Similar presentations:

Macroeconomic Forecasting in South Korea

1.

MacroeconomicForecasting in South

Korea

ALISHER ABU, ECFUC-21

2.

Exploring South Korea'sEconomic Forecasting

1.

Research Focus:

Topic: South Korea's Economic Growth.

Context: An in-depth analysis of how

key indicators shape the nation's

economic trajectory.

2.

Key Economic Indicators:

GDP Growth: Trends and predictions in

South Korea's GDP.

Inflation Rate: Analyzing the impact of

inflation on the economy.

Unemployment Rate: Understanding its

correlation with economic health.

3.

South Korea's EconomicTransformation

1.

Post-War Recovery (1950s-60s):

Rebuilding from the Korean War devastation.

Early focus on agriculture and light industries.

2.

Industrialization Boom (1970s-80s):

Government-led push towards heavy industries: steel, shipbuilding,

and electronics.

Rapid urbanization and workforce expansion.

3.

Tech-Led Growth (1990s-Present):

Emergence as a global tech hub, led by brands like Samsung and

LG.

Focus on high-tech industries, IT services, and innovation.

4.

Recent Challenges:

Adapting to a digital, service-based economy.

Aging population and workforce sustainability.

Balancing export-led growth with domestic consumption.

4.

Future Outlook of SouthKorea's Economy

South Korea's economic future presents a complex picture,

influenced by both internal and external factors. Researchers

anticipate moderate growth recovery, contingent on structural

reforms and global economic conditions. The nation's average

GDP growth could maintain around 3% through 2030, but without

these reforms, growth could fall to as low as 1%. This forecast

highlights the pivotal position of South Korea's economy at a

global level.

The impact of the COVID-19 pandemic has been significant,

leading to structural changes across various sectors. The

manufacturing sector demonstrated resilience, while the services

sector experienced a more gradual recovery. The pandemic's

long-term effects are expected to suppress potential output,

dropping growth below 2%, with a medium-term recovery

anticipated around 2¼%.

5.

Future Outlook ofSouth Korea's

Economy

Economic policies, including South

Korea's universal transfer program,

have influenced the economy.

While supporting household

consumption and small businesses,

the exclusion of online and large

businesses raises concerns about

long-term economic efficiency

and fiscal sustainability.

Recent trends show a slight

acceleration in economic growth

in 2022, influenced by net trade

dynamics. However, challenges

such as a rapid decline in exports,

particularly to China, and

reduced government spending,

signal potential short-term

economic challenges.

6.

Future Outlook of SouthKorea's Economy

The transformation of the e-commerce landscape, led by

corporations like Coupang, Gmarket, and WeMakePrice, is

reshaping South Korea's economy. This rapid development in

cross-border e-commerce technologies emphasizes

environmental considerations and has led to shifts in the labor

market towards digital professions. Research by academics like

Cheong, Yoo, and Park et al. provides insights into the

macroeconomic implications of e-commerce on factors like

employment and wages.

Looking ahead, GDP growth is expected to ease to 1.4% in

2023, with a rebound to 2.3% in 2024 and 2.1% in 2025. Factors

such as elevated interest rates, energy prices, and a slowdown

in global demand, particularly from China, are impacting

private consumption and exports. The aging population is

projected to increase fiscal pressures, necessitating reforms in

fiscal policy and strategies to address productivity gaps, labor

market dualism, and environmental concerns

7.

ForecastingMethodologies in

Macroeconomic Analysis

1.

2.

Mean Forecast Method:

Utilizes the average of historical data for future

predictions, especially effective for data showing

a consistent pattern without significant

fluctuations.

Involves statistical functions (like meanf in R) to

generate forecasts, considering parameters such

as forecast periods and confidence levels.

Naïve Method:

A straightforward approach that assumes future

values will mirror the last observed value.

Despite its simplicity, it can show decent out-ofsample predictive accuracy but may not fully

capture data nuances, as indicated by high

Mean Absolute Percentage Error (MAPE) in certain

cases.

8.

ForecastingMethodologies in

Macroeconomic Analysis

1.

2.

ARIMA (AutoRegressive Integrated Moving Average):

ARIMA is a widely used method that captures

various aspects of time series data like trends,

cycles, and seasonality.

Suitable for more complex forecasting where data

patterns are not straightforward.

Exponential Smoothing Method:

Incorporates Winters Seasonal Method, adding a

seasonal component to Holt's Linear Trend

method.

Ideal for data with trends and seasonality, these

models are simple, easy to use, and require fewer

data inputs, often used for short-term economic

forecasting.

9.

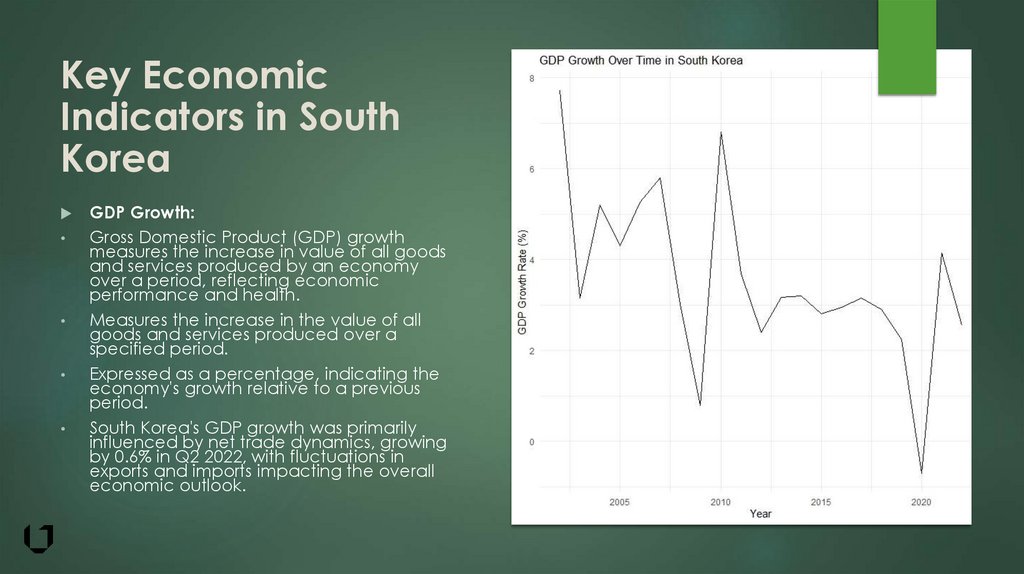

Key EconomicIndicators in South

Korea

GDP Growth:

Gross Domestic Product (GDP) growth

measures the increase in value of all goods

and services produced by an economy

over a period, reflecting economic

performance and health.

Measures the increase in the value of all

goods and services produced over a

specified period.

Expressed as a percentage, indicating the

economy's growth relative to a previous

period.

South Korea's GDP growth was primarily

influenced by net trade dynamics, growing

by 0.6% in Q2 2022, with fluctuations in

exports and imports impacting the overall

economic outlook.

10.

Key EconomicIndicators in South

Korea

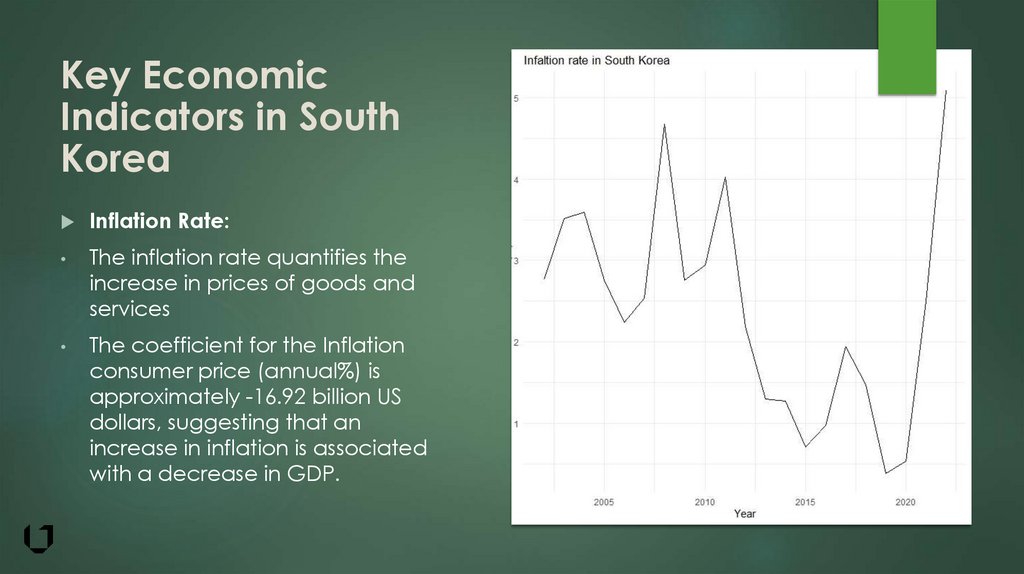

Inflation Rate:

The inflation rate quantifies the

increase in prices of goods and

services

The coefficient for the Inflation

consumer price (annual%) is

approximately -16.92 billion US

dollars, suggesting that an

increase in inflation is associated

with a decrease in GDP.

11.

Key EconomicIndicators in South

Korea

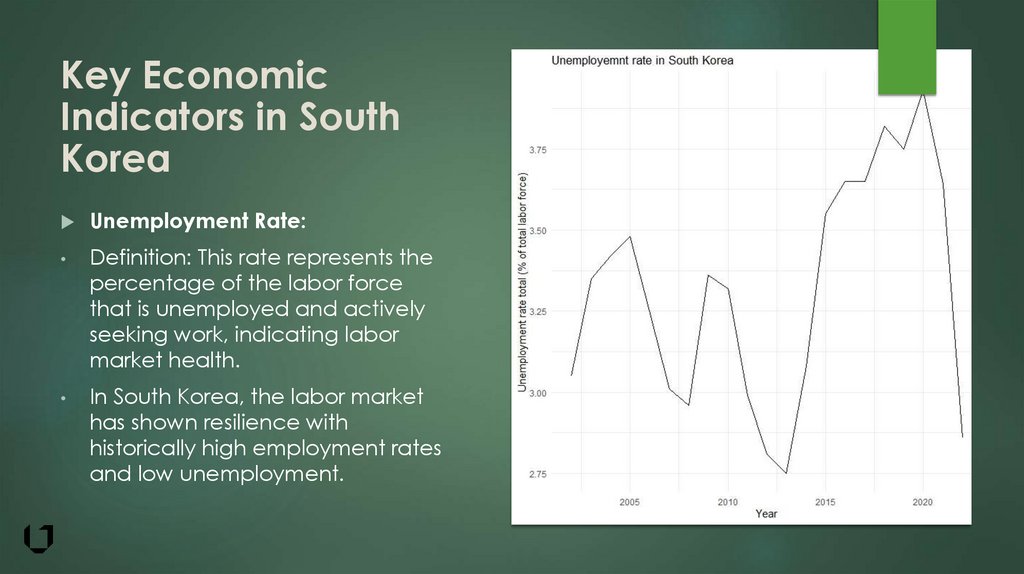

Unemployment Rate:

Definition: This rate represents the

percentage of the labor force

that is unemployed and actively

seeking work, indicating labor

market health.

In South Korea, the labor market

has shown resilience with

historically high employment rates

and low unemployment.

12.

Key EconomicIndicators in South

Korea

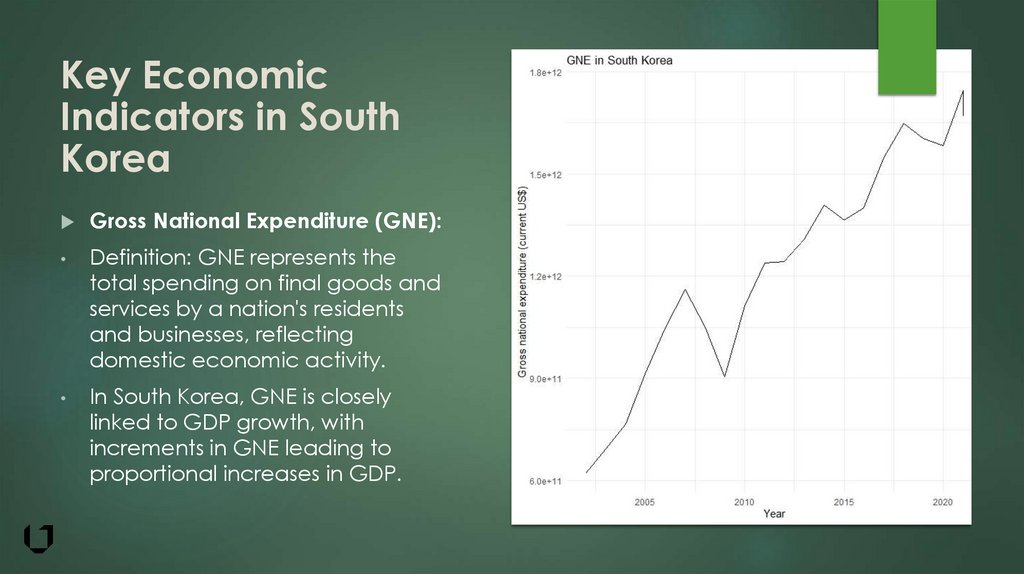

Gross National Expenditure (GNE):

Definition: GNE represents the

total spending on final goods and

services by a nation's residents

and businesses, reflecting

domestic economic activity.

In South Korea, GNE is closely

linked to GDP growth, with

increments in GNE leading to

proportional increases in GDP.

13.

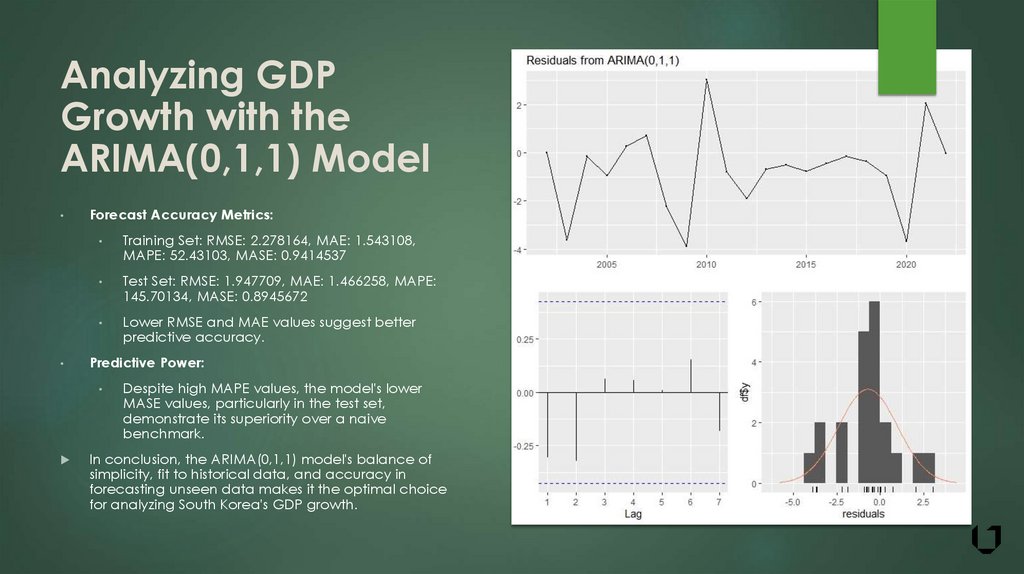

Analyzing GDPGrowth with the

ARIMA(0,1,1)

Model

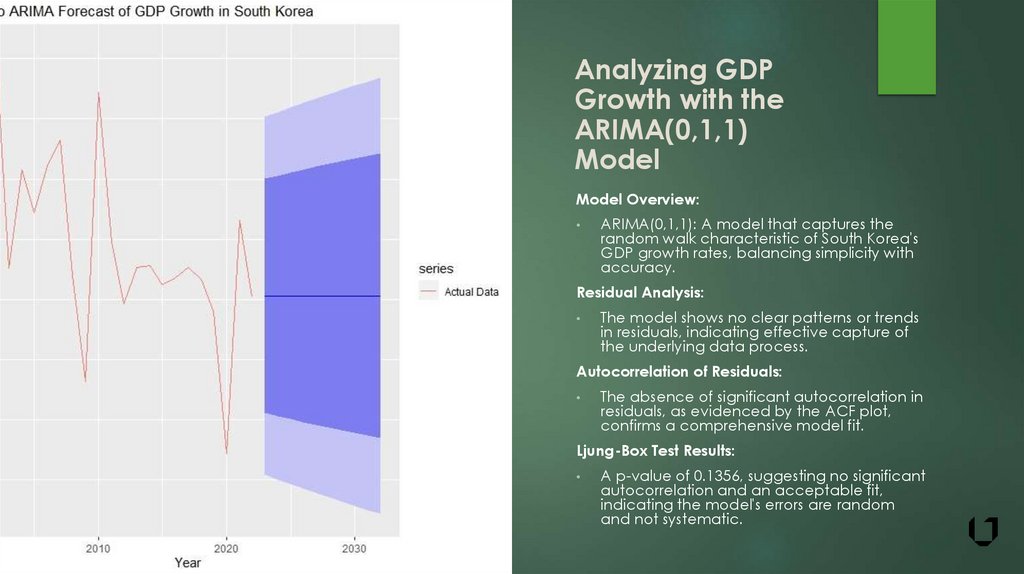

Model Overview:

ARIMA(0,1,1): A model that captures the

random walk characteristic of South Korea's

GDP growth rates, balancing simplicity with

accuracy.

Residual Analysis:

The model shows no clear patterns or trends

in residuals, indicating effective capture of

the underlying data process.

Autocorrelation of Residuals:

The absence of significant autocorrelation in

residuals, as evidenced by the ACF plot,

confirms a comprehensive model fit.

Ljung-Box Test Results:

A p-value of 0.1356, suggesting no significant

autocorrelation and an acceptable fit,

indicating the model's errors are random

and not systematic.

14.

Analyzing GDPGrowth with the

ARIMA(0,1,1) Model

Forecast Accuracy Metrics:

Training Set: RMSE: 2.278164, MAE: 1.543108,

MAPE: 52.43103, MASE: 0.9414537

Test Set: RMSE: 1.947709, MAE: 1.466258, MAPE:

145.70134, MASE: 0.8945672

Lower RMSE and MAE values suggest better

predictive accuracy.

Predictive Power:

Despite high MAPE values, the model's lower

MASE values, particularly in the test set,

demonstrate its superiority over a naive

benchmark.

In conclusion, the ARIMA(0,1,1) model's balance of

simplicity, fit to historical data, and accuracy in

forecasting unseen data makes it the optimal choice

for analyzing South Korea's GDP growth.

15.

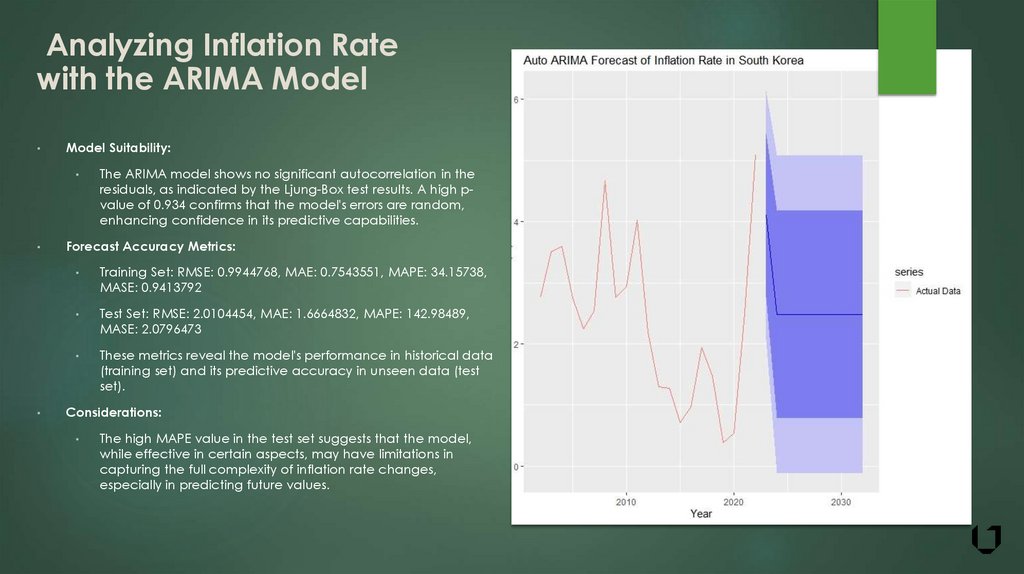

Analyzing Inflation Ratewith the ARIMA Model

Model Suitability:

The ARIMA model shows no significant autocorrelation in the

residuals, as indicated by the Ljung-Box test results. A high pvalue of 0.934 confirms that the model's errors are random,

enhancing confidence in its predictive capabilities.

Forecast Accuracy Metrics:

Training Set: RMSE: 0.9944768, MAE: 0.7543551, MAPE: 34.15738,

MASE: 0.9413792

Test Set: RMSE: 2.0104454, MAE: 1.6664832, MAPE: 142.98489,

MASE: 2.0796473

These metrics reveal the model's performance in historical data

(training set) and its predictive accuracy in unseen data (test

set).

Considerations:

The high MAPE value in the test set suggests that the model,

while effective in certain aspects, may have limitations in

capturing the full complexity of inflation rate changes,

especially in predicting future values.

16.

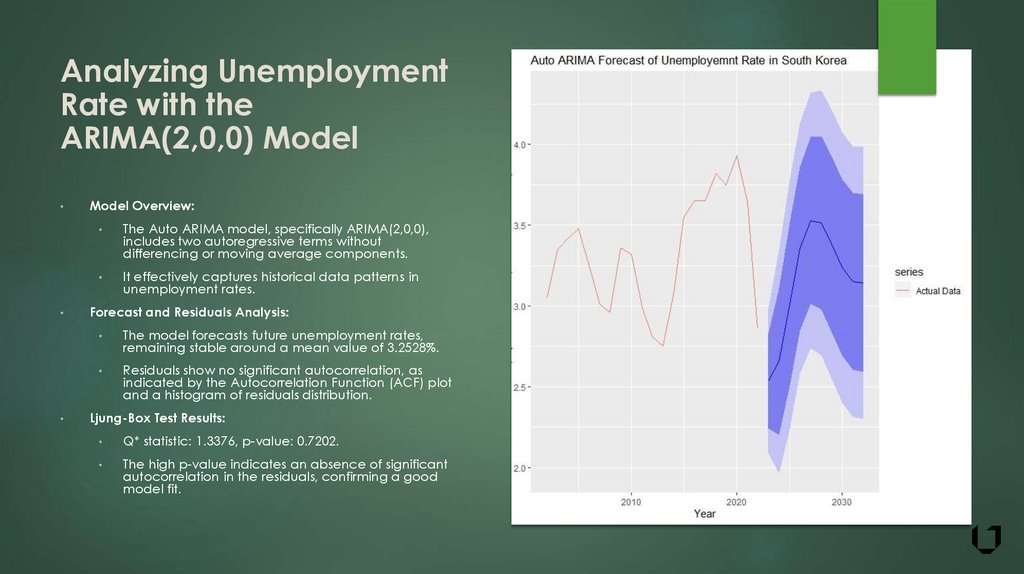

Analyzing UnemploymentRate with the

ARIMA(2,0,0) Model

Model Overview:

The Auto ARIMA model, specifically ARIMA(2,0,0),

includes two autoregressive terms without

differencing or moving average components.

It effectively captures historical data patterns in

unemployment rates.

Forecast and Residuals Analysis:

The model forecasts future unemployment rates,

remaining stable around a mean value of 3.2528%.

Residuals show no significant autocorrelation, as

indicated by the Autocorrelation Function (ACF) plot

and a histogram of residuals distribution.

Ljung-Box Test Results:

Q* statistic: 1.3376, p-value: 0.7202.

The high p-value indicates an absence of significant

autocorrelation in the residuals, confirming a good

model fit.

17.

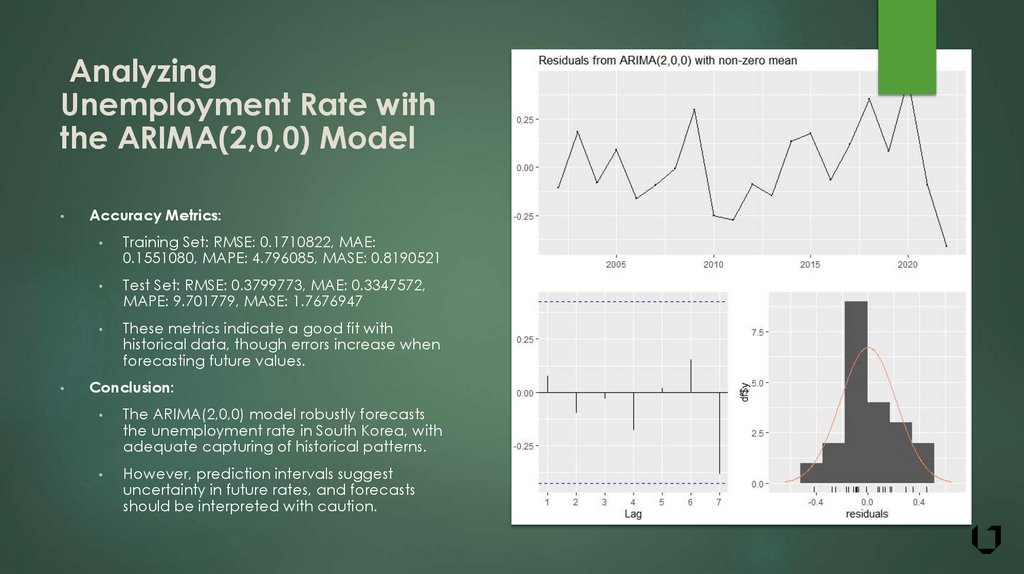

AnalyzingUnemployment Rate with

the ARIMA(2,0,0) Model

Accuracy Metrics:

Training Set: RMSE: 0.1710822, MAE:

0.1551080, MAPE: 4.796085, MASE: 0.8190521

Test Set: RMSE: 0.3799773, MAE: 0.3347572,

MAPE: 9.701779, MASE: 1.7676947

These metrics indicate a good fit with

historical data, though errors increase when

forecasting future values.

Conclusion:

The ARIMA(2,0,0) model robustly forecasts

the unemployment rate in South Korea, with

adequate capturing of historical patterns.

However, prediction intervals suggest

uncertainty in future rates, and forecasts

should be interpreted with caution.

18.

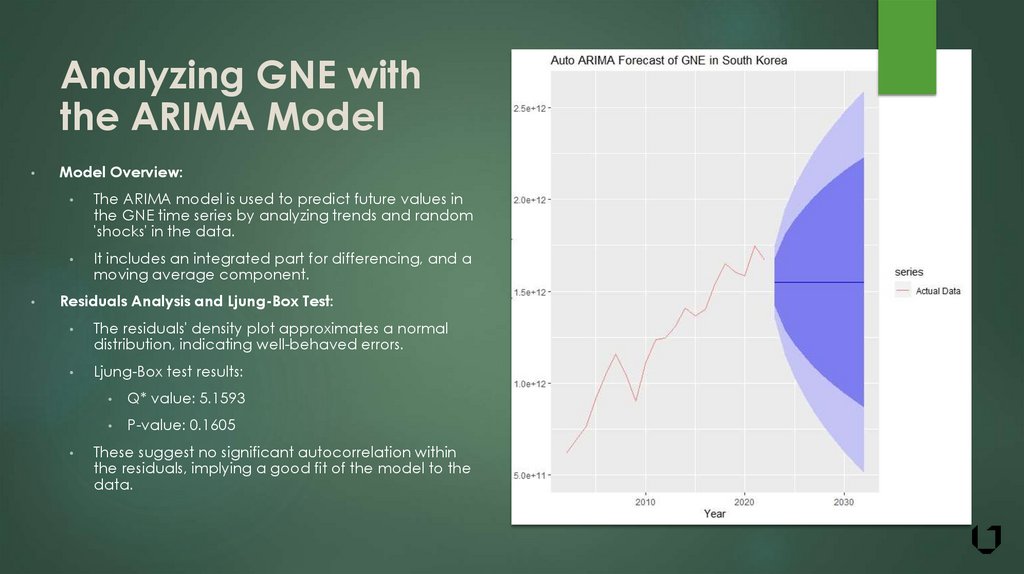

Analyzing GNE withthe ARIMA Model

Model Overview:

The ARIMA model is used to predict future values in

the GNE time series by analyzing trends and random

'shocks' in the data.

It includes an integrated part for differencing, and a

moving average component.

Residuals Analysis and Ljung-Box Test:

The residuals' density plot approximates a normal

distribution, indicating well-behaved errors.

Ljung-Box test results:

Q* value: 5.1593

P-value: 0.1605

These suggest no significant autocorrelation within

the residuals, implying a good fit of the model to the

data.

19.

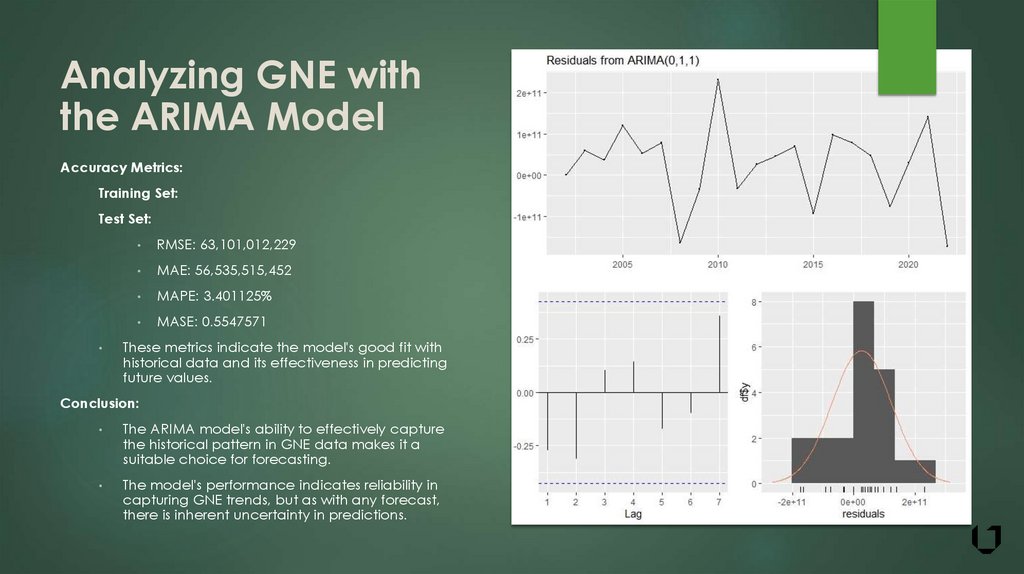

Analyzing GNE withthe ARIMA Model

Accuracy Metrics:

Training Set:

Test Set:

RMSE: 63,101,012,229

MAE: 56,535,515,452

MAPE: 3.401125%

MASE: 0.5547571

These metrics indicate the model's good fit with

historical data and its effectiveness in predicting

future values.

Conclusion:

The ARIMA model's ability to effectively capture

the historical pattern in GNE data makes it a

suitable choice for forecasting.

The model's performance indicates reliability in

capturing GNE trends, but as with any forecast,

there is inherent uncertainty in predictions.

20.

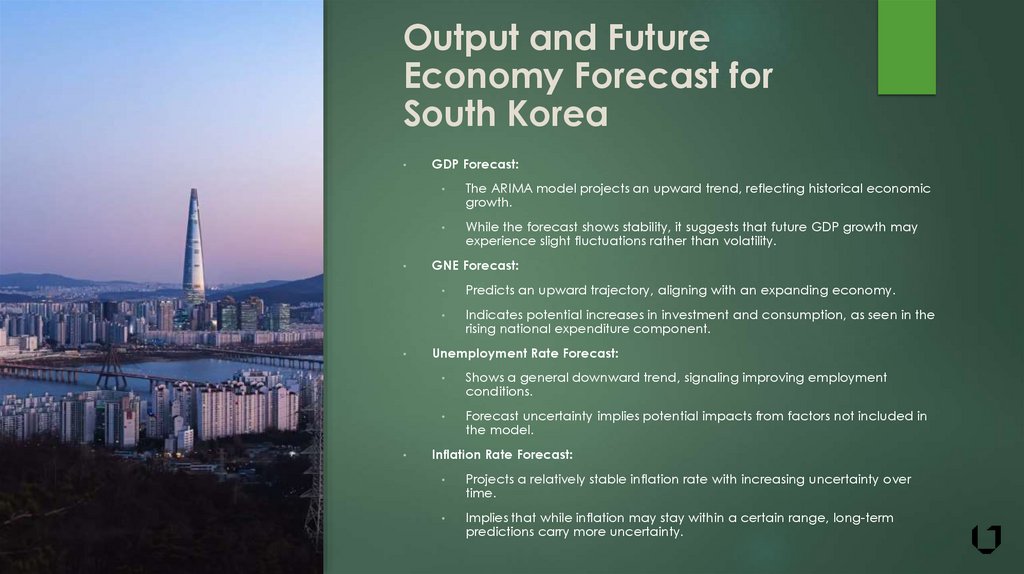

Output and FutureEconomy Forecast for

South Korea

GDP Forecast:

The ARIMA model projects an upward trend, reflecting historical economic

growth.

While the forecast shows stability, it suggests that future GDP growth may

experience slight fluctuations rather than volatility.

GNE Forecast:

Predicts an upward trajectory, aligning with an expanding economy.

Indicates potential increases in investment and consumption, as seen in the

rising national expenditure component.

Unemployment Rate Forecast:

Shows a general downward trend, signaling improving employment

conditions.

Forecast uncertainty implies potential impacts from factors not included in

the model.

Inflation Rate Forecast:

Projects a relatively stable inflation rate with increasing uncertainty over

time.

Implies that while inflation may stay within a certain range, long-term

predictions carry more uncertainty.

21.

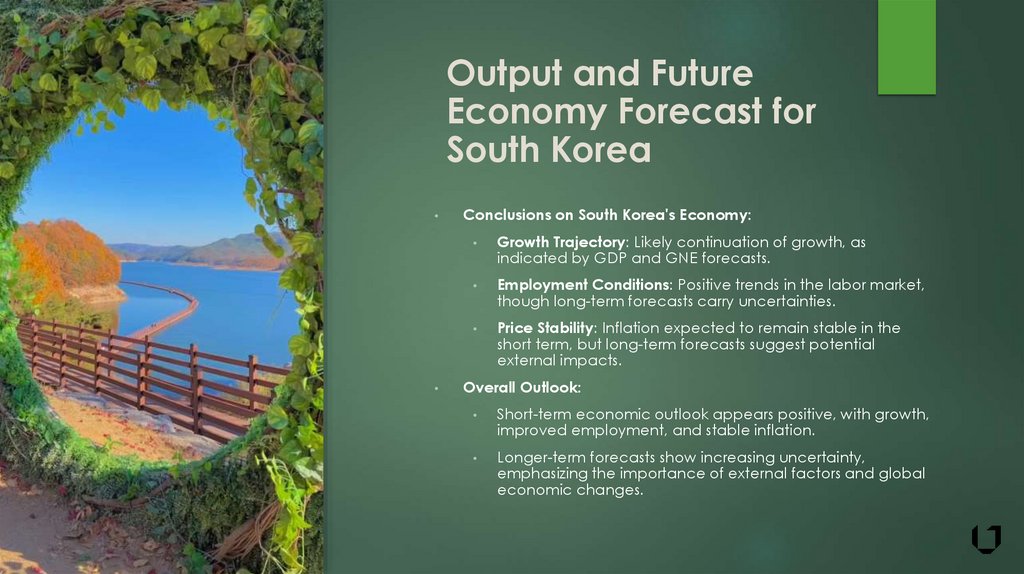

Output and FutureEconomy Forecast for

South Korea

Conclusions on South Korea's Economy:

Growth Trajectory: Likely continuation of growth, as

indicated by GDP and GNE forecasts.

Employment Conditions: Positive trends in the labor market,

though long-term forecasts carry uncertainties.

Price Stability: Inflation expected to remain stable in the

short term, but long-term forecasts suggest potential

external impacts.

Overall Outlook:

Short-term economic outlook appears positive, with growth,

improved employment, and stable inflation.

Longer-term forecasts show increasing uncertainty,

emphasizing the importance of external factors and global

economic changes.

22.

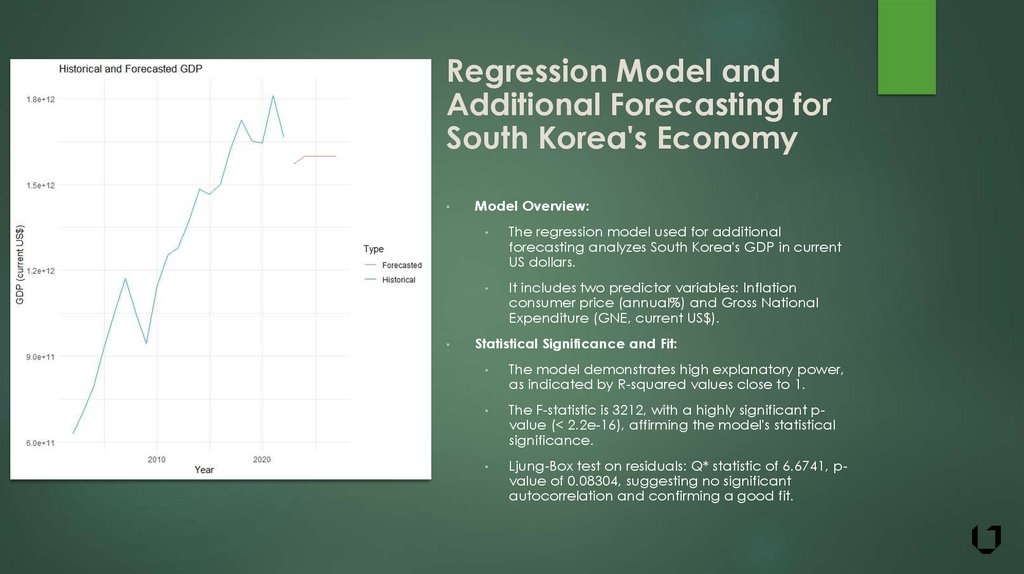

Regression Model andAdditional Forecasting for

South Korea's Economy

Model Overview:

The regression model used for additional

forecasting analyzes South Korea's GDP in current

US dollars.

It includes two predictor variables: Inflation

consumer price (annual%) and Gross National

Expenditure (GNE, current US$).

Statistical Significance and Fit:

The model demonstrates high explanatory power,

as indicated by R-squared values close to 1.

The F-statistic is 3212, with a highly significant pvalue (< 2.2e-16), affirming the model's statistical

significance.

Ljung-Box test on residuals: Q* statistic of 6.6741, pvalue of 0.08304, suggesting no significant

autocorrelation and confirming a good fit.

23.

Regression Model and AdditionalForecasting for South Korea's Economy

Model Coefficients and Impact:

The coefficients obtained are statistically significant.

GNE has a substantial positive impact on GDP, indicating that increases in

national expenditure significantly boost GDP.

In contrast, inflation has a negative impact, but its effect is comparatively

less pronounced than GNE.

Conclusion:

The regression model effectively captures the relationship between GDP

and its predictors (inflation and GNE), providing valuable insights for

forecasting.

Its adequacy in explaining GDP variation is evident from the lack of

autocorrelation in residuals and high explanatory power.

This model serves as a supplementary tool to time-series models, offering a

more nuanced understanding of economic dynamics.

24.

Challenges andLimitations in Economic

Forecasting

Complex Economic Interplay:

South Korea's technology-driven economy presents a complex

web of factors influencing GDP growth, making accurate

forecasting challenging.

The intricate relationship between various economic sectors and

global influences adds layers of complexity to predictive

modeling.

Data Limitations:

Forecasting is often constrained by the availability and quality of

data.

Historical data may not fully capture future economic dynamics,

especially in a rapidly evolving economy like South Korea's.

Model Selection Challenges:

Choosing the most suitable model involves balancing simplicity

with predictive power.

Each model, whether ARIMA or regression, has inherent strengths

and weaknesses, affecting their forecasting accuracy.

25.

Challenges andLimitations in Economic

Forecasting

Vulnerability to External Shocks:

Economic forecasts are susceptible to unforeseen

global events and external shocks, which can

significantly deviate actual outcomes from

predictions.

This includes technological innovations, geopolitical

changes, or global economic trends.

Rapid Technological Change:

The fast pace of technological advancement in

South Korea can rapidly alter economic conditions,

making it difficult for models to keep pace with

changes.

Conclusion:

While the forecasting models provide valuable

insights into South Korea's economic trajectory, they

are not without limitations.

Stakeholders, from policymakers to businesses, must

interpret these forecasts within the context of these

challenges and limitations.

26.

Conclusion: South Korea'sEconomic Outlook

South Korea's economy is forecasted to continue growing, with GDP and GNE

trends indicating an expansion and increased national expenditure. The GDP

growth is expected to be stable, though with some fluctuations, suggesting

controlled volatility in the near future. Employment conditions look promising, as the

unemployment rate is projected to decrease, signaling an improving labor market.

However, there's an undercurrent of uncertainty in these forecasts, especially in the

long term.

Inflation rates are expected to remain relatively stable, but with increasing

uncertainty over time, indicating potential fluctuations in the future. This stability in

the short term is a positive sign, but the widening confidence intervals in the longterm forecasts suggest that external factors could impact this trend.

Overall, while the short-term outlook for South Korea's economy is positive, with

growth, better employment conditions, and stable inflation, the increasing

uncertainty in the longer-term forecasts indicates that predictions become less

reliable as they extend into the future. It's important to note that these forecasts are

based on past trends and do not incorporate external information or sudden

changes in economic conditions. Therefore, while the data currently suggests

stability and growth, external shocks or significant global economic changes could

impact these forecasts.

history

history