Similar presentations:

Futures and Forwards

1. CHAPTER 19

Futures Markets (40 slides)INVESTMENTS | BODIE, KANE, MARCUS

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

2. Futures and Forwards

19-2Futures and Forwards

• Forward – a deferred-delivery sale of an

asset with the sales price agreed on

now.

• Futures - similar to forward but feature

formalized and standardized contracts.

• Key difference in futures

– Standardized contracts create liquidity

– Marked to market

– Exchange mitigates credit risk

Ex next page

INVESTMENTS | BODIE, KANE, MARCUS

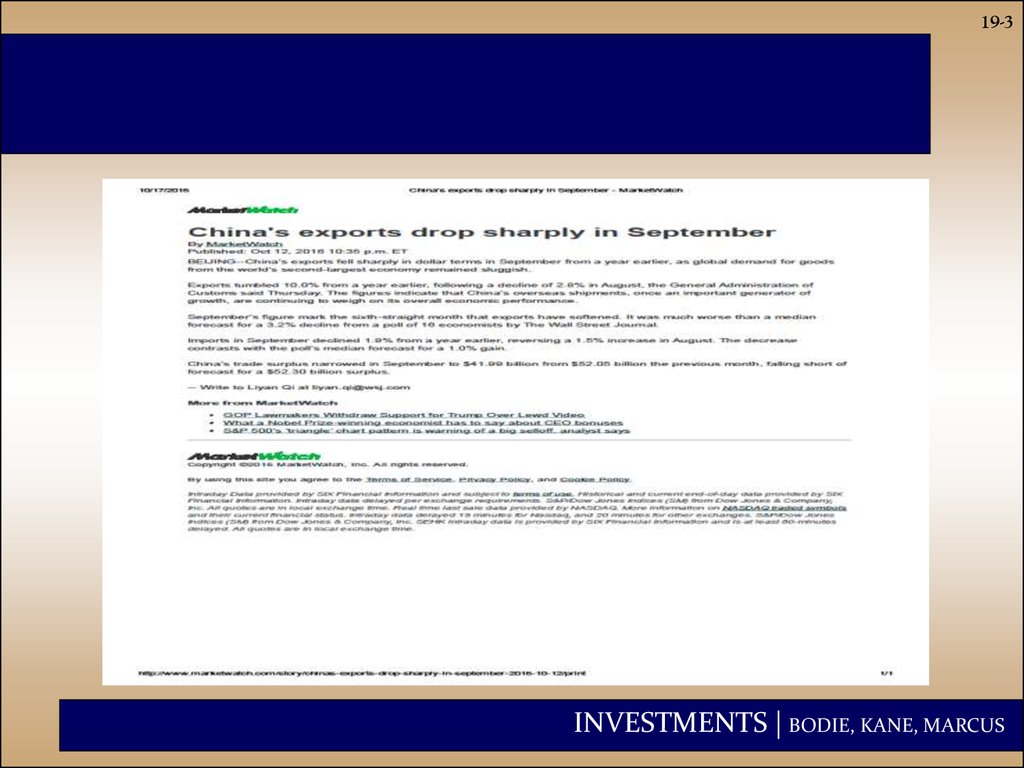

3.

19-3INVESTMENTS | BODIE, KANE, MARCUS

4.

19-4INVESTMENTS | BODIE, KANE, MARCUS

5.

19-5INVESTMENTS | BODIE, KANE, MARCUS

6.

19-6INVESTMENTS | BODIE, KANE, MARCUS

7.

19-7INVESTMENTS | BODIE, KANE, MARCUS

8.

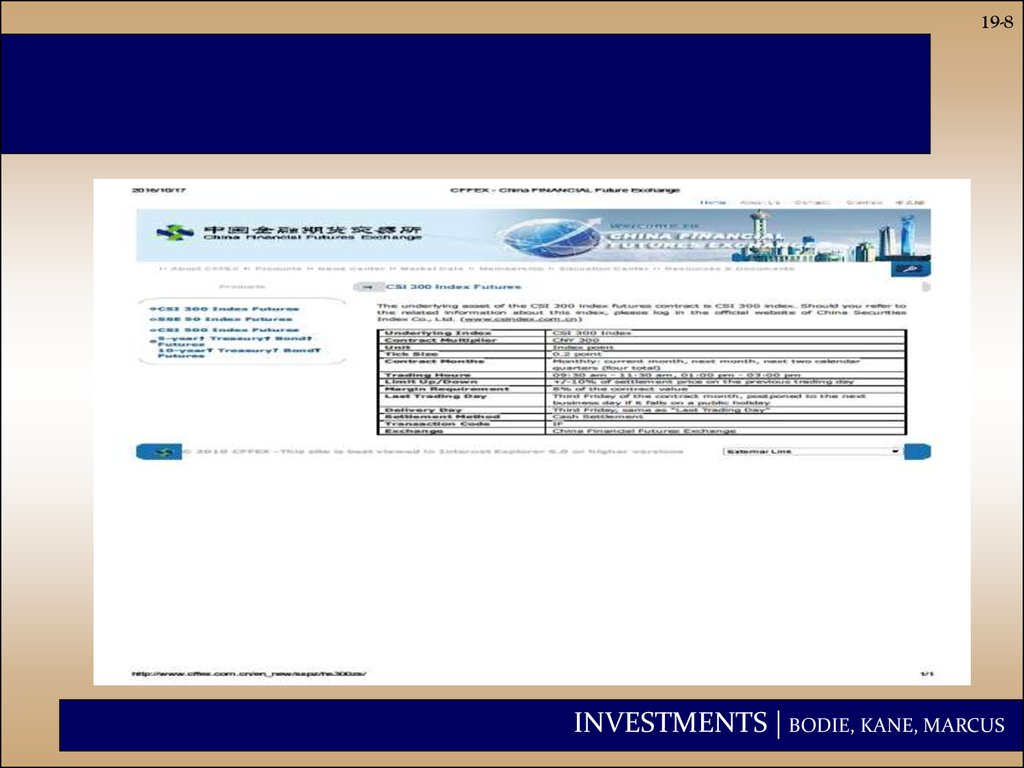

19-8INVESTMENTS | BODIE, KANE, MARCUS

9.

19-9INVESTMENTS | BODIE, KANE, MARCUS

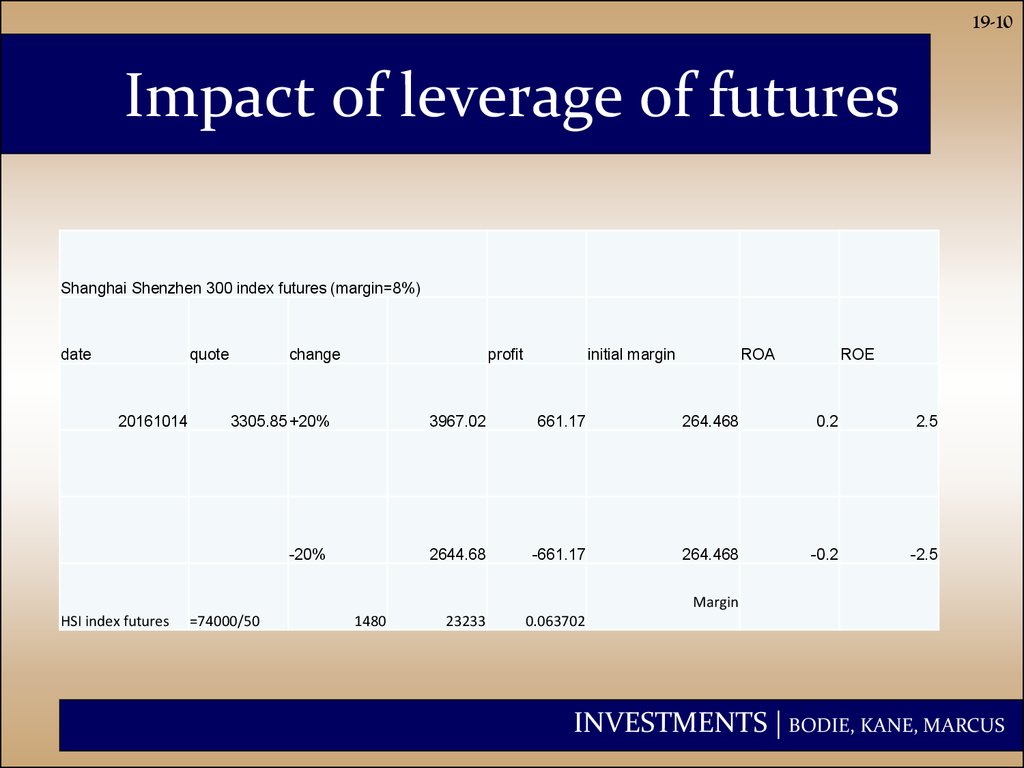

10. Impact of leverage of futures

19-10Impact of leverage of futures

Shanghai Shenzhen 300 index futures (margin=8%)

date

quote

20161014

change

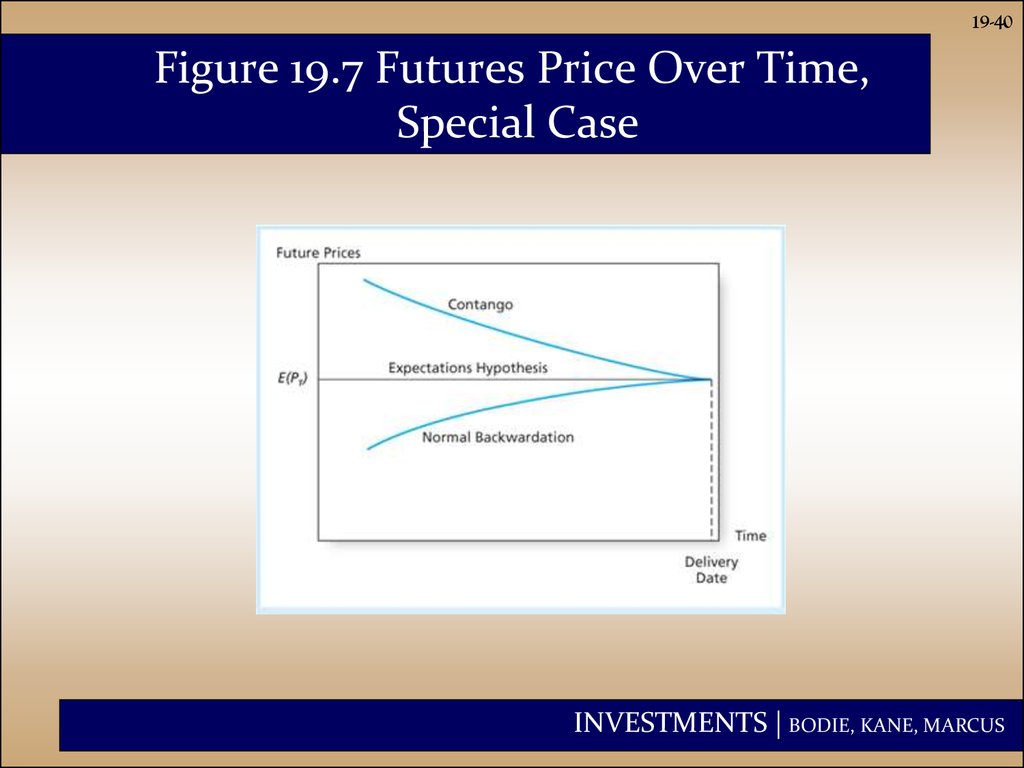

profit

initial margin

ROA

ROE

3305.85 +20%

3967.02

661.17

264.468

0.2

2.5

-20%

2644.68

-661.17

264.468

-0.2

-2.5

Margin

HSI index futures

=74000/50

1480

23233

0.063702

INVESTMENTS | BODIE, KANE, MARCUS

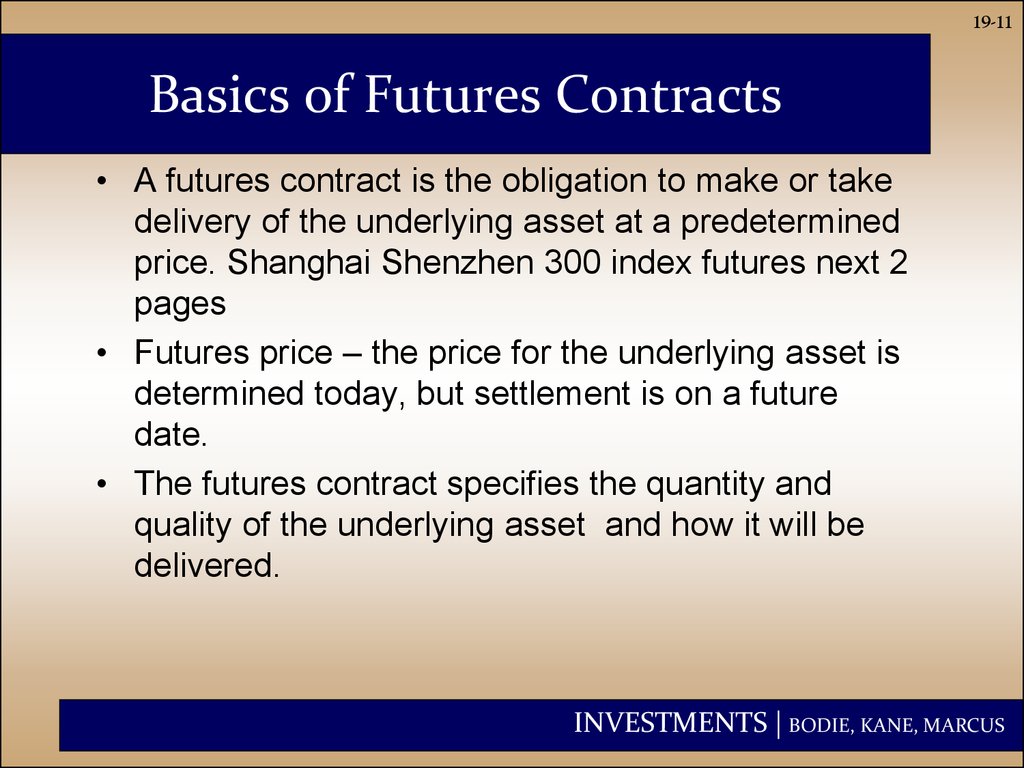

11. Basics of Futures Contracts

19-11Basics of Futures Contracts

• A futures contract is the obligation to make or take

delivery of the underlying asset at a predetermined

price. Shanghai Shenzhen 300 index futures next 2

pages

• Futures price – the price for the underlying asset is

determined today, but settlement is on a future

date.

• The futures contract specifies the quantity and

quality of the underlying asset and how it will be

delivered.

INVESTMENTS | BODIE, KANE, MARCUS

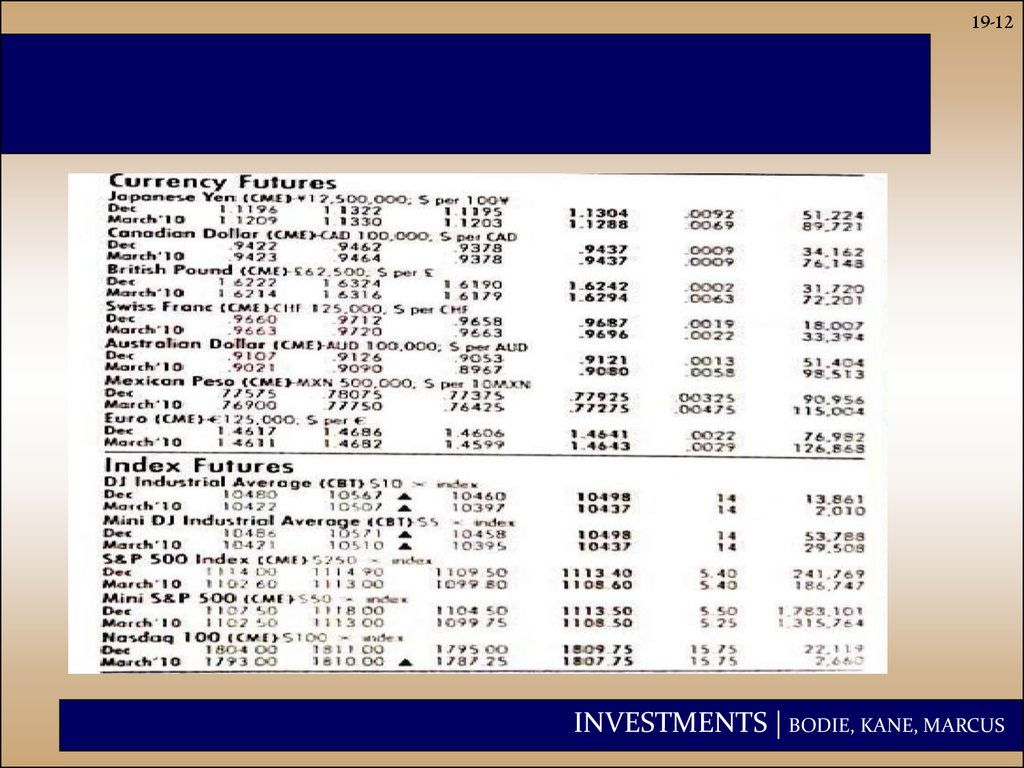

12.

19-12INVESTMENTS | BODIE, KANE, MARCUS

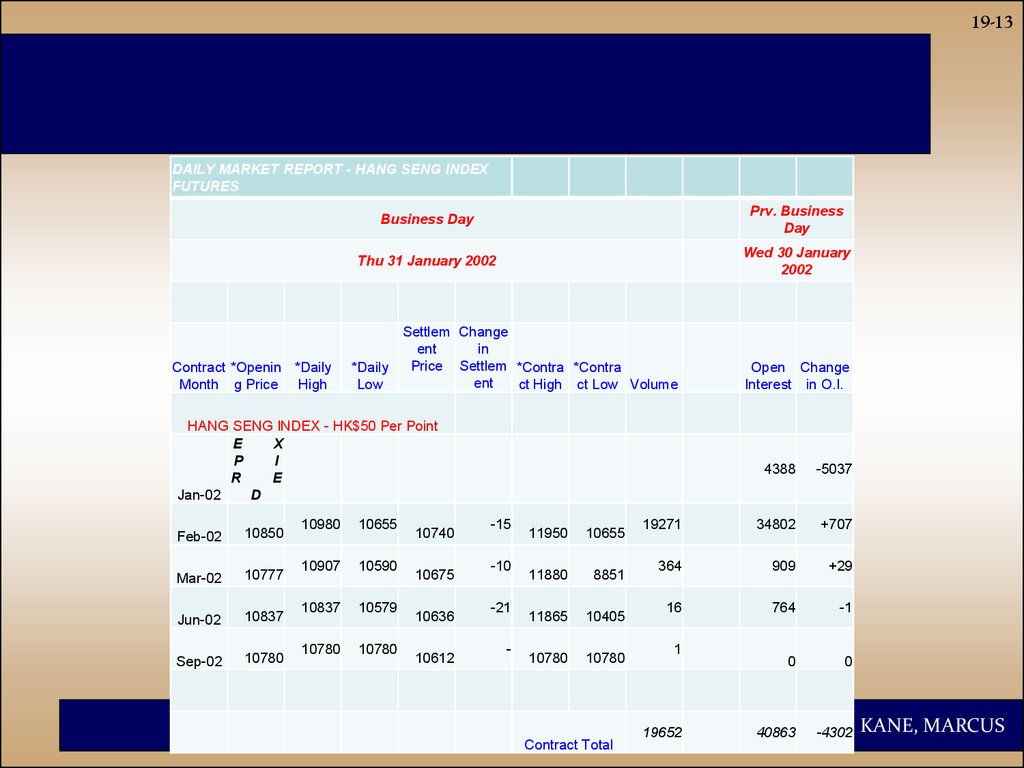

13.

19-13DAILY MARKET REPORT - HANG SENG INDEX

FUTURES

Contract *Openin *Daily

Month g Price High

Business Day

Prv. Business

Day

Thu 31 January 2002

Wed 30 January

2002

Settlem Change

ent

in

Price Settlem *Contra *Contra

*Daily

ent

Low

ct High ct Low Volume

HANG SENG INDEX - HK$50 Per Point

E

X

P

I

R

E

D

Jan-02

Feb-02

10850

Mar-02

10777

Jun-02

10837

Sep-02

10780

10980

10655

10907

10590

10837

10579

10780

10780

10740

10675

10636

10612

-15

-10

-21

-

11950

10655

11880

8851

11865

10405

10780

10780

Open Change

Interest in O.I.

4388

-5037

19271

34802

+707

364

909

+29

16

764

-1

0

0

1

INVESTMENTS

| BODIE,

19652

40863

-4302 KANE, MARCUS

Contract Total

14. Shanghai Shenzhen 300 index futures

19-14Shanghai Shenzhen 300 index futures

INVESTMENTS | BODIE, KANE, MARCUS

15. Dalian commodity exchange

19-15Dalian commodity exchange

Corn

Soybean Meal

Product

LLDPE

Coking Coal

No.1 Soybeans

No.2 Soybeans

Soybean Oil

RBD Palm Olein

PVC

Coke

Iron Ore

INVESTMENTS | BODIE, KANE, MARCUS

16. Basics of Futures Contracts

19-16Basics of Futures Contracts

• Long – a commitment to purchase the

commodity on the delivery date.

• Short – a commitment to sell the

commodity on the delivery date.

• Futures are traded on margin.

• At the time the contract is entered into, no

money changes hands.

INVESTMENTS | BODIE, KANE, MARCUS

17. Basics of Futures Contracts

19-17Basics of Futures Contracts

• Profit to long = Spot price at maturity - Original

futures price

• Profit to short = Original futures price - Spot

price at maturity

• The futures contract is a zero-sum game, which

means gains and losses net out to zero.

INVESTMENTS | BODIE, KANE, MARCUS

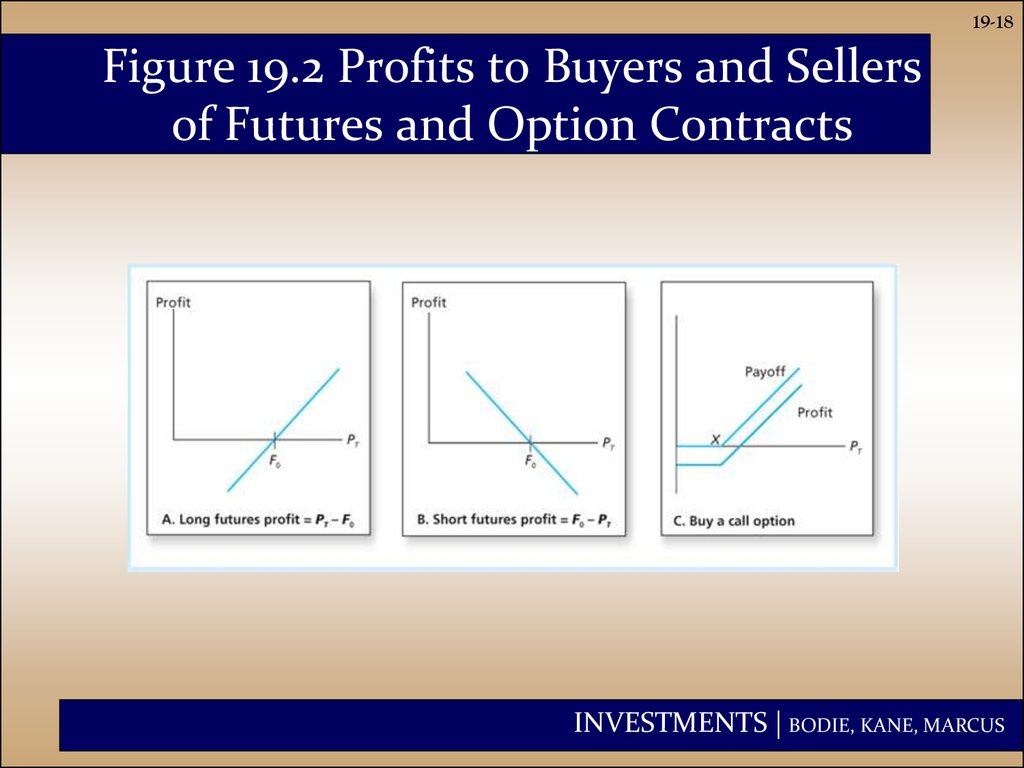

18. Figure 19.2 Profits to Buyers and Sellers of Futures and Option Contracts

19-18Figure 19.2 Profits to Buyers and Sellers

of Futures and Option Contracts

INVESTMENTS | BODIE, KANE, MARCUS

19. Figure 19.2 Conclusions

19-19Figure 19.2 Conclusions

• Profit is zero when the ultimate spot price,

PT equals the initial futures price, F0 .

• Unlike a call option, the payoff to the long

position can be negative because the

futures trader cannot walk away from the

contract if it is not profitable.

INVESTMENTS | BODIE, KANE, MARCUS

20. Existing Contracts

19-20Existing Contracts

• Futures contracts are traded on a wide

variety of assets in four main categories:

1.

2.

3.

4.

Agricultural commodities

Metals and minerals

Foreign currencies

Financial futures

INVESTMENTS | BODIE, KANE, MARCUS

21. Trading Mechanics

19-21Trading Mechanics

• Electronic trading

has mostly

displaced floor

trading.

• CBOT and CME

merged in 2007 to

form CME Group.

• The exchange acts

as a clearing house

and counterparty to

both sides of the

trade.

• The net position of

the clearing house is

zero.

INVESTMENTS | BODIE, KANE, MARCUS

22. Trading Mechanics

19-22Trading Mechanics

• Open interest is the number of contracts

outstanding.

• If you are currently long, you simply

instruct your broker to enter the short side

of a contract to close out your position.

• Most futures contracts are closed out by

reversing trades.

• Only 1-3% of contracts result in actual

delivery of the underlying commodity.

INVESTMENTS | BODIE, KANE, MARCUS

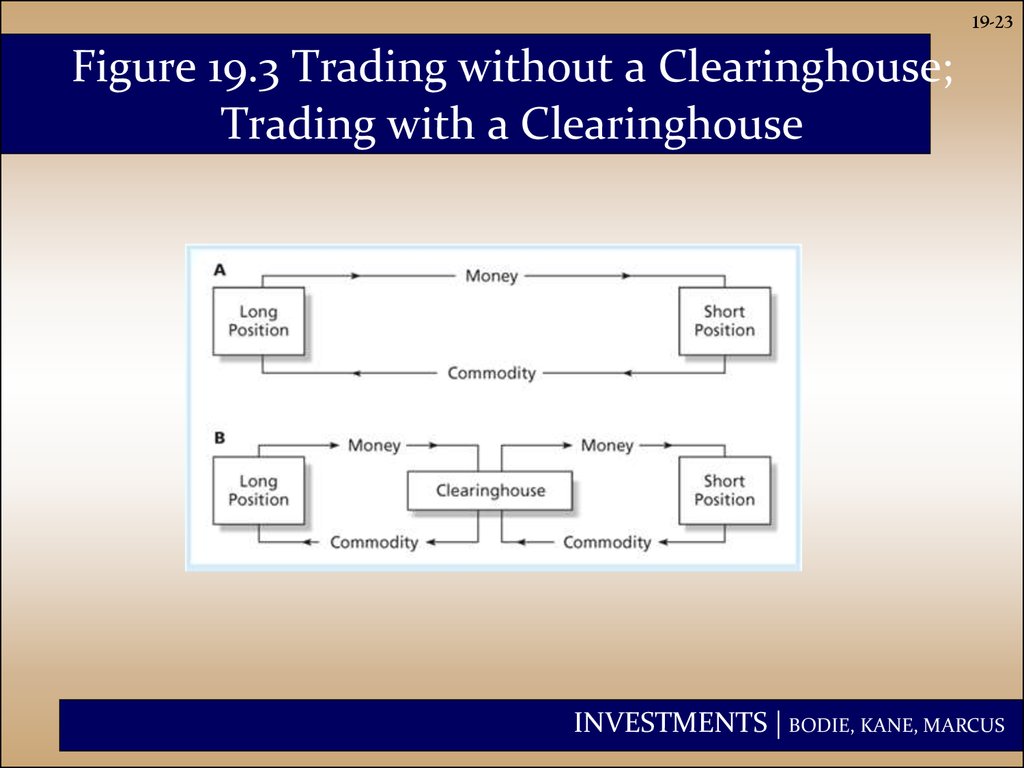

23. Figure 19.3 Trading without a Clearinghouse; Trading with a Clearinghouse

19-23Figure 19.3 Trading without a Clearinghouse;

Trading with a Clearinghouse

INVESTMENTS | BODIE, KANE, MARCUS

24. Margin and Marking to Market

19-24Margin and Marking to Market

• Marking to Market - each day the profits or

losses from the new futures price are paid

over or subtracted from the account

• Convergence of Price - as maturity

approaches the spot and futures price

converge

INVESTMENTS | BODIE, KANE, MARCUS

25. Margin and Trading Arrangements

19-25Margin and Trading Arrangements

• Initial Margin - funds or interest-earning

securities deposited to provide capital to

absorb losses

• Maintenance margin - an established value

below which a trader’s margin may not fall

• Margin call - when the maintenance margin

is reached, broker will ask for additional

margin funds

INVESTMENTS | BODIE, KANE, MARCUS

26. Trading Strategies

19-26Trading Strategies

Speculators

• seek to profit from price

movement

– short - believe price will fall

– long - believe price will rise

Hedgers

• seek protection from price

movement

– long hedge - protecting

against a rise in purchase

price

– short hedge - protecting

against a fall in selling price

INVESTMENTS | BODIE, KANE, MARCUS

27. Basis and Basis Risk

19-27Basis and Basis Risk

• Basis - the difference between the

futures price and the spot price, FT –

PT

• The convergence property says FT –

PT= 0 at maturity.

INVESTMENTS | BODIE, KANE, MARCUS

28. Basis and Basis Risk

19-28Basis and Basis Risk

• Before maturity, FT may differ

substantially from the current spot

price.

• Basis Risk - variability in the basis

means that gains and losses on the

contract and the asset may not

perfectly offset if liquidated before

maturity.

INVESTMENTS | BODIE, KANE, MARCUS

29. Futures Pricing

19-29Futures Pricing

Spot-futures parity theorem - two ways

to acquire an asset for some date in the

future:

1. Purchase it now and store it

2. Take a long position in futures

•These two strategies must have the

same market determined costs

INVESTMENTS | BODIE, KANE, MARCUS

30. Spot-Futures Parity Theorem

19-30Spot-Futures Parity Theorem

• With a perfect hedge, the futures payoff

is certain -- there is no risk.

• A perfect hedge should earn the

riskless rate of return.

• This relationship can be used to

develop the futures pricing relationship.

INVESTMENTS | BODIE, KANE, MARCUS

31. Hedge Example: Section 19.4

19-31Hedge Example: Section 19.4

• Investor holds $1000 in a mutual fund

indexed to the S&P 500.

• Assume dividends of $20 will be paid on

the index fund at the end of the year.

• A futures contract with delivery in one

year is available for $1,010.

• The investor hedges by selling or

shorting one contract .

INVESTMENTS | BODIE, KANE, MARCUS

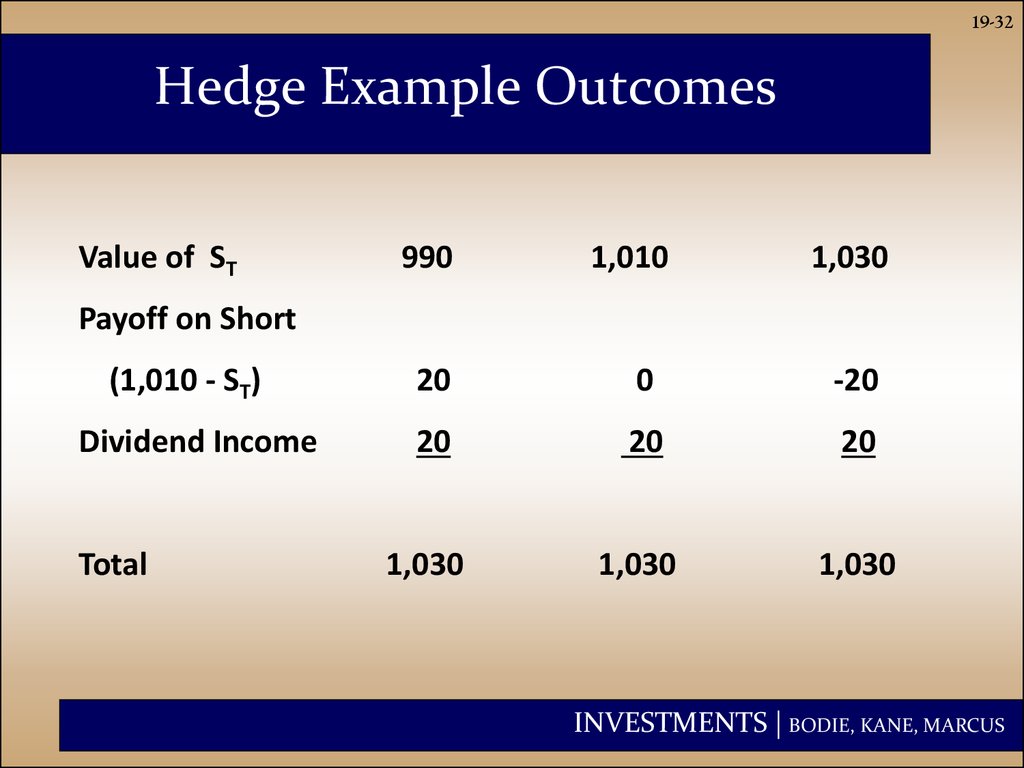

32. Hedge Example Outcomes

19-32Hedge Example Outcomes

Value of ST

990

1,010

1,030

Payoff on Short

(1,010 - ST)

Dividend Income

Total

20

0

-20

20

20

20

1,030

1,030

1,030

INVESTMENTS | BODIE, KANE, MARCUS

33. Rate of Return for the Hedge

19-33Rate of Return for the Hedge

( F0 D ) S 0

S0

(1,010 20) 1,000

3%

1,000

INVESTMENTS | BODIE, KANE, MARCUS

34. The Spot-Futures Parity Theorem

19-34The Spot-Futures Parity Theorem

( F0 D ) S 0

rf

S0

Rearranging terms

F0 S 0 (1 r f ) D S 0 (1 r f d )

d D

S0

INVESTMENTS | BODIE, KANE, MARCUS

35. Arbitrage Possibilities

19-35Arbitrage Possibilities

• If spot-futures parity is not observed,

then arbitrage is possible.

• If the futures price is too high, short the

futures and acquire the stock by

borrowing the money at the risk free rate.

• If the futures price is too low, go long

futures, short the stock and invest the

proceeds at the risk free rate.

INVESTMENTS | BODIE, KANE, MARCUS

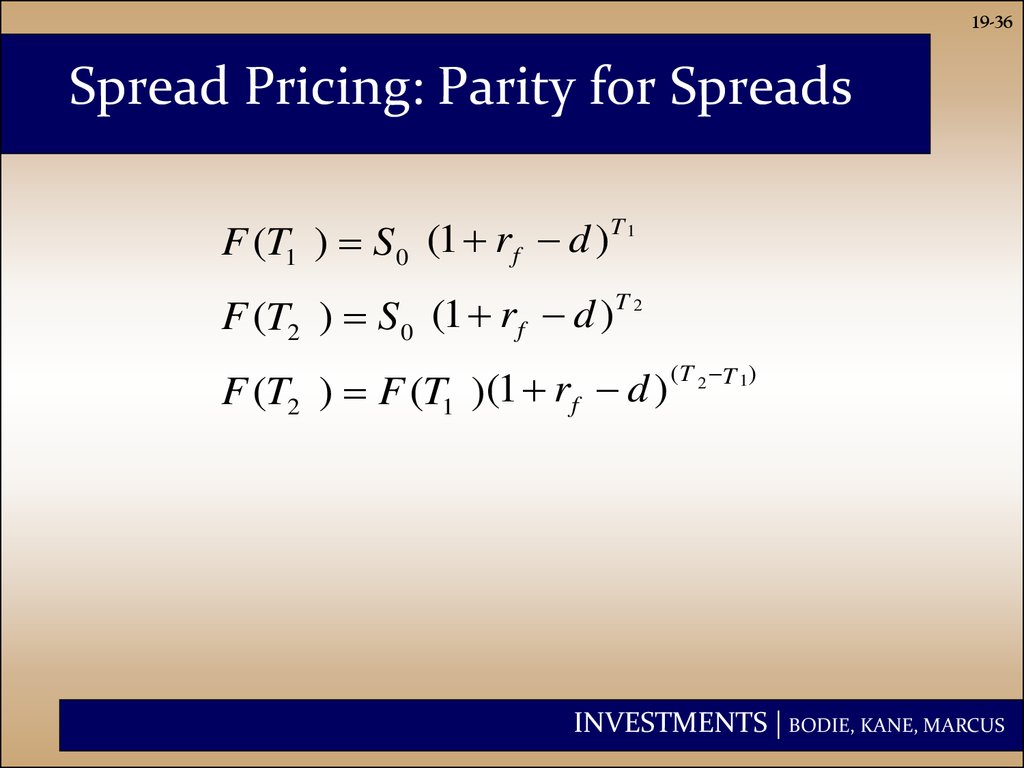

36. Spread Pricing: Parity for Spreads

19-36Spread Pricing: Parity for Spreads

T

F (T1 ) S0 (1 rf d ) 1

T

F (T2 ) S0 (1 rf d ) 2

F (T2 ) F (T1 )(1 rf d )

( T 2 T 1 )

INVESTMENTS | BODIE, KANE, MARCUS

37. Spreads

19-37Spreads

• If the risk-free rate is greater than the

dividend yield (rf > d), then the futures

price will be higher on longer maturity

contracts.

• If rf < d, longer maturity futures prices will

be lower.

• For futures contracts on commodities that

pay no dividend, d=0, F must increase as

time to maturity increases.

INVESTMENTS | BODIE, KANE, MARCUS

38. Figure 19.6 Gold Futures Prices

19-38Figure 19.6 Gold Futures Prices

INVESTMENTS | BODIE, KANE, MARCUS

39. Futures Prices vs. Expected Spot Prices

19-39Futures Prices vs. Expected Spot

Prices

• Expectations F0=E(PT), PT = future spot price

• Normal Backwardation: futures price bid down to a level

below E(PT) as speculators needs a profit of F0-E(PT) to

long the contract

• Contango: F0<E(PT) as the natural hedgers are the

purchasers of a commodity and want to hedge their

purchase at T

• Modern Portfolio Theory: if commodity prices pose

positive systematic risk, futures prices must be lower

than expected spot prices: F0=E(PT)[(1/rf)/(1+k)]T

INVESTMENTS | BODIE, KANE, MARCUS

40. Figure 19.7 Futures Price Over Time, Special Case

19-40Figure 19.7 Futures Price Over Time,

Special Case

INVESTMENTS | BODIE, KANE, MARCUS

finance

finance