Similar presentations:

Macroeconomic indicators in the system of national accounts. Topic 2

1.

TOPIC 2. MACROECONOMICINDICATORS IN THE SYSTEM

OF NATIONAL ACCOUNTS

1. System of National Accounts (SNA) as a regulatory

framework for macroeconomic accounting.

2. Gross domestic product (GDP) and methods for its

measurement.

3. Definition of final, intermediate products and value

added in the calculation of GDP

4. Nominal and real GDP. Deflator GDP, prices index.

2.

1. System of National Accounts (SNA).System of National Accounts (SNA) – is the internationally

agreed standard set of recommendations on how to compile

measures of economic activity.

The SNA describes a coherent, consistent and integrated set of

macroeconomic accounts in the context of a set of

internationally agreed concepts, definitions, classifications and

accounting rules.

3.

1. System of National Accounts (SNA).It can be distinguished:

consolidated national accounts – are accounts drawn up to

reflect the affairs of a group of entities. For example, a ministry

or holding company with many different operating agencies

or subsidiary companies may prepare consolidated accounts

reflecting the affairs of the organisation as a whole, as well as

accounts for each operating agency/subsidiary.

national accounts by sector – refers to the whole economy (a

country, the European Union (EU)) as a sector. All institutional

units operating within an economy can be assigned to a

particular institutional sector.

4.

1. System of National Accounts (SNA).The main methodological principles of the SNA:

Reflection of economic cycle in three aspects production, distribution and end use.

Grouping of economic units into sectors: entrepreneurial,

general government, households and non-profit sector

serving households.

Separation of the movement of products and resources

and the movement of income.

Separation of intermediate and final products.

Distinction of incomes and expenses for current (carried

out continuously), and capital (one-time expances).

5.

2. Gross domestic product (GDP) and methods ofits measurement

GDP measures the market value of final goods and

services produced in the economic territory of the

country for a certain period of time (as a rule, a year).

The term "gross" in the defined GDP means that when

calculating it, the consumption of fixed capital

(depreciation) is taken into account.

6.

2. Gross domestic product (GDP) and methods ofits measurement

Principles of GDP calculation:

Principle of income and expenditure equality – Income of one

firm is an expenditure of another firm, in such a way they

always should be equal.

Principle of non-consideration of income from non-production

operations –

Nonproduction transactions are of two types:

• purely financial transactions (Public transfer payments -the

social security payments, welfare payments ; Private transfer

payments - cash gifts given at Christmas time. ; Stock market

transactions - The buying and selling of stocks (and bonds))

• secondhand sales.

7.

2. Gross domestic product (GDP) and methods ofits measurement

Principles of GDP calculation:

The principle of inclusion in the assessment of income

not only market and explicit, but also non-market and

implicit income – We should assess the best usage of

capital available.

Principle of value added calculation – We can avoid

multiple counting by measuring and cumulating only

the value added at each stage.

Value added is the market value of a firm’s output

less the value of the inputs the firm has bought from

others.

8.

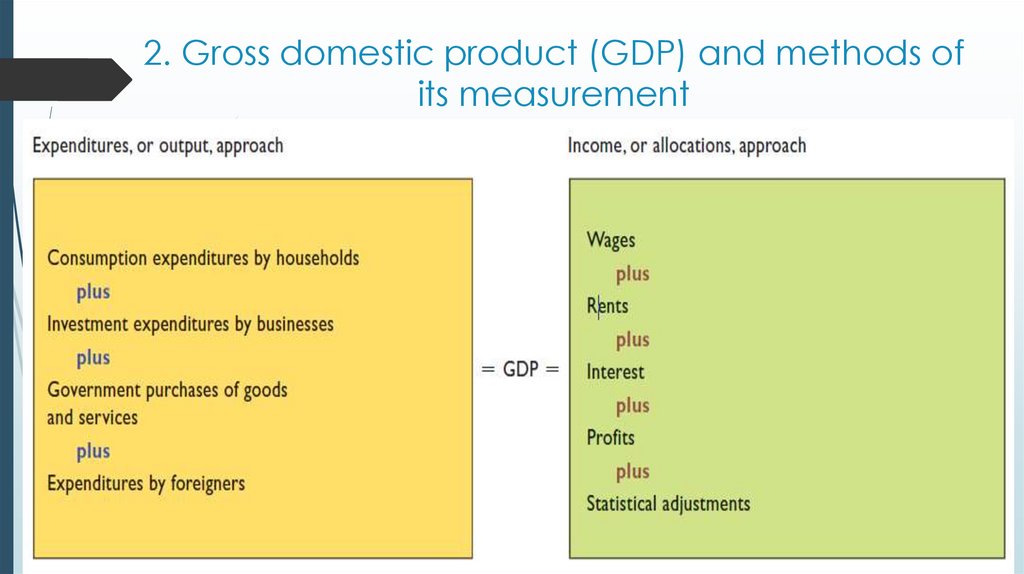

2. Gross domestic product (GDP) and methods ofits measurement

Methods of calculating GDP:

1. The method of output (by expenditure) - is calculated

as the amount of expenses of macro-economic entities

for the purchase of goods and services in a given year.

GDP exp = C + Ig + G + Xn

9.

2. Gross domestic product (GDP) and methods ofits measurement

1. C - consumption expenditures by households (only short-term)

2. Investment costs - Gross Private Domestic Investment (Ig)

Net investment = gross investment - depreciation

3. Government Purchases (G)

These expenditures have two components:

(1) expenditures for goods and services that government consumes

in providing public services and

(2) expenditures for publicly owned capital such as schools and

highways, which have long lifetimes.

4. Net Exports (Xn ) = exports (X) - imports (M).

10.

2. Gross domestic product (GDP) and methods ofits measurement

2. The earnings or allocations method (income method) - calculated as

the sum of cash income received from production during the year.

GDP inc = W+r+i+P+t+A

Compensation of Employees (Wages) - wages and salaries by business

and government to their employees.

Rents (r)consist of the income received by the households and

businesses that supply property resources.

Interest (i) consists of the money paid by private businesses to the

suppliers of loans used to purchase capital.

“Profits”(P) is broken into two accounts: proprietors’ income, which

consists of the net income of sole proprietorships, partnerships, and other

unincorporated businesses; and corporate profits. Corporate profits are

the earnings of corporations.

11.

2. Gross domestic product (GDP) and methods ofits measurement

National income accountants subdivide corporate profits into three

categories:

• Corporate income taxes These taxes are levied on corporations’

profits. They flow to the government.

• Dividends These are the part of after-tax profits that corporations

choose to pay out, or distribute, to their stockholders. They thus flow

to households—the ultimate owners of all corporations.

• Undistributed corporate profits Any after-tax profits that are not

distributed to shareholders are saved, or retained, by corporations to

be invested later in new plants and equipment.

12.

2. Gross domestic product (GDP) and methods ofits measurement

Taxes on Production and Imports - general sales taxes,

excise taxes, business property taxes, license fees, and

customs duties.

A – amortization or Depreciation of capital

13.

2. Gross domestic product (GDP) and methods ofits measurement

14.

2. Gross domestic product (GDP) and methods ofits measurement

3. The production method (value added) - is calculated

as the sum of value added created at all stages of the

production of goods and services during the year.

GDP= gross output – material expenditures +taxes on

products – subsidies (net taxes)

15.

2. Gross domestic product (GDP) and methods ofits measurement

OTHER GDP INDICATORS:

Gross domestic product is the basis for calculating other equally

important indicators of national production.

They include:

- Gross National Income (GNI)

- Gross National Disposable Income (GNDI)

- Net domestic product (NDP)

- Net national income (NNI)

16.

2. Gross domestic product (GDP) and methods ofits measurement

DISTINCTION BETWEEN GDP AND GNI INDICATORS

1) Qualitative: GDP measures the flow of final goods and services

produced by residents of the country;

GNI measures the flow of primary incomes received by

residents of the country.

2) Quantitative: GNI = GDP + Balance of net factor income from

abroad (NFI).

The balance of net incomes received from abroad is the

difference between the incomes of residents of this country

received from abroad and the income of non-residents paid

abroad from this country.

17.

2. Gross domestic product (GDP) and methods ofits measurement

GNI – is the total of all sources of private income (employee

compensation, rents, interest, proprietors’ income, and

corporate profits) plus government revenue from taxes on

production and imports.

Gross national disposable income may be derived from gross

national income by adding all current net transfers and net

taxes.

GNDI = GNI+ Net transfers from abroad (NTR)+net taxes (NT)

18.

2. Gross domestic product (GDP) and methods ofits measurement

Indicators of the domestic product and the national

product can be calculated on a gross and on a net

basis.

GDP and GNI less capital consumption are NDP (net

domestic product) and NNI (net national income).

NDP = GDP - consumption of fixed capital

(depreciation)

NNI = GNI - fixed capital (depreciation)

19.

3. Definition of final, intermediate products andvalue added in the calculation of GDP

When measuring GDP it is important to avoid multiple

counting - a situation where the same operation can be

taken into account twice. For this purpose in the SNA there

are the following concepts:

intermediate goods are goods and services purchased for the

purpose of further production, processing or resale;

final goods - goods and services purchased for the purpose of

final consumption, not for further processing or resale;

20.

3. Definition of final, intermediate products andvalue added in the calculation of GDP

added value of the enterprise is the cost of the products

manufactured by the company less the cost of intermediate

goods and services that were acquired by the enterprise and

used in the production process.

Added value = gross output - intermediate consumption

21.

3. Definition of final, intermediate products andvalue added in the calculation of GDP

Intermediate consumption is the cost of consumed

goods and consumed market services during this

period for the production of other goods and

services.

Intermediate consumption includes the following

elements: material expenses; payment for intangible

services; travel expenses; other elements of

intermediate consumption.

22.

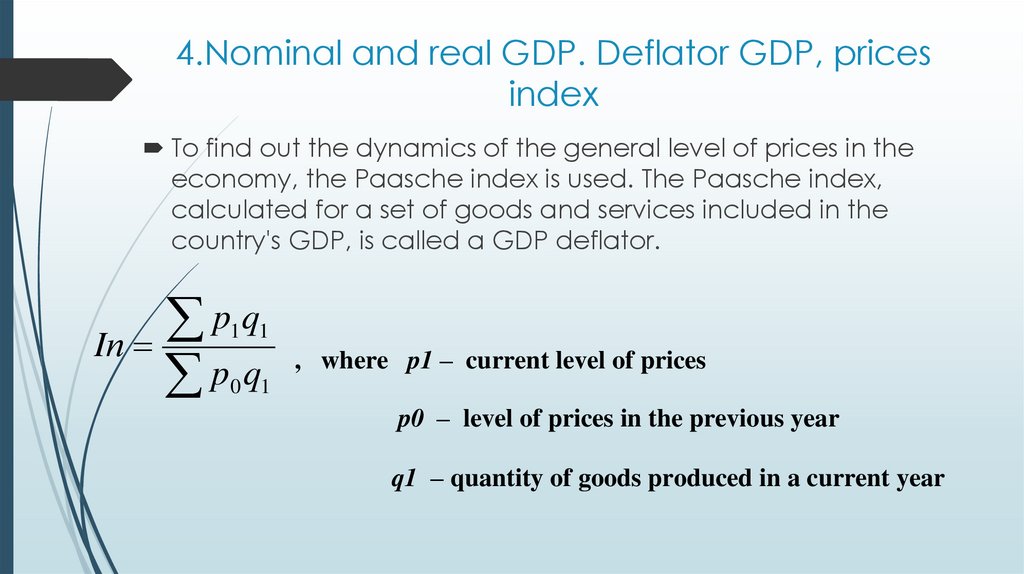

4.Nominal and real GDP. Deflator GDP, pricesindex

To find out the dynamics of the general level of prices in the

economy, the Paasche index is used. The Paasche index,

calculated for a set of goods and services included in the

country's GDP, is called a GDP deflator.

pq

Iп

p q

1 1

, where p1 – current level of prices

0 1

p0 – level of prices in the previous year

q1 – quantity of goods produced in a current year

23.

4.Nominal and real GDP. Deflator GDP, pricesindex

GDP deflator – measure of the level of prices of all new,

domestically produced, final goods and services in an

economy.

The GDP deflator is used to determine the difference between

nominal and real GDP.

A GDP based on the prices that prevailed when the output

was produced is called unadjusted GDP, or nominal GDP.

A GDP that has been deflated or inflated to reflect changes in

the price level is called adjusted GDP, or real GDP.

24.

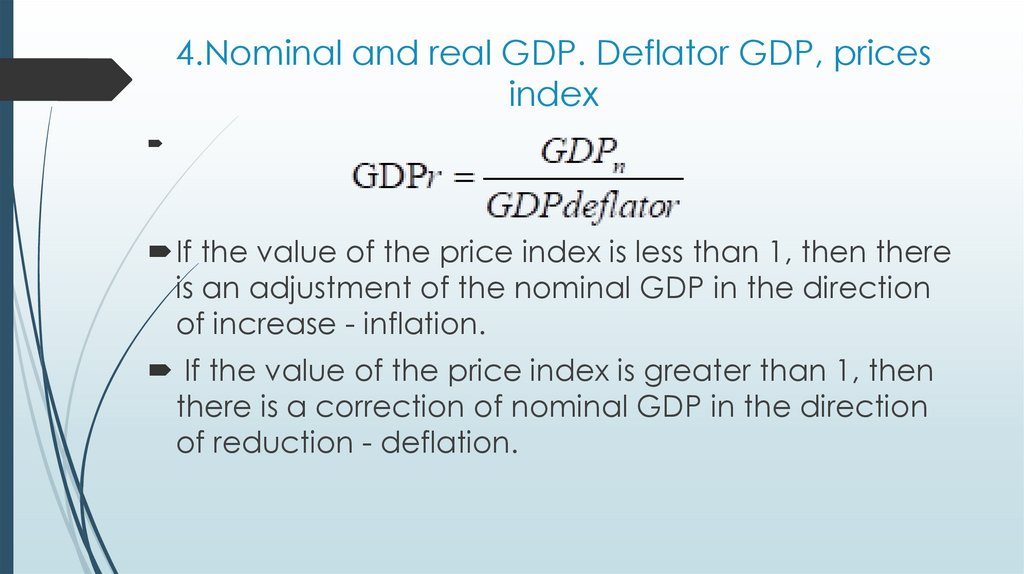

4.Nominal and real GDP. Deflator GDP, pricesindex

If the value of the price index is less than 1, then there

is an adjustment of the nominal GDP in the direction

of increase - inflation.

If the value of the price index is greater than 1, then

there is a correction of nominal GDP in the direction

of reduction - deflation.

economics

economics