Similar presentations:

Government Investment Policy

1. Government Investment Policy

Prepared by:Tibilova DianaBragina Kristina

2. Developing an Investment Policy

The key feature of foreign direct investment is that itis an investment made that establishes either

effective control of, or at least substantial influence

over, the decision making of a foreign business

Foreign direct investment frequently involves more

than just a capital investment. It may include

provision of management or technology as well.

Foreign direct investment (FDI)

is an investment made by a

company or individual in one

country in business interests in

another country, in the form of

either establishing business

operations or acquiring

business assets in the other

country, such as ownership or

controlling interest in a foreign

company.

3.

4. The World Bank Group developed an investment reform map, which offers three basic concepts to help governments clarify the

position of their countries in the world economy, set prioritiesand implement a country’s long-term vision:

1. Investment policy is not about

choosing between foreign and

domestic investment. It is about

connecting them both through

local, regional and global value

chains.

This means regulatory

reform should not only

focus on domestic laws

but also pursue

coherence between the

latter and international

investment agreements

which are increasingly

governing domestic and

international production.

2. An investment is not a

transaction; it is a

relationship.

An investment policy strategy

needs to go beyond attracting

initial investments – this is just

one small part of the story. The

real benefits to the state come

later on in the relationship,

when a country successfully

retains investment and builds

strong linkages with domestic

businesses.

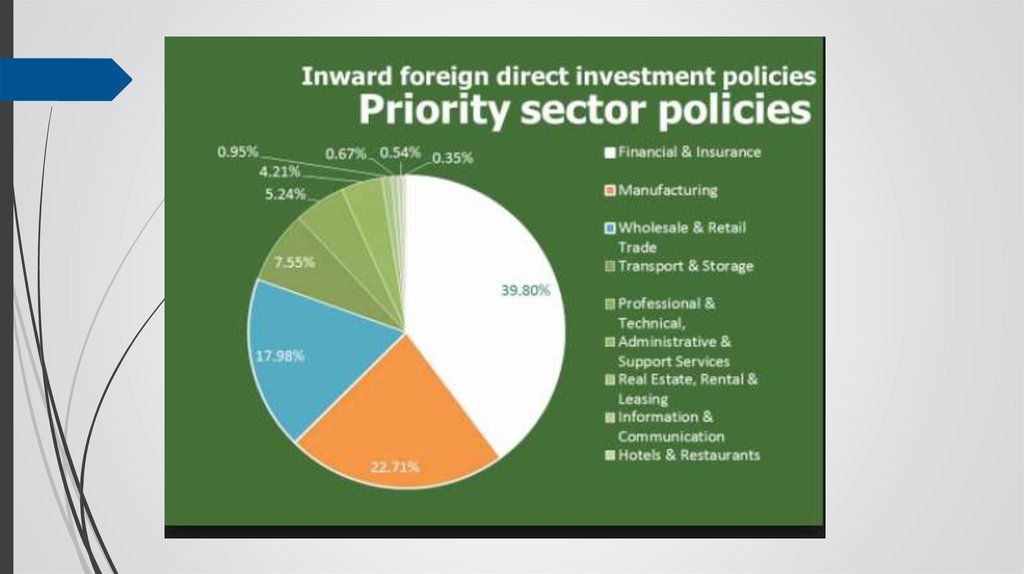

3. Not all types of

investment are the same.

Different types of

investment have

different effects on

socio-economic

development, and thus

require different

policies…Countries who

can apply this

framework to their

investment policies and

vision will have a

logical backbone for

implementing an

investment strategy

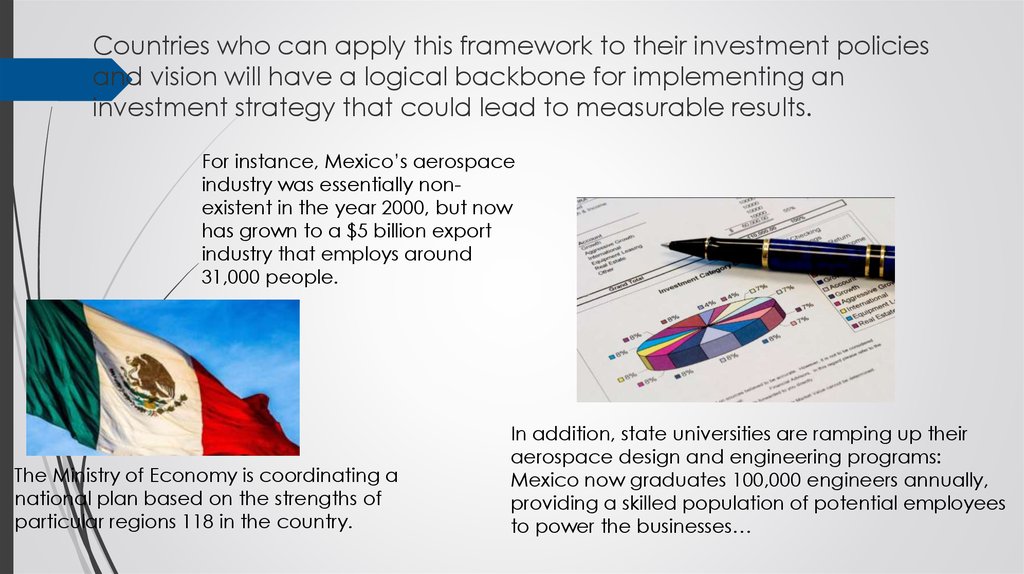

5. Countries who can apply this framework to their investment policies and vision will have a logical backbone for implementing an

investment strategy that could lead to measurable results.For instance, Mexico’s aerospace

industry was essentially nonexistent in the year 2000, but now

has grown to a $5 billion export

industry that employs around

31,000 people.

The Ministry of Economy is coordinating a

national plan based on the strengths of

particular regions 118 in the country.

In addition, state universities are ramping up their

aerospace design and engineering programs:

Mexico now graduates 100,000 engineers annually,

providing a skilled population of potential employees

to power the businesses…

6. Conclusion:

There is no one-size fits all solution to developing effective investmentpolicies. An approach that works within one country for one type of

investment at one particular time may need to be continually revised,

revamped, and reworked to take into account the changes or unique

circumstances in an economy. By using and adapting a framework such as

the investment reform map, governments can develop policies that work

for their own countries.

finance

finance