Similar presentations:

Unmas king the S ingle-L evel Pyramid S cheme

1.

Unmas king the S ingle-L evelPyramid S cheme

Welcome! This presentation will provide an in-depth look at the singlelevel pyramid scheme, explaining how it operates, the risks involved, and

how to avoid falling prey to this financial trap.

ЮЯ

2.

The Mechanics of the Single-Level PyramidScheme

Attracting Investors

Early Returns

Inevitability of Collapse

The scheme relies on a simple,

The initial participants receive

When the inflow of new investments

affordable approach to attract new

payments fueled by the investments of

stops, the pyramid scheme collapses,

investors, often appealing to those

new members, creating the illusion of

leaving most participants without

new to financial investments.

success and sustainability.

their money.

3.

Red Flags of the Single-LevelPyramid Scheme

1

Guaranteed High

Returns

2

Focus on Recruitment

Promises of incredibly high

Emphasis on recruiting new

returns with minimal effort

members instead of a

are a major red flag.

genuine business model is a

Legitimate investments

clear sign of a pyramid

rarely offer such lucrative

scheme. The primary focus

returns.

should be on real products

or services.

3

Lack of Transparency

Avoid any investment scheme that lacks transparency and clear

information about how your money is being used or invested.

4.

The Dangers of S ingle-L evelPyramid S chemes

Financial L os s

L egal Cons equences

The most immediate risk is the

Pyramid schemes are illegal in

loss of your initial investment,

most countries, and both

as the scheme is built on

organizers and participants

unsustainable financial

can face criminal charges and

practices.

penalties.

Emotional Dis tres s

The realization of being scammed can lead to financial hardship,

emotional distress, and damage to your credit score.

5.

Safeguarding Yourself from Financial ScamsEducate Yourself

1

Understanding the basics of financial investments and identifying common scams can

help you avoid falling victim to such schemes.

Research Thoroughly

2

Do your research on any investment opportunity before committing your

money, consulting with financial experts if necessary.

Trust Your Instincts

3

If something feels too good to be true, it probably is. If you are

pressured to invest quickly, it's a warning sign to proceed with

caution.

6.

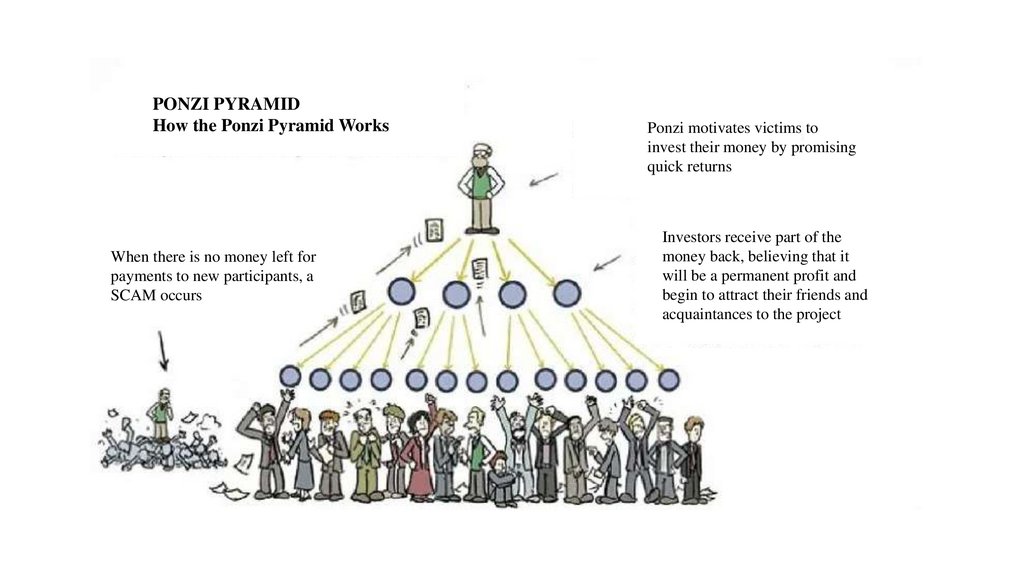

PONZI PYRAMIDHow the Ponzi Pyramid Works

When there is no money left for

payments to new participants, a

SCAM occurs

Ponzi motivates victims to

invest their money by promising

quick returns

Investors receive part of the

money back, believing that it

will be a permanent profit and

begin to attract their friends and

acquaintances to the project

finance

finance