Similar presentations:

Market structure, market power, and welfare ( lecture 2 )

1. Lecture 2: Market structure, market power, and welfare

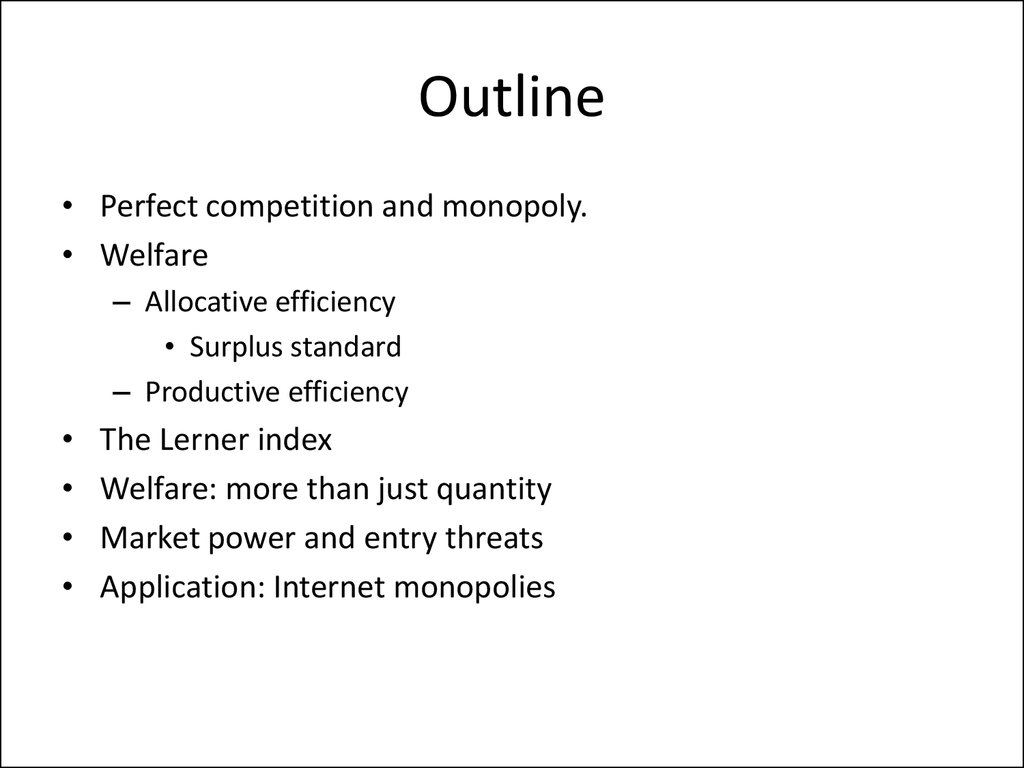

2. Outline

• Perfect competition and monopoly.• Welfare

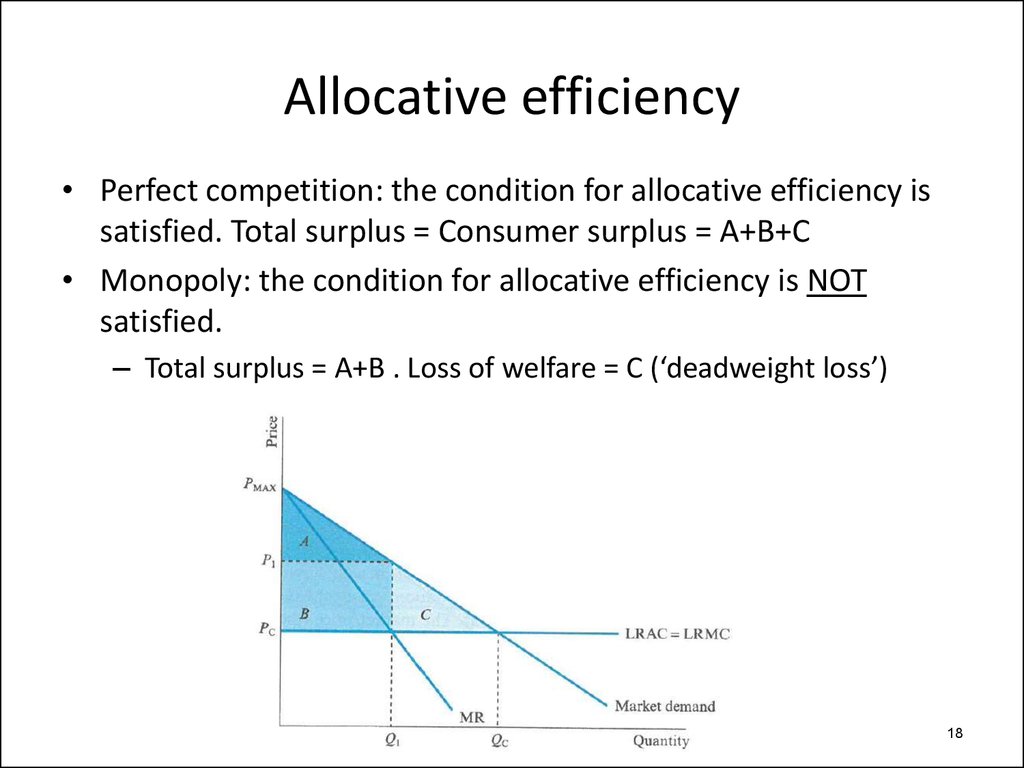

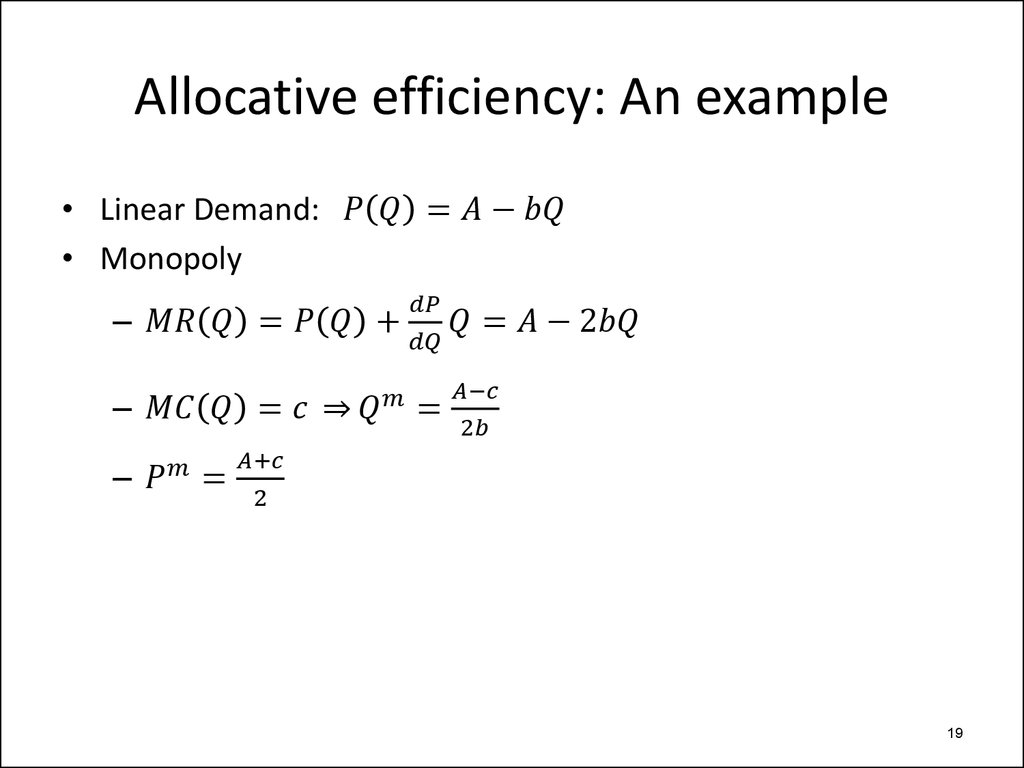

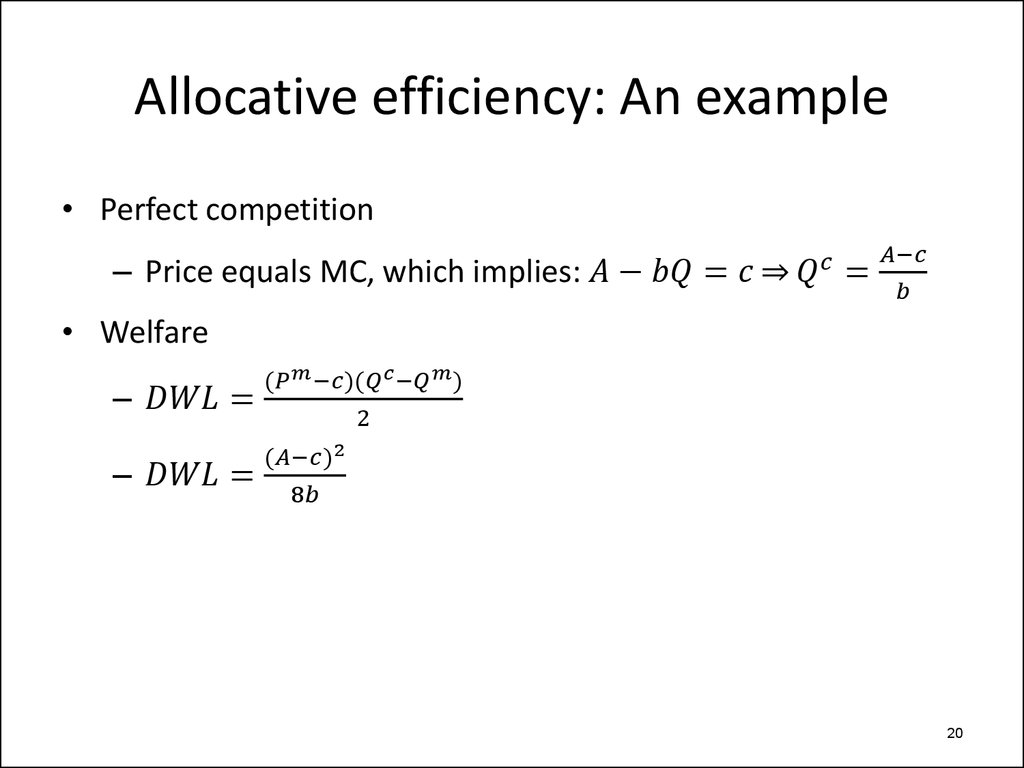

– Allocative efficiency

• Surplus standard

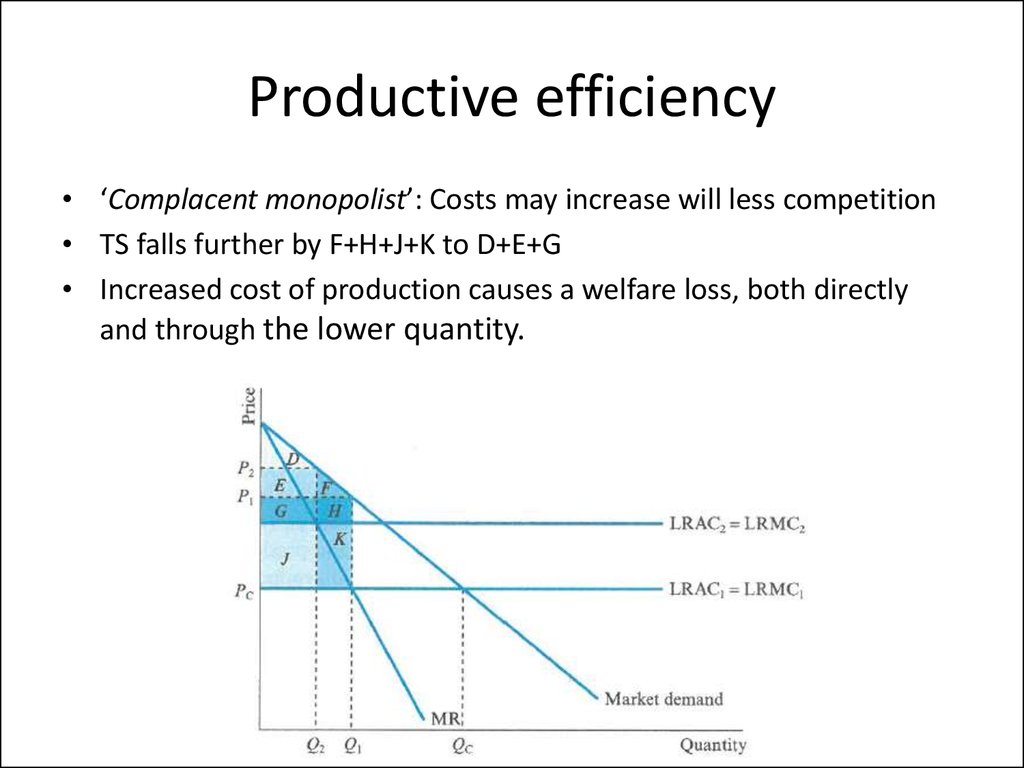

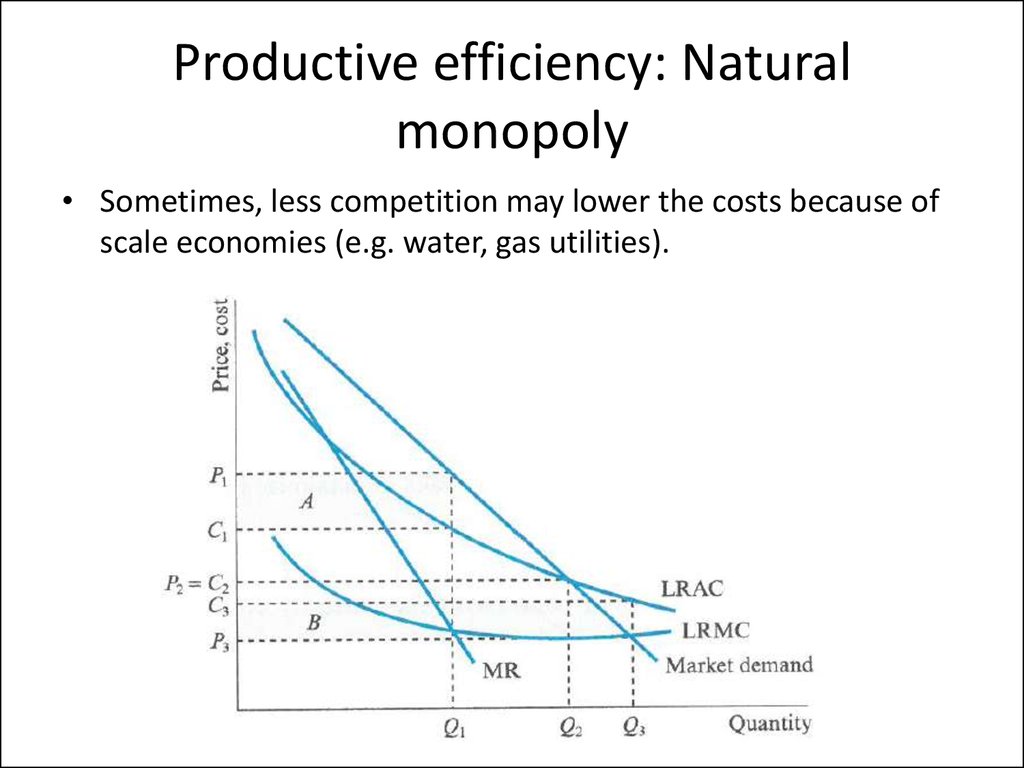

– Productive efficiency

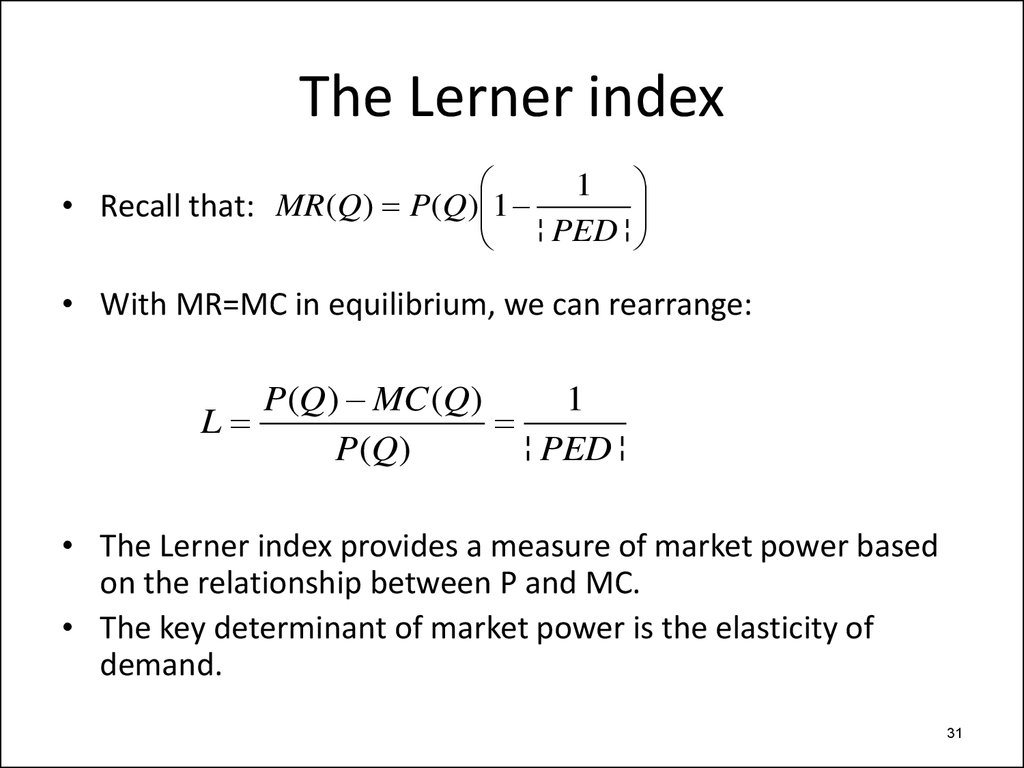

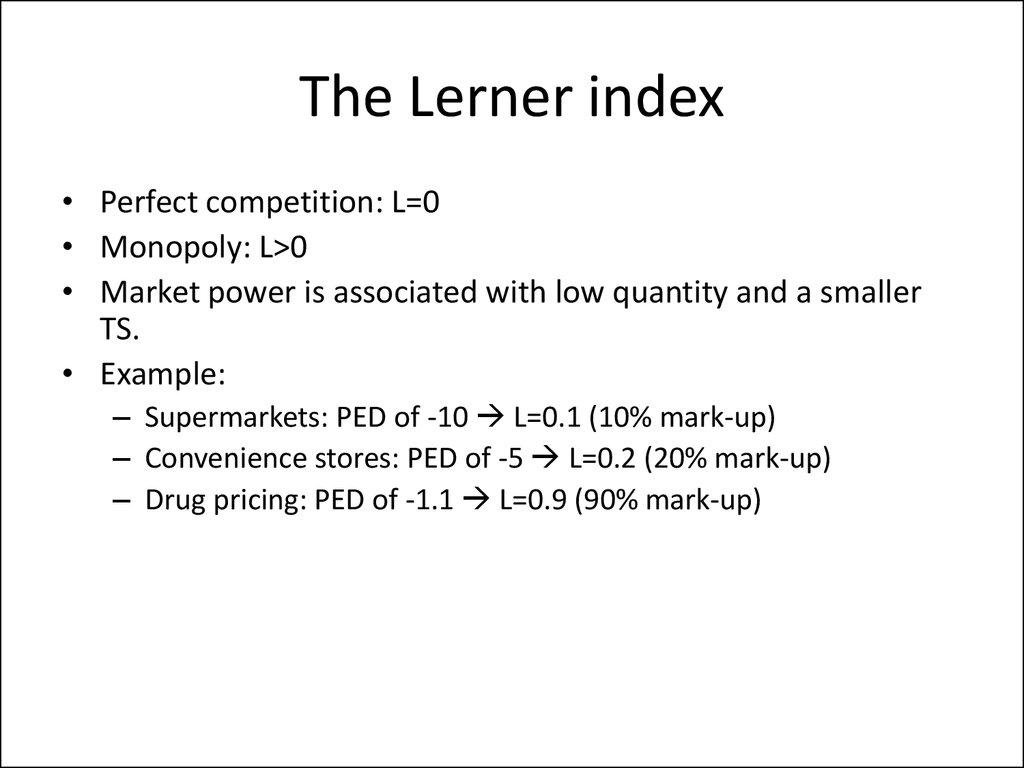

The Lerner index

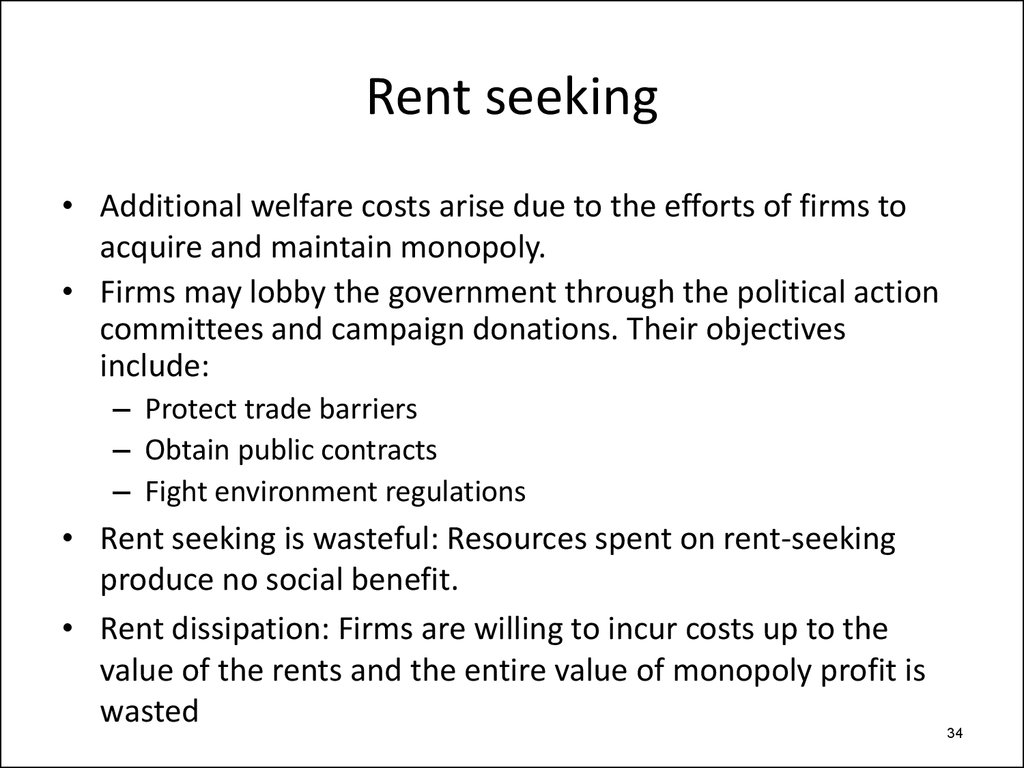

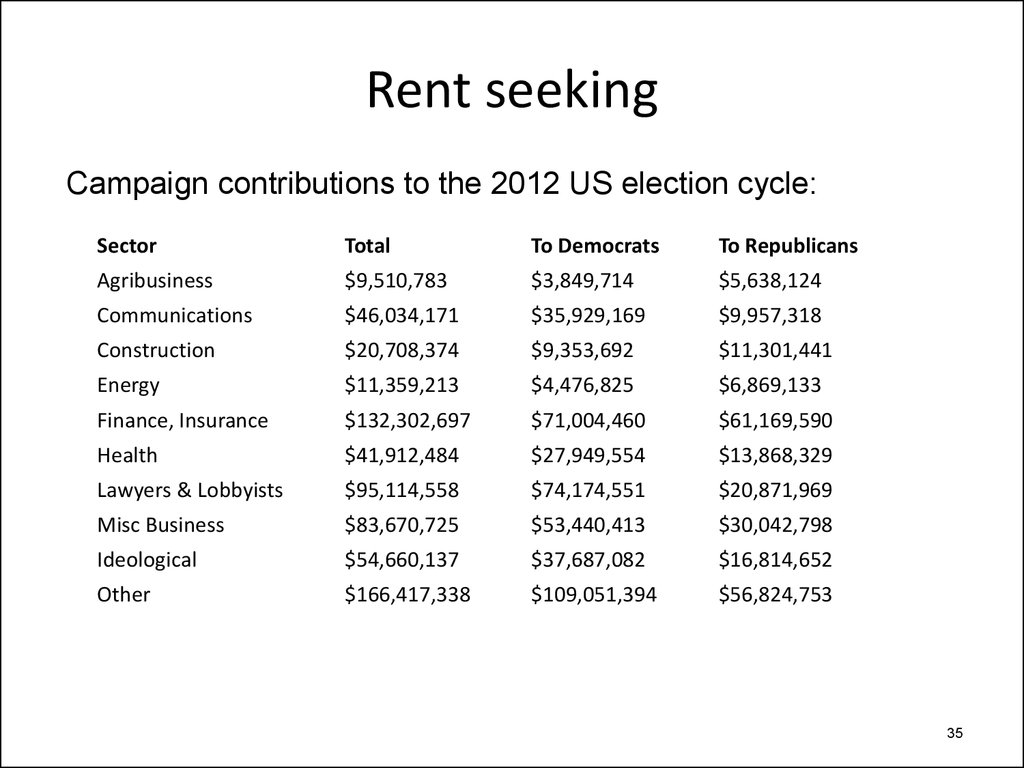

Welfare: more than just quantity

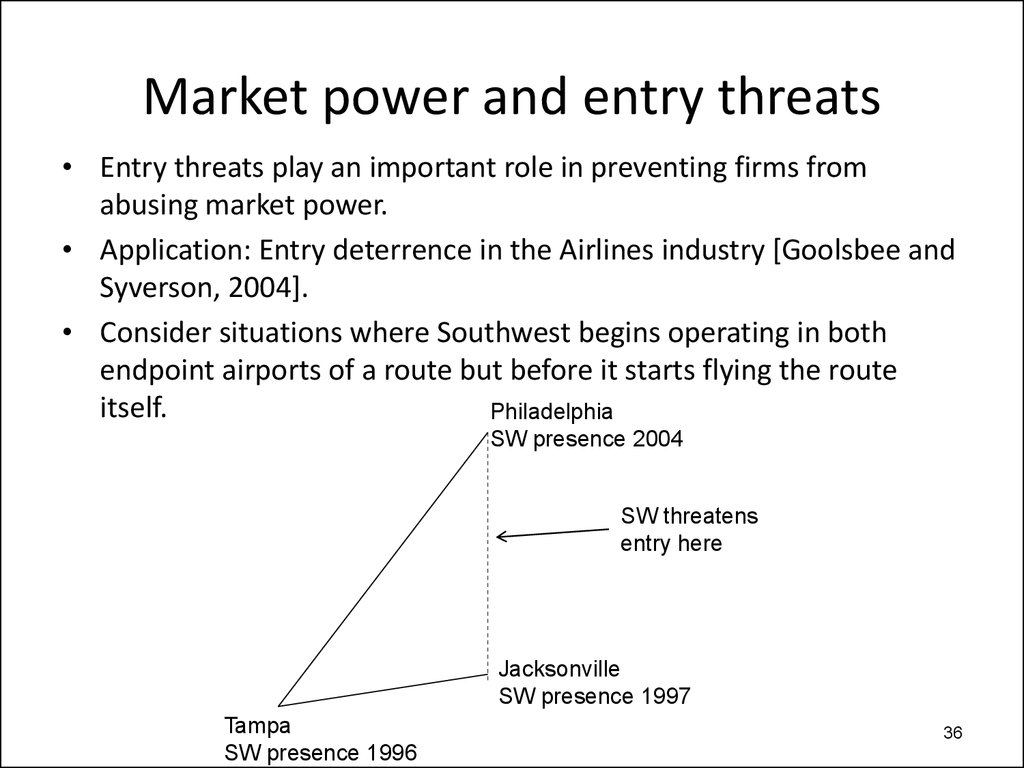

Market power and entry threats

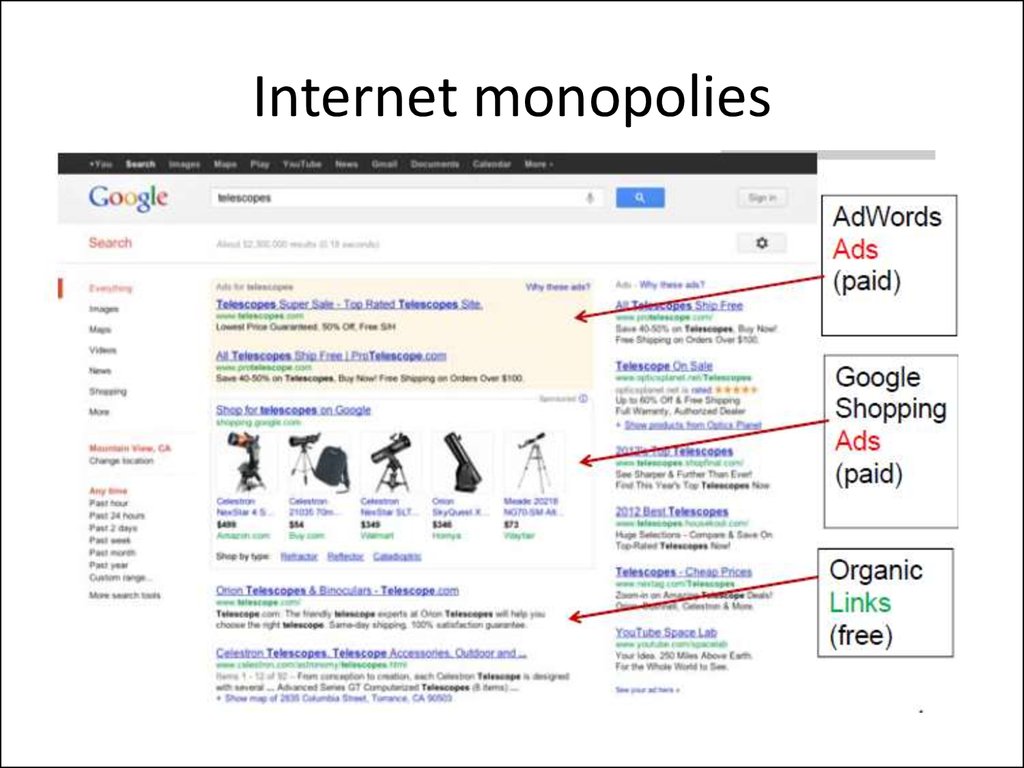

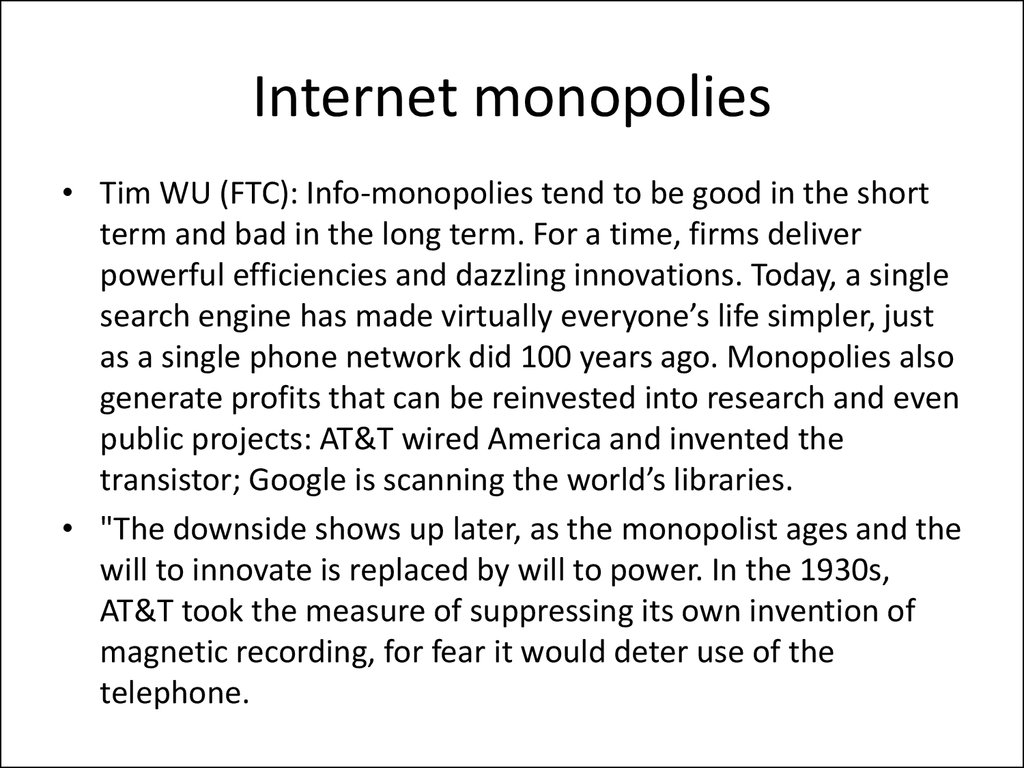

Application: Internet monopolies

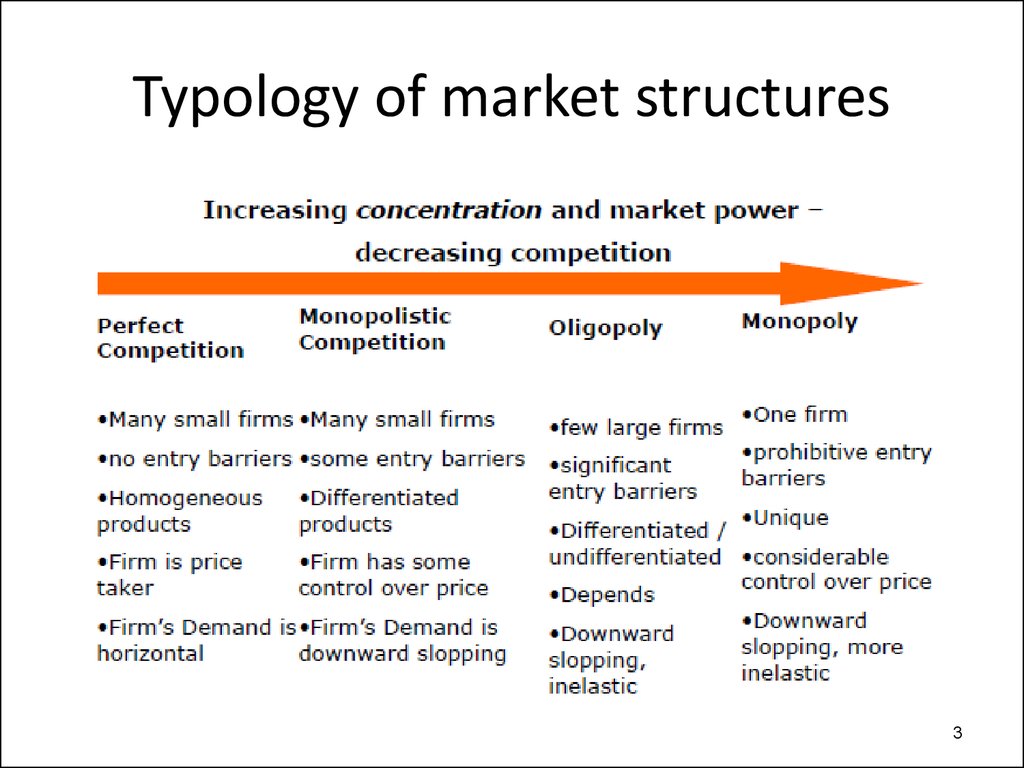

3. Typology of market structures

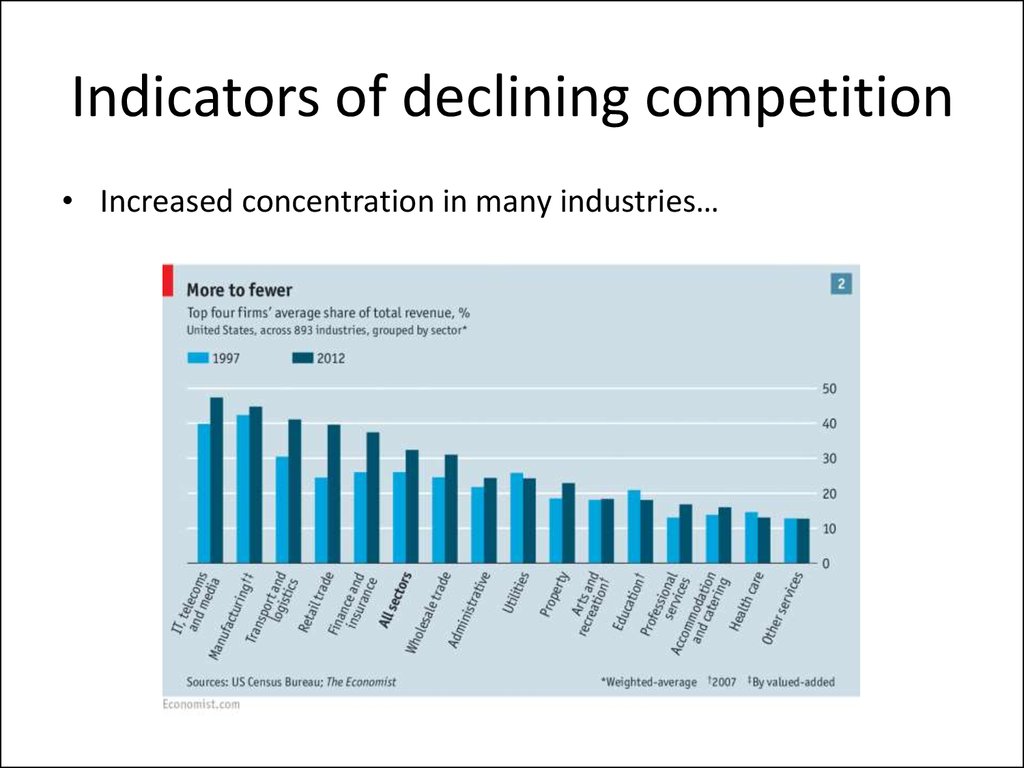

34. Indicators of declining competition

• Increased concentration in many industries…5. Indicators of declining competition

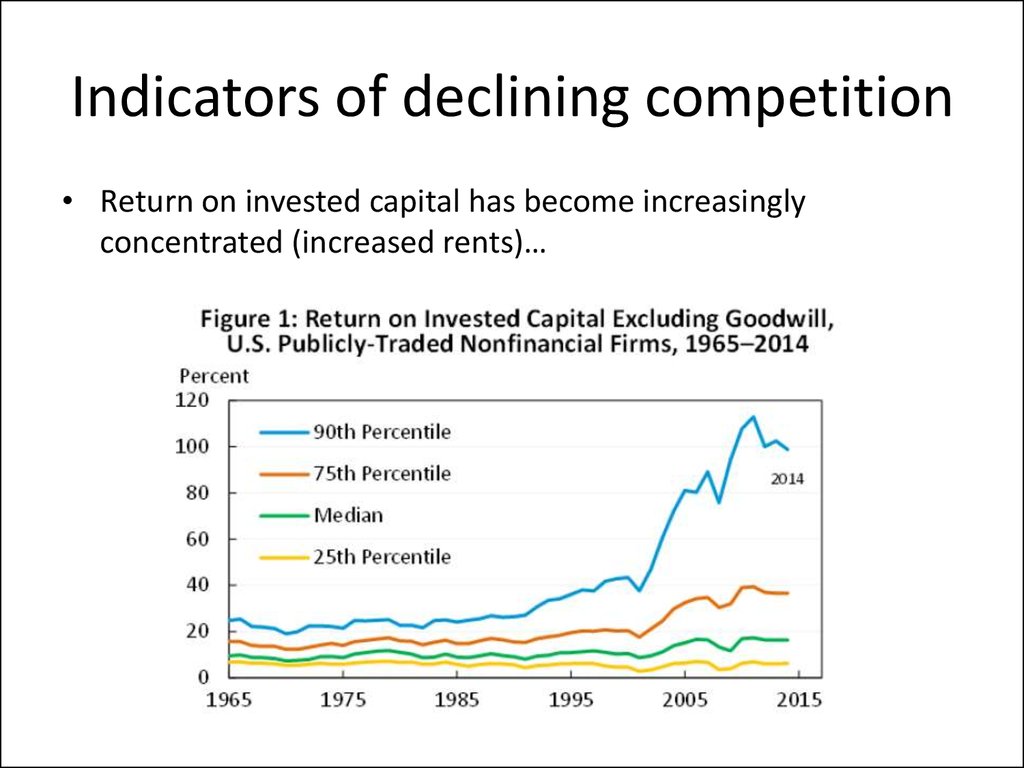

• Return on invested capital has become increasinglyconcentrated (increased rents)…

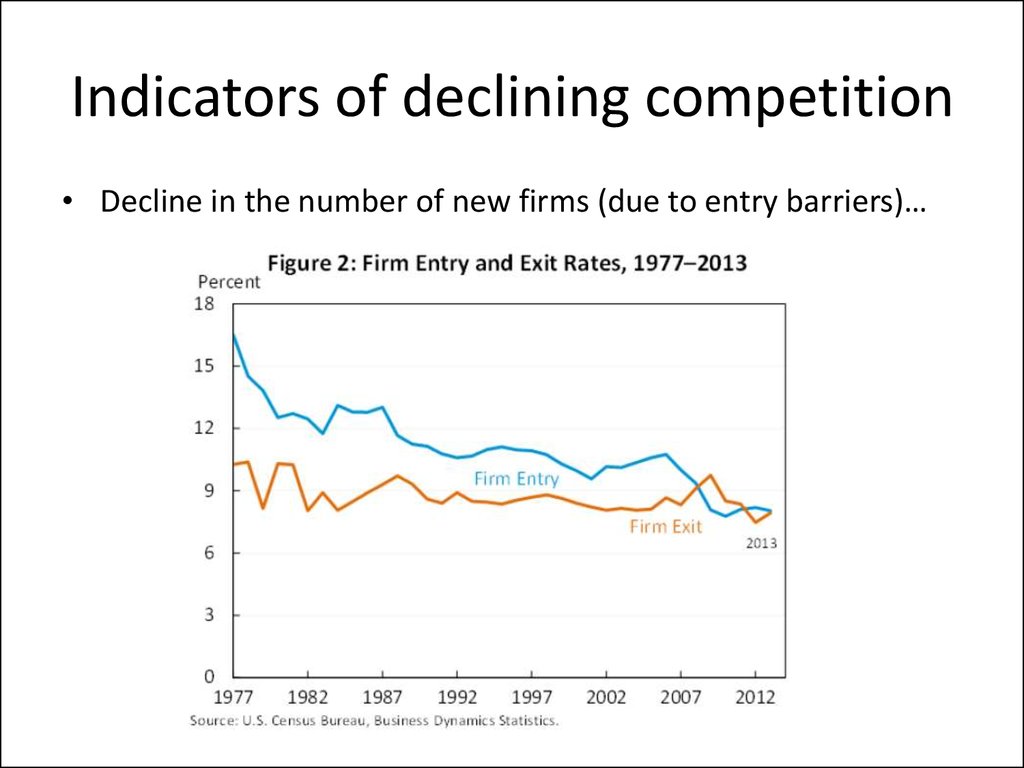

6. Indicators of declining competition

• Decline in the number of new firms (due to entry barriers)…7. Causes of declining competition

• Mergers: in 2015,– Global M&A volume hit $5 trillion, U.S. M&A made up 50% of

the total.

– 69 deals over $10 billion, and 10 deals over $50 billion.

– Pfizer’s $160 billion acquisition of Allergan.

– Anheuser-Busch InBev’s $117 billion acquisition of SABMiller.

• Firm conduct

–

–

–

–

R&D

Advertising

Collusion

Erecting entry barriers

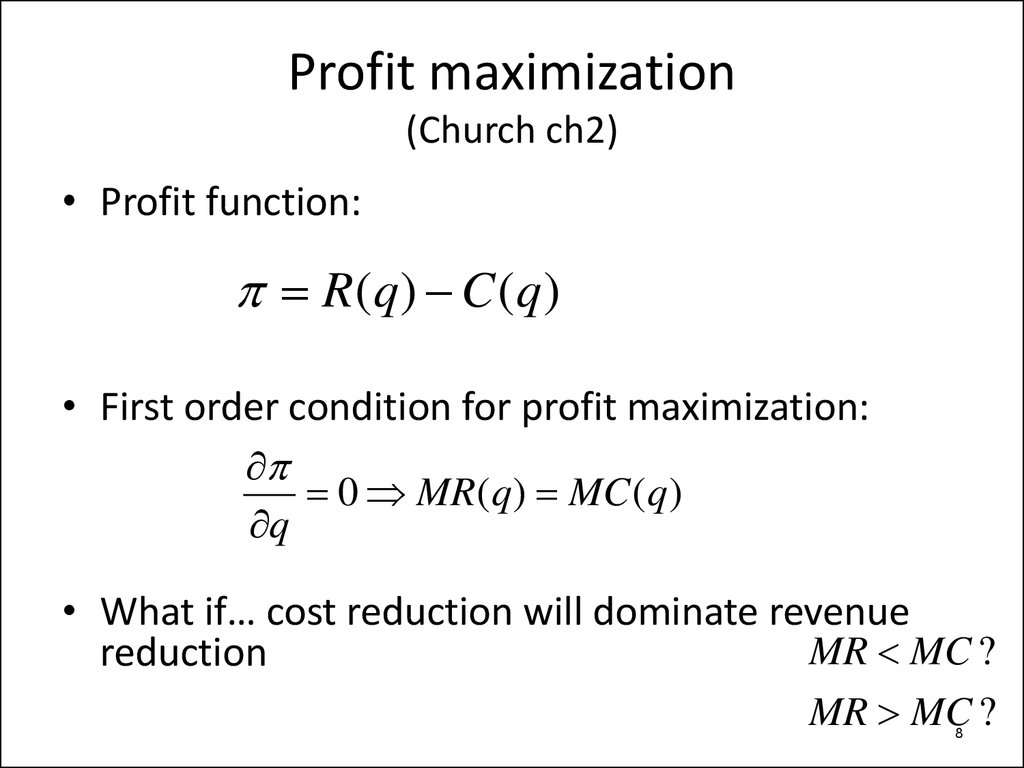

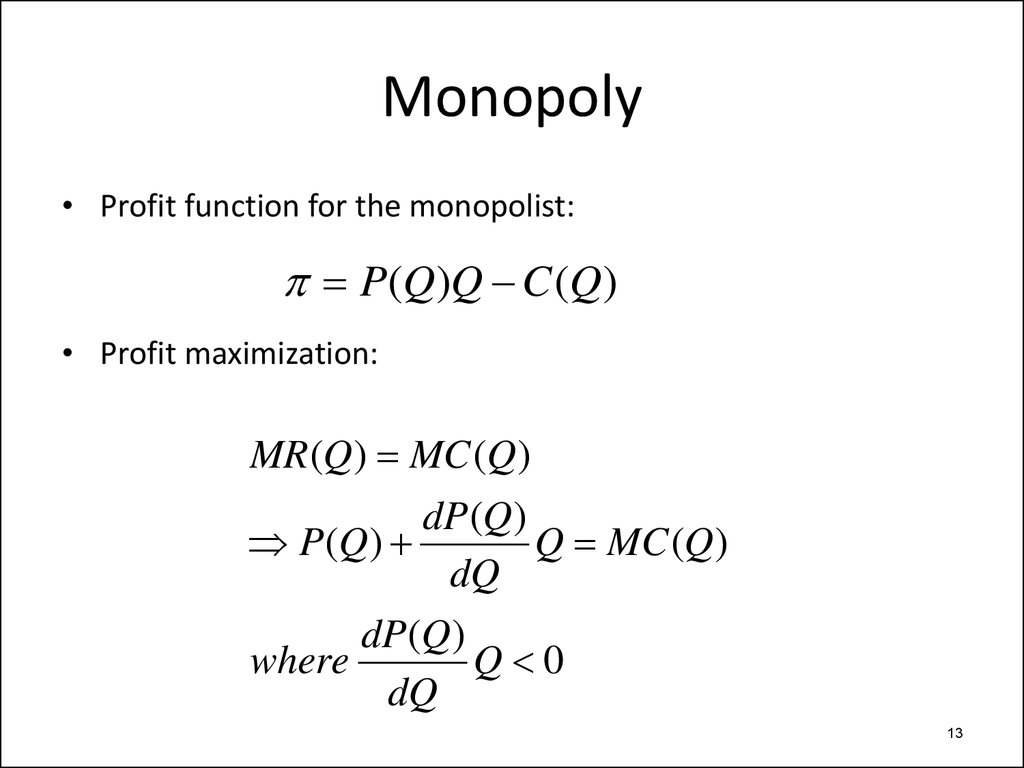

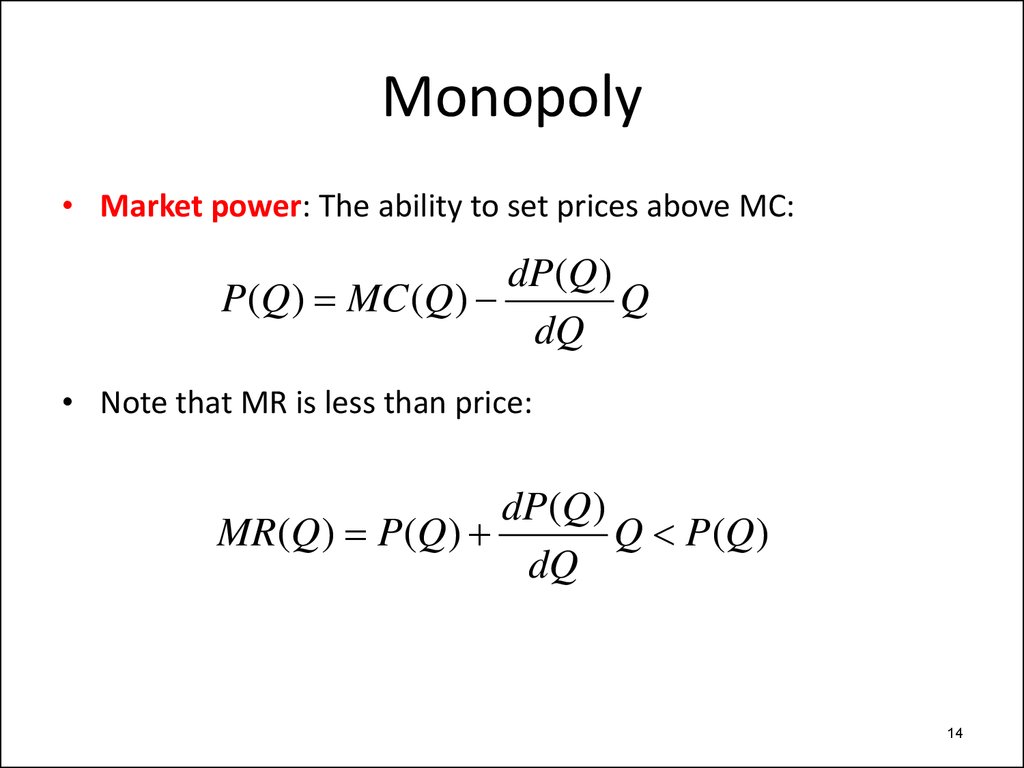

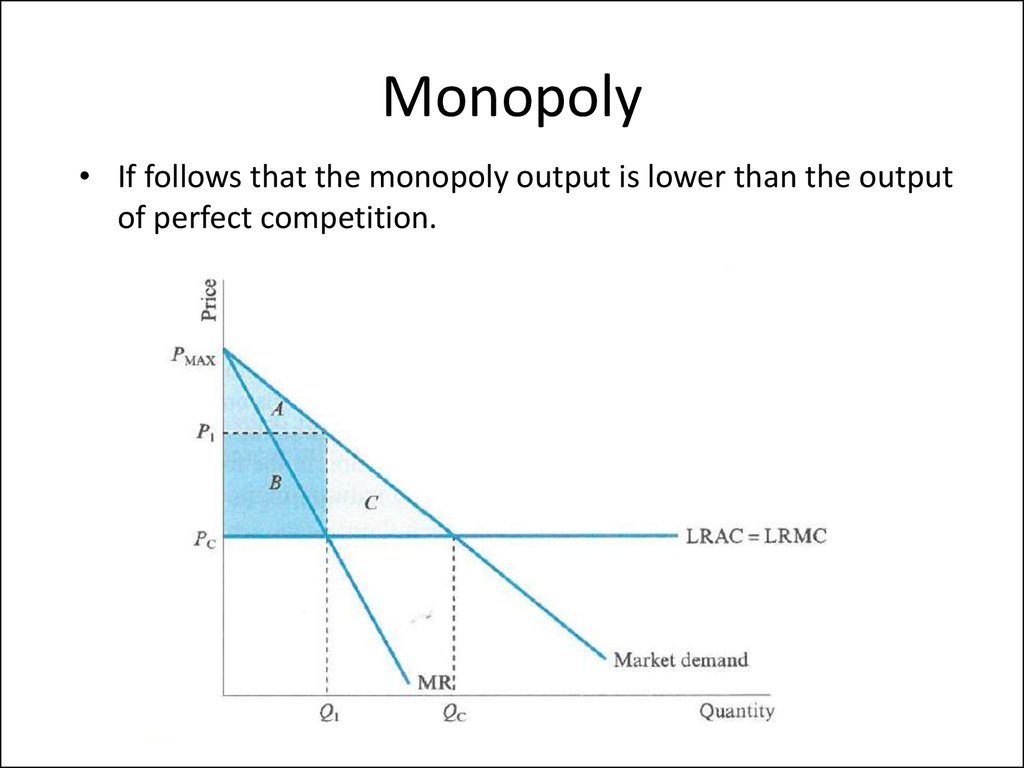

8. Profit maximization (Church ch2)

• Profit function:R(q) C (q)

• First order condition for profit maximization:

0 MR(q ) MC (q )

q

• What if… cost reduction will dominate revenue

MR MC ?

reduction

MR MC ?

8

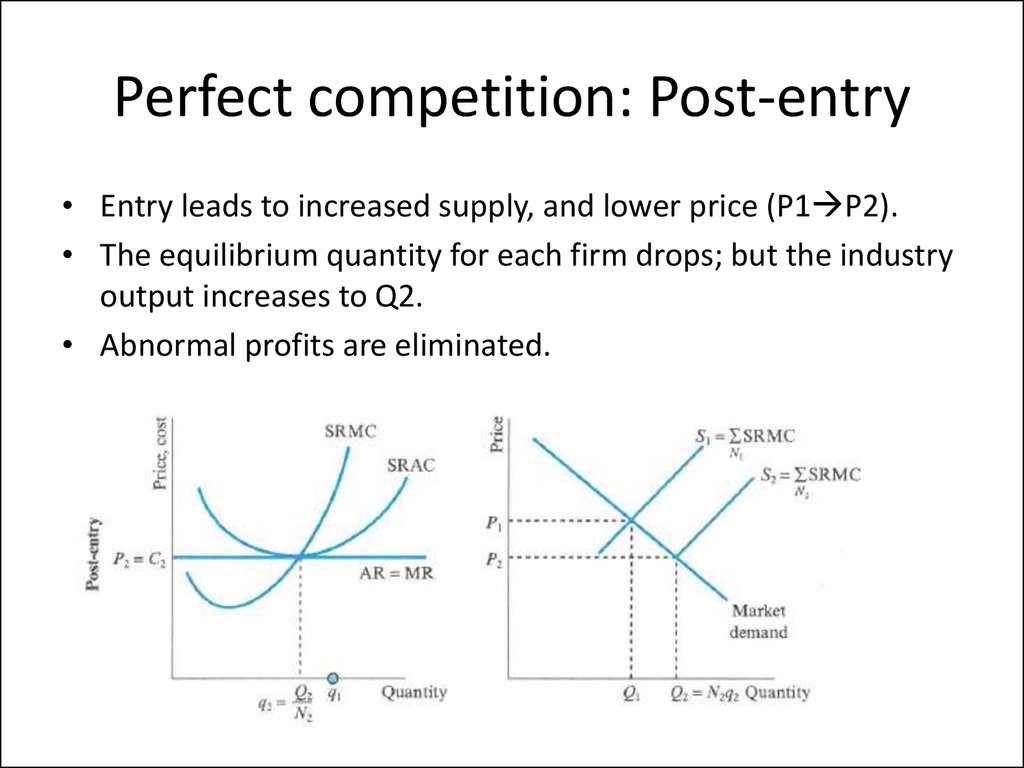

9. Perfect competition

• Assumptions: Large number of buyers and sellers, free entry,identical goods, perfect information, no transport costs.

• Firms are price takers:

R(q) pq MR(q) p

• Profit maximization implies that q is such that – price is equal

to marginal cost:

p MC (q)

economics

economics management

management business

business