Similar presentations:

Modeling and forecasting. Volatility

1.

Modeling and Forecasting VolatilityJoint Vienna Institute / IMF ICD

Macro-econometric Forecasting and Analysis

JV16.12, L10, Vienna, Austria, May 24, 2016

Presenter

Charis Christofides

This training material is the property of the International Monetary Fund (IMF) and is intended for use

in IMF Institute courses. Any reuse requires the permission of the IMF Institute.

2. Outline

1. Introduction: Why ARCH?2. ARCH Models

3. Extensions: GARCH, T-GARCH, Q4.

5.

6.

7.

GARCH, GARCH-M, Box-Cox GARCH

Estimation

Multivariate GARCH Models: Diagonal

Vech, BEKK and CCC

Application: Value-at-Risk (VaR)

Appendix

3. 1. Introduction: Why ARCH?

4.

Why ARCH?• ARMA and VAR models are based on the conditional

mean of the distribution where conditioning is based

on lagged values of the dependent variable.

• The conditional variance of the distribution is

assumed to be time-invariant (i.e.

homoskedasticity).

• In addition, if the error term is assumed to be

normal, the conditional distribution (and hence the

marginal and joint distributions) is Gaussian.

• Are these properties supported by real data?

4

5. Some example series: UST10Y

6. Dow Jones

Homoskedastic?Symmetric Shocks?

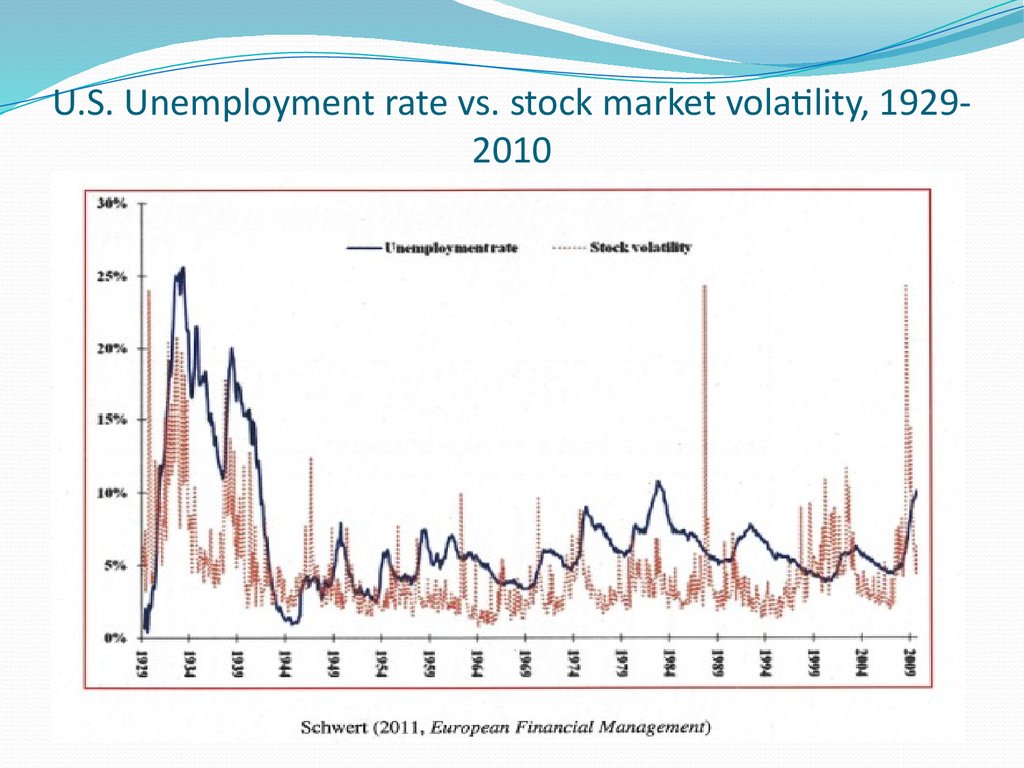

7. U.S. Unemployment rate vs. stock market volatility, 1929-2010

U.S. Unemployment rate vs. stock market volatility, 192920108. U.S. Realized Volatility (kernel based) 1997-2009

9.

An exampleLet us apply Box-Jenkins methods to a real time

series, namely, weekly returns on S&P500 from

April 1, 1986 to December 14, 2007.

RETURN_SP500

.08

.04

.00

-.04

-.08

-.12

-.16

86

88

90

92

94

96

98

00

02

04

06

9

10.

Example (cont.)Note:

RETURN_SP500

.08

.04

.00

-.04

Tranquil

period

-.08

Volatile period

-.12

-.16

86

88

90

92

94

96

98

00

02

04

06

10

11.

Example (cont. )RETURN_SP500

.08

.04

.00

-.04

-.08

Tranquil

period

-.12

Homoskedasticity?

Volatile period

Symmetry?

-.16

86

88

90

92

94

96

98

00

02

04

06

11

12.

Example (cont.)• Both ACF and PACF are flat, suggesting p=0 and

q=0 if we stay in the domain of ARMA.

0 . 00 . 40 . 8

AC F

V1

0

5

10

15

20

25

30

25

30

Series

x

- 0 . 0 50 . 0 5

P a r tia l A C F

Lag

0

5

10

15

20

Lag

12

13.

Example (cont. )Look at the histogram and some summary statistics

of the data:

300

Series: RETURN_SP500

Sample 4/04/1986 12/21/2007

Observations 1133

250

200

150

100

50

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

0.001647

0.003114

0.074923

-0.130071

0.021339

-0.713303

6.658444

Jarque-Bera

Probability

727.9250

0.000000

Asymmetry

Fat tails

0

-0.10

-0.05

0.00

0.05

Skewness= E[(y-m)3]/Var[y]3/2,

Kurtosis= E[(y-m)4]/Var[y]2

13

14. Skewness

• The shape of a uni-modal distribution can be symmetric orskewed to one side.

• If the bulk of the data is at the left and the right tail is longer, the

distribution is positively skewed; if the peak is toward the right and

the left tail is longer, the distribution is negatively skewed.

skewness = −0.5370

skewness = +0.5370

If skewness is less than −1 or greater than +1, the distribution is

highly skewed.

If skewness is between −1 and −½ or between +½ and +1, the

distribution is moderately skewed.

If skewness is between −½ and +½, the distribution is

approximately symmetric.

15. Kurtosis

• Kurtosis measures the height and sharpness of the peakrelative to the rest of the data .

• Higher values indicate a higher, sharper peak; lower values

indicate a lower, less distinct peak.

• Increasing kurtosis is associated with a movement of the

probability mass from the shoulders of a distribution into its

center and tails

Uniform(min=−√3,

max=√3)

kurtosis = 1.8,

excess = −1.2

Normal(μ=0, σ=1)

kurtosis = 3,

excess = 0

Logistic(α=0, β=0.55153)

kurtosis = 4.2,

excess = 1.2

16.

Remarks• Gaussian ARMA models are not able to generate

asymmetric or fat-tailed behavior.

• The previous time series plot shows that there are

turbulent periods where there is a sequence of

very large movements in returns and tranquil

periods where the magnitude of movements is

relatively small.

• This phenomenon is known as volatility

clustering, which highlights the property that the

volatility of financial returns is not constant over

time, but appears to come in bursts.

16

17.

Example• Variance of financial returns is often referred to as

volatility.

• To understand the dynamics of volatility, we can

examine the time series behavior of the squared

returns.

SQUARE_RET

.020

.016

.012

.008

.004

.000

86

88

90

92

94

96

98

00

02

04

06

17

18. EViews Example – Daily S&P 500 Returns

EViews Example – Daily S&P 500 Returns19. When we learn about GARCH(1,1)…

20. We’ll be able to make squared residuals white noise

21. Quality of TGARCH predictions: 1% quantiles, VaR(0.01), from August 1, 2007

22. 2. ARCH Models

23.

24.

ARCH(q)yt m j yt j t

j J

AR(J)-ARCH(q)

t ~ N (0, t2 )

t i 1 i t2 i

i q

2

2

1 i 1 i

i q

ARCH(q)

Steady-State

24

25.

A special case: ARCH(1)yt t et ,

et ~ N (0,1)

t2 1 yt2 1

• Properties [It-1 = y1,..,yt-1]

E ( yt I t 1 ) 0

E ( yt2 I t 1 ) t2 1 yt2 1

yt2 ~ AR (1) with the AR coefficient γ1

• If 0 < 1 < 1, the ARCH(1) is covariance

stationary

2

2

• Kurtosis = 3(1 1 ) (1 3 1 ) > 3

E ( yt ys ) 0 for any t ¹ s but E ( yt2 yt2 1 ) ¹ 0

25

26.

Testing for the ARCH effects• Regress yt2 on yt2 1 ,..., yt2 q .

• Calculate T × R 2 , which is an LM statistic.

• Under the null hypothesis of no ARCH effect, its

asymptotical distribution is the chi-square with q

degrees of freedom.

• If there exist a value of q such that the LM statistic

is larger than the critical value of the chi-square with

q degrees of freedom, we reject the null hypothesis

of no ARCH effect.

• In practice, a large q may be needed.

26

27. 3. Extensions

28.

GARCH(p,q)y t m j yt j t

AR(J)AR(J)-ARCH(q)

GARCH(p,q)

j J

t ~ N (0, t2 )

t i 1

i q

2

2

i p

i 1

1

2

i t i

GARCH(p,q)

i 1 i t i

i p

i 1

i i 1 i

i i 1 i < 1

>0

i p

i q

2

Steady-State

i q

• Additivity

• No negativity

28

29.

GARCH(1,1)• The most popular ARCH-type model

t2 1 t2 1 1 t2 1

VaR=1.645

Volatility ( )

29

30.

Properties of GARCH(1,1)2

1. t follows an ARMA(1,1) with the AR coefficient

1 1

1

, and the MA coefficient

2. If > 0, 1 > 0, 1 > 0, 1 1 < 1 , then t 2 is

covariance stationary.

3. The volatility persistence is determined by ,

1

1

which empirically is often close to one

30

31. I-GARCH

If the coefficients of the GARCH model sum to1, then the model has “integrated” volatility.

This is similar to having a random walk, but in

volatility instead of the variable itself.

Model itself remains stationary (if constant

variance model is stationary)

Likelihood-based inference remains valid

(Lumsdaine, 1996 Econometrica)

i p

i 1

i i 1 i 1

i q

32.

Impulse response functions (IRFs)of GARCH(1,1)

0.5

0.45

0.4

GARCH

0.35

0.3

0.25

0.2

0.15

0.1

0.05

0

- 0.05 0

5

10

15

20

25

30

35

The speed of decrease in the IRFs is determined by

1

1

32

33.

News impact curve (NIC)• NIC: t2 as a function of t 1 holding

other variables constant.

The NIC of GARCH(1,1):

It is symmetric.

33

34.

Student t -- GARCH(1,1)• Student t -- GARCH(1,1)

yt t et

et ~ tv 0,1

t2 t2 1 yt2 1

1

1

where

et2 2

2

1

pdf et

1 / 2 / 2

x x 1 exp( )d

0

• Compared to the Gaussian GARCH, the

Student t-GARCH can generate fatter tails.

34

35.

T-GARCH (Asymmetry)yt m j yt j t

j J

t ~ 0, t2

Threshold

t2 t2 1 t2 1 t 1 t2 1

1 t < 0

t

0 t > 0

Asymmetric

Volatility

• NIC is asymmetric.

• If

> 0 , bad news has a larger impact on the

future volatility then good news of the same

magnitude

• IRF depends on the type of news as well

35

36.

T-GARCH (Asymmetry)t2 t2 1 t2 1 t 1 t2 1

1 t < 0

t

0 t > 0

IRFs

36

37.

Q(uadratic)-GARCH (Asymmetry)y t m j yt j t

j J

t ~ 0, t2

t2 t2 1 t2 1 t 1

Asymmetric

Volatility

• NIC is asymmetric as long as

¹0

37

38.

NIC of Quadratic GARCH vs.Symmetric GARCH

38

39.

GARCH-M• An important application of the ARCH-type models is

in modeling the trade-off between the mean and the

volatility.

• In financial economics, this is known as risk-return

trade-off.

• The GARCH-M model is of the form

yt m t2 t et , et ~ N 0,1

t2 yt2 1 t2 1

GARCH in Mean

yt m t t et , et ~ N 0,1

t2 yt2 1 t2 1

39

40.

Box-Cox GARCH(1,1)yt t et

t 1

t 1 1

t 1 f et 1

f et 1 et 1 1et 1

• We model the power transformation of volatility.

• As long as ¹ 0 , NIC is asymmetric

• This is a non-linear model

40

41.

ummary: NICs of Alternative ARCHsInflation

Volatility

41

42. Summing up (see Appendix for an expanded list)

GARCH(1,1)T-GARCH(1,1)

Q-GARCH(1,1)

GARCH(1,1)-M (GJR)

Box-Cox GARCH(1,1)

t2 t2 1 t2 1

t2 t2 1 t2 1 t 1 t2 1

1 if t 1 0

t 1

0 if t 1 > 0

t2 t2 1 t2 1 t 1

t2 1 t 1 t2 1 t2 1 t 1 t2 1

0 if t 1 0

t 1

1 if t 1 > 0

t 1

t 1 1

t 1

t 1 f

t 1

f t 1 t 1 0 1 t 1 0

t 1 t 1

t 1

Asymmetric

Models

Non

linear

43. 3. Estimation

44. Maximum Likelihood

y f yl y , f y

t

t

t T

t

t

t 1

log l y t , L y t , t 1 log f y t

t T

L*

Maximize L(y, )

45. Maximum Likelihood (continued)

yt X t tht º var( t )

1

1

2

LogLikelihood log(ht ) ( yt X t ) / ht

2

2

The maximum likelihood decomposes in a

“mean” and a “variance” component. Estimation

has to be done numerically.

• Parameters for the mean can be estimated

consistently by OLS, but won’t be as efficient if

they don’t take account of heteroskedasticity.

• Note: we could have a non-normal error (e.g.,

Student-t or GED-density)

46. Optimization

Gradient and HillClimbing Techniques

Newton’s Method

Stochastic Newton Method

47. Multiple Solutions

Monte CarloGenetic Algorithms

48. 4. Multivariate models

49.

Multivariate GARCH Models• A natural extension of the time-varying variance

models based on the univariate GARCH framework is

the multivariate version whereby both variances and

covariances are modelled.

• This class of models is known as Multivariate

GARCH

yt I t 1 ~ N (0, St )

• The variance covariance matrix St needs to be

restricted to be positive definite for all t

• The number of unknown parameters governing the

behavior of the variances and covariances cannot be

too large

49

50.

Vech Model (2 variables)112 t 10 11 12t 1 12 1t 1 2t 1 13 22t 1 q11 112 t 1 q12 122 t 1 q13 222 t 1 ü

ï

2

2

2

2

2

2

12t 20 21 1t 1 22 1t 1 2t 1 23 2t 1 q 21 11t 1 q 22 12t 1 q 23 22t 1 ý

ï

222 t 30 31 12t 1 32 1t 1 2t 1 33 22t 1 q31 112 t 1 q32 122 t 1 q33 222 t 1 þ

• The conditional variance of each variable depends on

its own lagged value, on the lagged conditional

covariance, on the product of lagged squared errors

and errors.

• A large number of parameters (in this case, 21)

• Restrictions to ensure that S is positive definite are

t

complicated.

50

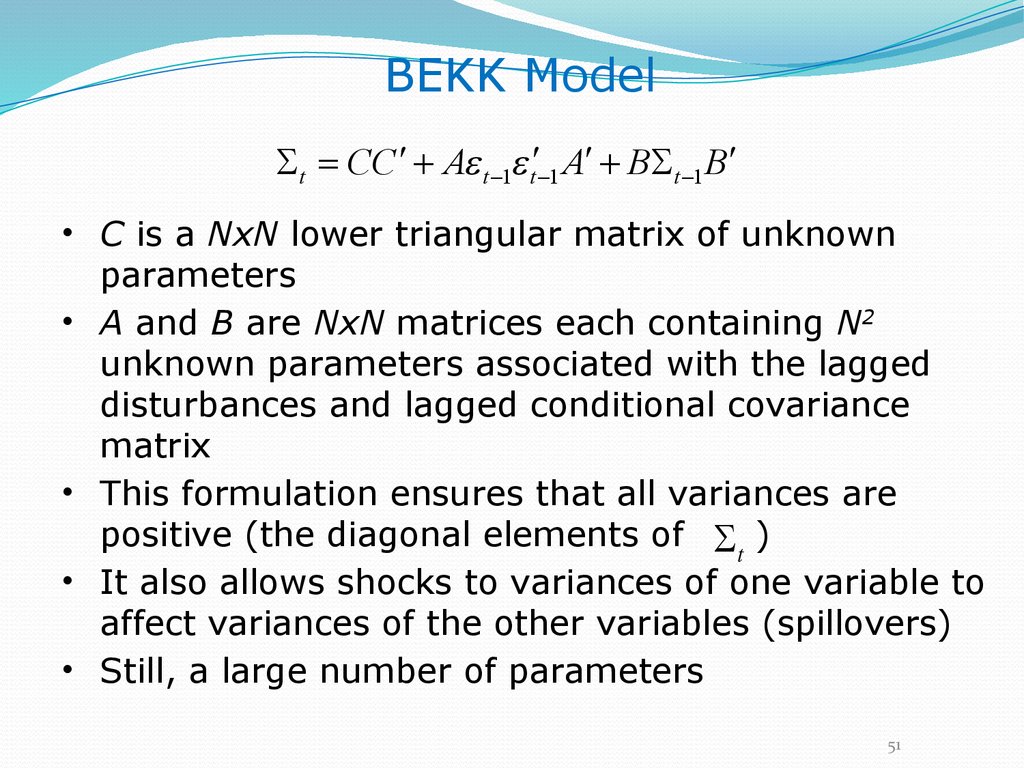

51.

BEKK ModelSt CC ¢ A t 1 t¢ 1 A¢ BSt 1 B¢

• C is a NxN lower triangular matrix of unknown

parameters

• A and B are NxN matrices each containing N2

unknown parameters associated with the lagged

disturbances and lagged conditional covariance

matrix

• This formulation ensures that all variances are

positive (the diagonal elements of St )

• It also allows shocks to variances of one variable to

affect variances of the other variables (spillovers)

• Still, a large number of parameters

51

52.

Diagonal Vech Model (2 variables)ü

ï

2

2

12t 20 22 1t 1 2t 1 q 22 12t 1 ý

ï

222 t 30 33 22t 1 q33 222 t 1 þ

112 t 10 11 12t 1 q11 112 t 1

• Variances and covariances are GARCH(1,1)

• Parameters are now 9 instead of the 21 of the Vech

model.

• Restrictions imply that there are no interactions

among variances S

t

52

53.

CCC(Constant Conditional Correlation) Model

• 3 variables

12t 1 1 12t 1 q11 12t 1 ü

ï

2

2

2

2t 2 2 2 t 1 q 21 2t 1 ý GARCH

ï

32t 3 3 32t 1 q31 32t 1 þ

12t 12 1t 2t ü

ï

13t 13 1t 3t ý Covariances

23t 23 2t 3t ïþ

• The correlation coefficients are all time invariant

53

54.

An extension: VAR + CCC• 3 variables

y1t 10 11 y1t 1 12 y2t 1 13 y3t 1 1t ü

ï

y2t 20 21 y1t 1 22 y2t 1 23 y3t 1 2t ý VAR

y3t 30 31 y1t 1 32 y2t 1 33 y3t 1 3t ïþ

12t 1 1 12t 1 q11 12t 1 ü

ï

2

2

2

2t 2 2 2t 1 q 21 2t 1 ý GARCH

ï

32t 3 3 32t 1 q31 32t 1 þ

12t 12 1t 2t ü

ï

13t 13 1t 3t ý Covariances

23t 23 2t 3t ïþ

54

55.

A further extension:VAR + CCC+ GARCH-M

y1t 10 11 y1t 1 12 y2t 1 13 y3t 1 14 12t 15 22t 16 32t 1t ü

ï

VAR

2

2

2

y2t 20 21 y1t 1 22 y2t 1 23 y3t 1 24 1t 25 2t 26 3t 2t ý

ï GARCHM

2

2

2

y3t 30 31 y1t 1 32 y2t 1 33 y3t 1 34 1t 35 2t 36 3t 3t þ

12t 1 1 12t 1 q11 12t 1 q12 12t 2 q13 22t 1 q14 32t 1 ü

ï

2

2

2

2

2

2

2t 2 2 2t 1 q 21 2t 1 q 22 2t 2 q 23 1t 1 q 24 3t 1 ý VGARCH

ï

32t 3 3 32t 1 q 31 32t 1 q 32 32t 2 q 33 12t 1 q 34 22t 1 þ

12t 12 1t 2t ü

ï

13t 13 1t 3t ý Covariance

23t 23 2t 3t ïþ

Interactions between

Markets

Contagion

55

56. An example of volatility “contagion’’

5657. 5. Application: Value-at-Risk (VaR)

58. VaR

What is the most I can lose on an investment?VaR tries to provide an answer.

It is used most often by commercial and

investment banks to capture the potential loss

in value of their traded portfolios from adverse

market movements over a specified period.

This potential loss can then be compared to

their available capital and cash reserves to

ensure that the losses can be covered without

putting the firms at risk.

VaR is applied widely in capital regulation

(Basel)

59. Value-at-Risk (VaR)

VaR summarizes the expected maximumloss over a time horizon within a given

confidence interval

The VaR approach tries to estimate the level

of losses that will be exceeded over a given

time period only with a certain (small)

probability

For example, the 95% VaR loss is the

amount of loss that will be exceeded only

5% of the time

59

60. Value-at-Risk (VaR) - Continued

The simplest assumption: daily gains/losses arenormally distributed and independent.

Calculate VaR from the standard deviation of the

portfolio change, σ, assuming the mean change in

the portfolio value is 0:

1-day VaR= N-1(X)σ, with X the confidence level.

The N-day VaR equals sqrt(N)

VaR.

times the 1-day

60

61. Measuring VaR with historical data

180180

69 occurrences out of 1380

160

160

140

140

120

120

100

100

5% Loss

Probability

80

80

60

60

40

40

20

20

0

0

-15

-12

-9

-6

-3

0

3

6

9

12

15

61

62. Assuming a Normal distribution

Assume that asset returns are normally distributedTheir behavior can be fully described in terms of mean and

standard deviation

Standard Deviation (σ)

0.45

0.40

0.35

Mean Return (μ)

0.30

0.25

0.20

0.15

0.10

0.05

0.00

-3.00

-2.50

-2.00

-1.50

-1.00

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

3.00

62

63. VaR with Normally Distributed Returns

The probability of the return falling below acertain threshold depends on how many

standard deviations the threshold is below the

mean return

Threshold L* μ-1.0σ

μ-1.65σ

μ-2σ

μ-2.33σ

μ-3σ

Pr(loss>L*)

0.05

0.023

0.01

0.001

0.16

95% confidence

interval

99% confidence

interval

63

64. Portfolio VaR

When we have more than one asset in our portfolio wecan exploit the gains from diversification.

There are gains from diversification whenever the VaR for

the portfolio does not exceed the sum of the stand-alone

VaRs (i.e., the VaRs on the single assets).

The VaR for the portfolio equals the sum of the stand-

alone VaRs if and only if the securities’ returns are

uncorrelated.

64

65. An Example

Let us consider the following investmentUS$200 million invested in 5-year zero coupon US

Treasury

Examine VaR using a daily horizon

Assume that the mean daily return is 0.01%

Based on past several years of actual returns, the

standard deviation is = 0.295%.

65

66. An Example (cont.)

Suppose we want to compute the 95% VaR.The critical threshold is 1.65 standard deviations

below the mean, i.e.,

0.0001-1.65 • 0.00295=-0.00477

VaR = 0.00477 • 200m=0.95m

Expect to lose $0.95 million or more on 1 day in 20

66

67. An Example of Portfolio VaR

Two securities30-year zero-coupon U.S. Treasury bond

5-year zero-coupon U.S. Treasury bond

For simplicity assume that the expected return is zero

Invest US$100 million in the 30-year bond

Daily return volatility (std dev) 1 = 1.409%

Invest US$200 million in the 5-year bond

Daily return volatility (std dev) 2 = 0.295%

67

68. An Example of Portfolio VaR

– 95% confidence level– 30 year zero VaR

1.65 * 0.01409 * 100m = $2,325,000

– 5 year zero VaR

1.65 * 0.00295 * 200m = $974,000

• Sum of individual VaRs = US$ 3.299m

• But US$3.299 million is not the VaR for the

portfolio...why?

68

69. VaR of the Portfolio

Suppose the correlation between the two bonds is 12=0.88Remember that

2p w12 12 w22 22 2 w1w2 1, 2 1 2

Portfolio variance:

(100*0.01409)2 + (200*0.00295)2

+2(100*0.01409)(200*0.00295) * 0.88 = 3.797

• Portfolio standard deviation:

p $1.948m

• Portfolio VaR = 1.65 * 1.948m = $3.214m

• This is different from the sum of VaRs

69

70. The problem with Normality: Kurtosis

Extreme asset price changes occur more oftenthan the normal distribution predicts.

Excess kurtosis (fat tails)

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

-3.00

-2.50

-2.00

-1.50

-1.00

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

3.00

70

71. Fat Tails and underestimation of VaR

If we assume that returns are normally distributedwhen they are not, we underestimate the VaR

VaR with

normal

returns

VaR with

actual return

distribution

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

-3.00

-2.50

-2.00

-1.50

-1.00

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

3.00

71

72. Backtesting

Model backtesting involves systematic comparisonsof the calculated VaRs with the subsequent realized

profits and losses.

With a 95% VaR bound, expect 5% of losses

greater than the bound

Example: Approximately 12 days out of 250

trading days

If the actual number of exceptions is

“significantly” higher than the desired

confidence level, the model may be

inaccurate.

Therefore, in additional to the risk predicted by the

VaR, there is also “model risk”

72

73. Relevance: Basel VaR Guidelines

VaR computed daily, holding period is 10 days.The confidence interval is 99 percent

Banks are required to hold capital in proportion to the

losses that can be expected to occur more often than once

every 100 periods

At least 1 year of data to calculate parameters

Parameter estimates updated at least quarterly

Capital provision is the greater of

Previous day’s VAR

3 times the average of the daily VAR for the preceding 60

business days plus a factor based on backtesting results

73

74. Summing up

A host of research has examineda. how best to compute VaR with assumptions

other than the standardized normal

b. How to obtain more reliable variance and

covariance values to use in the VaR

calculations.

Here Multivariate GARCH models play an

important role in assessing both portfolio

risk and diversification benefits.

We will see this in the forthcoming workshop

economics

economics