Similar presentations:

Budget Meeting (Kazakhstan)

1.

BUDGET MEETING(KAZAKHSTAN)

(09.02.2023)

2.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

2

3.

AlmawineMarket share by IWSR 2021

Business review vs 1st year

TOP-1 of import vodka – 17%

ROUST +147% for 3 BY

TOP-4 of whiskey category – 10%

Brown Forman +50% for 2BY

TOP-5 of wine category – 4%

William Grant and sons +84% for 2BY

TOP-1 in beer category (Carlsberg) – 44%

Wine portfolio +3441% for 3BY

Route to consumer

Storage and transportation facilities

20 subsidiary companies, 100% coverage

3 logistic hubs – Almaty, Aktobe, Pavlodar

28 787 active clients base

24 regional warehouses – 35 673 sq. m

4 main trade channels – Modern Trade,

Transportation facilities – more than 280

Traditional Trade, On-trade, Wholesale

Sales forces – 252 employee

vehicles – 736 tons per day

4.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

4

5.

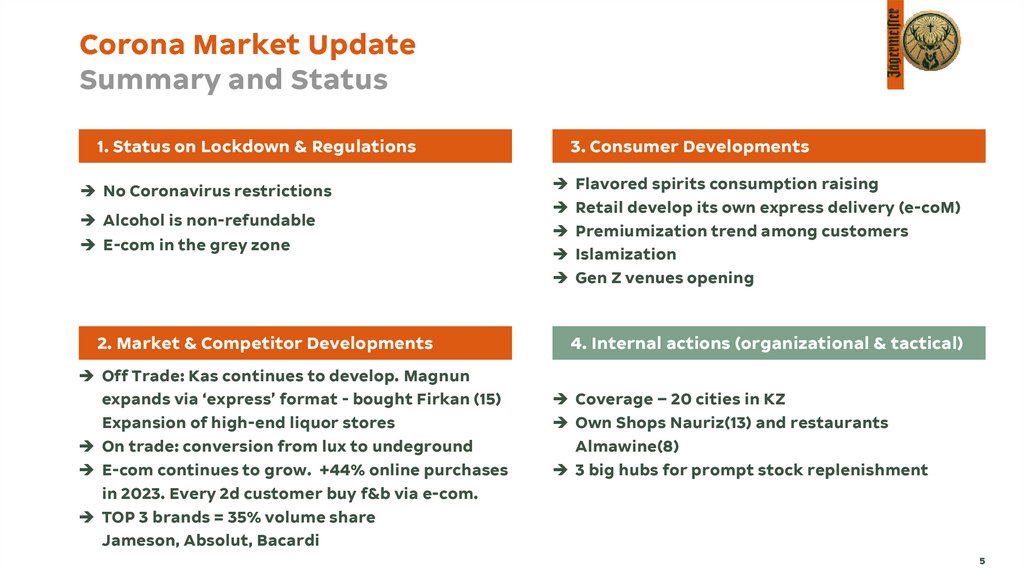

Corona Market UpdateSummary and Status

1. Status on Lockdown & Regulations

No Coronavirus restrictions

Alcohol is non-refundable

E-com in the grey zone

3. Consumer Developments

Flavored spirits consumption raising

Retail develop its own express delivery (e-coM)

Premiumization trend among customers

Islamization

Gen Z venues opening

2. Market & Competitor Developments

4. Internal actions (organizational & tactical)

Off Trade: Kas continues to develop. Magnun

expands via ‘express’ format - bought Firkan (15)

Expansion of high-end liquor stores

On trade: conversion from lux to undeground

E-com continues to grow. +44% online purchases

in 2023. Every 2d customer buy f&b via e-com.

TOP 3 brands = 35% volume share

Jameson, Absolut, Bacardi

Coverage – 20 cities in KZ

Own Shops Nauriz(13) and restaurants

Almawine(8)

3 big hubs for prompt stock replenishment

5

6.

PESTExternal Factors and Trends

External Factor

Description

New government

Impact on Spirits / Jägermeister

Development

Assessment

Description

Almaty – economical center

+-

Independent position, new “capital” of Asia

Russian-Ukrainian conflict

Constant Escalation

A huge number of manufacturers are

pulling off the Russian FMCG

market, which led to problems with

logistics chains and stands in

Kazakhstan.

This led to a reduction in the assortments and also

contributed to the price increase.

GDP

Inflation

Exchange rate

Unemployment

▲ 3,4% (2022)

▲20,7%

▲505 per 1 euro

Avg 4,8%

-

The value of money is rising. The security deposit is growing.

The burden for importers is growing

base rate of the national bank

Monthly calculation index

16,75%

▲3450 (3043) KZT

general increase in prices

and fall in the purchasing

value of KZT

minimum wage growth is lower than inflation growth

Migration

Internal and external

+

People come to big cities ( TOP4), ~300 companies think of

relocation to KZ.

Male \ Female

Avg Age

48% \ 52%

29,3 yo

+

200K+ (from 500K) people stayed for a living

E-com evolution

TOP marketplace - KASPI KZ

Negative effect on competitors

+33,7% transactions in e-com 22vs21 (~4 billions)

Virtual warehouse

State control

Positive effect

Transparent sales and reducing grey zone, operational load

on accountants, system. Refusal to sell strong spirits (BC)

Political

Economical

(FX, GDP, Inflation, retail turnover,

etc.)

Social

Technological

6

7.

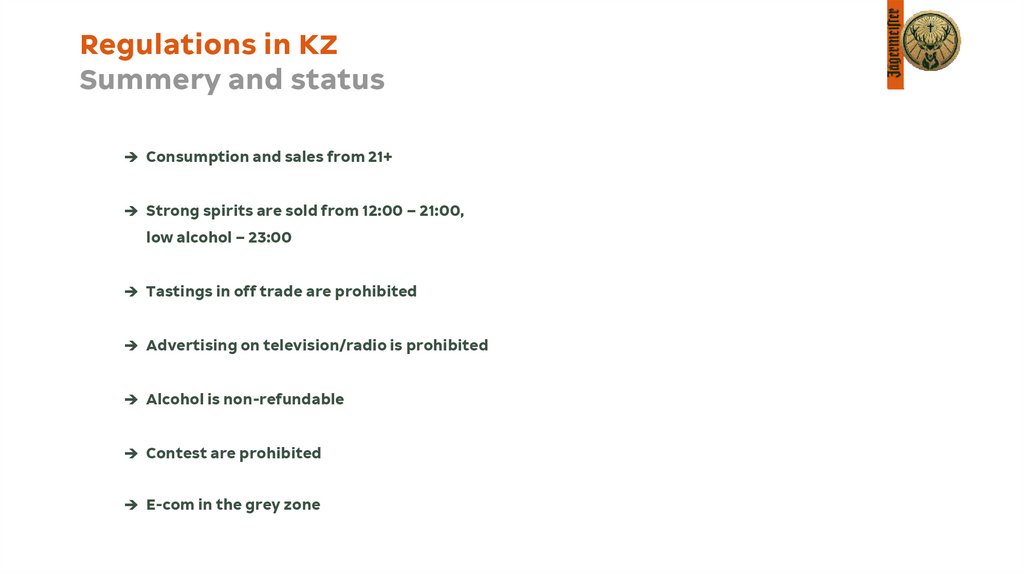

Regulations in KZSummery and status

Consumption and sales from 21+

Strong spirits are sold from 12:00 – 21:00,

low alcohol – 23:00

Tastings in off trade are prohibited

Advertising on television/radio is prohibited

Alcohol is non-refundable

Contest are prohibited

E-com in the grey zone

8.

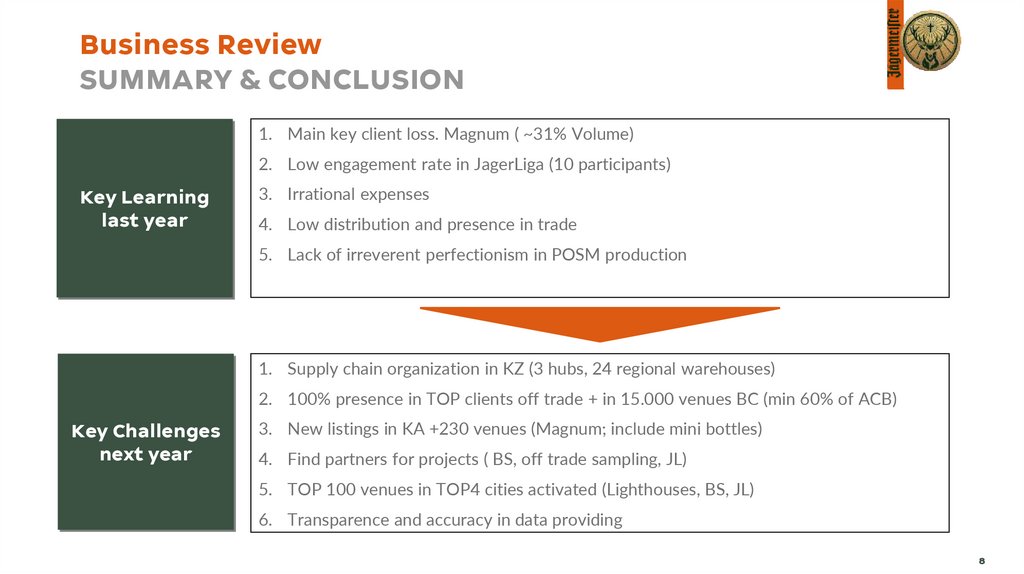

Business ReviewSUMMARY & CONCLUSION

1. Main key client loss. Magnum ( ~31% Volume)

2. Low engagement rate in JagerLiga (10 participants)

Key Learning

last year

3. Irrational expenses

4. Low distribution and presence in trade

5. Lack of irreverent perfectionism in POSM production

1. Supply chain organization in KZ (3 hubs, 24 regional warehouses)

2. 100% presence in TOP clients off trade + in 15.000 venues BC (min 60% of ACB)

Key Challenges

next year

3. New listings in KA +230 venues (Magnum; include mini bottles)

4. Find partners for projects ( BS, off trade sampling, JL)

5. TOP 100 venues in TOP4 cities activated (Lighthouses, BS, JL)

6. Transparence and accuracy in data providing

8

9.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

9

10.

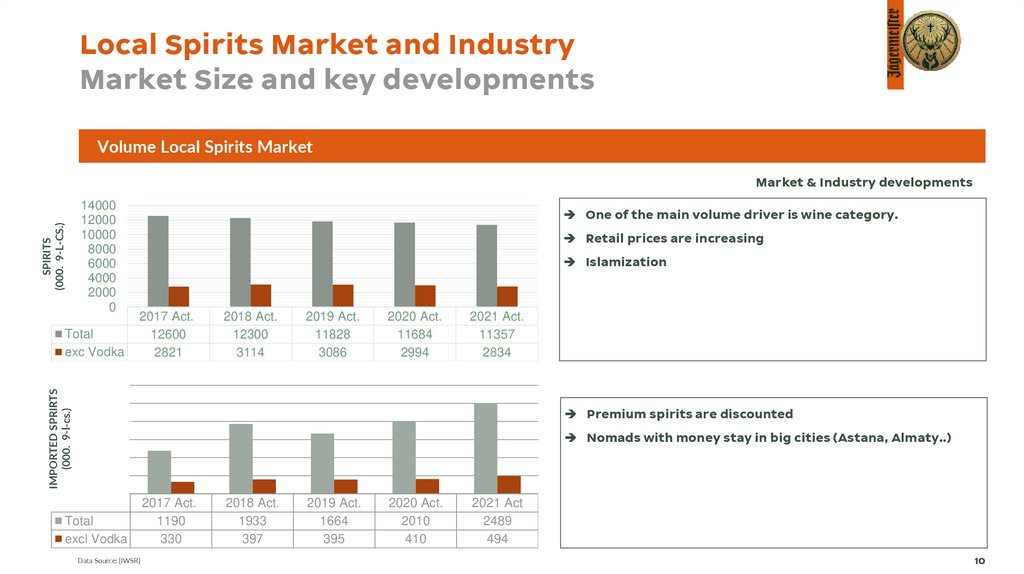

Local Spirits Market and IndustryMarket Size and key developments

Volume Local Spirits Market

SPIRITS

(000. 9-L-CS.)

Market & Industry developments

14000

12000

10000

8000

6000

4000

2000

0

Retail prices are increasing

Islamization

2017 Act.

12600

2821

2018 Act.

12300

3114

2019 Act.

11828

3086

2020 Act.

11684

2994

2021 Act.

11357

2834

IMPORTED SPRIRTS

(000. 9-l-cs.)

Total

exc Vodka

One of the main volume driver is wine category.

Premium spirits are discounted

Nomads with money stay in big cities (Astana, Almaty..)

Total

excl Vodka

Data Source: [IWSR]

2017 Act.

1190

330

2018 Act.

1933

397

2019 Act.

1664

395

2020 Act.

2010

410

2021 Act

2489

494

10

11.

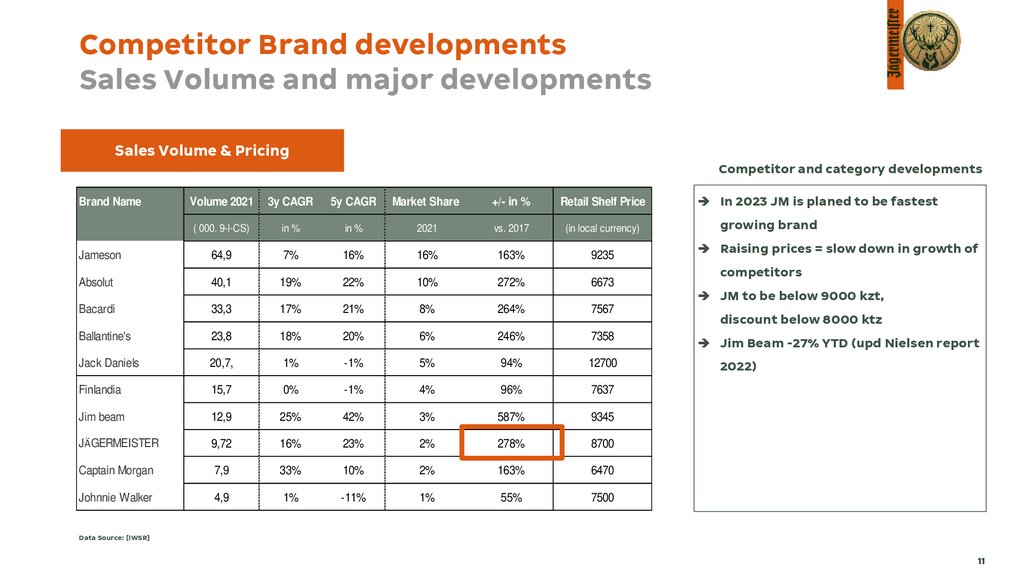

Competitor Brand developmentsSales Volume and major developments

Sales Volume & Pricing

Competitor and category developments

Brand Name

Volume 2021

3y CAGR

5y CAGR

Market Share

+/- in %

Retail Shelf Price

( 000. 9-l-CS)

in %

in %

2021

vs. 2017

(in local currency)

Jameson

64,9

7%

16%

16%

163%

9235

Absolut

40,1

19%

22%

10%

272%

6673

Bacardi

33,3

17%

21%

8%

264%

7567

Ballantine's

23,8

18%

20%

6%

246%

7358

Jack Daniels

20,7,

1%

-1%

5%

94%

12700

Finlandia

15,7

0%

-1%

4%

96%

7637

Jim beam

12,9

25%

42%

3%

587%

9345

JÄGERMEISTER

9,72

16%

23%

2%

278%

8700

Captain Morgan

7,9

33%

10%

2%

163%

6470

Johnnie Walker

4,9

1%

-11%

1%

55%

7500

In 2023 JM is planed to be fastest

growing brand

Raising prices = slow down in growth of

competitors

JM to be below 9000 kzt,

discount below 8000 ktz

Jim Beam -27% YTD (upd Nielsen report

2022)

Data Source: [IWSR]

11

12.

Pricing updated 25.01.2023On-trade and off-trade

Brand

Volume (000. 9-l-cs.)

9,7

20,7

40,1

33,

64,9

23,8

33,3

15,7

12,9

4,9

Retail Shelf Price (70cl)

8700

12700

6673

7567

9235

7358

6470

7637

9345

7500

Target Shelf Price (70cl)

8500

6607

8900

6370

5693

7787

6600

1799

2033

1613

1588

1499

1658

Promotion Price (70cl)

7850

Target Promotion Price

7560

On-trade Price (Shot)

1766

Target On-trade Price

1350

11798

2890

5990

1648

5957

1424

Data Source: [IWSR 2021]

12

13.

Stock and sales plan per SKU 2023TOTAL

4 190

4 500

1l

4 000

3 464

3 500

1200

2 793

3 000

2 500 2 277

999

1000

2 293

2 255

800

2 000

701

495

600

1 500

1 1551 155

1 095

1 155

400

1 000

338

383

Mar

Apr

473

518

563

608

May

Jun

Jul

Aug

765

542

200

500

0

0

Jan

Feb

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2022

Shipments cs

Sep

Oct

600

622

488

500

600

436

308

300

210

238

294

322

Dec

50 cl

700

400

Nov

Depletions cs

70 cl

500

720

350

378

448

476

400

337

343

242

300

200

200

165

187

Mar

Apr

253

275

297

231

May

Jun

Jul

Aug

352

374

265

100

100

0

0

Jan

Feb

Mar

Apr

May

Jun

Jul

Depletions cs

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Sep

Oct

Nov

Dec

Depletions cs

13

14.

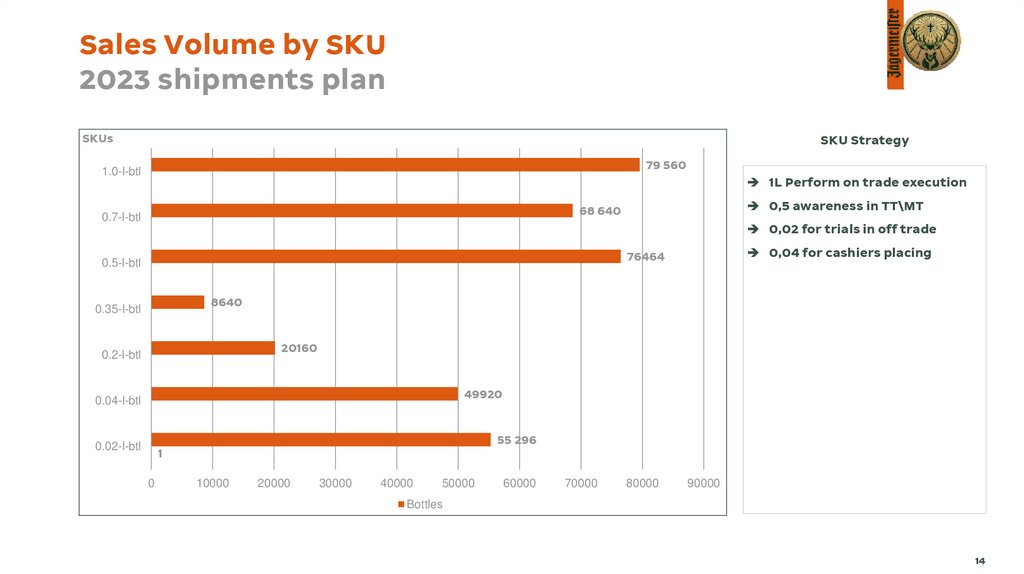

Sales Volume by SKU2023 shipments plan

SKUs

SKU Strategy

79 560

1.0-l-btl

1L Perform on trade execution

0,5 awareness in TT\MT

68 640

0.7-l-btl

0,02 for trials in off trade

0,04 for cashiers placing

76464

0.5-l-btl

8640

0.35-l-btl

20160

0.2-l-btl

49920

0.04-l-btl

0.02-l-btl

55 296

1

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

Bottles

14

15.

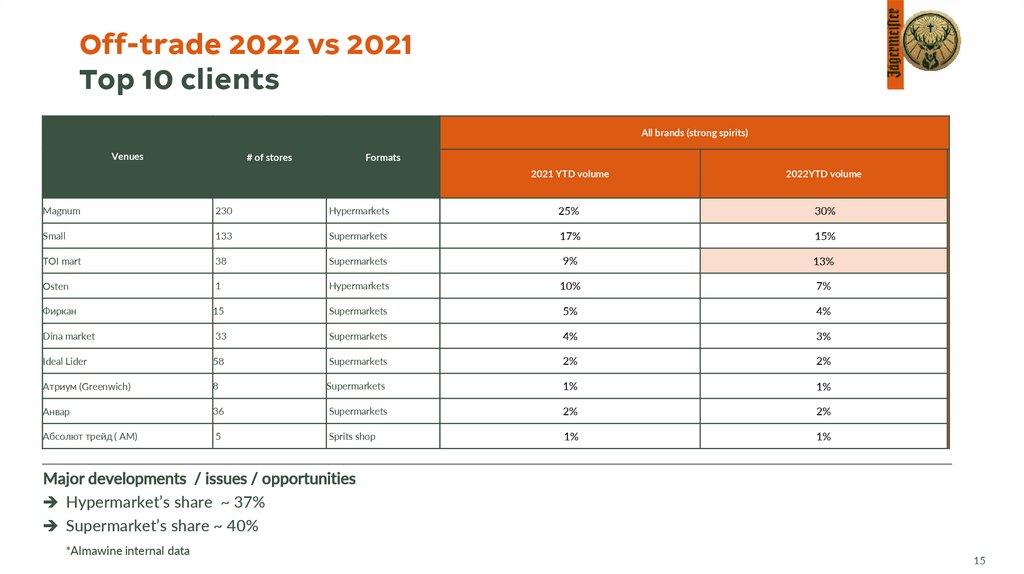

Off-trade 2022 vs 2021Top 10 clients

All brands (strong spirits)

Venues

# of stores

Formats

2021 YTD volume

2022YTD volume

Magnum

230

Hypermarkets

25%

30%

Small

133

Supermarkets

17%

15%

TOI mart

38

Supermarkets

9%

13%

Osten

1

Hypermarkets

10%

7%

Фиркан

15

Supermarkets

5%

4%

Dina market

33

Supermarkets

4%

3%

Ideal Lider

58

Supermarkets

2%

2%

Атриум (Greenwich)

8

Supermarkets

1%

1%

Анвар

36

Supermarkets

2%

2%

Абсолют трейд ( АМ)

5

Sprits shop

1%

1%

Major developments / issues / opportunities

Hypermarket’s share ~ 37%

Supermarket’s share ~ 40%

*Almawine internal data

15

16.

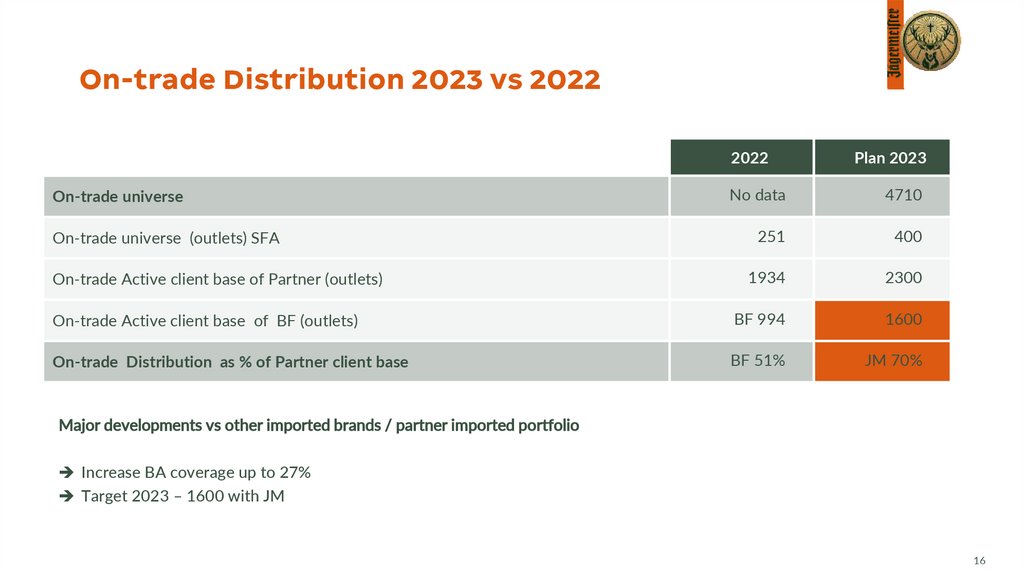

On-trade Distribution 2023 vs 20222022

Plan 2023

No data

4710

On-trade universe (outlets) SFA

251

400

On-trade Active client base of Partner (outlets)

1934

2300

On-trade Active client base of BF (outlets)

BF 994

1600

On-trade Distribution as % of Partner client base

BF 51%

JM 70%

On-trade universe

Major developments vs other imported brands / partner imported portfolio

Increase BA coverage up to 27%

Target 2023 – 1600 with JM

16

17.

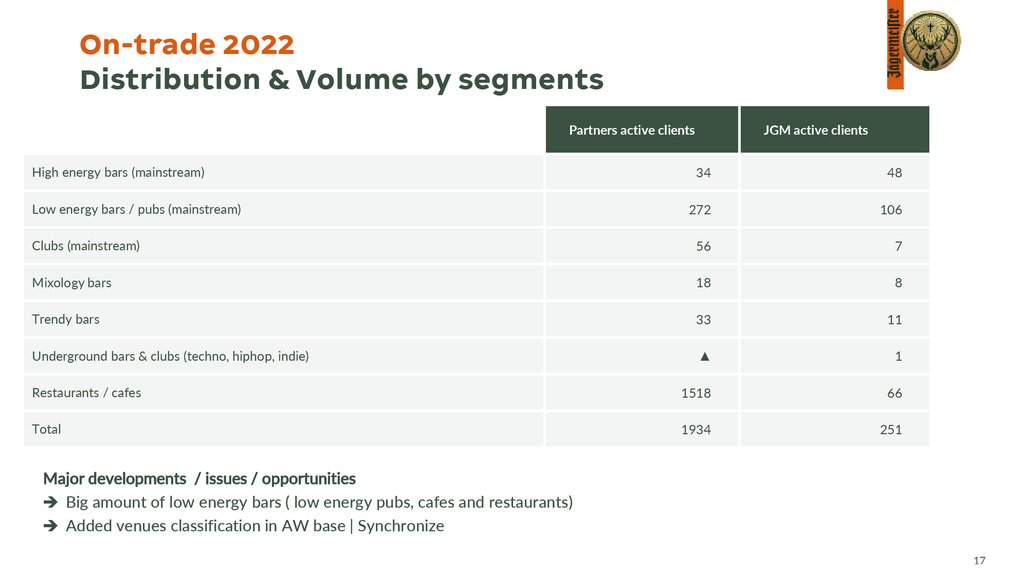

On-trade 2022Distribution & Volume by segments

Partners active clients

JGM active clients

High energy bars (mainstream)

34

48

Low energy bars / pubs (mainstream)

272

106

Clubs (mainstream)

56

7

Mixology bars

18

8

Trendy bars

33

11

Underground bars & clubs (techno, hiphop, indie)

▲

1

Restaurants / cafes

1518

66

Total

1934

251

Major developments / issues / opportunities

Big amount of low energy bars ( low energy pubs, cafes and restaurants)

Added venues classification in AW base | Synchronize

17

18.

On-trade 2021 - 2023Brand Ambassador performance / SFA KPIs

Key achievements / highlights

2021

2022

Plan 2023

Accounts visited by Bas

155

251

400

Increase BA’s coverage +15%

Average Score

47

30

55

Build 28 lighthouses

Basic branding

86

37

200

Placement 150 tap machines ( ~50 removed

Advaned Branding

39

28

150

Ice cold serve

146

160

300

JagerLiga attendees

10

5

50

Lighthouses

10

5

28

from venues by the previous distributor)

18

19.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

19

20.

JM Business DevelopmentPlan 2023

Top 5 Priorities for 2023

Achievements /

KPI Improvement

Brand awareness

28 Lighthouses in TOP 6 cities

Trial

Trials 55 000+ (BS, Events, Off trade sampling)

Win On

Avg SFA score 55 in TOP 1 priority cities

Off Trade

Ice cold communication (message)

Brand equity/digital

Listing mini SKU (0,04; 0,2; 0,35)

Ice cold in 75% Universe, 150 tap machines

Reach 12mio

20

21.

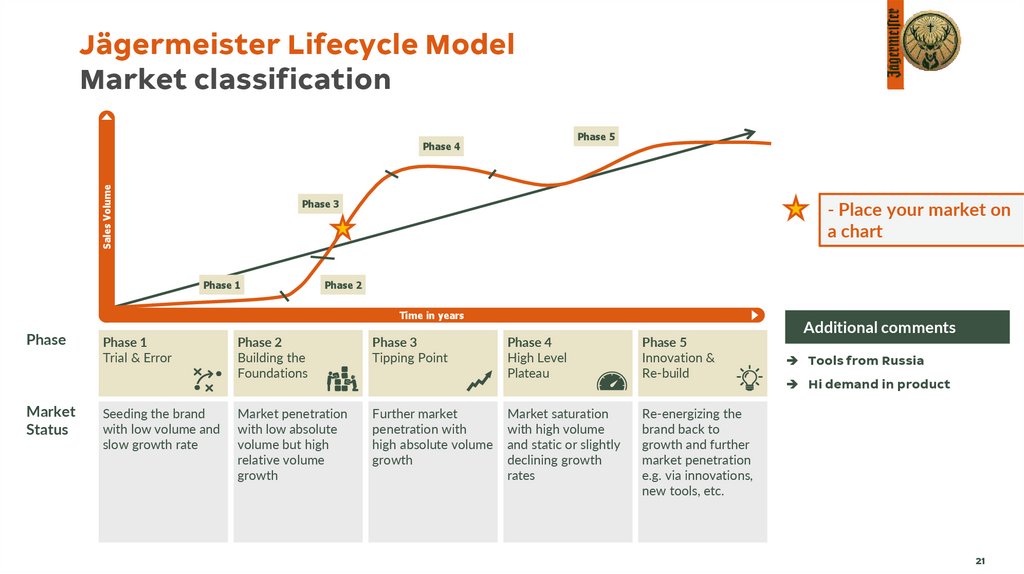

Jägermeister Lifecycle ModelMarket classification

Phase 5

Sales Volume

Phase 4

- Place your market on

a chart

Phase 3

Phase 1

Phase 2

Time in years

Phase

Market

Status

Phase 1

Trial & Error

Seeding the brand

with low volume and

slow growth rate

Phase 2

Building the

Foundations

Phase 3

Tipping Point

Market penetration

with low absolute

volume but high

relative volume

growth

Further market

penetration with

high absolute volume

growth

Phase 4

High Level

Plateau

Phase 5

Innovation &

Re-build

Market saturation

with high volume

and static or slightly

declining growth

rates

Re-energizing the

brand back to

growth and further

market penetration

e.g. via innovations,

new tools, etc.

Additional comments

Tools from Russia

Hi demand in product

21

22.

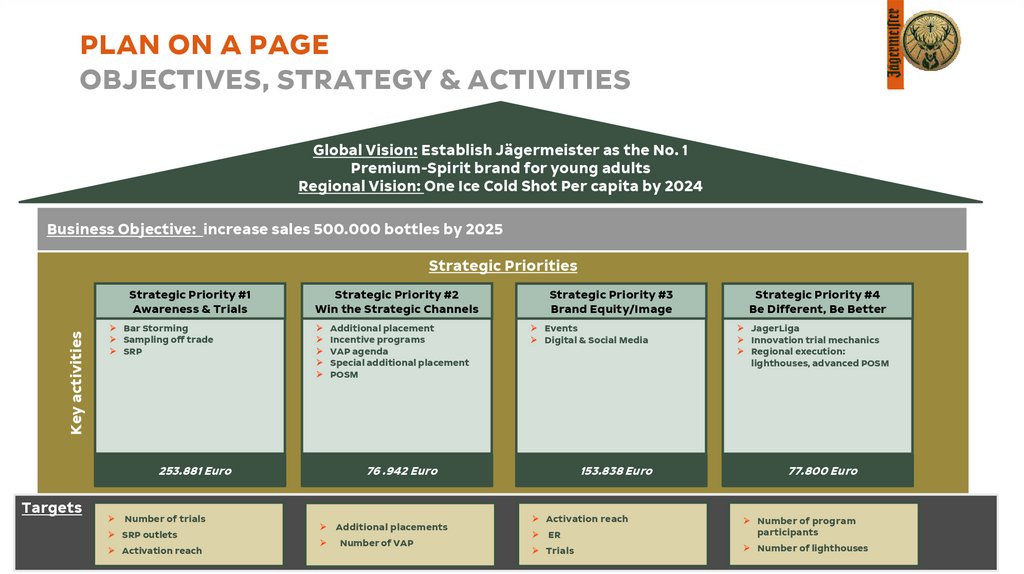

PLAN ON A PAGEOBJECTIVES, STRATEGY & ACTIVITIES

Global Vision: Establish Jägermeister as the No. 1

Premium-Spirit brand for young adults

Regional Vision: One Ice Cold Shot Per capita by 2024

Business Objective: increase sales 500.000 bottles by 2025

Strategic Priorities

Key activities

Strategic Priority #1

Awareness & Trials

Bar Storming

Sampling off trade

SRP

Strategic Priority #2

Win the Strategic Channels

Additional placement

Incentive programs

VAP agenda

Special additional placement

POSM

253.881 Euro

Targets

Number of trials

SRP outlets

Activation reach

Strategic Priority #3

Brand Equity/Image

Events

Digital & Social Media

153.838 Euro

76 .942 Euro

Additional placements

Number of VAP

Activation reach

Strategic Priority #4

Be Different, Be Better

JagerLiga

Innovation trial mechanics

Regional execution:

lighthouses, advanced POSM

77.800 Euro

ER

Number of program

participants

Trials

Number of lighthouses

22

23.

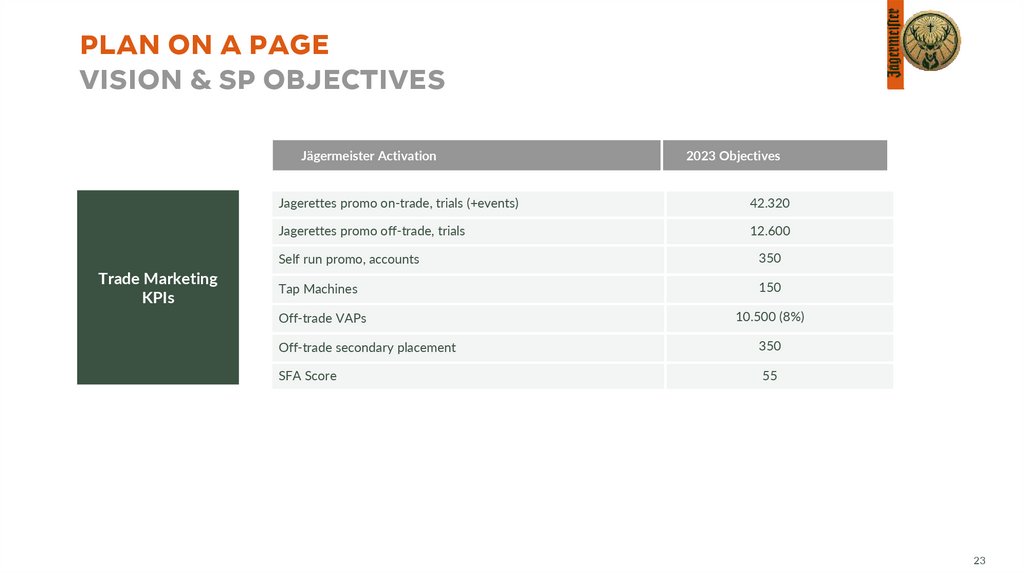

PLAN ON A PAGEVISION & SP OBJECTIVES

Jägermeister Activation

Trade Marketing

KPIs

2023 Objectives

Jagerettes promo on-trade, trials (+events)

42.320

Jagerettes promo off-trade, trials

12.600

Self run promo, accounts

350

Tap Machines

150

Off-trade VAPs

10.500 (8%)

Off-trade secondary placement

350

SFA Score

55

23

24.

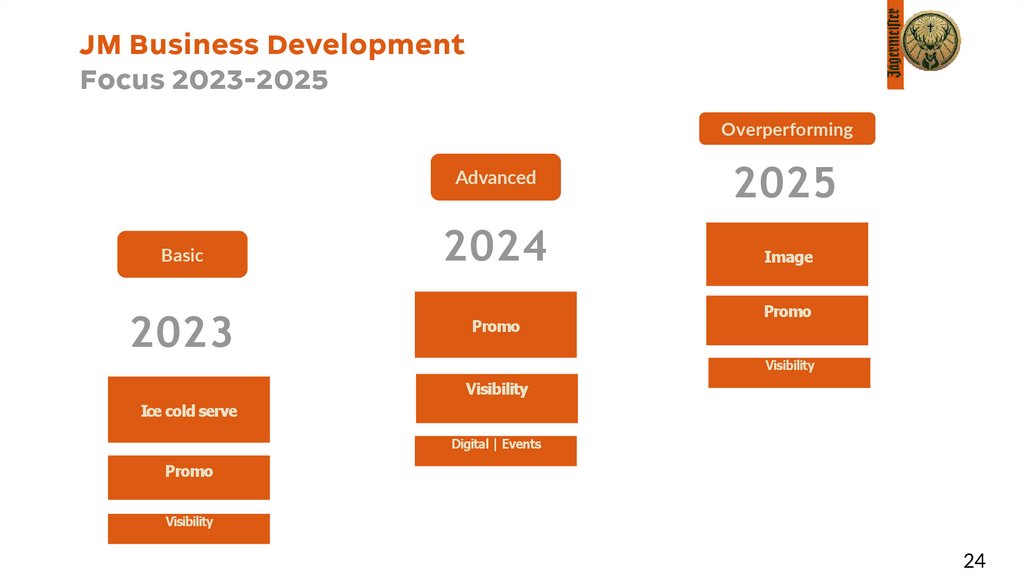

JM Business DevelopmentFocus 2023-2025

Overperforming

Advanced

Basic

2023

2024

Promo

2025

Image

Promo

Visibility

Visibility

Ice cold serve

Digital | Events

Promo

Visibility

24

25.

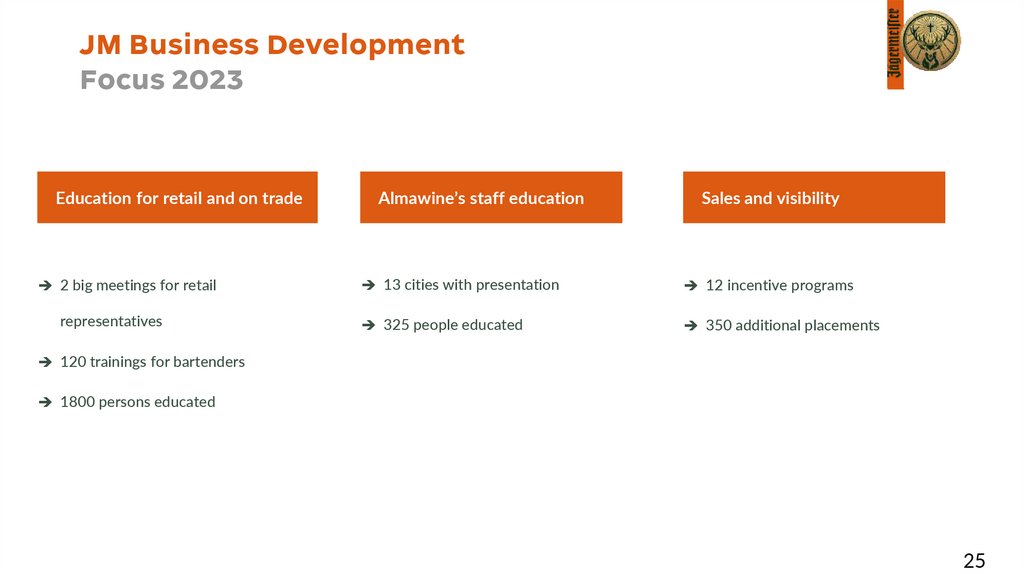

JM Business DevelopmentFocus 2023

Education for retail and on trade

2 big meetings for retail

representatives

Almawine’s staff education

Sales and visibility

13 cities with presentation

12 incentive programs

325 people educated

350 additional placements

120 trainings for bartenders

1800 persons educated

25

26.

JM Business DevelopmentPrioritization 2023

1st Priority

Alamaty

2d Priority

Shymkent

3d Priority

Aktau

Other cities

Kokshetau (Borovoye, touristic place)

Zhezkazgan (low)

Astana

Karaganda

Kostanay

Atyrau

Petropavlovsk

Semey (low, regional center)

Pavlodar

Taraz

Ekibastuz (low)

Uralsk

Aktobe

Balkhash ( salt\fresh lakes, touristic place)

Taldykorgan ( 300km to Almaty)

Kyzylorda (low)

…

Ustkamennogorsk

26

27.

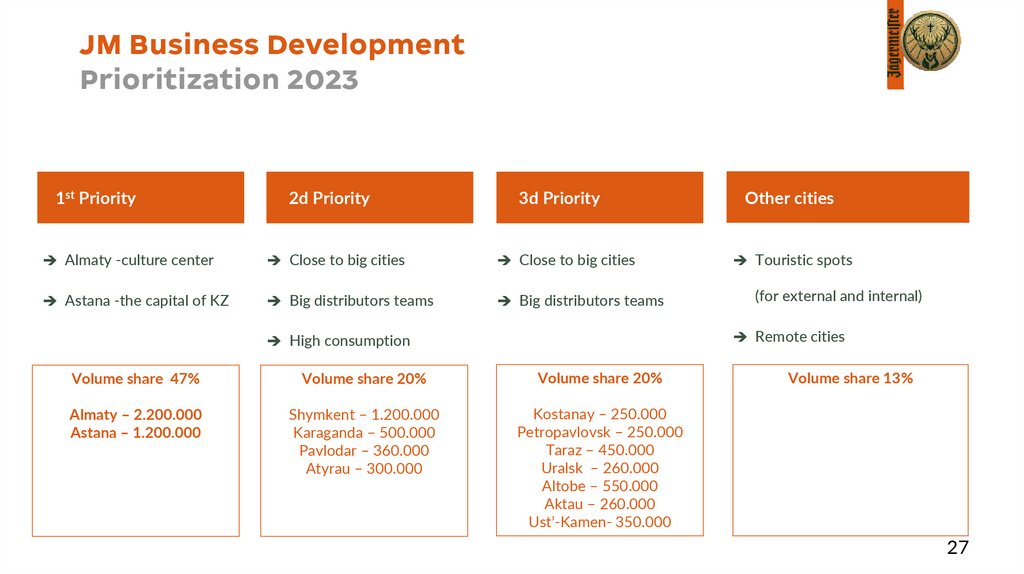

JM Business DevelopmentPrioritization 2023

2d Priority

3d Priority

Other cities

Almaty -culture center

Close to big cities

Close to big cities

Touristic spots

Astana -the capital of KZ

Big distributors teams

Big distributors teams

1st Priority

(for external and internal)

Remote cities

High consumption

Volume share 47%

Volume share 20%

Volume share 20%

Almaty – 2.200.000

Astana – 1.200.000

Shymkent – 1.200.000

Karaganda – 500.000

Pavlodar – 360.000

Atyrau – 300.000

Kostanay – 250.000

Petropavlovsk – 250.000

Taraz – 450.000

Uralsk – 260.000

Altobe – 550.000

Aktau – 260.000

Ust’-Kamen- 350.000

Volume share 13%

27

28.

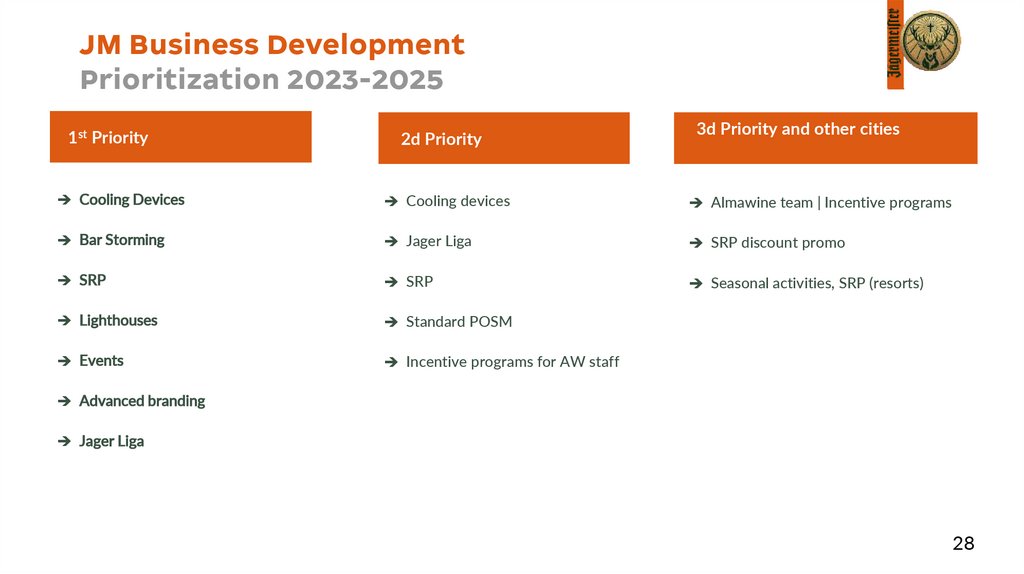

JM Business DevelopmentPrioritization 2023-2025

1st Priority

2d Priority

3d Priority and other cities

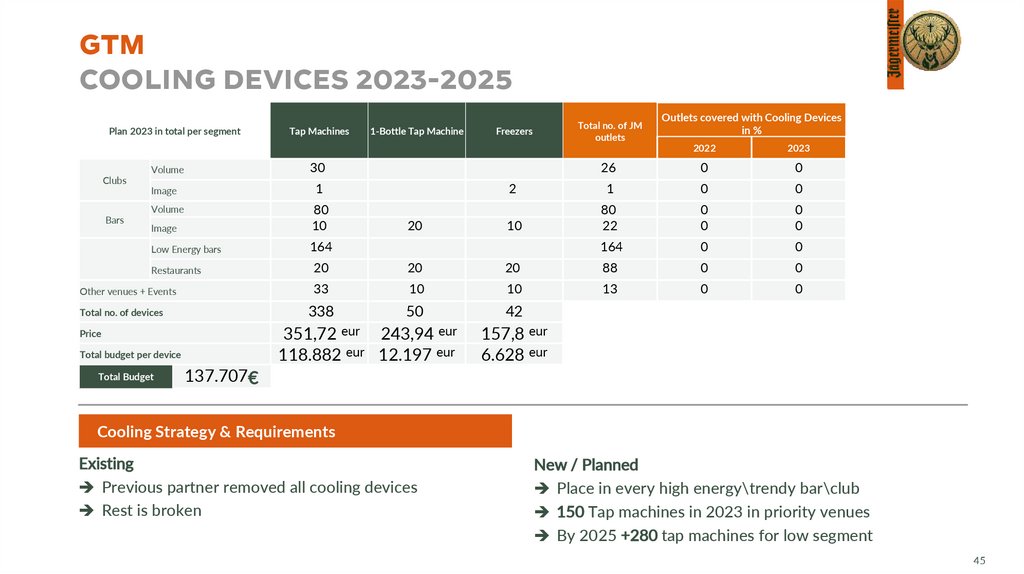

Cooling Devices

Cooling devices

Almawine team | Incentive programs

Bar Storming

Jager Liga

SRP discount promo

SRP

SRP

Seasonal activities, SRP (resorts)

Lighthouses

Standard POSM

Events

Incentive programs for AW staff

Advanced branding

Jager Liga

28

29.

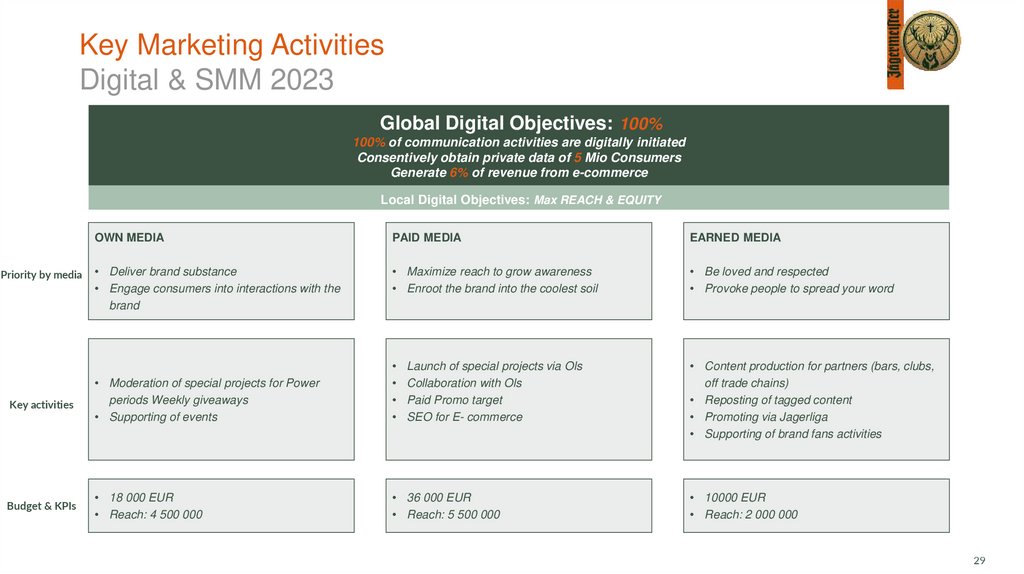

Key Marketing ActivitiesDigital & SMM 2023

Global Digital Objectives: 100%

100% of communication activities are digitally initiated

Consentively obtain private data of 5 Mio Consumers

Generate 6% of revenue from e-commerce

Local Digital Objectives: Max REACH & EQUITY

OWN MEDIA

PAID MEDIA

EARNED MEDIA

• Deliver brand substance

• Engage consumers into interactions with the

brand

• Maximize reach to grow awareness

• Enroot the brand into the coolest soil

• Be loved and respected

• Provoke people to spread your word

Key activities

• Moderation of special projects for Power

periods Weekly giveaways

• Supporting of events

• Content production for partners (bars, clubs,

off trade chains)

• Reposting of tagged content

• Promoting via Jagerliga

• Supporting of brand fans activities

Budget & KPIs

• 18 000 EUR

• Reach: 4 500 000

• 36 000 EUR

• Reach: 5 500 000

Priority by media

Launch of special projects via Ols

Collaboration with Ols

Paid Promo target

SEO for E- commerce

• 10000 EUR

• Reach: 2 000 000

29

30.

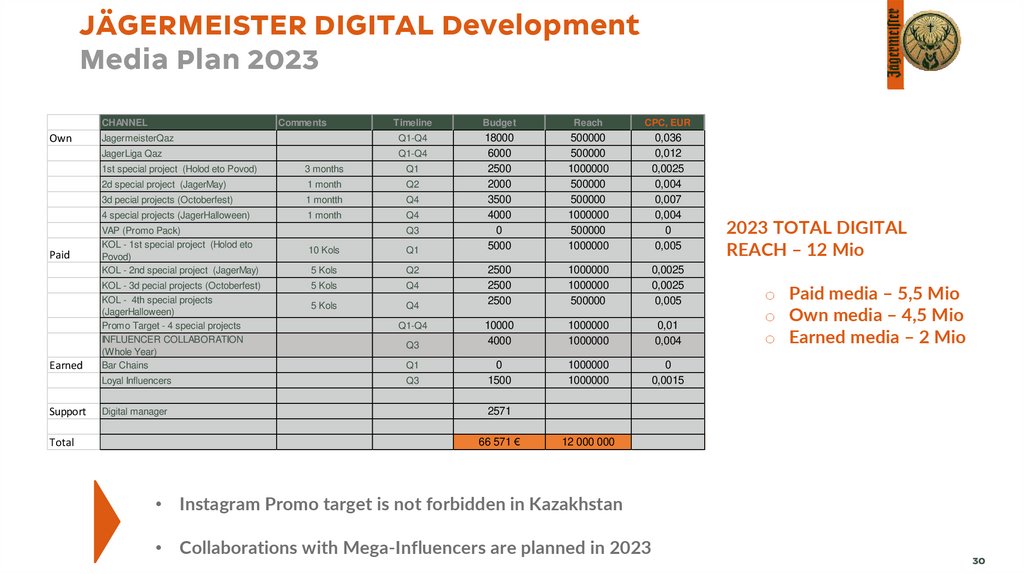

JÄGERMEISTER DIGITAL DevelopmentMedia Plan 2023

Comments

CHANNEL

Own

JagermeisterQaz

Total

CPC, EUR

Q1-Q4

18000

6000

2500

2000

3500

4000

0

5000

500000

500000

1000000

500000

500000

1000000

500000

1000000

0,036

0,012

0,0025

0,004

0,007

0,004

0

0,005

2500

2500

2500

1000000

1000000

500000

0,0025

0,0025

0,005

10000

4000

1000000

1000000

0,01

0,004

0

1500

1000000

1000000

0

0,0015

Q1

2d special project (JagerMay)

1 month

Q2

3d pecial projects (Octoberfest)

1 montth

Q4

4 special projects (JagerHalloween)

1 month

Q4

VAP (Promo Pack)

KOL - 1st special project (Holod eto

Povod)

KOL - 2nd special project (JagerMay)

KOL - 3d pecial projects (Octoberfest)

KOL - 4th special projects

(JagerHalloween)

Promo Target - 4 special projects

INFLUENCER COLLABORATION

(Whole Year)

Bar Chains

Loyal Influencers

Support

Reach

3 months

1st special project (Holod eto Povod)

Earned

Budget

Q1-Q4

JagerLiga Qaz

Paid

Timeline

Digital manager

Q3

10 Kols

Q1

5 Kols

Q2

5 Kols

Q4

5 Kols

Q4

Q1-Q4

Q3

Q1

Q3

2023 TOTAL DIGITAL

REACH – 12 Mio

o Paid media – 5,5 Mio

o Own media – 4,5 Mio

o Earned media – 2 Mio

2571

66 571 €

12 000 000

• Instagram Promo target is not forbidden in Kazakhstan

• Collaborations with Mega-Influencers are planned in 2023

30

31.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

31

32.

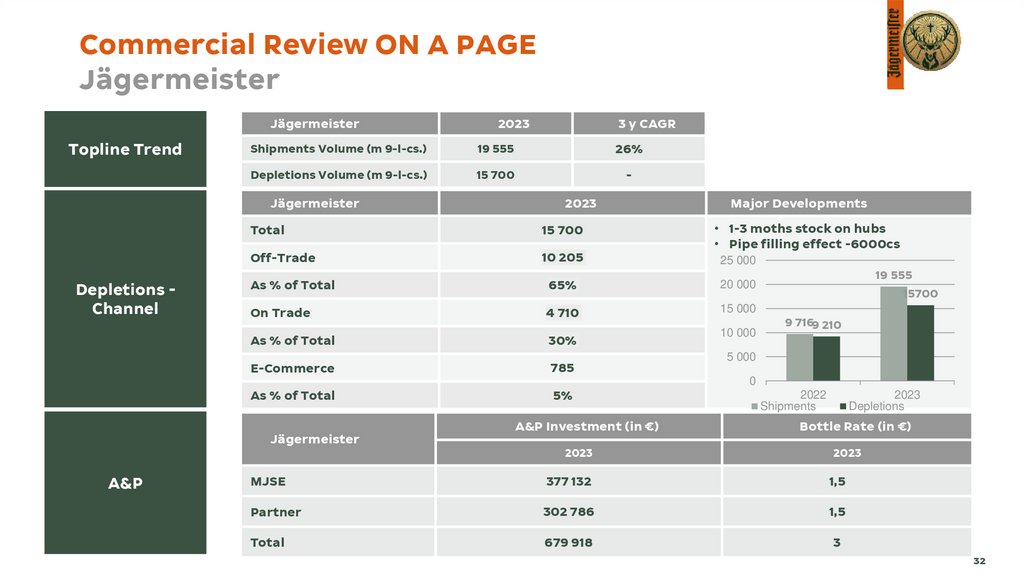

Commercial Review ON A PAGEJägermeister

Jägermeister

Topline Trend

3 y CAGR

Shipments Volume (m 9-l-cs.)

19 555

26%

Depletions Volume (m 9-l-cs.)

15 700

-

Jägermeister

Depletions Channel

2023

2023

Major Developments

• 1-3 moths stock on hubs

• Pipe filling effect -6000cs

Total

15 700

Off-Trade

10 205

As % of Total

65%

20 000

On Trade

4 710

15 000

As % of Total

30%

10 000

E-Commerce

785

As % of Total

5%

25 000

19 555

15700

9 7169 210

5 000

0

Jägermeister

A&P

A&P Investment (in €)

2023

2022

Shipments

2023

Depletions

Bottle Rate (in €)

2023

MJSE

377 132

1,5

Partner

302 786

1,5

Total

679 918

3

32

33.

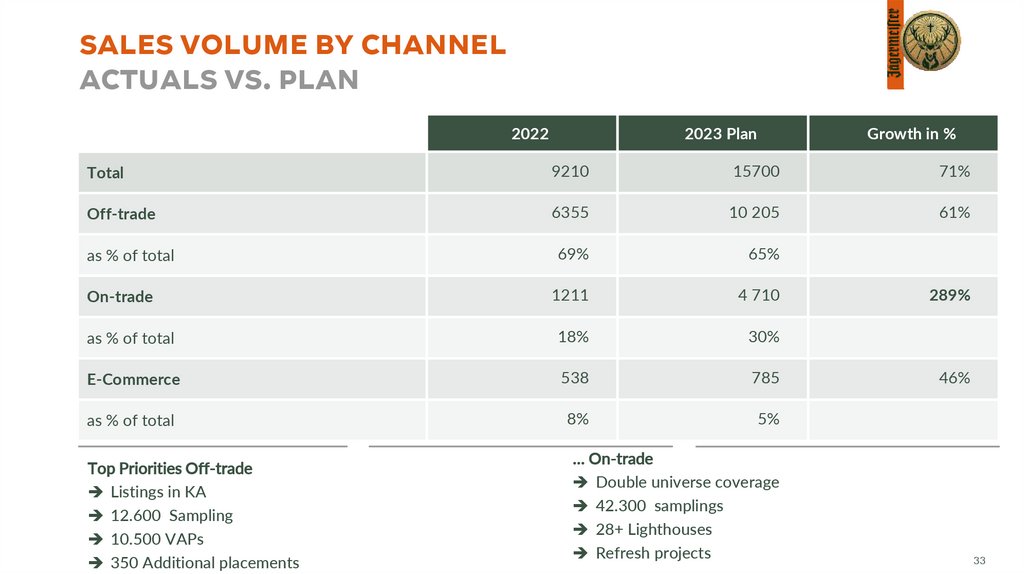

SALES VOLUME BY CHANNELACTUALS VS. PLAN

2022

2023 Plan

Growth in %

Total

9210

15700

71%

Off-trade

6355

10 205

61%

as % of total

69%

65%

On-trade

1211

4 710

as % of total

18%

30%

E-Commerce

538

785

as % of total

8%

5%

Top Priorities Off-trade

Listings in KA

12.600 Sampling

10.500 VAPs

350 Additional placements

… On-trade

Double universe coverage

42.300 samplings

28+ Lighthouses

Refresh projects

289%

46%

33

34.

OFF-TRADE LISTINGACTUAL & PLAN approved

Client Name

# of outlets

0,02/0,04

0,2

0,5

0,7

1,0

Plan to list in 2023

LISTED

LISTED

LISTED

uploaded 24.01

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Waiting for reply

LISTED

LISTED

LISTED

uploaded 21.01

LISTED

LISTED

LISTED

30.01.2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Next week

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

waiting for JM

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

LISTED

LISTED

LISTED

uploaded 30.01

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

waiting for JM

LISTED

LISTED

LISTED

uploaded 16.01

Plan to list in 2023

Plan to list in 2023

LISTED

LISTED

LISTED

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

LISTED

LISTED

LISTED

Uploaded 06.02

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

replacing product

Magnum

230

Small

133

Plan to list in 2023

Plan to list in 2023

TOI mart

38

Plan to list in 2023

Plan to list in 2023

Osten

1

Plan to list in 2022

Firkan

15

Dina market

33

Ideal Lider

58

Atrium (Greenwich)

8

Anvar

36

Absolut trade( АМ)

5

Plan to list in 2023

Vkusnaya Korzinka

17

Plan to list in 2023

Vinograd

1

Plan to list in 2023

Astykzhan

4

Solnechniy Super

4

Galmart

10

METRO

6

0,35

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2023

Plan to list in 2022

Plan to list in 2023

waiting for JM

Next week

Uploaded 16.01

34

35.

OFF-TRADE ACTIVITIESTOP 3 clients + BC (plans)

Client Name

Magnum

Played pallets

While discounts

Total

40 +2 big

50

92

Small and Skiff

6

40

46

TOIMART

10

45

55

157

157

Magnum

other

Grand total

Skiff \ TOIMART

Others

350

35

36.

CONTENTSBUSINESS REVIEW

ANNUAL PLAN

1 Market and Competition

4 Strategic Context

2 Commercial Review

5 Commercial Plan

3 Brand Marketing Review

6 Brand Marketing Plan

36

37.

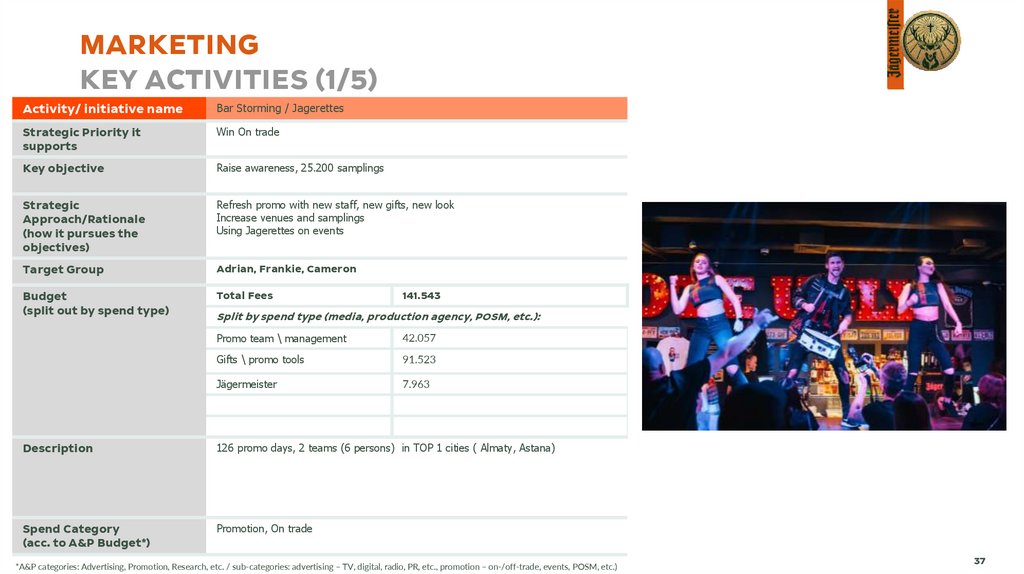

MARKETINGKEY ACTIVITIES (1/5)

Activity/ initiative name

Bar Storming / Jagerettes

Strategic Priority it

supports

Win On trade

Key objective

Raise awareness, 25.200 samplings

Strategic

Approach/Rationale

(how it pursues the

objectives)

Refresh promo with new staff, new gifts, new look

Increase venues and samplings

Using Jagerettes on events

Target Group

Adrian, Frankie, Cameron

Budget

(split out by spend type)

Total Fees

141.543

Split by spend type (media, production agency, POSM, etc.):

Promo team \ management

42.057

Gifts \ promo tools

91.523

Jägermeister

7.963

Description

126 promo days, 2 teams (6 persons) in TOP 1 cities ( Almaty, Astana)

Spend Category

(acc. to A&P Budget*)

Promotion, On trade

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

37

38.

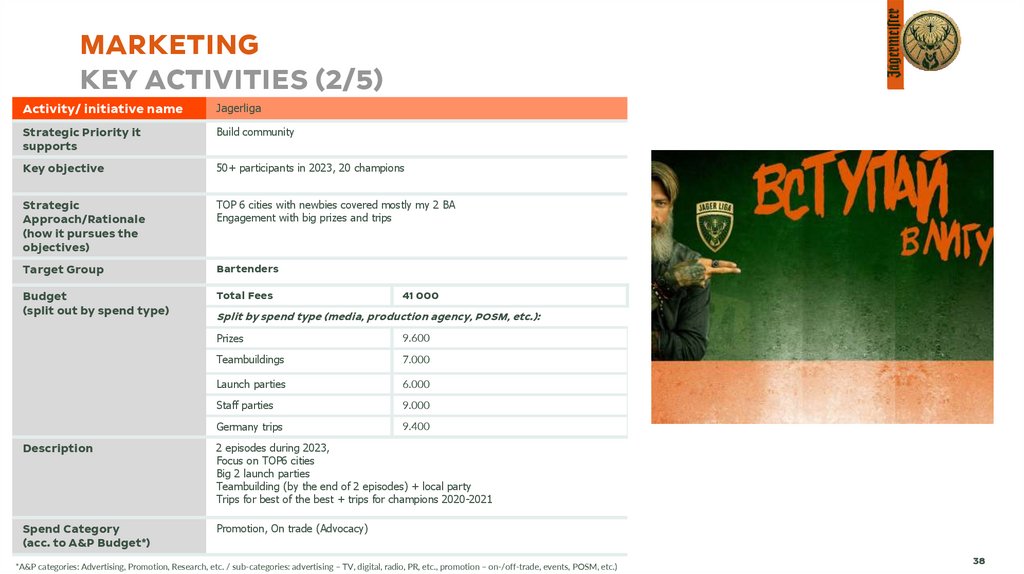

MARKETINGKEY ACTIVITIES (2/5)

Activity/ initiative name

Jagerliga

Strategic Priority it

supports

Build community

Key objective

50+ participants in 2023, 20 champions

Strategic

Approach/Rationale

(how it pursues the

objectives)

TOP 6 cities with newbies covered mostly my 2 BA

Engagement with big prizes and trips

Target Group

Bartenders

Budget

(split out by spend type)

Total Fees

41 000

Split by spend type (media, production agency, POSM, etc.):

Prizes

9.600

Teambuildings

7.000

Launch parties

6.000

Staff parties

9.000

Germany trips

9.400

Description

2 episodes during 2023,

Focus on TOP6 cities

Big 2 launch parties

Teambuilding (by the end of 2 episodes) + local party

Trips for best of the best + trips for champions 2020-2021

Spend Category

(acc. to A&P Budget*)

Promotion, On trade (Advocacy)

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

38

39.

MARKETINGKEY ACTIVITIES (3/5)

Activity/ initiative name

Lighthouses

Strategic Priority it

supports

Win on trade

Key objective

28 venues branded with advanced POSM

Strategic

Approach/Rationale

(how it pursues the

objectives)

Advanced and creative POSM production approach

Target Group

Adrian, Frankie and Cameron

Budget

(split out by spend type)

Total Fees

36.800

Split by spend type (media, production agency, POSM, etc.):

1 priority (Almaty, Astana)

28.800

2d priority (Shym, KGD, Ustr, Pavl)

8.000

Description

28 lighthouses in TOP 6 cities

Spend Category

(acc. to A&P Budget*)

Promotion, On trade

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

39

40.

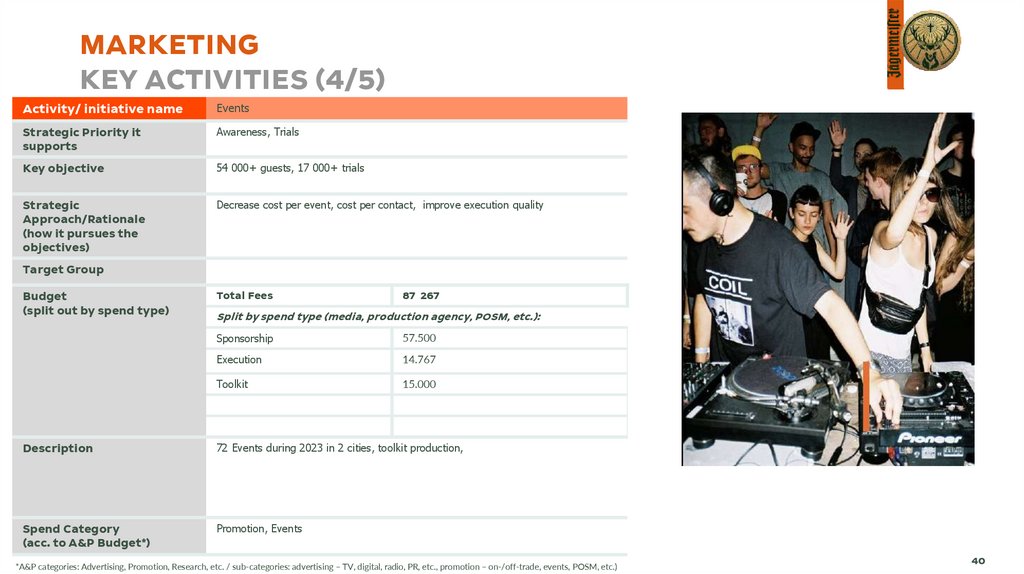

MARKETINGKEY ACTIVITIES (4/5)

Activity/ initiative name

Events

Strategic Priority it

supports

Awareness, Trials

Key objective

54 000+ guests, 17 000+ trials

Strategic

Approach/Rationale

(how it pursues the

objectives)

Decrease cost per event, cost per contact, improve execution quality

Target Group

Budget

(split out by spend type)

Total Fees

87 267

Split by spend type (media, production agency, POSM, etc.):

Sponsorship

57.500

Execution

14.767

Toolkit

15.000

Description

72 Events during 2023 in 2 cities, toolkit production,

Spend Category

(acc. to A&P Budget*)

Promotion, Events

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

40

41.

MARKETINGKEY ACTIVITIES (5/5)

Activity/ initiative name

Digital

Strategic Priority it

supports

Brand awareness, loyalty

Key objective

Reach 12mio, 15K subscribers in 2023 (+200%)

Strategic

Approach/Rationale

(how it pursues the

objectives)

Product engagement, KOL collaborations, promoting Home parties, special seasonal

projects

Target Group

Budget

(split out by spend type)

Description

Total Fees

66.571

Split by spend type (media, production agency, POSM, etc.):

SMM and target

34.000

Special projects

24.500

KOL

5.500

Digital support

2.571

Posting 12 months, 4 special occasional project, 12 activation with KOL’s

Updated:

1+ mio reach via 1 reel with contest

+1.927 participants during 1st activation ( on going)

Spend Category

(acc. to A&P Budget*)

Digital and social media

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

41

42.

MARKETINGKEY ACTIVITIES

Activity/ initiative name

Team

Strategic Priority it

supports

BRAND AMBASSADORS

Key objective

Perform execution in on trade

Strategic

Approach/Rationale

(how it pursues the

objectives)

KPI’s achievement

Target Group

On trade

Budget

(split out by spend type)

Total Fees

Description

32.341

Split by spend type (media, production agency, POSM, etc.):

Zarina Sadykova

16.170

Renas Gafurov

16.170

Build awareness in KZ

Launch and leading projects in on trade

Advocate and educate

Spend Category

(acc. to A&P Budget*)

*A&P categories: Advertising, Promotion, Research, etc. / sub-categories: advertising – TV, digital, radio, PR, etc., promotion – on-/off-trade, events, POSM, etc.)

42

43.

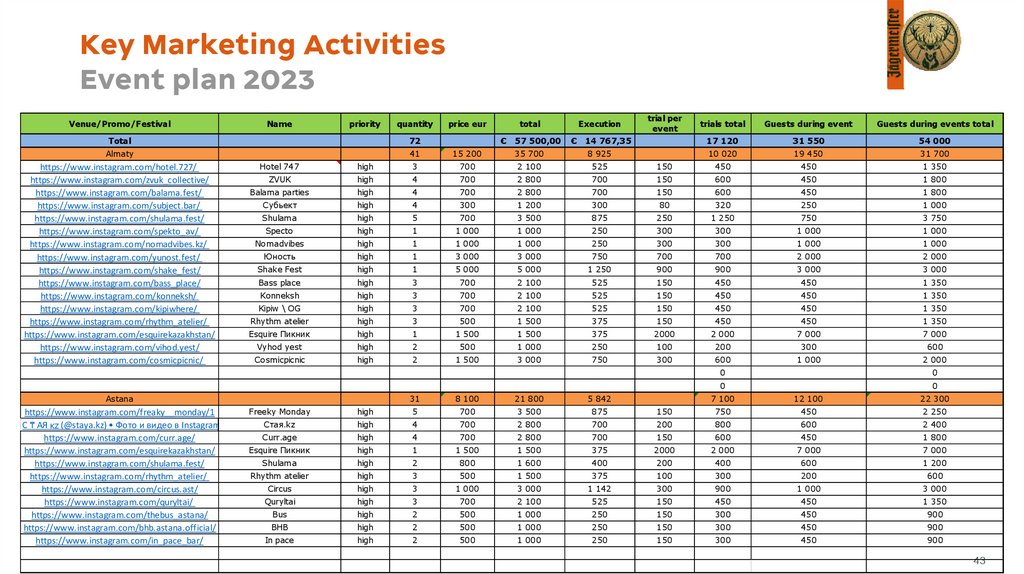

Key Marketing ActivitiesEvent plan 2023

Venue/Promo/Festival

Name

priority

quantity

price eur

total

57 500,00

€

trial per

event

trials total

Guests during event

Guests during events total

Total

72

14 767,35

17 120

31 550

54 000

Almaty

41

15 200

35 700

8 925

10 020

19 450

31 700

https://www.instagram.com/hotel.727/

https://www.instagram.com/zvuk_collective/

https://www.instagram.com/balama.fest/

https://www.instagram.com/subject.bar/

https://www.instagram.com/shulama.fest/

https://www.instagram.com/spekto_av/

https://www.instagram.com/nomadvibes.kz/

https://www.instagram.com/yunost.fest/

https://www.instagram.com/shake_fest/

https://www.instagram.com/bass_place/

https://www.instagram.com/konneksh/

https://www.instagram.com/kipiwhere/

https://www.instagram.com/rhythm_atelier/

https://www.instagram.com/esquirekazakhstan/

https://www.instagram.com/vihod.yest/

https://www.instagram.com/cosmicpicnic/

€

Execution

Hotel 747

high

3

700

2 100

525

150

450

450

1 350

ZVUK

high

4

700

2 800

700

150

600

450

1 800

Balama parties

high

4

700

2 800

700

150

600

450

1 800

Субьект

high

4

300

1 200

300

80

320

250

1 000

Shulama

high

5

700

3 500

875

250

1 250

750

3 750

Specto

high

1

1 000

1 000

250

300

300

1 000

1 000

Nomadvibes

high

1

1 000

1 000

250

300

300

1 000

1 000

Юность

high

1

3 000

3 000

750

700

700

2 000

2 000

Shake Fest

high

1

5 000

5 000

1 250

900

900

3 000

3 000

Bass place

high

3

700

2 100

525

150

450

450

1 350

Konneksh

high

3

700

2 100

525

150

450

450

1 350

Kipiw \ OG

high

3

700

2 100

525

150

450

450

1 350

Rhythm atelier

high

3

500

1 500

375

150

450

450

1 350

Esquire Пикник

high

1

1 500

1 500

375

2000

2 000

7 000

7 000

Vyhod yest

high

2

500

1 000

250

100

200

300

600

Сosmicpicnic

high

2

1 500

3 000

750

300

600

1 000

2 000

0

0

0

Astana

https://www.instagram.com/freaky__monday/1

С ₸ АЯ

economics

economics finance

finance