Similar presentations:

New trading instruments

1.

NEW TRADING INSTRUMENTS2.

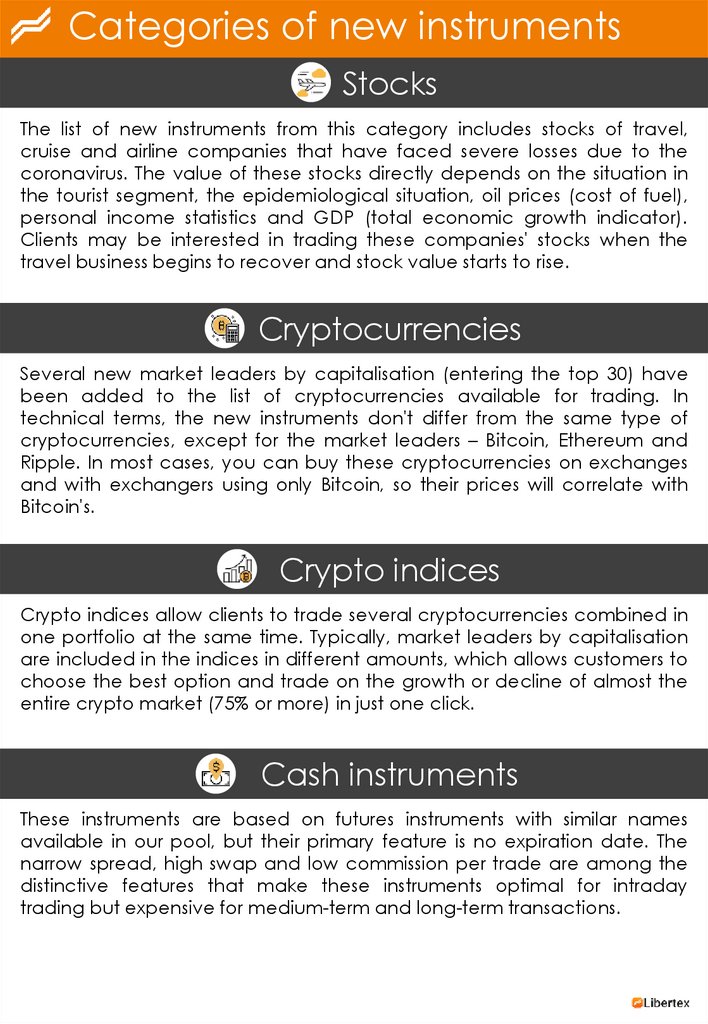

Categories of new instrumentsStocks

The list of new instruments from this category includes stocks of travel,

cruise and airline companies that have faced severe losses due to the

coronavirus. The value of these stocks directly depends on the situation in

the tourist segment, the epidemiological situation, oil prices (cost of fuel),

personal income statistics and GDP (total economic growth indicator).

Clients may be interested in trading these companies' stocks when the

travel business begins to recover and stock value starts to rise.

Cryptocurrencies

Several new market leaders by capitalisation (entering the top 30) have

been added to the list of cryptocurrencies available for trading. In

technical terms, the new instruments don't differ from the same type of

cryptocurrencies, except for the market leaders – Bitcoin, Ethereum and

Ripple. In most cases, you can buy these cryptocurrencies on exchanges

and with exchangers using only Bitcoin, so their prices will correlate with

Bitcoin's.

Crypto indices

Crypto indices allow clients to trade several cryptocurrencies combined in

one portfolio at the same time. Typically, market leaders by capitalisation

are included in the indices in different amounts, which allows customers to

choose the best option and trade on the growth or decline of almost the

entire crypto market (75% or more) in just one click.

Cash instruments

These instruments are based on futures instruments with similar names

available in our pool, but their primary feature is no expiration date. The

narrow spread, high swap and low commission per trade are among the

distinctive features that make these instruments optimal for intraday

trading but expensive for medium-term and long-term transactions.

3.

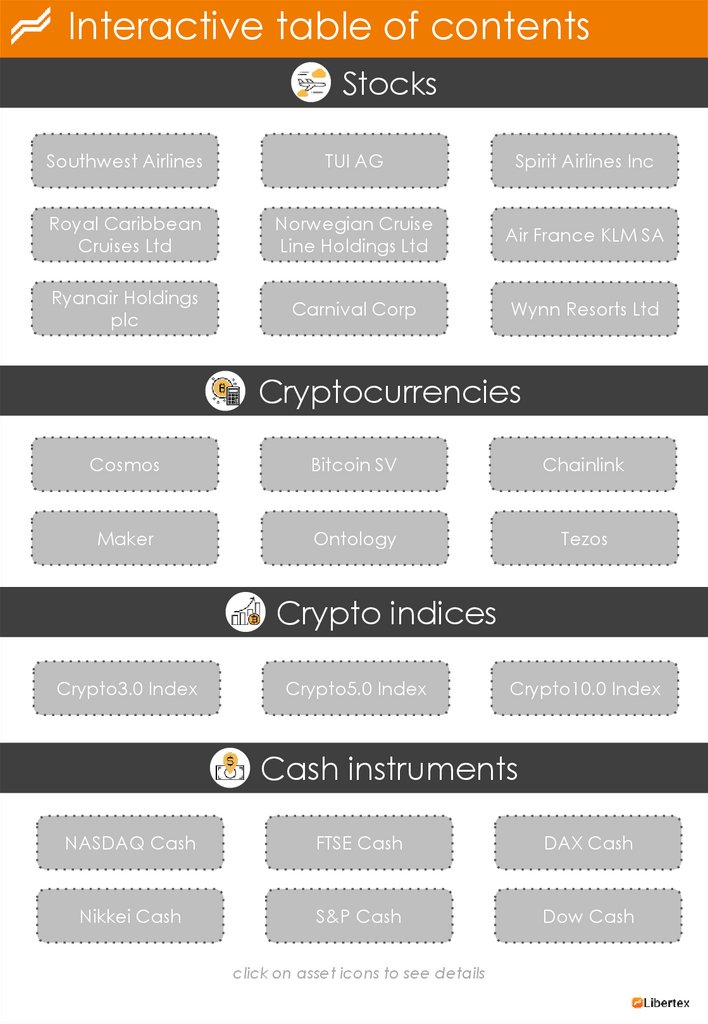

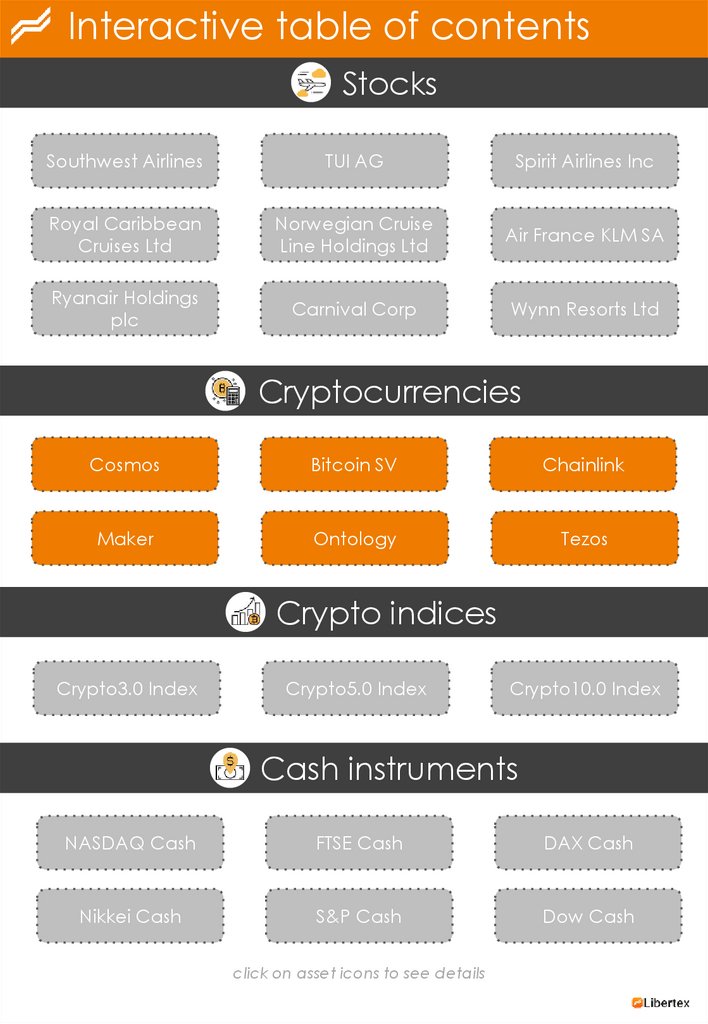

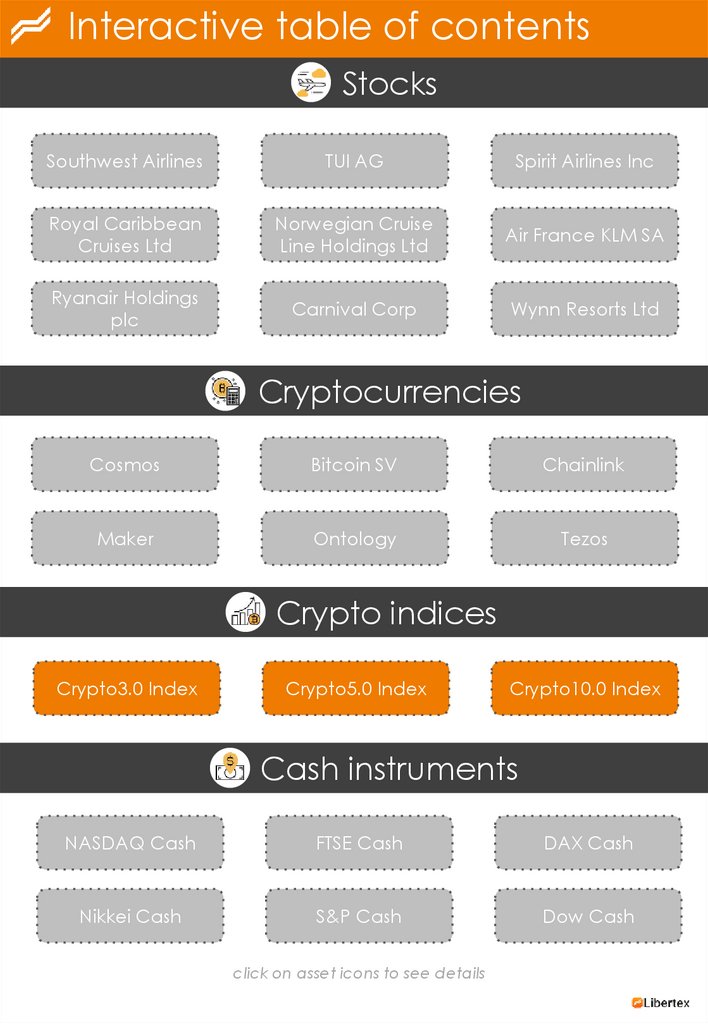

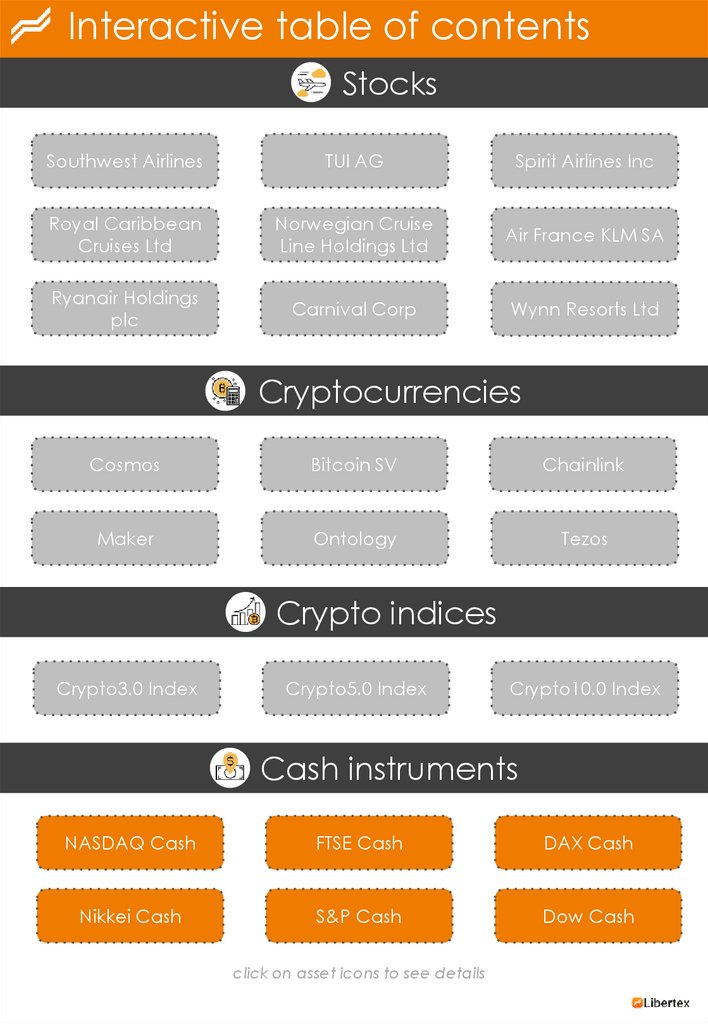

Interactive table of contentsStocks

Southwest Airlines

TUI AG

Spirit Airlines Inc

Royal Caribbean

Cruises Ltd

Norwegian Cruise

Line Holdings Ltd

Air France KLM SA

Ryanair Holdings

plc

Carnival Corp

Wynn Resorts Ltd

Cryptocurrencies

Cosmos

Bitcoin SV

Chainlink

Maker

Ontology

Tezos

Crypto indices

Crypto3.0 Index

Crypto5.0 Index

Crypto10.0 Index

Cash instruments

NASDAQ Cash

FTSE Cash

DAX Cash

Nikkei Cash

S&P Cash

Dow Cash

click on asset icons to see details

4.

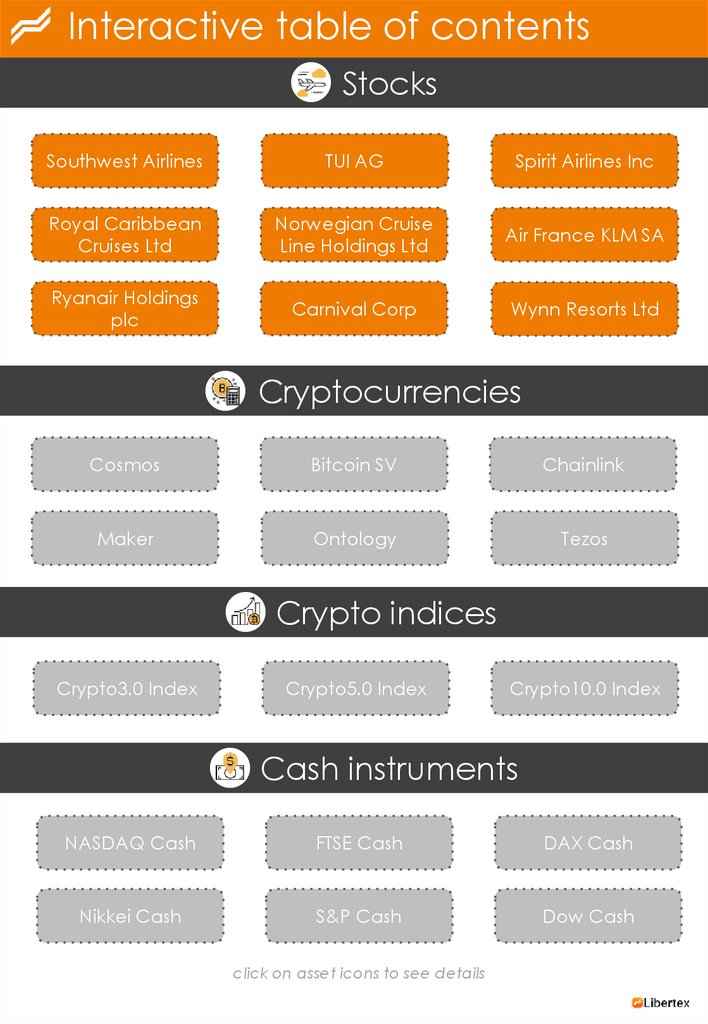

Interactive table of contentsStocks

Southwest Airlines

TUI AG

Spirit Airlines Inc

Royal Caribbean

Cruises Ltd

Norwegian Cruise

Line Holdings Ltd

Air France KLM SA

Ryanair Holdings

plc

Carnival Corp

Wynn Resorts Ltd

Cryptocurrencies

Cosmos

Bitcoin SV

Chainlink

Maker

Ontology

Tezos

Crypto indices

Crypto3.0 Index

Crypto5.0 Index

Crypto10.0 Index

Cash instruments

NASDAQ Cash

FTSE Cash

DAX Cash

Nikkei Cash

S&P Cash

Dow Cash

click on asset icons to see details

5.

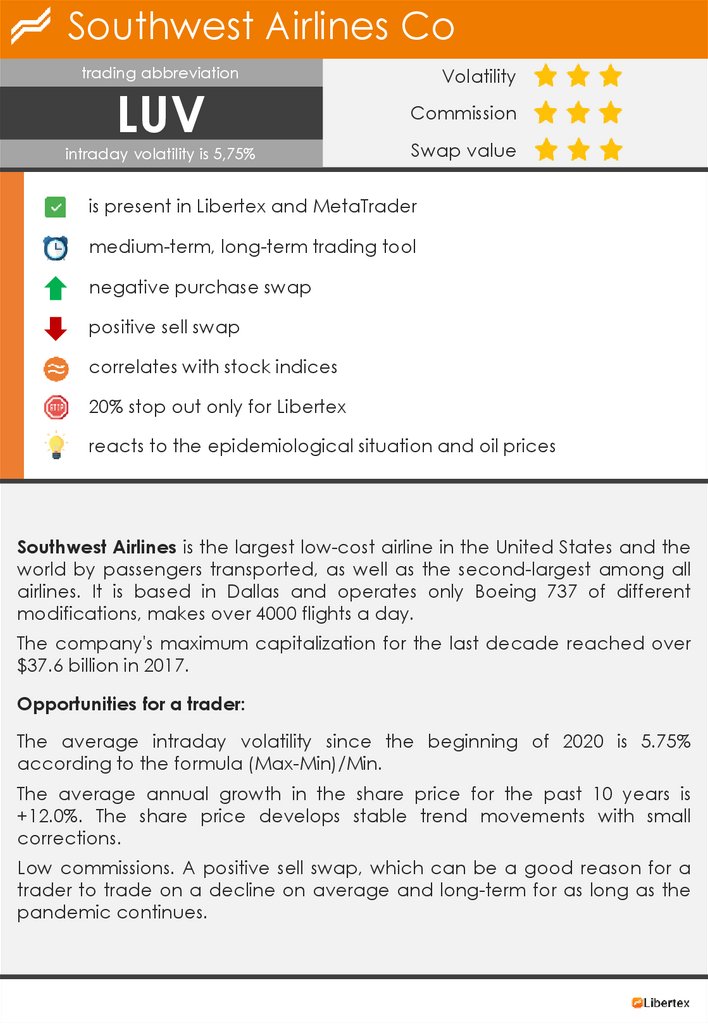

Southwest Airlines Cotrading abbreviation

LUV

intraday volatility is 5,75%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with stock indices

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Southwest Airlines is the largest low-cost airline in the United States and the

world by passengers transported, as well as the second-largest among all

airlines. It is based in Dallas and operates only Boeing 737 of different

modifications, makes over 4000 flights a day.

The company's maximum capitalization for the last decade reached over

$37.6 billion in 2017.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 5.75%

according to the formula (Max-Min)/Min.

The average annual growth in the share price for the past 10 years is

+12.0%. The share price develops stable trend movements with small

corrections.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

6.

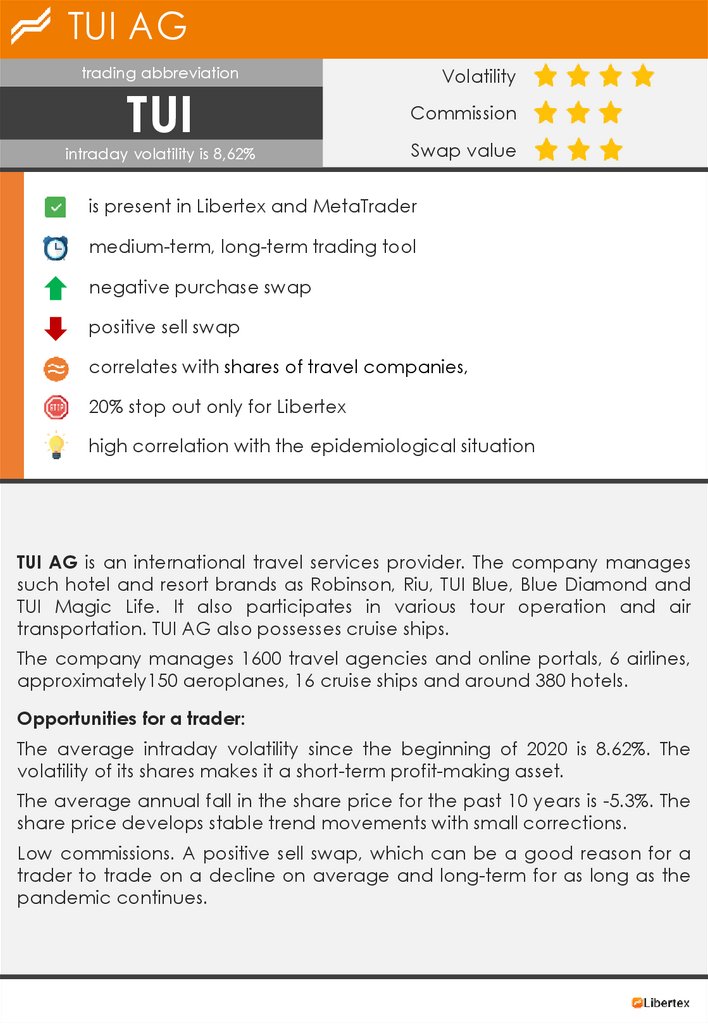

TUI AGtrading abbreviation

TUI

intraday volatility is 8,62%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with shares of travel companies,

20% stop out only for Libertex

high correlation with the epidemiological situation

TUI AG is an international travel services provider. The company manages

such hotel and resort brands as Robinson, Riu, TUI Blue, Blue Diamond and

TUI Magic Life. It also participates in various tour operation and air

transportation. TUI AG also possesses cruise ships.

The company manages 1600 travel agencies and online portals, 6 airlines,

approximately150 aeroplanes, 16 cruise ships and around 380 hotels.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 8.62%. The

volatility of its shares makes it a short-term profit-making asset.

The average annual fall in the share price for the past 10 years is -5.3%. The

share price develops stable trend movements with small corrections.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

7.

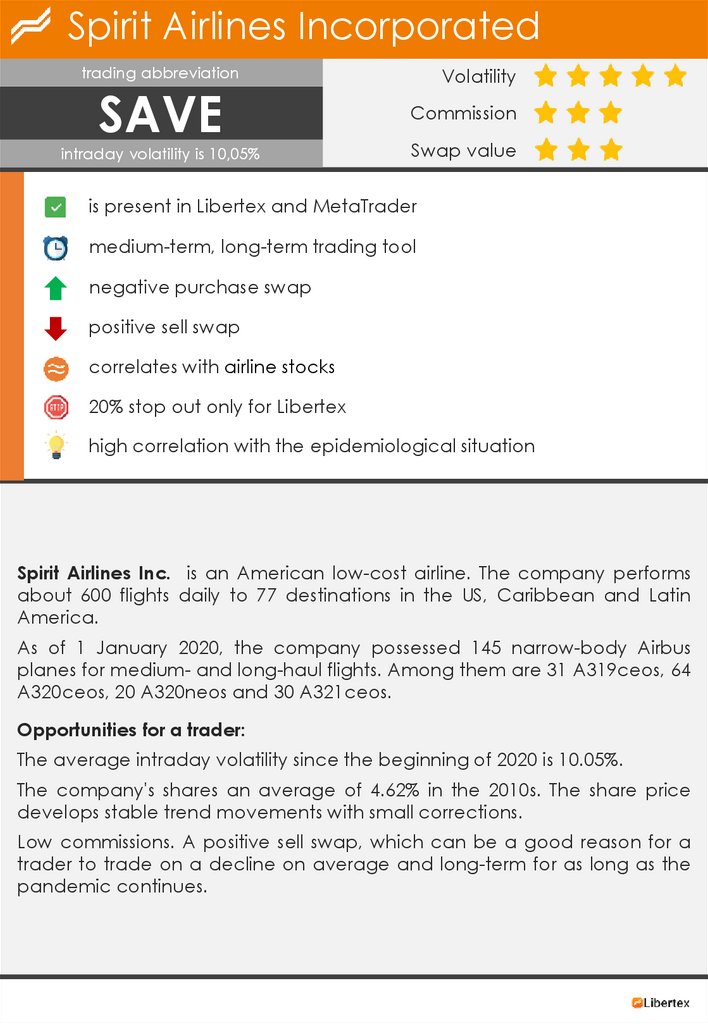

Spirit Airlines Incorporatedtrading abbreviation

SAVE

intraday volatility is 10,05%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with airline stocks

20% stop out only for Libertex

high correlation with the epidemiological situation

Spirit Airlines Inc. is an American low-cost airline. The company performs

about 600 flights daily to 77 destinations in the US, Caribbean and Latin

America.

As of 1 January 2020, the company possessed 145 narrow-body Airbus

planes for medium- and long-haul flights. Among them are 31 A319ceos, 64

A320ceos, 20 A320neos and 30 A321ceos.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 10.05%.

The company's shares an average of 4.62% in the 2010s. The share price

develops stable trend movements with small corrections.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

8.

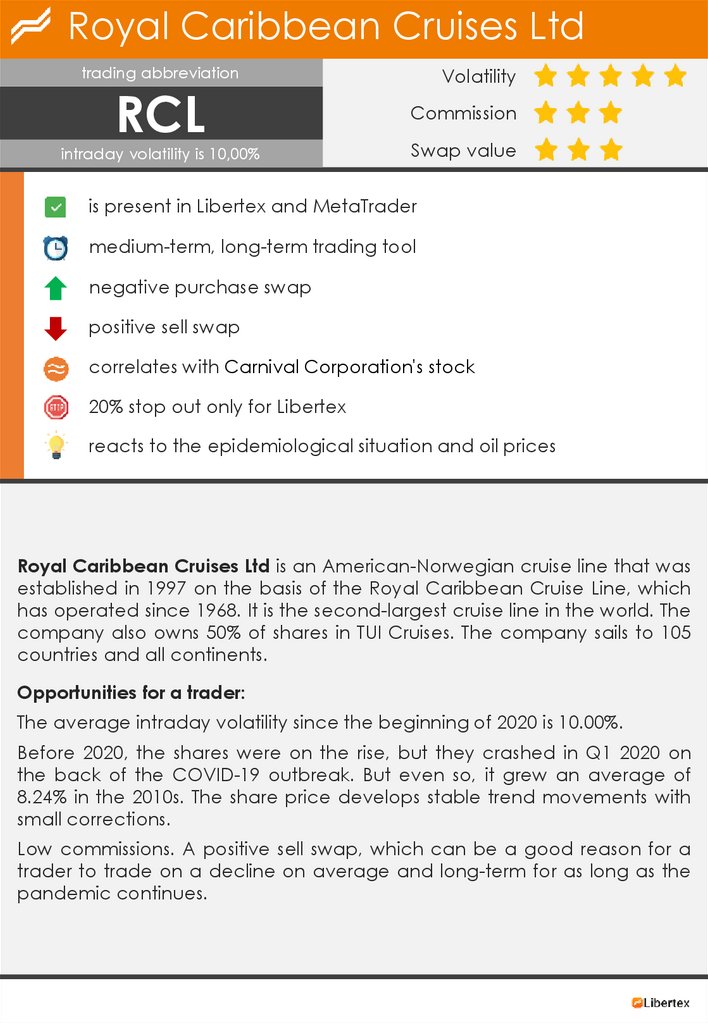

Royal Caribbean Cruises Ltdtrading abbreviation

RCL

intraday volatility is 10,00%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with Carnival Corporation's stock

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Royal Caribbean Cruises Ltd is an American-Norwegian cruise line that was

established in 1997 on the basis of the Royal Caribbean Cruise Line, which

has operated since 1968. It is the second-largest cruise line in the world. The

company also owns 50% of shares in TUI Cruises. The company sails to 105

countries and all continents.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 10.00%.

Before 2020, the shares were on the rise, but they crashed in Q1 2020 on

the back of the COVID-19 outbreak. But even so, it grew an average of

8.24% in the 2010s. The share price develops stable trend movements with

small corrections.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

9.

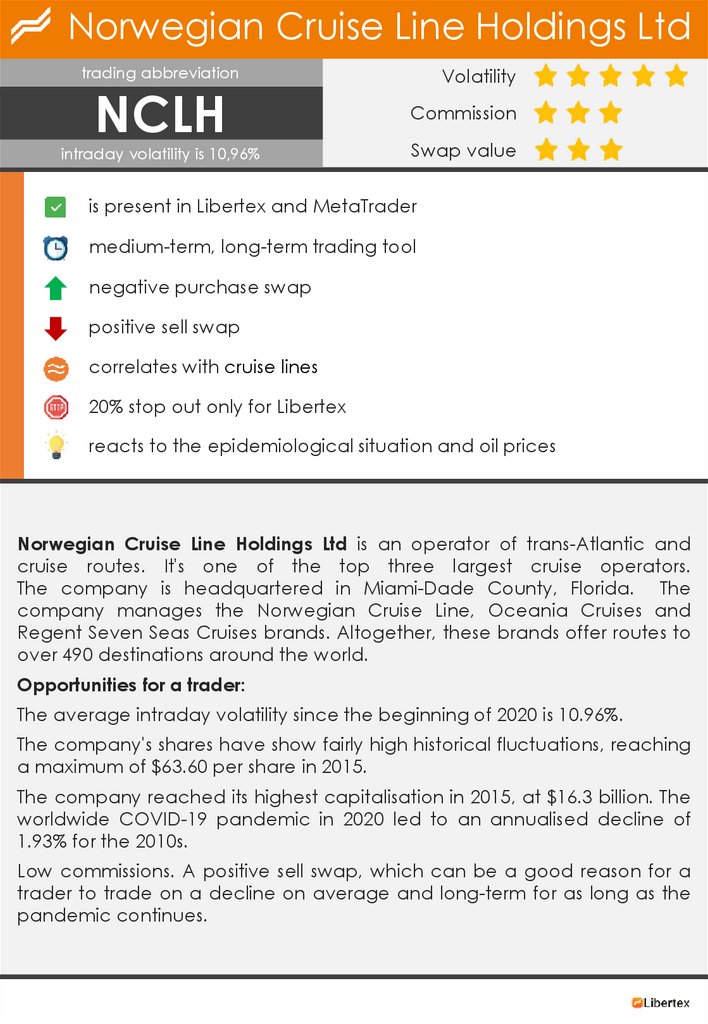

Norwegian Cruise Line Holdings Ltdtrading abbreviation

NCLH

intraday volatility is 10,96%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with cruise lines

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Norwegian Cruise Line Holdings Ltd is an operator of trans-Atlantic and

cruise routes. It's one of the top three largest cruise operators.

The company is headquartered in Miami-Dade County, Florida. The

company manages the Norwegian Cruise Line, Oceania Cruises and

Regent Seven Seas Cruises brands. Altogether, these brands offer routes to

over 490 destinations around the world.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 10.96%.

The company's shares have show fairly high historical fluctuations, reaching

a maximum of $63.60 per share in 2015.

The company reached its highest capitalisation in 2015, at $16.3 billion. The

worldwide COVID-19 pandemic in 2020 led to an annualised decline of

1.93% for the 2010s.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

10.

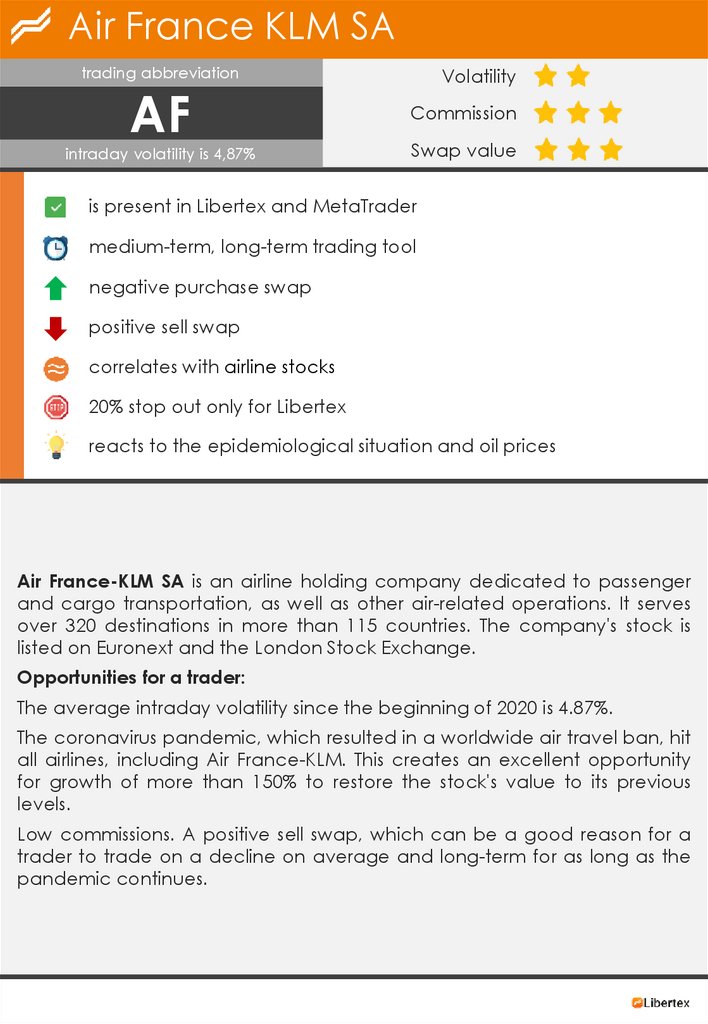

Air France KLM SAtrading abbreviation

AF

intraday volatility is 4,87%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with airline stocks

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Air France-KLM SA is an airline holding company dedicated to passenger

and cargo transportation, as well as other air-related operations. It serves

over 320 destinations in more than 115 countries. The company's stock is

listed on Euronext and the London Stock Exchange.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 4.87%.

The coronavirus pandemic, which resulted in a worldwide air travel ban, hit

all airlines, including Air France-KLM. This creates an excellent opportunity

for growth of more than 150% to restore the stock's value to its previous

levels.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

11.

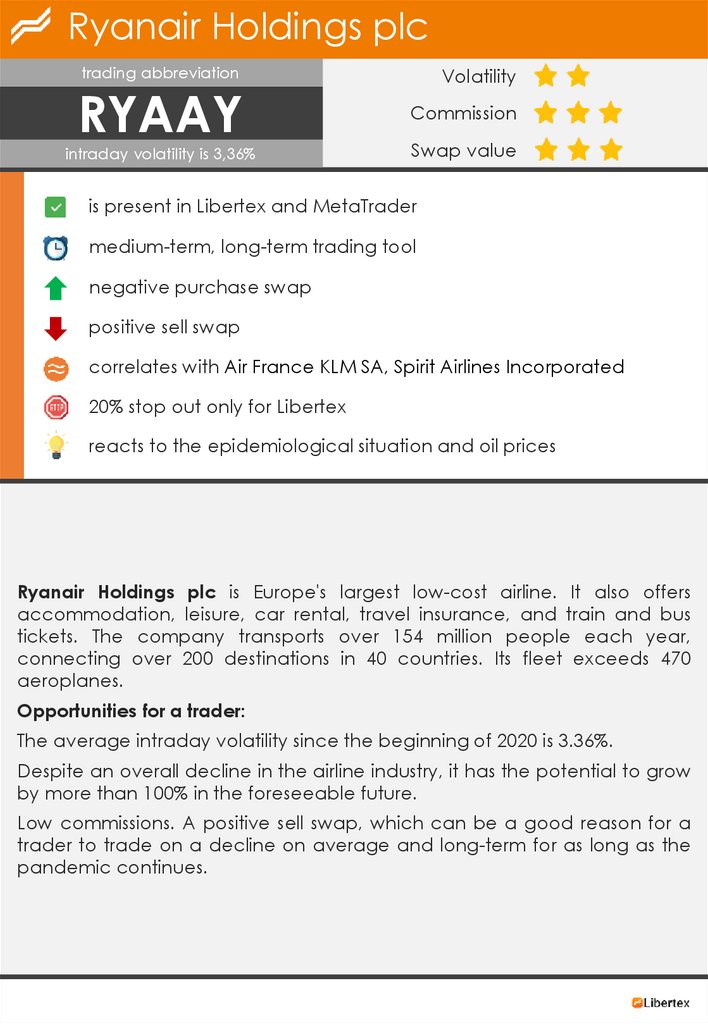

Ryanair Holdings plctrading abbreviation

RYAAY

intraday volatility is 3,36%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with Air France KLM SA, Spirit Airlines Incorporated

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Ryanair Holdings plc is Europe's largest low-cost airline. It also offers

accommodation, leisure, car rental, travel insurance, and train and bus

tickets. The company transports over 154 million people each year,

connecting over 200 destinations in 40 countries. Its fleet exceeds 470

aeroplanes.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 3.36%.

Despite an overall decline in the airline industry, it has the potential to grow

by more than 100% in the foreseeable future.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

12.

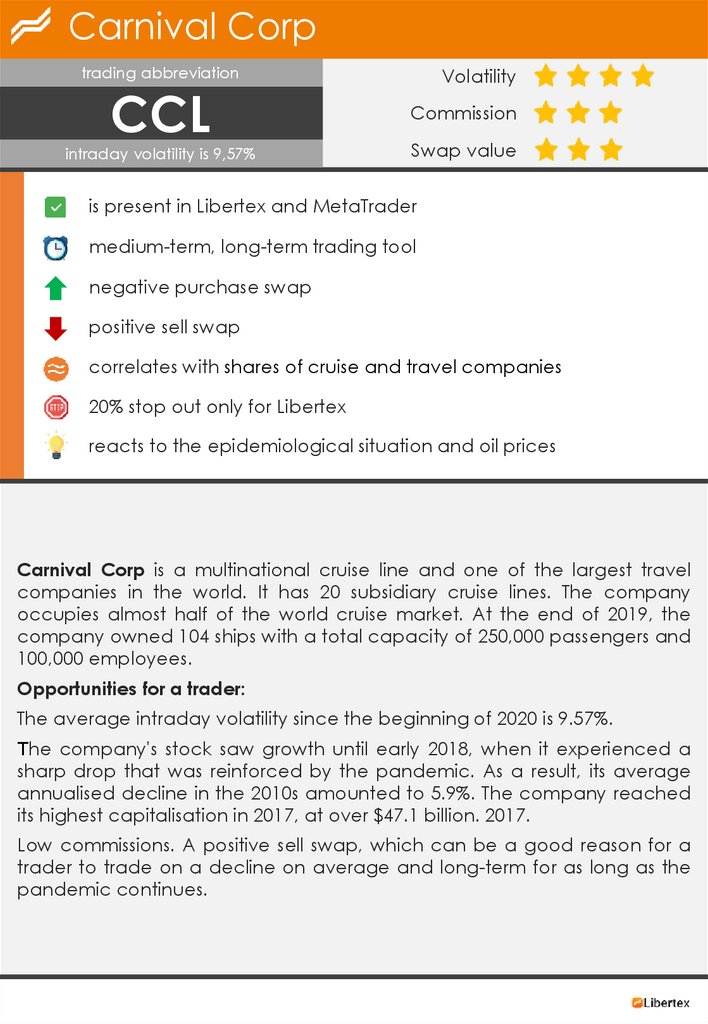

Carnival Corptrading abbreviation

CCL

intraday volatility is 9,57%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with shares of cruise and travel companies

20% stop out only for Libertex

reacts to the epidemiological situation and oil prices

Carnival Corp is a multinational cruise line and one of the largest travel

companies in the world. It has 20 subsidiary cruise lines. The company

occupies almost half of the world cruise market. At the end of 2019, the

company owned 104 ships with a total capacity of 250,000 passengers and

100,000 employees.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 9.57%.

The company's stock saw growth until early 2018, when it experienced a

sharp drop that was reinforced by the pandemic. As a result, its average

annualised decline in the 2010s amounted to 5.9%. The company reached

its highest capitalisation in 2017, at over $47.1 billion. 2017.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

13.

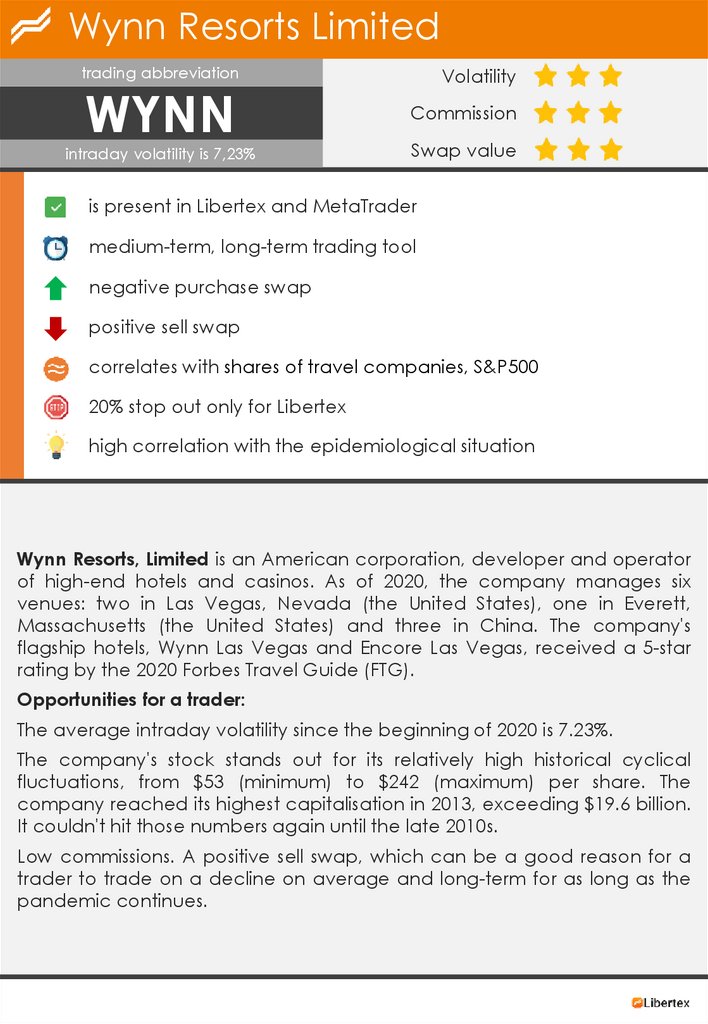

Wynn Resorts Limitedtrading abbreviation

WYNN

intraday volatility is 7,23%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

medium-term, long-term trading tool

negative purchase swap

positive sell swap

correlates with shares of travel companies, S&P500

20% stop out only for Libertex

high correlation with the epidemiological situation

Wynn Resorts, Limited is an American corporation, developer and operator

of high-end hotels and casinos. As of 2020, the company manages six

venues: two in Las Vegas, Nevada (the United States), one in Everett,

Massachusetts (the United States) and three in China. The company's

flagship hotels, Wynn Las Vegas and Encore Las Vegas, received a 5-star

rating by the 2020 Forbes Travel Guide (FTG).

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 7.23%.

The company's stock stands out for its relatively high historical cyclical

fluctuations, from $53 (minimum) to $242 (maximum) per share. The

company reached its highest capitalisation in 2013, exceeding $19.6 billion.

It couldn't hit those numbers again until the late 2010s.

Low commissions. A positive sell swap, which can be a good reason for a

trader to trade on a decline on average and long-term for as long as the

pandemic continues.

14.

Interactive table of contentsStocks

Southwest Airlines

TUI AG

Spirit Airlines Inc

Royal Caribbean

Cruises Ltd

Norwegian Cruise

Line Holdings Ltd

Air France KLM SA

Ryanair Holdings

plc

Carnival Corp

Wynn Resorts Ltd

Cryptocurrencies

Cosmos

Bitcoin SV

Chainlink

Maker

Ontology

Tezos

Crypto indices

Crypto3.0 Index

Crypto5.0 Index

Crypto10.0 Index

Cash instruments

NASDAQ Cash

FTSE Cash

DAX Cash

Nikkei Cash

S&P Cash

Dow Cash

click on asset icons to see details

15.

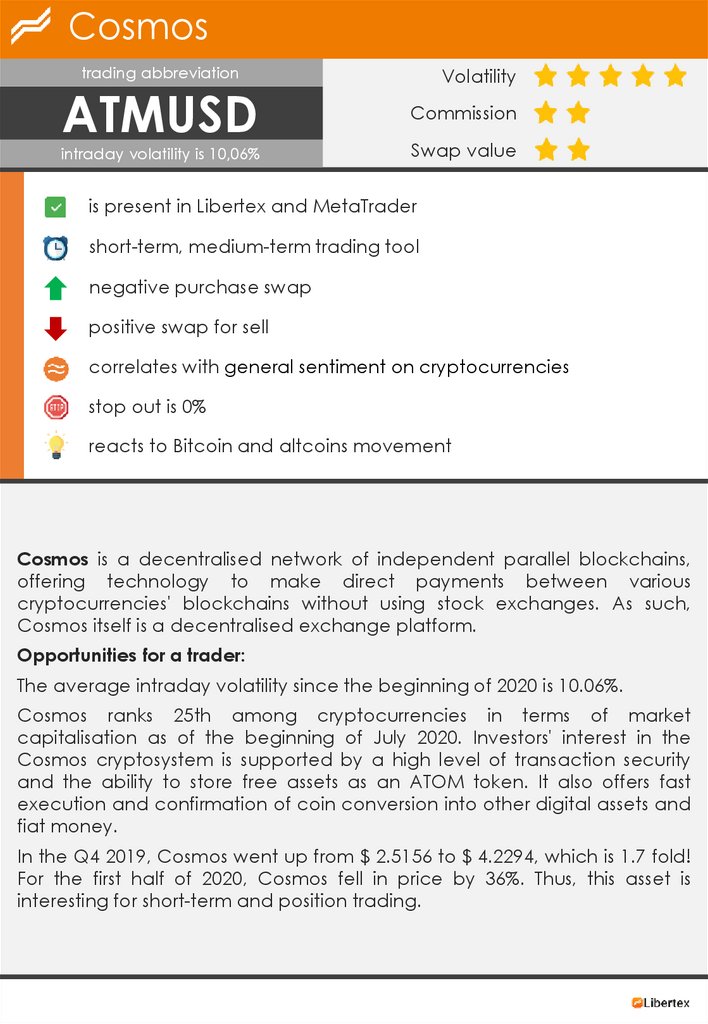

Cosmostrading abbreviation

ATMUSD

intraday volatility is 10,06%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive swap for sell

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Cosmos is a decentralised network of independent parallel blockchains,

offering technology to make direct payments between various

cryptocurrencies' blockchains without using stock exchanges. As such,

Cosmos itself is a decentralised exchange platform.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 10.06%.

Cosmos ranks 25th among cryptocurrencies in terms of market

capitalisation as of the beginning of July 2020. Investors' interest in the

Cosmos cryptosystem is supported by a high level of transaction security

and the ability to store free assets as an ATOM token. It also offers fast

execution and confirmation of coin conversion into other digital assets and

fiat money.

In the Q4 2019, Cosmos went up from $ 2.5156 to $ 4.2294, which is 1.7 fold!

For the first half of 2020, Cosmos fell in price by 36%. Thus, this asset is

interesting for short-term and position trading.

16.

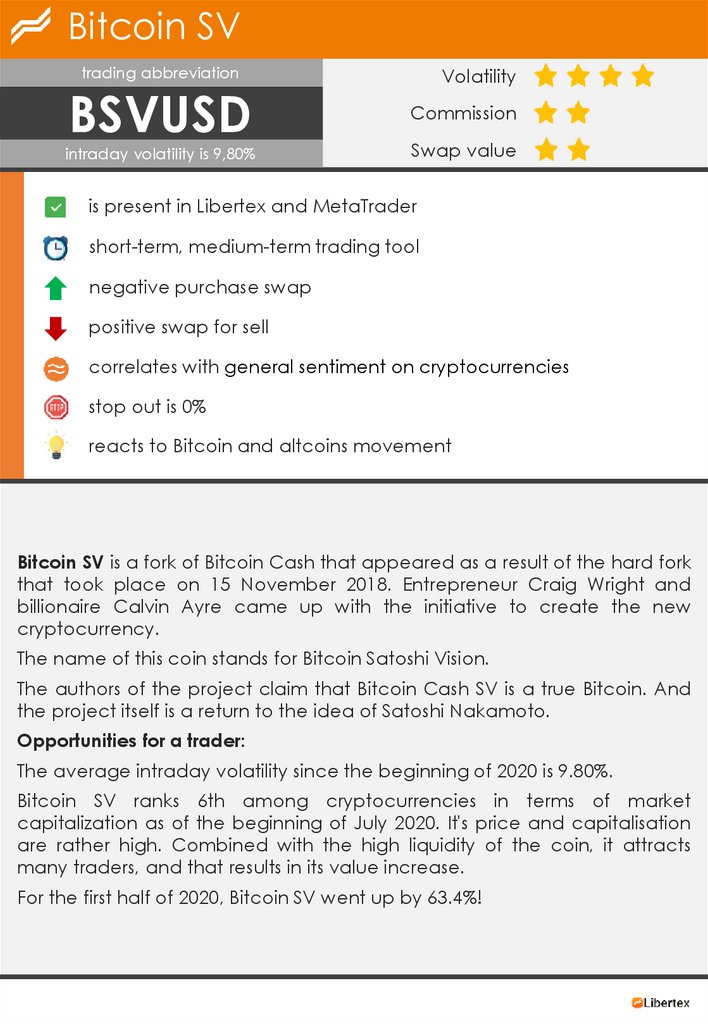

Bitcoin SVtrading abbreviation

BSVUSD

intraday volatility is 9,80%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive swap for sell

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Bitcoin SV is a fork of Bitcoin Cash that appeared as a result of the hard fork

that took place on 15 November 2018. Entrepreneur Craig Wright and

billionaire Calvin Ayre came up with the initiative to create the new

cryptocurrency.

The name of this coin stands for Bitcoin Satoshi Vision.

The authors of the project claim that Bitcoin Cash SV is a true Bitcoin. And

the project itself is a return to the idea of Satoshi Nakamoto.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 9.80%.

Bitcoin SV ranks 6th among cryptocurrencies in terms of market

capitalization as of the beginning of July 2020. It's price and capitalisation

are rather high. Combined with the high liquidity of the coin, it attracts

many traders, and that results in its value increase.

For the first half of 2020, Bitcoin SV went up by 63.4%!

17.

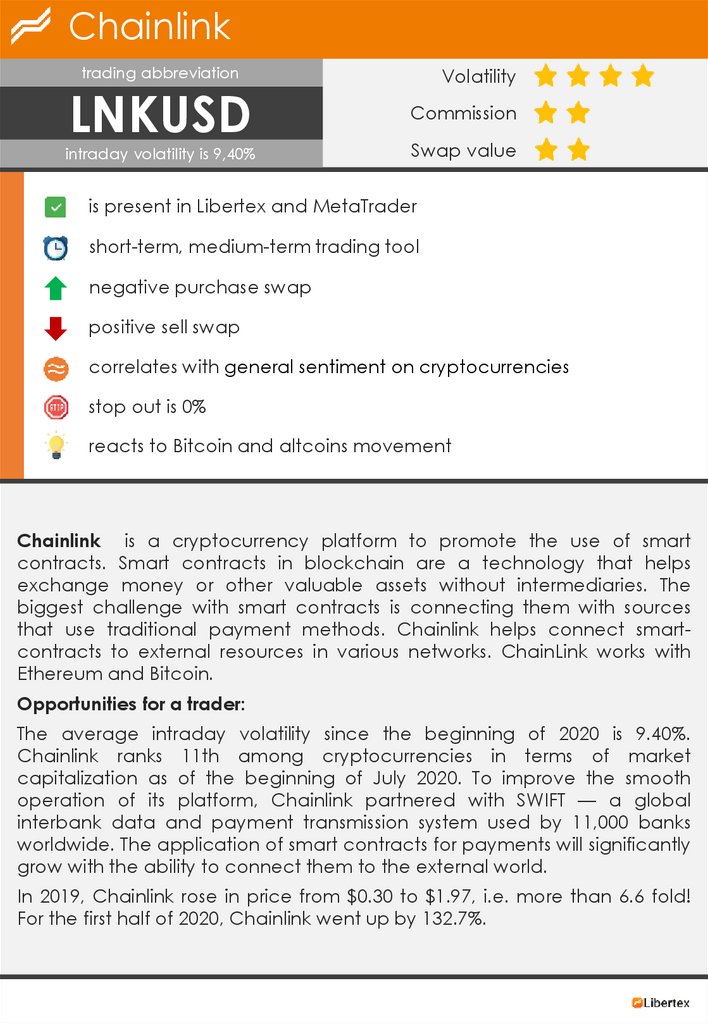

Chainlinktrading abbreviation

LNKUSD

intraday volatility is 9,40%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive sell swap

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Chainlink is a cryptocurrency platform to promote the use of smart

contracts. Smart contracts in blockchain are a technology that helps

exchange money or other valuable assets without intermediaries. The

biggest challenge with smart contracts is connecting them with sources

that use traditional payment methods. Chainlink helps connect smartcontracts to external resources in various networks. ChainLink works with

Ethereum and Bitcoin.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 9.40%.

Chainlink ranks 11th among cryptocurrencies in terms of market

capitalization as of the beginning of July 2020. To improve the smooth

operation of its platform, Chainlink partnered with SWIFT — a global

interbank data and payment transmission system used by 11,000 banks

worldwide. The application of smart contracts for payments will significantly

grow with the ability to connect them to the external world.

In 2019, Chainlink rose in price from $0.30 to $1.97, i.e. more than 6.6 fold!

For the first half of 2020, Chainlink went up by 132.7%.

18.

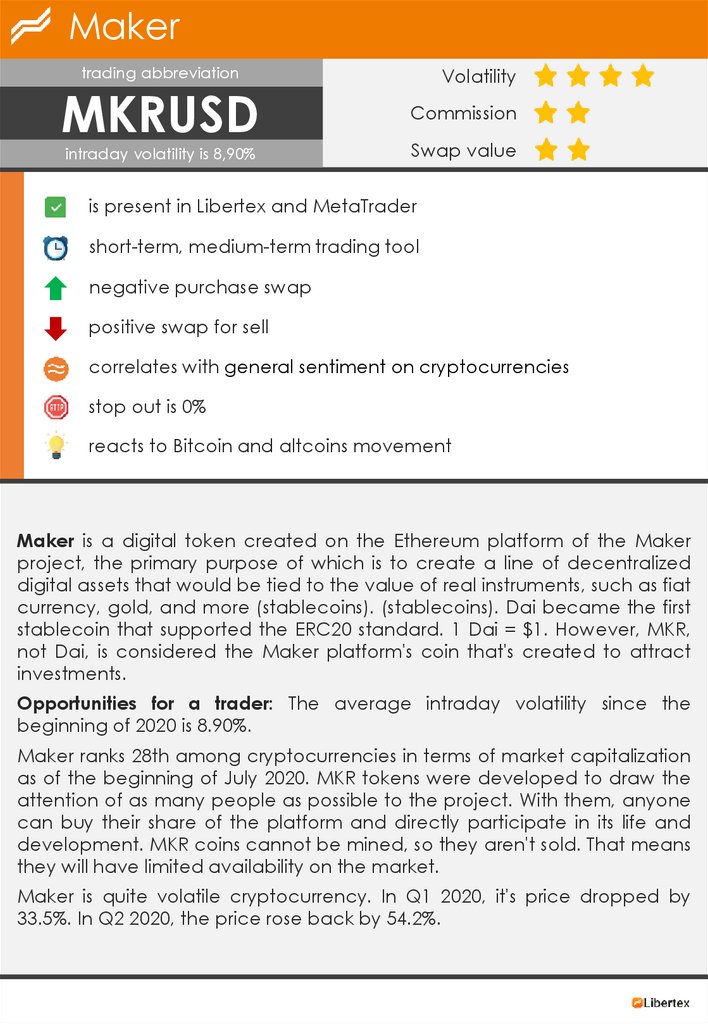

Makertrading abbreviation

MKRUSD

intraday volatility is 8,90%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive swap for sell

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Maker is a digital token created on the Ethereum platform of the Maker

project, the primary purpose of which is to create a line of decentralized

digital assets that would be tied to the value of real instruments, such as fiat

currency, gold, and more (stablecoins). (stablecoins). Dai became the first

stablecoin that supported the ERC20 standard. 1 Dai = $1. However, MKR,

not Dai, is considered the Maker platform's coin that's created to attract

investments.

Opportunities for a trader: The average intraday volatility since the

beginning of 2020 is 8.90%.

Maker ranks 28th among cryptocurrencies in terms of market capitalization

as of the beginning of July 2020. MKR tokens were developed to draw the

attention of as many people as possible to the project. With them, anyone

can buy their share of the platform and directly participate in its life and

development. MKR coins cannot be mined, so they aren't sold. That means

they will have limited availability on the market.

Maker is quite volatile cryptocurrency. In Q1 2020, it's price dropped by

33.5%. In Q2 2020, the price rose back by 54.2%.

19.

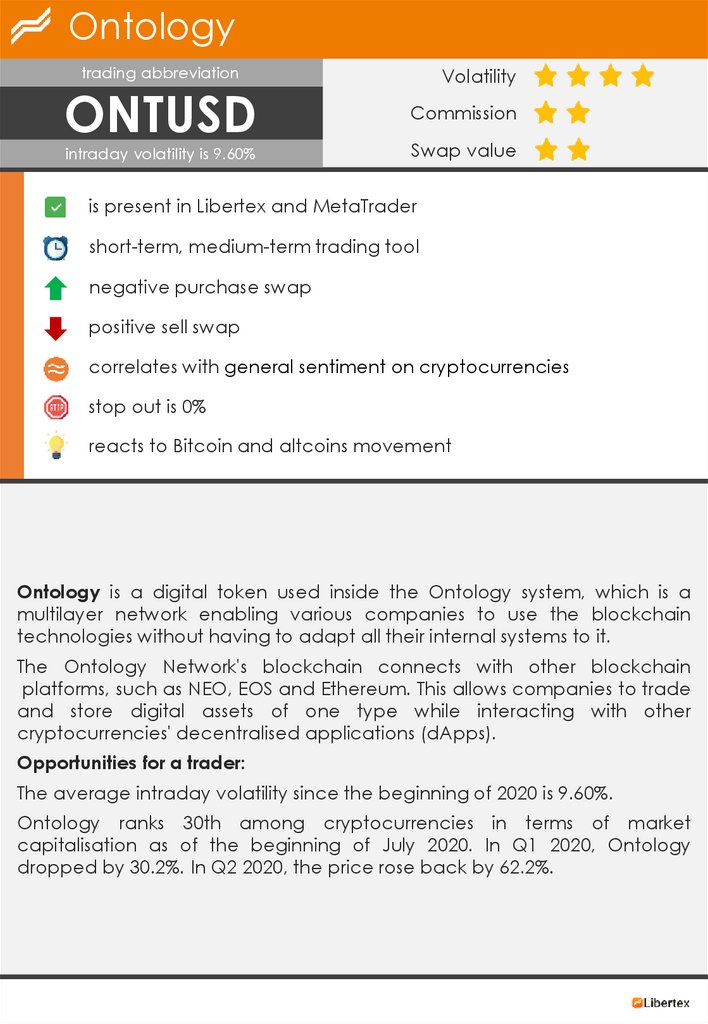

Ontologytrading abbreviation

ONTUSD

intraday volatility is 9.60%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive sell swap

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Ontology is a digital token used inside the Ontology system, which is a

multilayer network enabling various companies to use the blockchain

technologies without having to adapt all their internal systems to it.

The Ontology Network's blockchain connects with other blockchain

platforms, such as NEO, EOS and Ethereum. This allows companies to trade

and store digital assets of one type while interacting with other

cryptocurrencies' decentralised applications (dApps).

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 9.60%.

Ontology ranks 30th among cryptocurrencies in terms of market

capitalisation as of the beginning of July 2020. In Q1 2020, Ontology

dropped by 30.2%. In Q2 2020, the price rose back by 62.2%.

20.

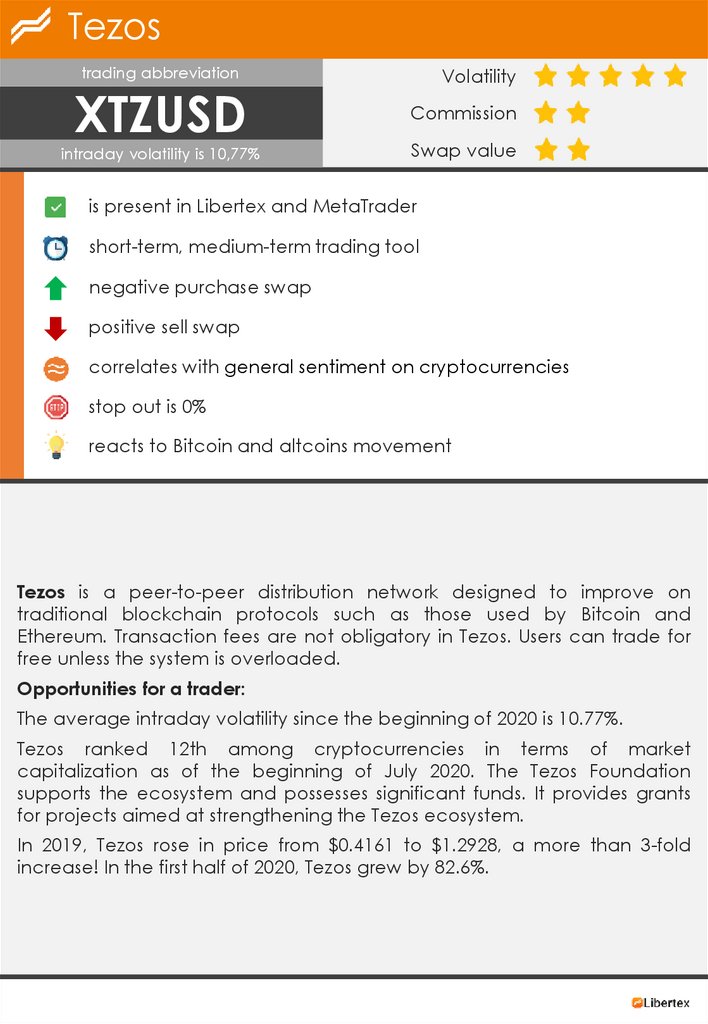

Tezostrading abbreviation

XTZUSD

intraday volatility is 10,77%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative purchase swap

positive sell swap

correlates with general sentiment on cryptocurrencies

stop out is 0%

reacts to Bitcoin and altcoins movement

Tezos is a peer-to-peer distribution network designed to improve on

traditional blockchain protocols such as those used by Bitcoin and

Ethereum. Transaction fees are not obligatory in Tezos. Users can trade for

free unless the system is overloaded.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 10.77%.

Tezos ranked 12th among cryptocurrencies in terms of market

capitalization as of the beginning of July 2020. The Tezos Foundation

supports the ecosystem and possesses significant funds. It provides grants

for projects aimed at strengthening the Tezos ecosystem.

In 2019, Tezos rose in price from $0.4161 to $1.2928, a more than 3-fold

increase! In the first half of 2020, Tezos grew by 82.6%.

21.

Interactive table of contentsStocks

Southwest Airlines

TUI AG

Spirit Airlines Inc

Royal Caribbean

Cruises Ltd

Norwegian Cruise

Line Holdings Ltd

Air France KLM SA

Ryanair Holdings

plc

Carnival Corp

Wynn Resorts Ltd

Cryptocurrencies

Cosmos

Bitcoin SV

Chainlink

Maker

Ontology

Tezos

Crypto indices

Crypto3.0 Index

Crypto5.0 Index

Crypto10.0 Index

Cash instruments

NASDAQ Cash

FTSE Cash

DAX Cash

Nikkei Cash

S&P Cash

Dow Cash

click on asset icons to see details

22.

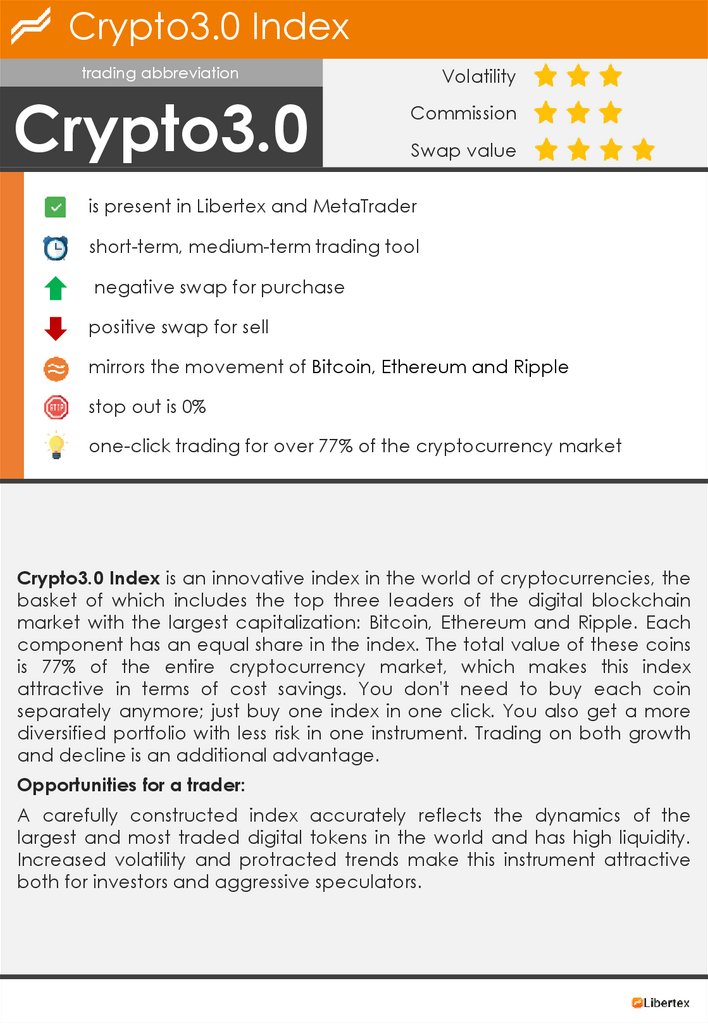

Crypto3.0 Indextrading abbreviation

Crypto3.0

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative swap for purchase

positive swap for sell

mirrors the movement of Bitcoin, Ethereum and Ripple

stop out is 0%

one-click trading for over 77% of the cryptocurrency market

Crypto3.0 Index is an innovative index in the world of cryptocurrencies, the

basket of which includes the top three leaders of the digital blockchain

market with the largest capitalization: Bitcoin, Ethereum and Ripple. Each

component has an equal share in the index. The total value of these coins

is 77% of the entire cryptocurrency market, which makes this index

attractive in terms of cost savings. You don't need to buy each coin

separately anymore; just buy one index in one click. You also get a more

diversified portfolio with less risk in one instrument. Trading on both growth

and decline is an additional advantage.

Opportunities for a trader:

A carefully constructed index accurately reflects the dynamics of the

largest and most traded digital tokens in the world and has high liquidity.

Increased volatility and protracted trends make this instrument attractive

both for investors and aggressive speculators.

23.

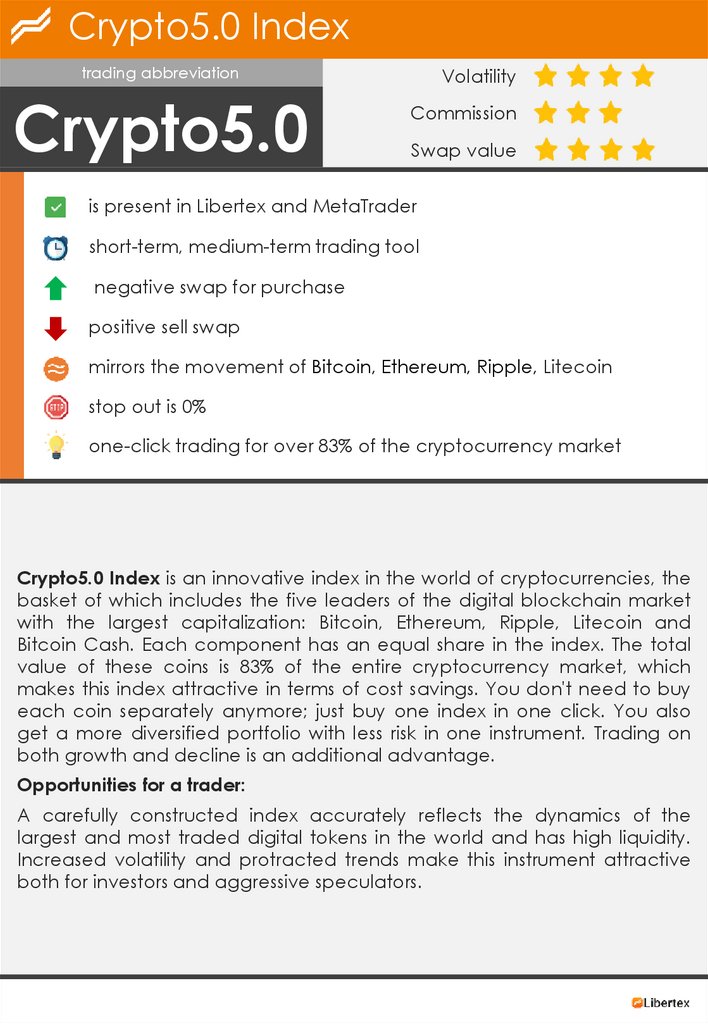

Crypto5.0 Indextrading abbreviation

Crypto5.0

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term, medium-term trading tool

negative swap for purchase

positive sell swap

mirrors the movement of Bitcoin, Ethereum, Ripple, Litecoin

stop out is 0%

one-click trading for over 83% of the cryptocurrency market

Crypto5.0 Index is an innovative index in the world of cryptocurrencies, the

basket of which includes the five leaders of the digital blockchain market

with the largest capitalization: Bitcoin, Ethereum, Ripple, Litecoin and

Bitcoin Cash. Each component has an equal share in the index. The total

value of these coins is 83% of the entire cryptocurrency market, which

makes this index attractive in terms of cost savings. You don't need to buy

each coin separately anymore; just buy one index in one click. You also

get a more diversified portfolio with less risk in one instrument. Trading on

both growth and decline is an additional advantage.

Opportunities for a trader:

A carefully constructed index accurately reflects the dynamics of the

largest and most traded digital tokens in the world and has high liquidity.

Increased volatility and protracted trends make this instrument attractive

both for investors and aggressive speculators.

24.

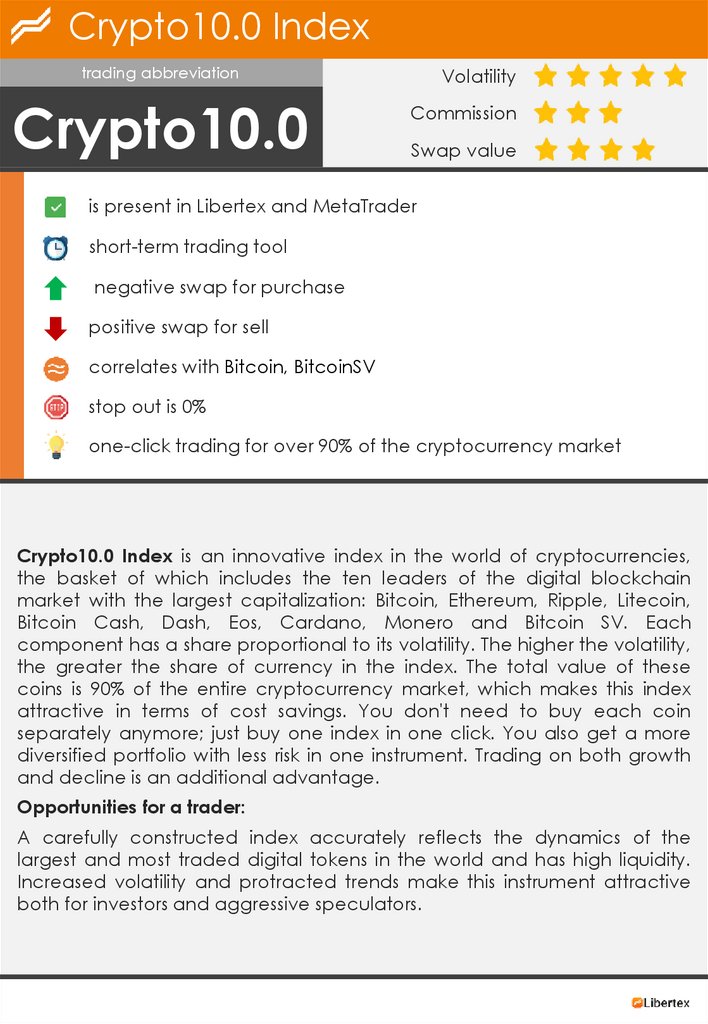

Crypto10.0 Indextrading abbreviation

Crypto10.0

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

negative swap for purchase

positive swap for sell

correlates with Bitcoin, BitcoinSV

stop out is 0%

one-click trading for over 90% of the cryptocurrency market

Crypto10.0 Index is an innovative index in the world of cryptocurrencies,

the basket of which includes the ten leaders of the digital blockchain

market with the largest capitalization: Bitcoin, Ethereum, Ripple, Litecoin,

Bitcoin Cash, Dash, Eos, Cardano, Monero and Bitcoin SV. Each

component has a share proportional to its volatility. The higher the volatility,

the greater the share of currency in the index. The total value of these

coins is 90% of the entire cryptocurrency market, which makes this index

attractive in terms of cost savings. You don't need to buy each coin

separately anymore; just buy one index in one click. You also get a more

diversified portfolio with less risk in one instrument. Trading on both growth

and decline is an additional advantage.

Opportunities for a trader:

A carefully constructed index accurately reflects the dynamics of the

largest and most traded digital tokens in the world and has high liquidity.

Increased volatility and protracted trends make this instrument attractive

both for investors and aggressive speculators.

25.

Interactive table of contentsStocks

Southwest Airlines

TUI AG

Spirit Airlines Inc

Royal Caribbean

Cruises Ltd

Norwegian Cruise

Line Holdings Ltd

Air France KLM SA

Ryanair Holdings

plc

Carnival Corp

Wynn Resorts Ltd

Cryptocurrencies

Cosmos

Bitcoin SV

Chainlink

Maker

Ontology

Tezos

Crypto indices

Crypto3.0 Index

Crypto5.0 Index

Crypto10.0 Index

Cash instruments

NASDAQ Cash

FTSE Cash

DAX Cash

Nikkei Cash

S&P Cash

Dow Cash

click on asset icons to see details

26.

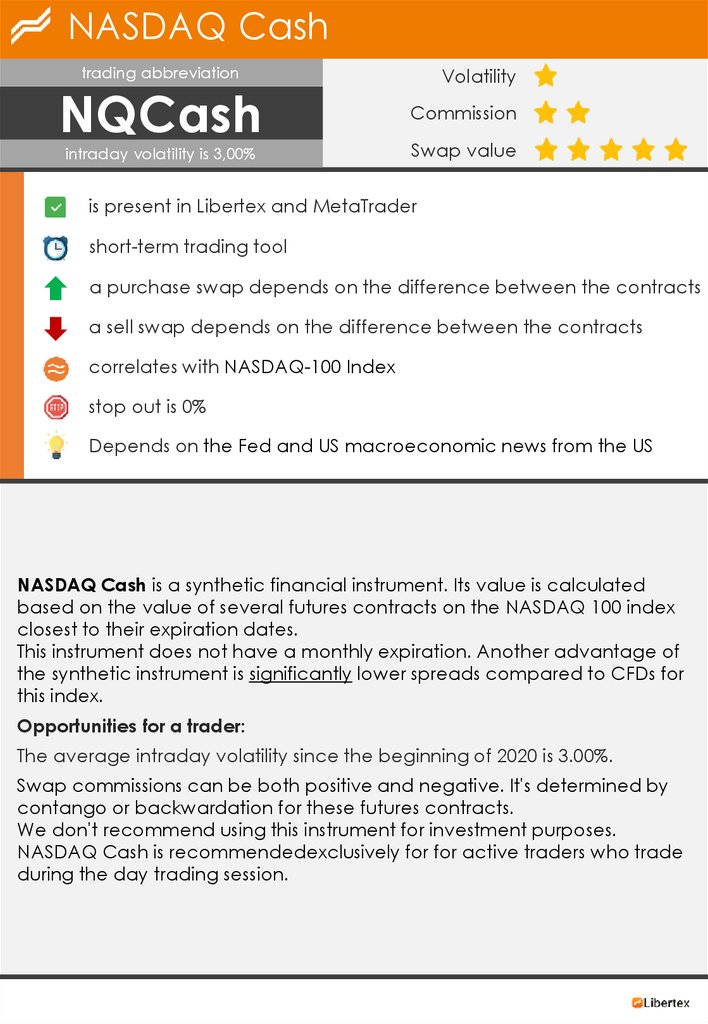

NASDAQ Cashtrading abbreviation

NQCash

intraday volatility is 3,00%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with NASDAQ-100 Index

stop out is 0%

Depends on the Fed and US macroeconomic news from the US

NASDAQ Cash is a synthetic financial instrument. Its value is calculated

based on the value of several futures contracts on the NASDAQ 100 index

closest to their expiration dates.

This instrument does not have a monthly expiration. Another advantage of

the synthetic instrument is significantly lower spreads compared to CFDs for

this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 3.00%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes.

NASDAQ Cash is recommendedexclusively for for active traders who trade

during the day trading session.

27.

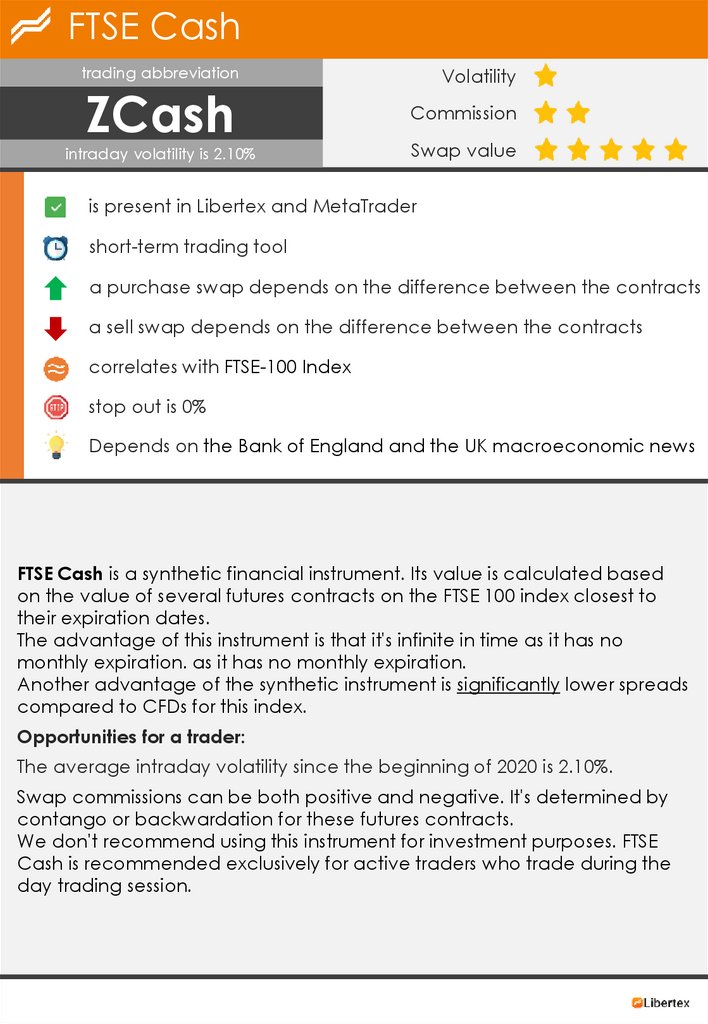

FTSE Cashtrading abbreviation

ZCash

intraday volatility is 2.10%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with FTSE-100 Index

stop out is 0%

Depends on the Bank of England and the UK macroeconomic news

FTSE Cash is a synthetic financial instrument. Its value is calculated based

on the value of several futures contracts on the FTSE 100 index closest to

their expiration dates.

The advantage of this instrument is that it's infinite in time as it has no

monthly expiration. as it has no monthly expiration.

Another advantage of the synthetic instrument is significantly lower spreads

compared to CFDs for this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 2.10%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes. FTSE

Cash is recommended exclusively for active traders who trade during the

day trading session.

28.

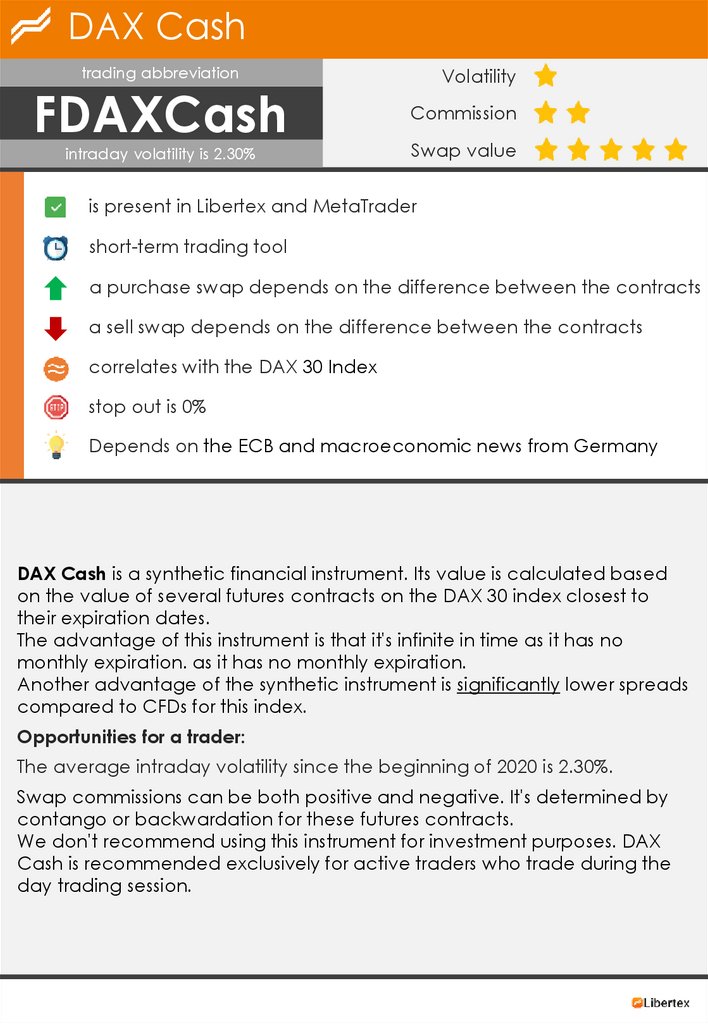

DAX Cashtrading abbreviation

FDAXCash

intraday volatility is 2.30%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with the DAX 30 Index

stop out is 0%

Depends on the ECB and macroeconomic news from Germany

DAX Cash is a synthetic financial instrument. Its value is calculated based

on the value of several futures contracts on the DAX 30 index closest to

their expiration dates.

The advantage of this instrument is that it's infinite in time as it has no

monthly expiration. as it has no monthly expiration.

Another advantage of the synthetic instrument is significantly lower spreads

compared to CFDs for this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 2.30%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes. DAX

Cash is recommended exclusively for active traders who trade during the

day trading session.

29.

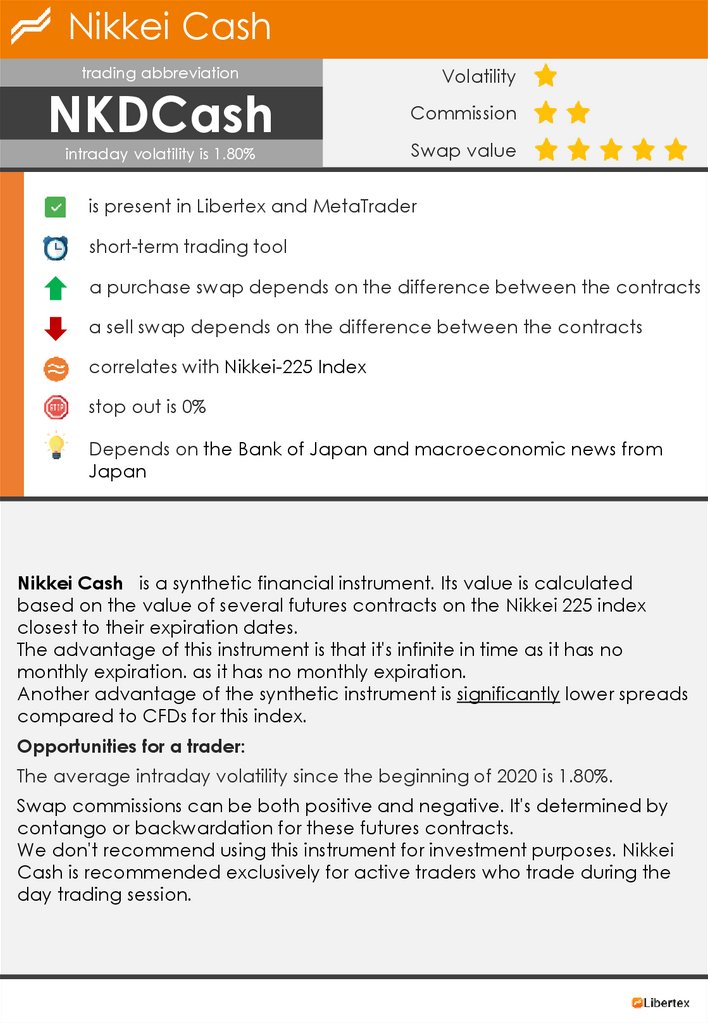

Nikkei Cashtrading abbreviation

NKDCash

intraday volatility is 1.80%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with Nikkei-225 Index

stop out is 0%

Depends on the Bank of Japan and macroeconomic news from

Japan

Nikkei Cash is a synthetic financial instrument. Its value is calculated

based on the value of several futures contracts on the Nikkei 225 index

closest to their expiration dates.

The advantage of this instrument is that it's infinite in time as it has no

monthly expiration. as it has no monthly expiration.

Another advantage of the synthetic instrument is significantly lower spreads

compared to CFDs for this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 1.80%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes. Nikkei

Cash is recommended exclusively for active traders who trade during the

day trading session.

30.

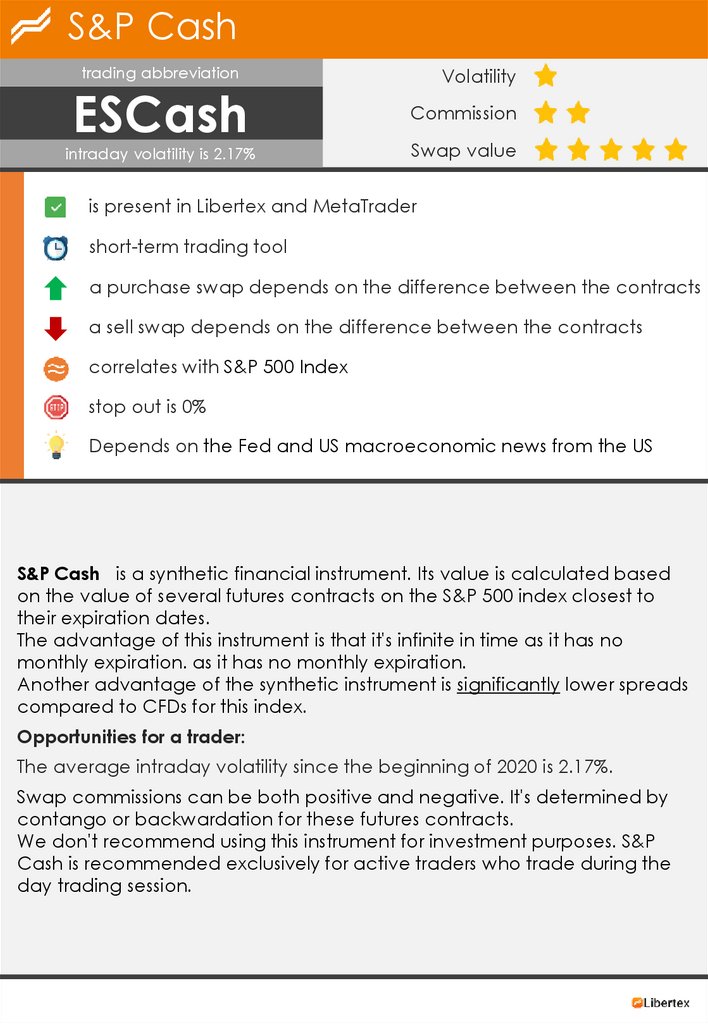

S&P Cashtrading abbreviation

ESCash

intraday volatility is 2.17%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with S&P 500 Index

stop out is 0%

Depends on the Fed and US macroeconomic news from the US

S&P Cash is a synthetic financial instrument. Its value is calculated based

on the value of several futures contracts on the S&P 500 index closest to

their expiration dates.

The advantage of this instrument is that it's infinite in time as it has no

monthly expiration. as it has no monthly expiration.

Another advantage of the synthetic instrument is significantly lower spreads

compared to CFDs for this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 2.17%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes. S&P

Cash is recommended exclusively for active traders who trade during the

day trading session.

31.

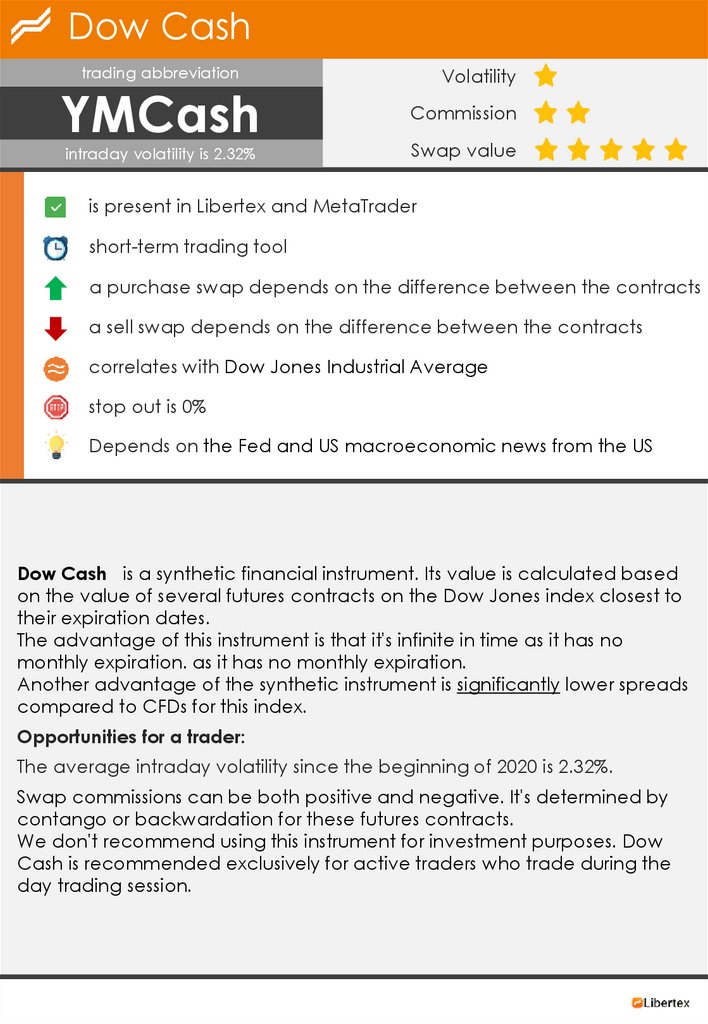

Dow Cashtrading abbreviation

YMCash

intraday volatility is 2.32%

Volatility

Commission

Swap value

is present in Libertex and MetaTrader

short-term trading tool

a purchase swap depends on the difference between the contracts

a sell swap depends on the difference between the contracts

correlates with Dow Jones Industrial Average

stop out is 0%

Depends on the Fed and US macroeconomic news from the US

Dow Cash is a synthetic financial instrument. Its value is calculated based

on the value of several futures contracts on the Dow Jones index closest to

their expiration dates.

The advantage of this instrument is that it's infinite in time as it has no

monthly expiration. as it has no monthly expiration.

Another advantage of the synthetic instrument is significantly lower spreads

compared to CFDs for this index.

Opportunities for a trader:

The average intraday volatility since the beginning of 2020 is 2.32%.

Swap commissions can be both positive and negative. It's determined by

contango or backwardation for these futures contracts.

We don't recommend using this instrument for investment purposes. Dow

Cash is recommended exclusively for active traders who trade during the

day trading session.

internet

internet