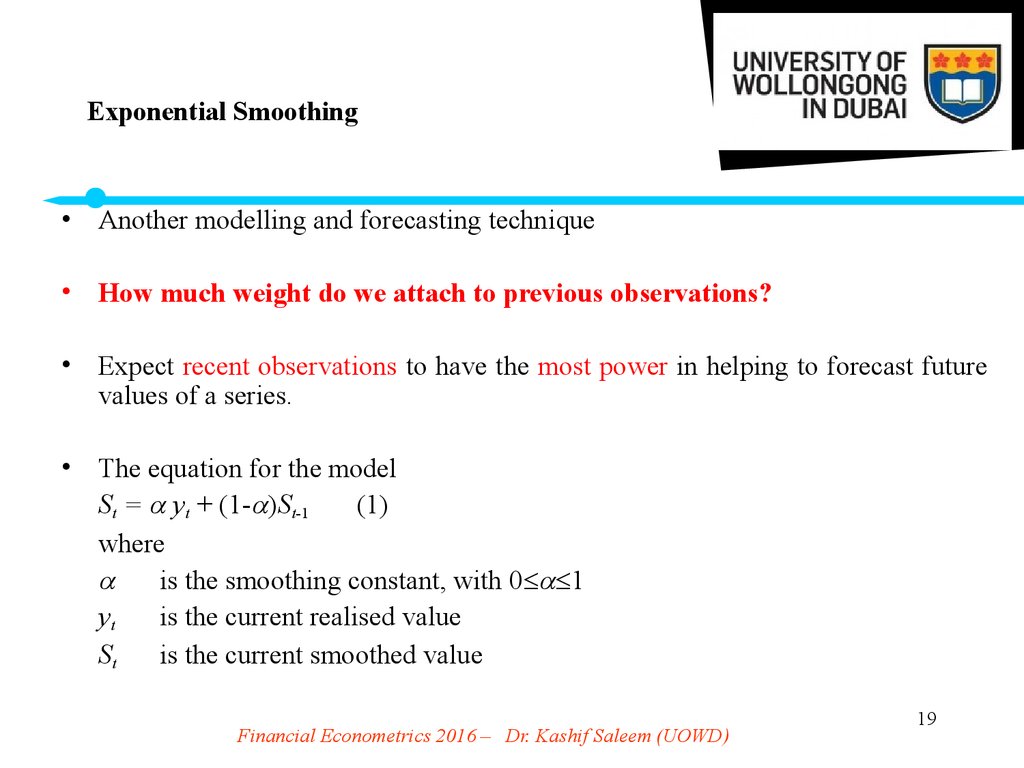

19. Exponential Smoothing

• Another modelling and forecasting technique• How much weight do we attach to previous observations?

• Expect recent observations to have the most power in helping to forecast future

values of a series.

• The equation for the model

St = yt + (1- )St-1

(1)

where

is the smoothing constant, with 0 1

yt

is the current realised value

St

is the current smoothed value

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

19

20. Forecasting in Econometrics

Forecasting = prediction.

An important test of the adequacy of a model.

We can distinguish two approaches:

- Econometric (structural) forecasting

- Time series forecasting

To understand how to construct forecasts, we need the idea of conditional

expectations:

E(yt+1 t )

We cannot forecast a white noise process: E(ut+s t ) = 0 s > 0.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

20

21. In-Sample Versus Out-of-Sample

• Expect the “forecast” of the model to be good in-sample.• Say we have some data - e.g. monthly FTSE returns for 120 months: 1990M1 –

1999M12. We could use all of it to build the model, or keep some observations

back:

• A good test of the model since we have not used the information from

1999M1 onwards when we estimated the model parameters.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

21

22. Models for Forecasting

Time Series Models

The current value of a series, yt, is modelled as a function only of its previous

values and the current value of an error term (and possibly previous values of

the error term).

Models include:

• simple unweighted averages

• exponentially weighted averages

• ARIMA models

• Non-linear models – e.g. threshold models, GARCH, bilinear models, etc.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

22

23. Forecasting with MA Models

• An MA(q) only has memory of q.e.g. say we have estimated an MA(3) model:

yt = + 1ut-1 + 2ut-2 + 3ut-3 + ut

yt+1 = + 1ut + 2ut-1 + 3ut-2 + ut+1

yt+2 = + 1ut+1 + 2ut + 3ut-1 + ut+2

yt+3 = + 1ut+2 + 2ut+1 + 3ut + ut+3

• We are at time t and we want to forecast 1,2,..., s steps ahead.

• We know yt , yt-1, ..., and ut , ut-1….

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

23

24. Forecasting with MA Models (cont’d)

ft, 1 = E(yt+1 t )=

=

E( + 1ut + 2ut-1 + 3ut-2 + ut+1)

+ 1ut + 2ut-1 + 3ut-2

ft, 2 = E(yt+2 t )

=

E( + 1ut+1 + 2ut + 3ut-1 + ut+2)

=

+ 2ut + 3ut-1

ft, 3 = E(yt+3 t )

=

=

+ 3ut

E( + 1ut+2 + 2ut+1 + 3ut + ut+3)

ft, 4 = E(yt+4 t )

=

ft, s = E(yt+s t )

=

s 4

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

24

25. Forecasting with AR Models

• Say we have estimated an AR(2)yt = + 1yt-1 + 2yt-2 + ut

yt+1 = + 1yt + 2yt-1 + ut+1

yt+2 = + 1yt+1 + 2yt + ut+2

yt+3 = + 1yt+2 + 2yt+1 + ut+3

ft, 1 = E(yt+1 t ) = E( + 1yt + 2yt-1 + ut+1)

= + 1E(yt) + 2E(yt-1)

= + 1yt + 2yt-1

ft, 2 = E(yt+2 t ) = E( + 1yt+1 + 2yt + ut+2)

= + 1E(yt+1) + 2E(yt)

= + 1 ft, 1 + 2yt

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

25

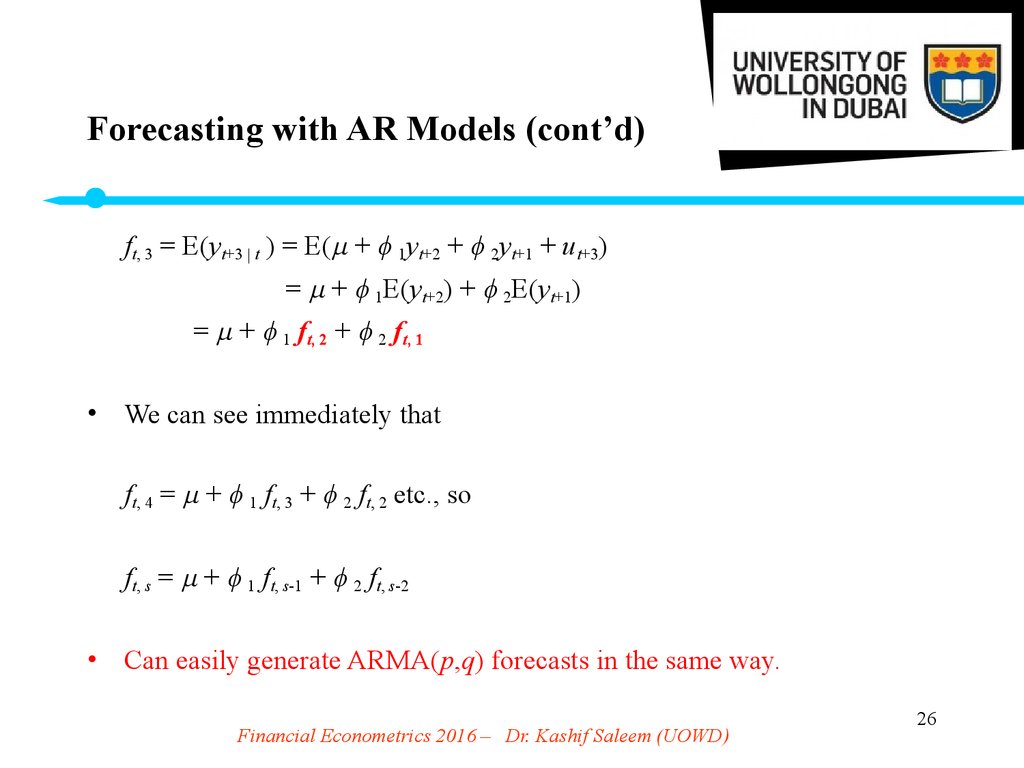

26. Forecasting with AR Models (cont’d)

ft, 3 = E(yt+3 t ) = E( + 1yt+2 + 2yt+1 + ut+3)= + 1E(yt+2) + 2E(yt+1)

= + 1 ft, 2 + 2 ft, 1

We can see immediately that

ft, 4 = + 1 ft, 3 + 2 ft, 2 etc., so

ft, s = + 1 ft, s-1 + 2 ft, s-2

Can easily generate ARMA(p,q) forecasts in the same way.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

26

27. How can we test whether a forecast is accurate or not?

Some of the most popular criteria for assessing the accuracy of time seriesforecasting techniques are:

Mean square error:

MAE is given by:

N

1

MSE

N

1

MAE

N

N

t 1

t 1

( yt s f t , s ) 2

yt s f t , s

1 N yt s f t , s

Mean absolute percentage error: MAPE 100

N t 1

yt s

Theil’s U-statistic :

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

27

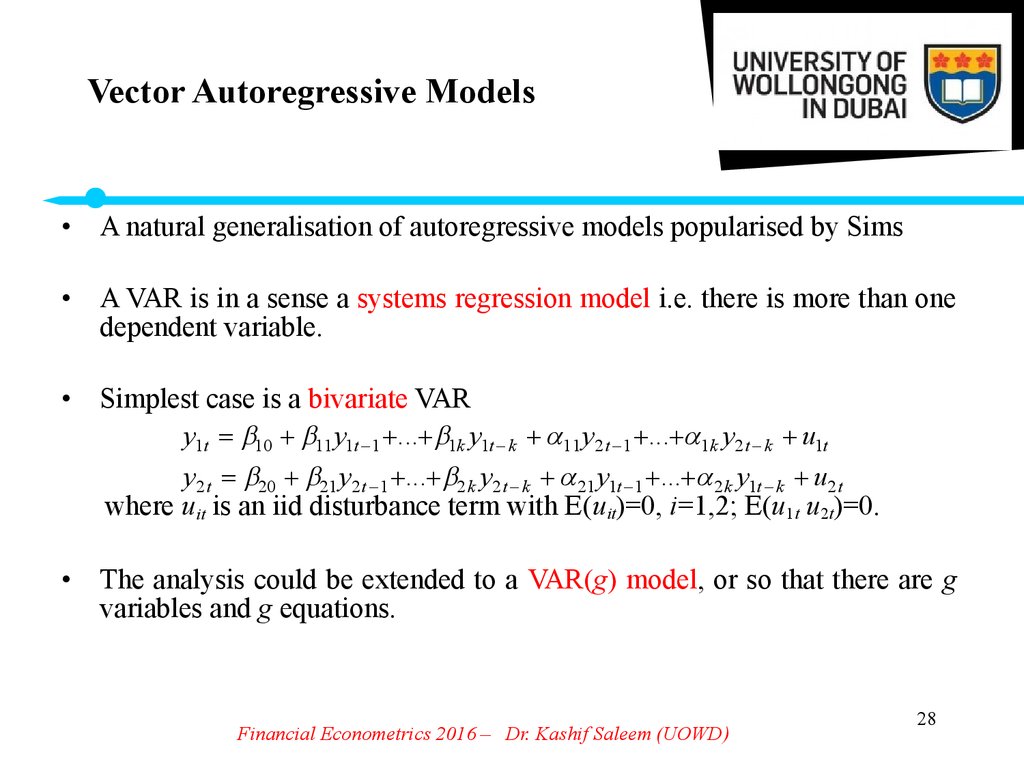

28. Vector Autoregressive Models

A natural generalisation of autoregressive models popularised by Sims

A VAR is in a sense a systems regression model i.e. there is more than one

dependent variable.

Simplest case is a bivariate VAR

y1t 10 11 y1t 1 ... 1k y1t k 11 y2 t 1 ... 1k y2 t k u1t

y2 t 20 21 y2 t 1 ... 2 k y2 t k 21 y1t 1 ... 2 k y1t k u2 t

where uit is an iid disturbance term with E(uit)=0, i=1,2; E(u1t u2t)=0.

The analysis could be extended to a VAR(g) model, or so that there are g

variables and g equations.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

28

29. Vector Autoregressive Models: Notation and Concepts

• One important feature of VARs is the compactness with which we can writethe notation. For example, consider the case from above where k=1.

• We can write this as

or

y1t 10 11 y1t 1 11 y2 t 1 u1t

y2 t 20 21 y2 t 1 21 y1t 1 u2 t

y1t 10 11 11 y1t 1 u1t

y2 t 20 21 21 y2 t 1 u2 t

or even more compactly as

yt

= 0

g 1 g 1

+ 1 yt-1

g g g 1

+ ut

g 1

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

29

30. Vector Autoregressive Models: Notation and Concepts (cont’d)

This model can be extended to the case where there are k lags of each

variable in each equation:

yt = 0

g 1

g 1

+ 1 yt-1

g g g 1

+ 2 yt-2

g g g 1

+...+

k yt-k + ut

g g g 1 g 1

We can also extend this to the case where the model includes first

difference terms and cointegrating relationships (a VECM).

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

30

31. Vector Autoregressive Models Compared with Structural Equations Models

Vector Autoregressive Models

Compared with Structural

Equations Models

Advantages of VAR Modelling

- Do not need to specify which variables are endogenous or exogenous - all are

endogenous

- Allows the value of a variable to depend on more than just its own lags or

combinations of white noise terms, so more general than ARMA modelling

- Provided that there are no contemporaneous terms on the right hand side of the

equations, can simply use OLS separately on each equation

- Forecasts are often better than “traditional structural” models.

Problems with VAR’s

- VAR’s are a-theoretical (as are ARMA models)

- How do you decide the appropriate lag length?

- So many parameters! If we have g equations for g variables and we have k lags of each

of the variables in each equation, we have to estimate (g+kg2) parameters. e.g. g=3, k=3,

parameters = 30

- How do we interpret the coefficients?

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

31

32. Choosing the Optimal Lag Length for a VAR

2 possible approaches: cross-equation restrictions and information criteriaCross-Equation Restrictions

In the spirit of (unrestricted) VAR modelling, each equation should have

the same lag length

Suppose that a bivariate VAR(8) estimated using quarterly data has 8 lags

of the two variables in each equation, and we want to examine a restriction

that the coefficients on lags 5 through 8 are jointly zero. This can be done

using a likelihood ratio test

Denote the variance-covariance matrix of residuals (given by uˆuˆ /T), as ˆ .

The likelihood ratio test for this joint hypothesis is given by

LR T log ˆ r log ˆ u

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

32

33. Choosing the Optimal Lag Length for a VAR (cont’d)

where ˆ r is the variance-covariance matrix of the residuals for the restrictedmodel (with 4 lags), ˆ u is the variance-covariance matrix of residuals for the

unrestricted VAR (with 8 lags), and T is the sample size.

•The test statistic is asymptotically distributed as a 2 with degrees of freedom

equal to the total number of restrictions. In the VAR case above, we are

restricting 4 lags of two variables in each of the two equations = a total of 4 *

2 * 2 = 16 restrictions.

•In the general case where we have a VAR with p equations, and we want to

impose the restriction that the last q lags have zero coefficients, there would

be p2q restrictions altogether

•Disadvantages: Conducting the LR test is cumbersome and requires a

normality assumption for the disturbances.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

33

34. Information Criteria for VAR Lag Length Selection

• Multivariate versions of the information criteria are required. These canbe defined as:

ˆ

MAIC ln

2k / T

k

MSBIC ln ˆ ln(T)

T

2

k

ln(ln(T))

MHQIC ln ˆ

T

where all notation is as above and k is the total number of regressors in

all equations, which will be equal to g2k + g for g equations, each with k

lags of the g variables, plus a constant term in each equation. The

values of the information criteria are constructed for 0, 1, … lags (up to

k

some pre-specified maximum

).

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

34

35. Block Significance and Causality Tests

• It is likely that, when a VAR includes many lags of variables, it will bedifficult to see which sets of variables have significant effects on each

dependent variable and which do not. For illustration, consider the

following bivariate VAR(3):

y1t 10 11 12 y1t 1 11 12 y1t 2 11 12 y1t 3 u1t

y 2t 20 21 22 y 2t 1 21 22 y 2t 2 21 22 y 2t 3 u 2t

• This VAR could be written out to express the individual equations as

y1t 10 11 y1t 1 12 y2t 1 11 y1t 2 12 y2t 2 11 y1t 3 12 y2t 3 u1t

y2t 20 21 y1t 1 22 y2t 1 21 y1t 2 22 y2t 2 21 y1t 3 22 y2t 3 u 2t

• We might be interested in testing the following hypotheses, and their

implied restrictions on the parameter matrices:

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

35

36. Block Significance and Causality Tests (cont’d)

Hypothesis1. Lags of y1t do not explain current y2t

2. Lags of y1t do not explain current y1t

3. Lags of y2t do not explain current y1t

4. Lags of y2t do not explain current y2t

Implied Restriction

21 = 0 and 21 = 0 and 21 = 0

11 = 0 and 11 = 0 and 11 = 0

12 = 0 and 12 = 0 and 12 = 0

22 = 0 and 22 = 0 and 22 = 0

• Each of these four joint hypotheses can be tested within the F-test framework,

since each set of restrictions contains only parameters drawn from one

equation.

• These tests could also be referred to as Granger causality tests.

• Granger causality tests seek to answer questions such as “Do changes in y1

cause changes in y2?” If y1 causes y2, lags of y1 should be significant in the

equation for y2. If this is the case, we say that y1 “Granger-causes” y2.

• If y2 causes y1, lags of y2 should be significant in the equation for y1.

• If both sets of lags are significant, there is “bi-directional causality”

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

36

37. Impulse Responses

VAR models are often difficult to interpret: one solution is to construct

the impulse responses and variance decompositions.

Impulse responses trace out the responsiveness of the dependent variables

in the VAR to shocks to the error term. A unit shock is applied to each

variable and its effects are noted.

Consider for example a simple bivariate VAR(1):

y1t 10 11 y1t 1 11 y2 t 1 u1t

y2 t 20 21 y2 t 1 21 y1t 1 u2 t

A change in u1t will immediately change y1. It will change change y2 and

also y1 during the next period.

We can examine how long and to what degree a shock to a given equation

has on all of the variables in the system.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

37

38. Variance Decompositions

Variance decompositions offer a slightly different method of examining

VAR dynamics. They give the proportion of the movements in the

dependent variables that are due to their “own” shocks, versus shocks to

the other variables.

This is done by determining how much of the s-step ahead forecast error

variance for each variable is explained innovations to each explanatory

variable (s = 1,2,…).

The variance decomposition gives information about the relative

importance of each shock to the variables in the VAR.

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

38

39. Home Assignment

• Vector Autoregressive Model:– Run a VAR (3) model by using exchange rate data

on any 3 series

– Conduct Block Significance and Causality Tests on

your model

– Present graphically Impulse Responses

– Present graphically Variance Decompositions

• Interpret your results

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

39

40. Home Assignment

ARMA FAMILY MODELS:•Use MICEX data to run the following models both on level and log

return data performing Stationarity and Unit Root Testing

– MA (5)

– AR (5)

– ARMA (5,5)

– ARMA (P,Q) – Based on the AIC Code

Interpret your results

Financial Econometrics 2016 – Dr. Kashif Saleem (UOWD)

40

economics

economics finance

finance english

english