Similar presentations:

A different opinion on quant’s job

1.

A different opinion on quant’s jobWith focus on real impact

and organizational dynamics

from an e-Trader

2.

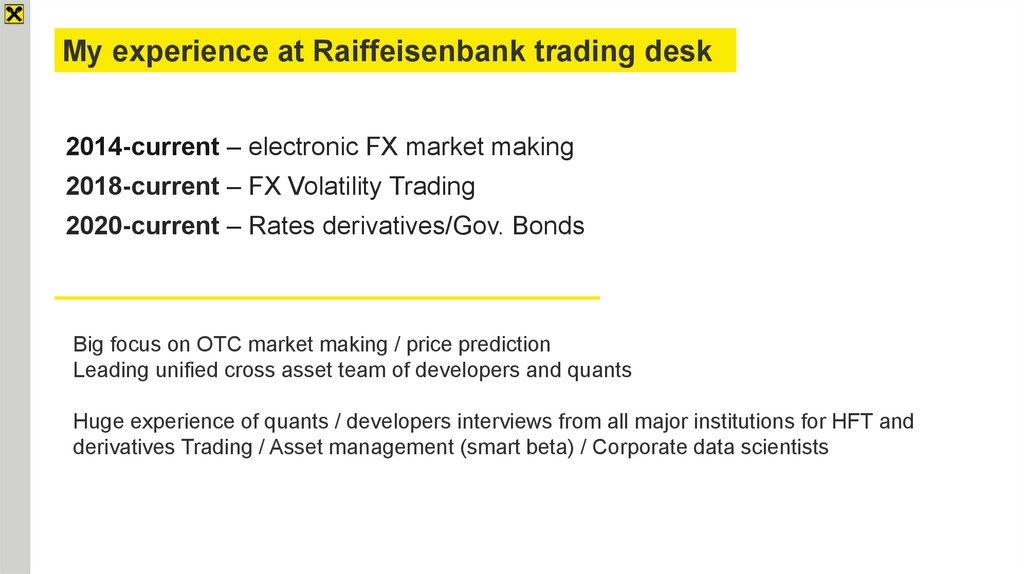

My experience at Raiffeisenbank trading desk2014-current – electronic FX market making

2018-current – FX Volatility Trading

2020-current – Rates derivatives/Gov. Bonds

Big focus on OTC market making / price prediction

Leading unified cross asset team of developers and quants

Huge experience of quants / developers interviews from all major institutions for HFT and

derivatives Trading / Asset management (smart beta) / Corporate data scientists

3.

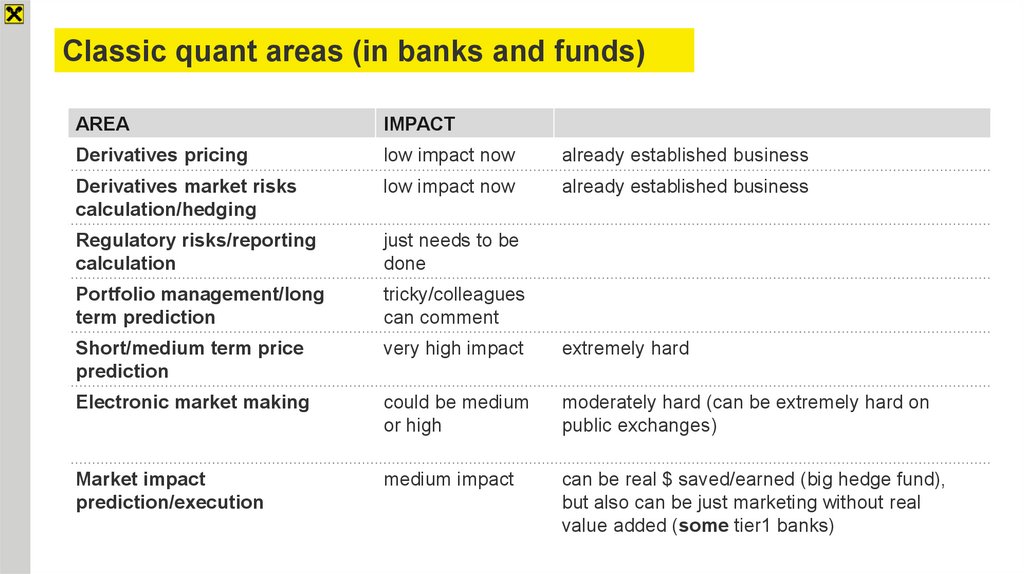

Classic quant areas (in banks and funds)AREA

IMPACT

Derivatives pricing

low impact now

already established business

Derivatives market risks

calculation/hedging

low impact now

already established business

Regulatory risks/reporting

calculation

just needs to be

done

Portfolio management/long

term prediction

tricky/colleagues

can comment

Short/medium term price

prediction

very high impact

extremely hard

Electronic market making

could be medium

or high

moderately hard (can be extremely hard on

public exchanges)

Market impact

prediction/execution

medium impact

can be real $ saved/earned (big hedge fund),

but also can be just marketing without real

value added (some tier1 banks)

4.

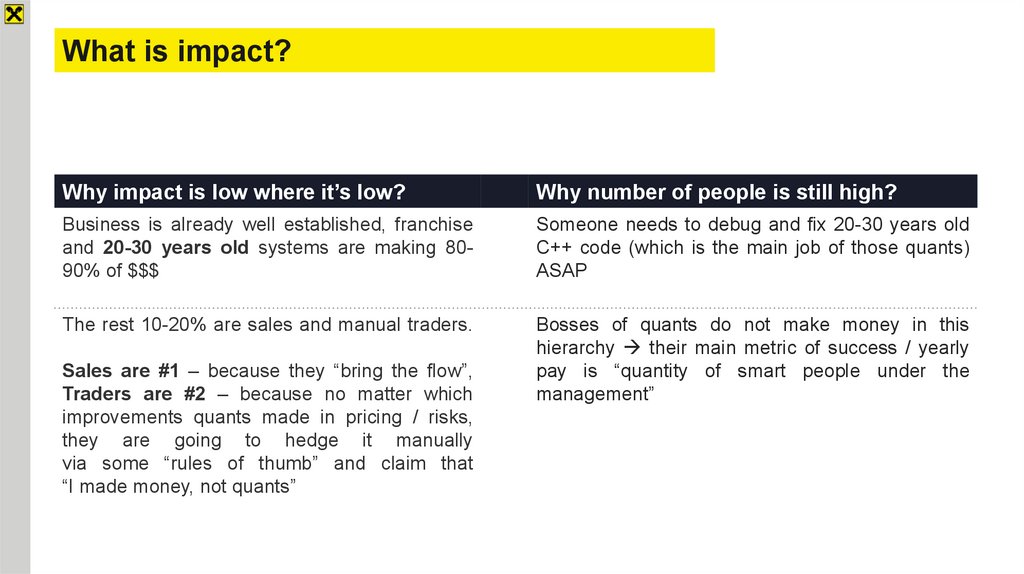

What is impact?Why impact is low where it’s low?

Why number of people is still high?

Business is already well established, franchise

and 20-30 years old systems are making 8090% of $$$

Someone needs to debug and fix 20-30 years old

C++ code (which is the main job of those quants)

ASAP

The rest 10-20% are sales and manual traders.

Bosses of quants do not make money in this

hierarchy their main metric of success / yearly

pay is “quantity of smart people under the

management”

Sales are #1 – because they “bring the flow”,

Traders are #2 – because no matter which

improvements quants made in pricing / risks,

they are going to hedge it manually

via some “rules of thumb” and claim that

“I made money, not quants”

5.

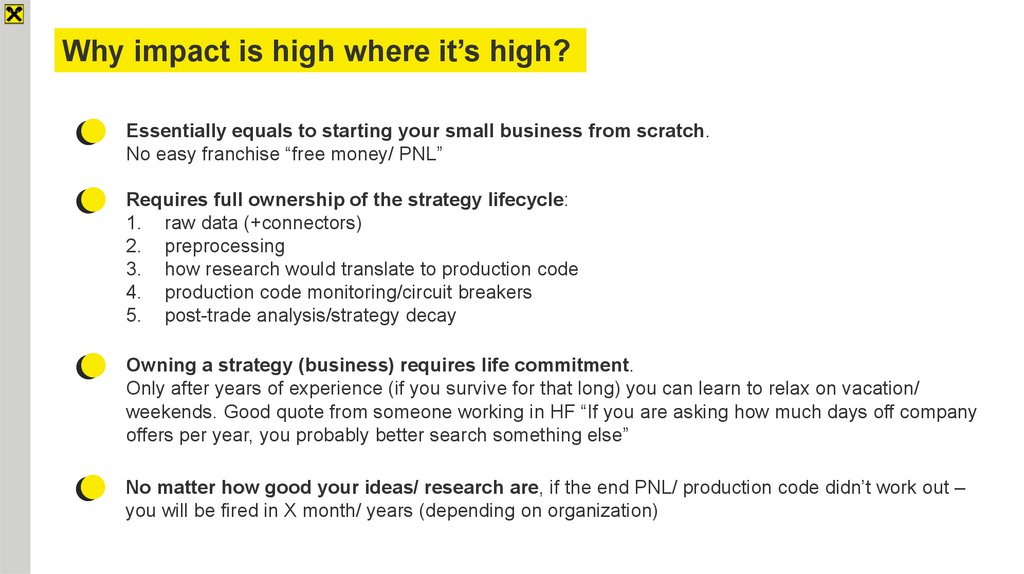

Why impact is high where it’s high?Essentially equals to starting your small business from scratch.

No easy franchise “free money/ PNL”

Requires full ownership of the strategy lifecycle:

1. raw data (+connectors)

2. preprocessing

3. how research would translate to production code

4. production code monitoring/circuit breakers

5. post-trade analysis/strategy decay

Owning a strategy (business) requires life commitment.

Only after years of experience (if you survive for that long) you can learn to relax on vacation/

weekends. Good quote from someone working in HF “If you are asking how much days off company

offers per year, you probably better search something else”

No matter how good your ideas/ research are, if the end PNL/ production code didn’t work out –

you will be fired in X month/ years (depending on organization)

6.

Unconventional skills required forhigh impact / low impact quants

LOW IMPACT (aka pricing/ risks/ reg.reporting/ debugging 20y old C++ code)

1. Learn who of the traders/ sales are the most important/ active and be useful for them –

this will make them think you are irreplaceable and they can rely on you => not be fired in the

next layoff

2. Make large and unreadable C++ codebase, which people would think you are the only one

who is able to support

3. Make journal papers with completely useless results in order to promote your organization

(aka quants marketing)

HIGH IMPACT (PNL related)

1. Learn to speak and communicate – PhD guy can be outperformed by BA dropout who communicate

his thoughts many times during a day instead of waiting for 2 weeks to present a failure result

2. Speed of iterations (and your small code infrastructure to support that) could be more important than

single ideas (=> prepare for huge amount of failed ideas/ projects)

3. Be open to criticism and throwing out bad ideas immediately (“don’t marry a strategy”)

4. Think about end-to-end. Good example of question: is it worth even researching this idea/ strategy, if it

would take 10 person/ year developers time to implement?

7.

Quants should not only focus on financeSome anecdotal examples

(same for developers/ not only quants)

Top 3 RU IT Company (aka low impact) – engineers/ data scientists mostly do their job (what

they’ve been told by senior business people without challenging them) and it’s very hard to

get fired for underperformance. Those who are not satisfied with slow/ no impact approach –

are hired by Raiffeisenbank

Top 3 worldwide IT company – some data scientists interviewed claim “who do not make big

$$$ progress in each of their half year review are fired right away without exceptions, those

who does – obviously would get paycheck closer to HF level”

8.

Our unique setup that we were able to achieve1.

Everyone can challenge everyone 24/7 (aka no politics), not only for particular

quant ideas/ strategies, but for the whole business model/ infrastructure

2.

Rare opportunity to see the “whole picture” of trading: from raw market data and

models to complicated OTC derivatives execution

3.

Infinite resources from the bank for infrastructure development and hiring

4.

All asset classes and full variety of tasks (no useless/ nonPNL generating tasks)

are united under one team

finance

finance