Similar presentations:

LD Family

1.

LD FamilyBrand review, Nov’07

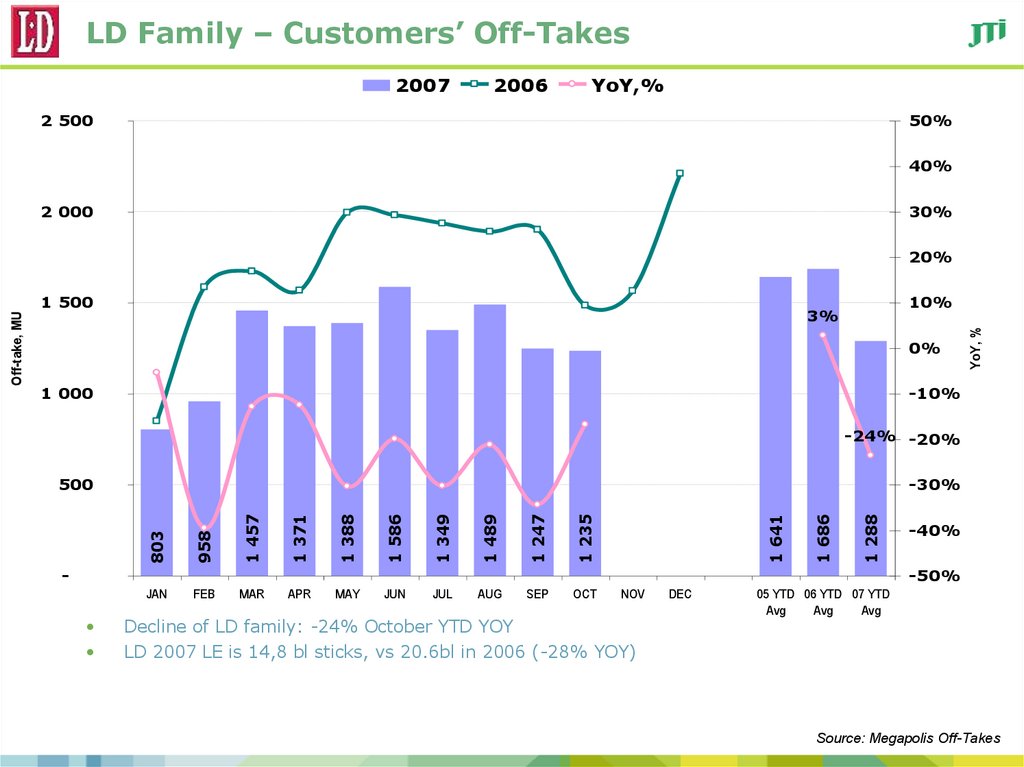

2. LD Family – Customers’ Off-Takes

20072006

YoY,%

2 500

50%

40%

2 000

30%

10%

3%

0%

1 000

YoY, %

1 500

-10%

-24% -20%

1 586

1 349

1 489

1 247

1 235

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

1 288

1 388

FEB

1 686

1 371

JAN

1 641

1 457

-30%

958

500

803

Off-take, MU

20%

-

-40%

-50%

NOV

Decline of LD family: -24% October YTD YOY

LD 2007 LE is 14,8 bl sticks, vs 20.6bl in 2006 (-28% YOY)

DEC

05 YTD 06 YTD 07 YTD

Avg

Avg

Avg

Source: Megapolis Off-Takes

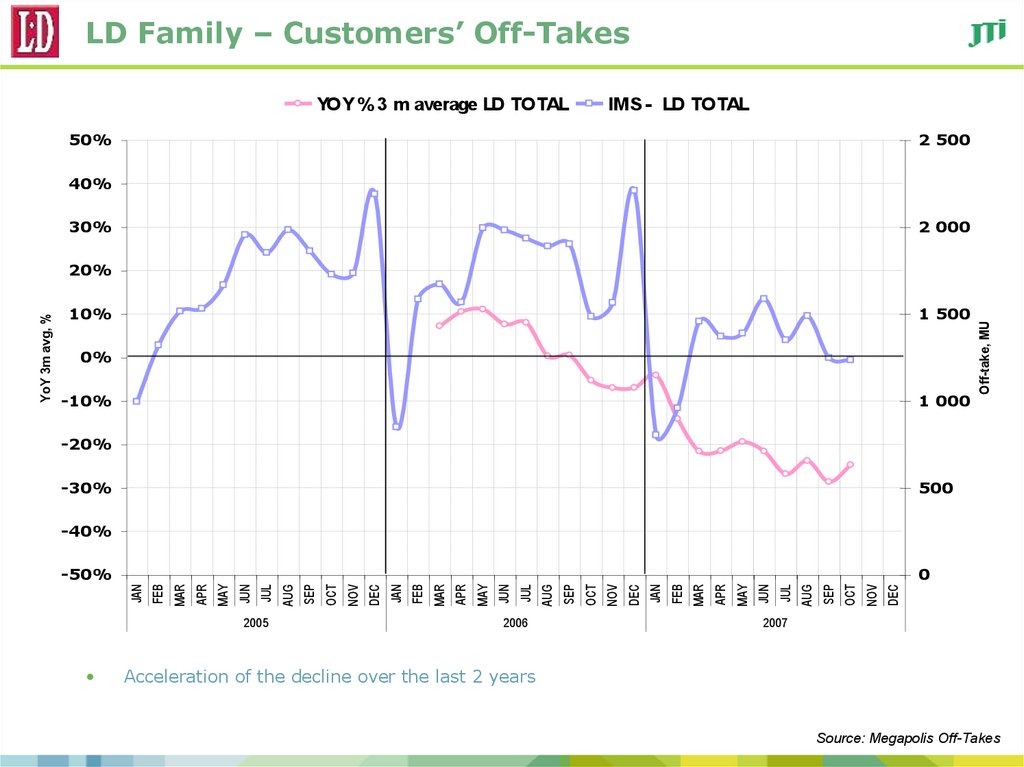

3. LD Family – Customers’ Off-Takes

YOY % 3 m average LD TOTALIMS - LD TOTAL

50%

2 500

40%

30%

2 000

1 500

0%

-10%

1 000

Off-take, MU

10%

-20%

-30%

500

-40%

2005

2006

DEC

OCT

NOV

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

OCT

NOV

SEP

AUG

JUL

JUN

MAY

APR

MAR

0

JAN

-50%

FEB

YoY 3m avg, %

20%

2007

Acceleration of the decline over the last 2 years

Source: Megapolis Off-Takes

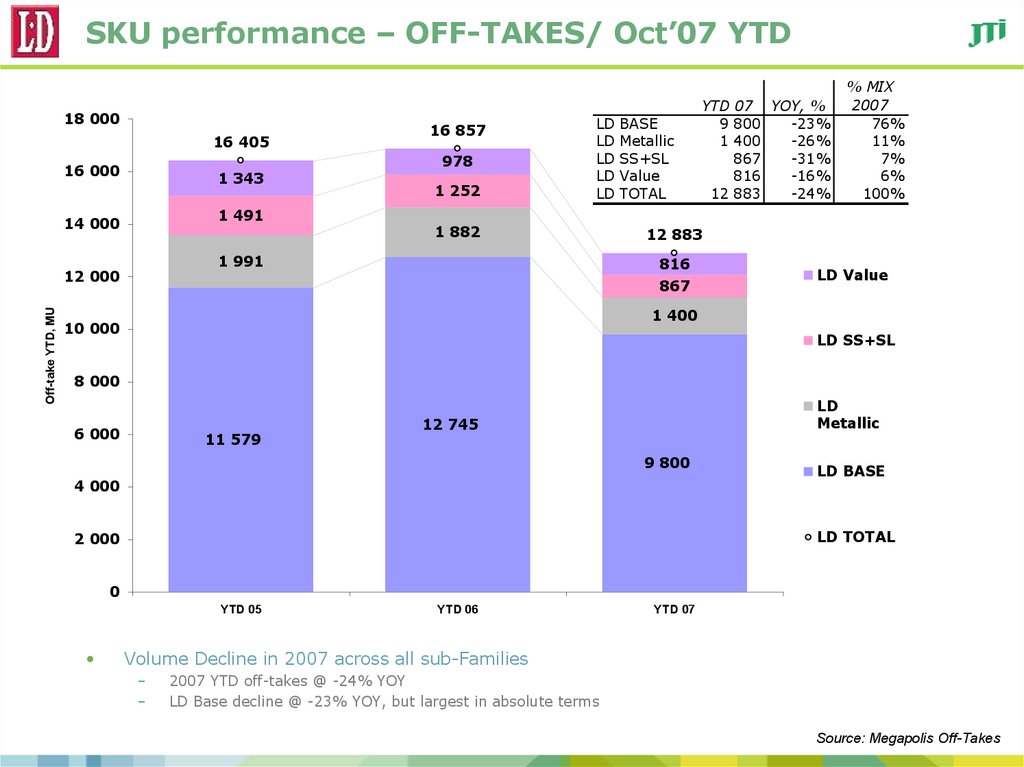

4. SKU performance – OFF-TAKES/ Oct’07 YTD

18 00016 405

16 000

1 343

1 491

14 000

978

1 252

LD

LD

LD

LD

LD

1 882

1 991

12 000

Off-take YTD, MU

16 857

BASE

Metallic

SS+SL

Value

TOTAL

YTD 07 YOY, %

9 800

-23%

1 400

-26%

867

-31%

816

-16%

12 883

-24%

% MIX

2007

76%

11%

7%

6%

100%

12 883

816

867

LD Value

1 400

10 000

LD SS+SL

8 000

6 000

11 579

LD

Metallic

12 745

9 800

4 000

LD BASE

LD TOTAL

2 000

0

YTD 05

YTD 06

YTD 07

Volume Decline in 2007 across all sub-Families

–

–

2007 YTD off-takes @ -24% YOY

LD Base decline @ -23% YOY, but largest in absolute terms

Source: Megapolis Off-Takes

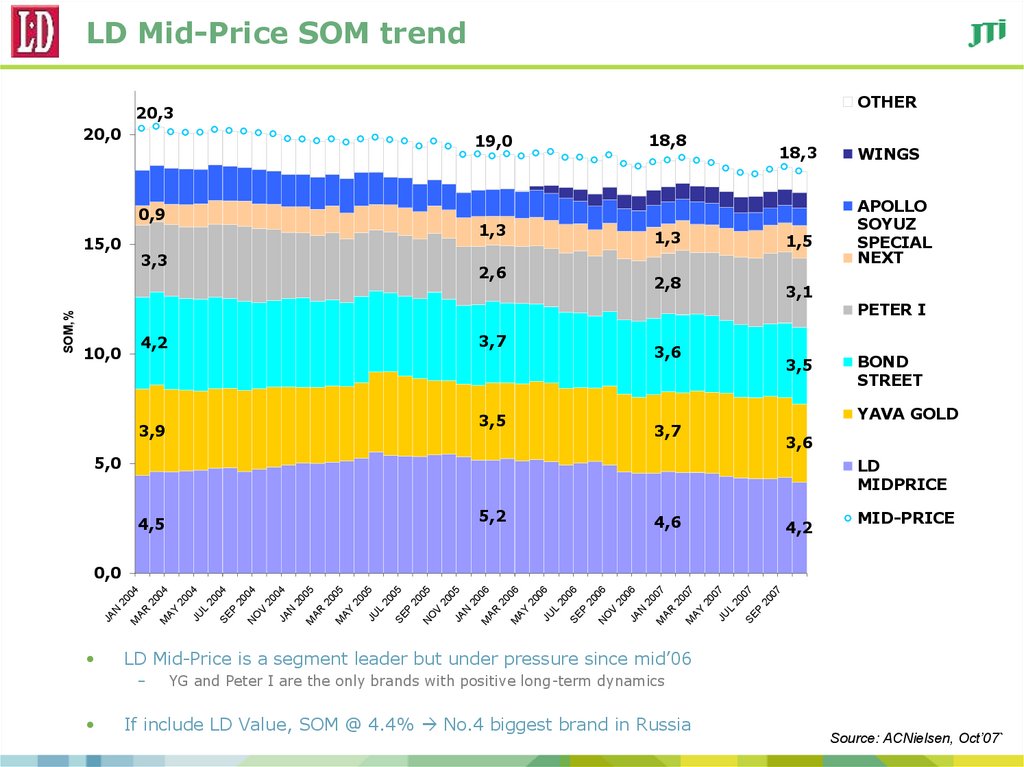

5. LD Mid-Price SOM trend

OTHER20,3

20,0

0,9

15,0

1,3

3,3

1,5

2,8

3,7

3,1

3,6

3,5

3,9

18,3

1,3

2,6

4,2

10,0

3,5

WINGS

APOLLO

SOYUZ

SPECIAL

NEXT

PETER I

BOND

STREET

YAVA GOLD

3,7

3,6

5,0

LD

MIDPRICE

5,2

4,5

4,6

4,2

MID-PRICE

20

07

20

07

SE

P

20

07

JU

L

20

07

AY

M

07

20

AR

M

20

06

JA

N

V

20

06

NO

20

06

SE

P

20

06

JU

L

20

06

AY

M

06

20

AR

M

20

05

V

JA

N

20

05

NO

20

05

SE

P

20

05

JU

L

AY

M

05

20

05

20

AR

M

20

04

V

JA

N

20

04

NO

20

04

SE

P

20

04

JU

L

20

04

AY

LD Mid-Price is a segment leader but under pressure since mid’06

–

M

M

AR

20

04

0,0

JA

N

SOM,%

18,8

19,0

YG and Peter I are the only brands with positive long-term dynamics

If include LD Value, SOM @ 4.4% No.4 biggest brand in Russia

Source: ACNielsen, Oct’07`

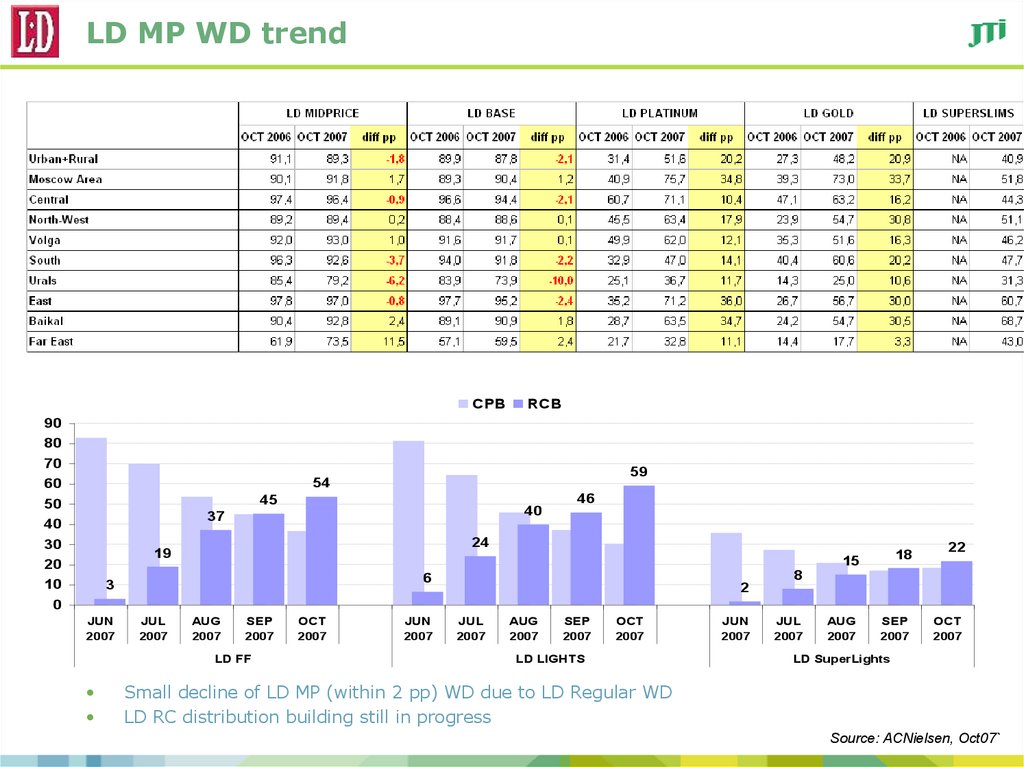

6. LD MP WD trend

CPB90

80

70

60

50

40

30

20

10

0

RCB

59

54

45

40

37

24

19

AUG

2007

SEP

2007

LD FF

OCT

2007

JUN

2007

22

8

6

JUL

2007

18

15

3

JUN

2007

46

2

JUL

2007

AUG

2007

SEP

2007

OCT

2007

LD LIGHTS

JUN

2007

JUL

2007

AUG

2007

SEP

2007

OCT

2007

LD SuperLights

Small decline of LD MP (within 2 pp) WD due to LD Regular WD

LD RC distribution building still in progress

Source: ACNielsen, Oct07`

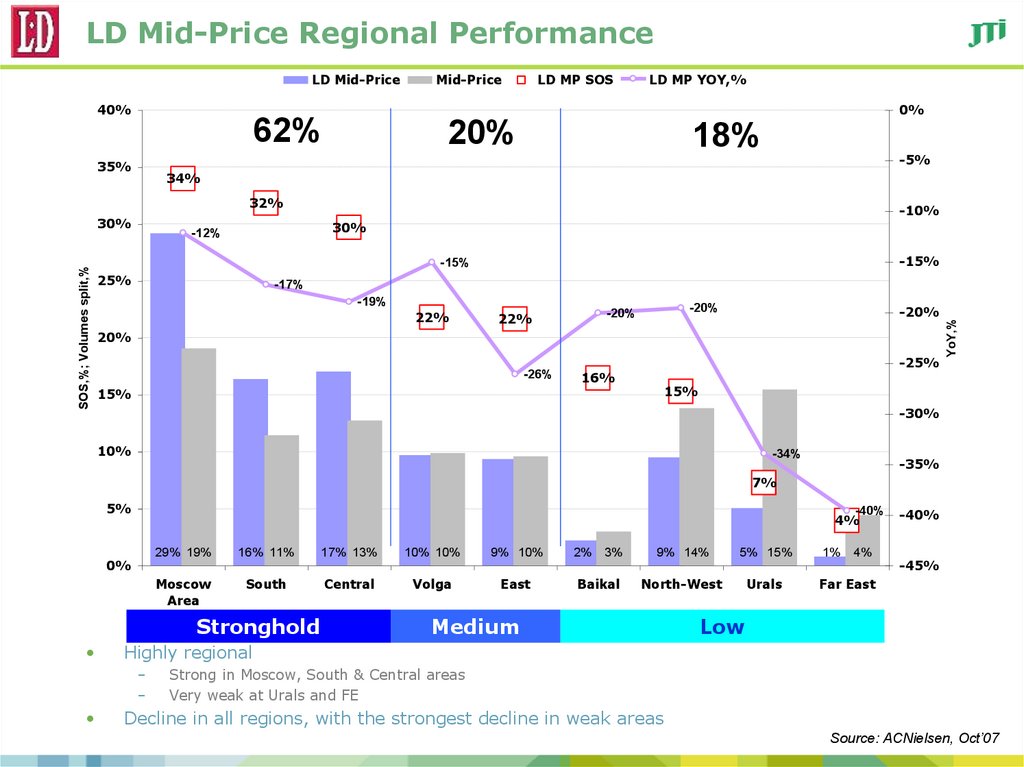

7. LD Mid-Price Regional Performance

LD Mid-PriceMid-Price

LD MP SOS

LD MP YOY,%

40%

0%

62%

35%

20%

18%

-5%

34%

32%

-10%

30%

-12%

-15%

-15%

25%

-17%

-19%

22%

-20%

-20%

22%

-20%

20%

-26%

-25%

16%

YoY,%

SOS,%; Volumes split,%

30%

15%

15%

-30%

10%

-34%

-35%

7%

5%

-40%

4%

0%

29% 19%

16% 11%

17% 13%

10% 10%

9% 10%

Moscow

Area

South

Central

Volga

East

Stronghold

3%

Baikal

9% 14%

5% 15%

North-West

Urals

Medium

1%

4%

-45%

Far East

Low

Highly regional

–

–

2%

-40%

Strong in Moscow, South & Central areas

Very weak at Urals and FE

Decline in all regions, with the strongest decline in weak areas

Source: ACNielsen, Oct’07

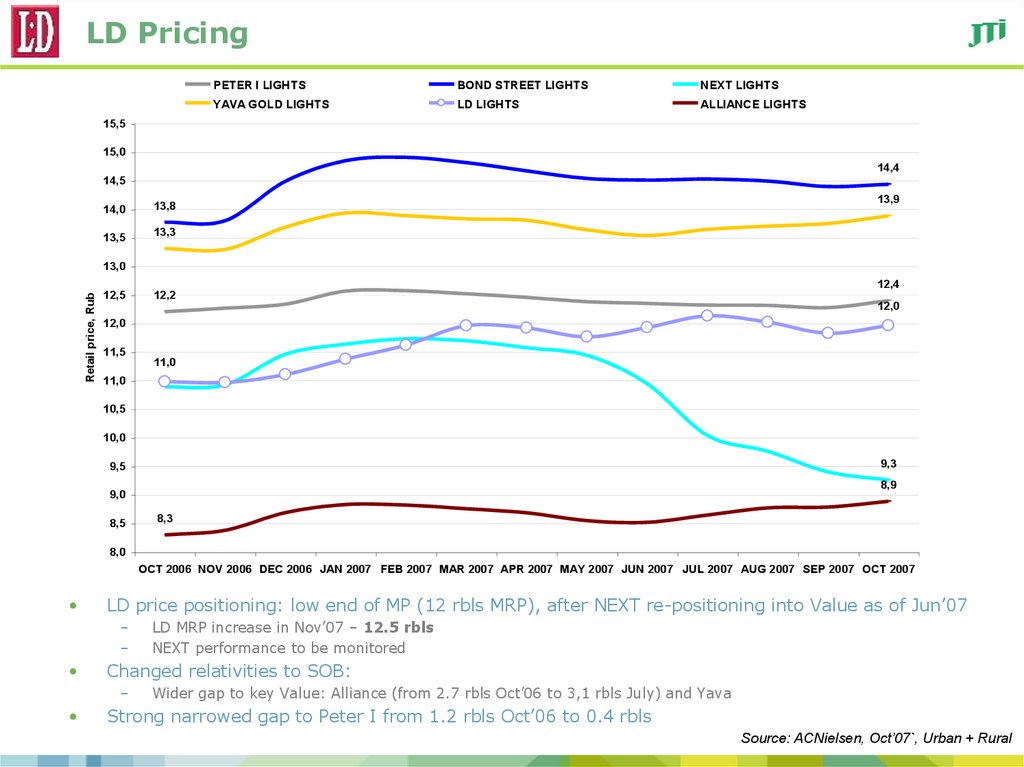

8. LD Pricing

PETER I LIGHTSBOND STREET LIGHTS

NEXT LIGHTS

YAVA GOLD LIGHTS

LD LIGHTS

ALLIANCE LIGHTS

15,5

15,0

14,4

14,5

14,0

13,8

13,5

13,3

13,9

13,0

Retail price, Rub

12,4

12,5

12,2

12,0

12,0

11,5

11,0

11,0

10,5

10,0

9,3

9,5

8,9

9,0

8,5

8,3

8,0

OCT 2006 NOV 2006 DEC 2006 JAN 2007 FEB 2007 MAR 2007 APR 2007 MAY 2007 JUN 2007 JUL 2007 AUG 2007 SEP 2007 OCT 2007

LD price positioning: low end of MP (12 rbls MRP), after NEXT re-positioning into Value as of Jun’07

–

–

Changed relativities to SOB:

–

LD MRP increase in Nov’07 – 12.5 rbls

NEXT performance to be monitored

Wider gap to key Value: Alliance (from 2.7 rbls Oct’06 to 3,1 rbls July) and Yava

Strong narrowed gap to Peter I from 1.2 rbls Oct’06 to 0.4 rbls

Source: ACNielsen, Oct’07`, Urban + Rural

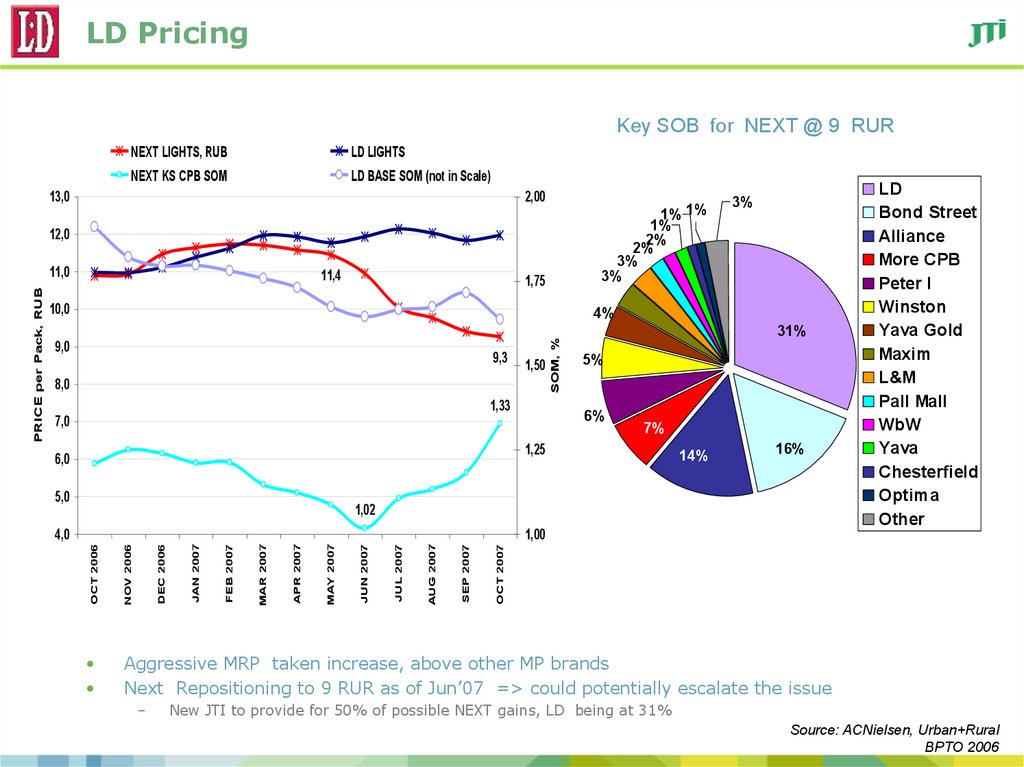

9. LD Pricing

Key SOB for NEXT @ 9 RURNEXT LIGHTS, RUB

LD LIGHTS

NEXT KS CPB SOM

LD BASE SOM (not in Scale)

13,0

2,00

1% 1%

1%

2%

2%

3%

3%

12,0

11,4

1,75

10,0

9,0

9,3

1,50

8,0

1,33

SOM, %

4%

31%

5%

6%

7,0

7%

1,25

6,0

5,0

14%

16%

1,02

4,0

LD

Bond Street

Alliance

More CPB

Peter I

Winston

Yava Gold

Maxim

L&M

Pall Mall

WbW

Yava

Chesterfield

Optima

Other

OCT 2007

SEP 2007

AUG 2007

JUL 2007

JUN 2007

MAY 2007

APR 2007

MAR 2007

FEB 2007

JAN 2007

DEC 2006

NOV 2006

1,00

OCT 2006

PRICE per Pack, RUB

11,0

3%

Aggressive MRP taken increase, above other MP brands

Next Repositioning to 9 RUR as of Jun’07 => could potentially escalate the issue

–

New JTI to provide for 50% of possible NEXT gains, LD being at 31%

Source: ACNielsen, Urban+Rural

BPTO 2006

10. LD Performance Summary

No.1 Mid-Price brand and No.4 largest brand in Russia

–

but volume under pressure (-24% Off-Takes Oct YTD’07)

11. Line Extensions

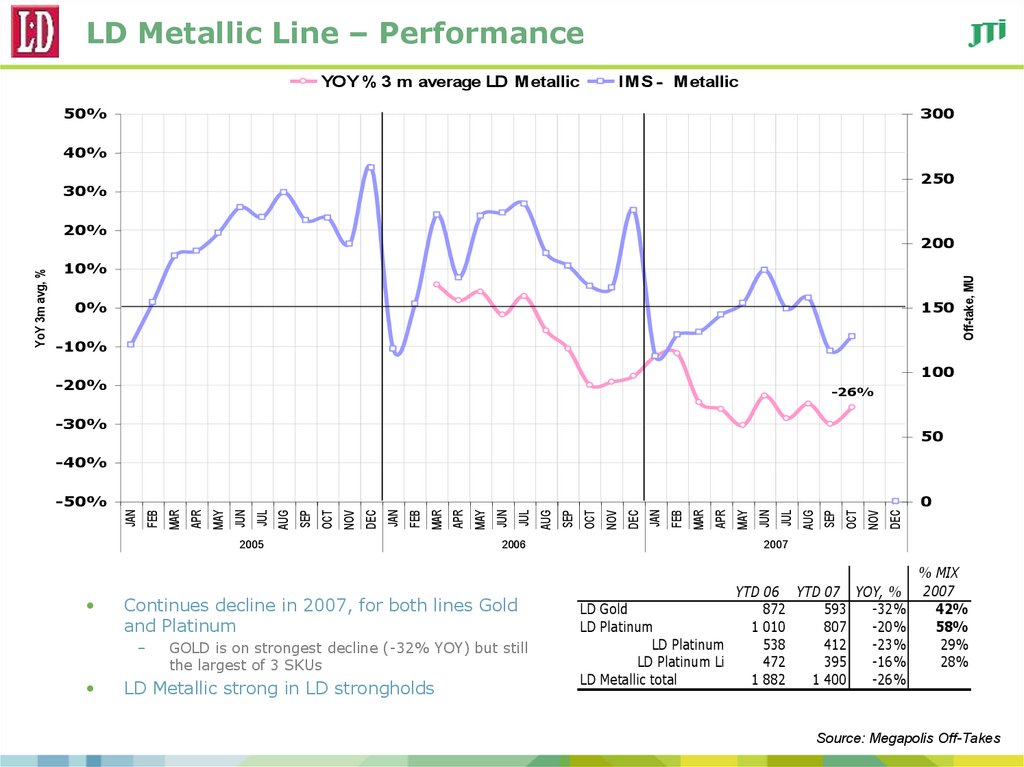

12. LD Metallic Line – Performance

YOY % 3 m average LD MetallicIMS - Metallic

50%

300

40%

250

30%

10%

0%

150

-10%

Off-take, MU

200

100

-20%

-26%

-30%

50

-40%

2005

GOLD is on strongest decline (-32% YOY) but still

the largest of 3 SKUs

LD Metallic strong in LD strongholds

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

AUG

JUL

MAY

JUN

2006

Continues decline in 2007, for both lines Gold

and Platinum

–

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

0

JAN

-50%

FEB

YoY 3m avg, %

20%

2007

YTD 06 YTD 07 YOY, %

LD Gold

872

593

-32%

LD Platinum

1 010

807

-20%

LD Platinum

538

412

-23%

LD Platinum Li

472

395

-16%

LD Metallic total

1 882

1 400

-26%

% MIX

2007

42%

58%

29%

28%

Source: Megapolis Off-Takes

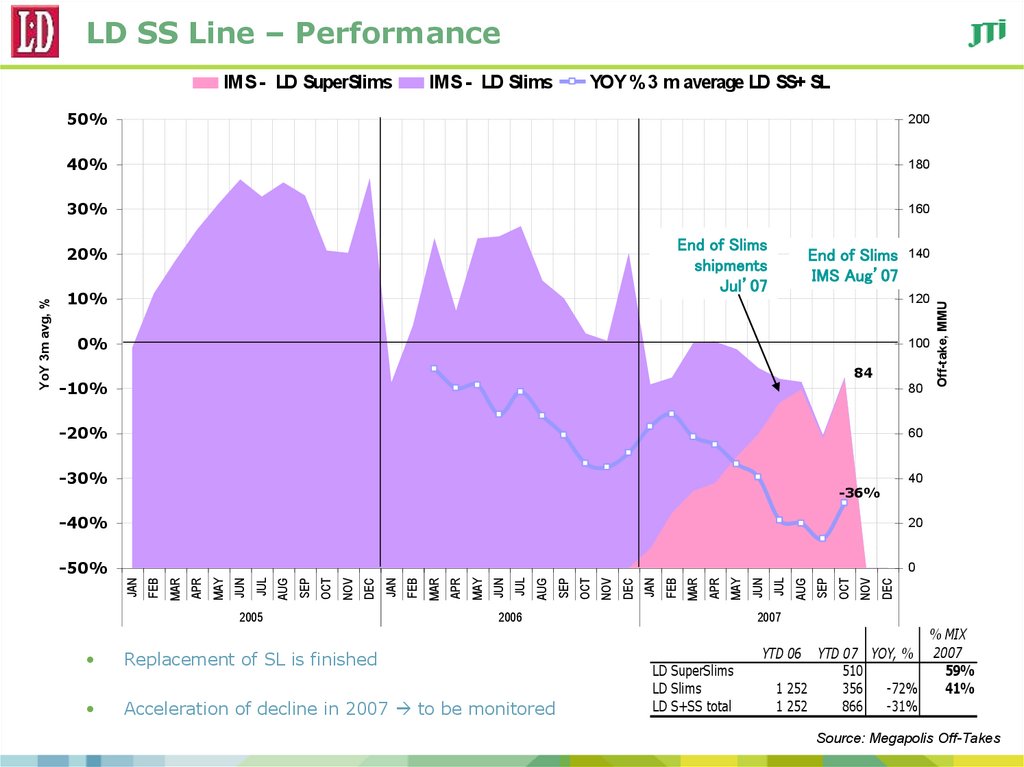

13. LD SS Line – Performance

IMS - LD SlimsYOY % 3 m average LD SS+ SL

50%

200

40%

180

30%

160

End of Slims

shipments

Jul’07

10%

End of Slims

IMS Aug’07

140

120

0%

100

84

-10%

80

-20%

60

-30%

-36%

40

2005

2006

Replacement of SL is finished

Acceleration of decline in 2007 to be monitored

DEC

NOV

SEP

OCT

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

OCT

NOV

SEP

AUG

JUL

JUN

MAY

0

APR

-50%

MAR

20

JAN

-40%

FEB

YoY 3m avg, %

20%

Off-take, MMU

IMS - LD SuperSlims

2007

YTD 06

LD SuperSlims

LD Slims

LD S+SS total

YTD 07 YOY, %

510

1 252

356

-72%

1 252

866

-31%

% MIX

2007

59%

41%

Source: Megapolis Off-Takes

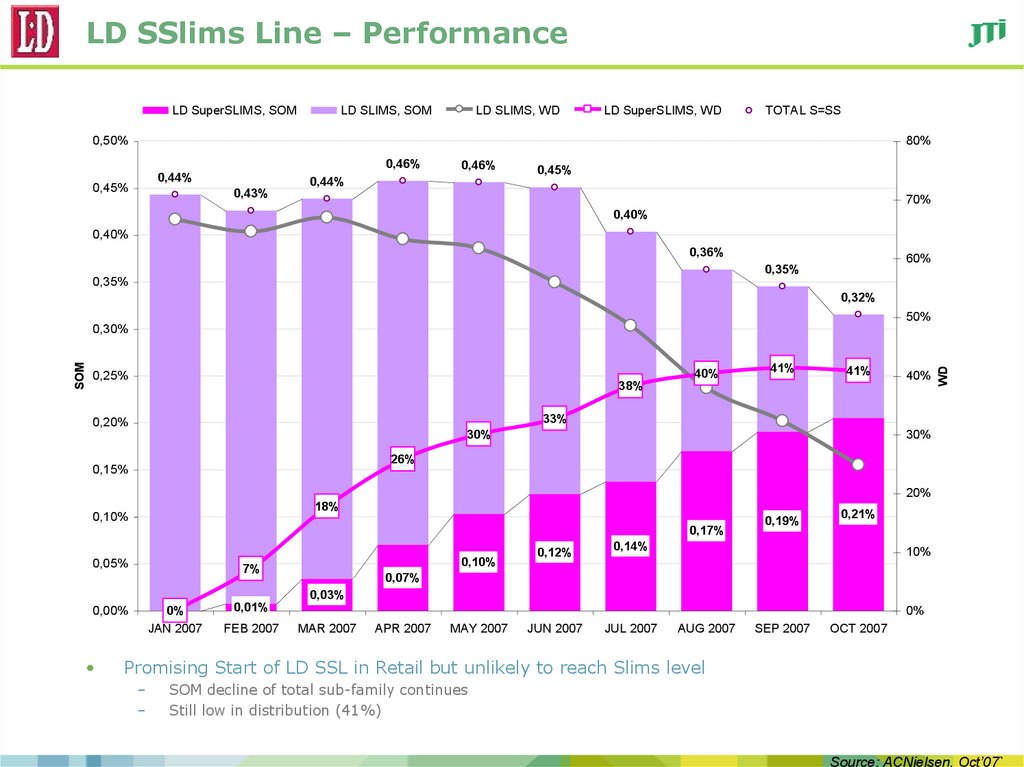

14. LD SSlims Line – Performance

LD SuperSLIMS, SOMLD SLIMS, SOM

LD SLIMS, WD

LD SuperSLIMS, WD

TOTAL S=SS

0,50%

80%

0,46%

0,44%

0,45%

0,46%

0,44%

0,45%

0,43%

70%

0,40%

0,40%

0,36%

60%

0,35%

0,35%

0,32%

50%

40%

0,25%

41%

41%

38%

40%

WD

SOM

0,30%

33%

0,20%

30%

30%

26%

0,15%

20%

18%

0,10%

0,17%

0,05%

0,10%

7%

0,12%

0,19%

0,21%

0,14%

10%

0,07%

0,03%

0,00%

0%

JAN 2007

0,01%

FEB 2007

0%

MAR 2007

APR 2007

MAY 2007

JUN 2007

JUL 2007

AUG 2007

SEP 2007

OCT 2007

Promising Start of LD SSL in Retail but unlikely to reach Slims level

–

–

SOM decline of total sub-family continues

Still low in distribution (41%)

Source: ACNielsen, Oct’07`

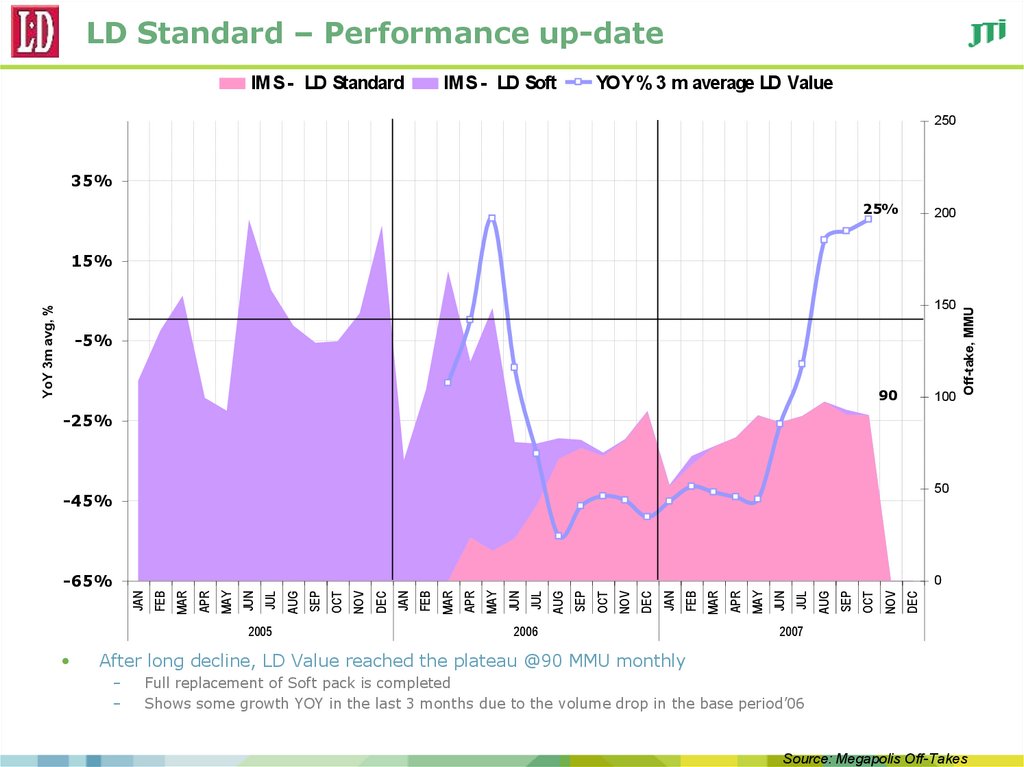

15. LD Standard – Performance up-date

IMS - LD StandardIMS - LD Soft

YOY % 3 m average LD Value

250

35%

25%

200

YoY 3m avg, %

150

-5%

90

100

Off-take, MMU

15%

-25%

50

-45%

-65%

2005

2006

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

JUL

AUG

JUN

MAY

APR

MAR

FEB

JAN

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAY

APR

MAR

FEB

JAN

0

2007

After long decline, LD Value reached the plateau @90 MMU monthly

–

–

Full replacement of Soft pack is completed

Shows some growth YOY in the last 3 months due to the volume drop in the base period’06

Source: Megapolis Off-Takes

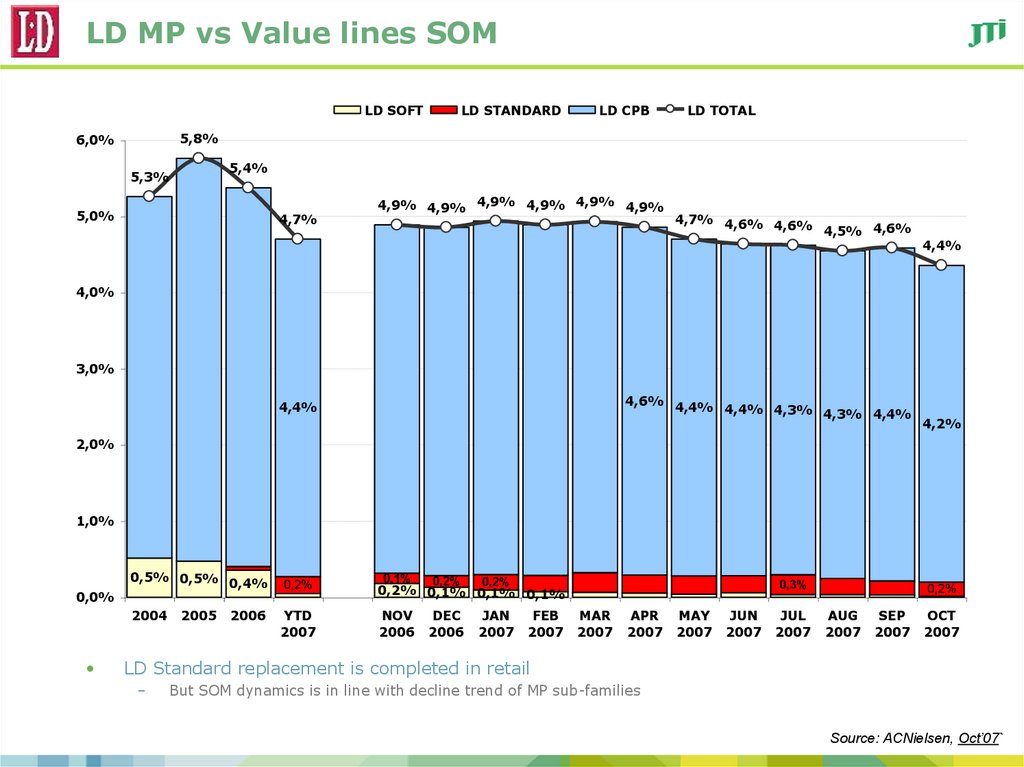

16. LD MP vs Value lines SOM

LD SOFTLD STANDARD

LD CPB

LD TOTAL

5,8%

6,0%

5,4%

5,3%

5,0%

4,7%

4,9% 4,9% 4,9% 4,9% 4,9% 4,9%

4,7% 4,6% 4,6%

4,5% 4,6%

4,4%

4,0%

3,0%

4,6%

4,4%

4,4% 4,4% 4,3%

4,3% 4,4%

4,2%

2,0%

1,0%

0,0%

0,5% 0,5% 0,4%

2004

2005

2006

0,2%

0,1%

0,2%

0,2%

0,2% 0,1% 0,1% 0,1%

YTD

2007

NOV

2006

DEC

2006

JAN

2007

FEB

2007

0,3%

MAR

2007

APR

2007

MAY

2007

JUN

2007

JUL

2007

0,2%

AUG

2007

SEP

2007

OCT

2007

LD Standard replacement is completed in retail

–

But SOM dynamics is in line with decline trend of MP sub-families

Source: ACNielsen, Oct’07`

17. LD Families Performance Summary

Appeal of Metallic line is dependent on the LD position in the region

Promising start of SSL but still decline of the total SS+SSL family over time

Flat performance of LD Standard after re-launch, with low GM vs other SKUs

18. Programs Q3’2007

LDNCP “SUMMER MOTION 2007”

RESULTS

19. Objectives, GEO, Timing, Mechanics

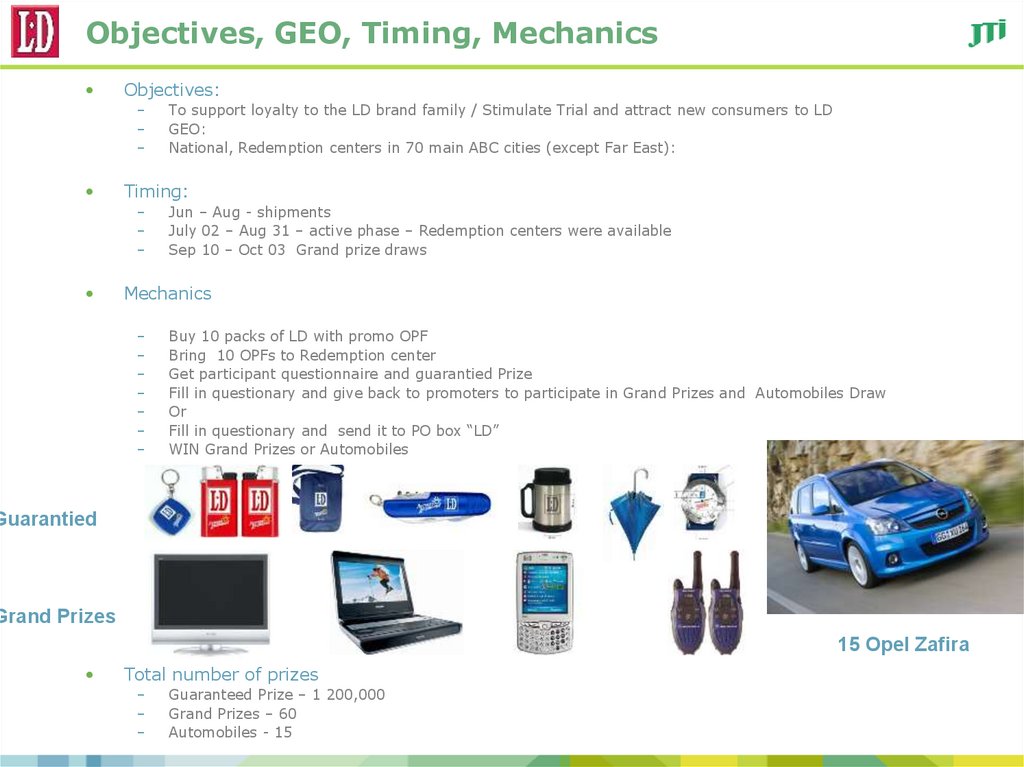

Objectives:

–

–

–

Timing:

–

–

–

To support loyalty to the LD brand family / Stimulate Trial and attract new consumers to LD

GEO:

National, Redemption centers in 70 main ABC cities (except Far East):

Jun – Aug - shipments

July 02 – Aug 31 – active phase – Redemption centers were available

Sep 10 – Oct 03 Grand prize draws

Mechanics

–

–

–

–

–

–

–

Buy 10 packs of LD with promo OPF

Bring 10 OPFs to Redemption center

Get participant questionnaire and guarantied Prize

Fill in questionary and give back to promoters to participate in Grand Prizes and Automobiles Draw

Or

Fill in questionary and send it to PO box “LD”

WIN Grand Prizes or Automobiles

Guarantied

Grand Prizes

15 Opel Zafira

Total number of prizes

–

–

–

Guaranteed Prize – 1 200,000

Grand Prizes – 60

Automobiles - 15

20. Communication Support

Pre-printed OPF

POSM (for retail outlets + KRA outlets equipment + X5 retail group equipment)

1-2-1

–

–

Hot Line

–

Moscow, St.Petersburg, Yekaterinburg, Novosibirsk, Samara – July-August (2 months)

RWS

–

16 national issues, 61 publication

Metro

–

The web site dedicated to the program has been created at www.ld-game.ru and

www.ldgame.ru

Press

–

8 800 200 02 03 was available from 04 Jun till 15 Oct

WEB

–

fGLH CCC promoters have been announcing the program within the boost dedicated

to LD only (2 weeks)

During promo f JTI CCC promoters have been announcing the program within

standard matrix and fGLH promoters during work in Redemption centers

Moscow and St.Petersburg - July-August (2 months)

Direct Mail

–

Direct mailing announcing Promo to 312 M participants of 2005 LD promo

21. Weekly Statistics – Number of Entries (10 POP’s)

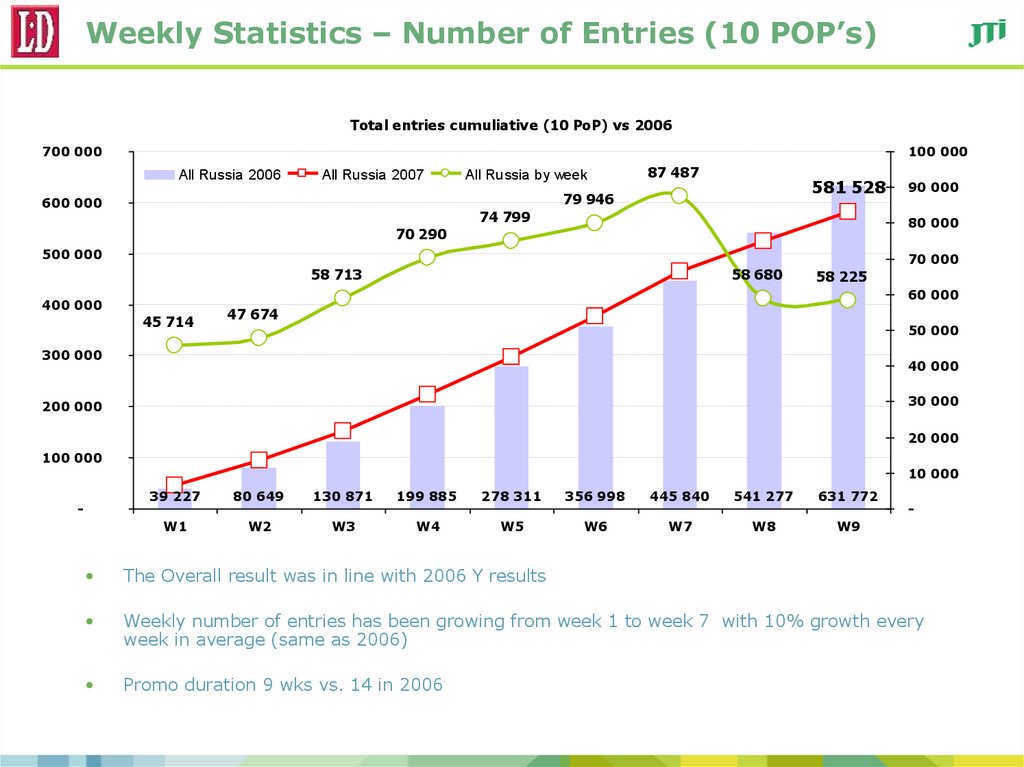

Total entries cumuliative (10 PoP) vs 2006700 000

100 000

All Russia 2006

All Russia 2007

All Russia by week

87 487

581 528

79 946

600 000

74 799

90 000

80 000

70 290

500 000

58 713

58 680

70 000

58 225

60 000

400 000

45 714

47 674

50 000

300 000

40 000

30 000

200 000

20 000

100 000

10 000

-

39 227

80 649

130 871

199 885

278 311

356 998

445 840

541 277

631 772

W1

W2

W3

W4

W5

W6

W7

W8

W9

-

The Overall result was in line with 2006 Y results

Weekly number of entries has been growing from week 1 to week 7 with 10% growth every

week in average (same as 2006)

Promo duration 9 wks vs. 14 in 2006

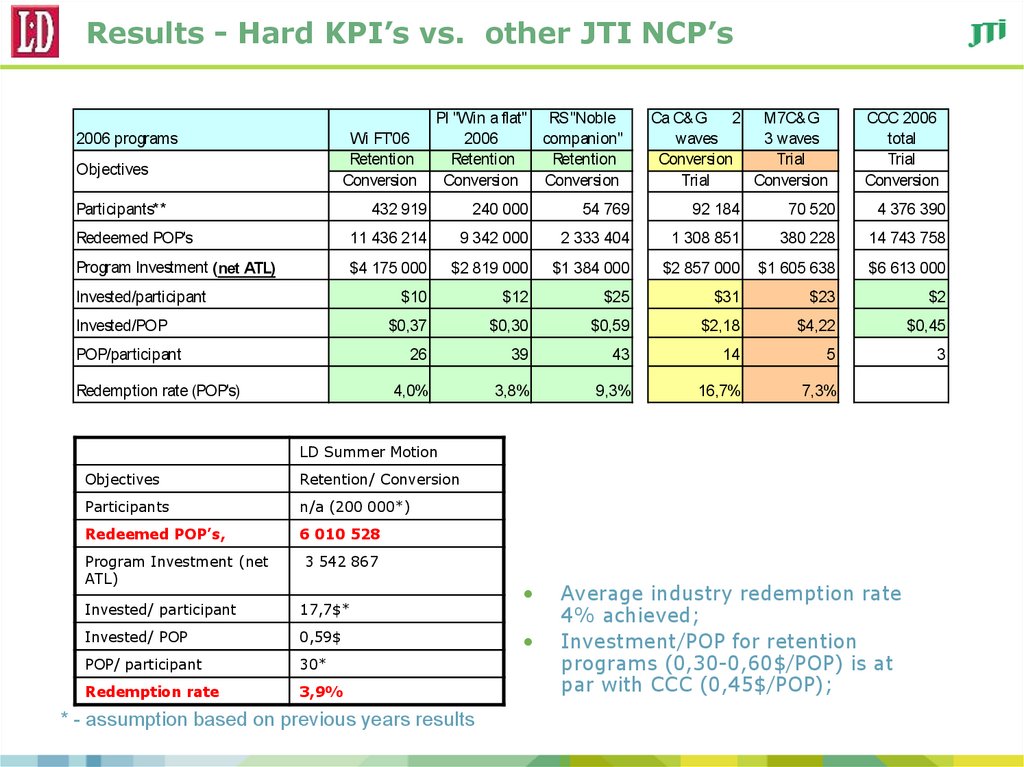

22. Results - Hard KPI’s vs. other JTI NCP’s

2006 programsWi FT'06

Retention

Conversion

Objectives

Participants**

PI "Win a flat" RS "Noble

2006

companion"

Retention

Retention

Conversion

Conversion

Ca C&G

2 M7C&G

waves

3 waves

Conversion

Trial

Trial

Conversion

CCC 2006

total

Trial

Conversion

432 919

240 000

54 769

92 184

70 520

4 376 390

Redeemed POP's

11 436 214

9 342 000

2 333 404

1 308 851

380 228

14 743 758

Program Investment (net ATL)

$4 175 000

$2 819 000

$1 384 000

$2 857 000

$1 605 638

$6 613 000

$10

$12

$25

$31

$23

$2

$0,37

$0,30

$0,59

$2,18

$4,22

$0,45

26

39

43

14

5

3

4,0%

3,8%

9,3%

16,7%

7,3%

Invested/participant

Invested/POP

POP/participant

Redemption rate (POP's)

LD Summer Motion

Objectives

Retention/ Conversion

Participants

n/a (200 000*)

Redeemed POP’s,

6 010 528

Program Investment (net

ATL)

3 542 867

Invested/ participant

17,7$*

Invested/ POP

0,59$

POP/ participant

30*

Redemption rate

3,9%

* - assumption based on previous years results

Average industry redemption rate

4% achieved;

Investment/POP for retention

programs (0,30-0,60$/POP) is at

par with CCC (0,45$/POP);

23. Key Learnings & Recommendation

Key Learnings & RecommendationProgram targets (1 200 000 entries) were too optimistic/ over-estimated

Free of charge SMS (instant win mechanics) is one of the key attractions, making enter easier

for SOB

Optimal length of retention-aimed program is close to 12-15 weeks (3-4 mnths); shorter then

that working towards only trial

RECOMMENDATION:

Exploit current promo mechanics further considering key learnings and research findings

–

–

–

Period of the program 3 months to ensure continuous retention and conversion

Free SMS as the key registration channel

Visual Execution should be perfect and in-line with Image communication

24. Programs Q4’2007

LD Round corner re-launchNov-Dec’07

25. LD – RC launch support (Nov-Dec)

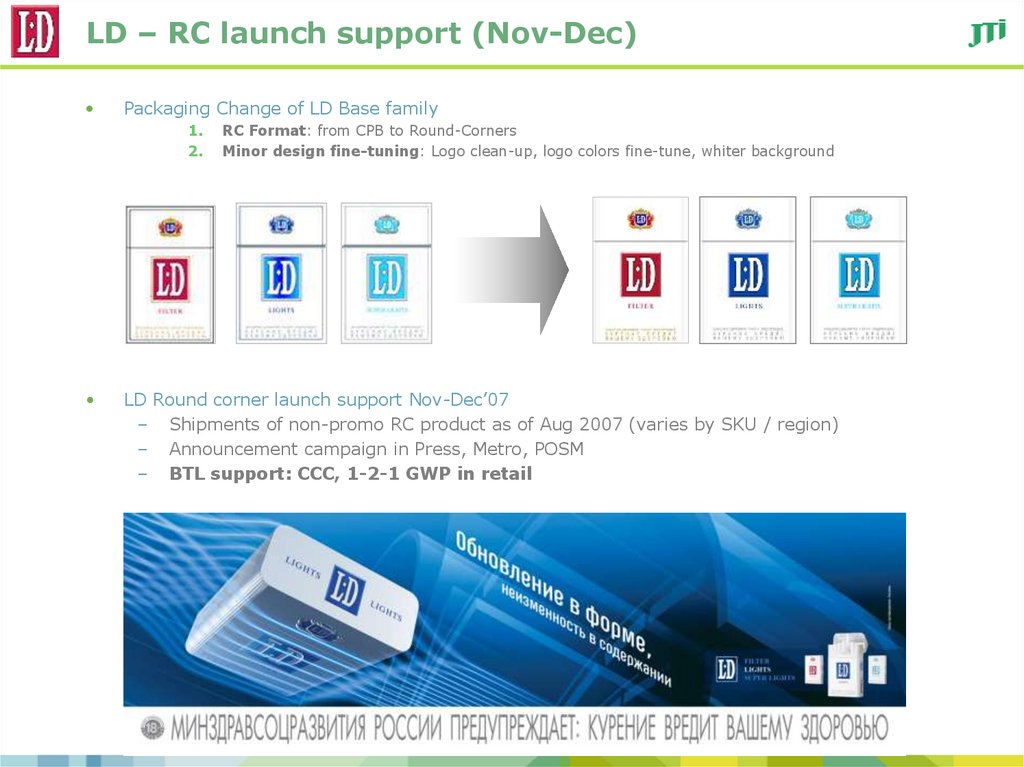

Packaging Change of LD Base family

1.

2.

RC Format: from CPB to Round-Corners

Minor design fine-tuning: Logo clean-up, logo colors fine-tune, whiter background

LD Round corner launch support Nov-Dec’07

– Shipments of non-promo RC product as of Aug 2007 (varies by SKU / region)

– Announcement campaign in Press, Metro, POSM

– BTL support: CCC, 1-2-1 GWP in retail

26. LD – Round Corner Launch Campaign

Awareness/ image

–

–

–

Press: mass press with high coverage, 34% TA Coverage (3+), JAN-FEB’08 – TBC

32 issues (Za rulem, Antenna, KP, Avtomir etc.)

Budget: 400 M USD

–

Metro in 7 cities, Nov’07 + Dec’07 (Moscow, St.Petersburg, Yekaterinburg, Novosibirsk, Nizhniy

Novgorod, Samara, Kazan), JAN-FEB’08 (MOW, STP) – TBC

337 sides Nov’07 and 391 sides in Dec’07

Budget: 550 M USD

–

–

Retail Visibility

–

–

–

–

–

–

Dominant Visibility flight:

Multi Facings;

POSMs

Full new JTI coverage

Cycle from Nov’07 to Feb’08

Branded Displays in mass KRA «Pyaterochka»

Retention/ Conversion

–

CCC 1-2-1, GWP in main ABC stratum cities (37)

Target: 1/ LD SOB; 2/ franchise

Target contacts: 427 000

27. Retail Visibility materials

Mini displayRetail Visibility

–

–

–

Mobile hard poster

Dominant Visibility flight: Multi Facings; POSMs

Nov’07 to Feb’08

Branded Displays in mass KRA «Pyaterochka»

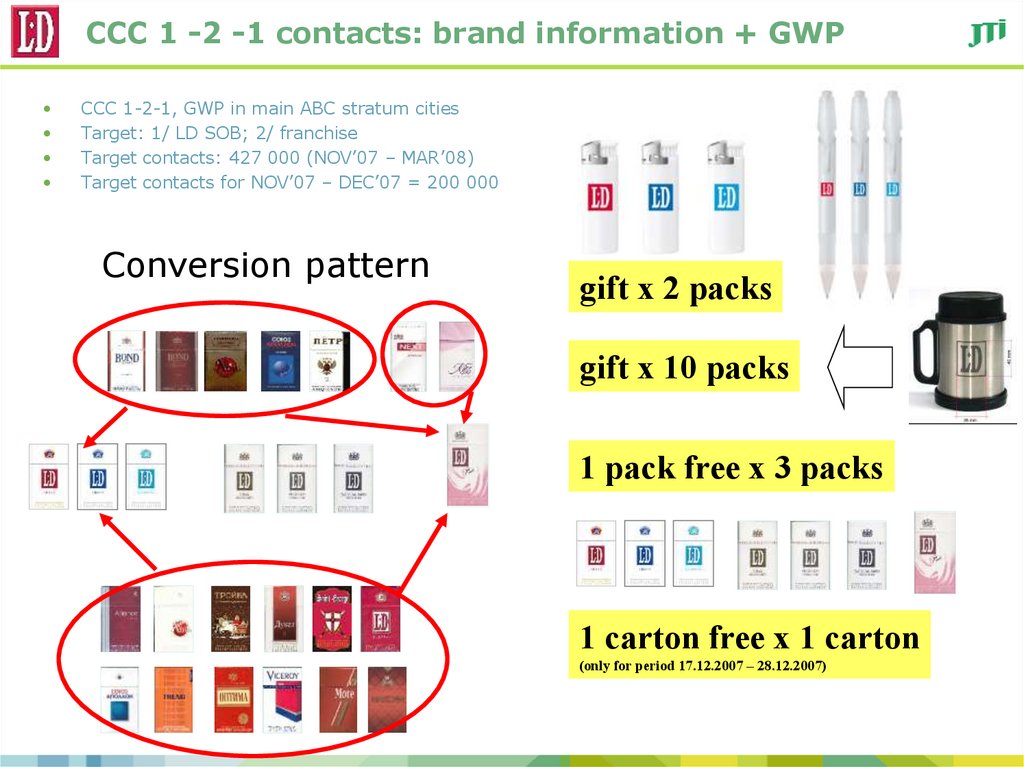

28. CCC 1 -2 -1 contacts: brand information + GWP

CCC 1-2-1, GWP in main ABC stratum cities

Target: 1/ LD SOB; 2/ franchise

Target contacts: 427 000 (NOV’07 – MAR’08)

Target contacts for NOV’07 – DEC’07 = 200 000

Conversion pattern

gift x 2 packs

gift x 10 packs

1 pack free x 3 packs

1 carton free x 1 carton

(only for period 17.12.2007 – 28.12.2007)

29. 2008 Brand Objectives and Support

30. 2008 Strategic Focus / Opportunities LD

Objective:– Consolidate the dominant position in Mid-Price to fuel Winston Growth

Fix

–

–

–

the Structure achieve superior performance of all Product mix elements

Packaging Up-grade: RC on the market; further evaluation – during Brand Audit

Product improvement

Pricing

Maximize potential of Brand extensions TBC based on brand Audit

– Leverage on Premium profile of LD Gold, Platinum, S. Slims

– Assess role of LD Standard

Rejuvenate Brand Image with relevant TTL

– Further evolve brand image

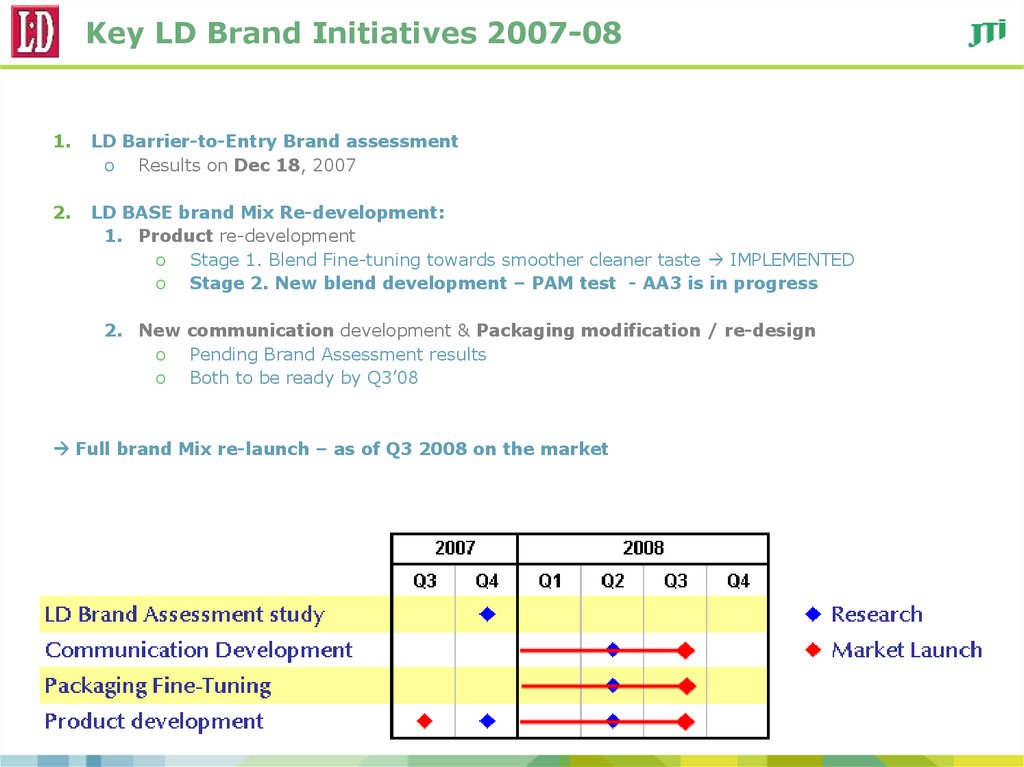

31. Key LD Brand Initiatives 2007-08

1.LD Barrier-to-Entry Brand assessment

o Results on Dec 18, 2007

2.

LD BASE brand Mix Re-development:

1. Product re-development

o Stage 1. Blend Fine-tuning towards smoother cleaner taste IMPLEMENTED

o Stage 2. New blend development – PAM test - AA3 is in progress

2. New communication development & Packaging modification / re-design

o Pending Brand Assessment results

o Both to be ready by Q3’08

Full brand Mix re-launch – as of Q3 2008 on the market

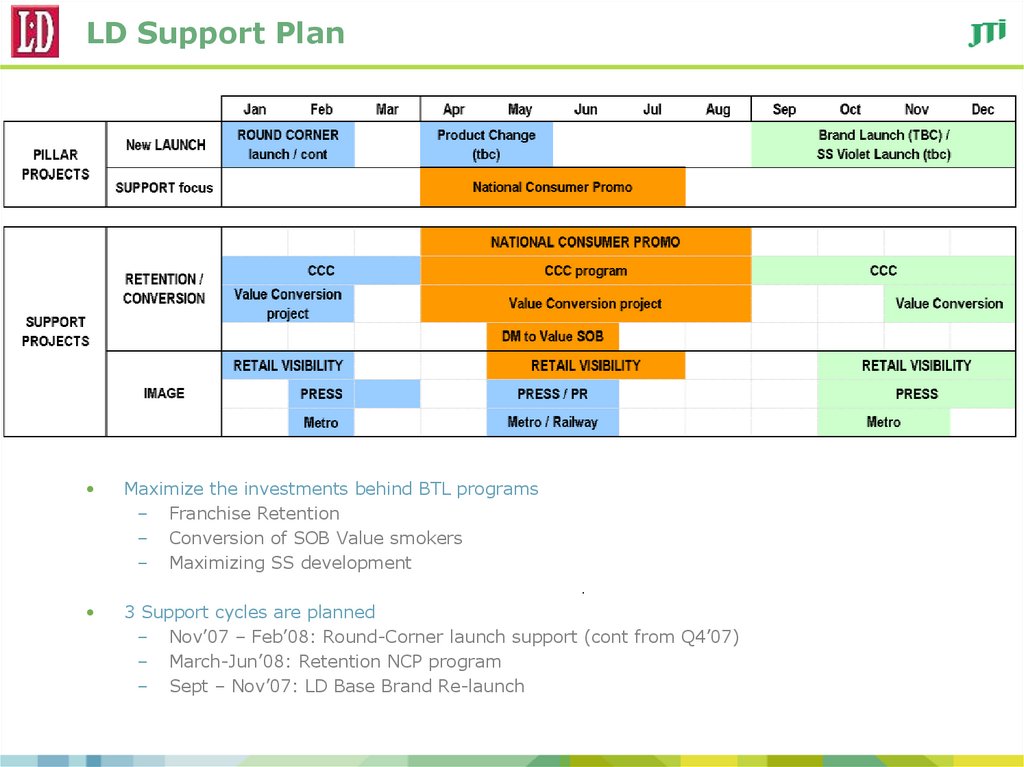

32. LD Support Plan

Maximize the investments behind BTL programs

– Franchise Retention

– Conversion of SOB Value smokers

– Maximizing SS development

3 Support cycles are planned

– Nov’07 – Feb’08: Round-Corner launch support (cont from Q4’07)

– March-Jun’08: Retention NCP program

– Sept – Nov’07: LD Base Brand Re-launch

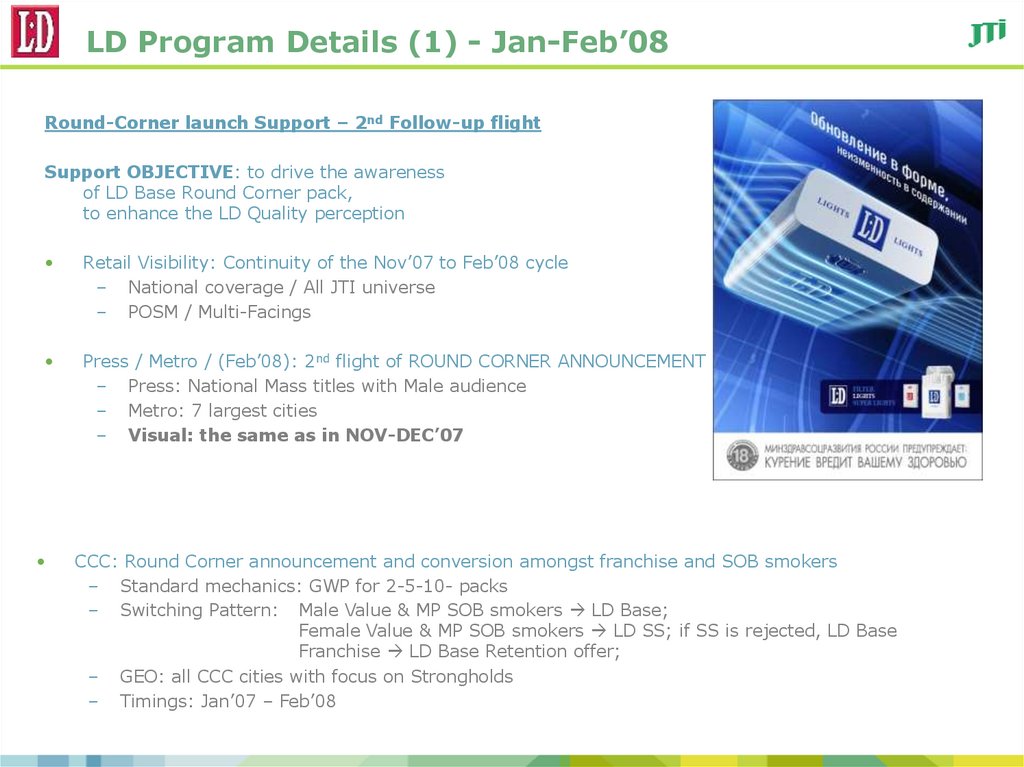

33. LD Program Details (1) - Jan-Feb’08

Round-Corner launch Support – 2nd Follow-up flightSupport OBJECTIVE: to drive the awareness

of LD Base Round Corner pack,

to enhance the LD Quality perception

Retail Visibility: Continuity of the Nov’07 to Feb’08 cycle

– National coverage / All JTI universe

– POSM / Multi-Facings

Press / Metro / (Feb’08): 2nd flight of ROUND CORNER ANNOUNCEMENT

– Press: National Mass titles with Male audience

– Metro: 7 largest cities

– Visual: the same as in NOV-DEC’07

CCC: Round Corner announcement and conversion amongst franchise and SOB smokers

– Standard mechanics: GWP for 2-5-10- packs

– Switching Pattern: Male Value & MP SOB smokers LD Base;

Female Value & MP SOB smokers LD SS; if SS is rejected, LD Base

Franchise LD Base Retention offer;

– GEO: all CCC cities with focus on Strongholds

– Timings: Jan’07 – Feb’08

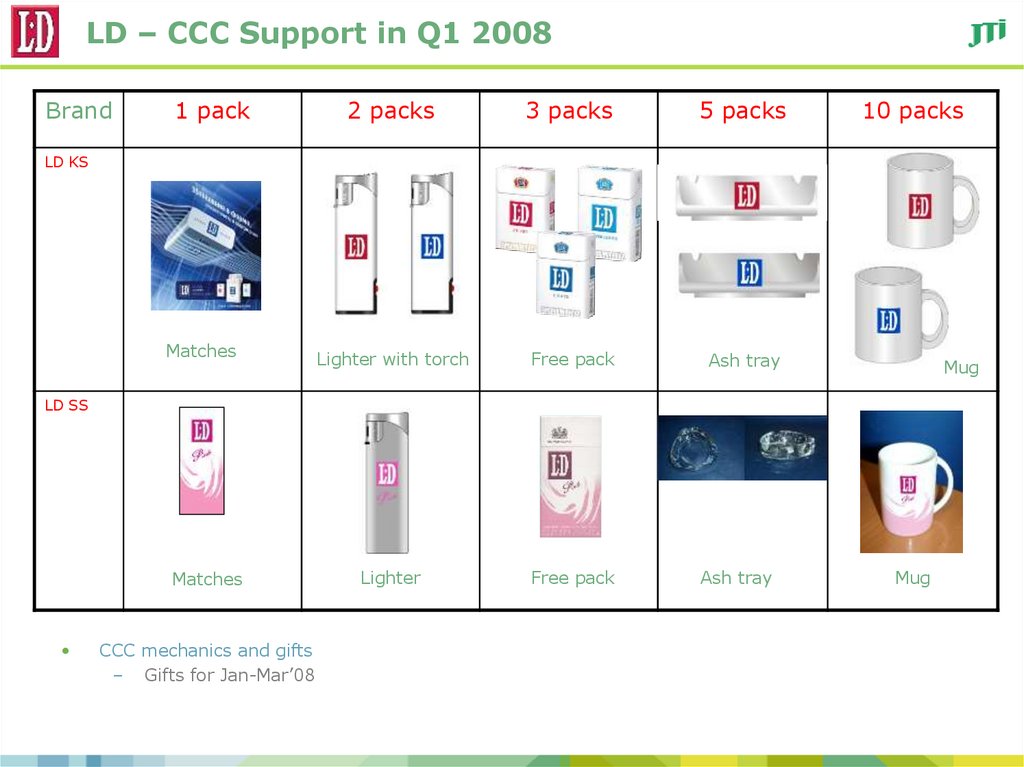

34. LD – CCC Support in Q1 2008

Brand1 pack

2 packs

3 packs

5 packs

Lighter with torch

Free pack

Ash tray

Lighter

Free pack

10 packs

LD KS

Matches

Mug

LD SS

Matches

CCC mechanics and gifts

– Gifts for Jan-Mar’08

Ash tray

Mug

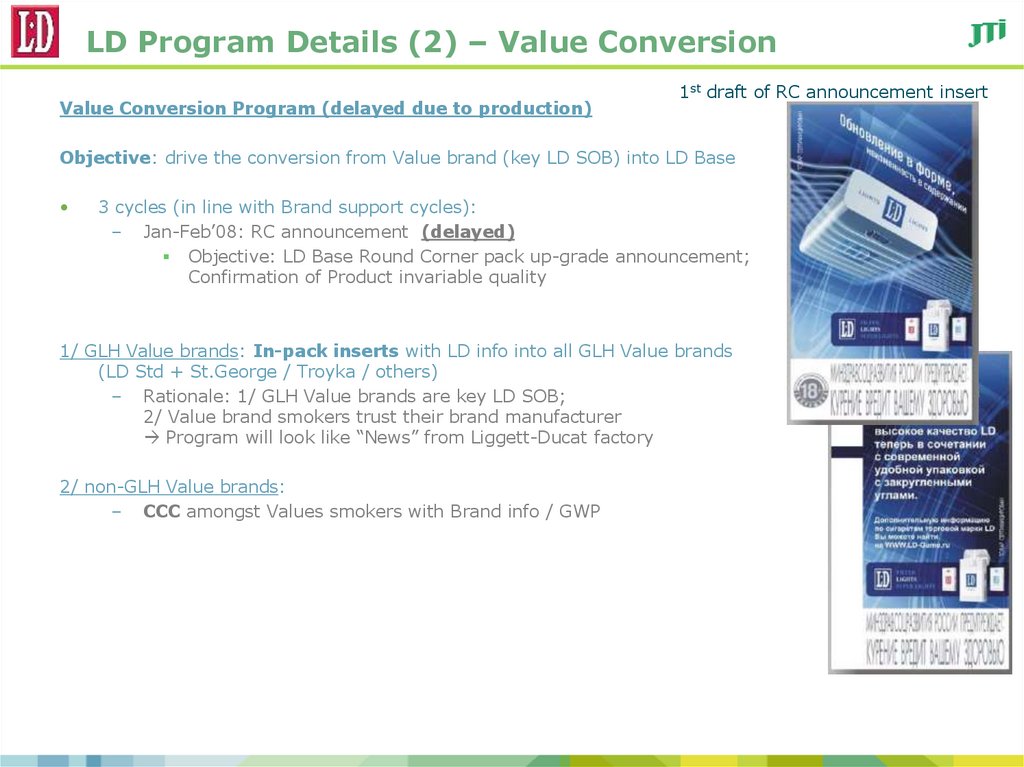

35. LD Program Details (2) – Value Conversion

Value Conversion Program (delayed due to production)1st draft of RC announcement insert

Objective: drive the conversion from Value brand (key LD SOB) into LD Base

3 cycles (in line with Brand support cycles):

– Jan-Feb’08: RC announcement (delayed)

Objective: LD Base Round Corner pack up-grade announcement;

Confirmation of Product invariable quality

1/ GLH Value brands: In-pack inserts with LD info into all GLH Value brands

(LD Std + St.George / Troyka / others)

– Rationale: 1/ GLH Value brands are key LD SOB;

2/ Value brand smokers trust their brand manufacturer

Program will look like “News” from Liggett-Ducat factory

2/ non-GLH Value brands:

– CCC amongst Values smokers with Brand info / GWP

36. LD Program Details (3) - NCP

National Consumer PromotionObjective: Franchise retention and SOB conversion (Value and MP)

Timings:

– Shipments

– Promo participation

Apr 2008

May – July 2008

Mechanics: Deco Pack with on-pack Promo announcement

– Concept / Mechanics: tbd – briefing process is started

– Promo Offer in all LD Mid-Price, but not Std

Support at:

Retail Visibility: national coverage

CCC: NCP info to SOB Value smokers

Info In-Pack insert in GLH Value brand (announcement only)

Direct Mail to Value SOB smokers (LD DB) – appr 50’000 smokers

Press announcement / post-PR: mass press announcements

Current status

–

–

In development (agencies have been briefed)

To be finalized in Dec’07

37. LD Program Details (4) – LD SS Drive

LD Super Slims Awareness / conversion driveObjective: to establish the LD SSL as the primary choice for MP / Value female smokers

– Programs may be corrected based on results of LD SS mix relevance assessment in

Brand Audit

1/ LD SS Pink Awareness and Image build-up amongst MP + Value SSL smokes

– Timings: Feb-March 2007

PRESS Support in National Mass female titles

– Visual: TBC

– Feb – Mar’08 (Women’s Day flight)

CCC amongst Value / MP female smokers

software

software