Similar presentations:

Strategic Metals, Tokenized

1.

Strategic Metals, TokenizedFully-backed rare earth and technology metals onchain

https://rareium.io

1

2.

Why Rareium, why now?Traditional trading hours only,

Large minimum purchases,

Settlement lag times,

Difficult to access.

24/7 metal trading,

Fractional ownership,

Near-instant transactions,

Trustless, frictionless, accessible.

https://rareium.io

2

3.

Anywhere, Anytime, AnyoneOpen

app

Connect

wallet

Anyone, expert or beginner,

whenever & wherever suits

Buy

token

Swapping or selling is just as

easy

$¥€

£₱

₩₨

https://rareium.io

3

4.

Global Liquidity PartnerWhat Rareium has makes it uniquely special:

Supply

Pricing

Expertise

Connections

Infrastructure

Accessibility

Liquidity

Only Rareium can bring strategic metals investing to

everyone

https://rareium.io

4

5.

The Market in totalCurrent Annual Value

Rare earth metals $5.9 billion

Technology metals $3.5 billion

} Vast majority is industrial demand

Strategic Metals to grow 7 to 24 times by 2035

Required for global energy transition

Crucial in high-tech devices

Industrial demand growth is strong

https://rareium.io

5

6.

The Market: Our focusInvestment market undeveloped

Only available since 2012

German-speaking areas most developed:

Commodity tokens for

comparison

Paxgold: $438m TVL. $10m vol / 24h

Population 100 million

Tether Gold: $584m TVL. $13m vol/24h

Annual investment approx $50 million

Agrotoken: $35m, $36k vol / 24h

Considering the west + Japan only:

Powerledger: $150m TVL. $19m vol/24h

Population 1 billion

20% of investment approx $100 million

We aim to capture market share from other

commodity investments too

With tokenization and global reach, we can

grow faster than even the industrial demand

https://rareium.io

6

7.

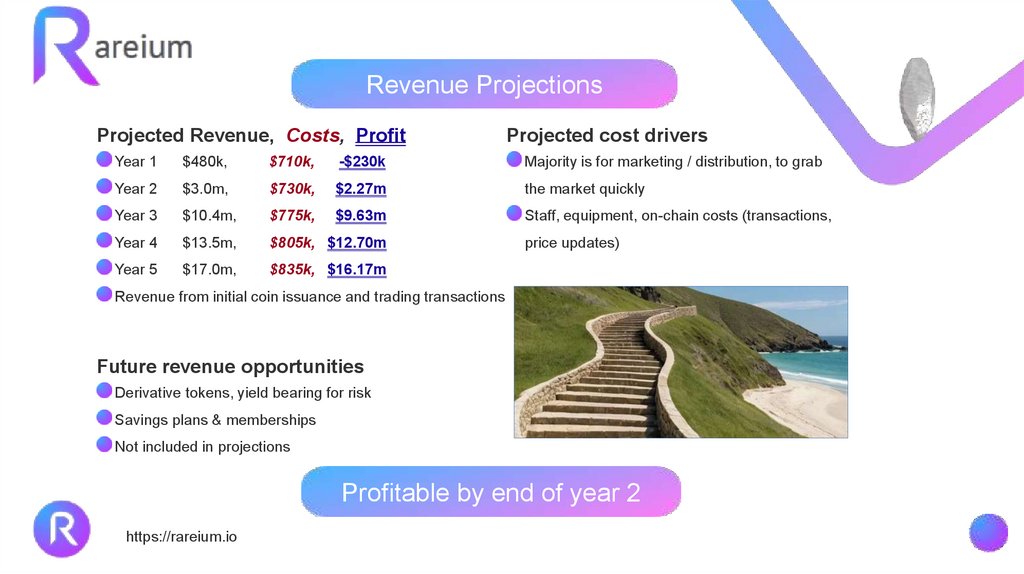

Revenue ProjectionsProjected Revenue, Costs, Profit

Projected cost drivers

Year 1

$480k,

$710k,

-$230k

Majority is for marketing / distribution, to grab

Year 2

$3.0m,

$730k,

$2.27m

the market quickly

Year 3

$10.4m,

$775k,

$9.63m

Staff, equipment, on-chain costs (transactions,

Year 4

$13.5m,

$805k, $12.70m

Year 5

$17.0m,

$835k, $16.17m

price updates)

Revenue from initial coin issuance and trading transactions

Future revenue opportunities

Derivative tokens, yield bearing for risk

Savings plans & memberships

Not included in projections

Profitable by end of year 2

https://rareium.io

7

8.

The TeamLouis O’ Connor

Co-founder, Title

<profile

picture>

Main

Experience

that is

relevant

https://rareium.io

Kurt Festraerts

Co-founder, Title

<profile

picture>

Main

Experience

that is

relevant

Cormac Guerin

Co-founder, Title

<profile

picture>

Main

Experience

that is

relevant

Sayaka Shiotani

Co-founder, Title

<profile

picture>

Main

Experience

that is

relevant

Conor D’Arcy

Co-founder, Title

<profile

picture>

Main

Experience

that is

relevant

8

9.

Let’s Profit TogetherOpportunity

Access to a constrained supply

Using technology and expertise

Large market growth

Undeveloped investment market

https://rareium.io

9

informatics

informatics