Similar presentations:

Danske Bank: a money laundering scandal

1. Danske Bank: a money laundering scandal

Danske Bank: a moneylaundering scandal

Anna Zakharova

Vinera Abdulova

Ekaterina Smutina

Natalia Kurukina

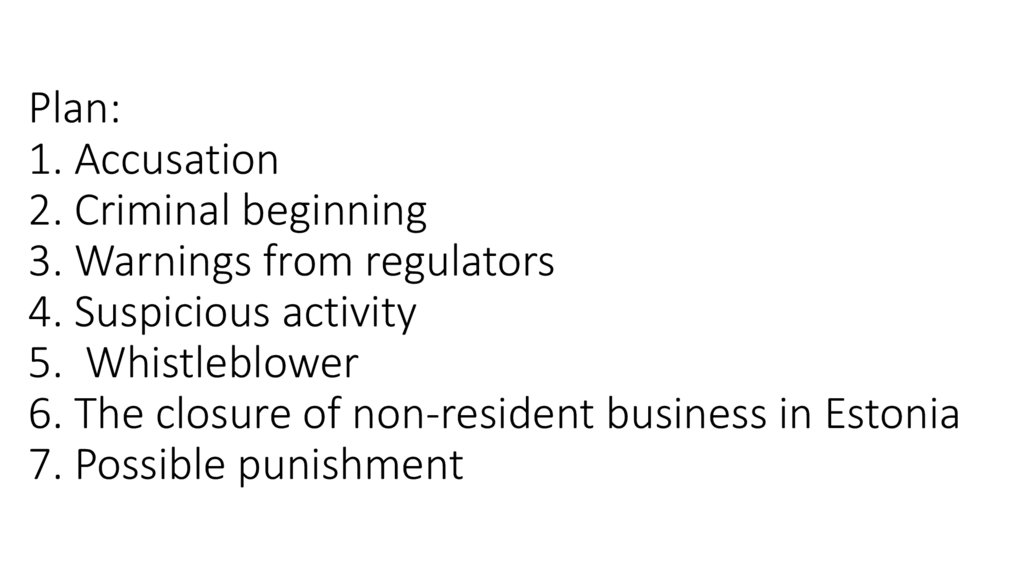

2. Plan: 1. Accusation 2. Criminal beginning 3. Warnings from regulators 4. Suspicious activity 5. Whistleblower 6. The closure

Plan:1. Accusation

2. Criminal beginning

3. Warnings from regulators

4. Suspicious activity

5. Whistleblower

6. The closure of non-resident business in Estonia

7. Possible punishment

3.

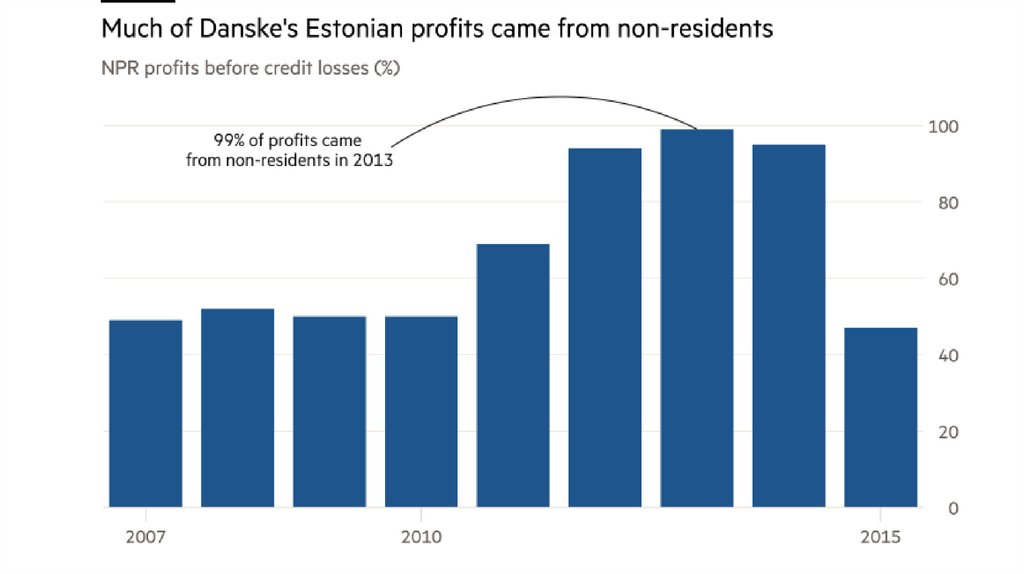

Flow of dirty moneyBetween 2007-2015 the

Estonian branch of Danske

Bank became a pipeline for

dirty money flowing out of

Russia, Azerbaijan and

Moldova

the Estonian branch of

Danske Bank

4.

The Beginning2007 - Danske Bank established its Estonian unit after takeover

a Finland Sampo Bank

5.

2008 - the Estonian branch generated 8% ofDanske’s total profits before tax

6.

accounting for 0,5% of thebank’s assets

7.

Warnings from Estonian regulatorsand Russian central bank

8.

9.

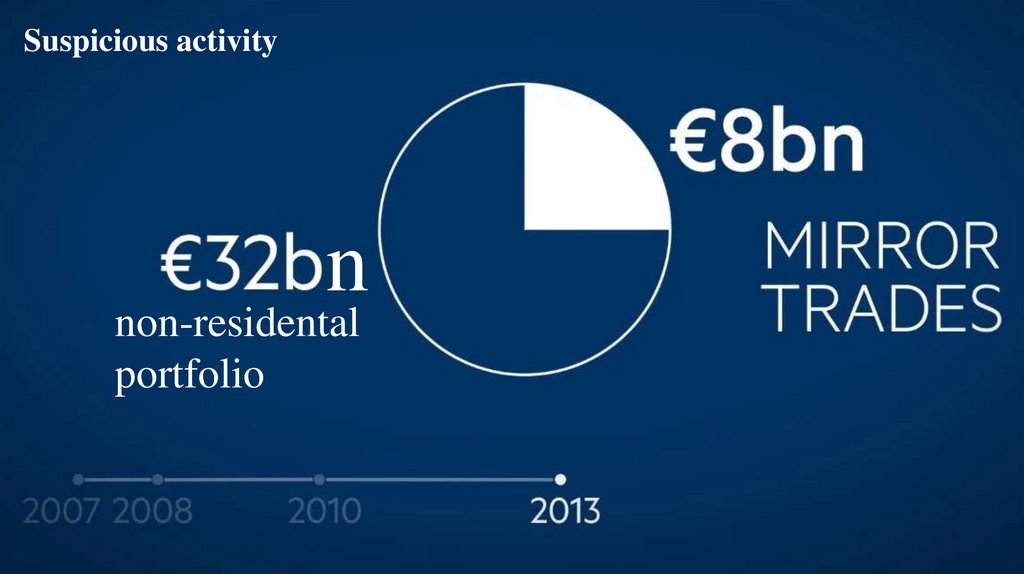

Suspicious activityn

non-residental

portfolio

10.

Mirror tradessale

the exact same

securities

purchase

11.

2013 - JPMorgan (a correspondent bank for dollartransactions for Danske in Estonia) quit - a massive

warning signal

12.

2013 - An internal email was written by a whistleblower13.

2014 - Danske’s internal auditors produced acritical report about the non-resident business

14.

In 2016Danske

completed

the closure

of its

nonresident

Business

in Estonia

15.

2018 – Danske bank is facing criminal investigationsfrom the US Department of Justice and Estonian

authorities

16. 2018 – Danske bank is facing criminal investigations from the US Department of Justice and Estonian authorities

Possible punishment• $8bn fine

• Bank liquidation

• Another US actions

english

english