Similar presentations:

ARCH and GARCH. Modeling Volatility Dynamics

1. ARCH and GARCH

Modeling Volatility Dynamics2. Modeling Unequal Variability

• Equal Variability: Homoscedasticity• Unequal Variability: Heteroscedasticity

– Means any variability (around the mean)

that is not homoscedasticity

– Models must be developed for specific

cases

3. What These Acronym Mean?

• ARCH– Autoregressive Conditional

Heteroscedasticity

• GARCH

– Generalized ARCH

4. Information in e2

• Let et have the mean 0 and the variance st.• Let et be the residual of a model fitted.

• Then:

– et estimates et

– et2 estimates the variance st2.

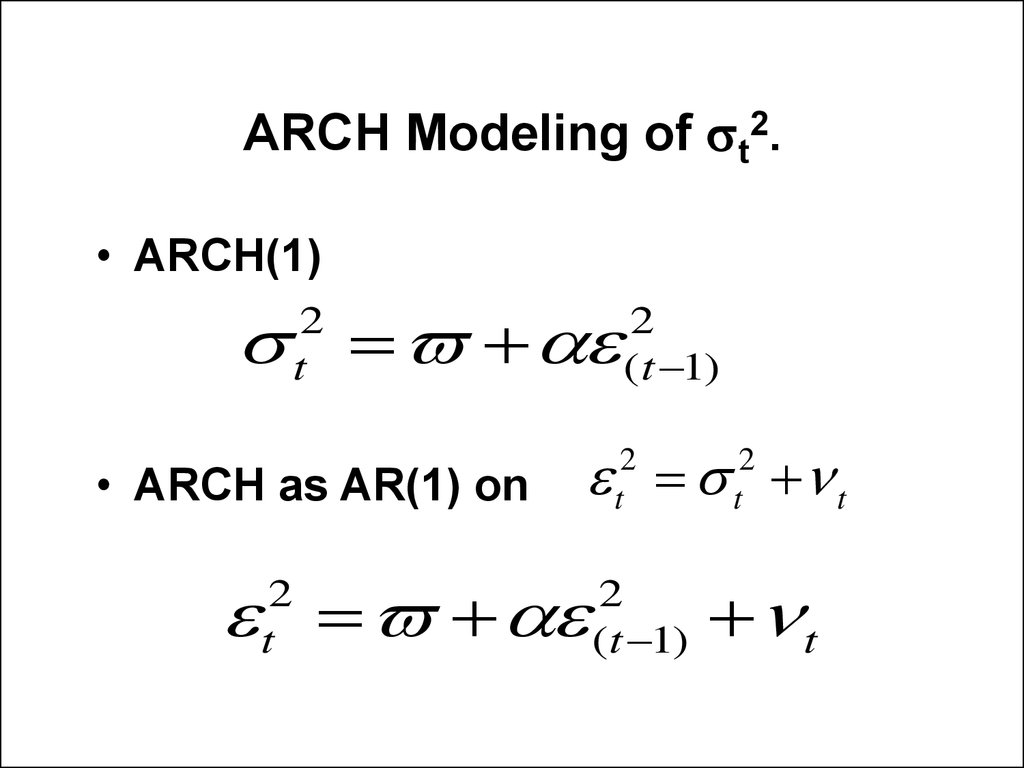

5. ARCH Modeling of st2.

• ARCH(1)s e

2

t

• ARCH as AR(1) on

e s t

e e

2

t

2

( t 1)

2

t

2

( t 1)

2

t

t

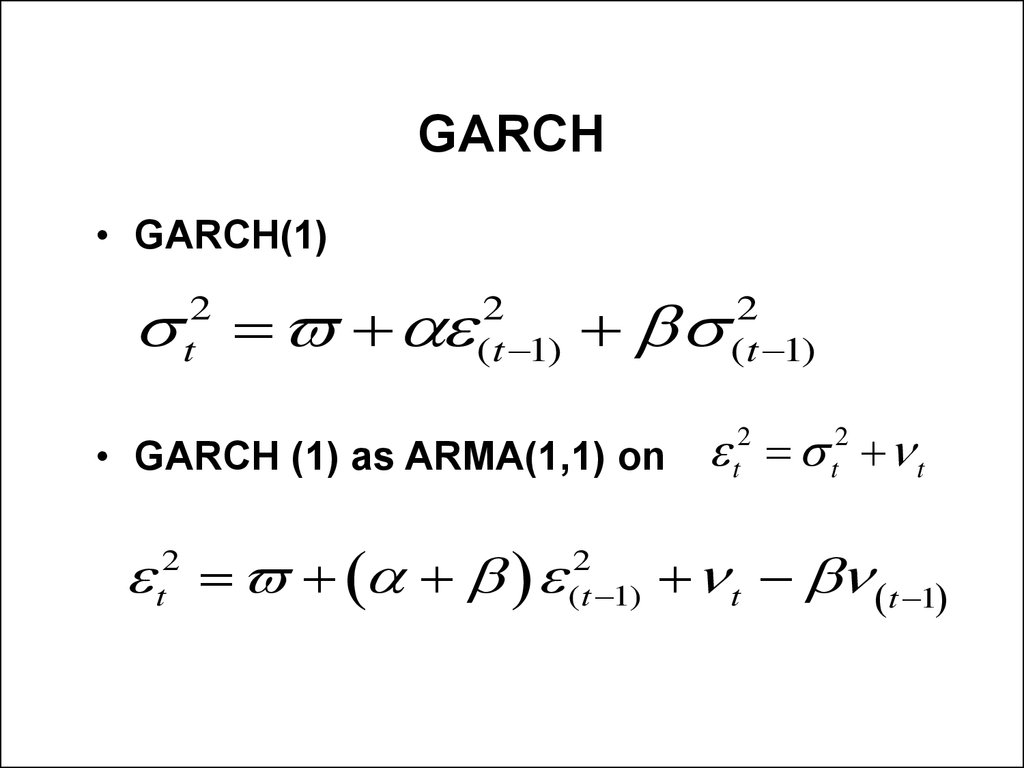

6. GARCH

• GARCH(1)s e

2

t

2

( t 1)

s

2

( t 1)

2

2

e

s

• GARCH (1) as ARMA(1,1) on

t

t t

e e

2

t

2

( t 1)

t t 1

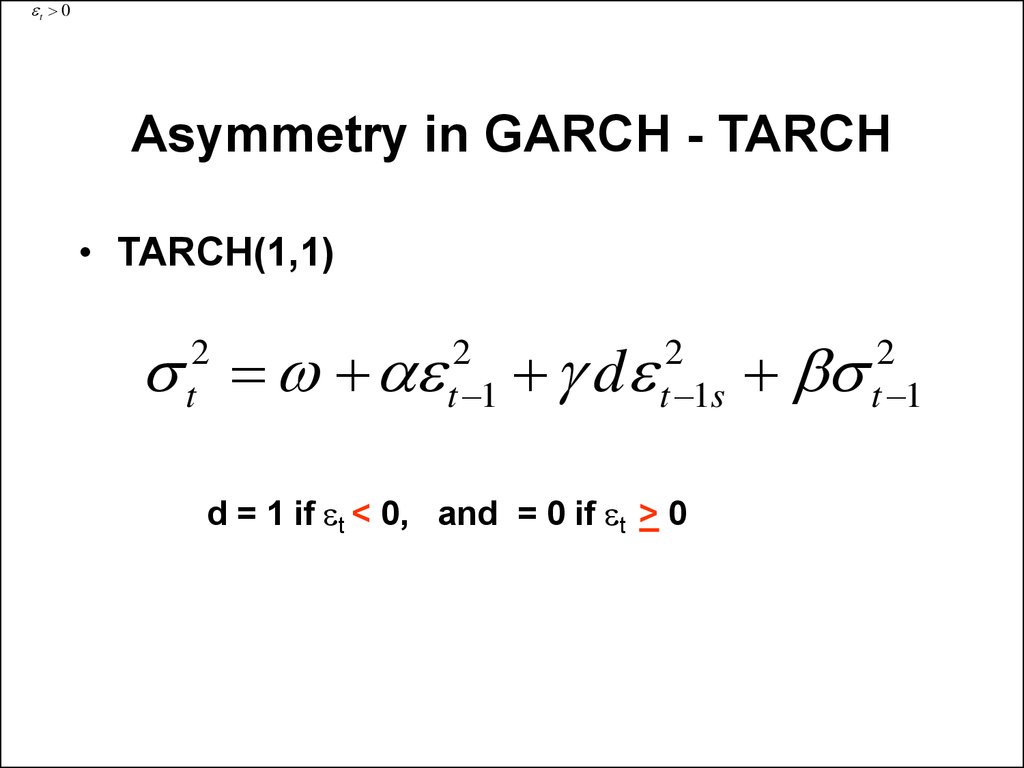

7. Asymmetry in GARCH - TARCH

et 0Asymmetry in GARCH - TARCH

• TARCH(1,1)

s e

2

t

2

t 1

de

2

t 1s

d = 1 if et < 0, and = 0 if et > 0

s

2

t 1

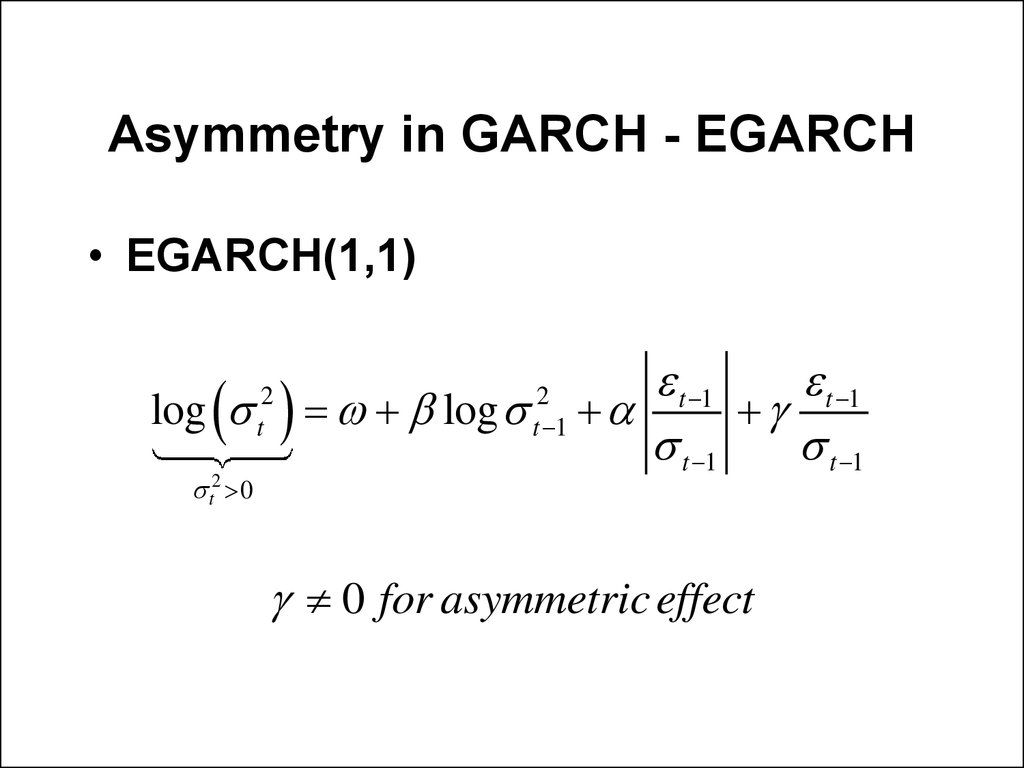

8. Asymmetry in GARCH - EGARCH

• EGARCH(1,1)log s

s t2 0

2

t

log s

2

t 1

e t 1

e t 1

s t 1

s t 1

0 for asymmetric effect

mathematics

mathematics