Similar presentations:

One or more alternatives lead to a block of possible outcomes with unknown probabilities. Subjective decision-making

1.

How managers can make a decisionin an uncertainty environment?

2.

2One or more alternatives lead to a block of possible

outcomes with unknown probabilities

Subjective decision-making

3.

3…no reliable data…

4.

42 approaches to decision making

under conditions of uncertainty

The Manager uses the

available information and

experience to define

subjective probabilities > risk

conditions

The Manager makes no assumptions

concerning the probabilities of external

conditions

5.

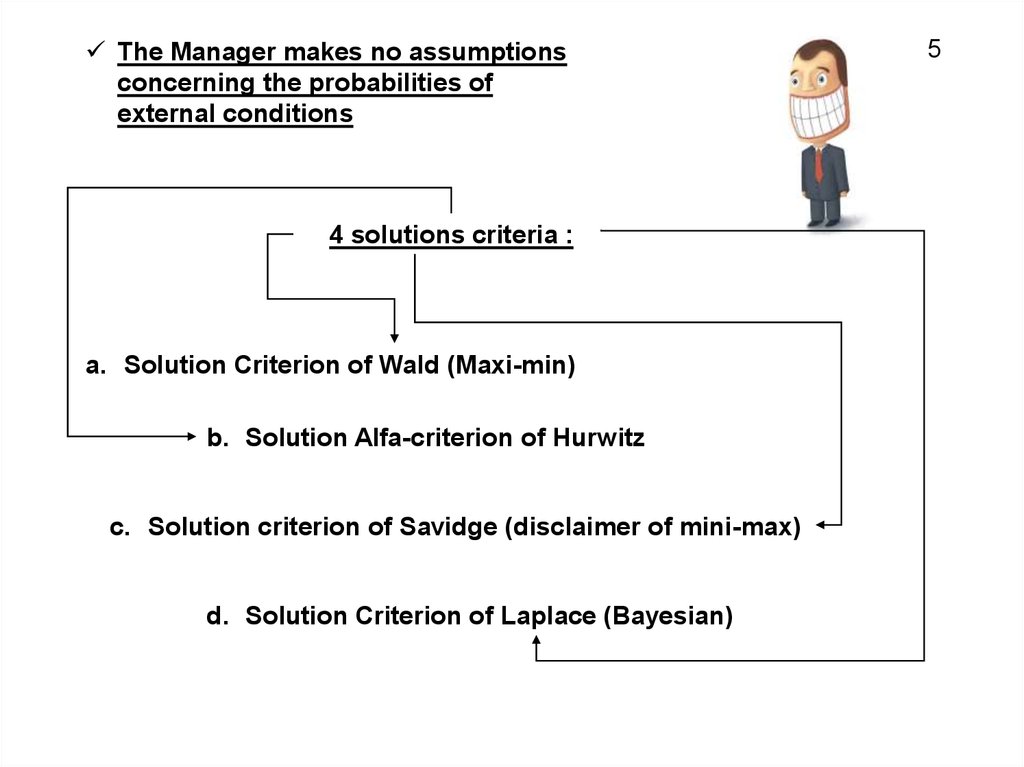

The Manager makes no assumptionsconcerning the probabilities of

external conditions

4 solutions criteria :

a. Solution Criterion of Wald (Maxi-min)

b. Solution Alfa-criterion of Hurwitz

c. Solution criterion of Savidge (disclaimer of mini-max)

d. Solution Criterion of Laplace (Bayesian)

5

6.

6The most suitable

criteria?

7.

7…take into account philosophy, temperament and

viewpoints of the present leadership of the company

8.

8a. Solution Criterion of Wald (Maxi-min)

The criterion of conservatism and attempt to

maximize reliability

External conditions are moody

and freakish

9.

9Define the worst possible result of each

strategy

Choose the strategy that provides the best

of the worst results

10.

11…probability of different states of economy are unknown

Decision matrix

Alternative

strategies

The state of the external environment

Criteria

Maxi-min

Maxi-max

11.

11Strategy S1 is just the most conservative - it implies the

lowest risks, but at the same time promises the lowest

profit

12.

12The criterion is suitable for small commercial

firms whose survival depends on the ability to

avoid losses

13.

13b. Solution Alfa-criteria of Hurwitz

d

Determine the index of the solution for each strategy, which is an

average weighted of its extreme outputs

Weighing factors

the coefficient of optimism alpha

and its addendum 1 -

α, which applies to the maximum return M,

α , which is applicable to the minimum return m

The cost of each strategy:

d i M i (1 )mi

The strategy with the highest value for di selected as

the optimal

14.

14The coefficient of optimism

α is located in the range from 0 to 1

15.

d i M i (1 )miIf a Manager is a

pessimist, he may

decide that α= 0

=> Maxi-Min

15

If the Manager is

optimistic, he

may decide that

α=1

=> Maxi-max

16.

Suppose that a Manager is optimistic and decides that a = 0,7d i M i (1 )mi

17.

17…depends on the amount of

….

….depends on their own relations “Manager for risk”…

18.

18Alpha-Hurwitz criterion: draw attention to the worst and

the best return of the concrete strategies

19.

19c. Solution criterion of Savage (disclaimer of mini-max)

Explores losses incurred as a result of making the wrong

decision

Losses are measured as the absolute difference between

the returns for this strategy, and returns of the most

effective strategy within the same state of the economy.

20.

Within each column, the biggest return is deducted from each of the next 20return in column (including yourself). The absolute difference between the

positions is a measurement of losses

Matrix of losses

21.

21The meaning of measurement of losses:

if we have chosen a strategy that provides the most

value for this condition, then we do not consider

losses

22.

22But if we choose any other strategy, the loss is the

difference between what happens in fact, and the

return that we would get by adopting a more optimal

solution

23.

When I use the criterion of Savidge, I refuseattempt to maximize the profit and choose

the strategy with a satisfactory return but

lower risk

It is useful for the evaluation of a series of projects over

a long period!

management

management