Similar presentations:

Intro to international relations (class 9)

1.

PLS 150 INTRO TO INTERNATIONALRELATIONS

DR MAJA SAVEVSKA

Assistant Professor

Department of Political Science and International Relations

SSH | Nazarbayev University

Office: 8.502

Email: [email protected]

30-11-22

Intro to IR

Nur-Sultan, Kazakhstan

2.

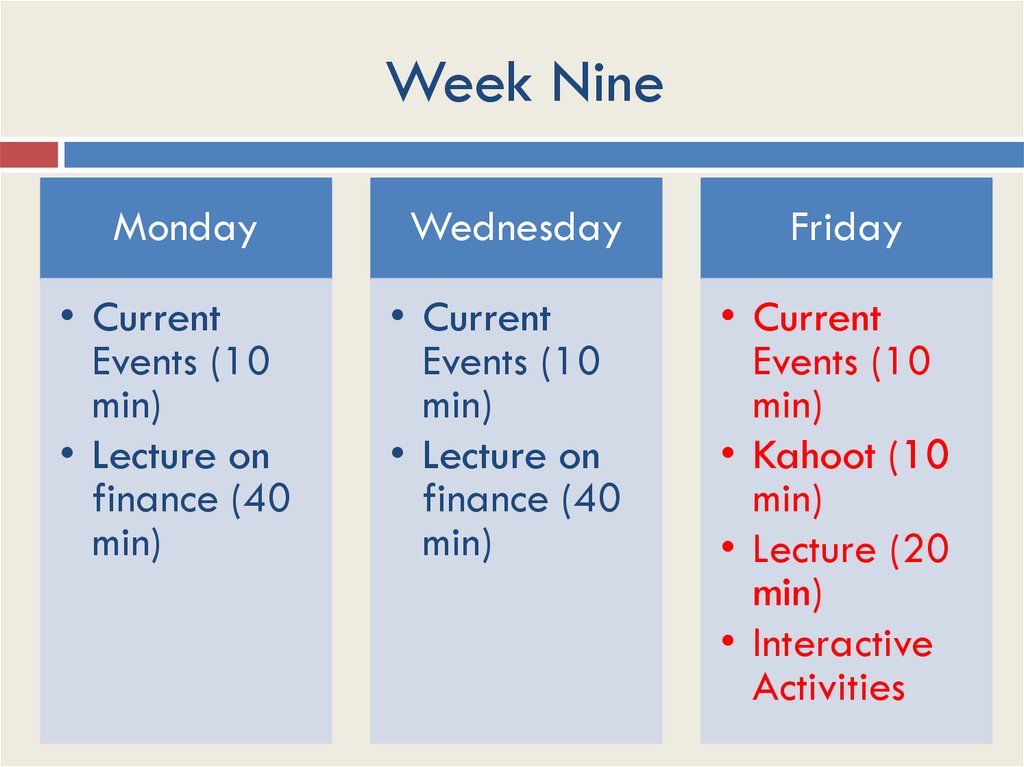

Week NineMonday

Wednesday

Friday

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Kahoot (10

min)

• Lecture (10

min)

• Interactive

Activities

3.

Current Events4.

RecapWhat does the Heckscher-Ohlin theory predict

about trade? What will a country export most?

What are the two alternative approaches to

explaining trade preference formation?

5.

Issue AreasTrade

Globalization of Production and FDI

Monetary Affairs

Development and Inequality

6.

Globalization“Accelerating set of processes involving

flows that encompass ever greater number

of the world’s spaces and the lead to

increasing integration and interconnectivity

among those spaces” (Ritzer 2009:1).

7.

Foreign InvestmentFDI

Portfolio

Sovereign Lending

8.

Foreign InvestmentForeign Direct Investment

Investment abroad

Managerial control

9.

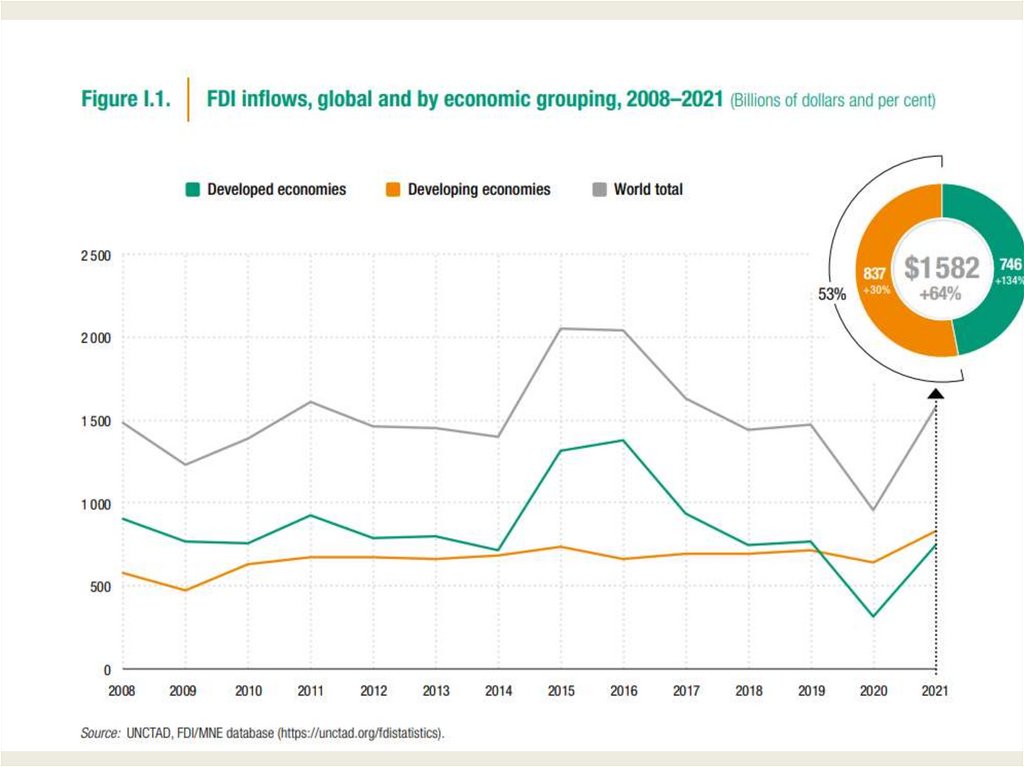

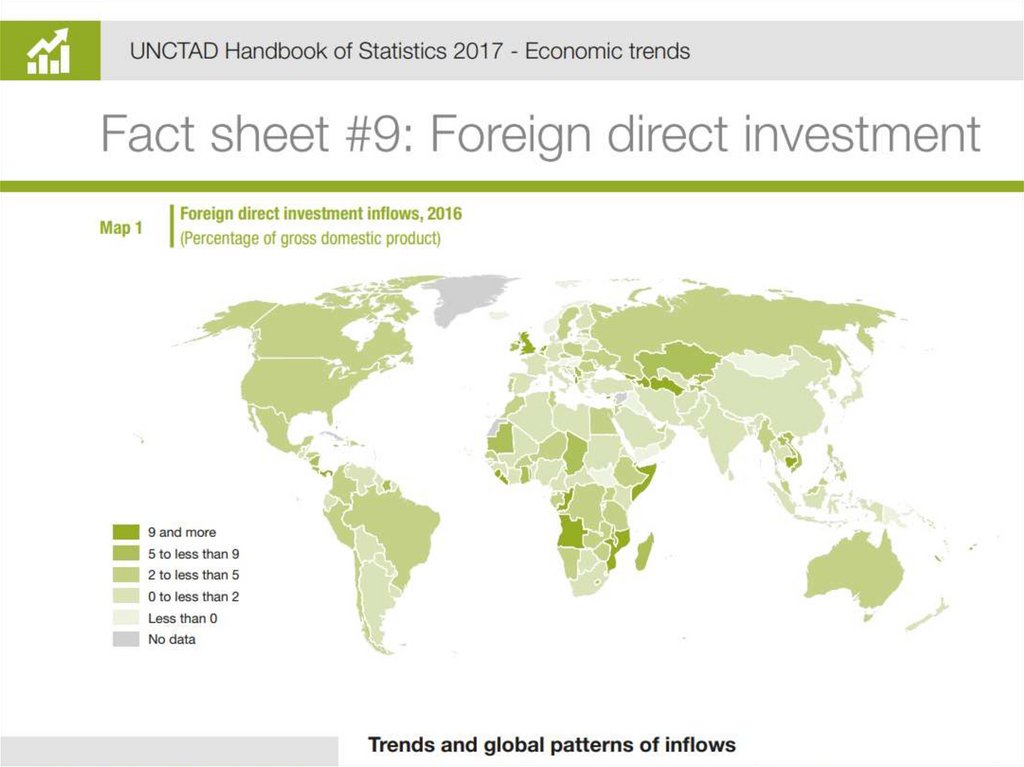

10.

11.

12.

13.

Foreign InvestmentPortfolio Investment

Stocks

Bonds

Loans

Securities

14.

Foreign InvestmentSovereign Lending

Loans to governments

Private investors

Public:

IMF

Bilateral

Concessional

15.

16.

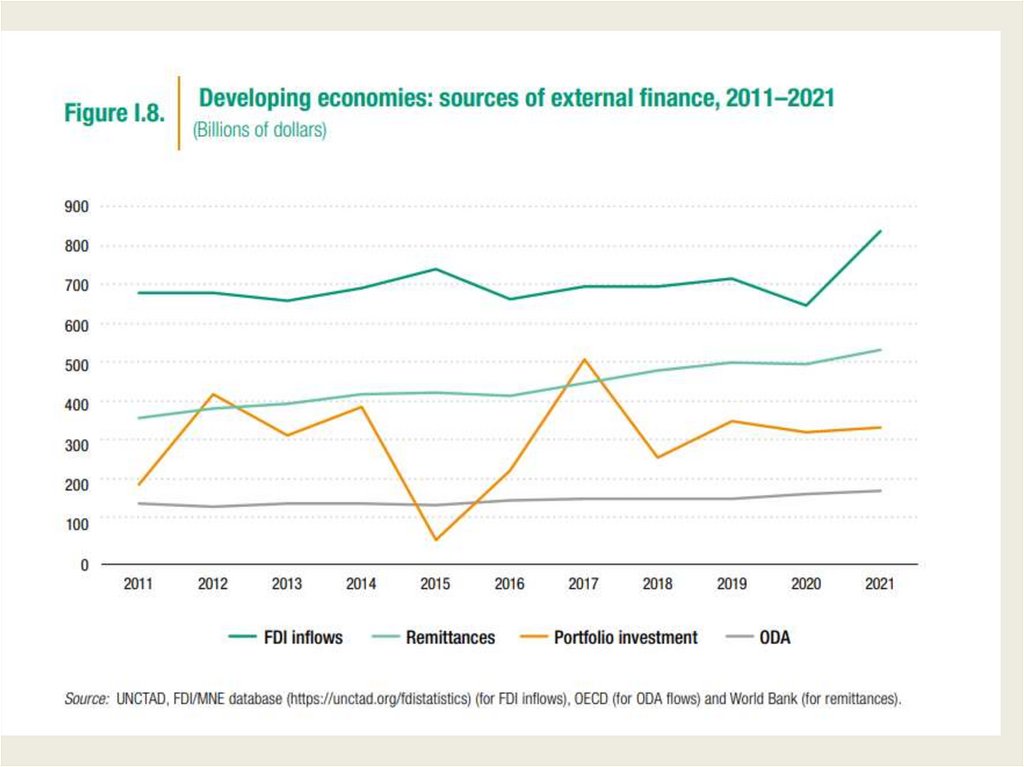

Developing CountriesExternal Sources of Capital

Official flows (from Multilateral Development

Banks)

Commercial banks’ loans (portfolio investments)

FDI

Until the early 90s official flows were dominant

form of capital

17.

18.

Week NineMonday

Wednesday

Friday

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Kahoot (10

min)

• Lecture (20

min)

• Interactive

Activities

19.

Current Events20.

Foreign InvestmentWhy Invest?

Common interests:

Profit for investors

Access to finance for recipients

21.

Foreign InvestmentRisks

Conflict of interests over distribution of benefits

Lending:

Repayment risks

Sovereign defaults

FDI:

Expropriation

22.

Foreign Investment: LendingDebtor-Creditor Relationship

Solutions to information asymmetry problems:

International Organizations

BIS

IMF

World Bank

23.

Open Economy Politics (Lake)Interests

Domestic Institutions

Interstate Bargaining

24.

Domestic Political InstitutionsRegime

Electoral

Partisan

• Democracies

• Autocracies

• Majoritarian

• Proportional

representation

• Fractionalization

• Left-right

division

25.

Political Regime TypesDemocratic

Democracies attract

more FDI

Authoritarian

Autocracies provide

better deals to MNCs

26.

International Investment RegimeLevel of Institutionalization

Protection of investment under international

law

Absence of multilateral organization

BITs:

Example of measures:

Regulation of expropriation

Preference of local companies vs. foreign

Fair and equitable treatment of foreign investors

27.

International Investment RegimeLevel of Enactment

Multilateral:

Trade-Related Investment Measures (TRIMS):

Applies only to investment measures related to trade

in goods:

Local content requirements

Trade balancing requirements

Bilateral Investment Treaties (BIT)

RTAs:

NAFTA – Chapter 11

28.

Week NineMonday

Wednesday

Friday

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Lecture on

finance (40

min)

• Current

Events (10

min)

• Kahoot (10

min)

• Lecture (20

min)

• Interactive

Activities

29.

Current Events30.

Kahoot!31.

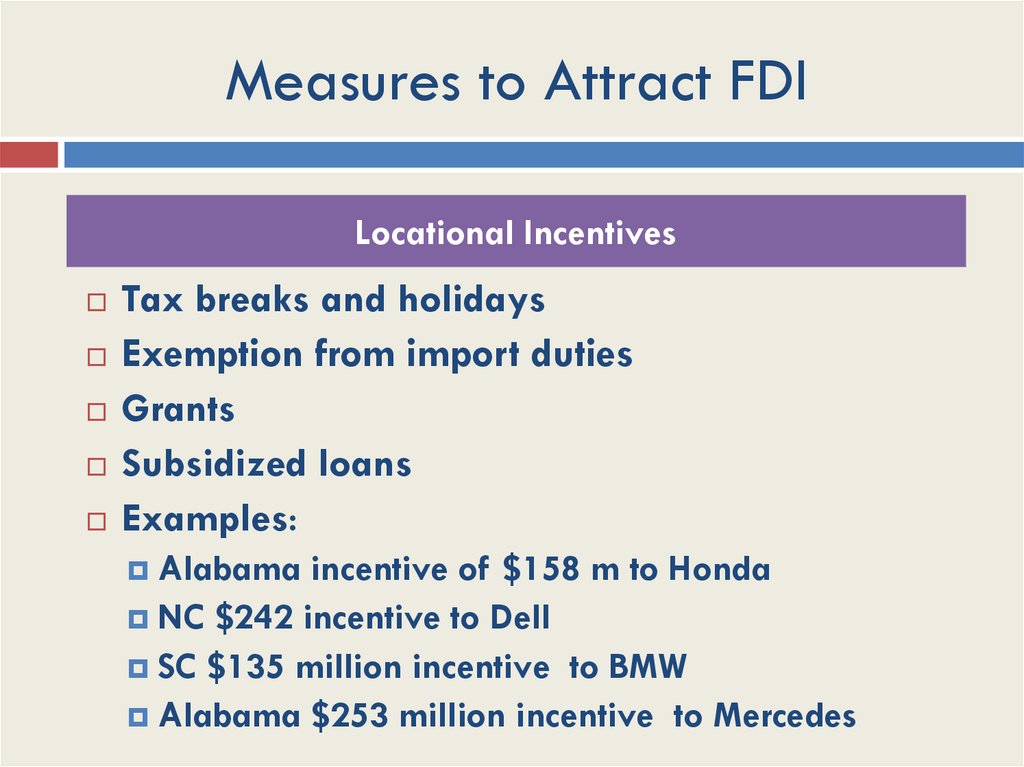

Measures to Attract FDILocational Incentives

Tax breaks and holidays

Exemption from import duties

Grants

Subsidized loans

Examples:

Alabama incentive of $158 m to Honda

NC $242 incentive to Dell

SC $135 million incentive

to BMW

Alabama $253 million incentive to Mercedes

32.

DataUNCTAD

Between 2000 and 2010 UNCTAD documented a total of

1944 investment-related regulatory changes

85% were liberalizing investment

15% were investment restrictive

33.

34.

35.

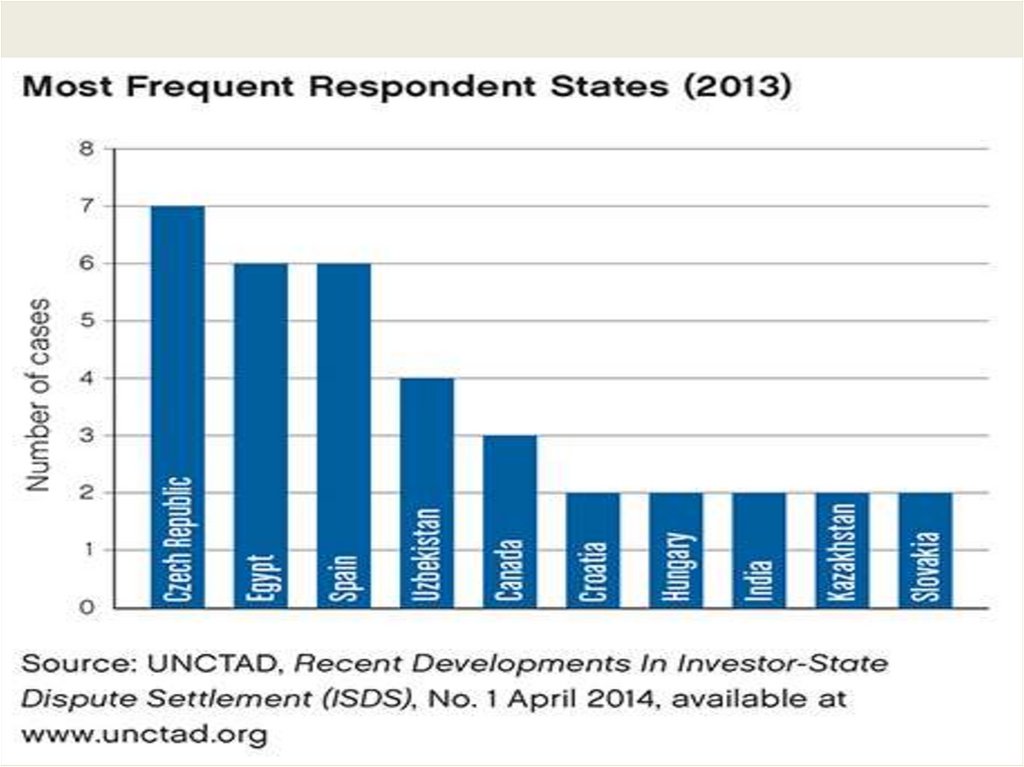

International Investment RegimeEnforcement Mechanism

Investor-State Dispute Settlement mechanisms

Judicial review

Ex: International Centre for the Settlement of

Investment Disputes (part of World Bank Group)

36.

37.

38.

Exercise IInvestment

UNCTAD’s investment hub

Find Kazakhstan data about how many BIT it

has signed and how many Treaties with

Investment Provisions (TIP).

How many BITs and TIPs in total in the world?

http://investmentpolicyhub.unctad.org/ISDS

39.

Exercise IIInvestment

UNCTAD’s investment hub

Explore the Investment Policy Monitor

Explore the Investment Law Navigator

Choose few countries and see the type of

measures they implement

40.

Exercise IIIInvestment

UNCTAD’s investment hub

Find Kazakhstan data about investor-state

dispute settlements

http://investmentpolicyhub.unctad.org/ISDS

41.

Q&ADr Maja

Savevska

Thank you for your attention

economics

economics