Similar presentations:

Russia's Resource Crossroads

1.

Russia's ResourceCrossroads

Reporter Zubak Timofei 2025/08/05

2.

ContentMacro Forces Shaping the Sector

Competitive Arena & Internal

Profile

Strategic Marketing Response

Call to Action

3.

01Macro Forces Shaping the Sector

4.

State Control & Sanctions Drive PivotThe Russian resource sector, a geopolitical asset under tight state control, is being redirected

from Europe to Asia due to strategic ownership, restrictive laws, and international sanctions.

Strategic State

Control

National security considerations drive

significant state control via giants like

Rosneft and Gazprom, with the "Subsoil

Law" capping foreign ownership.

Impact of

Sanctions

Sanctions targeting energy and mining

have restricted access to Western tech

and capital, compelling a strategic "pivot

to the East" to strengthen ties with Asian

markets.

Economic

Dependence

The sector is the primary driver of the

Russian economy, contributing a

massive share of GDP, government

revenue, and exports, creating a

"resource curse" dynamic.

5.

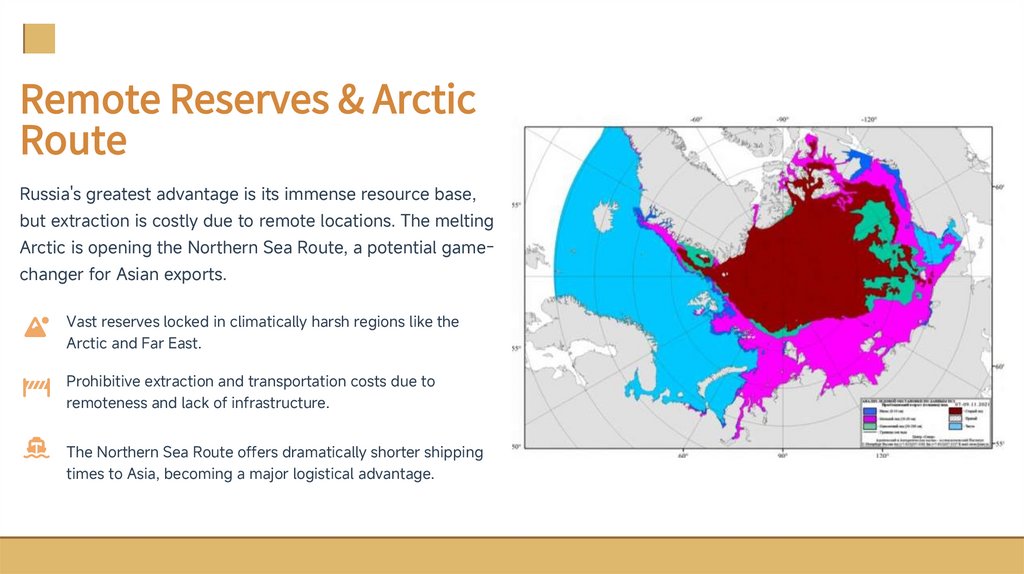

Remote Reserves & ArcticRoute

Russia's greatest advantage is its immense resource base,

but extraction is costly due to remote locations. The melting

Arctic is opening the Northern Sea Route, a potential gamechanger for Asian exports.

Vast reserves locked in climatically harsh regions like the

Arctic and Far East.

Prohibitive extraction and transportation costs due to

remoteness and lack of infrastructure.

The Northern Sea Route offers dramatically shorter shipping

times to Asia, becoming a major logistical advantage.

6.

02Competitive Arena & Internal Profile

7.

Industry Competition: Porter's FiveForces

High barriers protect current players, but buyer power and substitutes are rising threats.

Threat of New

Entrants

LOW

Supplier Power

Buyer Power

LOW to MED

MED to HIGH

Rivalry Among

Competitors

MEDIUM

Threat of Substitutes

MED &

GROWING

8.

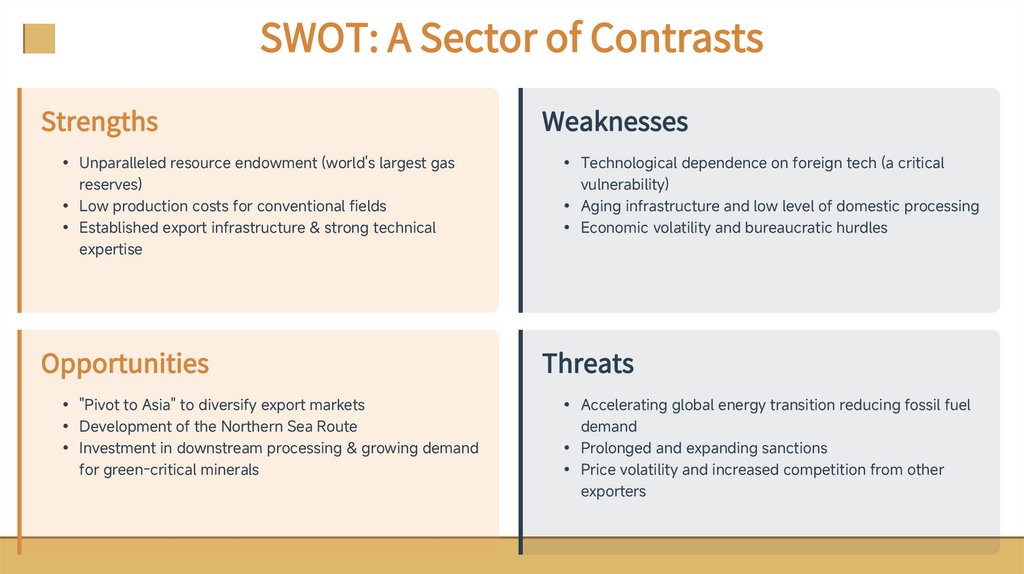

SWOT: A Sector of ContrastsStrengths

• Unparalleled resource endowment (world's largest gas

reserves)

• Low production costs for conventional fields

• Established export infrastructure & strong technical

expertise

Opportunities

• "Pivot to Asia" to diversify export markets

• Development of the Northern Sea Route

• Investment in downstream processing & growing demand

for green-critical minerals

Weaknesses

• Technological dependence on foreign tech (a critical

vulnerability)

• Aging infrastructure and low level of domestic processing

• Economic volatility and bureaucratic hurdles

Threats

• Accelerating global energy transition reducing fossil fuel

demand

• Prolonged and expanding sanctions

• Price volatility and increased competition from other

exporters

9.

03Strategic Marketing Response

10.

Diversify Markets: Lock inAsia

Aggressively pursue long-term contracts and partnerships

in Asia to reduce dependence on any single market.

Secure long-term supply contracts with major Chinese and

Indian energy companies.

Co-finance the development of Eastern Siberian fields and

associated export infrastructure.

Brand Russia as a reliable swing supplier capable of

delivering both pipeline gas and flexible LNG volumes.

11.

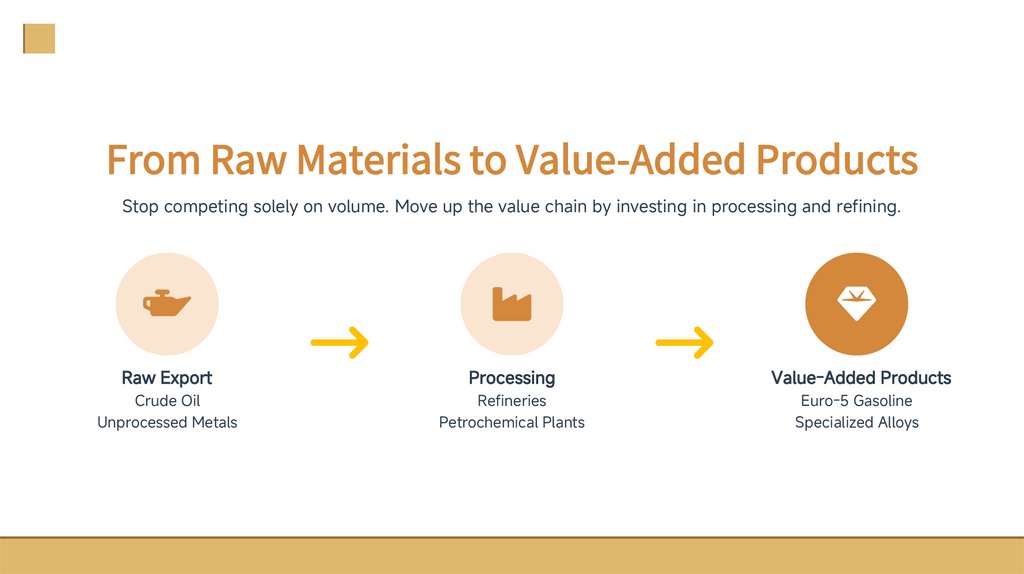

From Raw Materials to Value-Added ProductsStop competing solely on volume. Move up the value chain by investing in processing and refining.

Raw Export

Processing

Value-Added Products

Crude Oil

Unprocessed Metals

Refineries

Petrochemical Plants

Euro-5 Gasoline

Specialized Alloys

12.

Rebrand Critical Mineralsas "Green"

Counter the "dirty commodity" stigma by repositioning key

metals as essential enablers of the low-carbon economy.

"Russian Palladium: Powering Your Clean Future"

Market nickel and palladium as vital for EV batteries and

catalysts.

Provide technical datasheets on carbon footprint per unit of

metal.

Partner with green tech companies to build credibility.

13.

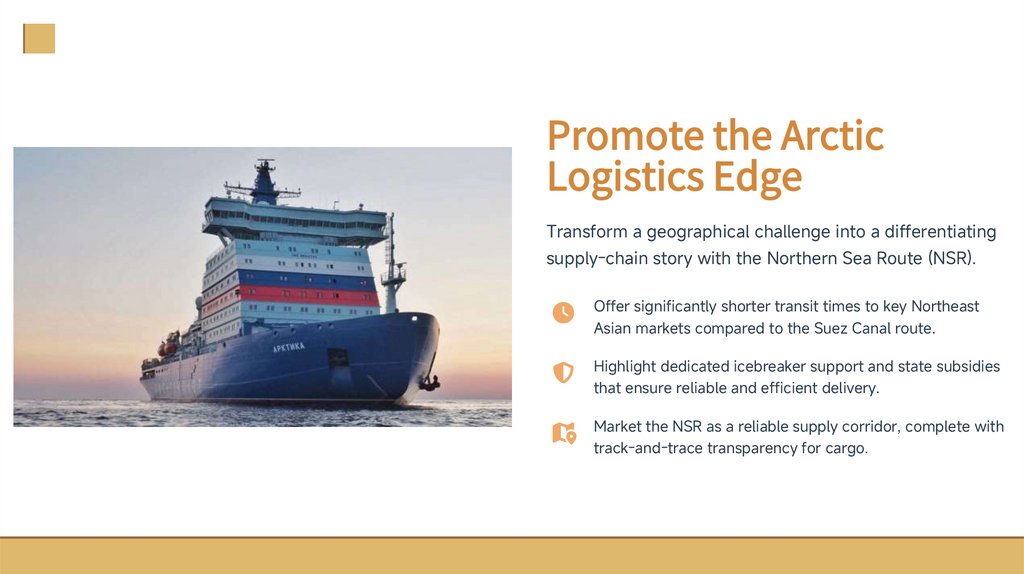

Promote the ArcticLogistics Edge

Transform a geographical challenge into a differentiating

supply-chain story with the Northern Sea Route (NSR).

Offer significantly shorter transit times to key Northeast

Asian markets compared to the Suez Canal route.

Highlight dedicated icebreaker support and state subsidies

that ensure reliable and efficient delivery.

Market the NSR as a reliable supply corridor, complete with

track-and-trace transparency for cargo.

14.

Partner to Bypass SanctionsMitigate the impact of technology and capital sanctions by forming strategic joint ventures

with partners from "friendly" countries.

Russia

Asian Partners

Resilient Project

Resources & Infrastructure

Capital & Technology

Reduced Risk

Structure agreements with service-of-supply clauses, insurance pools, and toll-processing to keep equipment and

capital flowing, showcasing project resilience to end-buyers.

15.

04Call to Action

16.

The Future: Sell Value, NotVolume

Russian resource firms must pivot from raw-volume pitches to integrated value propositions.

The window to secure premium offtake contracts in Asia is open, but narrowing.

Secure Supply

Downstream

Customization

Green-Critical Content

= Premium Value Proposition

Reliable Logistics

17.

THANK YOUReporter Zubak Timofei

5

2025/08/0