Similar presentations:

Financial System

1.

BUS 362 Financial Institutions andMarkets

Week 2: Financial System

Assoc. Prof. Hülya Hazar

Faculty of Economics and Administrative Sciences, Department of

Business Administration

hulyahazar@aydin.edu.tr

1

2.

Financial Institutions and Markets1. Overview of the Financial System

2. Function of Financial Markets

3. Segments of Financial Markets

4. Importance of Financial Markets

5. Structure of Financial Markets

6. Internationalization of Financial Markets

7. Intermediaries

8. Regulation of Financial Markets

ue.aydin.edu.tr

2

3.

Financial Institutions and MarketsOverview of the Financial System

ue.aydin.edu.tr

3

4.

Financial Institutions and MarketsFunction of Financial Markets

• Channels funds from person or business without investment

opportunities (i.e., “Lender-Savers”) to one who has them

(i.e., “Borrower-Spenders”)

• Improves economic efficiency

ue.aydin.edu.tr

4

5.

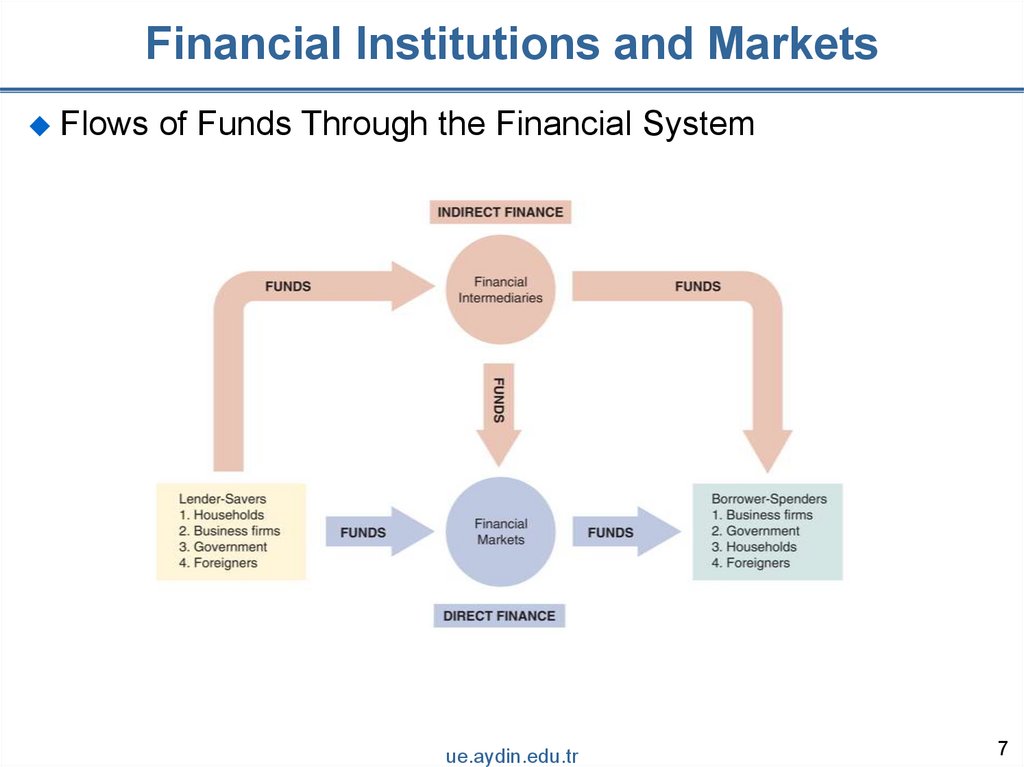

Financial Institutions and MarketsFinancial Markets Funds Transferees

Lender-Savers

1. Households

2. Business firms

3. Government

4. Foreigners

Borrower-Spenders

1. Business firms

2. Government

3. Households

4. Foreigners

ue.aydin.edu.tr

5

6.

Financial Institutions and MarketsSegments of Financial Markets

• Direct Finance

• Borrowers borrow directly from lenders in financial

markets by selling financial instruments which are claims

on the borrower’s future income or assets

• Indirect Finance

• Borrowers borrow indirectly from lenders via financial

intermediaries (established to source both loanable funds

and loan opportunities) by issuing financial instruments

which are claims on the borrower’s future income or

assets

ue.aydin.edu.tr

6

7.

Financial Institutions and MarketsFlows of Funds Through the Financial System

ue.aydin.edu.tr

7

8.

Financial Institutions and MarketsImportance of Financial Markets

• Saver and spender meets

• Efficient allocation of capital

• Improve the well-being of consumers

ue.aydin.edu.tr

8

9.

Financial Institutions and MarketsStructure of Financial Markets

• Debt Markets - Equity Markets

• Primary Market - Secondary Market

• Exchanges - Over-the-Counter Markets

ue.aydin.edu.tr

9

10.

Financial Institutions and MarketsClassifications of Financial Markets by Maturity

• Money Market

• Capital Market

ue.aydin.edu.tr

10

11.

Financial Institutions and MarketsInternationalization of Financial Markets

• International Bond Market & Eurobonds

• Eurocurrency Market

• World Stock Markets

ue.aydin.edu.tr

11

12.

Financial Institutions and MarketsIntermediaries: Indirect Finance

• Banks and financial institutions

• More important source of finance than securities markets

• Financial intermediaries reduce adverse selection and

moral hazard problems

ue.aydin.edu.tr

12

13.

Financial Institutions and MarketsMain Reasons for Regulation of Financial Markets

• Increase Information to Investors

• Ensure the Soundness of Financial Intermediaries

ue.aydin.edu.tr

13

14.

Subjects Covered1. Overview of the Financial System

2. Function of Financial Markets

3. Segments of Financial Markets

4. Importance of Financial Markets

5. Structure of Financial Markets

6. Internationalization of Financial Markets

7. Intermediaries

8. Regulation of Financial Markets

ue.aydin.edu.tr

14

15.

ReferencesReadings:

Chapter 2

Reference Book:

Mishkin, Frederic S. Financial Markets and Institutions. Eighth Edition.

UK: Pearson, 2016.

ue.aydin.edu.tr

15

16.

Financial Institutions and MarketsSee you next week…

ue.aydin.edu.tr

16

finance

finance